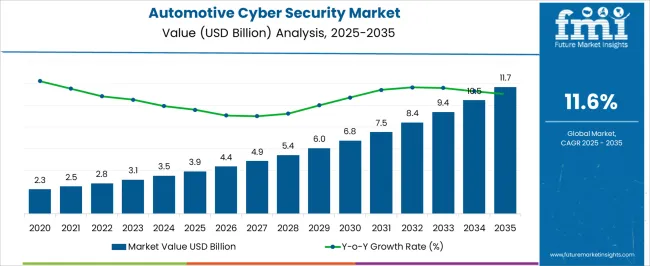

The Automotive Cyber Security Market is estimated to be valued at USD 3.9 billion in 2025 and is projected to reach USD 11.7 billion by 2035, registering a compound annual growth rate (CAGR) of 11.6% over the forecast period.

| Metric | Value |

|---|---|

| Automotive Cyber Security Market Estimated Value in (2025 E) | USD 3.9 billion |

| Automotive Cyber Security Market Forecast Value in (2035 F) | USD 11.7 billion |

| Forecast CAGR (2025 to 2035) | 11.6% |

The automotive cyber security market is witnessing accelerated growth as vehicles increasingly evolve into connected, software-defined platforms. Rising adoption of advanced driver-assistance systems, infotainment connectivity, and autonomous driving features is creating greater exposure to potential cyber threats, which is driving demand for robust security solutions. Regulatory bodies across major automotive markets are enforcing stringent cybersecurity standards, compelling manufacturers to integrate advanced protection mechanisms into vehicles from the design stage.

The growing shift toward electric vehicles and connected mobility ecosystems is further amplifying the need for end-to-end cybersecurity frameworks that safeguard communication networks, vehicle control systems, and user data. Increased investment by automakers and technology companies in in-vehicle firewalls, intrusion detection systems, and over-the-air security updates is reinforcing the market outlook.

As consumer reliance on digital services within vehicles continues to expand, ensuring data privacy, operational safety, and resilience against cyber-attacks will remain a central factor The long-term growth trajectory of the market is expected to be shaped by advancements in AI-driven threat detection, blockchain integration, and cooperative approaches between automotive OEMs and cybersecurity solution providers.

The automotive cyber security market is segmented by vehicle, security, form, application, and geographic regions. By vehicle, automotive cyber security market is divided into Passenger vehicles and Commercial vehicle. In terms of security, automotive cyber security market is classified into Network, Application, and Endpoint. Based on form, automotive cyber security market is segmented into In-vehicle cybersecurity and External cloud cybersecurity. By application, automotive cyber security market is segmented into ADAS & safety, Body control & comfort, Infotainment, Telematics, Powertrain systems, and Communication systems. Regionally, the automotive cyber security industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

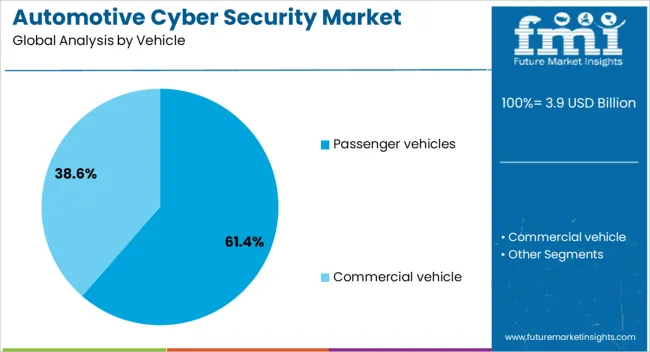

The passenger vehicles segment is projected to hold 61.4% of the automotive cyber security market revenue share in 2025, establishing it as the dominant vehicle category. This leadership is being driven by the rapid integration of digital connectivity features in personal vehicles, including advanced infotainment systems, telematics, and smart navigation tools.

Passenger vehicles are more frequently targeted by cyber threats due to their higher volumes and greater use of internet-enabled features compared to commercial fleets. Automakers are increasingly embedding cybersecurity solutions into vehicle architectures to meet regulatory mandates and address consumer expectations for data protection and safety.

The segment is also benefiting from the strong growth of electric and autonomous passenger vehicles, where software-defined systems play a critical role in vehicle control and user experience As personal mobility evolves toward greater connectivity and autonomy, the importance of comprehensive cybersecurity measures in passenger vehicles is set to intensify, reinforcing their leadership position within the overall market.

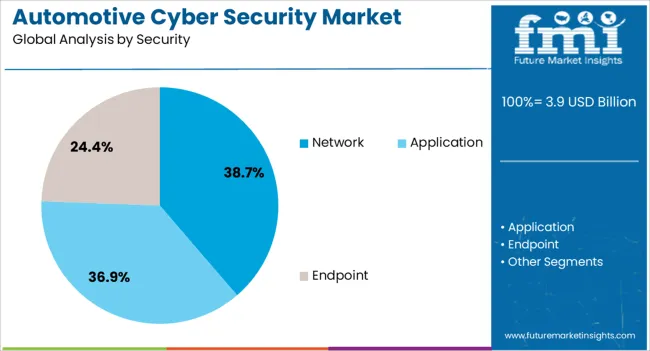

The network security segment is expected to account for 38.7% of the automotive cyber security market revenue share in 2025, making it a leading area of focus. This dominance is being reinforced by the need to secure communication between various electronic control units, sensors, and external networks in connected vehicles. The growing deployment of vehicle-to-vehicle and vehicle-to-infrastructure communication technologies is expanding the attack surface, requiring advanced encryption, intrusion prevention, and secure gateway solutions.

Network security is being prioritized by automakers and suppliers as it directly influences the reliability of critical safety systems, including braking, steering, and collision avoidance. Increasing collaboration between automotive manufacturers and cybersecurity technology firms is accelerating the integration of advanced network defense solutions.

With the expansion of over-the-air software updates and cloud-based vehicle services, maintaining the integrity of network communications has become indispensable The rising complexity of connected mobility ecosystems is expected to further drive adoption of robust network security frameworks, ensuring continued dominance of this segment in the coming years.

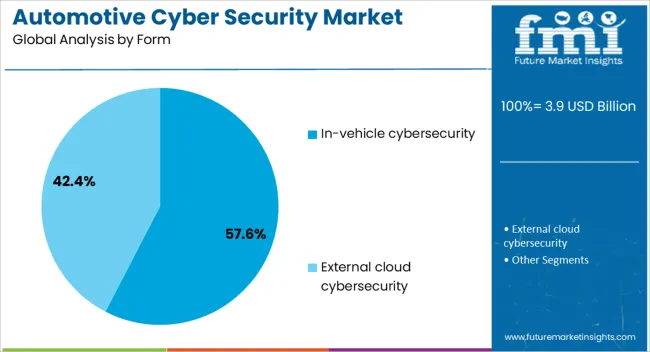

The in-vehicle cybersecurity form segment is anticipated to capture 57.6% of the automotive cyber security market revenue share in 2025, highlighting its critical importance in safeguarding modern vehicles. Its leadership is being supported by the need to protect embedded systems, sensors, and control units that directly manage essential vehicle operations. In-vehicle security solutions, such as secure gateways, intrusion detection systems, and endpoint protection, are being increasingly integrated to prevent unauthorized access and manipulation of vehicle functions.

The segment’s growth is further fueled by the rising adoption of software-defined architectures, electric drivetrains, and autonomous driving technologies, all of which rely heavily on secure in-vehicle communication. Regulatory frameworks mandating cyber resilience for vehicle electronics are accelerating adoption across global automotive markets.

The ability of in-vehicle cybersecurity systems to provide real-time monitoring and defense against emerging threats is enhancing confidence among automakers and consumers alike As vehicles become more reliant on software ecosystems, the demand for advanced in-vehicle security frameworks is expected to continue growing, ensuring this segment’s sustained leadership.

The usage of telematics services, such as information, navigation, safety, security, diagnostics, and entertainment, has been increased in recent years and is projected to grow at significant CAGR in the coming years. Along with this, connected cars and autonomous vehicles will be available globally in next five to ten years. The telematics services and connected cars requires internet for the functioning of some key applications and transferring of data.

As they required internet for sharing, they are also vulnerable to cyber-threats. Automotive Cyber Security is the system or technology which prevents or protect the systems of the vehicle which are susceptible to the any cyber-attack. As more and more vehicles are connected to the internet the automotive industry is working closely with the internet service providers, software companies, and others concerned players to provide better cyber security systems to end users.

The market for automotive cyber security is estimated to increase in the coming years due to increase in the adoption of telematics services in the vehicles. Also due to increasing threats of cyber-attacks in the automotive and transportation systems the need for automotive cyber security is increasing.

In next eight to ten years the demand for connected and autonomous vehicles is projected to grow, also number of companies are doing research in the field of connected vehicles and autonomous vehicles such as Google, Mobileye, Nissan, Audi, BMW, Ford, GM, Toyota, Daimler, and others.

Geographically, the Global Automotive Cyber Security Market can be divided by major regions which include North America, Latin America, Western and Eastern Europe, Asia-Pacific region, Japan, Middle East & Africa. North America, Western Europe, and Japan are the prominent market for automotive cyber security systems.

Due to increase in the adoption of advanced connected car systems in the vehicle in western countries the demand for automotive cyber security systems is increasing. Changing lifestyle along with increasing urbanization and purchasing power is anticipated to drive the Asia Pacific cyber security market during the forecast period.

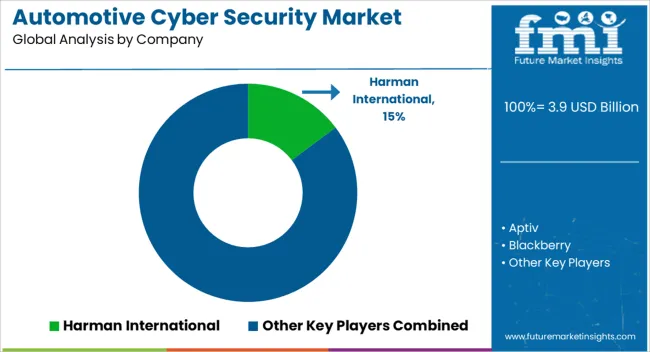

The major players identified across the value chain of global Automotive Cyber Security market include Argus Cyber Security Ltd., Cisco Systems Inc., Arilou Technologies, Harman International, Intel Corporation, NXP Semiconductors, ESCRYPT Embedded Systems, Secunet AG, and others.

The companies are emphasizing on research and development and new product development in order to maintain the competitive advantage in global automotive cyber security market during the forecast period. In order to meet the increasing demand of cyber security systems, companies all over the world are looking to expand the product portfolio and increase the sales strategies. The companies are also focusing on different strategies in order to maintain the market share in the global automotive cyber security market.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to categories such as market segments, geographies, types and applications.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts, and industry participants across the value chain. The report provides an in-depth analysis of parent market trends, macroeconomic indicators and governing factors, along with market attractiveness within the segments. The report also maps the qualitative impact of various market factors on market segments and various geographies.

| Country | CAGR |

|---|---|

| China | 15.7% |

| India | 14.5% |

| Germany | 13.3% |

| France | 12.2% |

| UK | 11.0% |

| USA | 9.9% |

| Brazil | 8.7% |

The Automotive Cyber Security Market is expected to register a CAGR of 11.6% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 15.7%, followed by India at 14.5%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 8.7%, yet still underscores a broadly positive trajectory for the global Automotive Cyber Security Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 13.3%. The USA Automotive Cyber Security Market is estimated to be valued at USD 1.4 billion in 2025 and is anticipated to reach a valuation of USD 3.5 billion by 2035. Sales are projected to rise at a CAGR of 9.9% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 192.9 million and USD 114.9 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.9 Billion |

| Vehicle | Passenger vehicles and Commercial vehicle |

| Security | Network, Application, and Endpoint |

| Form | In-vehicle cybersecurity and External cloud cybersecurity |

| Application | ADAS & safety, Body control & comfort, Infotainment, Telematics, Powertrain systems, and Communication systems |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Harman International, Aptiv, Blackberry, Continental, Denso, Intertek, Karamba Security, Lear, NXP, and Upstream Security |

The global automotive cyber security market is estimated to be valued at USD 3.9 billion in 2025.

The market size for the automotive cyber security market is projected to reach USD 11.7 billion by 2035.

The automotive cyber security market is expected to grow at a 11.6% CAGR between 2025 and 2035.

The key product types in automotive cyber security market are passenger vehicles and commercial vehicle.

In terms of security, network segment to command 38.7% share in the automotive cyber security market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA