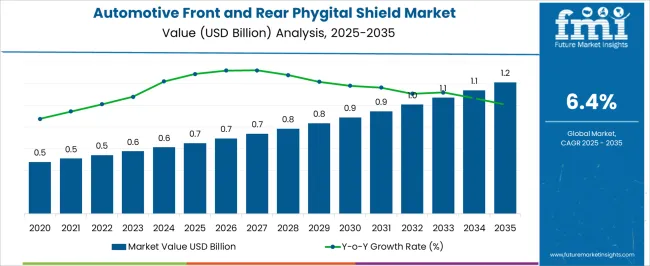

The automotive front and rear phygital shield market is anticipated to be worth 0.7 billion USD in 2025 and expected to reach 1.2 billion USD by 2035, expanding at a CAGR of 6.4 percent during the forecast period. This growth is being driven by the blending of physical protection with digital functionalities, creating shields that provide not only structural safety but also embedded sensors, connectivity, and adaptive features.

The year-on-year trajectory shows stability in the early period, with the market hovering between 0.5 and 0.7 billion USD until 2027, after which acceleration begins as adoption becomes stronger in premium and mid-range vehicles. By 2030, the market is estimated to cross 0.9 billion USD, a signal that digital integration is transforming traditional body parts into advanced automotive components.

Consumer expectations for safer, smarter, and more stylish vehicles are pushing automakers to integrate phygital shields that offer both protective strength and digital intelligence. The CAGR of 6.4 percent may appear moderate, but it signifies steady long-term growth rooted in technological adoption cycles, supply chain readiness, and regulatory encouragement for innovative safety features.

Suppliers that prioritize lightweight materials, digital sensor integration, and design adaptability are expected to capture higher share, particularly as automakers shift toward advanced EVs and connected vehicles. This market demonstrates a strong opportunity for those who understand that the shield is no longer just a physical barrier but an intelligent component shaping the next phase of automotive design.

| Metric | Value |

|---|---|

| Automotive Front and Rear Phygital Shield Market Estimated Value in (2025 E) | USD 0.7 billion |

| Automotive Front and Rear Phygital Shield Market Forecast Value in (2035 F) | USD 1.2 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

The automotive front and rear phygital shield market is influenced by five interconnected parent markets that collectively shape its adoption and long-term growth. The automotive safety systems market holds the largest share at nearly 40%, since phygital shields provide advanced crash protection while integrating digital sensors to enhance situational awareness.

The connected vehicle and telematics market contributes about 25%, as digital integration in shields supports data transmission, predictive maintenance, and driver-assist technologies. The automotive body and exterior components market accounts for nearly 15%, where demand arises from the need to balance lightweight materials, aerodynamics, and integrated electronics in shields. The smart materials and coatings market represents 12% share, driven by the use of self-healing polymers, nano-coatings, and anti-scratch layers that improve durability and performance. Lastly, the electric vehicle and advanced mobility market contributes around 8%, as automakers integrate phygital shields into EV architectures to maximize safety, efficiency, and design innovation.

This layered ecosystem shows that phygital shields are no longer just passive protective structures but are evolving into intelligent vehicle systems. Suppliers that bridge safety with digital intelligence will be better positioned to capture value, especially as automakers focus on differentiation through advanced design and enhanced user experience.

The automotive front and rear phygital shield market is advancing steadily, driven by the convergence of physical protective components with integrated digital functionalities to enhance vehicle safety, aerodynamics, and user interaction. Industry announcements and automotive technology briefings have underscored the role of phygital shields in providing both physical protection and embedded smart features such as sensors, displays, and connectivity modules.

The rise in demand for advanced driver assistance systems (ADAS) and vehicle personalization has increased adoption rates among OEMs. Passenger vehicle manufacturers, in particular, are incorporating phygital shields to align with evolving consumer expectations for safety and aesthetics.

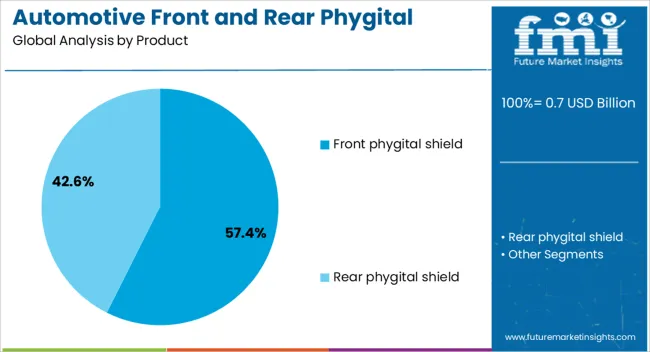

Advances in lightweight materials, impact resistance, and embedded electronics have further boosted product performance and reduced integration challenges. With regulations focusing on pedestrian safety, energy efficiency, and smart mobility, the market is expected to witness sustained growth. Segmental leadership is projected to remain with front phygital shields, passenger vehicles, and sensor-integrated technologies due to their high functional value and compatibility with next-generation automotive platforms.

The automotive front and rear phygital shield market is segmented by product, vehicle, technology, material, sales channel, and geographic regions. By product, automotive front and rear phygital shield market is divided into Front phygital shield and Rear phygital shield. In terms of vehicle, automotive front and rear phygital shield market is classified into Passenger vehicles and Commercial vehicles. Based on technology, automotive front and rear phygital shield market is segmented into Sensor-integrated shield, LED/display, and Aerodynamic. By material, automotive front and rear phygital shield market is segmented into Plastic/polymer-based, Metal-based, and Composite. By sales channel, automotive front and rear phygital shield market is segmented into OEM and Aftermarket. Regionally, the automotive front and rear phygital shield industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The front phygital shield segment is projected to account for 57.4% of the automotive front and rear phygital shield market revenue in 2025, retaining its dominant position due to its critical role in both vehicle aesthetics and safety. This segment’s growth has been driven by its integration with advanced lighting, sensor systems, and branding elements, making it a focal point for both functional and stylistic design.

Automotive design teams have prioritized front shield enhancements to accommodate radar, lidar, and camera modules essential for ADAS and autonomous driving capabilities. The position of the front shield as a primary aerodynamic surface has also contributed to vehicle efficiency improvements.

Furthermore, OEM investment in modular front shield designs has facilitated customization across vehicle models, appealing to diverse consumer segments. As front-facing technology integration expands in connected and semi-autonomous vehicles, the front phygital shield segment is expected to maintain its leadership.

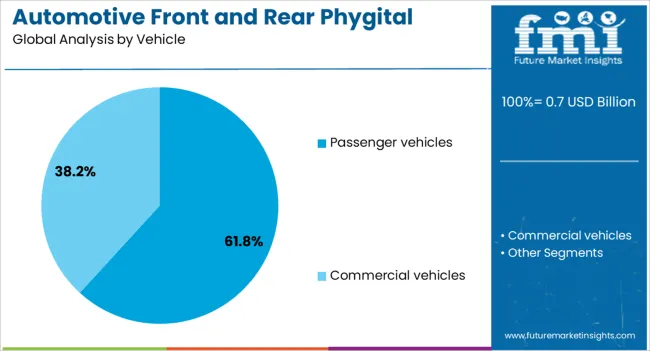

The passenger vehicles segment is projected to contribute 61.8% of the automotive front and rear phygital shield market revenue in 2025, maintaining its lead due to the high production volumes and consumer demand in this category. Growth in this segment has been supported by the widespread adoption of smart exterior components in premium and mid-range passenger cars, where enhanced safety, connectivity, and design are key selling points.

Passenger vehicle OEMs have invested heavily in embedding sensor arrays, adaptive lighting, and display features into shield systems to differentiate their models in a competitive market.

Consumer expectations for personalized vehicle exteriors and the rising adoption of electric vehicles have further encouraged integration of phygital shield technologies. With the passenger vehicle market serving as the primary testing ground for new automotive innovations, adoption rates for advanced shield systems are anticipated to remain highest in this segment.

The sensor-integrated shield segment is projected to hold 46.5% of the automotive front and rear phygital shield market revenue in 2025, positioning itself as the leading technology category. This growth has been driven by the increasing reliance on embedded sensors for navigation, collision avoidance, and adaptive driving functions.

Integration of radar, lidar, ultrasonic, and optical sensors within shield structures has streamlined vehicle design while protecting sensitive electronics from environmental exposure.

Automotive technology developers have focused on ensuring seamless operation of sensors without compromising shield aesthetics or structural integrity. The sensor-integrated approach has also supported the transition toward autonomous driving, where precise environmental mapping is critical. As regulatory frameworks evolve to require higher levels of safety and driver assistance features, the sensor-integrated shield segment is expected to see continued demand, driven by its essential role in modern and future mobility solutions.

The automotive front and rear phygital shield market is driven by luxury vehicle demand, ADAS integration, regulatory compliance, and aftermarket expansion. OEM partnerships and regional adoption will define growth trajectories.

The automotive front and rear phygital shield market is experiencing strong traction from premium and luxury vehicle manufacturers who are increasingly adopting advanced shielding solutions for performance and aesthetics. Automakers seek to enhance both the visual appeal and functional protection of vehicles, integrating digital features like adaptive lighting, smart displays, and interactive surfaces into shields. This trend is reinforced by consumer preference for personalization and premium styling, pushing OEMs to invest heavily in phygital shield technologies. Dollar sales, share, and brand positioning are being closely tracked by manufacturers to ensure competitiveness, while aftermarket demand also provides a growing revenue stream, particularly in regions with high luxury vehicle penetration.

The increasing reliance on ADAS and autonomous driving technologies is a significant dynamic driving the phygital shield market. Manufacturers are focusing on shields embedded with sensors, cameras, and connectivity features that support safety, navigation, and driver-assist functionalities. These shields not only protect vehicle components but also serve as carriers of digital intelligence, enabling seamless integration with real-time data systems. With automotive OEMs competing for differentiation in ADAS capabilities, the adoption of front and rear phygital shields is expected to expand rapidly. Market players are measuring growth through dollar sales, share improvements, and OEM collaborations, making it a key focus for R&D spending and product innovation.

Global automotive regulations on pedestrian safety, emissions, and vehicle design are reshaping demand for front and rear phygital shields. Compliance with crash safety standards and energy absorption requirements is driving shield innovation, ensuring both protection and regulatory adherence. Manufacturers are also integrating digital displays for signaling and communication in shields, aligning with road safety rules. This dual role, functional safety and digital interactivity, is expected to strengthen the shields’ position in global markets. Market stakeholders are evaluating dollar sales, share expansion, and compliance readiness as competitive advantages, with early movers expected to secure stronger market positions amid tightening regulations worldwide.

The aftermarket segment for automotive front and rear phygital shields is growing due to customization, replacement demand, and aesthetic upgrades. Regions like Asia-Pacific are showing accelerated adoption, with China, Japan, and South Korea leading in consumer-driven customization trends. Meanwhile, North America and Europe continue to focus on premium vehicle integration, aligning with advanced design and regulatory needs. This regional diversity creates opportunities for tailored product portfolios. Dollar sales, share metrics, and distribution channel strength are central factors for success. With both OEM and aftermarket channels contributing, manufacturers are expanding partnerships with distributors and service providers to capture untapped growth potential.

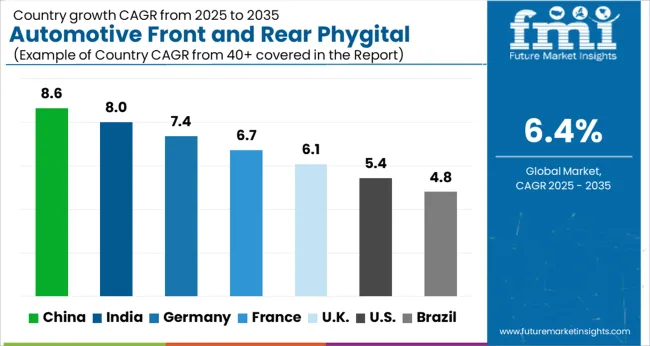

| Country | CAGR |

|---|---|

| China | 8.6% |

| India | 8.0% |

| Germany | 7.4% |

| France | 6.7% |

| U.K. | 6.1% |

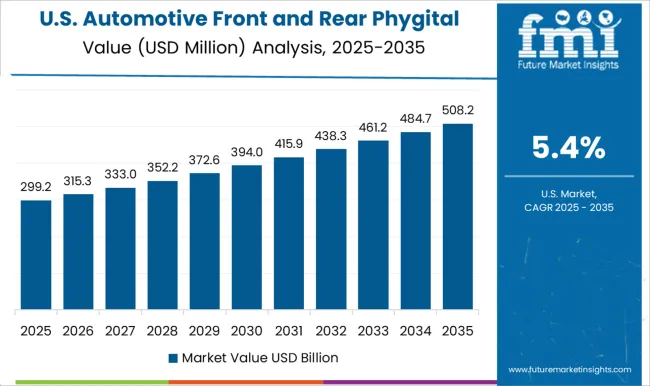

| U.S. | 5.4% |

| Brazil | 4.8% |

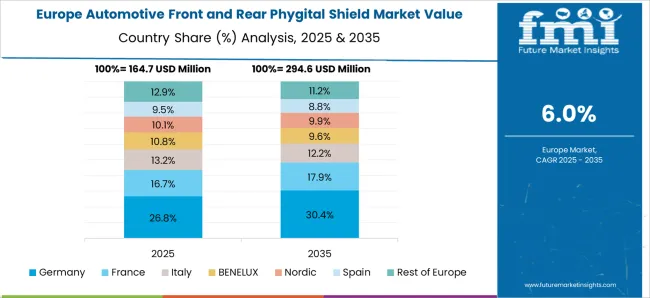

The global automotive front and rear phygital shield market is projected to grow at a CAGR of 6.4% between 2025 and 2035. China leads with an impressive 8.6% CAGR, driven by strong automotive manufacturing bases, technology adoption, and cost competitiveness. India follows at 8.0%, propelled by rising vehicle production, aftermarket customization, and growing demand for advanced shielding technologies. Germany, with 7.4% CAGR, remains a key hub for premium automotive engineering, while France (6.7%) and the U.K. (6.1%) focus on integrating design excellence with safety compliance. The U.S., growing at 5.4%, emphasizes premium adoption, R&D, and OEM collaborations for next-gen mobility solutions. Asia drives volume and cost efficiencies, while Europe and North America remain strong in innovation, compliance, and high-end vehicle markets. The analysis spans 40+ countries, with the leading markets shown below.

The automotive front and rear phygital shield market in China is projected to grow at a CAGR of 8.6% from 2025 to 2035, driven by scale manufacturing, large EV programs, and strong aftermarket demand. Domestic suppliers are leveraging mass production capabilities to supply both OEM and aftermarket channels, and leading component makers are prioritizing investments in smart surface integration. Vehicle platforms with integrated sensors, cameras, and interactive lighting are being adopted at scale, which increases demand for phygital shields that combine structural protection with electronic modules. Local supply chains are being optimized to reduce cost and cycle time, while partnerships with tier-1 global suppliers are being formed to access advanced sensor and materials know-how. For future competitiveness, emphasis is being placed on modular designs that permit faster platform adaptation and lower service costs. China will be viewed as the volume and cost hub for phygital shields, but premium engineering capabilities will be required to export higher-value integrated systems.

The automotive front and rear phygital shield market in India is estimated to expand at a CAGR of 8.0% from 2025 to 2035, as vehicle production volumes rise and demand for aftermarket customization grows. Manufacturing investments and assembly localization are being encouraged by policy measures and industry incentives, and component makers are being incentivized to offer cost-competitive phygital solutions for mass-market models. Integration of basic sensing and signaling functions into shields is being requested by OEMs to satisfy safety and user-experience goals without major cost penalties. Local startups are being observed to experiment with lightweight substrates and coating technologies that reduce weight while enabling embedded electronics. It is my view that India will become an important test bed for price-sensitive, scalable phygital shield designs that can be rolled out across emerging markets, provided supplier quality and regulatory compliance are consistently delivered.

The automotive front and rear phygital shield market in France is forecasted to grow at a CAGR of 6.7% from 2025 to 2035, supported by high engineering standards, safety regulation adherence, and premium OEM demand. Design-led integration is being emphasized by French automakers, and phygital shields with advanced surface finishes and embedded diagnostics are being preferred for premium segments. Regulatory compliance for pedestrian protection and crash performance is being enforced, which raises requirements for material selection and validation testing. Suppliers are being asked to demonstrate durability, signal integrity for embedded electronics, and ease of repairability under warranty programs. France will be seen as a market where quality and certification credentials are weighted more heavily than unit price, creating opportunities for suppliers that can deliver validated solutions with clear performance claims.

The automotive front and rear phygital shield market in the U.K. is anticipated to grow at a CAGR of 6.1% from 2025 to 2035, as research-intensive OEMs and suppliers pursue lightweighting and system integration. Academic-industry collaboration is being used to prototype sensor embedding techniques and reduce electromagnetic interference risks, and pilot programs are being run to test user-interface features embedded in exterior panels. Supply chain resilience and post-Brexit trade considerations are being managed by local manufacturers that are establishing regionalized sourcing strategies. Cost versus performance trade-offs are being examined closely by fleet buyers and premium vehicle makers, and serviceability under warranty is being requested as a selling point. The U.K. market will reward suppliers that can prove engineering credentials and offer after-sales support that minimizes downtime for connected exterior systems.

The automotive front and rear phygital shield market in the United States is projected to increase at a CAGR of 5.4% from 2025 to 2035, as electrification, fleet electrification pilots, and consumer demand for feature-rich vehicles stimulate adoption. Vehicle programs with integrated sensor suites are being specified by OEMs to improve driver assistance and diagnostics, and phygital shields are being treated as functional components rather than pure enclosures. Tier-1 suppliers are being contracted for full-system delivery, and emphasis is being placed on thermal management for embedded electronics and long-term reliability under varied climate conditions. U.S. demand will be slower in percentage terms but higher in unit value, since solutions with proven durability and high integration are being preferred for fleet and premium segments.

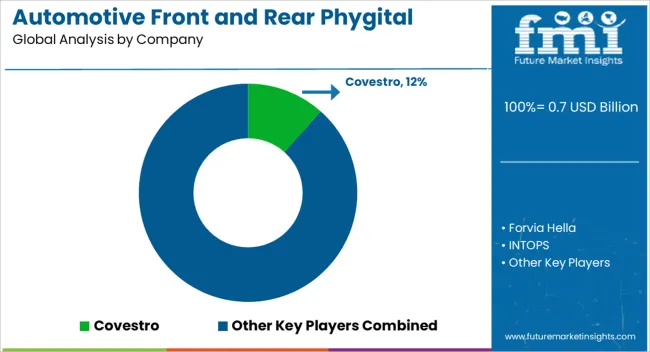

Competition in the market is defined by material innovation, sensor integration, and advanced manufacturing processes. Covestro plays a pivotal role with high-performance polymers and coatings optimized for durability and lightweight design. Forvia Hella leads in lighting and electronic integration, embedding advanced signaling and ADAS features within shield structures. INTOPS specializes in surface treatments and decorative technologies that blend aesthetics with functional sensor housing. Kia, as an OEM, drives adoption through in-house phygital shield integration across new EV and connected vehicle platforms. Magna brings expertise in exterior systems and structural integration, while Marelli focuses on combining design with functional electronics for global automakers. Motherson Group leverages its vast supply chain footprint to deliver scalable and cost-efficient solutions across regions. Niebling contributes expertise in precision molding and 3D surface technologies, enabling complex geometries and embedded functionalities.

Plastic Omnium (OPMobility) emphasizes smart exterior systems, integrating sensors, radars, and lighting within modular shield units. Valeo further strengthens competition with its capabilities in ADAS, thermal systems, and front-end electronics integration. Strategies revolve around modular shield platforms, weight reduction, and enhanced functionality with embedded sensors. Emphasis is also on aftermarket adaptability, where customizable shield solutions add incremental revenue. Supplier differentiation is marked by expertise in multi-material molding, embedded electronic durability, and co-development programs with OEMs. Collaboration across material suppliers, Tier-1 integrators, and OEMs is intensifying, signaling a competitive yet highly innovative market environment.

| Item | Value |

|---|---|

| Quantitative Units | USD 0.7 Billion |

| Product | Front phygital shield and Rear phygital shield |

| Vehicle | Passenger vehicles and Commercial vehicles |

| Technology | Sensor-integrated shield, LED/display, and Aerodynamic |

| Material | Plastic/polymer-based, Metal-based, and Composite |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Covestro, Forvia Hella, INTOPS, Kia, Magna, Marelli, Motherson Group, Niebling, Plastic Omnium (OPMobility), and Valeo |

| Additional Attributes | Dollar sales trends, regional and global market share, competitive positioning, material innovations, OEM adoption patterns, regulatory impacts, and growth opportunities across EV and connected vehicles. |

The global automotive front and rear phygital shield market is estimated to be valued at USD 0.7 billion in 2025.

The market size for the automotive front and rear phygital shield market is projected to reach USD 1.2 billion by 2035.

The automotive front and rear phygital shield market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in automotive front and rear phygital shield market are front phygital shield and rear phygital shield.

In terms of vehicle, passenger vehicles segment to command 61.8% share in the automotive front and rear phygital shield market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA