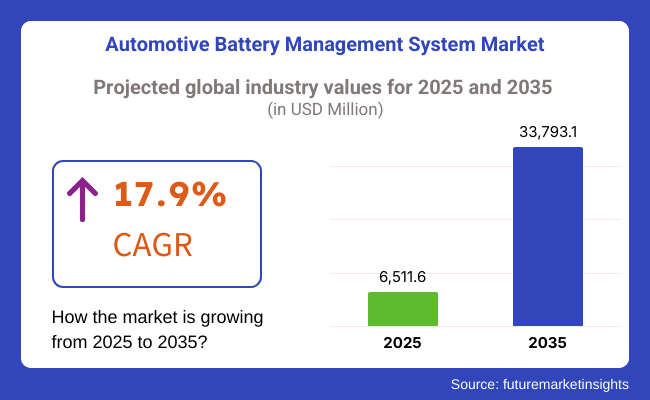

The Automotive Battery Management System (BMS) market is poised for remarkable growth over the next decade, driven by the rapid adoption of electric vehicles (EVs), advancements in battery technologies, and stringent regulations for energy efficiency and vehicle safety. The market is projected to grow from USD 6,511.6 million in 2025 to USD 33,793.1 million by 2035, at a compound annual growth rate (CAGR) of 17.9% during the forecast period.

The automotive Battery Management System (BMS) market is at the forefront of the modern era, during that time it was only but the need for the electric cars and hybrid vehicles, which battery management of the BMS is the main parameter for optimal performance.

This battery management capability is what the electric and hybrid cars are basically made up of. The major improvements that have been made in the areas of battery technology, battery monitoring, thermal management, and predictive maintenance are primarily driven by the industry's focus on energy efficiency and battery longevity.

The considerable progress accomplished in these three areas has been further complemented by the introduction of strict government rules that require batteries to adhere to certain safety and performance standards, thereby promoting the market.

Application of machine learning (ML) and Internet of Things (IoT) in BMS technology has resulted in the improvement of battery management capabilities such as real-time monitoring, predictive analytics, and performance optimization and thus, the solutions are offered in a more efficient and smart way.

The development of this technology not only increases the lifespan and safety of batteries but also supports the performance of electric vehicles and hybrid vehicles as a whole and in that way they create innovative opportunities in the market. The comprehensive automotive BMS is the augmentation of all these mentioned factors; its place as an important part in the design of new transportation technologies is indisputable.

The Automotive BMS market is poised to experience tremendous growth in the forthcoming decade, primarily due to the electrification of the transportation sector and the advent of modern battery technology.

With the automakers and battery builders focusing on the enhancement of battery efficiency, durability, and safety, BMS solutions will indeed be among the decisive factors in the operation of future mobility. Coping with the regulations, standardizations, and the breakthroughs in AI-driven monitoring will be the pathways for a sustainable and effective energy conversion in motor vehicle manufacturing.

Nоrth America is the most fast-moving region in e-mobility revolution, located mostly in the USA and Canada which are very keen on carbon emission control and innovation of green technologies that are moving society to electric mobility.

Tesla and GM are the top market players present in the region and so the funds funneled into EV R&D projects are in the region. California’s bypassing emissions standards, which are now followed by other states, are crucial in the promotion of electric mobility. The continent is likely to continue to lead the way in e-mobility due to further improvements in e-vehicle technology and networks.

Europe is still the main place for electric vehicles with firm carbon neutrality targets and government aid to electric mobility being the backbone of the market. With stringent emissions regulations and significant incentives for consumers and manufacturers, Germany, France, and the UK lead the pack in EV adoption. The European Union's Green Deal, along with measures like the Fit for 55 package, is aimed at effectively reducing greenhouse gas emissions, while sales of EVs are high as a result of this policy.

Automotive companies like Volkswagen and BMW are at the forefront of EV development through massive investments, while the region is also profiting from the charging network growth. Europe's assertive push for the adoption of public transport also plays a substantive role in the global EV market, which it has just cemented.

Asia-Pacific Chapter is very potent electric vehicle market driven largely by China the largest producer and consumer in the world. The Chinese Government's immense subsidies, subsidies for battery recycling, and substantial investments in battery manufacturing and recycling technologies are responsible for the shift. Additionally, the region also benefits from big players in the sector such as BYD and NIO.

The growth of the region is supported by India and Japan, with India the one promoting EVs with the offering of tax rebates and the setting up of charging networks. With the increasing investments clean energy and infrastructures, the Asia-pacific market EM is expected to lead in EV production and build a sustainable transport future.

Outside of the fast-emerging areas such as Latin America, the Middle East, and Africa, the electric vehicle market is finding acceptance through slow but steady adaptation. Latin America has Brazil and Mexico actively probing through projects designed for EV infrastructure and incentives, though economic barriers have delayed the uptake of such equipment.

The Middle East stands notably for UAE and Saudi Arabia's transition to EVs carving out their identity as the region pursuing greener methods and at the same time broadening their energy mix. Although Africa is currently a minor player, it is studying electrification, especially in cities, as it seeks to control pollution and boost energy efficiency. These, while on their emerging way, have potentials in the EV industry that are not being used yet.

Challenges

High Initial Investment Costs

The Battery Management Systems (BMS) are being adopted by the electric vehicle manufacturers and battery producers due to the substantial initial costs incurred. The addition of BMS components and the requirement for advanced hardware and software make the total costs high. For the manufacturers operating on a smaller scale or for the new entrants to the market, this is a huge financial strain that will be borne by them, thereby the BMS technologies will not be able to achieve high rates of prevalence.

Moreover, the initial investment of the infrastructure establishment and the interaction with already existing systems can be the reason for the small companies to avoid the technology thus curtailing growth prospects for BMS providers. Cost-reducing innovations and scalable solutions are the keys to overcoming such challenges, making BMS more available for a larger group of stakeholders.

Complex Integration Processes

Installing BMS systems in electric vehicles (EVs), or other energy storage systems is quite hard and needs specialized technical know-how and considerable testing to carry out it. Interchangeable battery types, vehicle types, and power source infrastructure are major existing problems.

A smooth integration process is important for the security, productivity, and effectiveness of the EVs. Nevertheless, the absence of agreements of common protocols between the different manufacturers and battery technologies is the factor that turns this should be easy solution into the difficult problem.

As a result, these factors could delay projects, cause technical problems which will lead to higher production costs and longer time-to-market for new models. Partnering and standardization across the parties in the industry are necessary to facilitate the integration process and guarantee the proper deployment in the whole sector.

Opportunities

Technological Advancements in Solid-State Batteries

Solid-state batteries realize the promise of new technological capabilities that deliver a quick and effective answer to the efficiency, energy density, and safety issues of electrical vehicles and energy storage systems. In this battery design, a solid electrolyte is employed instead of a liquid one, which leads to the benefits of a longer battery life, faster charging, and lower risks of overheating or fire.

Apart from the newly developed systems of solid-state batteries, the need for the high-end Battery Management Systems (BMS) would be enormous to ensure the highest performance and safety standards. These are the BMS manufacturers' avenue to the initiation of state-of-the-art solution, which will be exciting for the next-generation battery technology they are going to use, hence setting them up for growth in the energy storage industry, which is undergoing a makeover.

AI-Driven BMS Solutions and Second-Life Battery Applications

The addition of Artificial Intelligence (AI) into Battery Management Systems has significant growth possibilities by allowing predictive maintenance, performance optimization, and real-time monitoring. The AI will boost the lifecycle of the batteries by analyzing data in huge quantities which is a failure prevention method. Besides, the second life battery applications, in which the used EV batteries are recycled to be used for stationary storage, provide another good chance.

As the demand for renewable energy storage accelerates, the BMS for second-life batteries will become more and more critical. These new programs in AI and the repurposing of batteries will drive innovation, reduce costs, and create new income sources for BMS providers, thereby widening the market opportunities.

The Automotive Battery Management System (BMS) market has seen a substantial growth curve over the last 4 years, thanks to the increased acceptance of electric vehicles (EVs), support of government initiatives to switch to clean energy, and extra improvements made on lithium-ion battery technology.

The demand for battery efficiency, safety, and lifecycle optimization has sped up the integration of smart BMS solutions in passenger and commercial vehicles. On top of this, the increasing connections of vehicles to the internet and the emergence of self-driving ones have made the requirement of advanced battery monitoring and predictive analytics more urgent.

BMS will further transform in the process of the next stage of development from 2025 to 2035, which will be led by the inventions in solid batteries, AI-powered diagnostics, and cybersecurity. As the global shift progresses to totally electrified transport, the controlling of BMS will thusn be more and more essential for optimizing battery use and having an eco-friendly energy source.

Future Market Outlook 2025 to 2035

BMS will play the main role in the energy storing solution of the future, as it will guarantee the automotive batteries' efficiency, safety, and longevity. This paradigm shift will primarily rely on AI-powered BMS, which, along with the advent of predictive maintenance, will allow for optimal charging status. With the ascent of solid-state batteries, the BMS will need to integrate more energy and new chemical compositions.

The applications of vehicle-to-grid (V2G) technology will be more realistic, adding smart, technical infrastructures, and stretching the potential of solar electricity. In addition, the second-life battery business in conjunction with renewable energy will broaden the market and reaffirm the battery lake sustainability mantra. The future of the BMS market will be characterized by innovation, resilience, and realized global electrification goals.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Stricter emissions regulations and incentives for EV adoption. |

| Technological Advancements | Adoption of cloud-based BMS and real-time battery analytics. |

| Industry-Specific Demand | High demand in passenger EVs, hybrid vehicles, and commercial fleets. |

| Sustainability & Circular Economy | Focus on battery lifespan extension and recycling initiatives. |

| Market Growth Drivers | Increasing EV adoption, battery efficiency improvements, and cost reductions. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Global mandates for carbon neutrality and battery recycling policies. |

| Technological Advancements | AI-driven BMS, solid-state battery integration, and quantum computing for energy management. |

| Industry-Specific Demand | Expansion into energy storage systems, smart grids, and second-life battery applications. |

| Sustainability & Circular Economy | Widespread adoption of closed-loop battery ecosystems and biodegradable battery materials. |

| Market Growth Drivers | Advanced energy storage solutions, wireless BMS, and next-generation battery technologies. |

The growth of the USA Automotive BMS market is primarily driven by the increasing adoption of electric vehicles, the incentives provided by the government to promote clean transportation, and the elevation of the research and development in battery technology.

The USA hosts several of the world's leading electric vehicle manufacturers and battery developers, which in turn, are the main conveyor of innovation in BMS solutions. The regulations issued by both federal and state governments mandating all companies to meet stricter emissions standards play an important role in speeding up the development of battery management systems.

The advent of AI-integrated BMS has made it possible to reduce energy consumption and consequently, the lifespan of the battery in modern EVs has increased. Investments made in EV charging infrastructure as well as smart grid integration are other relevant factors contributing to demand for BMS.

Among other reasons, the fact that logistics and transportation companies increasingly embrace fleet electrification is what can be referenced as the prime equivalent for the market push.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 16.8% |

The BMS automotive market is growing rapidly in Germany due to its strong automotive industry, high-quality engineering skills, and focus on sustainability.

The top car manufacturers and tech companies are leading the way of the battery revolution, while they are including BMS in their cars and getting benefits of improved energy efficiency. The European Union's strict carbon emission rules and carbon neutrality programs are causing fast electrification of the automotive industry.

The rise of EV charging stations along with the financial support from the government is accelerating the integration of BMS. Furthermore, the research and development in solid-state batteries has led to the emergence of advanced BMS technologies and solutions for next-generation EVs.

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 18.2% |

Japan’s Automotive BMS market is growing steadily, Focus on manufacturing innovative machinery. The mention of the energy conversion and transport sectors by the government is increasing the demand for sophisticated BMS. The administration's green transport policies and net emissions target help the implementation of energy-preserving battery management technologies.

The production of hybrid and electric vehicles by Japan is the driving force behind the BMS requirement. Furthermore, the new-generation BMS applications are possible through the collaboration of car manufacturers and semiconductor companies.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 17.5% |

South Korea's Automotive BMS industry is on a fast track because of the efforts of the main battery manufacturers and the virus of the EV. The nation is one of the major sites in the world for lithium-ion battery production and the companies are heavily investing in the next-gen energy storage system.

Government policies for digital transport and carbon neutrality, in the main, are the accelerators BMS is making inroads. The industry's robots and electronics titans are heralding the trend of applying AI in BMS. Alongside, the rising EV infrastructure and fast-charging networks are bolstering the market demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 17.9% |

Hardware Component Leads Due to Advancements in Battery Monitoring

The hardware segment is a key player in the Automotive Battery Management System (BMS) market, as it is the one responsible for operating with real-time battery management, heat control, and electrical safety.

Important hardware components are battery control units, temperature sensors, microcontrollers, and power management circuits, therefore, making it possible to distribute energy efficiently and increase battery life. Due to the ongoing trend of electric vehicles (EVs) and hybrids, automakers are placing the latest hardware for better battery efficiency as a standard in their vehicles.

The two major players in the market, Asia-Pacific and Europe which are observers of the trend, are the result of government incentives for EV adoption and battery tech innovation. The demand seems to go up for solid-state batteries and fast-charging solutions, this going to be a door opener to the hardware BMS sector develop and drive energy efficiency along with vehicle performance.

Software Segment Expands with AI-Driven Battery Optimization

Software is one of the main pieces in the operation of modern Battery Management Systems (BMS), granting the possibility for real-time diagnostics, predictive analytics, and intelligent battery control.

AI integrated BMS software solutions promote battery efficacy through the analysis of charge-discharge cycles, temperature variations, and energy usage patterns. Wireless BMS (wBMS) technology, as reported by key players such as General Motors and Tesla, is minimizing vehicle weight and wire clutter, hence, improving the overall performance of the system.

Cloud-based BMS platforms and remote battery monitoring solutions are the main drivers for the growth of this market. At the time when EV adoption is climbing internationally, battery optimization driven by software and cybersecurity will be the number one tasks in warranty of secured, recycled and peak performance battery systems.

Lithium-Ion Batteries Dominate the Market with EV Growth

Lithium-ion (Li-ion) batteries have become synonymous with electric and hybrid vehicles, which serve as an impetus to the Advanced Battery Management System (BMS) sectored. Li-ion batteries are superior in that they have got more energy storage capacity, a longer life, and more rapid recharging when weight is put on older substitutes.

The upward trend in the production of EVs, with Tesla, BYD, and Volkswagen as prime examples, is equating to more money in the market for smart BMS applications related to Li-ion batteries. The li-ion battery sector is being positively influenced by government initiatives like EV subsidies in China and Europe's emissions mandates.

Moreover, improvements in solid-state lithium batteries alongside thermal management technologies are driving the battery efficiency up and safety high. With the ongoing rise of EVs, by using artificial intelligence, BMS solutions will effectively be in charge of the entire battery lifespan, status, and risks.

Lead-Acid Batteries Maintain Demand in Commercial and Auxiliary Applications

Despite the fact that lithium-ion technology is on the rise, lead-acid batteries still make themselves available in the market in a notable way as they are used mainly in commercial vehicular systems, backup power systems, and in auxiliary applications. Lead-acid batteries are the right choice because they are cheap, environmentally friendly, and dependable.

They find, thus, a place in internal combustion engine (ICE) vehicles, trucks, and buses. The integration of a battery management system (BMS) in lead-acid batteries has helped increase the reliability of the product by enhancing battery health monitoring, charge cycles optimization, and lifespan extension.

The demand still survives for countries such as India, Brazil, and Africa, whose major concern is economy. The coming of new technologies like improved lead-carbon batteries and smart BMS for fleet management is envisaged to be the saving force for lead-acid batteries, although the sector is all set for a shift toward markets dominated by vehicles.

The market of the Automotive Battery Management System (BMS) is on the rise as the shifting to the electronic and hybrid vehicles, as well as the need for sustainability and energy efficiency are the main drives.

BMS systems are the ones that are responsible for controlling the battery performance by monitoring it and making sure there is optimal operation, safety, and life buy batteries. BMS demand is on the top level, as the automotive industry is moving fast for people to be provided with safer cars, accompanied by lower operational costs through a more effective and dependable BMS.

Preeminent industry players like Continental, LG Energy Solution, and Bosch are placing huge resources into storms, real-time analytics, cybersecurity, and next-gen battery diagnostics for the sake of keeping the competitive edge. At the same time, the latest companies are making a splash with superior precision sensing and BMC chip integration. These chips are the key to compact, low-cost, and scalable solutions for BMS systems.

The technological jump to solely electric and hybrid vehicles, in coordination with stored energy systems, will possibly increase the importance of BMS applications in vehicles. As both sensors and machines develop, BMS will be one of the central energy facilitators, promoting the right use of batteries safely, efficiently, and sustainably in the automotive sector. The market is bound to growth very soon, so there are many chances for both already existing companies and the newcomers.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Continental AG | 12-18% |

| LG Energy Solution | 10-15% |

| Robert Bosch GmbH | 9-13% |

| Analog Devices Inc. | 7-12% |

| NXP Semiconductors | 5-9% |

| Other Companies | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Continental AG | Provides advanced BMS solutions with AI-driven monitoring and cloud integration. |

| LG Energy Solution | Specializes in BMS for EVs with high energy density and thermal management. |

| Robert Bosch GmbH | Develops next-gen BMS with predictive analytics and IoT connectivity. |

| Analog Devices Inc. | Focuses on precision BMS sensors and battery diagnostics. |

| NXP Semiconductors | Offers highly integrated BMS chips with real-time processing capabilities. |

Key Company Insights

Continental AG

Continental AG is one of the biggest players in the BMS market, which is leading with innovative solutions for electric and hybrid vehicles. The company with its system incorporates AI-powered monitoring, cloud-based analytics, and instant diagnostics to improve the battery performance and life.

In addition to that, Continental has a modular and scalable BMS architecture which it compares to the automotive industry and claims is the best value for money and provides a solution to the energy crisis. Continental is the first company in the industry to apply cybersecurity and data privacy to BMS design.

LG Energy Solution

LG Energy Solutions is a big battery producer and is a valuable player in the BMS business. The firm provides the most up-to-date battery management techniques for EV batteries related to thermal management, state-of-charge estimation, and balancing of the cells.

LG Energy Solution partners with big global car manufacturers to help them optimize battery performance via AI and together design the next generation of energy solutions.

Robert Bosch GmbH

Bosch is the market leader in the BMS technology sector, with an ambitious goal of developing IoT-based smart battery management and predictive analytics. The company's BMS solutions are specially created to effectively increase battery life, safety, and efficiency in electric and hybrid vehicles.

Bosch is funding part of the project which focuses on artificial machine learning techniques that predict battery lifetime and low energy dies which charge the battery. Also, through the strong connections in both the automotive and renewable energy sectors, Bosch is a leader in the development of BMS innovations.

Analog Devices Inc.

Analog Devices is involved in precision battery monitoring and diagnostics which stand for the supply of BMS sensors that are accurate and can be provided for both the EV and energy storage sectors.

The firm's distinct feature in measuring voltage, current, and temperature of battery output and capacity is that these factors influence the performance of the battery, hence, if you buy their products, you will have effective and efficient batteries. They are also in the process of the development of a BMS chip that uses less energy and is wire-free for battery communication. Apart from the chips, they also have a wireless module, thus being a market leader.

NXP Semiconductors

NXP Semiconductors is the supplier of BMS-Solutions that are highly integrated and support real-time processing. The company lays emphasis on secure data processing to ensure that the operation of the batteries on electric vehicles will be safe and efficient.

NXP's multi-cell battery monitoring chips not only allow the high-speed data acquisition but also the fault detection proving the push into the reformative BMS market is strong. In addition, the company has successfully widened its market network by teaming up with car manufacturers (OEMs) and battery manufacturers.

In terms of Vehicle Type: the industry is divided into Hardware, Software

In terms of System Type, the industry is divided into Standalone BMS, Integrated BMS

In terms of Battery Type, the industry is divided into Lithium-ion, Lead-acid, Other Batteries

In terms of Topology, the industry is divided into Modular, Centralized, Distributed

In terms of Application, the industry is divided into Passenger Vehicles, Commercial Vehicles, Other Vehicles

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The global Automotive Battery Management System Market is projected to reach USD 6,511.6 million by the end of 2025.

The market is anticipated to grow at a CAGR of 17.9% over the assessment period.

By 2035, the Automotive Battery Management System Market is expected to reach USD 33,793.1 million.

The electric vehicle (EV) segment is expected to dominate the Automotive Battery Management System (BMS) market.

Major companies operating in the Automotive Battery Management System Market include Pressure Texas Instruments, Panasonic Corporation, Denso Corporation, Renesas Electronics, STMicroelectronics, Hitachi Energy, Infineon Technologies.

Table 1: Global Market Value (US$ million) Forecast by Region, 2017 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2017 to 2033

Table 3: Global Market Value (US$ million) Forecast by Vehicle Type, 2017 to 2033

Table 4: Global Market Volume (Units) Forecast by Vehicle Type, 2017 to 2033

Table 5: Global Market Value (US$ million) Forecast by Connection Topology, 2017 to 2033

Table 6: Global Market Volume (Units) Forecast by Connection Topology, 2017 to 2033

Table 7: Global Market Value (US$ million) Forecast by Sales Channel, 2017 to 2033

Table 8: Global Market Volume (Units) Forecast by Sales Channel, 2017 to 2033

Table 9: North America Market Value (US$ million) Forecast by Country, 2017 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2017 to 2033

Table 11: North America Market Value (US$ million) Forecast by Vehicle Type, 2017 to 2033

Table 12: North America Market Volume (Units) Forecast by Vehicle Type, 2017 to 2033

Table 13: North America Market Value (US$ million) Forecast by Connection Topology, 2017 to 2033

Table 14: North America Market Volume (Units) Forecast by Connection Topology, 2017 to 2033

Table 15: North America Market Value (US$ million) Forecast by Sales Channel, 2017 to 2033

Table 16: North America Market Volume (Units) Forecast by Sales Channel, 2017 to 2033

Table 17: Latin America Market Value (US$ million) Forecast by Country, 2017 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2017 to 2033

Table 19: Latin America Market Value (US$ million) Forecast by Vehicle Type, 2017 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Vehicle Type, 2017 to 2033

Table 21: Latin America Market Value (US$ million) Forecast by Connection Topology, 2017 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Connection Topology, 2017 to 2033

Table 23: Latin America Market Value (US$ million) Forecast by Sales Channel, 2017 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Sales Channel, 2017 to 2033

Table 25: Europe Market Value (US$ million) Forecast by Country, 2017 to 2033

Table 26: Europe Market Volume (Units) Forecast by Country, 2017 to 2033

Table 27: Europe Market Value (US$ million) Forecast by Vehicle Type, 2017 to 2033

Table 28: Europe Market Volume (Units) Forecast by Vehicle Type, 2017 to 2033

Table 29: Europe Market Value (US$ million) Forecast by Connection Topology, 2017 to 2033

Table 30: Europe Market Volume (Units) Forecast by Connection Topology, 2017 to 2033

Table 31: Europe Market Value (US$ million) Forecast by Sales Channel, 2017 to 2033

Table 32: Europe Market Volume (Units) Forecast by Sales Channel, 2017 to 2033

Table 33: APEJ Market Value (US$ million) Forecast by Country, 2017 to 2033

Table 34: APEJ Market Volume (Units) Forecast by Country, 2017 to 2033

Table 35: APEJ Market Value (US$ million) Forecast by Vehicle Type, 2017 to 2033

Table 36: APEJ Market Volume (Units) Forecast by Vehicle Type, 2017 to 2033

Table 37: APEJ Market Value (US$ million) Forecast by Connection Topology, 2017 to 2033

Table 38: APEJ Market Volume (Units) Forecast by Connection Topology, 2017 to 2033

Table 39: APEJ Market Value (US$ million) Forecast by Sales Channel, 2017 to 2033

Table 40: APEJ Market Volume (Units) Forecast by Sales Channel, 2017 to 2033

Table 41: Japan Market Value (US$ million) Forecast by Country, 2017 to 2033

Table 42: Japan Market Volume (Units) Forecast by Country, 2017 to 2033

Table 43: Japan Market Value (US$ million) Forecast by Vehicle Type, 2017 to 2033

Table 44: Japan Market Volume (Units) Forecast by Vehicle Type, 2017 to 2033

Table 45: Japan Market Value (US$ million) Forecast by Connection Topology, 2017 to 2033

Table 46: Japan Market Volume (Units) Forecast by Connection Topology, 2017 to 2033

Table 47: Japan Market Value (US$ million) Forecast by Sales Channel, 2017 to 2033

Table 48: Japan Market Volume (Units) Forecast by Sales Channel, 2017 to 2033

Table 49: MEA Market Value (US$ million) Forecast by Country, 2017 to 2033

Table 50: MEA Market Volume (Units) Forecast by Country, 2017 to 2033

Table 51: MEA Market Value (US$ million) Forecast by Vehicle Type, 2017 to 2033

Table 52: MEA Market Volume (Units) Forecast by Vehicle Type, 2017 to 2033

Table 53: MEA Market Value (US$ million) Forecast by Connection Topology, 2017 to 2033

Table 54: MEA Market Volume (Units) Forecast by Connection Topology, 2017 to 2033

Table 55: MEA Market Value (US$ million) Forecast by Sales Channel, 2017 to 2033

Table 56: MEA Market Volume (Units) Forecast by Sales Channel, 2017 to 2033

Figure 1: Global Market Value (US$ million) by Vehicle Type, 2023 to 2033

Figure 2: Global Market Value (US$ million) by Connection Topology, 2023 to 2033

Figure 3: Global Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 4: Global Market Value (US$ million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ million) Analysis by Region, 2017 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2017 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ million) Analysis by Vehicle Type, 2017 to 2033

Figure 10: Global Market Volume (Units) Analysis by Vehicle Type, 2017 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 13: Global Market Value (US$ million) Analysis by Connection Topology, 2017 to 2033

Figure 14: Global Market Volume (Units) Analysis by Connection Topology, 2017 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Connection Topology, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Connection Topology, 2023 to 2033

Figure 17: Global Market Value (US$ million) Analysis by Sales Channel, 2017 to 2033

Figure 18: Global Market Volume (Units) Analysis by Sales Channel, 2017 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Connection Topology, 2023 to 2033

Figure 23: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ million) by Vehicle Type, 2023 to 2033

Figure 26: North America Market Value (US$ million) by Connection Topology, 2023 to 2033

Figure 27: North America Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 28: North America Market Value (US$ million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ million) Analysis by Country, 2017 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ million) Analysis by Vehicle Type, 2017 to 2033

Figure 34: North America Market Volume (Units) Analysis by Vehicle Type, 2017 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 37: North America Market Value (US$ million) Analysis by Connection Topology, 2017 to 2033

Figure 38: North America Market Volume (Units) Analysis by Connection Topology, 2017 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Connection Topology, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Connection Topology, 2023 to 2033

Figure 41: North America Market Value (US$ million) Analysis by Sales Channel, 2017 to 2033

Figure 42: North America Market Volume (Units) Analysis by Sales Channel, 2017 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Connection Topology, 2023 to 2033

Figure 47: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ million) by Vehicle Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ million) by Connection Topology, 2023 to 2033

Figure 51: Latin America Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ million) Analysis by Country, 2017 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ million) Analysis by Vehicle Type, 2017 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Vehicle Type, 2017 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ million) Analysis by Connection Topology, 2017 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Connection Topology, 2017 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Connection Topology, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Connection Topology, 2023 to 2033

Figure 65: Latin America Market Value (US$ million) Analysis by Sales Channel, 2017 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Sales Channel, 2017 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Connection Topology, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ million) by Vehicle Type, 2023 to 2033

Figure 74: Europe Market Value (US$ million) by Connection Topology, 2023 to 2033

Figure 75: Europe Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 76: Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ million) Analysis by Country, 2017 to 2033

Figure 78: Europe Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ million) Analysis by Vehicle Type, 2017 to 2033

Figure 82: Europe Market Volume (Units) Analysis by Vehicle Type, 2017 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 85: Europe Market Value (US$ million) Analysis by Connection Topology, 2017 to 2033

Figure 86: Europe Market Volume (Units) Analysis by Connection Topology, 2017 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Connection Topology, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Connection Topology, 2023 to 2033

Figure 89: Europe Market Value (US$ million) Analysis by Sales Channel, 2017 to 2033

Figure 90: Europe Market Volume (Units) Analysis by Sales Channel, 2017 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 93: Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by Connection Topology, 2023 to 2033

Figure 95: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: APEJ Market Value (US$ million) by Vehicle Type, 2023 to 2033

Figure 98: APEJ Market Value (US$ million) by Connection Topology, 2023 to 2033

Figure 99: APEJ Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 100: APEJ Market Value (US$ million) by Country, 2023 to 2033

Figure 101: APEJ Market Value (US$ million) Analysis by Country, 2017 to 2033

Figure 102: APEJ Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 103: APEJ Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: APEJ Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: APEJ Market Value (US$ million) Analysis by Vehicle Type, 2017 to 2033

Figure 106: APEJ Market Volume (Units) Analysis by Vehicle Type, 2017 to 2033

Figure 107: APEJ Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 108: APEJ Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 109: APEJ Market Value (US$ million) Analysis by Connection Topology, 2017 to 2033

Figure 110: APEJ Market Volume (Units) Analysis by Connection Topology, 2017 to 2033

Figure 111: APEJ Market Value Share (%) and BPS Analysis by Connection Topology, 2023 to 2033

Figure 112: APEJ Market Y-o-Y Growth (%) Projections by Connection Topology, 2023 to 2033

Figure 113: APEJ Market Value (US$ million) Analysis by Sales Channel, 2017 to 2033

Figure 114: APEJ Market Volume (Units) Analysis by Sales Channel, 2017 to 2033

Figure 115: APEJ Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 116: APEJ Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 117: APEJ Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 118: APEJ Market Attractiveness by Connection Topology, 2023 to 2033

Figure 119: APEJ Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: APEJ Market Attractiveness by Country, 2023 to 2033

Figure 121: Japan Market Value (US$ million) by Vehicle Type, 2023 to 2033

Figure 122: Japan Market Value (US$ million) by Connection Topology, 2023 to 2033

Figure 123: Japan Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 124: Japan Market Value (US$ million) by Country, 2023 to 2033

Figure 125: Japan Market Value (US$ million) Analysis by Country, 2017 to 2033

Figure 126: Japan Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 127: Japan Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: Japan Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: Japan Market Value (US$ million) Analysis by Vehicle Type, 2017 to 2033

Figure 130: Japan Market Volume (Units) Analysis by Vehicle Type, 2017 to 2033

Figure 131: Japan Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 132: Japan Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 133: Japan Market Value (US$ million) Analysis by Connection Topology, 2017 to 2033

Figure 134: Japan Market Volume (Units) Analysis by Connection Topology, 2017 to 2033

Figure 135: Japan Market Value Share (%) and BPS Analysis by Connection Topology, 2023 to 2033

Figure 136: Japan Market Y-o-Y Growth (%) Projections by Connection Topology, 2023 to 2033

Figure 137: Japan Market Value (US$ million) Analysis by Sales Channel, 2017 to 2033

Figure 138: Japan Market Volume (Units) Analysis by Sales Channel, 2017 to 2033

Figure 139: Japan Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 140: Japan Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 141: Japan Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 142: Japan Market Attractiveness by Connection Topology, 2023 to 2033

Figure 143: Japan Market Attractiveness by Sales Channel, 2023 to 2033

Figure 144: Japan Market Attractiveness by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ million) by Vehicle Type, 2023 to 2033

Figure 146: MEA Market Value (US$ million) by Connection Topology, 2023 to 2033

Figure 147: MEA Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 148: MEA Market Value (US$ million) by Country, 2023 to 2033

Figure 149: MEA Market Value (US$ million) Analysis by Country, 2017 to 2033

Figure 150: MEA Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 151: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: MEA Market Value (US$ million) Analysis by Vehicle Type, 2017 to 2033

Figure 154: MEA Market Volume (Units) Analysis by Vehicle Type, 2017 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 157: MEA Market Value (US$ million) Analysis by Connection Topology, 2017 to 2033

Figure 158: MEA Market Volume (Units) Analysis by Connection Topology, 2017 to 2033

Figure 159: MEA Market Value Share (%) and BPS Analysis by Connection Topology, 2023 to 2033

Figure 160: MEA Market Y-o-Y Growth (%) Projections by Connection Topology, 2023 to 2033

Figure 161: MEA Market Value (US$ million) Analysis by Sales Channel, 2017 to 2033

Figure 162: MEA Market Volume (Units) Analysis by Sales Channel, 2017 to 2033

Figure 163: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 164: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 165: MEA Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 166: MEA Market Attractiveness by Connection Topology, 2023 to 2033

Figure 167: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Figure 168: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA