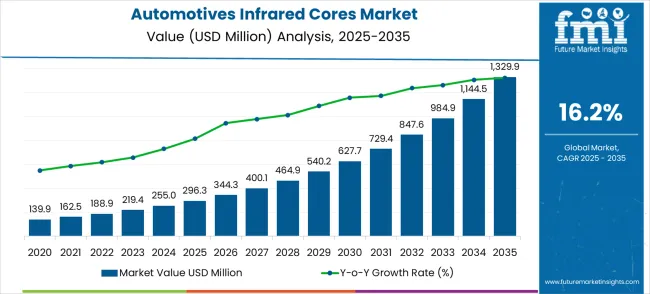

The global automotives infrared cores market is projected to expand from USD 296.3 million in 2025 to USD 1,329.9 million by 2035, growing at a CAGR of 16.2%. Over the ten-year horizon, the market will add USD 1,033.6 million in absolute value, representing more than fourfold growth. Ratio and proportion analysis reveals that the contribution to total growth is not uniform across the decade, with earlier years reflecting modest increments and later years driving the bulk of expansion. This distribution highlights how adoption of infrared cores in vehicles accelerates as technologies become cost-efficient, regulatory frameworks evolve, and integration into mass-market vehicle categories gains momentum.

From 2025 to 2028, the market grows from USD 296.3 million to USD 464.9 million, contributing USD 168.6 million, which accounts for 16.3% of the total decade-long increase. Annual increments rise from USD 48 million between 2025 and 2026 to USD 64.8 million by 2028. This phase marks the initial adoption of infrared cores in premium automotive applications, particularly in advanced driver-assistance systems and night vision solutions. The proportional share of growth in these years is smaller but significant in laying the foundation for larger-scale deployment. Early adopters, especially in high-end passenger vehicles, dominate segmental contributions during this period.

Between 2029 and 2032, expansion accelerates considerably, with the market rising from USD 540.2 million to USD 984.9 million, adding USD 444.7 million. This phase alone accounts for 43% of the decade’s total growth, underscoring its pivotal role as a key inflection point. Annual increments consistently exceed USD 100 million, reflecting broad-based adoption beyond luxury vehicles. Mid-range passenger vehicles and certain commercial vehicle categories are emerging as high contributors, as regulatory mandates and a growing focus on safety technologies drive wider deployment. Segmental contributions become more balanced, with mass-market adoption carrying greater weight compared to the earlier luxury-focused phase.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 296.3 million |

| Market Forecast Value (2035) | USD 1,329.9 million |

| Market Forecast CAGR | 16.2% |

The final stage, from 2033 to 2035, adds USD 345.4 million, representing 33.4% of cumulative growth. The market climbs from USD 984.9 million in 2032 to USD 1,329.9 million in 2035. Proportional contributions are still significant, showing that while the growth rate moderates slightly in percentage terms, the absolute value additions remain very high due to the larger base. By this stage, uncooled infrared cores are no longer niche technologies but increasingly standardized across automotive segments. Commercial vehicle applications and mid-tier passenger vehicles contribute strongly, while luxury applications stabilize in their share. This ratio-based assessment focuses that mid and later years are pivotal for market expansion, with adoption scaling rapidly across segments and geographies.

Market expansion is being supported by the rapid increase in autonomous vehicle development worldwide and the corresponding need for advanced sensor systems that provide superior detection performance and operational reliability in all weather conditions. Modern automotive safety systems rely on consistent thermal detection and environmental awareness capabilities to ensure optimal vehicle performance including collision avoidance, pedestrian detection, and autonomous navigation features. Even minor detection inefficiencies can require comprehensive safety protocol adjustments to maintain optimal vehicular safety standards and operational performance.

The growing complexity of automotive safety requirements and increasing demand for high-performance thermal imaging solutions are driving demand for infrared core systems from certified manufacturers with appropriate automotive-grade capabilities and technical expertise. Automotive manufacturers are increasingly requiring validated safety performance and system reliability to maintain regulatory compliance and consumer safety. Industry standards and safety regulations are establishing mandatory thermal detection procedures that require specialized sensor technologies and integrated system architectures.

The accelerating transition toward electric and autonomous vehicles is significantly contributing to market growth, as these advanced vehicles require sophisticated sensor arrays for optimal operation. Government safety mandates worldwide are increasingly requiring advanced driver assistance systems as standard equipment, driving widespread adoption of infrared thermal imaging technologies. The growing consumer awareness of vehicle safety features and willingness to pay for advanced safety systems is creating substantial market demand across all vehicle segments.

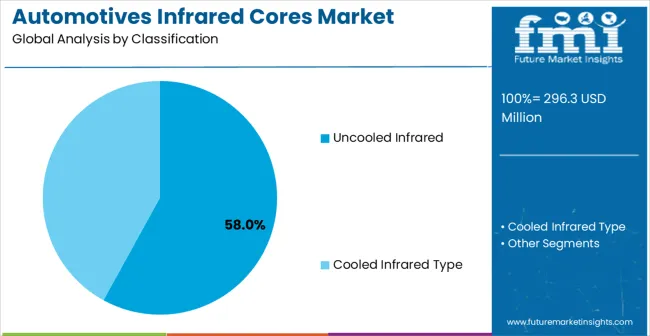

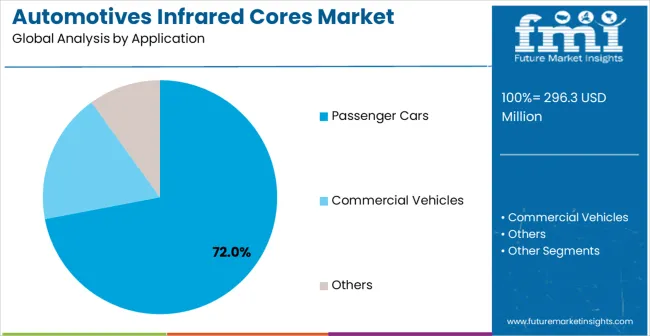

The market is segmented by product type, application, and region. By product type, the market is divided into uncooled infrared, cooled infrared, and others. Based on application, the market is categorized into passenger cars, commercial vehicles, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

In 2025, the uncooled infrared cores segment is projected to capture around 58% of the total market share, making it the leading product category. This dominance is largely driven by the widespread adoption of cost-effective thermal imaging systems that deliver reliable detection performance and operational efficiency, catering to a wide variety of automotive applications. The uncooled infrared technology is particularly favored for its ability to provide consistent thermal detection without requiring complex cooling systems, ensuring operational simplicity and reduced maintenance requirements.

Passenger car manufacturers, commercial vehicle producers, and automotive tier-one suppliers increasingly prefer this technology, as it meets demanding automotive requirements without imposing excessive system costs or complex integration challenges. The availability of well-established product portfolios, along with comprehensive integration support and technical assistance from leading manufacturers, further reinforces the segment's market position. This technology category benefits from consistent demand across vehicle segments, as it is considered a practical solution for automotive applications requiring reliable thermal detection. The combination of cost-effectiveness, performance, and integration simplicity makes uncooled infrared cores a dependable choice, ensuring their continued popularity in the automotive thermal imaging market.

The passenger car segment is expected to represent 72% of automotives infrared cores demand in 2025, highlighting its position as the most significant application sector. This dominance stems from the unique safety requirements of passenger vehicle environments, where consistent thermal detection and occupant protection are critical to vehicle safety performance. Passenger cars often feature multiple safety systems that demand reliable and efficient thermal imaging capabilities capable of detecting pedestrians, animals, and obstacles in various weather and lighting conditions.

Infrared core systems are particularly well-suited to passenger vehicle environments due to their ability to deliver superior detection capabilities quickly and effectively, even during challenging driving conditions such as fog, rain, or complete darkness. As passenger car safety standards continue to evolve and emphasize improved crash avoidance capabilities, the demand for advanced infrared thermal imaging systems continues to rise. The segment also benefits from heightened competition within the automotive industry, where manufacturers are increasingly prioritizing safety features and advanced driver assistance systems as differentiators to attract and retain customers.

With automotive manufacturers investing in comprehensive safety technologies and consumer satisfaction, infrared core systems provide an essential solution to maintain high-performance vehicle safety. The growth of premium and luxury vehicle segments, coupled with increasing regulatory requirements for advanced safety systems, ensures that passenger cars will remain the largest and most stable demand driver for automotives infrared cores in the forecast period.

The market is advancing rapidly due to increasing vehicle safety regulations and growing recognition of thermal imaging advantages over conventional optical sensors. The market faces challenges including higher integration costs compared to standard camera systems, need for specialized automotive-grade components meeting stringent reliability requirements, and varying safety standards across different geographic regions. Technology advancement efforts and cost reduction programs continue to influence system development and market adoption patterns.

The growing development of specialized automotive thermal imaging systems is enabling higher detection accuracy with improved weather resistance and enhanced reliability characteristics. Advanced sensor technologies and optimized thermal processing algorithms provide superior detection performance while maintaining automotive safety compliance requirements. These technologies are particularly valuable for autonomous vehicle developers who require reliable sensor performance that can support comprehensive environmental detection with consistent results across diverse driving conditions.

Modern automotive infrared core manufacturers are incorporating advanced artificial intelligence features and machine learning improvements that enhance detection accuracy and system effectiveness. Integration of predictive analytics systems and optimized threat assessment algorithms enables superior safety performance and comprehensive hazard detection capabilities. Advanced AI features support operation in diverse driving environments while meeting various safety requirements and operational specifications, ensuring reliable performance across different vehicle platforms and driving scenarios.

The Automotives Infrared Cores market is entering a transformative phase of growth, driven by demand for advanced vehicle safety, autonomous driving development, and evolving regulatory and technological standards. By 2035, these pathways together can unlock USD 400–500 million in incremental revenue opportunities beyond baseline growth.

Pathway A -- Cost-Effective Thermal Imaging Leadership (Uncooled Systems) The uncooled infrared segment already holds the largest share due to its optimal balance of performance and cost-effectiveness. Expanding automotive-specific optimizations, integration simplification, and volume production scaling can consolidate leadership. Opportunity pool: USD 120–150 million.

Pathway B -- Mass Market Vehicle Integration (Passenger Car Safety) Passenger cars account for the majority of demand. Growing safety regulation mandates, especially in emerging markets, will drive widespread adoption of thermal imaging systems across all vehicle price segments. Opportunity pool: USD 100–130 million.

Pathway C -- Autonomous Vehicle & ADAS Expansion Self-driving vehicle development and advanced driver assistance systems are expanding rapidly. Infrared cores optimized for autonomous navigation, with enhanced AI integration and sensor fusion capabilities, can capture significant growth. Opportunity pool: USD 80–100 million.

Pathway D -- Emerging Market Automotive Growth Asia-Pacific, Middle East, and Latin America present growing demand due to rising vehicle production and safety awareness. Targeting cost-effective solutions and local manufacturing partnerships will accelerate adoption. Opportunity pool: USD 60–80 million.

Pathway E -- Commercial Vehicle & Fleet Applications Commercial vehicles, trucks, and fleet operators are increasingly adopting advanced safety technologies. Specialized solutions for logistics, construction, and transportation industries offer significant growth potential. Opportunity pool: USD 40–60 million.

Pathway F -- Premium Technology Integration High-end vehicles with advanced sensor fusion, 360-degree thermal detection, and AI-powered threat assessment systems offer premium positioning for luxury and performance vehicle segments. Opportunity pool: USD 30–45 million.

Pathway G -- Aftermarket & Retrofit Solutions Existing vehicle fleet upgrades and aftermarket safety enhancement installations create recurring revenue opportunities with established vehicle populations. Opportunity pool: USD 25–35 million.

Pathway H -- Smart Connectivity & Data Services IoT-enabled thermal systems, cloud-based analytics, and predictive maintenance capabilities can elevate infrared cores into "smart safety" solutions while creating ongoing service revenue streams. Opportunity pool: USD 15–25 million.

| Country | CAGR (2025-2035) |

|---|---|

| China | 21.9% |

| India | 20.3% |

| Germany | 18.6% |

| Brazil | 17.0% |

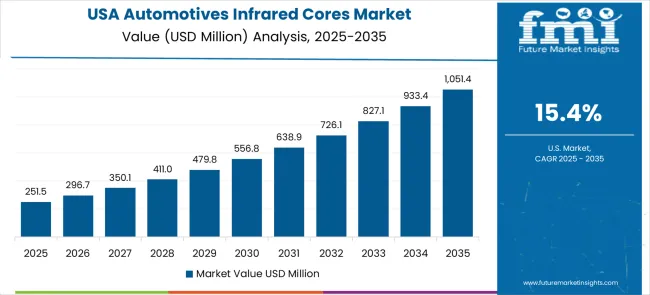

| United States | 15.4% |

| United Kingdom | 13.8% |

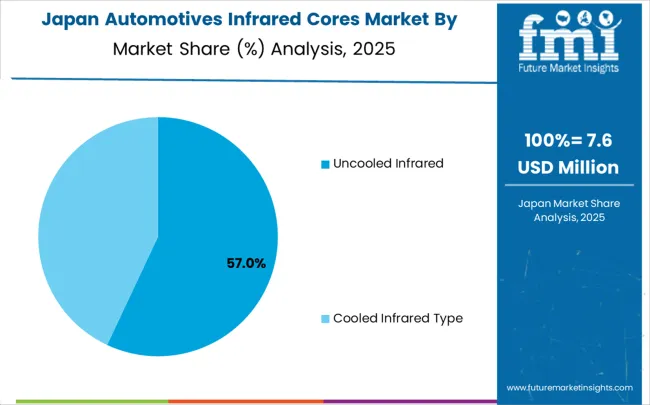

| Japan | 12.2% |

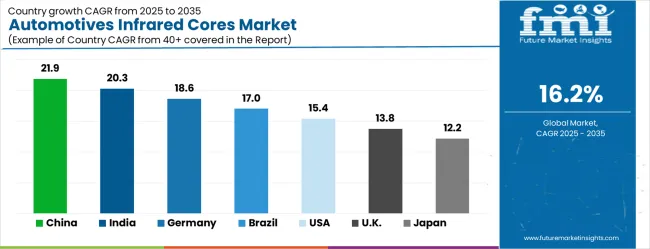

The market is experiencing exceptional growth globally, with China leading at a 21.9% CAGR through 2035, driven by massive electric vehicle production expansion and government mandates for advanced safety systems. India follows closely at 20.3%, supported by rapidly growing automotive manufacturing and increasing safety awareness in the passenger vehicle segment. Germany demonstrates strong growth at 18.6%, integrating advanced thermal imaging technologies into its established automotive manufacturing infrastructure. Brazil records substantial growth at 17.0%, focusing vehicle safety modernization and regulatory compliance initiatives. The United States shows robust expansion at 15.4%, focusing on autonomous vehicle development and advanced driver assistance systems. The United Kingdom maintains strong progress at 13.8%, driven by premium vehicle applications and safety technology adoption. Japan records solid growth at 12.2%, concentrating on precision manufacturing and automotive technology innovation.

The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

China is projected to exhibit the highest growth rate with a CAGR of 21.9% through 2035, driven by the country's massive electric vehicle production expansion and comprehensive government initiatives promoting advanced vehicle safety technologies. China's rapidly evolving automotive landscape, combined with substantial investments in autonomous vehicle development, is creating unprecedented demand for sophisticated thermal imaging systems. Major automotive manufacturers and technology companies are establishing comprehensive research and development centers to support the increasing requirements of EV producers and autonomous vehicle developers across key automotive manufacturing regions.

Government electric vehicle promotion policies and smart city development initiatives are supporting establishment of advanced automotive manufacturing facilities and intelligent transportation systems, driving demand for cutting-edge infrared core technologies throughout major metropolitan and industrial areas. National automotive industry modernization programs are facilitating adoption of next-generation safety systems that enhance vehicle intelligence and operational safety standards across automotive production networks.

India is expanding at a remarkable CAGR of 20.3%, supported by rapidly growing automotive manufacturing sector and increasing consumer awareness of vehicle safety technology benefits. The country's expanding passenger car market and rising middle-class purchasing power are driving demand for advanced safety features and thermal detection solutions. Automotive manufacturers and component suppliers are gradually implementing sophisticated safety technologies to meet evolving consumer expectations and emerging regulatory requirements.

Automotive sector growth and manufacturing infrastructure development are creating substantial opportunities for technology suppliers that can support diverse vehicle requirements and cost-effective implementation strategies. Technical training and automotive engineering programs are building expertise among manufacturing professionals, enabling effective utilization of infrared core technology that meets Indian automotive industry standards and performance requirements.

Germany is projected to grow at a substantial CAGR of 18.6%, supported by the country's leadership in automotive engineering and commitment to advanced vehicle safety technology development. German automotive manufacturers are implementing state-of-the-art thermal imaging systems that meet the most stringent performance requirements and operational specifications in the global industry. The market is characterized by focus on technological precision, system reliability, and compliance with comprehensive automotive safety standards.

Automotive industry investments are prioritizing breakthrough thermal imaging technologies that demonstrate exceptional performance and durability while meeting German engineering excellence and operational standards. Professional automotive engineering programs are ensuring comprehensive technical expertise among system integrators, enabling specialized safety system capabilities that support diverse automotive applications and performance requirements.

Brazil is growing at a robust CAGR of 17.0%, driven by increasing automotive production capacity and growing focus on vehicle safety technology integration. The country's expanding automotive manufacturing sector is gradually incorporating advanced thermal imaging systems to enhance vehicle safety performance and meet evolving consumer demands. Automotive facilities and component manufacturers are investing in infrared core technology to address developing market requirements and safety standards.

Automotive industry modernization is facilitating adoption of advanced safety technologies that support comprehensive vehicle protection capabilities across manufacturing regions. Professional automotive development programs are enhancing technical capabilities among industry professionals, enabling effective infrared system implementation that meets evolving automotive standards and operational requirements.

The USA is expanding at a strong CAGR of 15.4%, driven by established automotive technology leadership and intensive autonomous vehicle development initiatives. Large automotive manufacturers and technology companies are implementing comprehensive thermal imaging capabilities to support advanced driver assistance systems and autonomous vehicle requirements. The market benefits from established automotive supply chains and professional engineering programs that support various automotive safety applications.

Automotive industry leadership is enabling standardized thermal imaging system integration across multiple vehicle platforms, providing consistent safety performance and comprehensive operational coverage throughout regional automotive markets. Professional development and automotive engineering programs are building specialized technical expertise among system developers, enabling effective infrared core utilization that supports evolving automotive safety requirements.

The UK is projected to grow at a solid CAGR of 13.8%, supported by established premium automotive sectors and growing focus on advanced vehicle safety capabilities. British automotive manufacturers and luxury vehicle producers are implementing sophisticated thermal imaging systems that meet premium vehicle quality standards and operational requirements. The market benefits from established automotive engineering infrastructure and comprehensive technical training programs for automotive professionals.

Premium vehicle investments are prioritizing advanced thermal imaging systems that support luxury vehicle applications while maintaining established quality and performance standards. Professional automotive development programs are building technical expertise among engineering personnel, enabling specialized infrared system integration capabilities that meet evolving luxury vehicle requirements and quality standards.

Japan is growing at a steady CAGR of 12.2%, driven by the country's focus on precision automotive manufacturing and quality enhancement applications. Japanese automotive manufacturers are implementing advanced thermal imaging systems that demonstrate superior precision reliability and operational efficiency. The market is characterized by focus on manufacturing excellence, quality assurance, and integration with established automotive production workflows.

Automotive technology investments are prioritizing innovative thermal imaging solutions that combine advanced detection capabilities with precision engineering while maintaining Japanese automotive quality and reliability standards. Professional automotive development programs are ensuring comprehensive technical expertise among manufacturing engineers, enabling specialized safety system capabilities that support diverse automotive applications and quality requirements.

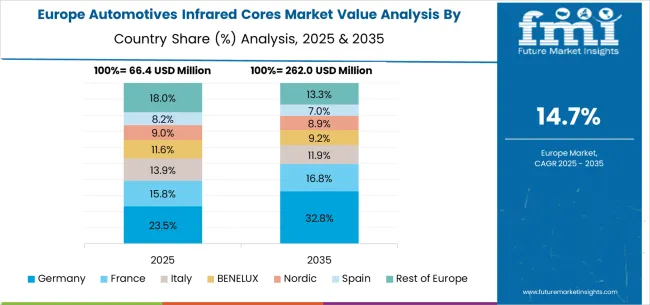

The automotives infrared cores market in Europe is forecast to expand from USD 82.1 million in 2025 to USD 368.4 million by 2035, registering a CAGR of 16.2%. Germany will remain the largest market, holding 32.5% share in 2025, maintaining approximately 31.8% by 2035, supported by strong automotive manufacturing infrastructure and advanced safety technology adoption. The United Kingdom follows, maintaining around 18.2% throughout the forecast period, driven by premium vehicle applications and autonomous vehicle development.

France is expected to grow from 14.8% to 15.2%, supported by automotive innovation and safety regulation compliance. Italy maintains stability at around 11.5%, supported by automotive manufacturing and luxury vehicle production, while Spain grows from 8.5% to 9.1% with expanding automotive manufacturing and safety technology adoption. BENELUX markets remain stable at around 5.8%, while the remainder of Europe grows from 9.2% to 10.2%, balancing emerging Eastern European automotive growth against mature Nordic markets.

The market is defined by intense competition among specialized thermal imaging manufacturers, automotive technology companies, and sensor solution providers. Companies are investing in advanced thermal sensor development, automotive-grade reliability optimization, AI-enhanced detection algorithms, and comprehensive integration capabilities to deliver reliable, efficient, and technologically advanced automotive safety solutions. Strategic partnerships, technological innovation, and automotive market expansion are central to strengthening product portfolios and market presence.

Teledyne FLIR offers comprehensive thermal imaging solutions with established automotive expertise and industry-leading sensor capabilities. Lynred provides specialized infrared detector technology with focus on automotive-grade performance reliability and operational efficiency. IRay Technology delivers innovative thermal imaging systems with focus on cost-effective solutions and advanced detection capabilities. Wuhan Guide Infrared Co., Ltd. specializes in thermal imaging equipment with integrated automotive applications.

Raytron Technology offers professional-grade infrared solutions with comprehensive automotive integration support capabilities. Leonardo DRS delivers established defense and automotive thermal imaging solutions with advanced sensor technologies. Semi Conductor Devices (SCD) provides specialized semiconductor infrared technology with focus on automotive applications. Global Sensor Technology, and Zhejiang ULIRVISION Technology offer regional manufacturing expertise, automotive-grade reliability, and comprehensive product development across global and automotive market segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 296.3 million |

| Product Type | Uncooled Infrared, Cooled Infrared, Others |

| Application | Passenger Cars, Commercial Vehicles, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | Teledyne FLIR, Lynred, IRay Technology, Wuhan Guide Infrared Co., Ltd., Raytron Technology, Leonardo DRS, Semi Conductor Devices (SCD), Global Sensor Technology, Zhejiang ULIRVISION Technology |

| Additional Attributes | Dollar sales by product type and application segment, regional demand trends across major automotive markets, competitive landscape with established thermal imaging manufacturers and emerging automotive technology providers, customer preferences for different infrared core configurations and integration approaches, integration with advanced driver assistance systems and autonomous vehicle platforms, innovations in automotive-grade thermal sensor technology and AI-enhanced detection capabilities, and adoption of sensor fusion features with enhanced safety performance for improved vehicular protection workflows. |

The global automotives infrared cores market is estimated to be valued at USD 296.3 million in 2025.

The market size for the automotives infrared cores market is projected to reach USD 1,329.9 million by 2035.

The automotives infrared cores market is expected to grow at a 16.2% CAGR between 2025 and 2035.

The key product types in automotives infrared cores market are uncooled infrared and cooled infrared type.

In terms of application, passenger cars segment to command 72.0% share in the automotives infrared cores market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Infrared Heating Pad Market Size and Share Forecast Outlook 2025 to 2035

Infrared Thermography Market Size and Share Forecast Outlook 2025 to 2035

Infrared Thermometer Market Growth – Trends & Forecast 2025 to 2035

Infrared Search and Track (IRST) Systems Market Analysis - Growth & Forecast 2025 to 2035

Infrared Sensors Market Analysis – Growth & Trends 2025 to 2035

Infrared (IR) LEDs Market by Component by Application & Region Forecast till 2035

Infrared Imaging Market

Mid-infrared Lasers Market Analysis - Growth & Trends 2025 to 2035

Near Infrared Absorbing Material Market Growth – Trends & Forecast 2024-2034

Global Near Infrared Imaging Market Analysis – Size, Trends & Forecast 2024-2034

Passive Infrared Sensor Market Size and Share Forecast Outlook 2025 to 2035

Long Wave Infrared Supercontinuum Laser Market Forecast and Outlook 2025 to 2035

Shortwave Infrared (SWIR) Market Size and Share Forecast Outlook 2025 to 2035

Medical Far Infrared Therapy Device Market Size and Share Forecast Outlook 2025 to 2035

Non-Dispersive Infrared (NDIR) Market Growth - Forecast 2025 to 2035

Non-Dispersive Infrared Sensing Market

Military Electro-Optics Infrared (EO/IR) Systems Market Report – Growth & Trends 2025 to 2035

Amorphous Metal Cores Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA