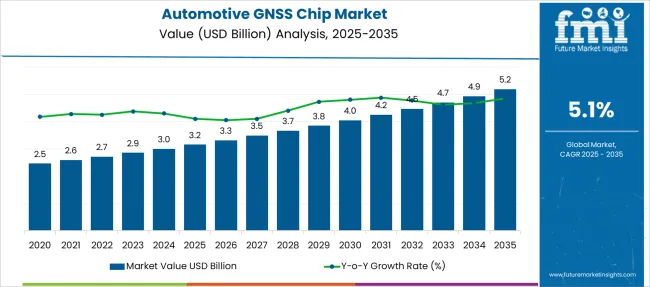

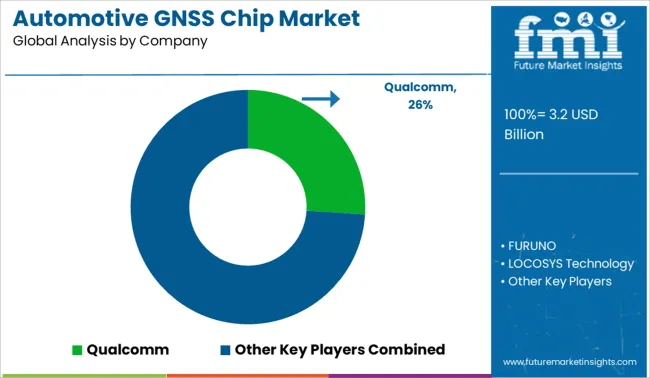

The Automotive GNSS Chip Market is estimated to be valued at USD 3.2 billion in 2025 and is projected to reach USD 5.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period.

| Metric | Value |

|---|---|

| Automotive GNSS Chip Market Estimated Value in (2025 E) | USD 3.2 billion |

| Automotive GNSS Chip Market Forecast Value in (2035 F) | USD 5.2 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

The automotive GNSS chip market is progressing steadily as advancements in connected mobility, regulatory mandates on vehicle tracking, and rising consumer demand for navigation features converge. Integration of GNSS technology into vehicles has been accelerated by the need for precise positioning, compliance with safety regulations, and enhancement of user experience.

Growth is being fostered by innovations in multi-constellation chips, reduced power consumption, and compatibility with autonomous driving systems. Future opportunities are anticipated to emerge from the proliferation of electric vehicles, expansion of smart transportation infrastructure, and increasing penetration of advanced driver assistance systems.

Rising emphasis on real-time data, improved traffic management, and integration of GNSS with other sensors is expected to further solidify its relevance, paving the way for sustained growth and deeper market penetration.

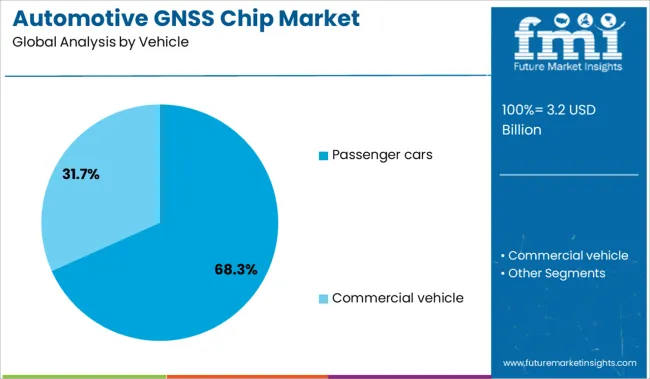

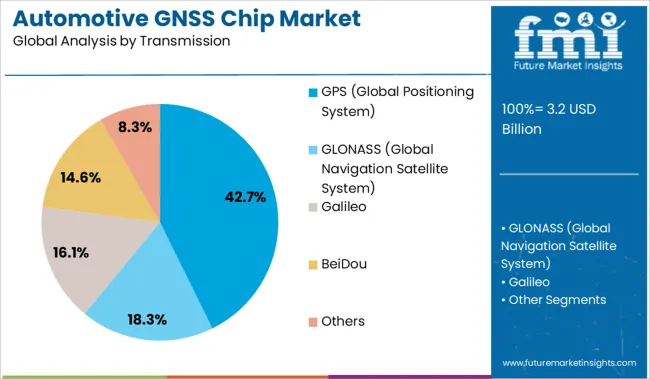

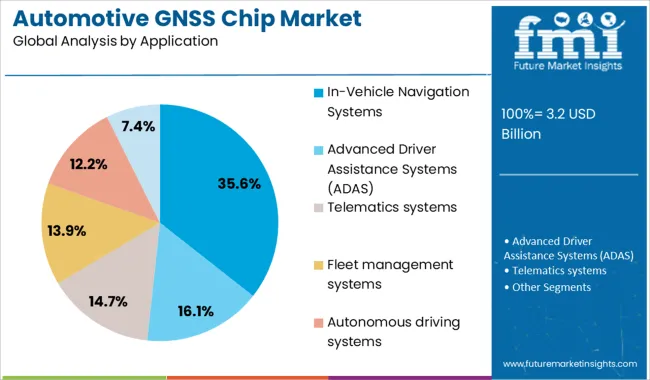

The automotive GNSS chip market is segmented by vehicle, transmission, application, and sales channel and geographic regions. The automotive GNSS chip market is divided into Passenger cars and Commercial vehicles. In terms of transmission of the automotive GNSS chip market is classified into GPS (Global Positioning System), GLONASS (Global Navigation Satellite System), Galileo, BeiDou, and Others. Based on the application of the automotive GNSS chip market, it is segmented into In-Vehicle Navigation Systems, Advanced Driver Assistance Systems (ADAS), Telematics systems, Fleet management systems, Autonomous driving systems, and Others. The automotive GNSS chip market is segmented by sales channel into OEM and Aftermarket. Regionally, the automotive GNSS chip industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by vehicle, passenger cars are projected to hold 68.3% of the total market revenue in 2025, affirming their position as the dominant segment. This leadership has been supported by increasing demand for integrated navigation and connectivity features within personal vehicles.

The growing adoption of mid to high-end passenger cars equipped with factory-installed GNSS-enabled systems has contributed significantly to the segment’s prominence. The ability of passenger cars to serve as platforms for advanced in-vehicle services, combined with rising consumer expectations for convenience and safety, has driven sustained investment in embedded GNSS solutions.

Manufacturers’ focus on differentiating their offerings through enhanced infotainment and navigation capabilities has further strengthened the segment’s position, ensuring its continued dominance in the market.

Segmented by transmission, GPS is expected to account for 42.7% of the automotive GNSS chip market revenue in 2025, maintaining its lead as the preferred transmission technology. This leadership has been shaped by the widespread availability, established infrastructure, and proven reliability of GPS systems across diverse geographies.

Manufacturers have prioritized GPS-based solutions due to their cost efficiency and compatibility with existing vehicle platforms, ensuring seamless integration. The enduring dominance of GPS has also been reinforced by its ability to support a range of applications including navigation, fleet tracking, and emergency response.

Although multi-constellation technologies are emerging, GPS remains the cornerstone for most automotive applications due to its extensive ecosystem and robust support, which continues to sustain its leading share.

When segmented by application, in-vehicle navigation systems are forecast to capture 35.6% of the market revenue in 2025, positioning them as the foremost application segment. This prominence has been driven by increasing consumer demand for real-time route guidance, traffic updates, and location-based services directly integrated into vehicles.

Automakers have been incorporating advanced navigation systems as standard or premium features to enhance user satisfaction and differentiate their offerings. The evolution of intuitive interfaces, voice-activated controls, and integration with smartphones has further increased the appeal of in-vehicle navigation systems.

Rising adoption in both developed and emerging markets, combined with growing awareness of the convenience and safety benefits of onboard navigation, has solidified this segment’s leadership in the automotive GNSS chip market.

GNSS chip demand is accelerating in automotive for navigation, safety, and connectivity. Growth is enabled by standard map-based services, emerging autonomous systems, and regional localization for navigation in vertical-specific vehicle models.

Automotive GNSS chips are experiencing increased adoption across vehicle segments as manufacturers integrate features like advanced driver assistance, geo-fencing, and over-the-air updates. These chips enable precise location tracking essential for lane-level navigation, turn-by-turn directions in dense urban roads, and automatic rerouting during traffic congestion. OEMs in Europe, North America, and Asia standardize on multi-frequency, multi-constellation chips (GPS, Galileo, BeiDou, GLONASS) to deliver robust performance even in tunnels and city canyons. Automotive-grade GNSS units provide high reliability in temperature extremes and comply with safety standards. Taxi fleets, shared mobility platforms, and logistics operators also adopt GNSS-based systems for fleet tracking, route optimization, and passenger safety. The growing integration of connected services, such as emergency response (eCall), further cements GNSS modules as indispensable vehicle infrastructure.

Opportunities in the automotive GNSS chip market expand through partnerships with map providers, vehicle infotainment system vendors, and local navigation solution providers. Offering firmware updates with regional map support and dead-reckoning augmentation can help penetrate regions where GNSS signal quality is poor or maps are sparse. Software-defined GNSS solutions tailored for specific vehicle platforms simplify integration with vehicle connectivity modules and enable OTA enhancements. In markets facing localization requirements, chips configured for regional standards and certifications ease regulator compliance. Collaboration with automakers to bundle GNSS modules with navigation subscriptions, mobility services, or connected car platforms enhances value. Emerging applications such as in-cabin location awareness, asset tracking for vehicle sharing services, and geofencing for usage-based insurance also present growth avenues. Scalable pricing models and tiered feature sets (basic positioning versus RTK-capable chips) help drive adoption across low-cost and premium vehicle categories.

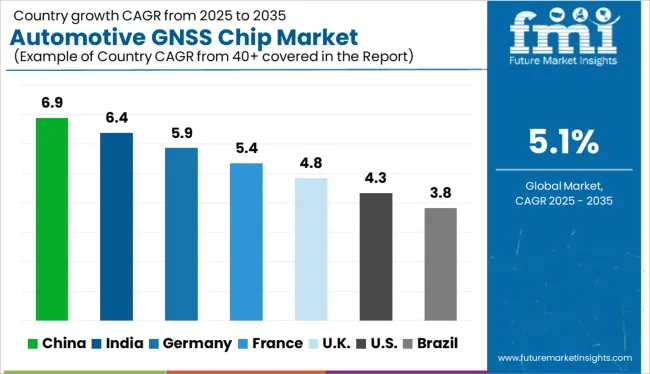

| Country | CAGR |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| France | 5.4% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

The global automotive GNSS (Global Navigation Satellite System) chip market is expected to register a CAGR of 5.1% from 2025 to 2035, fueled by the expansion of autonomous driving systems, real-time fleet tracking, and V2X (Vehicle-to-Everything) connectivity. BRICS economies are leading the surge, with China growing at 6.9% CAGR, driven by BeiDou integration, smart mobility ecosystems, and robust domestic EV production. India follows at 6.4%, supported by expanding telematics adoption, 5G rollouts, and localization mandates for navigation hardware. Germany, representing the OECD bloc, is advancing at 5.9% with innovations in precision navigation for ADAS and luxury segments. In contrast, the UK (4.8%) and US (4.3%) show slower growth due to legacy system dependencies and a maturing automotive tech stack. This report covers detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

With a projected CAGR of 6.9%, the Automotive GNSS Chip Market in China is advancing rapidly, driven by expanding electric vehicle (EV) infrastructure and government-backed autonomous driving pilots. Domestic brands are integrating multi-frequency GNSS modules to enhance lane-level accuracy, critical for urban navigation. The growth of vehicle-to-everything (V2X) systems, supported by BeiDou enhancements, enables high-precision mapping and real-time positioning. Startups and Tier-1 suppliers are optimizing chipsets for energy efficiency, enhancing adoption in entry- and mid-tier EVs.

India is poised for a 6.4% CAGR in the Automotive GNSS Chip Market, fueled by demand in fleet tracking, passenger safety, and smart mobility applications. The rise of telematics mandates and AIS 140-compliant solutions is driving deeper GNSS chip integration across commercial and ride-hailing vehicles. Indian chip designers are collaborating with international vendors to develop cost-effective multi-constellation GNSS modules suited for congested traffic conditions. Increased adoption in two-wheelers and entry-level EVs further boosts volume.

Automotive GNSS chip market in Germany, is set to expand at a 5.9% CAGR, anchored by high precision needs in premium vehicles and advanced driver-assistance systems (ADAS). Automakers are transitioning from single- to multi-constellation GNSS setups to meet reliability thresholds in automated navigation. German Tier-1 suppliers are co-developing GNSS-enhanced ADAS modules with redundant positioning features. Urban mobility pilots in cities like Hamburg and Munich are further validating chip accuracy in GPS-dense zones.

With a CAGR of 4.8%, the United Kingdom automotive GNSS chip market is growing steadily as the country scales intelligent transport systems and semi-autonomous driving projects. Integration of GNSS chips into fleet telematics and insurance-based vehicle tracking systems is becoming standard. Regulatory moves toward connected vehicle infrastructure and nationwide EV incentives are creating fresh demand for precise positioning tools.

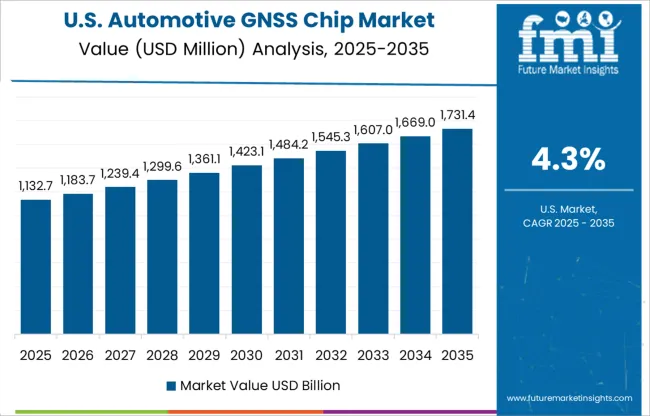

The United States is projected to witness a 4.3% CAGR in the automotive GNSS chip segment through 2035. Growth is largely driven by the expansion of smart highway initiatives, increased ADAS penetration, and demand from logistics and commercial fleets. Automakers are emphasizing sub-meter GNSS accuracy to support Level 3 and Level 4 autonomy pilots. Partnerships between chipmakers and cloud mapping providers are becoming essential for real-time updates and over-the-air accuracy corrections.

The automotive GNSS (Global Navigation Satellite System) chip market is moderately consolidated, led by Qualcomm commanding a significant share. Qualcomm’s dominance stems from its advanced integration of GNSS modules within automotive-grade SoCs, enabling high-accuracy positioning for ADAS, V2X communication, and autonomous navigation. Key competitors like u-blox, STMicroelectronics, and MediaTek provide robust multi-constellation support (GPS, GLONASS, Galileo, BeiDou) tailored for vehicle telematics and infotainment. Tier 2 players such as SkyTraq, LOCOSYS, and Unicore focus on cost-effective, high-sensitivity solutions for emerging markets. Growth is driven by rising demand for real-time navigation, connected vehicle ecosystems, and the evolution toward autonomous driving, all of which require precise and reliable positioning data.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.2 Billion |

| Vehicle | Passenger cars and Commercial vehicle |

| Transmission | GPS (Global Positioning System), GLONASS (Global Navigation Satellite System), Galileo, BeiDou, and Others |

| Application | In-Vehicle Navigation Systems, Advanced Driver Assistance Systems (ADAS), Telematics systems, Fleet management systems, Autonomous driving systems, and Others |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Qualcomm, FURUNO, LOCOSYS Technology, MediaTek, Quectel Wireless Solutions, SkyTraq Technology, STMicroelectronics, Texas Instruments, u-blox Holding, and Unicore Communications |

| Additional Attributes | Dollar sales by chip type, vehicle class, and navigation application; regional demand influenced by ADAS adoption, connected car infrastructure, and regulatory mandates; innovation in multi-frequency, multi-constellation GNSS support and sensor fusion integration; cost dynamics driven by silicon availability and integration complexity; environmental impact tied to chip manufacturing and disposal; and emerging use cases in autonomous driving, fleet management, and V2X communication. |

The global automotive GNSS chip market is estimated to be valued at USD 3.2 billion in 2025.

The market size for the automotive GNSS chip market is projected to reach USD 5.2 billion by 2035.

The automotive GNSS chip market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in automotive GNSS chip market are passenger cars, _hatchback, _sedan, _suv, _others , commercial vehicle, _light duty, _medium duty and _heavy duty.

In terms of transmission, gps (global positioning system) segment to command 42.7% share in the automotive GNSS chip market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA