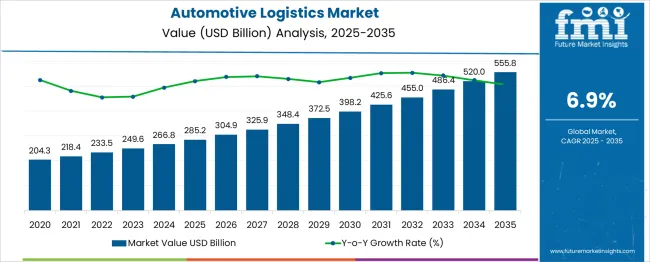

The automotive logistics market is projected to experience steady growth from USD 204.3 billion in 2025 to approximately USD 555.8 billion by 2035. During the initial phase from 2024 to 2029, the market value increases from USD 204.3 billion to USD 304.9 billion. This growth is driven by increasing vehicle production worldwide, expansion of automotive supply chains, and rising demand for just-in-time delivery solutions to optimize inventory and reduce lead times. The integration of digital technologies such as IoT, AI-powered tracking systems, and blockchain enhances transparency, efficiency, and security in logistics operations, contributing to market momentum. Between 2030 and 2034, the market further advances from USD 325.9 billion to USD 455.0 billion, supported by the growth of electric and autonomous vehicle production, which demands specialized handling and distribution processes. Moreover, the rise of e-commerce and aftermarket parts distribution drives demand for agile logistics solutions tailored to automotive components. From 2025 to 2035, the market accelerates from USD 486.4 billion to USD 555.8 billion, propelled by increased adoption of sustainable logistics practices, including alternative fuel vehicles and optimized routing algorithms that reduce carbon emissions. Strategic partnerships, investments in advanced warehouse automation, and regional diversification by key market players enhance competitiveness. Overall, the automotive logistics market is positioned for robust and sustained growth through 2035, driven by evolving industry requirements, technological advancements, and increasing focus on operational efficiency and sustainability.

| Metric | Value |

|---|---|

| Automotive Logistics Market Estimated Value in (2025 E) | USD 285.2 billion |

| Automotive Logistics Market Forecast Value in (2035 F) | USD 555.8 billion |

| Forecast CAGR (2025 to 2035) | 6.9% |

The automotive logistics market is currently navigating a phase of accelerated growth catalyzed by the expansion of global automotive production and the rise of electric vehicle platforms. Investment in integrated logistics solutions has been stimulated by OEMs focusing on just in time and just in sequence inventory strategies. Logistics providers are adopting advanced digital platforms featuring real time tracking, predictive analytics and warehouse management systems to improve operational visibility and reduce damages.

Sustainability trends and regulatory standards are influencing modal shifts and eco friendly packaging innovations. Supply chain resilience is being reinforced through multi modal capabilities and regional hub networks designed to buffer disruptions.

Consolidation among tier one logistics firms alongside partnerships with vehicle manufacturers is resulting in more standardized logistics networks and improved cost efficiency. Future opportunities will likely involve autonomous transport corridors, green logistics initiatives and expansion into growing EV markets.

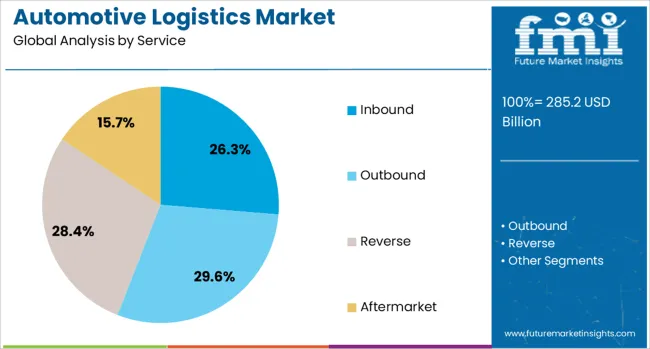

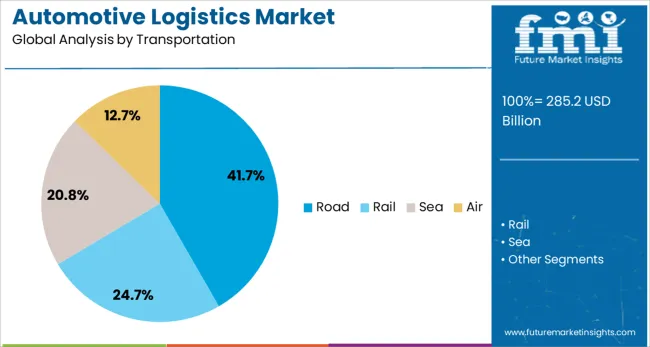

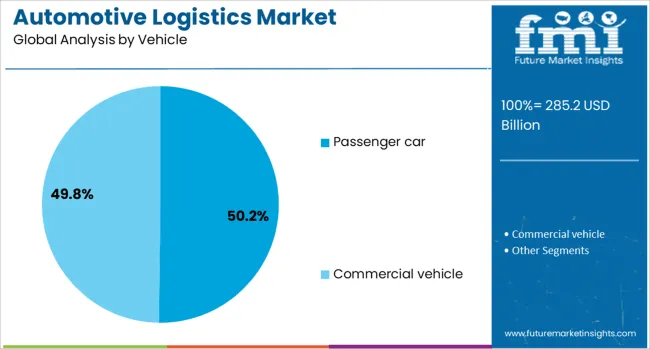

The automotive logistics market is segmented by service, transportation, vehicle distribution, and geographic regions. By service, the market is divided into Inbound, Outbound, Reverse, After market. In terms of transportation of the automotive logistics market is classified into Road, Rail, Sea Air. Based on vehicle of the automotive logistics market is segmented into Passenger car Commercial vehicle. By distribution of the automotive logistics market is segmented into Domestic International. Regionally, the automotive logistics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The inbound service segment is projected to hold 26.3% of automotive logistics revenue in 2025 marking it as a key focus area. This leadership position is supported by the increasing emphasis on supplier to plant delivery reliability and supplier consolidation strategies implemented by automakers.

Parts and components are being delivered through integrated logistics networks that leverage supplier parks and cross docking facilities designed for rapid throughput. The demand for inbound logistics has been elevated by the growth of modular assembly lines and the shift to electric vehicle production which relies heavily on battery and module transport.

Service providers offering synchronized inbound planning, supplier collaboration portals and dynamic scheduling tools have gained competitive advantage. As OEMs continue to emphasize operational resilience and lean manufacturing practices, the inbound logistics segment is expected to maintain its prominence and attract ongoing investment in technology and processes.

Within transportation modes road transport is forecasted to generate 41.7% of market revenue in 2025 establishing it as the top modality. Road has been favored due to its flexibility in door to door delivery and its ability to support variable shipment patterns across production and distribution networks. The dominance of road transport has been reinforced by refined trailer fleets equipped with advanced loading systems and condition monitoring sensors that reduce damage and downtime.

Last mile and inter modal connectivity have improved through streamlined regulations and optimized route planning tools. Road transport remains cost effective for regional parts distribution while enabling rapid response to demand fluctuations.

Investment in driver safety, telematics and carbon emission monitoring has also been prioritized by logistics providers to meet regulatory and sustainability objectives. Given these advantages, road transportation has secured a sustained leadership position in automotive logistics.

In vehicle type segmentation the passenger car category is set to account for 50.2% of automotive logistics market revenue in 2025 confirming its market leadership. This is driven by continuous global demand for passenger vehicles, including growth in emerging markets and increasing EV adoption. Logistics networks supporting passenger cars have been optimized through dedicated roll on roll off terminals, multi modal export corridors and flexible inland carrier fleets.

The requirement for secure and damage free transport has led to specialized loading systems and strict quality controls. OEMs continue to implement sequential delivery models that depend on high reliability and coordination across global logistics providers.

Furthermore investment in return logistics for vehicle parts and service components has been integrated with new vehicle distribution processes. The scale of passenger car production and distribution has sustained the segment’s share, and future growth is expected to be supported by EV expansion and aftermarket parts logistics.

Automotive logistics is evolving with expanding production hubs, growing aftermarket needs, EV-specific requirements, and increased use of digital optimization. These factors are shaping more complex yet efficient global supply chain operations.

The automotive logistics market is experiencing growth as vehicle production hubs diversify across regions to serve both domestic and export markets. Manufacturers are increasing reliance on efficient inbound and outbound logistics to maintain production continuity and meet delivery deadlines. Inbound logistics ensures timely delivery of components to assembly plants, supporting just-in-time and just-in-sequence manufacturing processes. Outbound logistics focuses on transporting finished vehicles to dealerships and distributors through rail, road, sea, and air networks. This expansion is driven by OEMs establishing facilities closer to key demand centers while maintaining links to global suppliers. The complexity of these networks requires integrated logistics strategies that optimize transit times, reduce costs, and minimize bottlenecks.

Aftermarket logistics plays a significant role in ensuring timely availability of spare parts and accessories for vehicles already in service. As global vehicle ownership increases, the demand for efficient parts distribution networks has grown. This includes warehousing, order processing, and last-mile delivery to repair shops and end customers. Delays in parts delivery can lead to extended vehicle downtime, affecting customer satisfaction and service provider operations. Logistics providers are deploying specialized inventory management systems and regional distribution centers to speed up fulfillment. The rise in e-commerce platforms for automotive parts has also reshaped aftermarket logistics, requiring faster processing times and improved reverse logistics capabilities.

The shift toward electric vehicles is reshaping automotive logistics, particularly in the handling of high-voltage batteries and specialized EV components. These items require strict compliance with hazardous materials regulations, temperature-controlled storage, and secure transport. Logistics providers are investing in training, equipment, and dedicated infrastructure to manage these requirements safely. Additionally, EV production often involves sourcing components from multiple international suppliers, increasing the complexity of inbound logistics. Finished vehicle transport for EVs also demands adaptations, such as weight distribution adjustments and charging considerations during transit. This trend is compelling both OEMs and logistics providers to develop specialized capabilities to meet the unique demands of the EV supply chain.

Digital tools are being leveraged to enhance visibility, track shipments, and optimize routing in automotive logistics. Real-time tracking allows OEMs and suppliers to monitor shipments, anticipate delays, and adjust schedules proactively. Data analytics helps forecast demand, allocate resources effectively, and reduce empty return trips. Automated warehouse systems improve order accuracy and reduce handling times, supporting both production and aftermarket logistics. Collaboration platforms are enabling better communication between OEMs, suppliers, and logistics providers, ensuring greater synchronization across the supply chain. The focus on efficiency and transparency is driving investments in systems that reduce operational costs while maintaining service quality.

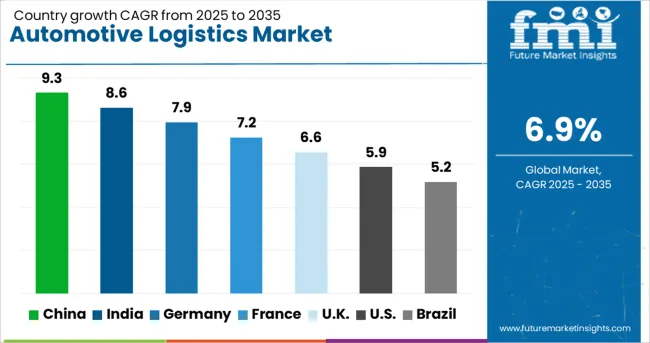

| Country | CAGR |

|---|---|

| China | 9.3% |

| India | 8.6% |

| Germany | 7.9% |

| France | 7.2% |

| UK | 6.6% |

| USA | 5.9% |

| Brazil | 5.2% |

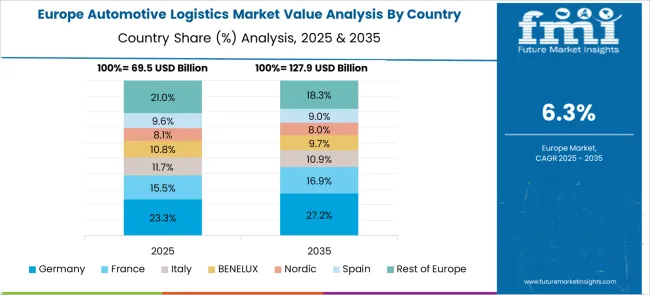

The automotive logistics market is expected to grow globally at a CAGR of 6.9% from 2025 to 2035, fueled by expanding vehicle production, increasing aftermarket parts distribution, and the integration of digital supply chain solutions. China leads with a CAGR of 9.3%, driven by high automotive manufacturing output, rising EV production, and investments in multimodal transport infrastructure. India follows at 8.6%, supported by growing domestic vehicle demand, export-oriented manufacturing hubs, and improved warehousing capacity. France grows at 7.2%, leveraging its strategic location for European vehicle exports and aftermarket distribution. The United Kingdom records 6.6%, with growth supported by premium segment exports and specialized logistics for EV components, while the United States posts 5.9%, reflecting steady demand for finished vehicle transport and aftermarket supply chain optimization. The analysis covers over 40 global markets, highlighting these countries as key benchmarks for capacity expansion, digital logistics adoption, and strategic investment in automotive supply chain resilience.

China is projected to post a CAGR of 9.3% during 2025–2035, outpacing the global 6.9%. Capacity additions in roll-on roll-off berths, rail-road consolidation hubs, and bonded warehouses have been prioritized by OEMs and tier suppliers. Finished vehicle exports to Asia, Middle East, and Latin America have expanded, which increases multiport routing needs and vessel scheduling precision. Battery and e-axle flows require hazmat-compliant handling, temperature control, and certified packaging, lifting value per move. Inbound parts logistics has shifted toward vendor-managed inventory and milkrun models to stabilize takt times at mega-plants. The aftermarket has been supported by regional distribution centers that shorten lead times for high-turn SKUs and collision parts. China is set to remain the most influential swing market for capacity planning and price discovery across lanes.

India is expected to record a CAGR of 8.6% for 2025–2035, well above the global average. Vehicle output growth in SUVs, two-wheelers, and small commercial vehicles has expanded hub-and-spoke flows across western and southern corridors. Dedicated freight corridors and private rail rakes have improved schedule reliability for finished vehicles. Parts consolidation at supplier parks near assembly plants has reduced dwell and boosted on-time performance. Export lanes for compact cars and tractors have supported roll-on roll-off frequency and container utilization. The service mix has moved toward time-defined deliveries, cross-docking, and KPI-linked contracts. India is judged to deliver compelling cost-to-serve with improving transit assurance, which encourages long-term network commitments from global OEMs.

France is projected to grow at 7.2% during 2025–2035. Northern and western ports have strengthened ro-ro schedules for European exports, while inland terminals support efficient pre-carriage and deconsolidation. Premium and light commercial vehicle flows have favored rail-road interchanges to reduce long-haul road exposure. Parts logistics has adopted slotting and fast-pick strategies for electronics, interiors, and glazing, improving pick accuracy and wave times. Import programs from Spain, Germany, and Maghreb suppliers have increased cross-dock volumes near assembly clusters. Finished vehicle pre-delivery inspection hubs near major metros have expanded, which shortens dealer handover cycles. The French network is set to benefit from tighter SLA governance and higher visibility across OEM, 3PL, and carrier interfaces.

The United Kingdom is expected to post a CAGR of 6.6% during 2025–2035, compared with an estimated 5.4% in 2020–2024. Earlier growth was held back by model cycle gaps, customs frictions, and port congestion that raised dwell and demurrage. The step-up to 6.6% is explained by a recovery in premium exports, higher EV component flows, and improved vessel scheduling at key ro-ro ports. Rail-served inland terminals have taken share for northbound distribution, while parts networks use dynamic slotting and vendor-managed inventory to lift fill rates. Aftermarket e-commerce has grown, which increases small-parcel and two-man deliveries for bulky items. In short, better lane reliability, richer value-added services, and improved asset turns have raised the UK growth curve.

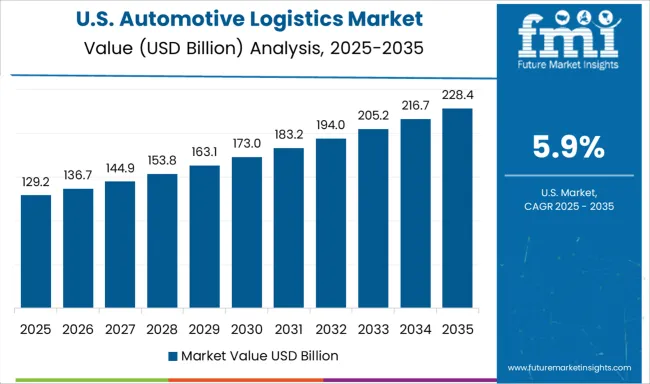

The United States is projected to grow at 5.9% during 2025–2035. Pickup and SUV volumes keep outbound networks busy, while plant-adjacent yards and rail ramps balance cycle times. Ocean imports of parts and EV components require appointment-based drayage and better chassis availability at gateways. Inland intermodal has improved reliability on key corridors, stabilizing finished vehicle lead times to Midwest and Southeast dealers. Aftermarket parts programs rely on regional DCs, zone skipping, and late cut-offs that support same-day ship promises. Network design has favored pool points near population centers, which cuts stem miles and improves trailer utilization. The USA remains a mature market where incremental gains come from disciplined yard management and precision scheduling.

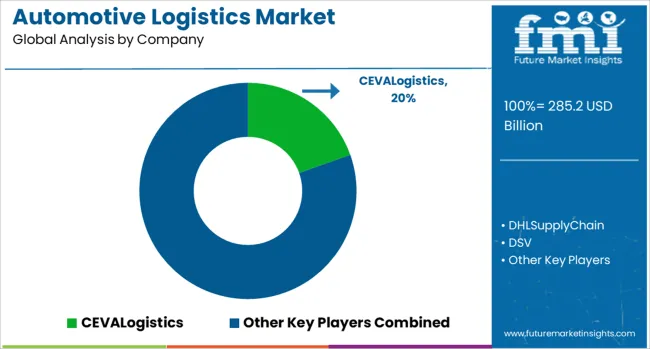

The automotive logistics market is shaped by global leaders such as CEVA Logistics, DHL Supply Chain, DSV, Expeditors International, Imperial Logistics, Kuehne + Nagel, Panalpina, Ryder System, SNCF Logistics, and XPO Logistics. These companies provide integrated solutions covering inbound parts logistics, outbound finished vehicle transport, aftermarket distribution, and value-added services like pre-delivery inspections and sequencing. DHL Supply Chain leverages its extensive warehousing and contract logistics expertise to serve OEM assembly plants and aftermarket networks. CEVA Logistics maintains strong partnerships with global automakers, focusing on multimodal transport and vendor-managed inventory solutions. Kuehne + Nagel emphasizes digital freight platforms and visibility tools for end-to-end supply chain management. XPO Logistics specializes in just-in-sequence delivery and cross-border flows, particularly in North America and Europe.

DSV combines road, air, and sea freight to optimize multimodal connectivity for automotive components and finished vehicles, while Expeditors International focuses on customs compliance and time-definite services for high-value automotive parts. Imperial Logistics strengthens its presence in emerging markets by integrating regional trucking networks with OEM manufacturing hubs. Panalpina (now part of DSV) and SNCF Logistics have invested in rail-road intermodal solutions to reduce transit times and costs, especially in Europe. Ryder System plays a significant role in fleet management and dedicated transportation solutions for automotive OEMs. Competitive strategies in this market include digital platform integration, investment in EV battery logistics capabilities, expansion of ro-ro terminal access, and deployment of temperature-controlled solutions for sensitive components. The success of these players will rely on enhancing visibility, improving delivery reliability, and meeting evolving OEM requirements in a rapidly transforming mobility landscape.

Recent 2025 Automotive Logistics Developments

Kuehne+Nagel (Mar 24, 2025) consolidated and doubled cross-dock capacity at the U.S.–Mexico border in Laredo, Texas, adding an FTZ to streamline duties. The site will be operational from mid-April.

CEVA Logistics / CMA CGM (Apr 27, 2025) agreed to acquire Borusan’s logistics arm in Turkey for $440M, materially expanding warehousing, ground transport, and finished-vehicle logistics exposure. The deal is pending regulatory approval.

| Item | Value |

|---|---|

| Quantitative Units | USD 285.2 Billion |

| Service | Inbound, Outbound, Reverse, and Aftermarket |

| Transportation | Road, Rail, Sea, and Air |

| Vehicle | Passenger car and Commercial vehicle |

| Distribution | Domestic and International |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | CEVALogistics, DHLSupplyChain, DSV, ExpeditorsInternational, ImperialLogistics, Kuehne+Nagel, Panalpina, RyderSystem, SNCFLogistics, and XPLogistics |

| Additional Attributes | Dollar sales, share, key regional growth hotspots, competitive benchmarking, technology adoption in fleet operations, regulatory impacts, cost efficiency metrics, and emerging OEM–logistics partnerships. |

The global automotive logistics market is estimated to be valued at USD 285.2 billion in 2025.

The market size for the automotive logistics market is projected to reach USD 555.8 billion by 2035.

The automotive logistics market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in automotive logistics market are inbound, outbound, reverse and aftermarket.

In terms of transportation, road segment to command 41.7% share in the automotive logistics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Logistics Management Software Market Size and Share Forecast Outlook 2025 to 2035

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Logistics Packaging Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA