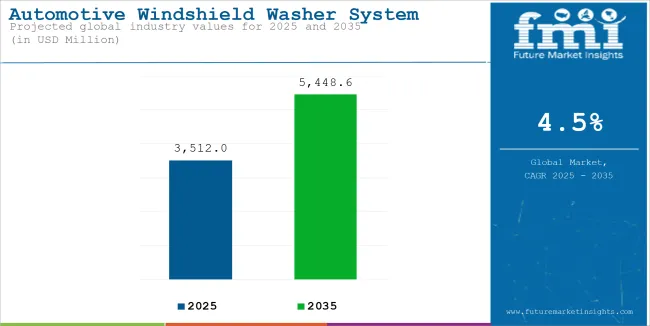

Global sales of windshield washer system were reported at USD 2,666.8 million in 2020. Demand for windshield wiper system is anticipated to reach USD 3,512 million in 2025. Over the assessment period (2025 to 2035), the market is projected to expand at a CAGR of 4.5% and attain value of USD 5,448.6 million by the end of 2035.

Windscreen-washer system means the system consisting of a device for storing a fluid and applying it to the outer face of the windscreen, together with the controls necessary for starting and stopping the device.

Windshield washer components include the washer fluid reservoir, pump, hoses, and nozzles. The washer fluid reservoir stores the cleaning solution, while the pump circulates fluid through the system. The wiper motor powers the wiper blades, which clean the windshield, and hoses connect the components.

Nozzles spray the fluid onto the windshield. This system specifically excludes wipers and wiper motors, since they are meant primarily to clear water from the windshield during rain rather than to clean it. The washer system might be independent, but it will still define the scope of cleaning rather than only clearing the windshield, as defined by its role.

| Attributes | Key Insights |

|---|---|

| Market Value, 2025 | USD 3,512 million |

| Market Value, 2035 | USD 5,448.6 million |

| Value CAGR (2025 to 2035) | 4.5% |

The windshield washer system plays a critical role in ensuring clear visibility by removing rain, dirt, and debris. It enhances driver safety in various weather conditions, like snow, rain, and fog, by improving visibility, especially during adverse driving circumstances.

Windshield washer components are typically made from durable plastics, rubber, and metal. Plastics are used for reservoirs, nozzles, and hoses; rubber is used for wiper blades; metal for motors and pumps. These materials ensure reliability, flexibility, and resistance to wear, corrosion, and weather.

Technological advancements such as integrated ultrasonic nozzles for finer spray distribution, heated wiper systems to prevent freezing, automatic windshield washers that activate based on sensor detection, and self-cleaning windshield coatings are significantly boosting the demand for advanced windshield washer systems in modern vehicles.

Windshield washer systems vary in size and capacity, typically ranging from 1.5 liters to over 5 liters. Smaller systems, around 1.5-2 liters, are commonly used in compact vehicles, while larger capacities, such as 3-5 liters, are found in SUVs, trucks, and commercial vehicles.

The size and capacity of the washer system determine how much fluid can be stored and dispensed for cleaning. Larger systems are ideal for heavy-duty vehicles and longer trips, ensuring extended visibility and safety during adverse weather conditions.

The table below presents the annual growth rates of the global windshield washer system market from 2025 to 2035. With a base year of 2024 extending to the current year 2025, the report examines how the sector's growth trajectory evolves from the first half of the year (January to June, H1) to the second half (July to December, H2). This analysis offers stakeholders insights into the industry's performance over time, highlighting potential developments that may emerge.

These figures indicate the growth of the sector in each half-year, between the years 2024 and 2025. The industry is expected to grow at a CAGR of 4.5% from 2025 to 2035. In H2, the growth rate increases.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 3.8% (2024 to 2034) |

| H2 2024 | 3.9% (2024 to 2034) |

| H1 2025 | 4.4% (2025 to 2035) |

| H2 2025 | 4.5% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2025, the CAGR is projected to slightly increase from 4.4% in the first half to 4.5% in the second half. In the first half (H1), the sector saw an increase of 60 BPS, while in the second half (H2), there was a smaller increase of 60 BPS, indicating steady growth and rising demand in the windshield washer system market.

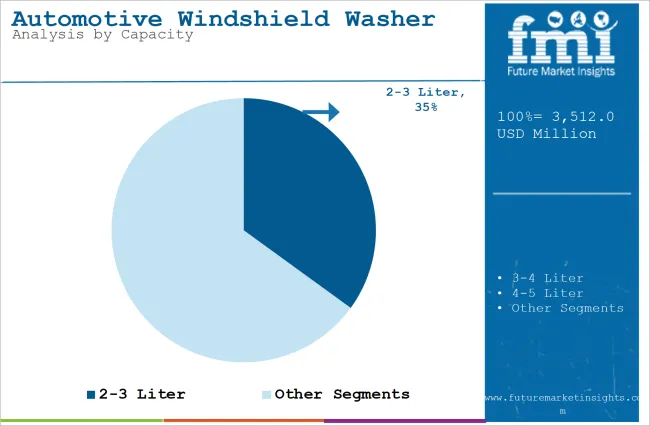

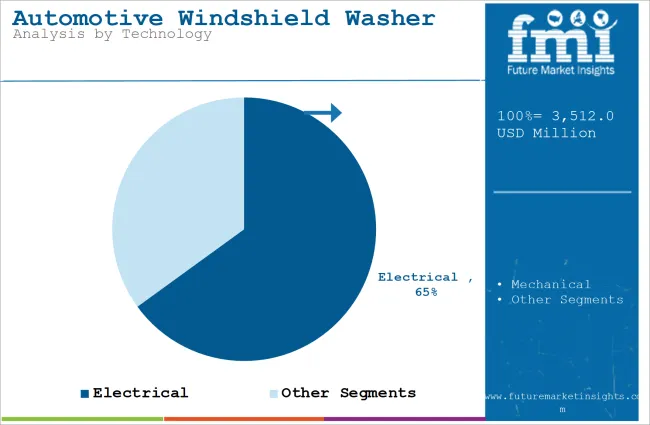

The section explains the growth of the leading segments in the industry. In terms of capacity, 2-3 liter capacity will likely dominate and generate a share of around 35% in 2024. Based on the technology, the electrical is projected to hold a major share of 65% in 2024. The analysis would enable potential clients to make effective business decisions for investment purposes.

| Segment | 2-3 liter ( Capacity) |

|---|---|

| Value Share (2024) | 35% |

The dominance of 2-3 liter windshield washer systems is driven by their balanced fluid storage capacity, making them ideal for a wide range of vehicles. This capacity offers sufficient fluid for regular use without adding excessive weight or taking up significant space, which is especially important for passenger cars and urban vehicles. As mid-sized vehicles dominate global markets, the 2-3 liter segment has emerged as the most practical and efficient option for manufacturers and consumers.

Additionally, these systems align with the growing need for compact yet high-performing components in modern vehicles, where space optimization is critical. Their compatibility with various vehicle types, including sedans and small SUVs, ensures widespread adoption. The increasing focus on urban commuting and shorter driving distances further supports the preference for this capacity, strengthening its position as a dominant segment in the windshield washer system market.

| Segment | Electrical ( Technology) |

|---|---|

| Value Share (2024) | 65% |

Enhanced efficiency is a key factor driving the demand for electrical windshield washer systems, as they provide consistent fluid pressure with lower power consumption. This reduces overall vehicle energy use, making them more environmentally friendly and cost-effective. In addition, smart automation, such as rain sensors and automatic activation, is revolutionizing the user experience.

These systems can detect weather changes and adjust fluid application without any manual intervention, offering convenience and improving safety by maintaining clear visibility during driving. Moreover, better vehicle integration plays a significant role in their adoption.

Electrical washer systems are compact and flexible, making them easy to incorporate into various vehicle designs, including electric and hybrid vehicles that prioritize energy efficiency. The seamless integration with other vehicle systems enhances the overall functionality and reliability of the vehicle, meeting the growing demand for advanced, efficient, and automated features in modern automobiles.

Rising Automotive Production and Fleet Expansion is Boosting the Automotive Windshield System

The continuous growth in automotive production globally is a fundamental driver for the windshield washer system market. With increasing urbanization and economic development in emerging economies such as China, India, and Brazil, the demand for both passenger and commercial vehicles is on the rise. As windshield washer systems are a standard feature in all types of vehicles, their adoption is directly proportional to the growth in vehicle production.

The expansion of vehicle fleets across industries such as logistics, e-commerce, and shared mobility platforms has also fueled the need for frequent maintenance and replacement of washer systems. The growing middle class in developing nations, coupled with rising disposable incomes, is increasing the ownership of private vehicles, further bolstering the market.

Automakers are also focusing on introducing vehicles tailored for specific markets, such as compact cars for urban areas and SUVs for rural regions, which require robust washer systems to ensure optimal visibility. This surge in vehicle ownership and usage drives the demand for original equipment manufacturer (OEM) washer systems and aftermarket products.

Stringent Safety and Visibility Regulations is Fueling the Demand for Automotive Windshield Washer System

Governments and regulatory bodies worldwide are enforcing stringent vehicle safety norms, which mandate the integration of efficient windshield washer systems to ensure clear visibility under all weather conditions. Regulatory frameworks such as the Federal Motor Vehicle Safety Standards (FMVSS) in the United States and UNECE regulations in Europe require vehicles to have functional windshield washer systems that comply with specific performance criteria.

Clear visibility is a critical safety aspect in preventing accidents caused by rain, snow, dust, or debris. Poor visibility is a significant factor in road accidents, making functional washer systems essential. According to reports, poor visibility is a contributing factor in 25% of road accidents globally.

Automotive manufacturers are compelled to ensure compliance with these regulations to avoid penalties and maintain brand reputation. As a result, automakers are investing in advanced washer systems that improve cleaning efficiency, minimize fluid wastage, and enhance reliability.

The growing emphasis on road safety, supported by initiatives from organizations such as the International Transport Forum, has further amplified the demand for high-quality washer systems. This regulatory push ensures that all vehicles, regardless of their segment or price point, are equipped with washer systems, thereby driving market growth.

Increasing Demand for Advanced Driver Assistance Systems (ADAS) is driving the Demand for Automotive Windshield Washer System

The rapid adoption of Advanced Driver Assistance Systems (ADAS) in modern vehicles has significantly influenced the windshield washer system market. ADAS technologies rely on cameras which are often mounted on or near the windshield. These components require unobstructed visibility to function effectively, making advanced windshield washer systems crucial.

To meet the demands of ADAS-equipped vehicles, manufacturers are developing washer systems that provide targeted cleaning for cameras, in addition to the windshield. For instance, specialized washer nozzles and fluids are being integrated into vehicles to clean camera without causing damage.

This need for precision cleaning has created a new segment within the washer system market, with growing investments in R&D. According to study, over 50% of new vehicles produced in 2023 include at least one ADAS feature. The integration of cameras and LiDAR sensors is expected to grow by 20% annually, necessitating targeted cleaning mechanisms.

As governments and regulatory bodies encourage the adoption of ADAS features to improve road safety, the penetration of such technologies in vehicles is increasing. This trend has elevated the importance of efficient washer systems, which are now seen as critical components for enabling the seamless operation of ADAS technologies, thereby propelling market growth.

Diverse Weather and Environmental Conditions is Boosting the Automotive Windshield System

The windshield washer system market is significantly driven by the need to adapt to diverse weather and environmental conditions globally. Regions with heavy rainfall, snowfall, or dust storms require robust washer systems to ensure clear visibility for drivers.

For example, countries in North America and Europe face harsh winters, necessitating the use of washer systems with anti-freeze fluids and heated nozzles to prevent ice buildup. The USA experiences over 70 million snow-related driving hours annually, emphasizing the need for washer systems with de-icing capabilities.

In contrast, arid and dusty regions, such as the Middle East and parts of Africa, demand washer systems that can effectively clean accumulated dust and sand. The increasing frequency of extreme weather events due to climate change further accentuates the importance of reliable washer systems in ensuring road safety.

Moreover, environmental factors such as insects, pollen, and tree sap, which can obscure the driver’s vision, necessitate regular windshield cleaning. Automotive manufacturers are addressing these challenges by offering washer systems with enhanced spray patterns, high-pressure nozzles, and improved fluid reservoirs. The necessity to cater to a wide range of environmental conditions is a fundamental driver that sustains the demand for innovative windshield washer systems globally.

From 2020 to 2024, the global automotive windshield washer system market experienced steady growth, driven by rising vehicle production and increased demand for safety and visibility features. The adoption of advanced technologies, such as heated washer systems and sensor-based automatic washers, enhanced convenience and performance, especially in adverse weather conditions.

Innovations in nozzle design and fluid distribution systems contributed to efficient cleaning and reduced water usage. The expansion of electric and hybrid vehicles also supported the integration of advanced windshield washer systems, aligning with the evolving needs of modern vehicles.

Looking ahead to 2025 to 2035, the windshield washer system market is expected to grow steadily due to rising safety regulations and consumer preferences for enhanced visibility solutions. Advancements in washer system technologies, such as ultrasonic spray nozzles, eco-friendly fluids, and self-cleaning systems, will drive adoption.

Increasing vehicle production in emerging markets and the growing focus on safety and functionality in modern vehicles will further sustain demand for innovative windshield washer systems that improve performance, reliability, and environmental compliance.

Tier-1 companies account for around 50-55% of the overall market with a product revenue from the automotive windshield system market of more than USD 100 million. Mitsuba Corp., Continental Automotive Systems, Inc. (VDO), and other players.

Tier-2 and other companies such as Cebi, Prabha Engineering, and other players are projected to account for 45-50% of the overall market with the estimated revenue under the range of USD 100 million through the sales of automotive windshield washer system.

The section below covers the industry analysis for automotive windshield wiper system in different countries. The demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia Pacific, Western Europe, Eastern Europe, Middle East, and Africa is provided. This data helps investors to keenly observe and go through the recent trends and examine them in an ordered manner.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| China | 5.5% |

| India | 6.2% |

| The USA | 4.3% |

| Germany | 3.5% |

| Japan | 3.3% |

The USA is a key driver of the windshield washer system market due to the dominance of SUVs and trucks, which accounted for 80% of new vehicle sales in 2023. These vehicles, often used for off-road, long-distance travel, and severe weather conditions, require washer systems that deliver high performance under demanding environments.

The USA experiences a wide range of weather challenges-nearly 70% of states experience snowfall annually, and regions like the Southwest face frequent dust storms. As a result, washer systems with high-pressure nozzles and advanced de-icing capabilities are in demand. Innovations include Ford's Terrain Management Systems, which integrate washer functionalities to maintain visibility in rugged conditions. Moreover, increasing miles driven per capita (averaging 13,500 miles annually) further necessitate durable washer solutions for regular maintenance.

Germany’s prominence in the luxury automotive segment is a major driver for advanced windshield washer systems. In 2023, 45% of the vehicles produced in Germany were premium or luxury models, which prioritize high-performance components. Vehicles from brands like BMW, Audi, and Mercedes-Benz are equipped with advanced washer systems that ensure clarity at high speeds on autobahns, where vehicles often exceed 200 km/h.

Additionally, Germany’s stringent safety regulations under UNECE mandates require efficient washer systems for both windshields and headlamps. Innovations such as Audi’s dirt-detection sensors optimize fluid use and improve cleaning precision, while BMW’s invisible jet nozzles integrate aesthetics with functionality. Germany’s focus on autonomous vehicles also drives demand for washer systems that clean ADAS sensors and cameras, ensuring uninterrupted system performance in luxury and performance vehicles.

China’s rapid urbanization and the rise of shared mobility services, such as ride-hailing platforms like Didi Chuxing, are driving demand for high-durability windshield washer systems. By 2023, China managed over 30 million daily rides through shared mobility platforms, necessitating frequent maintenance and washer replacements for fleets. Additionally, increasing vehicle usage in dense urban areas leads to higher exposure to pollutants, dust, and debris, further emphasizing the need for reliable washer systems.

To meet this demand, automakers like Geely are developing long-lasting washer fluids and systems with self-cleaning nozzles to reduce service intervals. China’s focus on advanced manufacturing technologies has also led to washer systems with improved fluid efficiency, making them ideal for heavy-use applications. The country’s growing urban middle class further propels vehicle sales, reinforcing washer system demand.

Technological advancements in the automotive windshield washer system market are improving efficiency, convenience, and performance. The shift toward electric and sensor-based systems is gaining traction due to their ability to provide automatic activation, enhancing driver convenience and safety. Manufacturers are focusing on developing systems that offer precise fluid distribution, such as ultrasonic nozzles and smart spray patterns, to ensure thorough cleaning without waste.

Innovations in nozzle design and fluid delivery systems are improving the performance of washer systems, making them more efficient in various weather conditions. Additionally, the integration of heated washer systems is becoming more common, ensuring functionality even in freezing temperatures.

With the increasing focus on vehicle safety and consumer demand for enhanced visibility, these advancements are driving the adoption of high-performance windshield washer systems in passenger cars and commercial vehicles, making them an essential feature in modern automotive design.

Recent Industry Developments

The capacity is further categorized into 1.5- 2 liter, 2-3 liter, 3- 4 liter, 4- 5 liter and above 5 liter.

The technology is classified into electrical and mechanical.

The vehicle type is classified into passenger vehicles, commercial vehicles and off road vehicles.

The sales channel is classified into OEM and aftermarket.

Regions considered in the study include North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East and Africa.

The automotive windshield washer system was valued at USD 3,383.4 million in 2024.

The demand for automotive windshield washer system is set to reach USD 3,512 million in 2025.

The global automotive windshield washer system is driven by demand for safety, improved visibility, vehicle integration, smart automation, and enhanced performance.

The automotive windshield washer system demand is projected to reach USD 5,448.6 million in 2035.

The 2-3 liter are expected to lead during the forecasted period because provides optimal fluid storage, ensuring extended usage, efficient cleaning, and better performance in various driving conditions.

Table 1: Global Market Value (US$ million) Forecast by Region, 2017 to 2033

Table 2: Global Market Value (US$ million) Forecast by Capacity, 2017 to 2033

Table 3: Global Market Value (US$ million) Forecast by Sales Channel, 2017 to 2033

Table 4: Global Market Value (US$ million) Forecast by Technology , 2017 to 2033

Table 5: Global Market Value (US$ million) Forecast by Vehicle Type, 2017 to 2033

Table 6: North America Market Value (US$ million) Forecast by Country, 2017 to 2033

Table 7: North America Market Value (US$ million) Forecast by Capacity, 2017 to 2033

Table 8: North America Market Value (US$ million) Forecast by Sales Channel, 2017 to 2033

Table 9: North America Market Value (US$ million) Forecast by Technology , 2017 to 2033

Table 10: North America Market Value (US$ million) Forecast by Vehicle Type, 2017 to 2033

Table 11: Latin America Market Value (US$ million) Forecast by Country, 2017 to 2033

Table 12: Latin America Market Value (US$ million) Forecast by Capacity, 2017 to 2033

Table 13: Latin America Market Value (US$ million) Forecast by Sales Channel, 2017 to 2033

Table 14: Latin America Market Value (US$ million) Forecast by Technology , 2017 to 2033

Table 15: Latin America Market Value (US$ million) Forecast by Vehicle Type, 2017 to 2033

Table 16: Europe Market Value (US$ million) Forecast by Country, 2017 to 2033

Table 17: Europe Market Value (US$ million) Forecast by Capacity, 2017 to 2033

Table 18: Europe Market Value (US$ million) Forecast by Sales Channel, 2017 to 2033

Table 19: Europe Market Value (US$ million) Forecast by Technology , 2017 to 2033

Table 20: Europe Market Value (US$ million) Forecast by Vehicle Type, 2017 to 2033

Table 21: APEJ Market Value (US$ million) Forecast by Country, 2017 to 2033

Table 22: APEJ Market Value (US$ million) Forecast by Capacity, 2017 to 2033

Table 23: APEJ Market Value (US$ million) Forecast by Sales Channel, 2017 to 2033

Table 24: APEJ Market Value (US$ million) Forecast by Technology , 2017 to 2033

Table 25: APEJ Market Value (US$ million) Forecast by Vehicle Type, 2017 to 2033

Table 26: Japan Market Value (US$ million) Forecast by Country, 2017 to 2033

Table 27: Japan Market Value (US$ million) Forecast by Capacity, 2017 to 2033

Table 28: Japan Market Value (US$ million) Forecast by Sales Channel, 2017 to 2033

Table 29: Japan Market Value (US$ million) Forecast by Technology , 2017 to 2033

Table 30: Japan Market Value (US$ million) Forecast by Vehicle Type, 2017 to 2033

Table 31: MEA Market Value (US$ million) Forecast by Country, 2017 to 2033

Table 32: MEA Market Value (US$ million) Forecast by Capacity, 2017 to 2033

Table 33: MEA Market Value (US$ million) Forecast by Sales Channel, 2017 to 2033

Table 34: MEA Market Value (US$ million) Forecast by Technology , 2017 to 2033

Table 35: MEA Market Value (US$ million) Forecast by Vehicle Type, 2017 to 2033

Figure 1: Global Market Value (US$ million) by Capacity, 2023 to 2033

Figure 2: Global Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 3: Global Market Value (US$ million) by Technology, 2023 to 2033

Figure 4: Global Market Value (US$ million) by Vehicle Type, 2023 to 2033

Figure 5: Global Market Value (US$ million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ million) Analysis by Region, 2017 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ million) Analysis by Capacity, 2017 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 12: Global Market Value (US$ million) Analysis by Sales Channel, 2017 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 15: Global Market Value (US$ million) Analysis by Technology, 2017 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 18: Global Market Value (US$ million) Analysis by Vehicle Type, 2017 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 21: Global Market Attractiveness by Capacity, 2023 to 2033

Figure 22: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 23: Global Market Attractiveness by Technology, 2023 to 2033

Figure 24: Global Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ million) by Capacity, 2023 to 2033

Figure 27: North America Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 28: North America Market Value (US$ million) by Technology, 2023 to 2033

Figure 29: North America Market Value (US$ million) by Vehicle Type, 2023 to 2033

Figure 30: North America Market Value (US$ million) by Country, 2023 to 2033

Figure 31: North America Market Value (US$ million) Analysis by Country, 2017 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 34: North America Market Value (US$ million) Analysis by Capacity, 2017 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 37: North America Market Value (US$ million) Analysis by Sales Channel, 2017 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 40: North America Market Value (US$ million) Analysis by Technology, 2017 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 43: North America Market Value (US$ million) Analysis by Vehicle Type, 2017 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Capacity, 2023 to 2033

Figure 47: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Technology, 2023 to 2033

Figure 49: North America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 50: North America Market Attractiveness by Country, 2023 to 2033

Figure 51: Latin America Market Value (US$ million) by Capacity, 2023 to 2033

Figure 52: Latin America Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 53: Latin America Market Value (US$ million) by Technology, 2023 to 2033

Figure 54: Latin America Market Value (US$ million) by Vehicle Type, 2023 to 2033

Figure 55: Latin America Market Value (US$ million) by Country, 2023 to 2033

Figure 56: Latin America Market Value (US$ million) Analysis by Country, 2017 to 2033

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 59: Latin America Market Value (US$ million) Analysis by Capacity, 2017 to 2033

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 62: Latin America Market Value (US$ million) Analysis by Sales Channel, 2017 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ million) Analysis by Technology, 2017 to 2033

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 68: Latin America Market Value (US$ million) Analysis by Vehicle Type, 2017 to 2033

Figure 69: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Capacity, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 73: Latin America Market Attractiveness by Technology, 2023 to 2033

Figure 74: Latin America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 75: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 76: Europe Market Value (US$ million) by Capacity, 2023 to 2033

Figure 77: Europe Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 78: Europe Market Value (US$ million) by Technology, 2023 to 2033

Figure 79: Europe Market Value (US$ million) by Vehicle Type, 2023 to 2033

Figure 80: Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ million) Analysis by Country, 2017 to 2033

Figure 82: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 83: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 84: Europe Market Value (US$ million) Analysis by Capacity, 2017 to 2033

Figure 85: Europe Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 86: Europe Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 87: Europe Market Value (US$ million) Analysis by Sales Channel, 2017 to 2033

Figure 88: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 89: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 90: Europe Market Value (US$ million) Analysis by Technology, 2017 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 93: Europe Market Value (US$ million) Analysis by Vehicle Type, 2017 to 2033

Figure 94: Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 95: Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 96: Europe Market Attractiveness by Capacity, 2023 to 2033

Figure 97: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 98: Europe Market Attractiveness by Technology, 2023 to 2033

Figure 99: Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 100: Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: Asia Pacific excluding Japan (APEJ) Market Value (US$ million) by Capacity, 2023 to 2033

Figure 102: APEJ Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 103: APEJ Market Value (US$ million) by Technology, 2023 to 2033

Figure 104: APEJ Market Value (US$ million) by Vehicle Type, 2023 to 2033

Figure 105: APEJ Market Value (US$ million) by Country, 2023 to 2033

Figure 106: APEJ Market Value (US$ million) Analysis by Country, 2017 to 2033

Figure 107: APEJ Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 108: APEJ Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 109: APEJ Market Value (US$ million) Analysis by Capacity, 2017 to 2033

Figure 110: APEJ Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 111: APEJ Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 112: APEJ Market Value (US$ million) Analysis by Sales Channel, 2017 to 2033

Figure 113: APEJ Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 114: APEJ Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 115: APEJ Market Value (US$ million) Analysis by Technology, 2017 to 2033

Figure 116: APEJ Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 117: APEJ Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 118: APEJ Market Value (US$ million) Analysis by Vehicle Type, 2017 to 2033

Figure 119: APEJ Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 120: APEJ Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 121: APEJ Market Attractiveness by Capacity, 2023 to 2033

Figure 122: APEJ Market Attractiveness by Sales Channel, 2023 to 2033

Figure 123: APEJ Market Attractiveness by Technology, 2023 to 2033

Figure 124: APEJ Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 125: APEJ Market Attractiveness by Country, 2023 to 2033

Figure 126: Japan Market Value (US$ million) by Capacity, 2023 to 2033

Figure 127: Japan Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 128: Japan Market Value (US$ million) by Technology, 2023 to 2033

Figure 129: Japan Market Value (US$ million) by Vehicle Type, 2023 to 2033

Figure 130: Japan Market Value (US$ million) by Country, 2023 to 2033

Figure 131: Japan Market Value (US$ million) Analysis by Country, 2017 to 2033

Figure 132: Japan Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Japan Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Japan Market Value (US$ million) Analysis by Capacity, 2017 to 2033

Figure 135: Japan Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 136: Japan Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 137: Japan Market Value (US$ million) Analysis by Sales Channel, 2017 to 2033

Figure 138: Japan Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 139: Japan Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 140: Japan Market Value (US$ million) Analysis by Technology, 2017 to 2033

Figure 141: Japan Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 142: Japan Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 143: Japan Market Value (US$ million) Analysis by Vehicle Type, 2017 to 2033

Figure 144: Japan Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 145: Japan Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 146: Japan Market Attractiveness by Capacity, 2023 to 2033

Figure 147: Japan Market Attractiveness by Sales Channel, 2023 to 2033

Figure 148: Japan Market Attractiveness by Technology, 2023 to 2033

Figure 149: Japan Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 150: Japan Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ million) by Capacity, 2023 to 2033

Figure 152: MEA Market Value (US$ million) by Sales Channel, 2023 to 2033

Figure 153: MEA Market Value (US$ million) by Technology, 2023 to 2033

Figure 154: MEA Market Value (US$ million) by Vehicle Type, 2023 to 2033

Figure 155: MEA Market Value (US$ million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ million) Analysis by Country, 2017 to 2033

Figure 157: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 158: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 159: MEA Market Value (US$ million) Analysis by Capacity, 2017 to 2033

Figure 160: MEA Market Value Share (%) and BPS Analysis by Capacity, 2023 to 2033

Figure 161: MEA Market Y-o-Y Growth (%) Projections by Capacity, 2023 to 2033

Figure 162: MEA Market Value (US$ million) Analysis by Sales Channel, 2017 to 2033

Figure 163: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 164: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 165: MEA Market Value (US$ million) Analysis by Technology, 2017 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 168: MEA Market Value (US$ million) Analysis by Vehicle Type, 2017 to 2033

Figure 169: MEA Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 170: MEA Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 171: MEA Market Attractiveness by Capacity, 2023 to 2033

Figure 172: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Figure 173: MEA Market Attractiveness by Technology, 2023 to 2033

Figure 174: MEA Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 175: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA