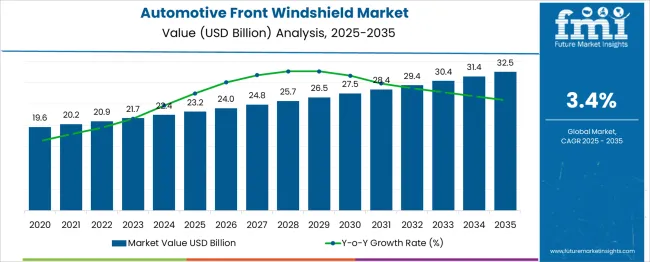

The Automotive Front Windshield Market is estimated to be valued at USD 23.2 billion in 2025 and is projected to reach USD 32.5 billion by 2035, registering a compound annual growth rate (CAGR) of 3.4% over the forecast period.

The automotive front windshield market displays a steady upward trend, growing from USD 19.6 billion in 2021 to USD 26.5 billion by 2030, marking an absolute dollar opportunity of USD 6.9 billion during the decade. This reflects a compound annual growth rate (CAGR) of approximately 3.4%, signaling consistent but moderate expansion across both OEM and aftermarket segments.

Year-on-year analysis highlights incremental growth, with the market moving from USD 19.6 billion in 2021 to USD 20.2 billion in 2022, then to USD 20.9 billion in 2023, supported by the gradual recovery of automotive production volumes and replacement demand in key regions.

By 2024, the market reaches USD 21.7 billion, followed by USD 22.4 billion in 2025, driven by the rising incorporation of laminated glass, advanced safety glazing, and UV-protection technologies. The mid-decade period witnesses higher integration of smart windshields with heads-up display (HUD) compatibility, which accelerates premium vehicle adoption.

Moving into the latter half of the forecast, the market grows steadily to USD 23.2 billion in 2026, USD 24.0 billion in 2027, and USD 24.8 billion by 2028, supported by technological innovations such as rain sensors, acoustic glazing, and solar control coatings.

By 2029, the market value climbs to USD 25.7 billion, ultimately reaching USD 26.5 billion in 2030. Growth is further driven by increased safety regulations, the penetration of electric and autonomous vehicles, and expanding aftermarket services in emerging economies.

Companies that emphasize lightweight laminated windshields, enhanced durability, and integration of advanced driver-assistance systems (ADAS) will remain at the forefront of this evolving market landscape, ensuring both safety and performance in next-generation mobility solutions.

| Metric | Value |

|---|---|

| Automotive Front Windshield Market Estimated Value in (2025 E) | USD 23.2 billion |

| Automotive Front Windshield Market Forecast Value in (2035 F) | USD 32.5 billion |

| Forecast CAGR (2025 to 2035) | 3.4% |

The automotive front windshield market holds a significant role within the broader automotive glass industry, accounting for an estimated 40% to 45% share, as front windshields are mandatory safety components in every vehicle. Within the overall automotive components market, its contribution is comparatively modest, around 3% to 4%, given the dominance of larger systems like powertrains, electronics, and braking systems. In the automotive glazing market, which includes side windows, rear glass, and sunroofs, the front windshield segment remains the largest due to its universal application and increasing complexity in modern vehicles.

Growing adoption of laminated glass for enhanced safety, acoustic control, and UV protection has strengthened its position. Advanced Driver Assistance Systems (ADAS) integration, such as heads-up displays, rain sensors, and embedded cameras for lane departure and collision avoidance, has further elevated the value proposition of front windshields.

Demand is also driven by rising production of passenger vehicles globally and strong replacement cycles in aftermarket segments due to cracks, accidents, and environmental wear. Electric vehicles and premium car models are fueling demand for technologically advanced windshields with smart features like heating elements and solar control coatings.

Despite challenges related to raw material costs and manufacturing complexity, innovations in lightweight laminated glass and augmented reality displays ensure the front windshield segment remains a critical component of automotive safety and connectivity ecosystems worldwide.

The automotive front windshield market is evolving rapidly due to increasing demand for safety features, structural integrity, and the integration of advanced driver assistance systems. As vehicles become more connected and sensor-rich, the windshield is being redefined as a functional and interactive component rather than a passive protective layer. Rising vehicle production, particularly in emerging economies, and stringent crash safety regulations are reinforcing the adoption of high-performance windshield materials across passenger and commercial vehicles.

Innovations in head-up displays, rain sensors, solar coating, and embedded antennas have increased the functional complexity of windshields, prompting greater investment from OEMs in smart glass technologies. The shift toward electric vehicles has also accelerated the integration of lightweight, acoustically insulating laminated glass to improve thermal efficiency and cabin comfort.

Market expansion is further supported by the trend of vehicle electrification and infotainment system enhancements, positioning the windshield as a vital interface for next-generation mobility experiences. Over the forecast period, continued advancements in windshield engineering are expected to support the market’s growth across all vehicle categories.

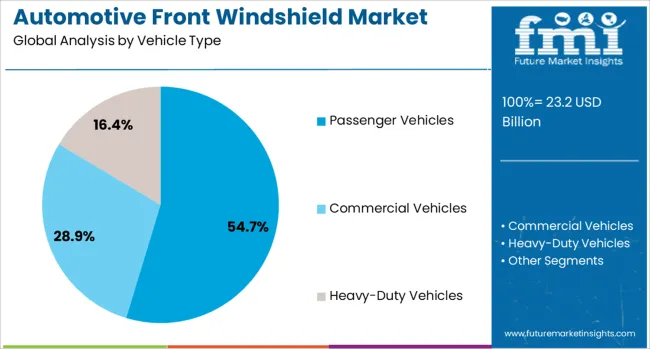

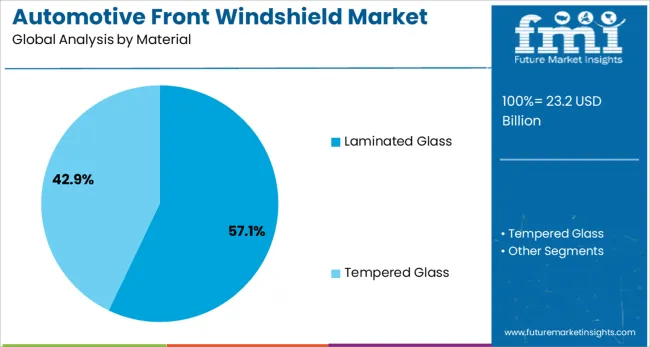

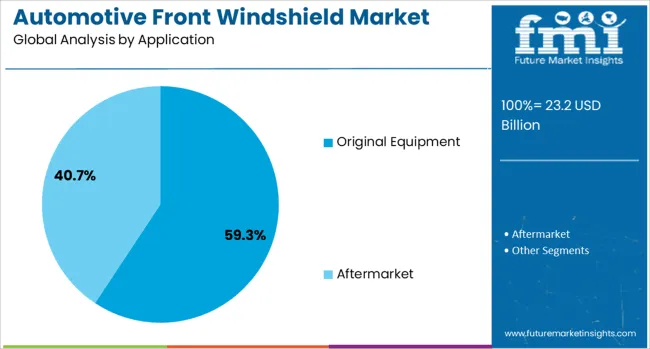

The automotive front windshield market is segmented by vehicle type, material, application, technology, and geographic regions. The automotive front windshield market is divided by vehicle type into Passenger Vehicles, Commercial Vehicles, and Heavy-Duty Vehicles. The automotive front windshield market is classified into Laminated Glass and Tempered Glass. Based on the application, the automotive front windshield market is segmented into Original Equipment and Aftermarket. The automotive front windshield market is segmented into Heated Windshields, Acoustic Windshields, and Head-Up Display (HUD). Regionally, the automotive front windshield industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Passenger vehicles are expected to hold 54.7% of the automotive front windshield market revenue share in 2025, positioning the segment as the leading contributor by vehicle type. This dominance is influenced by the steady rise in personal vehicle ownership, especially in urbanizing regions, and the growing preference for enhanced in-vehicle comfort and safety features.

Automotive manufacturers have increasingly focused on integrating laminated and acoustic windshields in passenger cars to meet consumer expectations for cabin noise reduction and impact resistance. The growing adoption of ADAS technologies, including lane departure warnings and collision alerts, has necessitated precision-designed windshields capable of supporting camera and sensor integration.

Regulatory frameworks promoting pedestrian and occupant safety have further encouraged the adoption of advanced windshield designs in this segment. With OEMs prioritizing both aesthetic appeal and functional enhancements, the passenger vehicle segment continues to lead due to its scale, diverse consumer base, and technological adaptability.

Laminated glass is projected to account for 57.1% of the revenue share in the automotive front windshield market in 2025, reflecting its widespread application and safety benefits. The use of laminated glass has become standard in front windshields due to its ability to prevent shattering upon impact and provide enhanced structural support during collisions.

Laminated glass construction, which involves bonding layers with a polymer interlayer, contributes to improved acoustic insulation and UV protection, making it preferable for both conventional and electric vehicles. OEMs have adopted laminated windshields to support embedded sensors and HUD displays, ensuring uninterrupted operation of safety systems and driver interfaces.

The material’s compliance with global crash safety and e-mark certification standards has accelerated its integration across vehicle categories. The need for thermally efficient, noise-reducing, and optically stable windshields in evolving mobility platforms has further strengthened the position of laminated glass as the material of choice in modern automotive design.

The original equipment segment is anticipated to contribute 59.3% of the overall revenue in the automotive front windshield market in 2025, establishing it as the dominant application segment. This growth is being driven by the increasing rate of vehicle production and the trend toward factory-installed advanced features.

Automotive OEMs are equipping vehicles with windshields that support functionalities such as ADAS, rain and light sensors, infrared reflectivity, and soundproofing directly during manufacturing. The shift toward tighter emissions and noise control regulations has further incentivized manufacturers to adopt premium-quality windshield materials at the assembly stage.

The push for fuel efficiency and electric vehicle performance has led to the selection of lightweight, laminated glass components that contribute to overall vehicle weight reduction. The growing consumer expectation for factory-fitted safety and convenience technologies is prompting OEMs to integrate multifunctional windshield systems from the outset, thus reinforcing the original equipment segment’s market leadership.

Automotive front windshields are evolving with safety-focused laminated and acoustic glass, lightweight designs, and sensor compatibility to enhance performance and aesthetics. Integration of connected features, AR displays, and multifunctional glazing is transforming windshields into key components for advanced vehicle intelligence.

The demand for automotive front windshields has been influenced by safety regulations and consumer preferences for superior driving visibility. Laminated glass with high-impact resistance has been widely adopted to reduce injuries during collisions. The integration of acoustic glass for noise reduction has gained attention in premium and mid-range segments. Increased production of electric and hybrid vehicles has driven the development of lightweight windshields to enhance energy efficiency. High penetration of sensor-compatible glass for features like rain detection and lane assist has been prioritized by manufacturers. Strong emphasis on aesthetic design and aerodynamics in modern vehicles has elevated the role of front windshields as a functional and stylistic component in automotive engineering.

Automotive front windshields are increasingly utilized as platforms for connected technologies. Augmented reality heads-up displays and advanced driver-assistance systems have necessitated the use of specialized glass coatings and optical clarity standards. Automakers have incorporated heated windshields for rapid defogging and de-icing, enhancing driver convenience in varying climates. Demand for advanced glazing solutions to improve energy efficiency and UV protection has expanded, particularly in regions with extreme weather conditions. Strategic collaborations between glass manufacturers and OEMs have been observed to support large-scale adoption of multifunctional windshields. Enhanced durability, improved clarity, and compatibility with embedded electronics have transformed windshields into critical components for delivering safer and smarter vehicle experiences.

The automotive front windshield market is witnessing strong momentum due to the growing integration of Advanced Driver Assistance Systems (ADAS). Windshields are now designed to accommodate sensors, cameras, and heads-up displays, making them a vital part of vehicle safety and connectivity systems. Automakers are increasingly adopting smart glass technologies such as electrochromic glazing, solar control layers, and augmented reality displays to enhance driver experience and visibility. These innovations require high-precision manufacturing and specialized coatings, driving OEM partnerships with glass manufacturers. As ADAS adoption accelerates globally, front windshields are transitioning from passive components to advanced functional elements in modern vehicles.

Consumer expectations for quieter cabins and improved climate control are fueling demand for laminated windshields with acoustic damping and solar heat-reducing features. This trend is particularly evident in premium and electric vehicles, where noise reduction and energy efficiency are critical. Manufacturers are incorporating advanced PVB (polyvinyl butyral) interlayers and infrared-reflective coatings to deliver better sound insulation and temperature regulation. Additionally, stricter safety regulations mandating laminated glass for impact resistance are reinforcing adoption in mid-range models. These dynamics, combined with increasing urban driving and longer commutes, underscore the growing role of front windshields in improving both safety and passenger comfort, making them a key differentiator in competitive automotive markets.

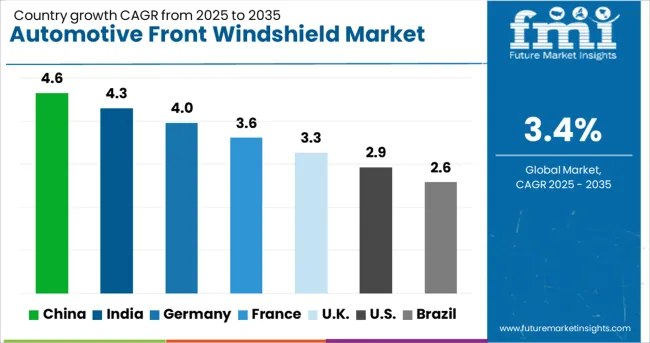

| Country | CAGR |

|---|---|

| China | 4.6% |

| India | 4.3% |

| Germany | 4.0% |

| France | 3.6% |

| UK | 3.3% |

| USA | 2.9% |

| Brazil | 2.6% |

The automotive front windshield industry, projected to expand at a global CAGR of 3.4% from 2025 to 2035, exhibits varying growth dynamics across major countries. China, a member of the BRICS group, is leading with a 4.6% CAGR driven by large-scale automotive production and growing demand for sensor-compatible windshields. India follows with a 4.3% CAGR, supported by rising passenger vehicle sales and increasing preference for advanced glazing solutions.

Germany records a 4.0% CAGR, influenced by strong adoption of premium features and OEM integration of driver-assist technologies. Slower yet steady growth is seen in the United Kingdom at 3.3%, stable automotive manufacturing, and gradual adoption of connected windshield features. The United States, at 2.9%, represents a mature market with steady replacement demand and gradual introduction of augmented reality displays.

These trends underline the importance of country-specific regulations, technological adoption, and OEM strategies in shaping windshield advancements. The report provides an in-depth review of over 40 countries, with the top five highlighted as references.

The CAGR of the automotive front windshield market in China moved from approximately 3.8% during 2020-2024 to 4.6% in the period of 2025-2035. Strong recovery in automotive manufacturing after supply chain disruptions contributed to this acceleration. Increased adoption of laminated glass with acoustic features has supported premium vehicle segments, while sensor-compatible glazing for driver-assistance features strengthened OEM partnerships.

Investments in EV production lines elevated demand for lightweight windshields to optimize efficiency. Stringent safety standards reinforced the use of laminated structures. The surge in connected technologies and integration of augmented reality displays further boosted demand for advanced glazing technologies, creating new revenue streams for domestic manufacturers.

The CAGR for India increased from nearly 3.6% between 2020-2024 to 4.3% for 2025-2035, driven by strong passenger vehicle output and mid-segment upgrades. Rapid growth in EV adoption prompted demand for lighter glass compositions, supported by industry partnerships for energy-efficient solutions. Enhanced preference for acoustic and solar control windshields reshaped procurement strategies across OEM networks.

Improved availability of ADAS-compatible glazing expanded installation in SUVs and sedans. The aftermarket sector maintained relevance through replacement sales in Tier 2 and Tier 3 cities. Local suppliers have increased capacity through strategic alliances with glass technology firms, ensuring competitive pricing in advanced windshield categories.

The CAGR for Germany climbed from about 3.4% during 2020-2024 to 4.0% for 2025-2035. This growth has been influenced by strict safety norms and a significant rise in luxury vehicle production. OEMs have integrated advanced glazing technologies for noise control and enhanced clarity to support heads-up display adoption. Laminated glass penetration increased as part of EU regulations on passenger safety.

Growing preference for heated windshields in colder regions reinforced demand consistency. Local suppliers have focused on manufacturing optically advanced products for AR displays, giving Germany a strategic advantage in the premium vehicle category. Aftermarket demand for specialized coatings added further expansion opportunities.

The CAGR of the UK automotive front windshield market rose from around 2.7% in 2020-2024 to 3.3% in 2025-2035. This increase has been shaped by gradual EV penetration, leading to greater demand for lightweight windshields with thermal coatings. OEM adoption of AR-compatible windshields and smart glass technologies grew steadily in premium vehicle segments.

Replacement demand has been driven by insurance-linked claims, supporting stable aftermarket performance. Partnerships between European glass processors and local assembly plants strengthened supply chain resilience. Market evolution toward integrated electronics for ADAS and heated surfaces reinforced product complexity, positioning the UK as a consistent contributor within Europe.

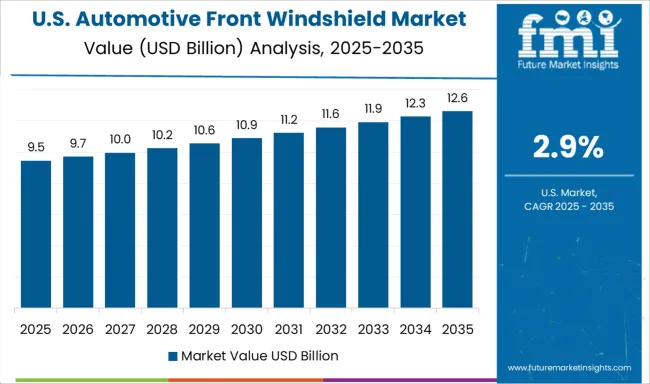

The CAGR for the United States advanced from nearly 2.3% during 2020-2024 to 2.9% across 2025-2035. This improvement stems from the incremental adoption of advanced windshields in electric vehicles and high-end SUVs. Heated windshields gained traction due to regional weather variability, while OEMs expanded offerings with laminated and acoustic glass in response to consumer expectations.

Partnerships with ADAS technology firms encouraged the inclusion of sensor-based features in standard configurations. The aftermarket maintained relevance with replacement products catering to premium and luxury cars. Regulatory emphasis on safety glass standards consolidated the demand for laminated windshields across multiple vehicle classes.

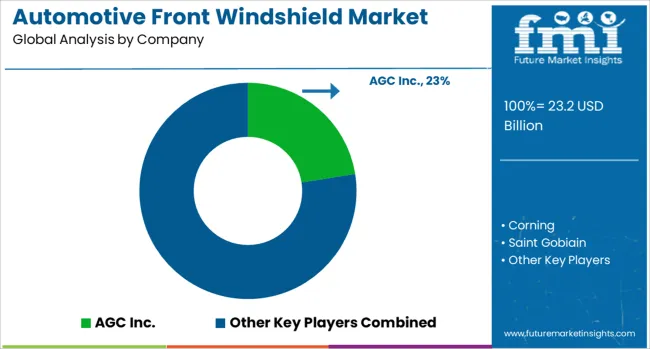

The automotive front windshield industry is evolving rapidly as leading manufacturers focus on combining structural integrity with advanced technology to meet the needs of modern vehicles. AGC Inc., Corning, and Saint-Gobain dominate the global landscape with strong collaborations with automakers, offering laminated safety glass with enhanced acoustic insulation and ADAS compatibility for sensor and camera integration.

These companies are investing in smart glazing solutions incorporating heads-up display features, infrared reflection, and solar heat control to improve driving comfort and energy efficiency, particularly for electric vehicles. Fuyao Group has strengthened its competitive edge by delivering cost-effective windshields with advanced coatings, anti-fog layers, and thermal absorption properties tailored to regional climate requirements.

Guardian and Splintex Distribution are focusing on lightweight glass architectures and superior optical clarity to support large-scale OEM production, addressing efficiency and sustainability goals. Nippon Glass and PPG are pioneering specialized products for augmented reality windshields and connected mobility solutions, integrating projection-ready glass for navigation and safety alerts.

These innovations are supported by strategic investments in R&D, regional manufacturing hubs, and partnerships with technology providers to enhance product functionality. The competitive landscape is also shaped by efforts to meet stringent global safety norms and growing consumer demand for quieter, more thermally efficient cabins, positioning front windshields as a critical element in advanced automotive design and smart mobility ecosystems.

In January 2025, Guardian Glass announced the closure of its historic Llodio (Álava) plant in Spain within six months, affecting 171 workers, due to reduced demand and expensive furnace maintenance needs.

| Item | Value |

|---|---|

| Quantitative Units | USD 23.2 Billion |

| Vehicle Type | Passenger Vehicles, Commercial Vehicles, and Heavy-Duty Vehicles |

| Material | Laminated Glass and Tempered Glass |

| Application | Original Equipment and Aftermarket |

| Technology | Heated Windshields, Acoustic Windshields, and Head-Up Display (HUD) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AGC Inc., Corning, Saint Gobiain, Fuyao Group, Splintex Distribution, Gaurdian, Nippon Glass, and PPG |

| Additional Attributes | Dollar sales, share by product type and vehicle category, regional demand patterns, OEM vs aftermarket trends, pricing benchmarks, raw material cost analysis, regulatory impact, ADAS integration rates, and competitive positioning across global markets. |

The global automotive front windshield market is estimated to be valued at USD 23.2 billion in 2025.

The market size for the automotive front windshield market is projected to reach USD 32.5 billion by 2035.

The automotive front windshield market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in automotive front windshield market are passenger vehicles, commercial vehicles and heavy-duty vehicles.

In terms of material, laminated glass segment to command 57.1% share in the automotive front windshield market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Front and Rear Phygital Shield Market Size and Share Forecast Outlook 2025 to 2035

Automotive Front End Module Market Growth - Trends & Forecast 2025 to 2035

Automotive Windshield Washer System Market Growth – Trends & Forecast 2025 to 2035

Automotive Engine Front Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Front Office BPO Services Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA