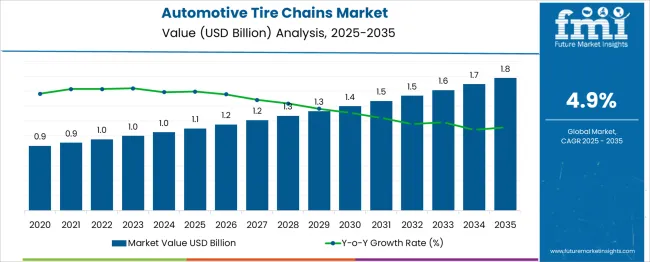

The Automotive Tire Chains Market is estimated to be valued at USD 1.1 billion in 2025 and is projected to reach USD 1.8 billion by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period.

The automotive tire chains market exhibits a slow but steady growth trend throughout the forecast period, expanding from USD 0.9 billion in 2021 to USD 1.3 billion by 2030, resulting in an absolute dollar opportunity of USD 0.4 billion and reflecting a CAGR of approximately 4.2%. The year-on-year values indicate marginal increases, beginning at USD 0.9 billion in 2021 and 2022, followed by a slight rise to USD 1.0 billion in 2023, which remains consistent through 2024 and 2025, signaling a relatively flat initial phase driven by mature demand and limited seasonal dependency in developed markets.

Post-2025, growth becomes more noticeable as the market value reaches USD 1.1 billion in 2026, USD 1.2 billion in 2027 and 2028, and finally USD 1.3 billion in 2029 and 2030. This moderate increase is attributed to the continued requirement for tire chains in regions with harsh winters, mountainous terrains, and regulatory mandates for snow traction devices. However, the penetration of all-weather tires and the growing adoption of advanced traction control systems in modern vehicles restrain faster market growth.

Despite the limited expansion, demand persists in commercial and heavy-duty vehicle segments, particularly in logistics operations that operate in snow-prone areas. Manufacturers focusing on lightweight, easy-to-install chains, corrosion-resistant materials, and quick-fit solutions are likely to maintain competitive positioning. Strategic distribution partnerships and customization for heavy vehicles and SUVs will further enhance growth potential, making this market a stable, niche segment within the broader automotive accessories industry.

| Metric | Value |

|---|---|

| Automotive Tire Chains Market Estimated Value in (2025 E) | USD 1.1 billion |

| Automotive Tire Chains Market Forecast Value in (2035 F) | USD 1.8 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

The automotive tire chains industry accounts for a relatively small yet essential share within these broader markets. In the overall automotive tire market, tire chains hold an estimated share of around 0.8–1%, as their usage is limited to seasonal and regional conditions. Within the automotive accessories segment, their contribution is slightly higher, approximately 1–1.2%, driven by demand for winter safety equipment.

In the snow safety gear category, which includes snow socks and studs, tire chains maintain a dominant role, holding a major portion of this specialized niche market. Their share in the overall vehicle safety products market remains modest, below 1%, due to the prevalence of year-round traction technologies and all-weather tires.

Despite these small shares, tire chains are critical in regions where severe winter weather and mandatory traction laws necessitate their use, particularly in Europe, North America, and parts of Asia. The market is supported by increasing emphasis on road safety, government regulations for winter equipment, and the growth of tourism in snow-prone regions.

With advancements in lightweight materials, quick-fit designs, and corrosion-resistant coatings, tire chains are becoming easier to install and maintain, ensuring steady adoption among private car owners and commercial fleet operators. These innovations position tire chains as a vital safety solution in challenging driving conditions.

The automotive tire chains market is experiencing steady demand growth, primarily driven by regulatory mandates for winter driving safety, rising incidences of extreme weather conditions, and expanded commercial transport operations in snow-covered terrains. Tire chains are being increasingly adopted as essential auxiliary equipment for enhancing vehicle grip and control during icy or snowy conditions, especially in regions across North America, Europe, and parts of Asia.

Advances in metallurgy and surface treatment technologies have supported the development of stronger, corrosion-resistant chain materials, enhancing both product life and operational safety. Furthermore, stricter road safety compliance measures introduced by transportation authorities are accelerating the uptake of chain systems among logistics and commercial fleet operators.

Growing emphasis on minimizing road closures and freight delays during winter months has made traction devices a critical investment for businesses. Over the coming years, market expansion is expected to be further supported by innovations in quick-fit mechanisms, integration of smart wear indicators, and collaborations between automotive OEMs and chain system suppliers.

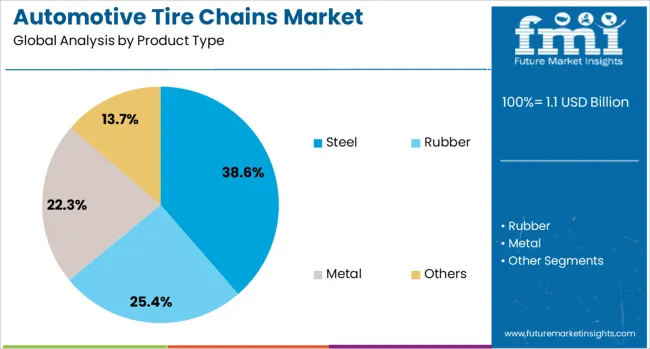

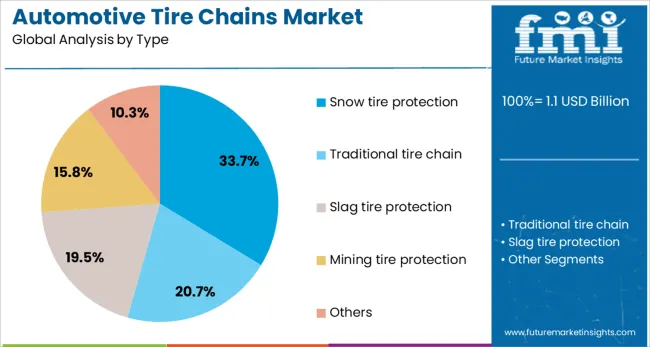

The automotive tire chains market is segmented by product type, vehicle type, distribution channel and geographic regions. The automotive tire chains market is divided by product type into Steel, Rubber, Metal, and Others. In terms of the type of automotive tire chains, the market is classified into Snow tire protection, Traditional tire chain, Slag tire protection, Mining tire protection, and Others.

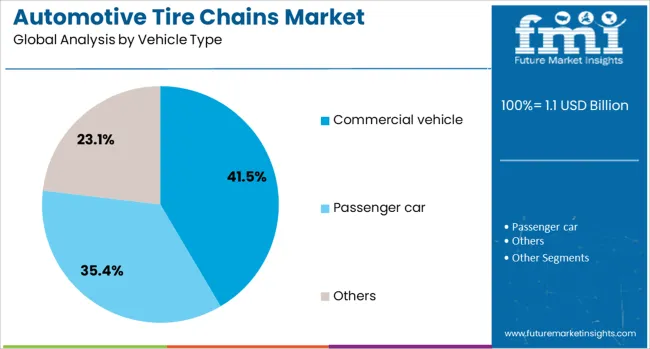

Based on vehicle type, the automotive tire chains market is segmented into commercial vehicles, passenger cars, and Others. The distribution channel of the automotive tire chains market is segmented into Indirect and Direct. Regionally, the automotive tire chains industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Steel is projected to account for 38.6% of the overall revenue share in the automotive tire chains market in 2025, making it the leading product type. This leadership is attributed to the material’s high tensile strength, wear resistance, and ability to provide reliable traction under severe winter conditions.

Steel chains have been widely utilized due to their adaptability across various vehicle categories and terrain types, especially in mountainous and high-altitude routes. Enhanced galvanization and anti-corrosive coatings have improved the lifespan and functionality of steel chains, making them a preferred choice for commercial fleets operating in extreme conditions.

The segment's growth is further reinforced by the affordability of steel chains compared to advanced composite alternatives, along with their compliance with local snow chain usage regulations. The continued dominance of steel has also been supported by advancements in design geometry, enabling efficient self-cleaning and improved grip on ice-covered surfaces, while reducing road surface abrasion.

Snow tire protection is expected to contribute 33.7% of the automotive tire chains market revenue share in 2025, reflecting its dominance among application types. This segment’s growth is being propelled by increased winter weather variability and a rising number of regulatory jurisdictions requiring snow chain usage during specific months or conditions.

Demand for snow tire protection systems has surged as vehicle owners and fleet operators prioritize safety and traction efficiency during snowstorms and black ice events. The widespread compatibility of tire chains with both winter tires and all-season tires has contributed to their increased use in snow-dense regions.

The ability to retrofit vehicles quickly, coupled with easy-to-store designs and durable linkage systems, has further driven segment expansion. Moreover, improvements in installation systems such as automatic tensioning and self-centering features have made snow tire chains more accessible to non-professional drivers, increasing penetration in both personal and fleet markets across Europe and North America.

Commercial vehicles are anticipated to hold 41.5% of the automotive tire chains market revenue share in 2025, making this the leading vehicle type segment. Growth in this segment has been driven by the need for uninterrupted freight and passenger movement during winter months, especially across logistics corridors susceptible to snowfall and icy roads. Fleet managers are prioritizing tire chain installation to comply with transport regulations and avoid penalties or road bans during mandated snow chain periods.

The segment’s dominance is also supported by the increasing deployment of medium and heavy-duty trucks in cross-border cold climate routes, where safety and schedule adherence are paramount. Manufacturers are catering to this segment with high-strength chains designed for heavier axle loads and prolonged usage cycles.

Furthermore, demand is being boosted by growing investments in public transportation systems, including buses operating in winter-prone cities, where traction devices are critical for minimizing service interruptions. As a result, the commercial vehicle category remains a key driver of overall market growth.

Seasonal regulations, e-commerce accessibility, and the need for durable, quick-installation designs are shaping demand for automotive tire chains. Commercial fleets are prioritizing high-performance chains due to legal requirements, operational continuity, and growing reliance on custom-fit, warranty-backed solutions.

The demand for automotive tire chains has been influenced by varying weather conditions in regions with heavy snow and ice. Automotive safety regulations have mandated the use of traction devices during the winter months, creating a structured demand cycle. Rental services and e-commerce distribution have been prioritized by market participants for better accessibility. Chains manufactured from high-grade steel with corrosion-resistant coatings are being used to improve durability and compliance with road standards. Demand from passenger vehicles and light trucks has grown consistently, while fleets have adopted chains for enhanced grip on challenging terrains. Competitive pricing combined with quick-installation designs has been observed as a strong factor that shapes consumer decisions in this segment.

The application of tire chains within logistics and construction fleets has expanded because of requirements for uninterrupted operations in icy conditions. Load-bearing capacity and compatibility with modern tire sizes have been considered essential by operators for efficient movement. Manufacturers have focused on heat-treated alloy chains that exhibit higher performance under stress conditions. Online product demonstrations and compatibility tools have been deployed to guide buyers toward appropriate models. Legal obligations in mountainous areas have created structured procurement by fleet managers. This trend is expected to accelerate as infrastructure projects and mining operations prioritize traction devices for operational continuity under severe weather challenges. Market share is projected to tilt toward vendors offering custom-fit designs and warranty-backed products.

The automotive tire chains market is witnessing increased demand as several countries enforce strict regulations for winter driving safety. Regions such as Europe and North America have implemented mandatory traction requirements during severe weather conditions, pushing both passenger and commercial vehicle owners to adopt tire chains. Government safety campaigns and insurance compliance policies further strengthen this trend, as failure to equip vehicles with proper traction devices can lead to penalties or restricted road access. This regulatory landscape has created a stable and recurring demand, particularly in mountainous areas and snow-prone regions where chains remain the most reliable solution for icy and rugged terrain.

Technological advancements in design and materials are transforming the tire chains market from traditional heavy-metal structures to lightweight, corrosion-resistant alloys and composite solutions. These innovations aim to reduce installation time and improve durability, addressing common consumer concerns about complexity and wear. Quick-fit and self-tightening mechanisms are gaining popularity, catering to drivers who prioritize convenience and performance in harsh conditions. Additionally, manufacturers are developing compact storage solutions and universal fit models to appeal to urban consumers and fleet operators alike. These product enhancements, combined with increasing availability through online channels and automotive accessory networks, are driving higher adoption rates and expanding the market's accessibility across multiple vehicle segments.

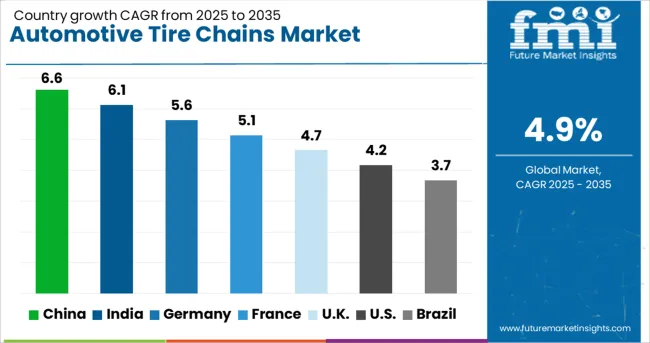

| Country | CAGR |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| France | 5.1% |

| UK | 4.7% |

| USA | 4.2% |

| Brazil | 3.7% |

The automotive tire chains industry, projected to expand at a global CAGR of 4.9% from 2025 to 2035, is experiencing different growth patterns across major markets. A 6.6% CAGR is being recorded in China, a BRICS member, driven by heavy snowfall regions and stringent seasonal safety mandates. India, another BRICS member, is exhibiting a 6.1% CAGR supported by rising adoption in mountainous terrains and growth in fleet-based applications.

Germany, part of the OECD group, is seeing a 5.6% CAGR with a structured demand cycle linked to winter regulations and strong compliance requirements. Lower growth has been noted in the United Kingdom and the United States, both OECD members, at 4.7% and 4.2% respectively, due to mature markets and availability of alternative traction technologies. Higher adoption potential exists in Asia due to expanding e-commerce availability and regional legislation enforcing winter safety standards. The report includes comprehensive insights across 40+ countries, with the top five countries highlighted for strategic reference.

The CAGR in China moved from nearly 5.8% during 2020–2024 to 6.6% for 2025–2035, driven by heightened winter road safety enforcement and consistent snowfall patterns in northern regions. Increased adoption has been recorded across passenger vehicles and light commercial fleets. Provincial regulations have mandated the use of traction devices, while e-commerce platforms have simplified consumer access to advanced chain models. Manufacturing hubs in Hebei and Shandong have scaled operations through the integration of alloy-grade steel processing to meet durability standards. Partnerships between local producers and OEMs have expanded distribution channels.

The CAGR rose from 5.2% in 2020–2024 to 6.1% for 2025–2035, supported by growth in hilly region mobility and legal enforcement of traction requirements during severe winters. Passenger cars in northern states and utility vehicles in the Himalayan terrain contributed strongly to aftermarket demand. Increasing penetration of online marketplaces and dealership-based distribution boosted product reach to semi-urban locations. Investments were directed toward local production hubs in Uttarakhand and Himachal Pradesh, reducing reliance on imports. Price-sensitive buyers leaned toward lightweight designs with quick-fit capability.

Germany’s CAGR advanced from about 4.9% during 2020–2024 to 5.6% in 2025–2035, linked to consistent regulatory compliance under winter tire and chain mandates. High consumer preference for premium quick-installation chains drove premiumization within the segment. Distribution partnerships with auto service networks enhanced product penetration across federal states. Local manufacturers emphasized zinc-coated, corrosion-resistant designs to support extended use in salt-laden roads. Increased attention toward heavy-duty variants for freight carriers boosted industrial traction device demand.

The CAGR shifted from nearly 3.8% in 2020–2024 to 4.7% in 2025–2035, reflecting increased preparedness for winter disruptions and moderate expansion in vehicle ownership across high-altitude areas. Greater reliance on automotive rental services and rising aftermarket sales through digital platforms influenced market performance. Public procurement for emergency services in rural Scotland supported volume stability. Domestic distributors promoted lightweight composite-linked chains to address ease-of-installation concerns among private drivers. E-commerce platforms introduced AI-driven selection interfaces for personalized product recommendations, creating higher conversion rates.

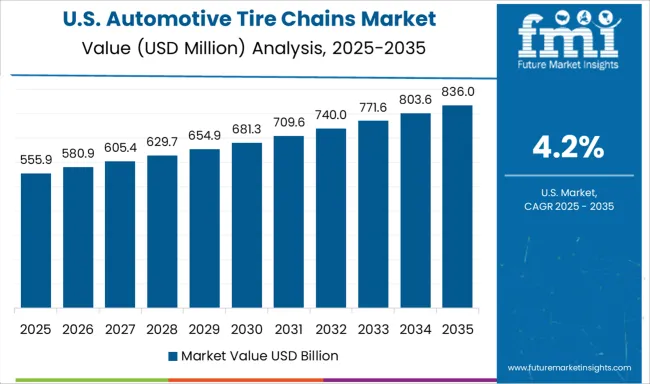

The CAGR climbed from nearly 3.5% during 2020–2024 to 4.2% in 2025–2035, supported by compliance enforcement in mountain passes and an expanding aftermarket through big-box retail partnerships. Commercial freight carriers accelerated procurement programs due to operational mandates in heavy snow corridors. Consumers displayed a higher preference for self-tensioning, low-vibration designs that minimize road wear. Distribution consolidation among regional wholesalers reduced lead times for high-volume buyers. Increased educational campaigns on winter driving safety created an upswing in seasonal purchases across northern states.

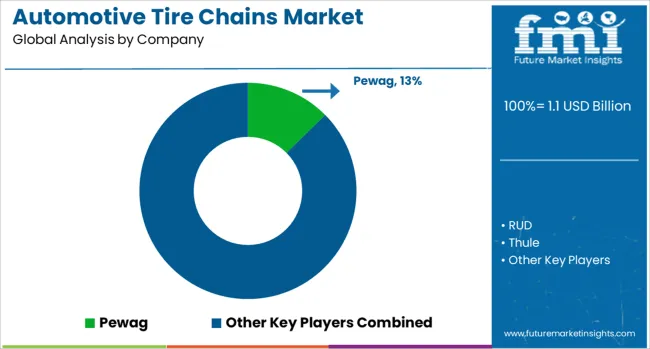

The automotive tire chains market is highly competitive, with leading players focusing on durability, compliance, and ease of use to cater to varying climatic and regulatory demands. Global leaders like Pewag, RUD, and Thule dominate through high-strength alloy construction, corrosion-resistant coatings, and innovative self-tensioning systems, ensuring superior traction and user-friendly installation for both passenger cars and heavy-duty vehicles.

These companies have invested heavily in design optimization to meet stringent winter safety regulations in Europe and North America. Brands such as Maggi, Trygg, and QualityChain are diversifying their portfolios by introducing lightweight chains and hybrid traction devices, leveraging OEM partnerships and online retail platforms to expand their customer base.

In North America, established names like Laclede and Felice have reinforced market penetration by collaborating with major automotive distributors and focusing on quick-installation designs tailored for commercial fleets. Premium specialists such as BABAC and Spikes-Spider have carved a niche with high-performance chains targeting luxury and high-end vehicle segments, emphasizing innovative fastening mechanisms for ease of mounting.

Meanwhile, emerging players including Lambert, Dawson, Gowin, Lianyi, and Shanxing are aggressively expanding in Asia-Pacific and global markets by offering cost-competitive models and custom solutions for diverse terrain conditions, positioning themselves as strong challengers through localized manufacturing and competitive pricing strategies.

In 2024, the automotive tire chains market strategies emphasize regulatory compliance, product innovation, and e-commerce expansion. Manufacturers are introducing lightweight, corrosion-resistant materials and quick-fit systems to simplify installation and attract consumers in snow-prone regions. Strategic partnerships with OEMs and large automotive retailers remain crucial for strengthening distribution networks.

Companies plan to leverage smart design technologies, automated tensioning mechanisms, and expanded digital sales platforms to enhance convenience and accessibility. Rising winter safety regulations, growing demand for premium vehicle accessories, and increasing tourism in mountainous regions will continue to drive adoption, positioning tire chains as essential traction solutions globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.1 Billion |

| Product Type | Steel, Rubber, Metal, and Others |

| Type | Snow tire protection, Traditional tire chain, Slag tire protection, Mining tire protection, and Others |

| Vehicle Type | Commercial vehicle, Passenger car, and Others |

| Distribution Channel | Indirect and Direct |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Pewag, RUD, Thule, Maggi, Trygg, QualityChain, Laclede, Felice, BABAC, Spikes-Spider, Lambert, Dawson, Gowin, Lianyi, and Shanxing |

| Additional Attributes | Dollar sales, market share, pricing benchmarks, demand by vehicle type, seasonal trends, regulatory mandates, competitive landscape, raw material cost impact, distribution channels, and OEM partnerships. |

The global automotive tire chains market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the automotive tire chains market is projected to reach USD 1.8 billion by 2035.

The automotive tire chains market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in automotive tire chains market are steel, rubber, metal and others.

In terms of type, snow tire protection segment to command 33.7% share in the automotive tire chains market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA