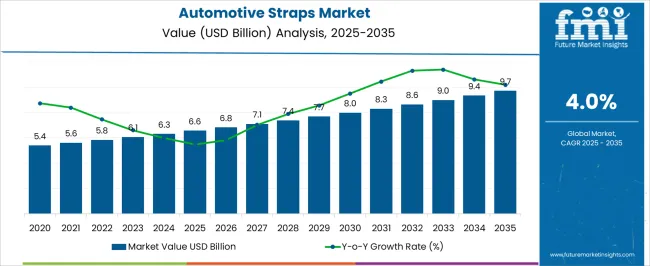

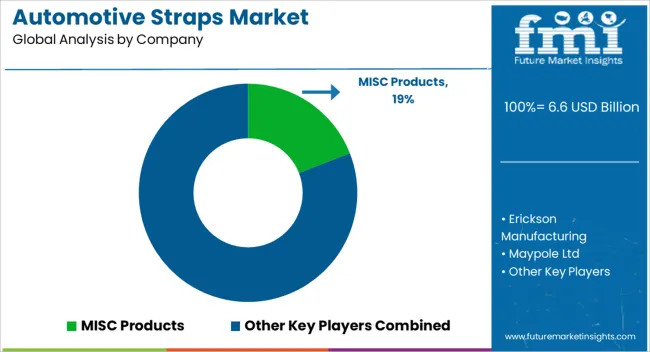

The Automotive Straps Market is estimated to be valued at USD 6.6 billion in 2025 and is projected to reach USD 9.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period.

| Metric | Value |

|---|---|

| Automotive Straps Market Estimated Value in (2025 E) | USD 6.6 billion |

| Automotive Straps Market Forecast Value in (2035 F) | USD 9.7 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The automotive straps market is witnessing consistent growth, supported by the increasing demand for enhanced safety, durability, and comfort features in vehicles across both passenger and commercial segments. Straps are being increasingly integrated into multiple automotive systems, including seating, cargo management, and structural fastening, as automakers seek lightweight and reliable solutions. Rising emphasis on occupant safety standards in developed economies and the introduction of stricter regulatory frameworks globally are boosting the adoption of high-quality strap systems.

Materials and designs are advancing rapidly, with manufacturers focusing on tensile strength, resistance to environmental factors, and long lifecycle performance. Growing production of vehicles in emerging markets, coupled with expanding adoption of electric vehicles, is generating additional demand for adaptable and high-strength strap solutions.

Continuous innovation in material science, particularly with polyester and advanced composites, is also enhancing functionality and performance As automotive manufacturing continues to prioritize safety and efficiency, the market is expected to expand steadily, supported by technological advancements and increasing regulatory compliance requirements across global automotive supply chains.

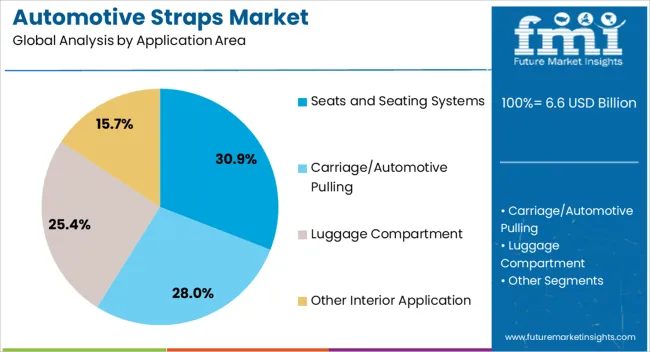

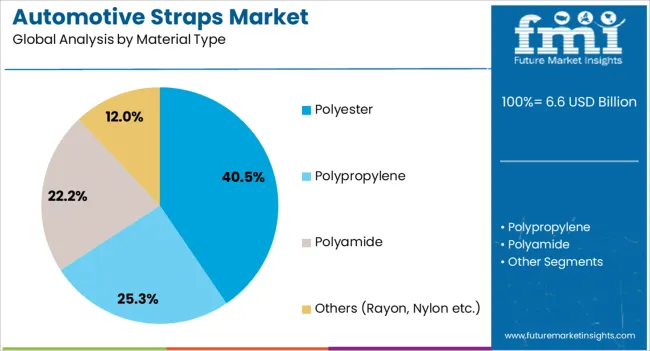

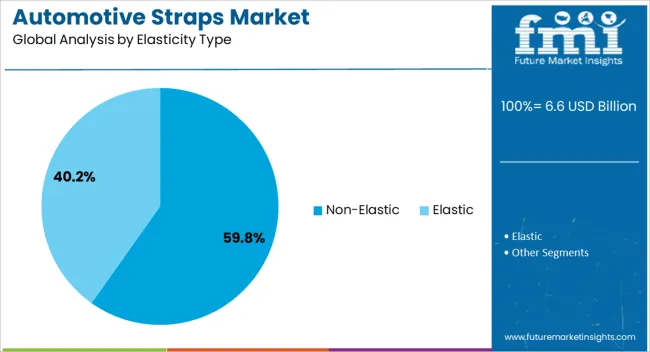

The automotive straps market is segmented by application area, material type, elasticity type, vehicle type, distribution channel, and geographic regions. By application area, automotive straps market is divided into Seats and Seating Systems, Carriage/Automotive Pulling, Luggage Compartment, and Other Interior Application. In terms of material type, automotive straps market is classified into Polyester, Polypropylene, Polyamide, and Others (Rayon, Nylon etc.). Based on elasticity type, automotive straps market is segmented into Non-Elastic and Elastic. By vehicle type, automotive straps market is segmented into Passenger Vehicles and Commercial Vehicles. By distribution channel, automotive straps market is segmented into OEM and Aftermarket. Regionally, the automotive straps industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The seats and seating systems application area segment is projected to hold 30.9% of the automotive straps market revenue share in 2025, making it the leading application. Its dominance is being supported by the growing importance of safety and ergonomic comfort in vehicle interiors, which has increased the need for durable and reliable straps in seating assemblies. Straps are essential in securing seating components and ensuring structural stability under dynamic driving conditions, which makes them indispensable for meeting crash safety standards.

Increasing adoption of advanced seat configurations, such as adjustable and foldable seating systems in passenger vehicles, is also driving demand for high-performance straps. The segment benefits from rising production of vehicles in both mass and premium categories, as consumer expectations for comfort and safety continue to expand.

Enhanced material strength and improved fatigue resistance have further reinforced the widespread use of straps in this application As automotive manufacturers continue to innovate in interior design and safety compliance, the seats and seating systems segment is expected to maintain its leading position within the market.

The polyester material type segment is anticipated to account for 40.5% of the automotive straps market revenue share in 2025, making it the largest material segment. Its leadership is being attributed to the combination of high tensile strength, resistance to stretching, and durability under varying environmental conditions. Polyester straps offer superior resistance to moisture, UV exposure, and abrasion, making them highly reliable in automotive applications where long-term performance is critical.

Their cost-effectiveness and versatility across multiple uses, from seat belt assemblies to cargo securement, are contributing to widespread adoption. Advances in polymer technology are enabling manufacturers to enhance the performance characteristics of polyester, further improving its strength-to-weight ratio and sustainability profile. With automotive OEMs increasingly prioritizing materials that deliver both safety and lifecycle efficiency, polyester has emerged as the preferred choice.

The segment is also benefitting from strong demand in both conventional and electric vehicles, where lightweight yet strong materials are required This sustained preference is expected to reinforce polyester’s dominant position in the global automotive straps market.

The non-elastic elasticity type segment is expected to hold 59.8% of the automotive straps market revenue share in 2025, securing its position as the leading elasticity type. This dominance is being driven by the critical role non-elastic straps play in ensuring secure fastening, stability, and safety in automotive applications. Their inability to stretch under load provides consistent performance and reliability, particularly in applications where load-bearing capacity and durability are essential.

The segment benefits significantly from widespread use in seating systems, cargo restraints, and structural fastening applications, where maintaining form and strength is vital. Non-elastic straps are also favored due to their cost-effectiveness and proven track record in meeting stringent automotive safety standards.

The increasing focus on enhancing passenger safety, reducing maintenance costs, and improving long-term performance is encouraging manufacturers to continue adopting non-elastic strap solutions As automotive OEMs expand production and place higher emphasis on safety and reliability, the non-elastic segment is anticipated to maintain its strong leadership within the global automotive straps market.

Straps are used across various industries for holding, reinforcing or fastening an items. Straps could be made from a wide range of materials primarily plastics, depending upon the purpose and tensile strength required.

The materials can be bonded by a variety of methods: sewing, pressing, hooking, and injection molding etc. In automotive industry straps are employed in luggage compartment, car interiors, seating systems and transportation. In luggage set-ups straps are commonly used for fastening purposes.

Contrary pull straps made with high grade webbing materials are being empirically used for towing, hauling and carrying vehicles. These days high standards of interior designs and functionality can be seen in modern vehicles, and straps forms an integral part of this structure. Not only they are being used as safety belts but also used for tightening and positioning seats, tethering airbags, retaining spare tires etc.

The market is full of diverse elastic and non-elastic straps for vehicle interiors. Automotive straps are available in variegated designs and forms owing to the purpose it satisfies. The global market for straps used in automotive industry is anticipated to see a decent CAGR over the forecast period.

Due to the global expansion of the automotive industry, the criticality of automotive straps has increased. It is pertinent to ensure the highest standards to ensure consumer satisfaction and compliance with safety regulations.

Due to high market competition, consumers show a preference for high-quality automotive straps that are affordable. This has made it difficult for new entrants to gain a level playing field in the market. The industry is dominated by industry giants such as Erickson, Taurus, and Grunt.

The use of automotive straps for land transportation is finding increased utility. Similarly, it also finds application in towing vehicles. Innovations in the automotive straps industry have aided in the development of innovative products garnering consumer attraction.

High competition, driven by rising consumer demands for affordable, highly efficient products, continues to burden the automotive straps market.

Europe's highly advanced automotive sector is one of the global leaders in the market for automotive straps. This is also fostered by the long-term presence of automotive giants such as Mercedes Benz in the region.

North America's robust automotive sector is expected to continue the growth of the market for automotive straps in the region. There is rising adoption of new-age technology-enhanced vehicles in the region such as Tesla.

Expansion of the OEM and other automotive manufacturers in the Asia-Pacific region provides a promising growth outlook for the region during the forecast period. This is primarily driven by government policies that incentivize the manufacturing of automotive components in the region.

The rising adoption of electric vehicles in countries like China and India due to stringent emission guidelines is expected to bring greater market growth.

The continuous growth in automobile sales across the globe is anticipated to be the primary factor driving the global automotive straps market in the forecast period. With advancement in automotive logistics and growth in transportation sector the need for pull straps used for automobile carriage purposes is presumed to rise.

Alongside, the growth in tourism and logistics industry across the world will drive the demand for straps used for fixing luggage in car boots. Accompanying this the rising demand for multifunctional and beautiful car interiors is also expected to fuel the market for straps used in automotive interiors.

At the same time the ever changing consumer needs and some technological advancement might counter effect the growth in the conventional straps market.

In terms of geography, the global automotive straps market has been divided in to seven key regions including North America, Latin America, Eastern Europe, Western Europe, Asia-Pacific excluding Japan, Middle East & Africa and Japan.

The APEJ nations (especially China) are expected to significantly contribute in the growth of global automotive strap market. With avid economic growth in the Asian nations, rising FDI, cheap labor cost; the growth in automobile manufacturing/transportation as well as consumption is destined to show an impressive increment, in-turn increasing their share of pie in the global automotive straps market.

Furthermore owing to the large number of car owners and innumerous logistic activities, North America and European markets are anticipated to protectively hold their majority share in the forecast period. In essence, the global growth in transportation and automotive sector will escalate the global automotive straps market across all the covered regions.

Some of the key players in the automotive straps market are JUMBO-Textile GmbH & Co., Maypole Ltd, Zilmont SRA, Damar Webbing Solutions Limited, Erickson Manufacturing Ltd., Sturges Manufacturing Inc., MISC Products Inc., etc.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data.

It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to market segments such as geographies, channel types, vehicle type and technology.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

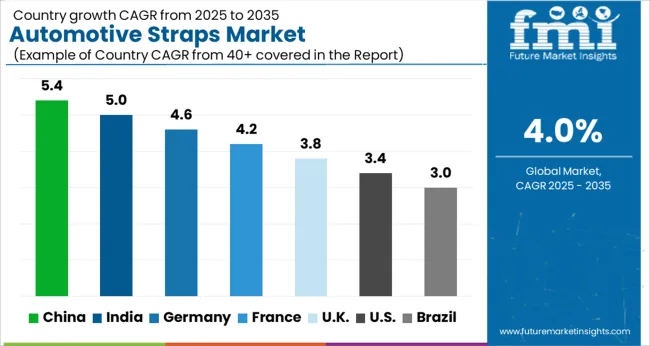

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

| USA | 3.4% |

| Brazil | 3.0% |

The Automotive Straps Market is expected to register a CAGR of 4.0% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 5.4%, followed by India at 5.0%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 3.0%, yet still underscores a broadly positive trajectory for the global Automotive Straps Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 4.6%. The USA Automotive Straps Market is estimated to be valued at USD 2.4 billion in 2025 and is anticipated to reach a valuation of USD 3.3 billion by 2035. Sales are projected to rise at a CAGR of 3.4% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 330.1 million and USD 221.1 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.6 Billion |

| Application Area | Seats and Seating Systems, Carriage/Automotive Pulling, Luggage Compartment, and Other Interior Application |

| Material Type | Polyester, Polypropylene, Polyamide, and Others (Rayon, Nylon etc.) |

| Elasticity Type | Non-Elastic and Elastic |

| Vehicle Type | Passenger Vehicles and Commercial Vehicles |

| Distribution Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | MISC Products, Erickson Manufacturing, Maypole Ltd, Zilmont s.r.o., JUMBO-Textil GmbH & Co, Sturges Manufacturing, and Damar Webbing Solutions Limited |

The global automotive straps market is estimated to be valued at USD 6.6 billion in 2025.

The market size for the automotive straps market is projected to reach USD 9.7 billion by 2035.

The automotive straps market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in automotive straps market are seats and seating systems, carriage/automotive pulling, luggage compartment and other interior application.

In terms of material type, polyester segment to command 40.5% share in the automotive straps market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA