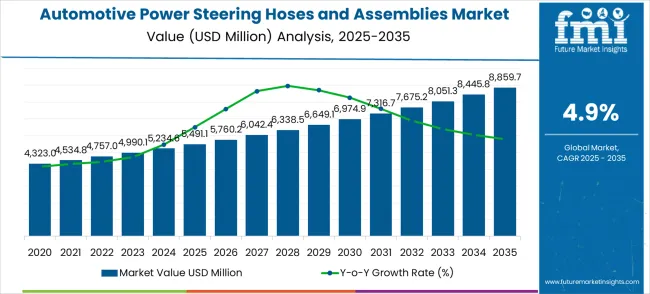

The automotive power steering hoses and assemblies market is expected to grow from USD 5,491.1 million in 2025 to USD 8,859.7 million by 2035, advancing at a CAGR of 4.9%. The growth curve exhibits a steady and linear trajectory, reflecting consistent demand across the automotive sector. Early in the period, from 2025 to 2028, demand is driven by replacement needs, expansion in passenger vehicle production, and increasing adoption of power steering systems in mid-range and premium vehicles. The gradual adoption of electric power steering (EPS) in emerging markets contributes to incremental growth, supporting the base of the curve.

Between 2028 and 2032, the curve maintains a steady slope, driven by rising vehicle production and stricter safety regulations that require reliable and durable power steering components. Original equipment manufacturers (OEMs) and aftermarket suppliers benefit from repeat demand for high-quality hoses and assemblies. In the latter phase, 2032 to 2035, growth continues at a similar pace as expansion in electric and hybrid vehicles accelerates, requiring updated hose designs and assemblies to meet performance and durability standards. The curve indicates minimal volatility, prioritizing stable, predictable expansion. Manufacturers can leverage this pattern to optimize production planning, develop targeted product innovations, and expand regional distribution networks, aligning with steady market growth.

The automotive power steering hoses and assemblies market is segmented into passenger vehicles (42%), commercial vehicles (28%), electric vehicles (16%), heavy-duty trucks and buses (9%), and specialty vehicles including construction and off-road equipment (5%). Passenger vehicles lead adoption due to rising demand for comfort, maneuverability, and reliable steering performance. Commercial vehicles rely on power steering assemblies for enhanced drivability and safety during long-haul operations. Electric vehicles are driving demand for lightweight, high-efficiency hoses and assemblies compatible with advanced steering systems. Heavy-duty trucks and specialty vehicles adopt them to withstand higher pressures, temperature variations, and continuous usage in challenging environments.

Trends in the market include use of advanced polymers, reinforced composites, and corrosion-resistant coatings to improve durability and reduce weight. Manufacturers are innovating with integrated hose assemblies, quick-connect fittings, and higher pressure ratings for performance and maintenance efficiency. Expansion into electric and hybrid vehicles, autonomous transport systems, and aftermarket upgrades is accelerating adoption.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 5,491.1 million |

| Market Forecast Value (2035) | USD 8,859.7 million |

| Forecast CAGR (2025–2035) | 4.9% |

Market expansion is being supported by the continuous growth of global automotive production across established and emerging markets and the corresponding need for reliable hydraulic steering components that ensure optimal vehicle handling and driver safety. Modern vehicles require sophisticated power steering systems that can deliver precise steering control, reduced driver effort, and enhanced road feedback while operating under diverse driving conditions and temperature ranges. The superior pressure resistance and durability characteristics of high-quality power steering hoses and assemblies make them essential components in automotive hydraulic systems where steering performance directly impacts vehicle safety and driver satisfaction.

The growing focus on vehicle safety standards and driving comfort enhancement is driving demand for advanced steering system components from certified manufacturers with proven track records of quality and reliability in automotive applications. Vehicle manufacturers and aftermarket service providers are increasingly investing in premium power steering hoses and assemblies that offer extended service life while maintaining consistent hydraulic pressure and system efficiency. Regulatory requirements and automotive standards are establishing performance benchmarks that favor high-quality steering system components with superior material properties and resistance to environmental stresses.

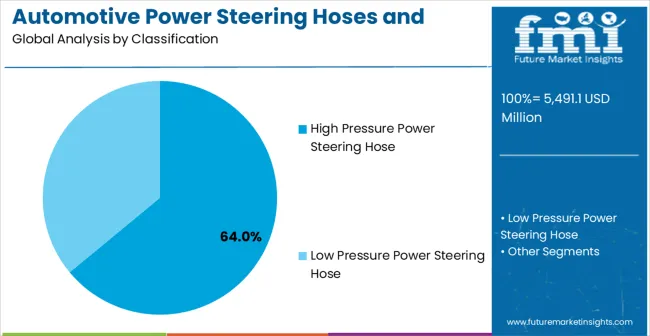

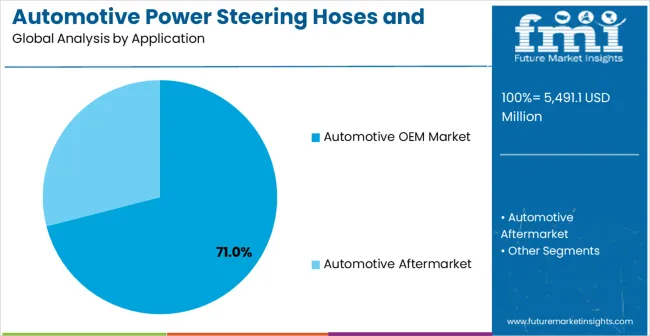

The market is segmented by hose type, application, and region. By hose type, the market is divided into high pressure power steering hose and low pressure power steering hose configurations. Based on application, the market is categorized into automotive OEM market and automotive aftermarket segments. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

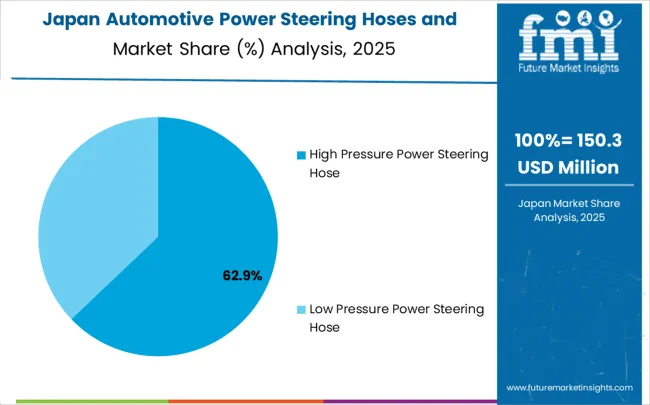

High pressure power steering hose configurations are projected to account for 64% of the automotive power steering hoses and assemblies market in 2025. This leading share is supported by the critical importance of high-pressure hydraulic lines in power steering system operation and the superior engineering requirements that high-pressure hoses demand for reliable steering performance. High pressure power steering hoses handle the primary hydraulic pressure from power steering pumps to steering gears, making them essential components for vehicle steering functionality and driver safety. The segment benefits from technological advancements that have improved pressure ratings, temperature resistance, and service life expectations.

Modern high pressure power steering hoses incorporate advanced rubber compounds, reinforced braiding materials, and specialized fitting technologies that deliver exceptional pressure resistance while maintaining flexibility and durability under demanding automotive operating conditions. These innovations have significantly improved hose reliability while maintaining compatibility with various power steering fluid types and reducing system maintenance requirements through enhanced resistance to degradation and leakage. The automotive OEM sector particularly drives demand for high pressure solutions, as vehicle manufacturers require reliable steering components that can meet stringent quality standards and warranty requirements.

Automotive OEM market applications are expected to represent 71% of automotive power steering hoses and assemblies demand in 2025. This dominant share reflects the substantial volume of new vehicle production globally and the need for original equipment manufacturers to source reliable steering system components that meet vehicle design specifications and quality standards. Automotive OEMs require consistent supplies of power steering hoses and assemblies for passenger cars, commercial vehicles, and specialty automotive applications across diverse global manufacturing facilities. The segment benefits from ongoing vehicle production growth and increasing focus on steering system performance and reliability in new vehicle designs.

Automotive OEM applications demand exceptional component quality to ensure reliable steering system performance throughout vehicle warranty periods while meeting stringent automotive quality standards and regulatory compliance requirements. These applications require power steering hoses capable of withstanding automotive manufacturing processes, quality testing procedures, and long-term vehicle operation under diverse environmental conditions and driving patterns.

The automotive power steering hoses and assemblies market is advancing steadily due to continuing global vehicle production growth and increasing recognition of steering system reliability importance in automotive safety and performance. The market faces challenges including raw material price volatility affecting component costs, increasing adoption of electric power steering systems reducing hydraulic component demand, and varying automotive regulations across different regional markets affecting component specifications. Quality standards and certification requirements continue to influence component manufacturing and market development patterns.

The growing deployment of advanced rubber compounds, synthetic materials, and reinforcement technologies is enabling superior performance characteristics and extended service life in power steering hose applications. Advanced material formulations and manufacturing processes provide enhanced resistance to heat, ozone, and automotive fluids while maintaining flexibility and pressure resistance compared to traditional rubber hose technologies. These innovations are particularly valuable for automotive manufacturers that require reliable components capable of meeting extended warranty periods and demanding operating conditions.

Modern automotive manufacturers are incorporating electric power-assisted steering systems and hybrid hydraulic-electric technologies that require specialized hose configurations and integration capabilities with electronic control systems. Integration of sensors, electronic pressure management, and intelligent steering assistance creates opportunities for advanced hose assemblies that support both traditional hydraulic operation and electronic system integration. Advanced connector technologies and sensor integration also support development of more sophisticated steering system solutions for modern automotive applications.

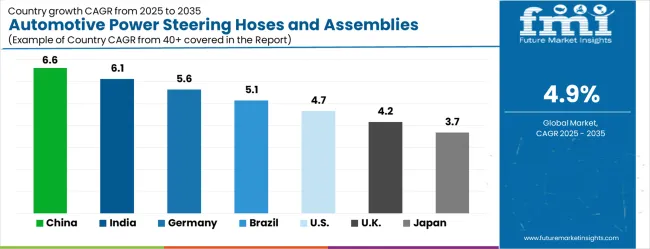

| Country | CAGR (2025–2035) |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| Brazil | 5.1% |

| United States | 4.7% |

| United Kingdom | 4.2% |

| Japan | 3.7% |

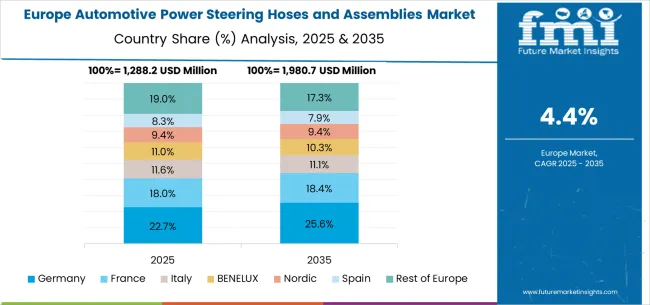

The automotive power steering hoses and assemblies market is growing steadily, with China leading at a 6.6% CAGR through 2035, driven by massive automotive production expansion, increasing domestic vehicle demand, and comprehensive automotive manufacturing infrastructure development supporting both domestic consumption and export markets. India follows at 6.1%, supported by rapid automotive industry growth, expanding middle-class vehicle ownership, and increasing investments in automotive manufacturing capabilities serving domestic and regional markets. Germany records strong growth at 5.6%, prioritizing on premium automotive manufacturing, advanced engineering standards, and automotive technology leadership in power steering system innovation. Brazil grows steadily at 5.1%, integrating automotive production expansion with growing domestic vehicle demand and regional automotive manufacturing development. The United States shows solid growth at 4.7%, focusing on automotive aftermarket services, vehicle fleet maintenance, and advanced automotive technologies. The United Kingdom maintains steady expansion at 4.2%, supported by automotive manufacturing heritage and aftermarket service demand. Japan demonstrates consistent growth at 3.7%, prioritizing on technological innovation and manufacturing excellence.

The report covers an in-depth analysis of 40+ countries, Top-performing countries are highlighted below.

China is expected to expand at a CAGR of 6.6% from 2025 to 2035, above the global average for the market. Growth is driven by rising vehicle production, increasing adoption of hydraulic and electric power steering systems, and investments in domestic automotive component manufacturing. Manufacturers are focusing on durable, high-performance hoses and assemblies capable of handling higher pressures and temperatures. Technological innovations such as reinforced hose materials and integrated assembly systems are improving reliability and maintenance cycles. Domestic companies like Wanxiang Group and Zhejiang Yibin are leading production, while international suppliers collaborate to introduce advanced solutions in passenger cars, commercial vehicles, and electric vehicles. The market is further supported by stricter quality and safety standards across the automotive industry.

India is anticipated to grow at a CAGR of 6.1% from 2025 to 2035, influenced by expanding automotive manufacturing and rising vehicle ownership. Power steering hoses and assemblies are increasingly used in hydraulic, electric, and hybrid steering systems to improve vehicle performance and safety. Manufacturers are introducing lightweight, corrosion-resistant hoses designed for high-pressure operation and durability under extreme temperatures. Companies such as Sundaram Clayton and Motherson Sumi Systems are enhancing production capacity and technological capability to meet domestic and export demands. Adoption is further encouraged by government incentives for automotive component manufacturing and local assembly programs. The trend toward electric and hybrid vehicles is expected to increase demand for specialized hoses and integrated assemblies.

Germany is projected to grow at a CAGR of 5.6% from 2025 to 2035, driven by high-performance automotive production and the presence of leading vehicle manufacturers. Power steering hoses and assemblies are critical for hydraulic and electric steering systems in passenger cars, trucks, and commercial vehicles. German manufacturers focus on advanced materials, enhanced flexibility, and thermal resistance to meet stringent automotive standards. Suppliers like Continental and Bosch are developing modular hose assemblies that improve installation efficiency and reduce maintenance requirements. The market benefits from the automotive sector’s focus on reliability, safety, and integration with modern steering technologies, including electric power steering systems and autonomous driving applications.

Brazil is expected to grow at a CAGR of 5.1% from 2025 to 2035, supported by vehicle manufacturing and maintenance demands in passenger and commercial segments. Power steering hoses and assemblies are being implemented to improve vehicle handling, safety, and reliability in hydraulic and electric steering systems. Manufacturers focus on producing corrosion-resistant and heat-tolerant hoses suitable for tropical climates. Key players, including Magneti Marelli and Tupy, are increasing local production and collaborating with global technology providers to meet growing requirements. Demand is concentrated in urban areas and automotive hubs where vehicle assembly and aftermarket maintenance are increasing. Quality certification and compliance with international automotive standards are accelerating market adoption.

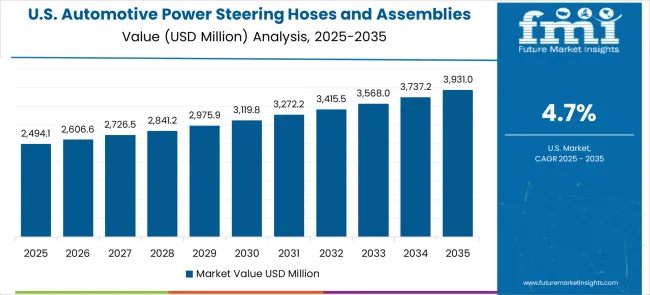

The United States is expected to grow at a CAGR of 4.7% from 2025 to 2035, reflecting steady demand in passenger vehicles, commercial trucks, and electric vehicles. Power steering hoses and assemblies are required for reliable hydraulic and electric steering systems. USA manufacturers prioritize high-strength materials, lightweight components, and improved thermal and pressure resistance. Companies such as Gates Corporation and Parker Hannifin are developing advanced integrated assemblies with better durability and longer maintenance intervals. Increasing adoption of electric power steering systems in new vehicles is expected to further support demand, alongside aftermarket replacements for existing hydraulic steering systems.

The United Kingdom is expected to grow at a CAGR of 4.2% from 2025 to 2035, driven by steady automotive production and increasing retrofitting of electric power steering systems. Power steering hoses and assemblies are being implemented to improve handling, safety, and operational efficiency. Manufacturers focus on corrosion-resistant, flexible, and heat-tolerant hose designs suitable for European vehicle standards. Key suppliers, including Delphi Technologies and GKN Automotive, provide integrated assemblies that reduce installation complexity and maintenance frequency. The market benefits from regulatory compliance for safety and quality standards, particularly in passenger cars and commercial vehicles.

Japan is expected to experience a CAGR of 3.7% from 2025 to 2035, reflecting moderate growth in automotive component adoption. Power steering hoses and assemblies are essential for hydraulic and electric steering systems in passenger cars, trucks, and hybrid vehicles. Japanese manufacturers prioritize high-quality materials, compact designs, and thermal and pressure resistance to meet domestic automotive standards. Companies like Denso and JTEKT are developing advanced integrated hose assemblies that offer improved durability and reduced maintenance requirements. The trend toward hybrid and electric vehicles is expected to create incremental demand for specialized steering hose solutions.

The automotive power steering hoses and assemblies market is defined by competition among established automotive component manufacturers, specialized hydraulic system providers, and emerging automotive technology firms. Companies are investing in advanced materials technology, manufacturing process optimization, quality management systems, and global supply chain capabilities to deliver reliable, durable, and cost-effective steering system components. Strategic partnerships, technological advancement, and geographic expansion are central to strengthening product portfolios and market presence.

Continental, operating globally, offers comprehensive automotive steering system solutions with focus on advanced materials, engineering excellence, and automotive OEM partnerships. Hwaseung, Asia-based automotive supplier, provides specialized power steering components with focus on manufacturing efficiency and quality consistency. Nichirin, Japanese automotive component specialist, delivers advanced rubber and hydraulic technologies with focus on precision engineering and automotive applications. Yokohama Rubber offers comprehensive automotive component solutions with focus on material science innovation and global manufacturing capabilities.

Summit Racing provides automotive aftermarket components with focus on performance applications and customer service excellence. Dayco delivers specialized automotive belt and hose systems with focus on aftermarket distribution and technical support. Imperial Auto offers automotive hydraulic components with focus on commercial vehicle applications. Codan Rubber provides specialized rubber component manufacturing with focus on automotive and industrial applications.

Gates Corporation, Nanjing Orientleader Technology, Zhejiang Junhe Technology, Chuanhuan Technology, Qingdao Sunsong, Shanghai XinShangXiang Automobile Hoses, and Luohe Letone Hydraulics Technology offer specialized automotive hydraulic expertise, regional manufacturing capabilities, and technical support across global and regional automotive markets.

The automotive power steering hoses and assemblies market underpins vehicle safety enhancement, driving comfort optimization, automotive manufacturing efficiency, and transportation reliability improvement. With vehicle production growth, advancing steering technologies, and increasing aftermarket service demand, the sector must balance component quality, manufacturing efficiency, and cost competitiveness. Coordinated contributions from governments, automotive associations, component manufacturers, vehicle producers, and investors will accelerate the transition toward advanced, reliable, and highly efficient automotive steering systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 5,491.1 million |

| Hose Type | High Pressure Power Steering Hose, Low Pressure Power Steering Hose |

| Application | Automotive OEM Market, Automotive Aftermarket |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, and other 40+ countries |

| Key Companies Profiled | Continental, Hwaseung, Nichirin, Yokohama Rubber, Summit Racing, Dayco, Imperial Auto, Codan Rubber, Gates Corporation, Nanjing Orientleader Technology, Zhejiang Junhe Technology, Chuanhuan Technology, Qingdao Sunsong, Shanghai XinShangXiang Automobile Hoses, Luohe Letone Hydraulics Technology |

| Additional Attributes | Dollar sales by hose type and application, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established automotive component manufacturers and emerging technology specialists, deployment preferences for high pressure versus low pressure steering hose configurations, integration with automotive manufacturing processes and aftermarket service networks, innovations in rubber compounds and reinforcement technologies for enhanced durability and performance reliability, and adoption of advanced hydraulic systems with electronic integration and intelligent steering assistance capabilities for improved vehicle safety and driving comfort. |

The global automotive power steering hoses and assemblies market is estimated to be valued at USD 5,491.1 million in 2025.

The market size for the automotive power steering hoses and assemblies market is projected to reach USD 8,859.7 million by 2035.

The automotive power steering hoses and assemblies market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in automotive power steering hoses and assemblies market are high pressure power steering hose and low pressure power steering hose.

In terms of application, automotive oem market segment to command 71.0% share in the automotive power steering hoses and assemblies market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA