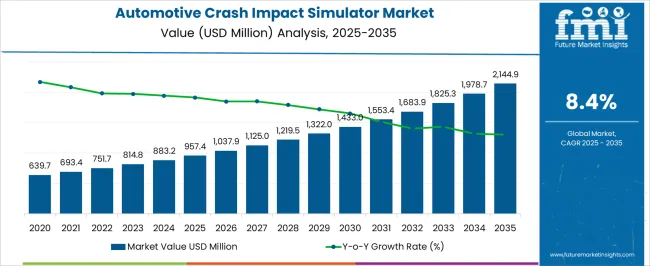

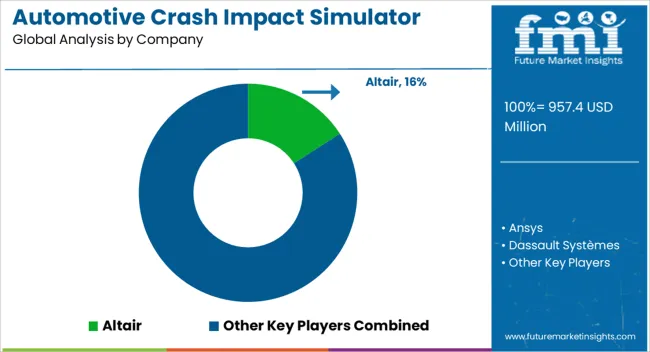

The automotive crash impact simulator market, valued at USD 957.4 million in 2025, is projected to reach USD 2,144.9 million by 2035, growing at a CAGR of 8.4%. A breakpoint analysis reveals key inflection points throughout the forecast period. From 2021 to 2025, the market is projected to grow from USD 639.7 million to USD 957.4 million, with annual increments reaching USD 693.4 million, USD 751.7 million, USD 814.8 million, and USD 883.2 million. This early phase represents steady adoption of crash simulation technologies by automotive manufacturers for improving vehicle safety and regulatory compliance.

The growth is driven by increasing demands for crash test simulations that enhance vehicle design and minimize physical testing. Between 2026 and 2030, the market strengthens significantly, advancing from USD 957.4 million to USD 1,433.0 million, with intermediate values passing through USD 1,037.9 million, 1,125.0 million, and 1,219.5 million. This period sees accelerated growth as more companies adopt advanced simulation systems to improve vehicle performance, safety standards, and achieve cost-effective testing. From 2031 to 2035, the market is projected to reach USD 2,144.9 million, with values increasing to USD 1,553.4 million, USD 1,683.9 million, USD 1,825.3 million, and USD 1,978.7 million, respectively. This final phase reflects strong growth, driven by innovation in simulation technology, the rising complexity of crash tests, and increasing focus on advanced driver-assistance systems (ADAS) and autonomous vehicle testing.

| Metric | Value |

|---|---|

| Automotive Crash Impact Simulator Market Estimated Value in (2025 E) | USD 957.4 million |

| Automotive Crash Impact Simulator Market Forecast Value in (2035 F) | USD 2144.9 million |

| Forecast CAGR (2025 to 2035) | 8.4% |

The automotive industry market is the largest contributor, accounting for approximately 40-45% of the market. Crash impact simulators are widely used by automotive manufacturers to test vehicle safety, improve crashworthiness, and comply with safety regulations, making them an essential tool in vehicle design and testing. The automotive safety systems market contributes around 25-30%, as advancements in safety technologies such as airbags, seatbelts, and autonomous driving systems rely heavily on crash impact simulations to enhance their effectiveness in protecting passengers during collisions. The engineering simulation software market holds about 15-18%, as simulation software used in the automotive crash impact simulator market plays a vital role in analyzing crash dynamics and improving vehicle designs.

The research and development (R&D) market adds approximately 8-12%, with automakers and safety organizations investing in R&D to create innovative crash safety features, which are tested using impact simulators. Lastly, the regulatory compliance market contributes around 5-8%, as government agencies and safety organizations establish regulations and standards for crash testing, driving demand for crash impact simulators to ensure vehicles meet the required safety standards.

The automotive crash impact simulator market is witnessing sustained expansion, fueled by increasing emphasis on vehicular safety standards, regulatory compliance, and technological advancements in simulation software and hardware. The current market scenario reflects heightened adoption among automotive manufacturers seeking to optimize crashworthiness evaluations without incurring excessive physical testing costs. Rising complexity in vehicle designs, combined with the integration of advanced driver assistance systems (ADAS) and evolving propulsion technologies, has intensified the need for precise crash modeling capabilities.

The future outlook indicates accelerated demand, driven by the global push toward improved occupant safety, reduced development cycles, and enhanced material testing efficiency. Continuous advancements in simulation fidelity, coupled with the adoption of virtual prototyping, are expected to minimize time-to-market for new vehicle models.

As regulations tighten worldwide, particularly in emerging economies, investment in crash simulation infrastructure is projected to rise, ensuring compliance while reducing overall production expenses.

The automotive crash impact simulator market is segmented by vehicle, propulsion, inverter, and geographic regions. By vehicle, automotive crash impact simulator market is divided into Passenger vehicles and Commercial vehicles. In terms of propulsion, automotive crash impact simulator market is classified into ICE, Electric vehicles, and Inverter. Based on inverter, automotive crash impact simulator market is segmented into Single-phase and Three-phase. Regionally, the automotive crash impact simulator industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

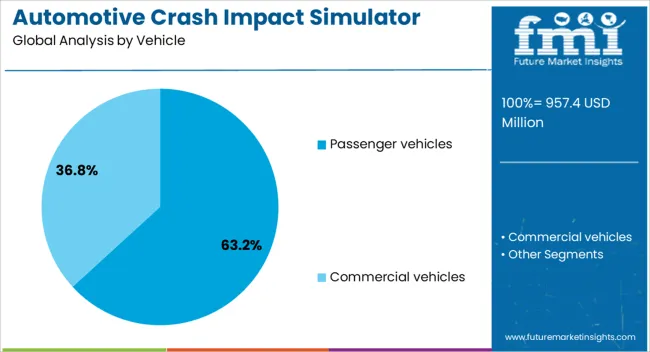

The passenger vehicles segment leads the market in the vehicle category, holding approximately 63.2% share. This dominance has been supported by high production volumes, increased model diversity, and stringent occupant safety regulations specific to passenger transport. Growing consumer expectations for advanced safety features have further propelled simulation adoption in this category, enabling manufacturers to validate designs for various crash scenarios more effectively.

The segment benefits from the versatility of crash impact simulators in testing different body structures, materials, and safety system integrations, ensuring compliance with global standards. Adoption has been reinforced by the need to reduce physical prototype expenses while accelerating product launches.

Passenger vehicles, given their significant market penetration across developed and emerging economies, continue to be the primary focus for simulation-based safety validation. The segment’s leading position is expected to remain intact as manufacturers leverage advanced simulation technologies to meet evolving safety benchmarks and consumer demands for enhanced vehicle protection.

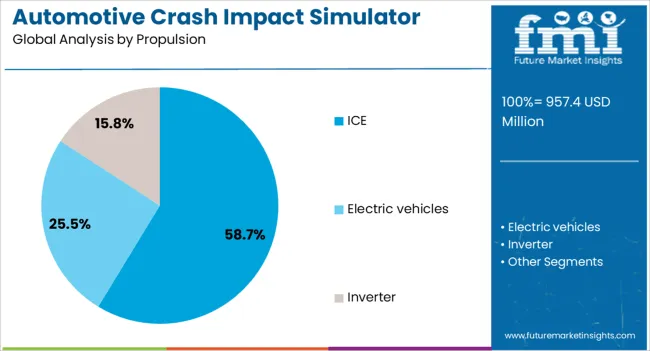

The internal combustion engine (ICE) segment dominates the propulsion category, accounting for approximately 58.7% of the market. This share is largely sustained by the global prevalence of ICE-powered vehicles, particularly in regions where electrification infrastructure is still developing. Crash impact simulation for ICE vehicles remains essential due to the complexity of fuel system safety, engine compartment design, and thermal management considerations during collisions.

The segment’s growth is supported by continuous production of ICE models alongside hybrid variants, ensuring sustained demand for safety testing. In many markets, ICE vehicles constitute the majority of the on-road fleet, necessitating extensive crash analysis to maintain compliance with safety regulations.

Additionally, legacy manufacturing capabilities and established supply chains for ICE vehicles reinforce their continued relevance. Although the shift toward electrification is gaining momentum, the ICE segment is expected to maintain a strong position over the near term due to its entrenched market presence and ongoing safety optimization requirements.

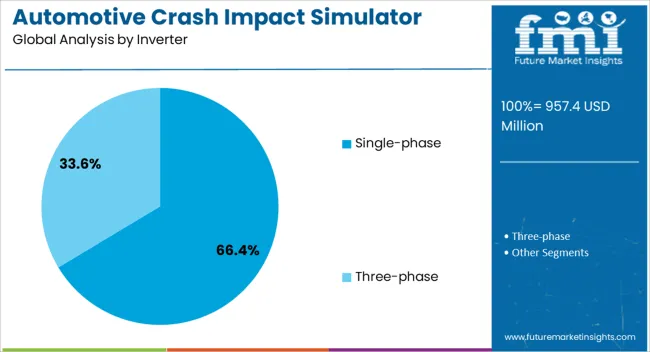

The single-phase segment holds the largest share in the inverter category, representing approximately 66.4% of the market. This dominance is attributed to the widespread use of single-phase inverter systems in crash impact simulators, offering cost efficiency and simplified integration for most testing environments. The segment’s growth is reinforced by its capability to provide stable power output for simulation equipment without the complexity of multi-phase configurations.

Manufacturers and testing facilities favor single-phase systems for their reliability, lower maintenance requirements, and compatibility with standard electrical infrastructure. In the context of crash simulation, single-phase inverters are valued for ensuring consistent operational performance during extended test cycles, thereby minimizing downtime.

Their adaptability across a wide range of simulation setups has further supported adoption, particularly among small to mid-sized testing facilities. Given the ongoing demand for accessible and efficient testing solutions, the single-phase segment is expected to retain its leadership position, supported by its balance of performance, cost-effectiveness, and operational simplicity.

The fiberglass duct wrap insulation market is growing due to rising demand for energy-efficient solutions in the construction industry, driven by energy conservation efforts and stricter regulations. It offers significant health and comfort benefits by improving indoor air quality and reducing noise. Challenges include raw material costs, sustainability concerns, and performance in extreme conditions. Opportunities exist in green building certifications and smart technologies, as fiberglass insulation helps achieve energy savings and meets eco-friendly building standards. Innovations in product features, including moisture-resistant coatings and integration with smart technologies, are shaping the market's future.

The demand for automotive crash impact simulators is driven by the need for advanced safety features in vehicles and the growing number of stringent crash safety regulations worldwide. As governments and regulatory bodies tighten vehicle safety standards, automakers are increasingly investing in simulation technologies to assess vehicle performance during crash scenarios. Automotive crash impact simulators enable manufacturers to design safer vehicles by virtually testing different crash scenarios and improving structural integrity, airbag deployment, and occupant protection systems. This rising demand for vehicle safety innovation, combined with the regulatory push for higher safety ratings, is fueling the market for crash impact simulation solutions.

Despite its many benefits, the fiberglass duct wrap insulation market faces challenges related to raw material costs, performance, and market competition. The production of fiberglass insulation requires significant energy, and concerns over the cost of raw materials such as glass fibers and binders can impact overall pricing. Additionally, while fiberglass insulation is effective in improving energy efficiency, it may not perform as well in extreme temperature environments compared to newer materials like spray foam or cellulose. Manufacturers are working to address these issues by exploring cost-effective production methods and focusing on performance enhancements to make fiberglass duct wrap a competitive option.

Opportunities in the automotive crash impact simulator market lie in the integration of AI and machine learning technologies to improve simulation accuracy and efficiency. AI-powered systems can analyze vast datasets to predict crash outcomes with greater precision, while machine learning algorithms can continuously refine simulations based on real-world crash data. Another opportunity is the growing trend of virtual testing, which allows manufacturers to test various crash scenarios without the need for physical prototypes, reducing costs and time to market. Multi-physics simulations that account for a range of crash conditions such as airbag deployment, vehicle deformation, and occupant injury are gaining popularity, as they provide more comprehensive insights into vehicle safety performance. Suppliers that can offer high-accuracy, cost-effective, and advanced simulation solutions will be well-positioned to lead in this evolving market.

The automotive crash impact simulator market is trending towards the integration of simulation software with other engineering tools, enabling seamless workflows for vehicle design, testing, and manufacturing. Virtual prototyping, where digital models of vehicles are subjected to simulated crash tests, is becoming more common in the automotive industry, allowing manufacturers to test and refine designs without the need for costly physical prototypes. Real-time testing and the use of cloud computing to process large datasets are also transforming the way crash simulations are performed, improving speed and accuracy. These trends, driven by the need for faster, more accurate results and cost reductions, are pushing the market towards more advanced, integrated, and accessible simulation technologies.

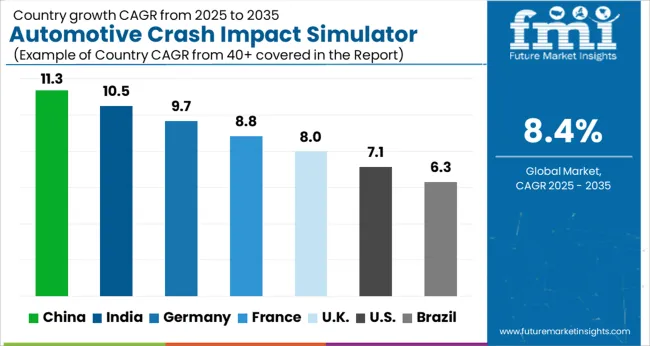

| Countries | CAGR |

|---|---|

| China | 11.3% |

| India | 10.5% |

| Germany | 9.7% |

| France | 8.8% |

| UK | 8.0% |

| USA | 7.1% |

| Brazil | 6.3% |

The automotive crash impact simulator market is projected to grow at a global CAGR of 8.4% from 2025 to 2035. China leads the market with a growth rate of 11.3%, followed by India at 10.5% and Germany at 9.7%. The UK and USA. are expected to grow at 8.0% and 7.1%, respectively. This growth is driven by the increasing emphasis on vehicle safety, technological advancements in crash simulation software, and the rising demand for electric vehicles (EVs). As automakers strive to meet stricter safety regulations and improve vehicle safety features, crash impact simulators are becoming integral to the design and testing process, boosting the demand for these systems worldwide. The analysis spans over 40+ countries, with the leading markets shown below.

The automotive crash impact simulator market in China is expected to grow at a CAGR of 11.3% from 2025 to 2035, driven by the country’s growing automotive manufacturing sector and emphasis on safety standards. As China continues to be one of the largest automobile markets globally, automakers are increasingly adopting advanced crash simulation technologies to meet stringent safety regulations and improve vehicle design. With a rising focus on electric vehicles (EVs) and autonomous driving technologies, the demand for accurate crash testing and simulations is growing. The Chinese government’s initiatives to enhance road safety, along with the adoption of global safety standards, are boosting the demand for crash simulators. The continuous development of automotive technologies, including advanced driver-assistance systems (ADAS) and lightweight materials, is also contributing to the market’s expansion.

The automotive crash impact simulator market in India is projected to grow at a CAGR of 10.5% from 2025 to 2035, supported by the country’s expanding automotive sector and rising demand for safety compliance. As India’s automobile industry continues to evolve, the need for advanced simulation tools to enhance vehicle safety and meet global standards is increasing. Manufacturers are leveraging crash simulators to optimize vehicle designs, minimize injuries, and improve overall safety performance. The increasing focus on safety regulations, along with consumer preference for safer vehicles, is driving the market. The rise of electric vehicles (EVs) and the development of innovative materials are further contributing to the growth of crash simulation technologies in India. The country’s growing automotive manufacturing base, coupled with a shift towards more stringent safety norms, is expected to create significant opportunities for market players.

The automotive crash impact simulator market in Germany is expected to grow at a CAGR of 9.7% from 2025 to 2035, fueled by the country’s robust automotive industry and its commitment to vehicle safety and innovation. As the home to several major automakers, Germany’s demand for advanced crash simulation technologies is driven by stringent European safety standards and the growing need for accurate testing in vehicle development. The increasing complexity of modern vehicles, especially with the rise of EVs, hybrid vehicles, and autonomous driving features, is accelerating the use of crash impact simulators. Germany’s well-established automotive R&D and focus on sustainable mobility also contribute to the demand for these simulators. The European Union’s focus on road safety and carbon emissions is pushing automakers to use more sophisticated simulation tools.

The UK automotive crash impact simulator market is projected to grow at a CAGR of 8.0% from 2025 to 2035, driven by the country’s evolving automotive industry and growing emphasis on vehicle safety. As the UK continues to prioritize road safety, the demand for accurate crash testing tools is on the rise. Automakers in the country are increasingly adopting advanced simulators to meet stringent safety requirements for both domestic and international markets. The shift towards electric vehicles (EVs) and the development of autonomous driving technologies are also key factors contributing to the growth of crash simulators. The UK’s position as a global hub for automotive innovation and its participation in safety standard-setting initiatives further drive the market’s expansion.

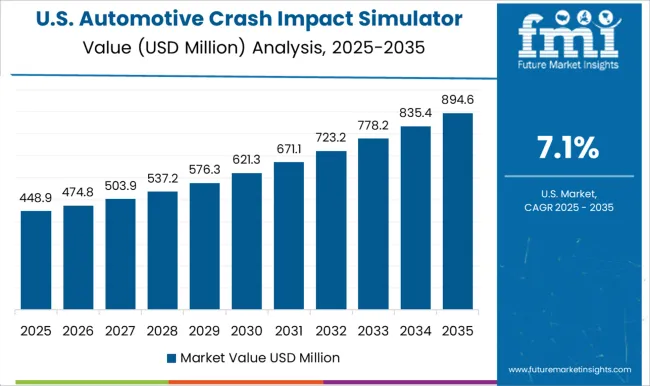

The USAautomotive crash impact simulator market is expected to grow at a CAGR of 7.1% from 2025 to 2035, supported by strong demand from both established and emerging automakers. As one of the largest automotive markets globally, the USA is heavily investing in advanced simulation technologies to meet safety regulations and enhance vehicle performance. The rising adoption of electric and autonomous vehicles, along with the push for reducing road accidents and fatalities, is contributing to the increasing demand for crash simulators. The ongoing focus on R&D in the USA automotive industry, including innovations in crash safety technologies, further strengthens the need for high-performance simulation tools.

In the automotive crash impact simulator market, competition is driven by the need for advanced simulation technologies that enhance vehicle safety, improve design efficiency, and reduce development costs. Altair competes by offering a comprehensive suite of simulation tools, including crash and impact analysis solutions, to help automotive manufacturers optimize vehicle design for safety and performance. The company’s focus is on providing high-fidelity simulations that account for real-world crash scenarios, enabling engineers to test and refine designs virtually. Ansys offers similar capabilities, with a strong emphasis on simulation accuracy, using advanced finite element analysis (FEA) and computational fluid dynamics (CFD) tools to model vehicle crash dynamics and improve safety outcomes. Dassault Systèmes is a key player, providing virtual simulation solutions through its CATIA and SIMULIA platforms. These platforms offer highly detailed crash analysis, allowing manufacturers to test structural integrity and safety systems in diverse crash scenarios. ESI Group focuses on providing highly specialized crash simulation tools, integrating both crashworthiness and occupant safety into their software solutions, which are used to optimize vehicle design and meet regulatory safety standards. Hexagon provides simulation software with advanced capabilities in crash testing, leveraging its expertise in 3D modeling, simulation, and digital twins to improve crash performance prediction. Illinois Tool Works competes by offering simulation-based tools for testing vehicle structures, providing OEMs with solutions to assess crash safety and vehicle dynamics during development. MathWorks offers robust tools for simulation and model-based design, focusing on improving vehicle control systems and crash response characteristics. Siemens, with its Simcenter suite, provides an integrated approach to crash testing and performance simulation, incorporating multi-body dynamics, crashworthiness analysis, and crash simulation for automotive safety. TUV SUD and VI-grade offer specialized solutions for virtual crash testing, ensuring compliance with global safety standards and regulations. Strategies in this market emphasize advanced computational tools, real-time simulation, and integration with existing design workflows. Product brochures highlight features like crash scenario modeling, impact analysis, occupant safety systems, virtual prototyping, and regulatory compliance tools. Companies focus on enhancing simulation accuracy, reducing development time, and improving safety standards, helping manufacturers achieve more reliable crash tests and better vehicle performance outcomes.

| Item | Value |

|---|---|

| Quantitative Units | USD 957.4 Million |

| Vehicle | Passenger vehicles and Commercial vehicles |

| Propulsion | ICE, Electric vehicles, and Inverter |

| Inverter | Single-phase and Three-phase |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Altair, Ansys, Dassault Systèmes, ESI Group, Hexagon, Illinois Tool Works, MathWorks, Siemens, TUV SUD, and VI-grade |

| Additional Attributes | Dollar sales by software type (finite element analysis, multi-body dynamics, structural analysis), application (safety testing, vehicle design, compliance testing), and industry (OEMs, tier suppliers, research institutions). Demand dynamics are driven by stringent safety regulations, increasing consumer demand for vehicle safety features, and the need for cost-effective testing solutions in vehicle design. Regional growth is strong in North America, Europe, and Asia-Pacific, supported by ongoing investments in automotive safety, regulatory standards, and virtual testing technologies. |

The global automotive crash impact simulator market is estimated to be valued at USD 957.4 million in 2025.

The market size for the automotive crash impact simulator market is projected to reach USD 2,144.9 million by 2035.

The automotive crash impact simulator market is expected to grow at a 8.4% CAGR between 2025 and 2035.

The key product types in automotive crash impact simulator market are passenger vehicles, _hatchback, _sedan, _suv, commercial vehicles, _light commercial vehicles (lcv) and _heavy commercial vehicles (hcv).

In terms of propulsion, ice segment to command 58.7% share in the automotive crash impact simulator market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA