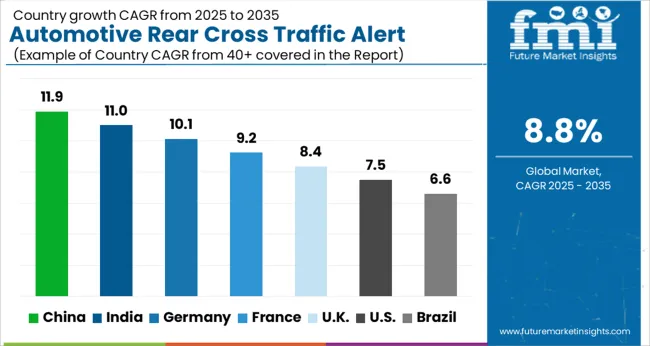

The automotive rear cross traffic alert market is estimated to be valued at USD 4.5 billion in 2025 and is projected to reach USD 10.5 billion by 2035, registering a compound annual growth rate (CAGR) of 8.8% over the forecast period.

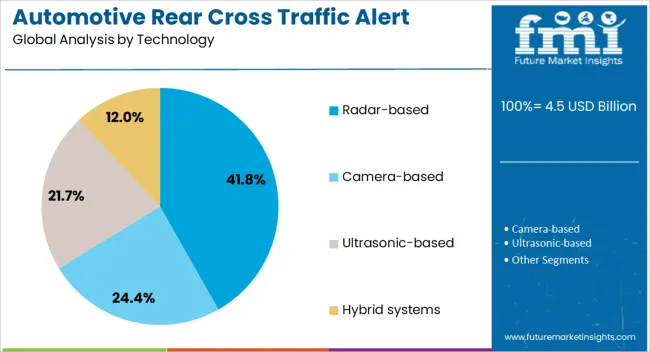

Contribution analysis by technology indicates that radar-based systems hold the largest share, as their proven reliability in detecting vehicles and obstacles across wider angles positions them as the backbone of rear cross traffic safety. Radar modules offer accurate object detection under poor weather and low-light conditions, which ensures dominance in both premium and mid-range vehicle segments. Ultrasonic sensor-based systems contribute primarily to entry-level applications, particularly in compact vehicles where affordability and short-range precision are key considerations. However, their limited range compared to radar reduces their scope in higher-end installations.

Camera-based solutions are emerging strongly, as advancements in image recognition and AI integration enable enhanced threat classification and reduced false alerts. Their rising contribution is closely tied to the broader adoption of advanced driver assistance systems. The most rapid contribution growth is expected from sensor fusion, where radar, camera, and ultrasonic technologies are combined for multi-layered detection. This integration provides a higher level of accuracy and reliability, aligning with the market shift toward semi-autonomous and autonomous driving ecosystems, thereby shaping the technology mix significantly over the forecast period.

| Metric | Value |

|---|---|

| Automotive Rear Cross Traffic Alert Market Estimated Value in (2025 E) | USD 4.5 billion |

| Automotive Rear Cross Traffic Alert Market Forecast Value in (2035 F) | USD 10.5 billion |

| Forecast CAGR (2025 to 2035) | 8.8% |

The automotive rear cross traffic alert market represents a specialized category within advanced driver assistance systems, demonstrating its increasing relevance in vehicle safety technologies. Within the overall ADAS market, it accounts for nearly 3.7%, highlighting its role in collision avoidance and parking assistance. In the passenger vehicle safety systems segment, its share is about 3.1%, supported by the growing installation of rear sensing technologies. Across the automotive radar and sensor components sector, it secures 2.8%, while in the electronic parking assist technologies segment, it is positioned at 2.4%. Within the smart mobility and connected vehicle safety ecosystem, it contributes nearly 2.2%, underlining its importance in driver awareness and accident prevention. Recent developments in this market emphasize sensor fusion, improved detection accuracy, and broader vehicle integration.

Advancements in short range radar and ultrasonic sensors have strengthened performance in crowded environments, reducing false alarms and enhancing response times. Leading automakers are integrating rear cross traffic alert with blind spot monitoring and automatic emergency braking, creating unified safety suites. Semiconductor and sensor suppliers are investing in miniaturized radar modules and advanced signal processing, supporting compact vehicle platforms. Collaborations between technology providers and OEMs have resulted in adaptive alert algorithms, improving performance under varying weather and lighting conditions. Increasing regulatory focus on rear safety measures has accelerated adoption, particularly in mid-range vehicles. These advancements illustrate how safety innovation, regulatory alignment, and consumer demand are driving growth in this specialized automotive safety market.

The market is experiencing steady growth driven by the rising demand for advanced driver assistance systems and enhanced vehicle safety technologies. Increasing consumer awareness regarding vehicle safety, coupled with stringent government regulations on road safety and collision prevention, is supporting market expansion. Growth is further encouraged by the rising adoption of connected car technologies and the integration of intelligent sensors and software systems in vehicles.

Manufacturers are focusing on integrating radar, ultrasonic, and camera-based technologies to provide real-time alerts and automated responses to rear traffic hazards. The passenger vehicle segment has emerged as a key driver due to higher safety expectations and rapid adoption of technologically advanced vehicles.

Technological advancements in radar and sensor systems, along with decreasing component costs, have increased accessibility and adoption rates across vehicle categories In addition, the focus on reducing road accidents, especially in urban environments and parking areas, is expected to continue driving market growth over the next decade, providing opportunities for both OEMs and aftermarket solution providers.

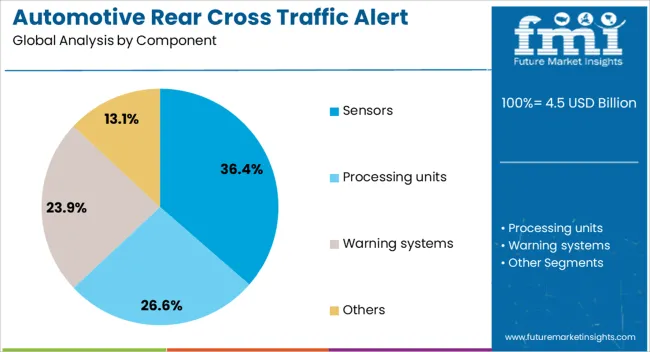

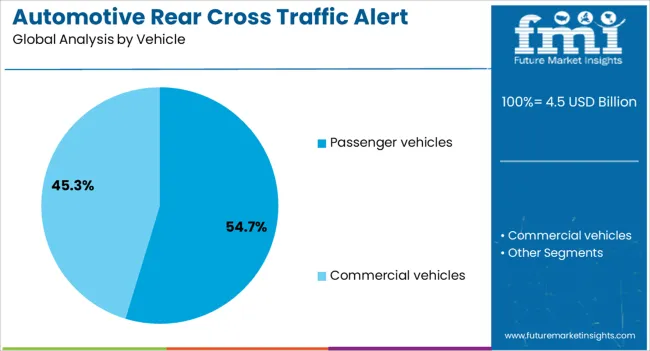

The automotive rear cross traffic alert market is segmented by component, vehicle, technology, sales channel, and geographic regions. By component, automotive rear cross traffic alert market is divided into sensors, processing units, warning systems, and others. In terms of vehicle, automotive rear cross traffic alert market is classified into passenger vehicles and commercial vehicles. Based on technology, automotive rear cross traffic alert market is segmented into radar-based, camera-based, ultrasonic-based, and Hhybrid systems. By sales channel, automotive rear cross traffic alert market is segmented into OEM and aftermarket. Regionally, the automotive rear cross traffic alert industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The sensors component segment is projected to hold 36.40% of the automotive rear cross traffic alert market revenue in 2025, making it the leading component segment. This dominance is attributed to the critical role sensors play in detecting obstacles and transmitting real-time data to vehicle control systems.

The growth of this segment has been supported by continuous technological advancements in radar, ultrasonic, and LiDAR sensors, which offer higher accuracy and reliability in traffic detection. The modular design and integration capabilities of sensors allow for easier incorporation into various vehicle models, ensuring compatibility with both existing and new vehicle architectures.

Additionally, the demand for vehicles equipped with automated safety systems has driven OEMs to prioritize high-quality sensors to enhance system performance and comply with global safety regulations The segment’s market leadership is expected to be reinforced as sensor technologies continue to evolve, offering improved detection ranges, lower power consumption, and seamless integration with software-defined safety systems.

The passenger vehicles end-use segment is expected to account for 54.70% of the market revenue in 2025, establishing it as the largest consumer segment. This growth is being driven by the widespread adoption of advanced driver assistance systems in passenger cars due to increasing safety awareness among vehicle owners.

OEMs are increasingly equipping passenger vehicles with rear cross traffic alert systems to enhance market competitiveness and meet regulatory safety requirements. Rising urban traffic congestion and a growing focus on reducing parking-related collisions have reinforced the segment’s demand.

Additionally, passenger vehicles offer greater flexibility in integrating radar, camera, and ultrasonic technologies, enabling higher performance of cross traffic alert systems As consumer preference shifts toward vehicles with intelligent safety features, the passenger vehicle segment is poised to maintain its leading position, with further growth expected from mid-size and luxury vehicle categories that prioritize safety and technology-driven convenience.

The radar-based technology segment is projected to hold 41.80% of the market revenue in 2025, emerging as the leading technology. This leadership is driven by radar systems’ superior ability to detect moving objects under various environmental conditions, including low visibility and adverse weather.

Radar technology enables precise distance measurement and object tracking, which is critical for real-time collision warning and automated braking systems. The adoption of radar-based systems has been supported by their compatibility with passenger vehicles and integration with other sensor types to provide a comprehensive safety solution.

Additionally, decreasing production costs, miniaturization of radar modules, and the growing emphasis on reducing rear-end accidents in urban areas have reinforced market growth As vehicle manufacturers continue to focus on enhancing driver safety through advanced ADAS features, radar-based technology is expected to retain its leading share, driven by its reliability, scalability, and integration potential across diverse vehicle platforms.

The market has gained traction as driver assistance systems continue to expand across vehicle categories. This technology uses radar and sensor-based systems to detect approaching vehicles from the side when reversing, reducing risks of collision in congested environments. Increasing consumer demand for enhanced vehicle safety features and regulatory encouragement of advanced driver assistance systems are shaping adoption. Automakers are integrating these systems into both premium and mid-range models. Rising urban traffic density, parking space constraints, and the shift toward automated driving technologies are also supporting the market expansion globally.

Rear cross traffic alert is increasingly integrated as part of broader advanced driver assistance systems in modern vehicles. Automakers are embedding this function with blind spot detection and parking assist modules, ensuring greater coverage for drivers in complex reversing situations. Demand has been reinforced by safety-conscious consumers who are valuing comprehensive driver assistance packages. The integration of rear cross traffic alert with existing sensor and radar architectures has reduced costs, making it more accessible in mid-segment cars. Regulatory encouragement of advanced safety standards across Europe, North America, and parts of Asia has also accelerated its adoption, ensuring its presence in mass-market vehicles.

One of the key drivers of the market is the rising consumer preference for systems that enhance safety in parking environments. With growing traffic congestion and limited parking availability, vehicles are increasingly exposed to collision risks during reversing maneuvers. Rear cross traffic alert addresses this challenge by detecting approaching traffic from blind spots, improving driver confidence and safety. Automakers are promoting this feature as a differentiating factor in competitive vehicle segments, especially in SUVs and crossovers where rear visibility is limited. As drivers prioritize convenience and peace of mind in urban traffic conditions, adoption of rear cross traffic alert systems has strengthened.

Safety regulations and vehicle rating systems have had a considerable influence on the expansion of the rear cross traffic alert market. Programs such as the European New Car Assessment Programme and the United States National Highway Traffic Safety Administration have elevated awareness of advanced safety features, influencing consumer choice and automaker compliance strategies. Automakers aiming for higher safety ratings are increasingly equipping vehicles with rear cross traffic alert as part of their standard safety package. Regional governments promoting collision avoidance and driver assistance technologies are further accelerating market growth, making regulatory pressure a powerful driver of system adoption globally.

Rear cross traffic alert systems are being recognized as critical building blocks in the transition toward higher levels of automated driving. Their ability to sense approaching traffic and communicate with other vehicle systems provides a foundation for autonomous parking and collision avoidance functions. Automakers and suppliers are leveraging rear cross traffic alert technologies to support the development of fully automated safety platforms. As vehicles continue to integrate greater connectivity and vehicle-to-everything communication, rear cross traffic alert systems will serve as an essential layer of redundancy and driver assistance. This positions the technology at the intersection of present safety needs and future automation.

| Country | CAGR |

|---|---|

| China | 11.9% |

| India | 11.0% |

| Germany | 10.1% |

| France | 9.2% |

| UK | 8.4% |

| USA | 7.5% |

| Brazil | 6.6% |

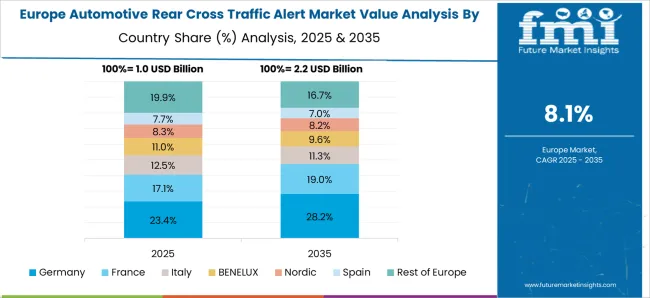

The market is forecasted to expand steadily with strong adoption in major economies. China is projected at 11.9%, driven by increasing deployment of advanced driver assistance systems. India follows at 11.0% where integration in mid-segment vehicles is strengthening growth. Germany is estimated at 10.1% as automakers focus on enhancing road safety features across premium and compact categories. The United Kingdom is expected at 8.4% with consistent adoption supported by regulatory emphasis on vehicle safety. The United States is projected at 7.5%, where rising consumer preference for advanced safety technologies in SUVs and passenger cars continues to shape demand. The market outlook suggests wider integration of rear cross traffic alert technology across automotive segments. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is anticipated to grow at a CAGR of 11.9%, driven by the rapid adoption of advanced driver assistance systems in passenger and commercial vehicles. Growing vehicle ownership and government policies that encourage road safety have supported the integration of technologies such as rear cross traffic alert. Automakers are increasingly equipping mid-range and premium models with these systems to enhance consumer appeal. Rising demand for safety-focused features, combined with strong investments in smart mobility, continues to boost market development. With domestic production capabilities and expanding adoption in both electric and conventional vehicles, China is positioned as a major contributor to the global automotive rear cross traffic alert market.

India is projected to grow at a CAGR of 11.0%, supported by the rising focus on vehicle safety and technology adoption. Rear cross traffic alert is being increasingly integrated into new vehicle models to reduce collision risks during reversing. Automakers are enhancing safety offerings to meet consumer demand and regulatory requirements. Although the feature is more common in higher-end vehicles, gradual cost reductions are expected to enable wider adoption across different segments. Expanding vehicle sales, particularly in the SUV and passenger car categories, are further driving market penetration. The trend toward connected mobility also enhances opportunities for rear cross traffic alert systems in India.

Germany is expected to record a CAGR of 10.1%, supported by its strong automotive manufacturing base and innovation in safety technologies. Rear cross traffic alert has become a standard safety feature in many premium vehicle segments, with growing penetration in mid-range cars as well. The emphasis on road safety and consumer demand for advanced driver assistance is accelerating system integration. Strong R&D activities by domestic automakers further contribute to market expansion. With Germany’s leadership in automotive engineering, adoption of rear cross traffic alert technology is expected to rise steadily across domestic and export markets.

The United Kingdom is forecast to expand at a CAGR of 8.4%, driven by increasing awareness of vehicle safety and adoption of driver assistance systems. Rear cross traffic alert is being integrated into a wider range of passenger vehicles, particularly SUVs and crossovers, which dominate consumer preferences. Regulatory measures encouraging advanced safety technologies have further supported adoption. The rising trend of connected vehicles and emphasis on reducing road accidents are also contributing to demand. Although adoption has been higher in premium models, mid-segment vehicle integration is gaining traction, ensuring consistent market growth.

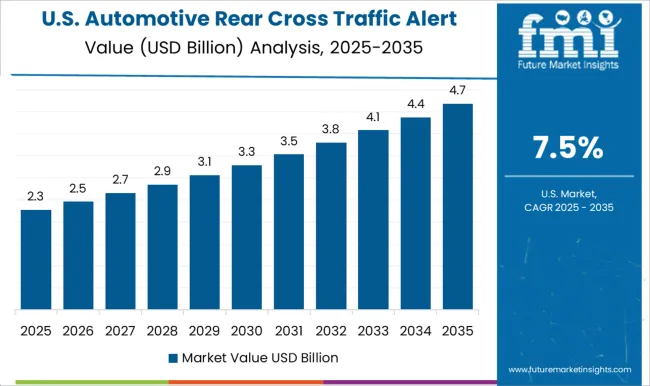

The United States is projected to grow at a CAGR of 7.5%, supported by rising consumer preference for safety-focused vehicles and regulatory emphasis on accident reduction. Rear cross traffic alert systems are widely adopted in SUVs, pickup trucks, and premium cars, which dominate the USA vehicle market. Automakers are increasingly offering these systems as either standard or optional features across different vehicle classes. The growing role of advanced driver assistance systems in enhancing road safety continues to influence adoption. With strong automotive sales and consumer awareness of safety, the USA remains a significant market for rear cross traffic alert systems.

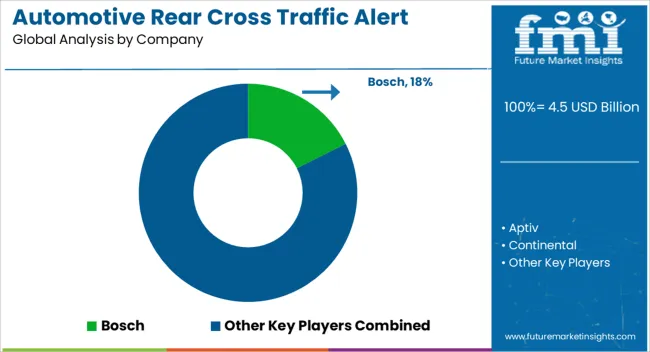

The market is characterized by the involvement of leading global automotive technology providers and semiconductor manufacturers. Bosch remains at the forefront with its advanced driver assistance systems that integrate radar and sensor technologies for enhanced rear detection. Aptiv offers electronic architectures and active safety solutions designed to improve vehicle situational awareness. Continental is a strong player with radar and camera-based systems aimed at reducing collision risks during reversing maneuvers. Denso contributes significantly through its sensor and electronic control systems that support safety functionalities in passenger and commercial vehicles. Infineon plays a critical role as a semiconductor supplier, providing microcontrollers and radar chips essential for rear cross traffic alert functions.

NXP Semiconductors supports the market with secure connectivity and radar processing solutions tailored for automotive applications. Sensata focuses on intelligent sensor technologies that enhance vehicle safety, while Valeo delivers advanced radar and ultrasonic systems integrated into parking and driver assistance modules. ZF Friedrichshafen combines its expertise in safety electronics and autonomous driving technologies to expand its presence in rear cross traffic alert solutions. Together, these companies shape a competitive and technology-driven landscape, with continuous innovation in radar, sensors, and AI-based algorithms driving adoption across global automotive markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.5 billion |

| Component | Sensors, Processing units, Warning systems, and Others |

| Vehicle | Passenger vehicles and Commercial vehicles |

| Technology | Radar-based, Camera-based, Ultrasonic-based, and Hybrid systems |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bosch, Aptiv, Continental, Denso, Infineon, NXP Semiconductors, Sensata, Valeo, and ZF Friedrichshafen |

| Additional Attributes | Dollar sales by system type and vehicle category, demand dynamics across passenger and commercial vehicles, regional trends in advanced driver assistance adoption, innovation in sensor integration, detection accuracy, and connectivity, environmental impact of electronic component production and disposal, and emerging use cases in autonomous driving systems and smart safety technologies. |

The global automotive rear cross traffic alert market is estimated to be valued at USD 4.5 billion in 2025.

The market size for the automotive rear cross traffic alert market is projected to reach USD 10.5 billion by 2035.

The automotive rear cross traffic alert market is expected to grow at a 8.8% CAGR between 2025 and 2035.

The key product types in automotive rear cross traffic alert market are sensors, processing units, warning systems and others.

In terms of vehicle, passenger vehicles segment to command 54.7% share in the automotive rear cross traffic alert market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA