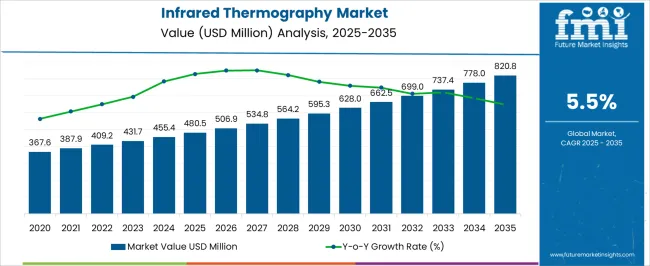

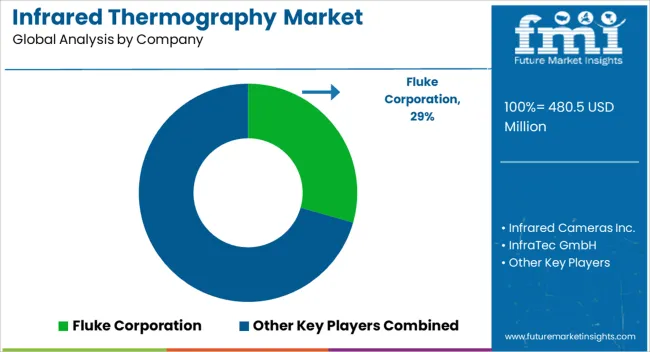

The infrared thermography market is estimated to be valued at USD 480.5 million in 2025 and is projected to reach USD 820.8 million by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

The infrared thermography market is expected to expand from USD 480.5 million in 2025 to USD 820.8 million by 2035, exhibiting a compound annual growth rate (CAGR) of 5.5%. Year-on-year growth is projected to remain steady, with the market reaching USD 534.8 million in 2027 and USD 628 million by 2030. Revenue generation is being influenced by increasing adoption across industrial inspections, predictive maintenance, electrical monitoring, and building diagnostics.

Applications in preventive maintenance are being prioritized as businesses seek reliable, non-contact methods for detecting anomalies and minimizing operational disruptions, contributing to consistent market expansion. Over the 2025 to 2035 period, market fluctuations are being moderated as supply chains, service providers, and end-user segments align to meet the rising demand.

Investment in product quality, precision, and imaging resolution is being recognized as a competitive advantage, and adoption of infrared thermography in safety-critical industries is being accelerated. Market traction is being supported by regulatory requirements and operational efficiency expectations, which are being integrated into strategic deployment plans. By 2035, the infrared thermography market is projected to achieve strong revenue accumulation, reflecting widespread utilization across diverse industrial and commercial applications.

| Metric | Value |

|---|---|

| Infrared Thermography Market Estimated Value in (2025 E) | USD 480.5 million |

| Infrared Thermography Market Forecast Value in (2035 F) | USD 820.8 million |

| Forecast CAGR (2025 to 2035) | 5.5% |

The infrared thermography market is estimated to hold a notable proportion within its parent markets, accounting for approximately 15-17% of the thermal imaging market, around 10-12% of the non-destructive testing market, close to 8-9% of the condition monitoring market, about 6-7% of the industrial inspection equipment market, and roughly 4-5% of the security and surveillance equipment market. Collectively, the cumulative share across these parent segments is observed in the range of 43-50%, reflecting a strong presence of infrared thermography solutions across industrial, security, and inspection applications.

The market has been influenced by the growing need for accurate thermal diagnostics, predictive maintenance, and quality control, where reliability, precision, and rapid data acquisition are highly prioritized. Adoption has been reinforced by procurement patterns focused on operational efficiency, ease of integration with monitoring systems, and compatibility with diverse industrial and security environments. Market participants have emphasized robust equipment, high-resolution imaging, and data analytics support to maintain consistent performance across critical applications.

As a result, the infrared thermography market has not only captured a substantial share within core thermal imaging and non-destructive testing segments but has also influenced condition monitoring, industrial inspection, and security equipment markets, highlighting its strategic role in enhancing operational oversight, preventive maintenance, and safety assurance across multiple domains.

The infrared thermography market is experiencing consistent growth fueled by rising demand for non contact temperature measurement, predictive maintenance, and advanced inspection capabilities across multiple industries. Increased emphasis on workplace safety, energy efficiency, and early fault detection has accelerated the adoption of infrared imaging solutions.

Continuous advancements in sensor technology, image resolution, and analytics integration have improved detection accuracy and usability. Government initiatives promoting energy conservation and regulatory mandates for preventive maintenance in industrial facilities are further enhancing market expansion.

As industries continue to focus on operational efficiency, asset protection, and compliance with safety standards, infrared thermography is set to remain a critical diagnostic tool, supporting both industrial and commercial applications worldwide.

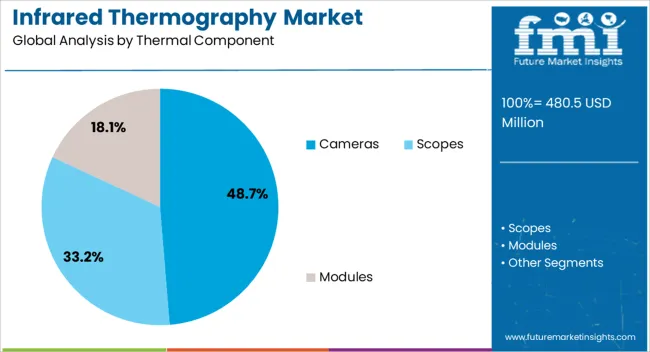

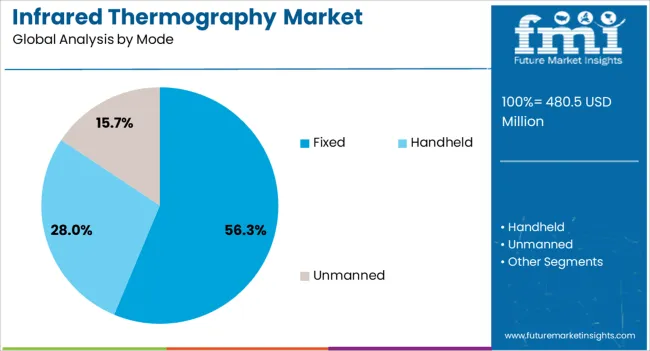

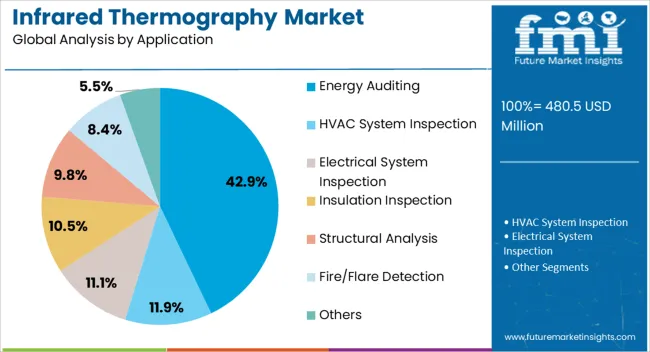

The infrared thermography market is segmented by thermal component, mode, application, end-use industry, and geographic regions. By thermal component, infrared thermography market is divided into cameras, scopes, and modules. In terms of mode, infrared thermography market is classified into fixed, handheld, and unmanned. Based on application, infrared thermography market is segmented into energy auditing, HVAC system inspection, electrical system inspection, insulation inspection, structural analysis, fire/flare detection, and others. By end-use industry, infrared thermography market is segmented into industrial, commercial, and residential. Regionally, the infrared thermography industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cameras segment is projected to account for 48.7% of total market revenue by 2025 within the thermal component category, making it the leading segment. This dominance is supported by their capability to deliver high resolution thermal imaging, portability, and versatility across diverse environments.

Cameras enable rapid detection of temperature anomalies, structural defects, and equipment faults without direct contact, enhancing operational safety and reducing downtime. Technological enhancements such as improved sensitivity, wireless connectivity, and integration with AI driven analytics have further boosted their adoption.

As industries demand precise and efficient diagnostic tools, the cameras segment continues to lead in delivering superior performance and adaptability.

The fixed mode segment is expected to capture 56.3% of the market by 2025 within the mode category, establishing it as the dominant mode type. This is driven by its effectiveness in continuous monitoring applications, enabling uninterrupted surveillance of critical assets and infrastructure.

Fixed systems offer higher stability, long term performance, and integration with automated monitoring frameworks, making them ideal for environments where consistent inspection is essential. Their use in manufacturing plants, power generation facilities, and critical infrastructure has been reinforced by the need to prevent failures and enhance productivity.

The reliability and efficiency offered by fixed mode systems have solidified their market leadership.

The energy auditing segment is forecast to hold 42.9% of the total market by 2025 within the application category, positioning it as the leading application area. This growth is driven by the global push toward energy conservation, carbon footprint reduction, and compliance with building efficiency standards.

Infrared thermography is widely used to identify insulation gaps, detect air leaks, and evaluate heat loss, thereby enabling targeted corrective actions. Governments and organizations are investing heavily in energy assessment programs, further boosting demand.

The precision, speed, and non invasive nature of thermal inspections have established infrared thermography as an essential tool in energy auditing practices, ensuring cost savings and environmental benefits.

The infrared thermography market is driven by rising demand in industrial inspection, predictive maintenance, and safety applications. Opportunities are emerging from healthcare, energy, and environmental monitoring, while trends emphasize portable, high-resolution imaging devices with multi-spectral capabilities. Challenges persist from high equipment costs and the need for skilled operators. Despite these constraints, infrared thermography is increasingly relied upon for non-contact temperature measurement, anomaly detection, and operational efficiency, supporting steady market expansion across industrial, medical, and energy sectors worldwide.

The demand for infrared thermography has been increasingly fueled by its applications in industrial inspection, predictive maintenance, and safety monitoring. Electrical, mechanical, and building systems are regularly scanned to detect heat anomalies, prevent equipment failure, and improve operational reliability. Maintenance teams and facility managers in sectors such as manufacturing, oil and gas, and construction are relying on infrared cameras to reduce downtime and optimize asset performance. Adoption is further driven by the need for non-contact, real-time temperature monitoring, which improves efficiency and safety. Enhanced awareness of equipment monitoring and process optimization has contributed to steady market expansion across North America, Europe, and Asia-Pacific, as industries seek to integrate thermography into routine maintenance programs.

Opportunities in the infrared thermography market are emerging from its use in healthcare, energy, and environmental monitoring. In medical diagnostics, infrared imaging assists in early detection of circulatory, muscular, and dermatological conditions. Energy and utilities sectors employ thermography to identify heat losses, monitor equipment, and optimize energy consumption. Manufacturers are developing compact, portable, and high-resolution cameras to address sector-specific needs. The integration of infrared thermography with drones, robotics, and automated systems presents additional revenue streams. As organizations increasingly recognize the value of precise thermal imaging for cost savings, efficiency, and early problem detection, adoption is expected to expand across multiple professional segments.

A prominent trend in the infrared thermography market is the focus on portable, handheld, and high-resolution imaging devices. Compact thermal cameras with wireless connectivity, real-time analytics, and smartphone integration are gaining traction among industrial inspectors, HVAC professionals, and building surveyors. The market is also witnessing an increase in multi-spectral imaging, where infrared thermography is combined with visible light imaging for enhanced diagnostics and precision monitoring. These trends are prompting manufacturers to refine sensor accuracy, improve image clarity, and provide intuitive user interfaces. Consequently, adoption is being influenced by the demand for versatile, user-friendly solutions that reduce operational complexity while providing actionable thermal data.

The infrared thermography market faces challenges due to the high costs of equipment, calibration, and maintenance. Advanced thermal cameras with high-resolution sensors and analytical software require significant capital investment, limiting accessibility for smaller enterprises. Moreover, proper usage and interpretation of thermal images demand technical expertise, operator training, and experience, which can restrict adoption in certain industries. Manufacturers and service providers are responding with training programs, simplified interfaces, and rental or subscription-based models to overcome cost and skill barriers. Despite these measures, the balance between affordability, performance, and user proficiency continues to influence purchasing decisions and market growth.

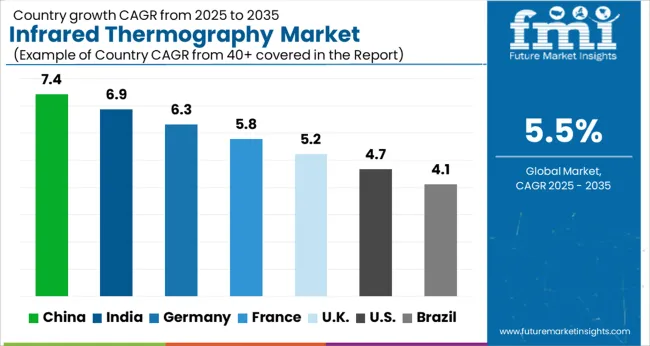

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The global infrared thermography market is projected to grow at a CAGR of 5.5% from 2025 to 2035. China leads with a growth rate of 7.4%, followed by India at 6.9%, and France at 5.8%. The United Kingdom records a growth rate of 5.2%, while the United States shows the slowest growth at 4.7%. Market expansion is fueled by increasing adoption of non-contact temperature measurement solutions, rising industrial automation, and the growing need for predictive maintenance across sectors. Emerging markets like China and India witness higher growth due to expanding manufacturing, energy, and building inspection sectors, while mature economies such as the USA, UK, and France focus on advanced analytics, integration with IoT systems, and safety compliance. This report covers insights on 40+ countries; top markets are highlighted here.

The infrared thermography market in China is projected to grow at a CAGR of 7.4%. Adoption is driven by the expanding manufacturing and industrial automation sectors, where predictive maintenance and quality inspections require accurate, non-contact temperature measurements. The construction and energy sectors increasingly utilize thermography solutions for preventive maintenance, safety inspections, and monitoring critical equipment. Local manufacturers and international suppliers are expanding production, providing advanced thermal cameras and analytical solutions tailored to industrial applications. Government initiatives promoting energy efficiency and safety standards further boost market penetration. The increasing awareness of operational efficiency, cost savings, and risk reduction strengthens demand. The combination of industrial growth, policy support, and technological integration continues to drive sustained market expansion in China.

The infrared thermography market in India is projected to grow at a CAGR of 6.9%. The manufacturing and energy sectors are rapidly adopting thermography solutions for predictive maintenance, equipment monitoring, and safety inspections. Growing infrastructure projects, industrial automation, and government regulations on energy efficiency are driving demand. Manufacturers are expanding their portfolios to include advanced thermal cameras, handheld devices, and integrated analytics software to cater to diverse industry needs. Awareness about operational efficiency, asset protection, and early fault detection contributes to higher adoption. Retail, distribution, and service networks across urban and semi-urban regions ensure broad accessibility of infrared thermography products, supporting steady market growth across India.

The infrared thermography market in France is projected to grow at a CAGR of 5.8%. Industrial and energy sectors increasingly employ thermal imaging solutions for predictive maintenance, equipment inspection, and energy audits. Regulatory requirements for workplace safety, energy efficiency, and building inspections support market growth. Manufacturers focus on high-resolution thermal cameras, portable devices, and software analytics to meet the demand for precise and reliable temperature monitoring. Integration with IoT platforms and industrial monitoring systems is enhancing adoption across sectors. Steady industrial expansion and growing awareness of preventive maintenance benefits contribute to a stable market trajectory in France, supporting incremental growth over the forecast period.

The infrared thermography market in the United Kingdom is projected to grow at a CAGR of 5.2%. Demand is driven by industrial maintenance, building inspections, and energy monitoring applications. Manufacturers emphasize high-quality thermal imaging solutions with analytical capabilities to support predictive maintenance and operational safety. The construction, oil & gas, and energy sectors increasingly adopt infrared thermography for early fault detection, cost reduction, and compliance with safety standards. Distribution through specialized vendors, retail networks, and online platforms ensures broad product accessibility. The combination of industry adoption, regulatory frameworks, and technological integration sustains steady market growth in the UK throughout the forecast period.

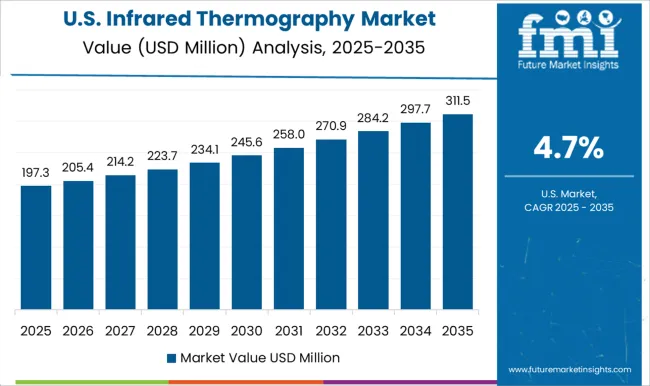

The infrared thermography market in the United States is projected to grow at a CAGR of 4.7%. Adoption is fueled by industrial maintenance, energy management, and building inspection applications. Manufacturers provide high-resolution thermal cameras, portable devices, and integrated software solutions to meet the demand for predictive maintenance and fault detection. Industrial sectors, including oil & gas, manufacturing, and energy, increasingly rely on infrared thermography to reduce downtime, improve safety, and optimize operations. Retail and online distribution channels facilitate accessibility and product availability across diverse regions. The mature market benefits from technological integration with IoT systems and industry analytics, supporting consistent, moderate growth in the United States.

The infrared thermography market is shaped by global leaders and specialized technology providers offering advanced thermal imaging solutions for industrial, military, and commercial applications. Fluke Corporation, Infrared Cameras Inc., and InfraTec GmbH lead with comprehensive portfolios emphasizing accuracy, reliability, and ease of use.

Brochures highlight high-resolution imaging, rapid temperature detection, and compatibility with diverse industrial systems, catering to predictive maintenance, electrical inspections, and building diagnostics. Micro-Epsilon Messtechnik GmbH & Co. KG and Optris GmbH differentiate through precision sensors and compact solutions, appealing to automation, quality control, and laboratory applications. Raytheon Technologies Corporation targets defense and aerospace sectors, emphasizing rugged designs, extended ranges, and integration with mission-critical systems.

Regional and emerging players such as Teledyne FLIR LLC compete on specialized applications, affordability, and technological support. Marketing materials focus on sensor sensitivity, thermal resolution, and software integration, reflecting rising demand for accurate and non-contact temperature measurement. Competition revolves around performance, durability, calibration standards, and ease of deployment. Brochures frequently stress operational efficiency, detection speed, and versatility across multiple industries, positioning infrared thermography systems as indispensable tools for safety, preventive maintenance, and process optimization. Companies are increasingly emphasizing modular designs, real-time monitoring capabilities, and data analytics features to differentiate offerings and capture new industrial and commercial market segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 480.5 million |

| Thermal Component | Cameras, Scopes, and Modules |

| Mode | Fixed, Handheld, and Unmanned |

| Application | Energy Auditing, HVAC System Inspection, Electrical System Inspection, Insulation Inspection, Structural Analysis, Fire/Flare Detection, and Others |

| End-use Industry | Industrial, Commercial, and Residential |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Fluke Corporation, Infrared Cameras Inc., InfraTec GmbH, Micro-Epsilon Messtechnik GmbH & Co. KG, Optris GmbH, Raytheon Technologies Corporation, and Teledyne FLIR LLC |

| Additional Attributes | Dollar sales by device type (handheld cameras, fixed cameras, sensors) and application (building inspection, electrical, industrial, medical) are key metrics. Trends include rising demand for predictive maintenance, energy efficiency assessments, and non-contact diagnostics. Regional adoption, technological advancements, and regulatory standards are driving market growth. |

The global infrared thermography market is estimated to be valued at USD 480.5 million in 2025.

The market size for the infrared thermography market is projected to reach USD 820.8 million by 2035.

The infrared thermography market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in infrared thermography market are cameras, scopes and modules.

In terms of mode, fixed segment to command 56.3% share in the infrared thermography market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Infrared Heating Pad Market Size and Share Forecast Outlook 2025 to 2035

Infrared Thermometer Market Growth – Trends & Forecast 2025 to 2035

Infrared Search and Track (IRST) Systems Market Analysis - Growth & Forecast 2025 to 2035

Infrared Sensors Market Analysis – Growth & Trends 2025 to 2035

Infrared (IR) LEDs Market by Component by Application & Region Forecast till 2035

Infrared Imaging Market

Mid-infrared Lasers Market Analysis - Growth & Trends 2025 to 2035

Near Infrared Absorbing Material Market Growth – Trends & Forecast 2024-2034

Global Near Infrared Imaging Market Analysis – Size, Trends & Forecast 2024-2034

Passive Infrared Sensor Market Size and Share Forecast Outlook 2025 to 2035

Long Wave Infrared Supercontinuum Laser Market Forecast and Outlook 2025 to 2035

Shortwave Infrared (SWIR) Market Size and Share Forecast Outlook 2025 to 2035

Automotives Infrared Cores Market Size and Share Forecast Outlook 2025 to 2035

Non-Dispersive Infrared (NDIR) Market Growth - Forecast 2025 to 2035

Non-Dispersive Infrared Sensing Market

Military Electro-Optics Infrared (EO/IR) Systems Market Report – Growth & Trends 2025 to 2035

Veterinary Thermography Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA