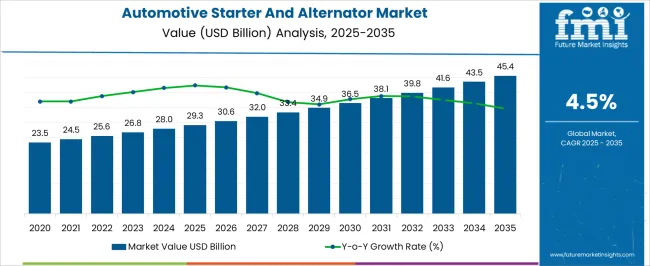

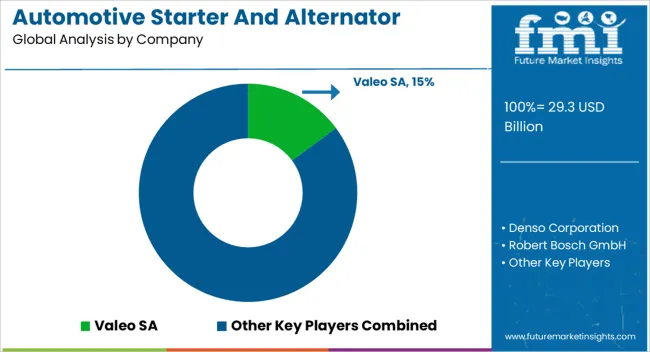

The Automotive Starter And Alternator Market is estimated to be valued at USD 29.3 billion in 2025 and is projected to reach USD 45.4 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

| Metric | Value |

|---|---|

| Automotive Starter And Alternator Market Estimated Value in (2025 E) | USD 29.3 billion |

| Automotive Starter And Alternator Market Forecast Value in (2035 F) | USD 45.4 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The Automotive Starter and Alternator market is experiencing robust growth, driven by rising vehicle production, increasing demand for fuel-efficient engines, and the shift toward electrification in conventional automotive systems. Adoption is being fueled by the need for reliable and high-performance starters and alternators that ensure engine efficiency, reduce emissions, and improve overall vehicle performance. Technological advancements in electric starter motors, alternator designs, and lightweight materials are enhancing durability, energy efficiency, and operational reliability.

Growing demand from emerging markets for light commercial vehicles and passenger cars is further supporting expansion. The market is also benefiting from increasing investments in automotive R&D, including the development of high-capacity alternators and compact starter solutions that integrate with modern vehicle electronics.

Regulatory emphasis on emission control, fuel efficiency, and vehicle safety continues to influence design standards and adoption As automotive manufacturers seek scalable, energy-efficient, and reliable powertrain components, the market is positioned for sustained growth, with technological innovation and vehicle electrification shaping the competitive landscape over the coming decade.

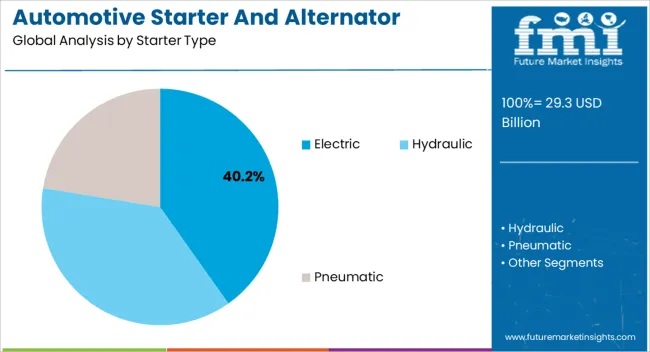

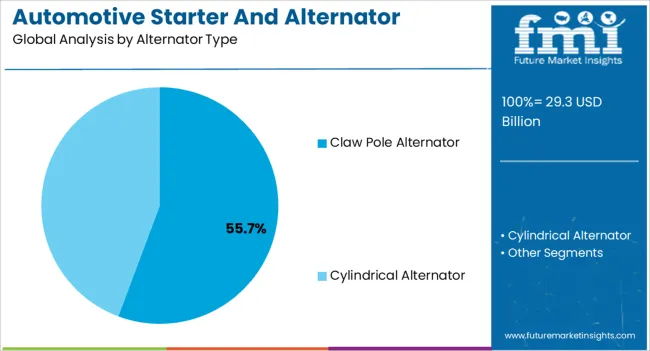

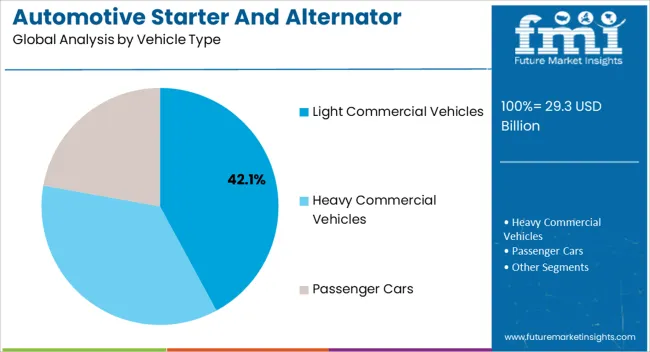

The automotive starter and alternator market is segmented by starter type, alternator type, vehicle type, and geographic regions. By starter type, automotive starter and alternator market is divided into Electric, Hydraulic, and Pneumatic. In terms of alternator type, automotive starter and alternator market is classified into Claw Pole Alternator and Cylindrical Alternator. Based on vehicle type, automotive starter and alternator market is segmented into Light Commercial Vehicles, Heavy Commercial Vehicles, and Passenger Cars. Regionally, the automotive starter and alternator industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The electric starter segment is projected to hold 40.2% of the market revenue in 2025, establishing it as the leading starter type. Its growth is being driven by increasing adoption in light commercial vehicles, passenger cars, and hybrid vehicles that require reliable, low-maintenance engine starting systems. Electric starters offer high torque, improved fuel efficiency, and compatibility with modern engine management systems, making them a preferred choice among OEMs.

The ability to deliver consistent performance under varying climatic and operational conditions reinforces their adoption. Advancements in compact and lightweight electric starter designs have enabled integration into smaller engine compartments without compromising reliability.

The segment is also being supported by growing vehicle production in emerging economies, where demand for cost-effective and durable starting systems is high With rising emphasis on emission reduction and operational efficiency, the electric starter type is expected to maintain its market leadership, driven by technological innovation, regulatory compliance, and expanding adoption across multiple vehicle categories.

The claw pole alternator segment is expected to account for 55.7% of the market revenue in 2025, making it the leading alternator type. Its growth is being fueled by widespread adoption in light commercial and passenger vehicles due to its compact design, cost efficiency, and reliability. Claw pole alternators offer consistent voltage output, high durability, and low maintenance requirements, making them suitable for engines with variable electrical loads.

Technological enhancements, such as improved winding and magnetic materials, have increased efficiency and power output while reducing heat generation. The ability to integrate with modern vehicle electrical systems, including start-stop technology and hybrid configurations, further supports adoption.

Increasing production of light commercial vehicles and rising demand for energy-efficient alternators in emerging markets are driving growth As automotive manufacturers focus on reducing operational costs and improving vehicle electrical performance, claw pole alternators are expected to retain their leading position in the alternator segment.

The light commercial vehicles segment is projected to hold 42.1% of the market revenue in 2025, establishing it as the leading vehicle type. Growth is being driven by increasing demand for delivery, logistics, and transport services, which has accelerated the production and sales of light commercial vehicles globally. These vehicles require high-performance starters and alternators that can reliably support frequent engine starts and extended operational hours under heavy load conditions.

The adoption of electric starters and claw pole alternators in this segment provides optimal energy efficiency, reliability, and durability, supporting operational cost reduction. Regulatory mandates on emission standards and fuel efficiency are encouraging the integration of efficient starter and alternator systems.

Additionally, the expansion of e-commerce and urban delivery networks is fueling demand for lightweight, energy-efficient commercial vehicles As fleet operators seek reliable powertrain components to ensure uninterrupted service, the light commercial vehicles segment is expected to remain the primary revenue contributor, supported by technological advancements and growing commercial transport infrastructure.

The automotive starter and alternator market are expected to be worth US$ 40.1 billion by the end of 2035. Automotive starters and alternators are prominently used in diesel and gasoline engine vehicles. Growing production and sales of vehicles are anticipated to drive the market growth of automotive starters and alternators.

According to FMI, the automotive starter and alternator market is expected to be valued at US$ 26.8 billion in 2025 and is projected to grow at a CAGR of 4.5 percent from 2025 to 2035.

| Market Size (2025) | US$ 25.4 billion |

| Market Size 2025 | US$ 26.8 billion |

| Market Size 2035 | US$ 40.1 billion |

| Value CAGR (2025 to 2035) | 4.5 % |

The starting motor uses electric power to start the engine by turning it. The three types of automotive starters are hydraulic, pneumatic, and electric. Over the forecast period, the electric starter type is anticipated to dominate the market. Electric starters used in the automotive industry include gear reduction, folo-thru drives, inertia starters, and moveable pole shoes. The claw-pole alternators are expected to experience significant expansion in the near future in terms of alternator type.

The automotive starter and alternator market are anticipated to grow significantly over the forecast period owing to the rise in demand for automobiles and the rising adoption of micro- and hybrid-technology vehicles.

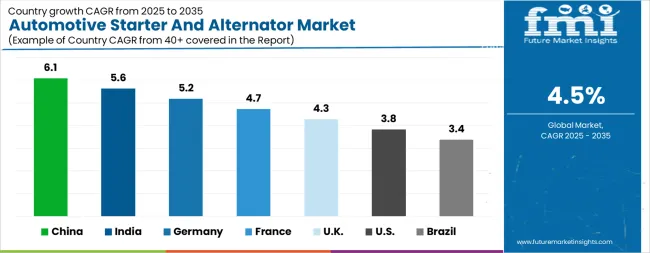

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

The Automotive Starter And Alternator Market is expected to register a CAGR of 4.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 6.1%, followed by India at 5.6%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 3.4%, yet still underscores a broadly positive trajectory for the global Automotive Starter And Alternator Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 5.2%. The USA Automotive Starter And Alternator Market is estimated to be valued at USD 10.1 billion in 2025 and is anticipated to reach a valuation of USD 14.7 billion by 2035. Sales are projected to rise at a CAGR of 3.8% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 1.3 billion and USD 993.3 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 29.3 Billion |

| Starter Type | Electric, Hydraulic, and Pneumatic |

| Alternator Type | Claw Pole Alternator and Cylindrical Alternator |

| Vehicle Type | Light Commercial Vehicles, Heavy Commercial Vehicles, and Passenger Cars |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Valeo SA, Denso Corporation, Robert Bosch GmbH, Ningbo zhongwang auto fittings Co., LTD, Hitachi Automotive Systems, Ltd., Mitsubishi Electric Corporation, ASIMCO Technologies Ltd, Hella KGaA Hueck & Co., BBB Industries, Unipoint Electric MFG Co., Ltd., Remy International, Inc., Lucas Electrical Limited, and Mitsuba Corporation |

The global automotive starter and alternator market is estimated to be valued at USD 29.3 billion in 2025.

The market size for the automotive starter and alternator market is projected to reach USD 45.4 billion by 2035.

The automotive starter and alternator market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in automotive starter and alternator market are electric, hydraulic and pneumatic.

In terms of alternator type, claw pole alternator segment to command 55.7% share in the automotive starter and alternator market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA