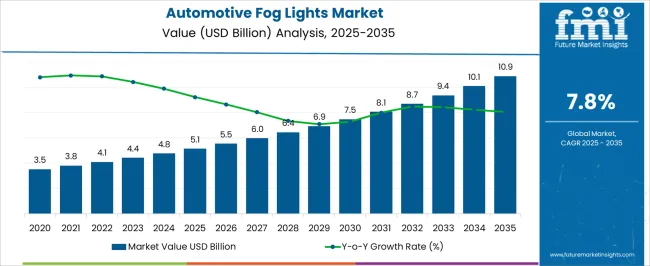

The Automotive Fog Lights Market is estimated to be valued at USD 5.1 billion in 2025 and is projected to reach USD 10.9 billion by 2035, registering a compound annual growth rate (CAGR) of 7.8% over the forecast period.

| Metric | Value |

|---|---|

| Automotive Fog Lights Market Estimated Value in (2025 E) | USD 5.1 billion |

| Automotive Fog Lights Market Forecast Value in (2035 F) | USD 10.9 billion |

| Forecast CAGR (2025 to 2035) | 7.8% |

The automotive fog lights market is witnessing significant expansion, supported by growing concerns for road safety and increasing adoption of advanced lighting technologies in vehicles. Rising global vehicle production, coupled with stricter regulations on visibility and driver assistance systems, is boosting demand for high-performance fog lighting solutions. Advancements in semiconductor lighting technologies, particularly the integration of LEDs with intelligent control systems, are reshaping the market landscape by enabling enhanced brightness, energy efficiency, and durability.

Consumer preference for vehicles equipped with safety-enhancing features is driving adoption across both passenger cars and commercial vehicles. Furthermore, the growing aftermarket demand for upgraded fog lighting systems, influenced by aesthetic appeal as well as functional performance, is contributing to market growth.

Regional governments are also emphasizing stricter automotive lighting standards, encouraging manufacturers to invest in innovative designs and high-quality materials As electrification, autonomous driving technologies, and premium vehicle sales increase, the market for automotive fog lights is anticipated to experience sustained growth, supported by strong innovation pipelines and expanding integration of advanced lighting systems into modern vehicles.

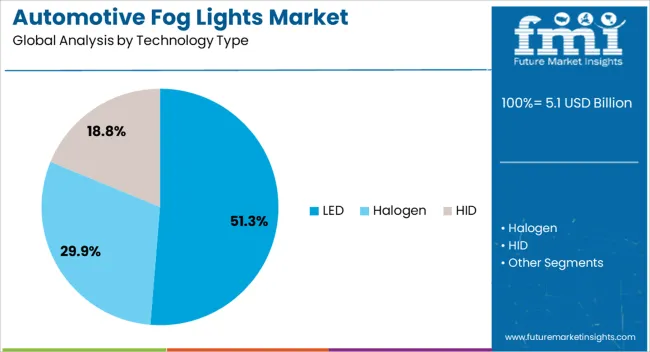

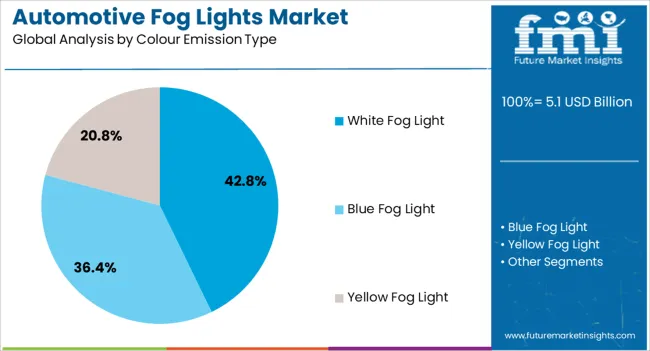

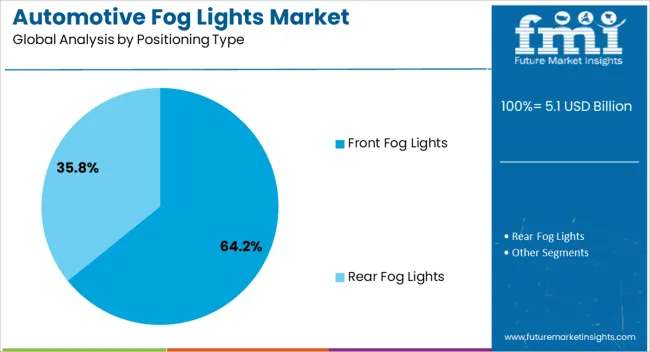

The automotive fog lights market is segmented by technology type, colour emission type, positioning type, channel type, and geographic regions. By technology type, automotive fog lights market is divided into LED, Halogen, and HID. In terms of colour emission type, automotive fog lights market is classified into White Fog Light, Blue Fog Light, and Yellow Fog Light. Based on positioning type, automotive fog lights market is segmented into Front Fog Lights and Rear Fog Lights. By channel type, automotive fog lights market is segmented into OEMs and Aftermarket. Regionally, the automotive fog lights industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The LED technology type segment is projected to account for 51.3% of the automotive fog lights market revenue share in 2025, making it the leading technology. Its dominance is being reinforced by superior energy efficiency, longer lifespan, and higher brightness compared to conventional halogen or xenon lighting. LEDs are enabling manufacturers to deliver compact and flexible designs that enhance both functionality and aesthetics in modern vehicles.

Their lower power consumption is highly advantageous for electric and hybrid vehicles, where energy optimization is a priority. Additionally, LED fog lights provide faster illumination response, which enhances driver safety in adverse weather conditions. Continuous advancements in semiconductor design and heat management technologies are further improving durability and performance, making LEDs more reliable in demanding automotive environments.

Growing consumer demand for premium vehicles equipped with advanced lighting features is accelerating adoption Furthermore, stricter regulatory standards on visibility and efficiency are compelling automakers to shift toward LED solutions, ensuring this segment maintains its leadership position in the coming years.

The white fog light colour emission type segment is expected to represent 42.8% of the automotive fog lights market revenue share in 2025, positioning it as the leading colour category. Its dominance is supported by the superior visibility it provides to drivers in foggy, rainy, or snowy conditions compared to yellow or other emission types. White light closely resembles natural daylight, improving driver comfort and reducing eye strain during extended night driving.

The growing trend toward modern vehicle aesthetics also favors white fog lights, as they align seamlessly with LED headlamp designs and enhance the overall vehicle appearance. Regulatory guidelines in several regions that encourage the use of high-visibility lighting systems are supporting the adoption of white fog lights.

In addition, advancements in optical lens design and reflector technologies are enabling optimized beam distribution, ensuring better illumination of road surfaces without glare As consumer expectations for safety, performance, and visual appeal continue to rise, white fog lights are expected to sustain their leadership in the market, reinforced by ongoing innovation in lighting efficiency and design integration.

The front fog lights positioning type segment is anticipated to hold 64.2% of the automotive fog lights market revenue share in 2025, establishing itself as the dominant positioning category. This leadership is being driven by the critical role front-mounted fog lights play in ensuring road visibility during severe weather conditions, where headlights alone are insufficient. Their low placement on the vehicle body enables them to illuminate the road directly beneath fog layers, providing clearer visibility and improving driver response time.

The segment is gaining momentum as automotive manufacturers integrate advanced lighting modules with adaptive beam control and automatic activation systems, enhancing driver safety and convenience. Increasing consumer awareness of the safety benefits associated with front fog lights is also supporting higher adoption across passenger cars and light commercial vehicles.

Furthermore, regulatory mandates in various countries requiring vehicles to be equipped with front fog lights are reinforcing their widespread use As technology advances and integration with LED and intelligent lighting systems grows, front fog lights are expected to maintain their dominant position in the market.

The automotive fog light market has witnessed a historic growth rate of 2.7 % from 2025 to 2025.

The COVID-19 pandemic, the trade war between the USA and China, and the conflict between Russia and Ukraine have all had a negative impact on the electronic, semiconductor, and automotive industries. As a result of severe preventive regulations imposed by each country's regional governments, disrupted supply chains, and raw material shortages, European and Asian countries suffered massive losses.

To meet rising demand, this market revenue is expected to rise at a healthy CAGR over the forecast period. Furthermore, the demand for automotive fog lights is expected to rise in tandem with the growing demand for electric vehicles, as they are installed in both hybrid and electric vehicles.

The government's strengthening of passenger vehicle safety rules and regulations, as well as rising safety awareness, are key drivers for the automotive fog light market. Governments and policymakers across the globe have introduced new norms applicable to increase the safety of travelers in passenger as well as commercial vehicles.

Front and rear fog lights became mandatory for passengers and commercial vehicles in many countries, especially in Germany and Sweden. The purpose of rear fog lights is to reveal the position of the vehicle on the road to enhance safety while driving in snow, fog, or other weather conditions that reduce visibility. These safety rules are generating demand for the automotive fog light market.

Fog light demand is expected to be high in the forecast period owing to an increase in road accidents due to a lack of visibility and consumers' preference for luxury and premium vehicles, as well as increased concern for driver and vehicle safety. Advanced and high-power fog lights are able to detect obstacles in dark and bad weather conditions, allowing the driver to take safety actions.

Fog lights have a limited lifespan and must be replaced frequently. As a result, the aftermarket for fog lights for automobiles is growing. Over the forecast period, this demand for fog lamp replacement and maintenance is expected to drive market growth.

Manufacturers' innovation in fog light technologies for end consumers is boosting market growth for automotive fog light systems. The increasing market for automobiles will create lucrative opportunities for the automotive fog light market.

Lack of awareness of fog lights is the restraining factor for the fog light market's growth. Across the globe, a lack of awareness among end-users restrains the market for fog lights, as they are considered part of the vehicle's design rather than a safety feature. The lack of fog lights on the market as a result of a supply shortage is also expected to limit fog light market growth.

The record-high prices caused by raw material shortages in the previous year are still having a significant impact on the economy. the production of fog lights and subcomponents that generate supply shortages. The changing global socioeconomic landscape, as well as political influence on global trade, are significant factors that are expected to drive up raw material costs and availability, negatively impacting the automotive fog light market.

The parent market of the automotive fog light is the automotive market, which is segmented into seven regions: North America, Latin America, Western Europe, Eastern Europe, Asia Pacific Excluding Japan (APEJ), Japan, and the Middle East and Africa (MEA). The APEJ region is a hub of automotive manufacturing across the globe and contributes a major share of the global automotive fog light market.

With rising automotive production and vehicle sales as a result the Asia Pacific region is expected to provide highly lucrative and rewarding opportunities for the automotive fog light market. Vehicle sales in developing economies such as India, China, and Indonesia are influenced by rising disposable income and per capita income, as well as rising population. South Asian countries are planning to become the manufacturing hub for automobiles and the technologies that will create the demand for fog lights.

The presence of key automotive manufacturers in the European and North American region, changing weather conditions, as well as the implementation of strict safety regulations by regional governments in this region, are expected to provide significant opportunities for automotive fog light markets.

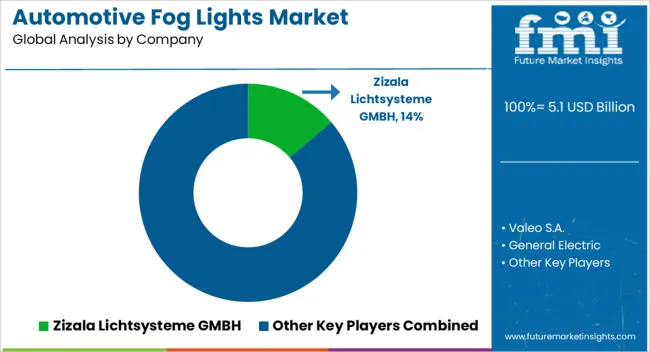

Major market players, including Zizala Lichtsysteme GMBH, Valeo S.A., General Electric, Hyundai Mobis, Magneti Marelli S.P.A., Osram GMBH, Royal Philips Electronics, PIAA corporation, Hella Kgaa Hueck & Co., Blazzer international, Warn Industries, Inc., Nokya, Sammoon Lighting & Electrical Co., Ltd., and Guangzhou Ledoauto Company Ltd., are using different strategies, such as product launches, strategic collaborations and acquisitions, partnerships, agreements, and contracts, to offer better products and remain competitive.

Opportunities in the fog light market can be created by key players through continuous innovation and deployment. Continuous Research and Development, combined with the market's growing automobile fleet, is expected to create significant market opportunities.

In 2025, leading fog light manufacturer OSRAM developed new fog lights to experience a whole new dimension in brightness.

LED driving FOG is the first LED fog light from OSRAM to use even light guide optics. With its wide beam angle and a wider field of vision, this LED light sets the standard. LED driving fog lights are an excellent replacement for most modern fog lights and can also be used as a daytime running light.

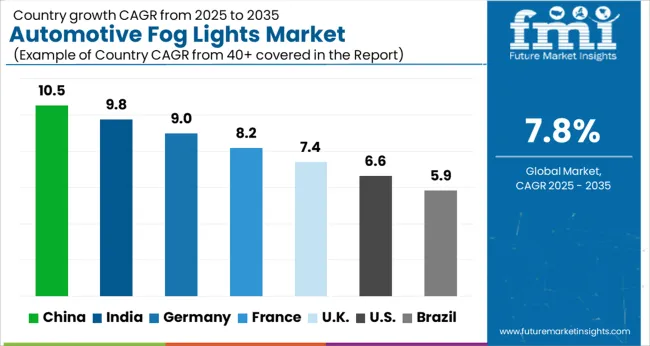

| Country | CAGR |

|---|---|

| China | 10.5% |

| India | 9.8% |

| Germany | 9.0% |

| France | 8.2% |

| UK | 7.4% |

| USA | 6.6% |

| Brazil | 5.9% |

The Automotive Fog Lights Market is expected to register a CAGR of 7.8% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 10.5%, followed by India at 9.8%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 5.9%, yet still underscores a broadly positive trajectory for the global Automotive Fog Lights Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 9.0%. The USA Automotive Fog Lights Market is estimated to be valued at USD 1.8 billion in 2025 and is anticipated to reach a valuation of USD 3.4 billion by 2035. Sales are projected to rise at a CAGR of 6.6% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 269.1 million and USD 146.4 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.1 Billion |

| Technology Type | LED, Halogen, and HID |

| Colour Emission Type | White Fog Light, Blue Fog Light, and Yellow Fog Light |

| Positioning Type | Front Fog Lights and Rear Fog Lights |

| Channel Type | OEMs and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Zizala Lichtsysteme GMBH, Valeo S.A., General Electric, Hyundai Mobis, Magneti Marelli S.P.A, Osram GMBH, Royal Philips Electronics, PIAA corporation, Hella Kgaa Hueck & Co., Blazzer international, Warn Industries, Inc., Nokya, Sammoon Lighting & Electrical Co., Ltd., and Guangzhou Ledoauto Company Ltd. |

The global automotive fog lights market is estimated to be valued at USD 5.1 billion in 2025.

The market size for the automotive fog lights market is projected to reach USD 10.9 billion by 2035.

The automotive fog lights market is expected to grow at a 7.8% CAGR between 2025 and 2035.

The key product types in automotive fog lights market are led, halogen and hid.

In terms of colour emission type, white fog light segment to command 42.8% share in the automotive fog lights market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Defogger System Market

Anti-Fog Lights Market

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA