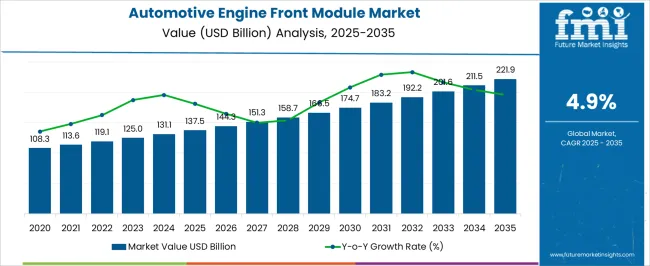

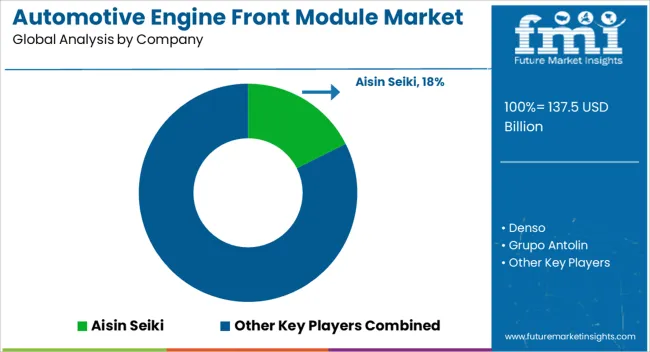

The automotive engine front module market is projected to grow from USD 137.5 billion in 2025 to USD 221.9 billion by 2035, with an absolute dollar opportunity of USD 84.4 billion. This growth is expected to be driven by increasing vehicle production, particularly in the mid and high-end segments, where engine front modules are essential for structural support, safety, and cooling systems.

The market's steady expansion reflects a rising demand for integrated modules that combine radiators, condensers, and other key components, improving overall vehicle performance and safety. The strong absolute dollar opportunity points to ongoing investments from OEMs focused on efficiency and regulatory compliance in their engine designs. From 2030 onward, the market is expected to see continued growth, with increasing demand from electric vehicle platforms, where engine front modules play a critical role in supporting powertrains and battery cooling systems.

The opportunity will also be supported by the shift towards lightweight materials and modular designs, which help optimize fuel efficiency and reduce vehicle weight. Suppliers focusing on durable materials, ease of assembly, and long-term performance are expected to capture the majority of the market share.

| Metric | Value |

|---|---|

| Automotive Engine Front Module Market Estimated Value in (2025 E) | USD 137.5 billion |

| Automotive Engine Front Module Market Forecast Value in (2035 F) | USD 221.9 billion |

| Forecast CAGR (2025 to 2035) | 4.9% |

The automotive engine front module segment is estimated to contribute about 19% of the automotive front end modules market, around 12% of the automotive engine components market, close to 8% of the automotive structural components market, about 16% of the automotive thermal management systems market, and nearly 6% of the automotive body and chassis market. Combined, this accounts for approximately 61% across the listed parent categories.

The essential role of engine front modules is in integrating critical vehicle systems such as the radiator, condenser, and cooling systems within the front-end structure of the vehicle. These modules are designed to optimize space, reduce weight, and improve vehicle safety and crash performance. Analysts view this segment as a key enabler for improving vehicle efficiency, safety, and overall performance, particularly in compact and mid-size vehicle designs. The demand has been supported by regulatory pressures to enhance crashworthiness, improve aerodynamics, and reduce fuel consumption, as well as by increasing consumer demand for lightweight, high-performance vehicles.

The growth of electric vehicles, in particular, has introduced new opportunities for engine front modules, with a focus on cooling efficiency and space management for high-voltage systems. As such, the automotive engine front module market is positioned as an integral component within these parent markets, with long-term stability expected as automotive design continues to evolve in response to both safety and efficiency demands.

The automotive engine front module market is showing steady growth, driven by the rising demand for lightweight, integrated, and efficient front-end assemblies in modern vehicles. Increasing adoption of modular designs is enabling manufacturers to optimize assembly processes, reduce production time, and enhance vehicle performance. The growing focus on vehicle safety, aerodynamics, and emissions compliance is further influencing the adoption of advanced front module designs.

Integration of multiple components such as radiators, headlamps, air conditioning condensers, and crash management systems into a single module is improving cost efficiency and structural integrity. The expansion of the passenger vehicle segment, coupled with growing demand in emerging markets, is contributing significantly to revenue growth.

Technological advancements in materials and manufacturing techniques are enabling higher durability while reducing weight. As global automotive production continues to recover and evolve towards electric and hybrid platforms, engine front modules are expected to adapt with enhanced thermal management capabilities, ensuring their continued relevance and growth across the industry.

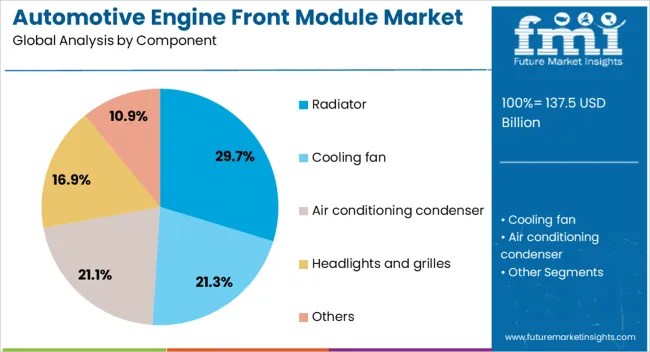

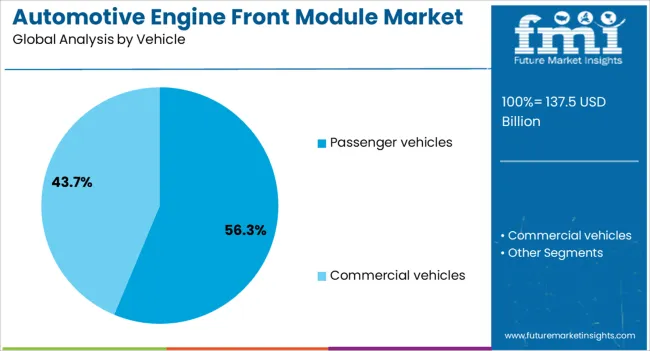

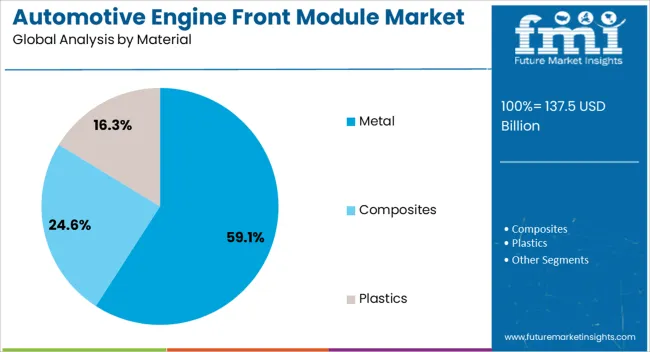

The automotive engine front module market is segmented by component, vehicle, material, sales channel, and geographic regions. By component, automotive engine front module market is divided into Radiator, Cooling fan, Air conditioning condenser, Headlights and grilles, and Others. In terms of vehicle, automotive engine front module market is classified into Passenger vehicles and Commercial vehicles. Based on material, automotive engine front module market is segmented into Metal, Composites, and Plastics. By sales channel, automotive engine front module market is segmented into OEM and Aftermarket. Regionally, the automotive engine front module industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The radiator segment is projected to account for 29.7% of the automotive engine front module market revenue share in 2025, establishing it as the leading component. This dominance is being driven by the critical role radiators play in engine cooling and thermal management, ensuring optimal operating temperatures and preventing overheating. Increasing demand for high-performance cooling systems in both internal combustion and hybrid vehicles is reinforcing the importance of advanced radiator designs within front modules.

Manufacturers are integrating lightweight and corrosion-resistant materials to enhance efficiency and longevity, aligning with industry trends toward improved fuel economy and reduced emissions. The rise in global vehicle production, combined with the growing adoption of modular assemblies that incorporate radiators as a core element, is boosting market penetration.

Technological improvements, such as enhanced fin structures and optimized coolant flow patterns, are enabling better heat dissipation, meeting the requirements of modern engines with higher power density This performance reliability and integration compatibility are key factors sustaining the radiator segment’s leadership.

The passenger vehicles segment is expected to hold 56.3% of the automotive engine front module market revenue share in 2025, making it the dominant vehicle category. Its leadership is being reinforced by the large-scale production volumes of passenger cars worldwide and the continuous demand for comfort, safety, and performance. Engine front modules in this segment are being designed for optimal integration of multiple components to improve manufacturing efficiency and reduce assembly complexity.

The growing focus on vehicle weight reduction to improve fuel economy and comply with stringent emission standards is encouraging the adoption of lightweight modular front assemblies. Increasing consumer preference for technologically advanced vehicles with enhanced cooling, aerodynamics, and safety systems is also driving demand.

The expansion of electric and hybrid passenger vehicle production is introducing new requirements for front module designs with improved thermal management for battery systems and electronics. As the global passenger vehicle market continues to expand, especially in emerging economies, demand for advanced engine front modules is set to remain strong.

The metal segment is projected to represent 59.1% of the automotive engine front module market revenue share in 2025, establishing itself as the leading material type. This dominance is being supported by the superior structural strength, impact resistance, and thermal conductivity that metals provide in front module applications. Metal-based engine front modules offer enhanced durability and can withstand the mechanical stresses and temperature variations encountered in diverse driving conditions.

Their compatibility with existing manufacturing and welding processes also contributes to cost efficiency and scalability in high-volume production. While composite and plastic materials are gaining traction for weight reduction, metals remain the preferred choice in applications where structural integrity and longevity are prioritized.

Advances in lightweight metal alloys are enabling manufacturers to balance strength with weight savings, aligning with the automotive industry’s efficiency goals. The sustained use of metal materials in engine front modules is also driven by their recyclability, supporting the industry’s shift toward sustainable manufacturing practices without compromising performance standards.

The automotive engine front module market is expected to grow as manufacturers prioritize crashworthiness, lightweight designs, and energy-efficient layouts for front-end structures. Demand is being reinforced by OEM fitment of integrated bumper beams, crash boxes, radiators, and air intakes. Opportunities are opening in electric vehicle platforms, modular designs, and lightweight materials like aluminum and composites. Trends point to aerodynamic integration, multi-functional modules, and customizable configurations. Challenges persist around material costs, crash performance variability, supplier consolidation, and evolving regulatory standards in safety testing.

Demand has been supported by stringent safety regulations that require integrated engine front modules to meet crash test standards while optimizing space for cooling systems, sensors, and electrical components. OEMs are increasingly opting for modules that combine bumper beams, radiators, and air intakes in one compact assembly to streamline production and improve vehicle aerodynamics. The strongest pull is coming from light and mid-size vehicle segments, where balance between crash safety and weight reduction is critical. Increased focus on pedestrian safety features and integrated crash boxes is shaping the demand for more robust front-end modules. As vehicles become more complex, the trend toward multifunctional modules with optimized airflow and thermal management will continue to drive demand.

Opportunities are opening in the electric vehicle (EV) market, where the need for lightweight and compact engine front modules is growing. Manufacturers are turning to materials like aluminum, high-strength steel, and composites to reduce the overall weight of front-end structures, which directly impacts vehicle range and performance. Multi-functional and modular designs that can be easily adapted for different vehicle models are gaining traction. The most significant opportunity lies in supplying integrated front-end modules to the rapidly expanding EV market, where space optimization for batteries and electronic components is essential. Suppliers that offer scalable, adaptable modules will capture a larger share of the market as manufacturers look to streamline assembly and reduce production costs.

Trends in the automotive engine front module market are emphasizing aerodynamic integration and customizable designs. As vehicle manufacturers seek to improve fuel efficiency and reduce drag, front-end modules are becoming more streamlined and optimized for airflow. The integration of cooling systems, sensor mounts, and other front-end components into a single modular unit is gaining popularity, reducing complexity and improving assembly efficiency. The most notable trend is the move toward more customizable front-end modules that can be adapted to different vehicle platforms, offering greater flexibility to manufacturers. The ability to create bespoke solutions for various vehicle designs will likely continue to shape the market in the coming years.

Rising material costs primarily drive challenges in the automotive engine front module market, stringent crash testing requirements, and evolving safety regulations. While lightweight materials like aluminum and composites offer significant advantages in terms of weight reduction, their higher costs and manufacturing complexities pose challenges for widespread adoption. Additionally, front-end modules must pass increasingly rigorous crash tests, which increases R&D and production costs.

Regulatory changes, especially in pedestrian safety standards and crash test requirements, continue to evolve, adding complexity to the design and testing phases. Suppliers who invest in cost-effective materials, while maintaining regulatory compliance, will be best positioned to meet the growing demand. Without these efficiencies, rising material and testing costs could limit profitability in an already competitive market.

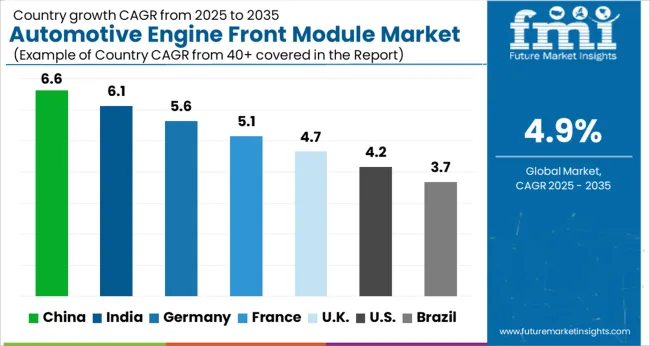

| Country | CAGR |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| France | 5.1% |

| UK | 4.7% |

| USA | 4.2% |

| Brazil | 3.7% |

The global automotive engine front module market is projected to grow at 4.9% from 2025 to 2035. China leads at 6.6%, followed by India 6.1% and France 5.1%; the United Kingdom 4.7% and the United States 4.2% follow. Demand is driven by increasing vehicle production, especially in compact and electric vehicles, where integration of components such as radiators, AC condensers, and crash beams is crucial. The market is also influenced by OEM trends toward modularization, cost reduction, and weight optimization for improved fuel efficiency. Asia is expected to lead in volume production, while Europe and the USA focus on premium technologies and regulations-compliant systems. Markets that optimize production efficiency and integrate multiple functions into a single module will gain the most traction. This report includes insights on 40+ countries; the top markets are shown here for reference.

The automotive engine front module market in China is expected to expand at 6.6%. Growth is being driven by high domestic vehicle production, with a particular emphasis on small and mid-sized vehicles where engine front modules (EFMs) are crucial for integration and weight reduction. Domestic OEMs are investing in modular platforms that combine radiators, condensers, and intercoolers to reduce complexity, weight, and space usage. Moreover, the adoption of electric vehicles (EVs) is accelerating the need for lightweight, efficient EFMs. In China, the automotive market is benefiting from a strong supplier base and the push for standardized manufacturing processes, making it a key player in both domestic and global supply chains.

The automotive engine front module market in India is projected to grow at 6.1%. As vehicle demand increases, particularly for compact cars and mid-size vehicles, the need for integrated and lightweight engine front modules is growing. OEMs are focusing on reducing vehicle weight, improving fuel efficiency, and cutting manufacturing costs, all of which are driving demand for modular engine front solutions. India’s automotive industry, led by both domestic manufacturers and global OEMs, is steadily adopting technologies that combine multiple functions, such as cooling, crash protection, and air intake, into single engine front modules. The market will continue to see strong growth, driven by cost-effective manufacturing and expanding demand for automotive safety and efficiency.

The automotive engine front module market in France is forecast to rise at 5.1%. France’s automotive market is moving toward lightweight and energy-efficient solutions, with a focus on reducing vehicle emissions and improving overall performance. The increasing adoption of electric vehicles (EVs) is spurring demand for lighter, more efficient engine front modules, while OEMs are focusing on integrating safety features such as crash beams and cooling systems within the engine front module. With stringent regulatory requirements around emissions and safety, the French market is likely to continue favoring advanced engine front modules that align with these standards.

The automotive engine front module market in the UK is expected to expand at 4.7%. The UK’s automotive market is witnessing a shift toward greater vehicle efficiency, particularly with regard to vehicle weight and energy consumption. Engine front modules are being designed with a focus on reducing space and integrating multiple functions, such as cooling, air intake, and crash protection, to improve overall vehicle performance. Furthermore, the increasing adoption of electric vehicles (EVs) in the UK is leading to more demand for lightweight engine front modules that align with the efficiency goals of EV platforms. It is expected that growth will continue steadily in the UK, driven by integration trends and a focus on reducing the environmental impact of vehicle manufacturing.

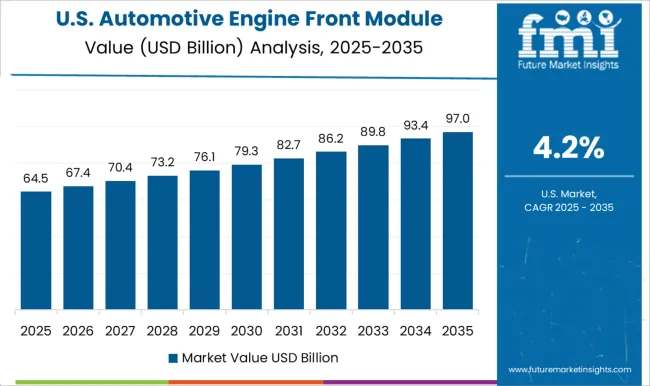

The automotive engine front module market in the United States is projected to grow at 4.2%. The demand for engine front modules in the USA is being shaped by increasing vehicle production, particularly in light-duty trucks, SUVs, and passenger vehicles. Manufacturers are focusing on integrating multiple components into a single module to improve vehicle performance and reduce space. The rise of electric and hybrid vehicles is creating additional demand for efficient and lightweight engine front modules. The USA market is expected to continue expanding as automakers work to meet stricter emissions standards and improve fuel efficiency.

Key players such as Magna International, Faurecia, Plastic Omnium, Hyundai Mobis, and Aisin Seiki dominate the market through extensive product portfolios, strong engineering capabilities, and integrated supply chain networks. Competition is primarily driven by the ability to deliver lightweight, durable, and crash-resistant modules that integrate radiators, cooling fans, impact absorbers, and structural supports efficiently. Differentiation among manufacturers is achieved through innovations in material science, such as the use of high-strength plastics, aluminum, and composite materials, as well as modular designs that enable faster assembly and compatibility across multiple vehicle platforms.

Regional production capabilities and proximity to OEM assembly plants influence competitive positioning, allowing faster lead times and lower logistics costs. Strategic alliances, joint ventures, and investments in research and development for electric and hybrid vehicle front-end modules further intensify rivalry. Mid-sized and niche suppliers focus on specialized solutions, including active grille shutters, pedestrian safety modules, and thermal management systems, adding depth to the competitive landscape.

| Item | Value |

|---|---|

| Quantitative Units | USD 137.5 Billion |

| Component | Radiator, Cooling fan, Air conditioning condenser, Headlights and grilles, and Others |

| Vehicle | Passenger vehicles and Commercial vehicles |

| Material | Metal, Composites, and Plastics |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Aisin Seiki, Denso, Grupo Antolin, Hella, HYUNDAI Mobis, Magna, Magneti Marelli, Mahle, Robert Bosch, and Valeo |

| Additional Attributes | Dollar sales by component type (vacuum booster, hydraulic booster, electronic brake booster, master cylinder), Dollar sales by vehicle class (passenger cars, light commercial, heavy commercial), Dollar sales by powertrain type (internal combustion engine, hybrid, electric vehicles), Trends in brake-by-wire and ADAS integration, Role in improving braking performance and safety, Regional demand across North America, Europe, Asia Pacific. |

The global automotive engine front module market is estimated to be valued at USD 137.5 billion in 2025.

The market size for the automotive engine front module market is projected to reach USD 221.9 billion by 2035.

The automotive engine front module market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in automotive engine front module market are radiator, cooling fan, air conditioning condenser, headlights and grilles and others.

In terms of vehicle, passenger vehicles segment to command 56.3% share in the automotive engine front module market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA