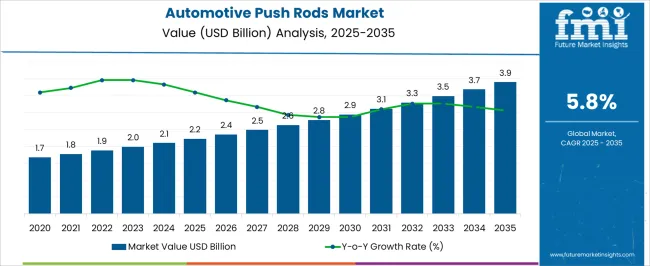

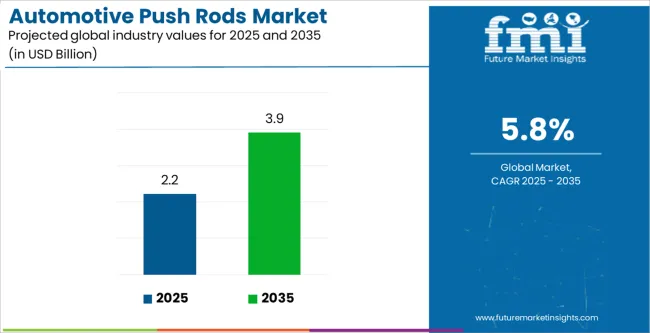

The Automotive Push Rods Market is estimated to be valued at USD 2.2 billion in 2025 and is projected to reach USD 3.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.8% over the forecast period.

| Metric | Value |

|---|---|

| Automotive Push Rods Market Estimated Value in (2025 E) | USD 2.2 billion |

| Automotive Push Rods Market Forecast Value in (2035 F) | USD 3.9 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

The Automotive Push Rods Market is experiencing consistent growth as internal combustion engine demand continues across global markets, particularly in regions where electrification is progressing gradually. Push rods remain a critical component in engines by transferring motion from the camshaft to the valve mechanism, ensuring reliable engine operation. The market outlook is shaped by the increasing demand for passenger cars and commercial vehicles that utilize push rod engines in both developed and emerging economies.

Rising production of light vehicles, along with the continued presence of push rod engines in performance and heavy-duty vehicles, has supported stable adoption. Investments by automakers in improving fuel efficiency and durability of engines are further creating opportunities for advanced push rod designs and materials.

The ability of push rods to provide cost-effective performance and withstand high-stress applications ensures their ongoing relevance While electric mobility trends are expected to influence long-term demand, the current market continues to benefit from established use in existing vehicle fleets and ongoing demand for combustion engine platforms.

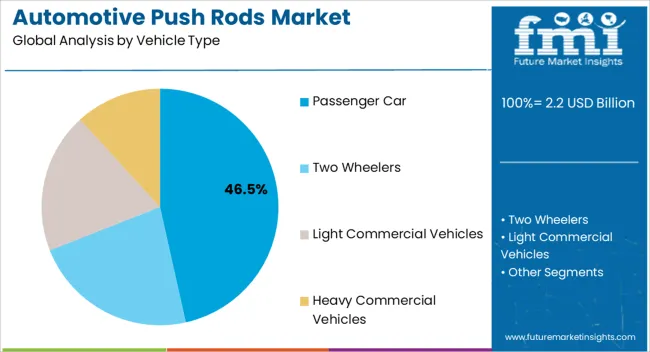

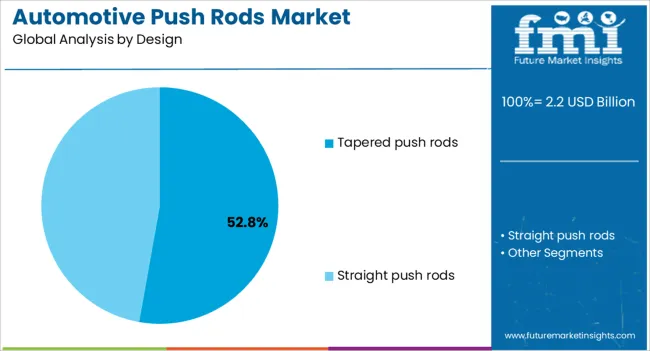

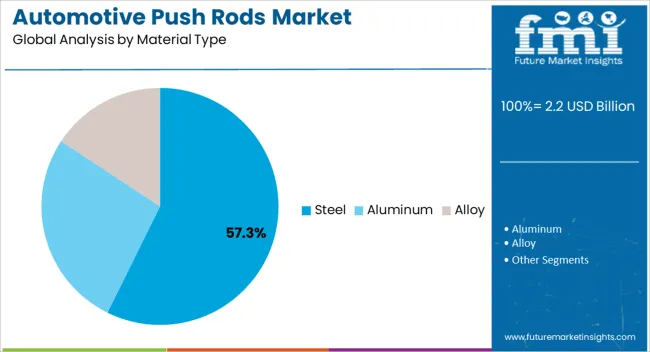

The automotive push rods market is segmented by vehicle type, design, material type, distribution channel, sales channel, and geographic regions. By vehicle type, automotive push rods market is divided into Passenger Car, Two Wheelers, Light Commercial Vehicles, and Heavy Commercial Vehicles. In terms of design, automotive push rods market is classified into Tapered push rods and Straight push rods. Based on material type, automotive push rods market is segmented into Steel, Aluminum, and Alloy. By distribution channel, automotive push rods market is segmented into Offline and Online. By sales channel, automotive push rods market is segmented into OEM and After Market. Regionally, the automotive push rods industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Passenger Car segment is projected to hold 46.50% of the Automotive Push Rods Market revenue in 2025, making it the leading vehicle type. This leadership position is being driven by the rising production volumes of passenger vehicles worldwide, particularly in Asia Pacific and North America, where consumer demand for reliable and affordable cars remains strong. Push rods in passenger cars have maintained relevance due to their cost-effectiveness, ease of integration, and compatibility with compact engine designs.

Automakers have focused on improving efficiency and performance by enhancing the durability and precision of push rods used in these vehicles. The continued reliance on internal combustion engines for passenger mobility, especially in markets where hybrid adoption is gradual, has reinforced the demand for push rod-equipped engines.

Additionally, the preference for low-maintenance and fuel-efficient vehicles has created favorable conditions for passenger car push rod applications As vehicle ownership rises in developing markets, the passenger car segment is expected to sustain its dominant market share supported by high production scale and widespread adoption.

The Tapered Push Rods design segment is anticipated to hold 52.80% of the Automotive Push Rods Market revenue in 2025, establishing it as the leading design category. This dominance has been achieved due to the superior strength-to-weight ratio offered by tapered designs, which improve performance and durability under high load conditions. These push rods are preferred in engines where efficiency, stability, and reduced mass are critical to achieving higher fuel economy and lower emissions.

Manufacturers have adopted tapered push rods to optimize the structural rigidity of engine assemblies, which reduces flexing and enhances valve timing precision. The segment has also benefited from growing applications in both passenger cars and performance-oriented vehicles, where durability and stability are essential.

The ability of tapered push rods to handle higher stress levels without compromising performance has supported their widespread adoption As automakers continue to focus on light weighting strategies and improved engine efficiency, the use of tapered designs is expected to remain strong and further reinforce segmental leadership.

The Steel material type segment is projected to account for 57.30% of the Automotive Push Rods Market revenue in 2025, emerging as the leading material category. This position is attributed to the high strength, durability, and cost-effectiveness of steel push rods, which make them the preferred choice for mass vehicle production. Steel push rods are capable of withstanding significant mechanical stress, high temperatures, and continuous wear, ensuring reliable performance in combustion engines over long service lives.

Their widespread availability and ease of manufacturing have made them the dominant material option across both passenger and commercial vehicle applications. In addition, steel push rods offer a favorable balance between cost and performance, supporting their selection by automakers seeking durable yet affordable solutions.

The segment has also been supported by ongoing improvements in metallurgical processes that enhance fatigue resistance and thermal stability As global vehicle production remains dependent on internal combustion engines, steel push rods are expected to sustain their leadership due to proven reliability and cost advantages.

Automotive push rods are connected with the rocker arms for synchronizing engine’s valve operating time. Automotive push rods are mostly used in twin V engine and overhead camshaft engines. Automotive push rods are available in different diameters according to the design of push rods. Nowadays, engine manufacturers prefer one piece push rods rather than three-piece push rods, in which the ends are welded.

Moreover, manufacturers are focusing on to reduce the weight of the push rods in order to increase the efficiency of the vehicles. Advancement in the design, material and manufacturing of automotive push rods is expected to contribute to the growth of the global automotive push rods market.

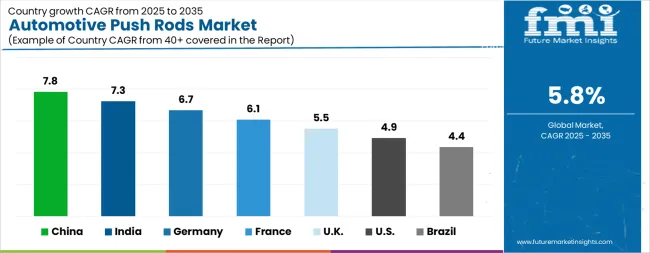

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

The Automotive Push Rods Market is expected to register a CAGR of 5.8% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 7.8%, followed by India at 7.3%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.4%, yet still underscores a broadly positive trajectory for the global Automotive Push Rods Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 6.7%. The USA Automotive Push Rods Market is estimated to be valued at USD 844.3 million in 2025 and is anticipated to reach a valuation of USD 1.4 billion by 2035. Sales are projected to rise at a CAGR of 4.9% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 105.7 million and USD 71.6 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.2 Billion |

| Vehicle Type | Passenger Car, Two Wheelers, Light Commercial Vehicles, and Heavy Commercial Vehicles |

| Design | Tapered push rods and Straight push rods |

| Material Type | Steel, Aluminum, and Alloy |

| Distribution Channel | Offline and Online |

| Sales Channel | OEM and After Market |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

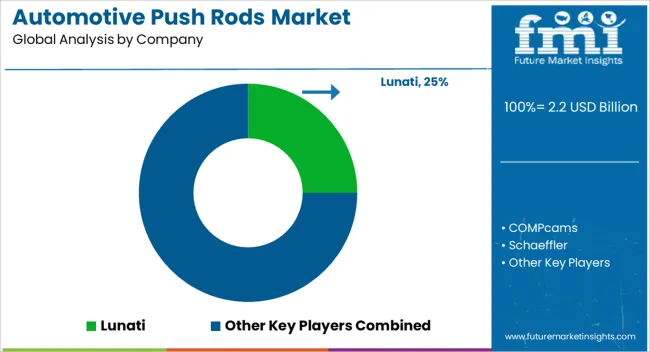

| Key Companies Profiled | Lunati, COMPcams, Schaeffler, Smith Bros. Pushrods, Wuxi Xizhou Machinery, Rane Engine Valve, Yuhuan Huiyu Tappets, JINAN WORLDWIDE AUTO-ACCESSORY, TRW, and Rossignol |

The global automotive push rods market is estimated to be valued at USD 2.2 billion in 2025.

The market size for the automotive push rods market is projected to reach USD 3.9 billion by 2035.

The automotive push rods market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in automotive push rods market are passenger car, two wheelers, light commercial vehicles and heavy commercial vehicles.

In terms of design, tapered push rods segment to command 52.8% share in the automotive push rods market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA