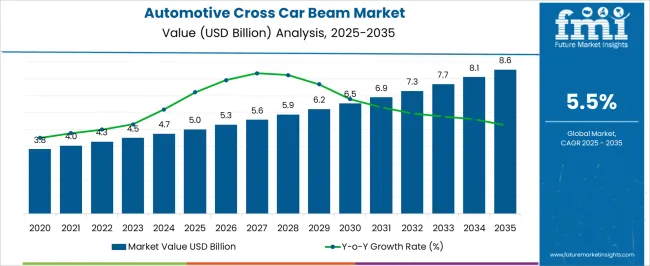

The automotive cross car beam market is expected to grow from USD 5.0 billion in 2025 to USD 8.6 billion by 2035, registering a 5.5% CAGR and creating an absolute dollar opportunity of USD 3.6 billion. Cross car beams, which provide structural support for dashboards and integrate electronic, safety, and HVAC components, are witnessing higher demand due to the rising production of passenger vehicles, increased focus on lightweight materials, and growing safety standards in both developed and emerging markets. Peak-to-trough analysis highlights how market performance shifts over time.

From 2025 to 2028, the market advances steadily, reaching an early peak driven by strong vehicle production in North America, Europe, and East Asia. During this phase, increased use of aluminum and composite beams enhances growth momentum. Between 2029 and 2031, the market experiences a trough as global vehicle production cycles stabilize and supply chain pressures, including raw material price fluctuations, slightly reduce adoption rates. From 2032 to 2035, the market enters another peak phase, supported by renewed automotive demand in Asia Pacific and Latin America, integration of smart modules into beams, and stricter safety regulations. Overall, the USD 3.6 billion opportunity reflects a cyclical yet upward trend, where peaks of high adoption offset troughs of moderate slowdowns, ensuring sustained long-term expansion.

| Metric | Value |

|---|---|

| Automotive Cross Car Beam Market Estimated Value in (2025 E) | USD 5.0 billion |

| Automotive Cross Car Beam Market Forecast Value in (2035 F) | USD 8.6 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

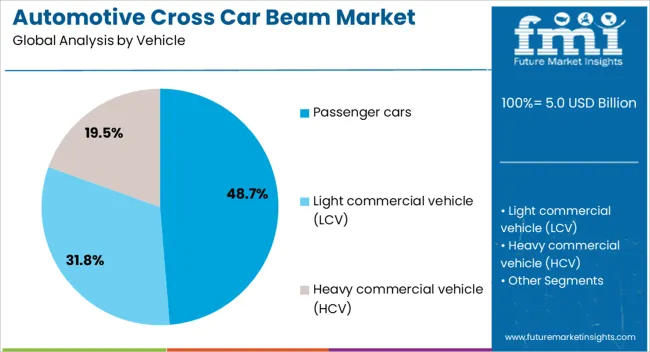

The automotive cross car beam market is mainly supported by the passenger vehicle sector, which makes up about 47% of the market share, as these beams are integrated into cars to improve crash safety, dashboard stability, and overall structural integrity. The commercial vehicle segment contributes around 28%, using stronger beams in trucks, vans, and buses for enhanced rigidity and load-bearing capacity. The electric vehicle segment accounts for close to 15%, where lightweight materials such as aluminum and composites are prioritized to offset heavy battery weight. The remaining 10% comes from specialty vehicles, including sports cars and defense automobiles, where high-performance beams are required for advanced safety and design flexibility. The market is evolving with advancements in lightweight materials, safety regulations, and modular design. Aluminum, magnesium, and carbon fiber reinforced composites are gaining traction to reduce vehicle weight without compromising strength. Integration of cross car beams with electronic modules, HVAC ducts, and airbag systems is increasing design efficiency and cost savings. Manufacturers are focusing on cost-effective production processes such as hydroforming and extrusion. Collaborations with automotive OEMs are driving innovation in beam design to meet crash test standards and support new vehicle platforms. Rising demand for electric and hybrid vehicles, coupled with stricter global safety norms, continues to accelerate adoption of advanced cross car beam solutions.

The automotive cross car beam market is advancing steadily as manufacturers focus on structural integrity, passenger safety, and weight optimization in modern vehicle designs. Increasing regulatory pressure around crashworthiness and fuel efficiency has accelerated the integration of cross car beams engineered for strength and reduced mass.

Automakers are prioritizing designs that enable modularity and platform sharing, further boosting demand for adaptable beam structures. Technological developments in simulation based testing and multi material integration are also supporting the use of cross car beams that meet both performance and cost benchmarks.

The growing adoption of electric vehicles is reshaping vehicle architectures, driving the need for cross car beams that can accommodate electrical routing and advanced dashboard components. These shifts are expected to sustain long term growth across automotive segments, especially as OEMs and suppliers continue to invest in safer, lighter, and more functional interior structural solutions.

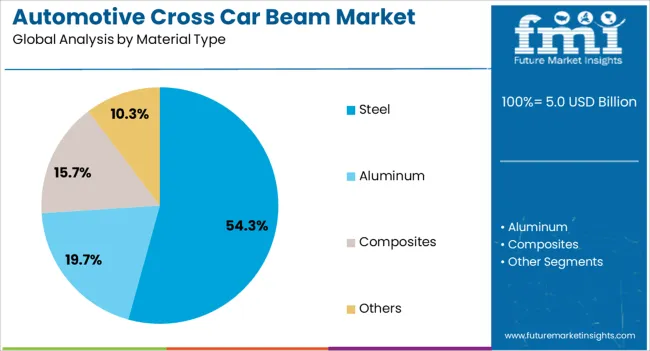

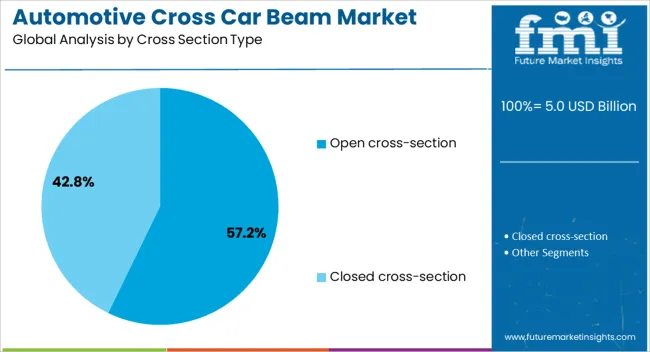

The automotive cross car beam market is segmented by vehicle, material type, cross section type, sales channel, and geographic regions. By vehicle, automotive cross car beam market is divided into Passenger cars, Light commercial vehicle (LCV), and Heavy commercial vehicle (HCV). In terms of material type, automotive cross car beam market is classified into Steel, Aluminum, Composites, and Others. Based on cross section type, automotive cross car beam market is segmented into Open cross-section and Closed cross-section. By sales channel, automotive cross car beam market is segmented into OEM and Aftermarket. Regionally, the automotive cross car beam industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The passenger cars segment is anticipated to account for 48.70% of total revenue by 2025 within the vehicle category, marking it as the leading contributor. This dominance is attributed to the high production volumes of passenger vehicles globally and the increasing integration of safety components within their cabin structures.

Passenger cars demand enhanced occupant protection, and cross car beams serve as essential reinforcements for airbag modules, steering systems, and dashboard stability. As design trends move toward lighter and more spacious interiors, the structural performance of cross car beams becomes even more critical.

Additionally, growing consumer expectations for safety features in compact and mid size cars have reinforced the use of such beams across all price segments.

Steel is projected to hold 54.30% of market revenue by 2025 under the material type category, emerging as the dominant material. This leadership is driven by steel’s proven strength, cost effectiveness, and compatibility with mass production processes.

High strength steel variants offer the ability to reduce component weight while maintaining crash resistance, making them favorable in cross car beam applications. OEMs continue to rely on steel for its machinability, formability, and recycling benefits.

Its established supply chain and performance history also contribute to its widespread use. As vehicle manufacturers aim for structural optimization without compromising safety, steel remains the preferred choice for cross car beam assemblies.

The open cross section segment is expected to capture 57.20% of the market by 2025 within the cross section type category, reflecting its position as the leading configuration. This is due to its structural efficiency, ease of manufacturing, and suitability for integration with dashboards and electronic components.

Open cross sections allow for optimized routing of HVAC systems, wiring harnesses, and instrument panel supports, enhancing overall vehicle assembly efficiency. Their design flexibility supports modular dashboard platforms used across multiple vehicle models.

As automakers pursue cost efficient structural components that align with platform based vehicle strategies, the open cross section remains the preferred engineering solution in cross car beam design.

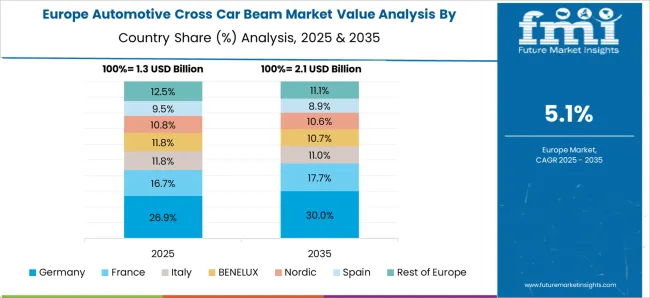

The automotive cross car beam market is expanding with increasing vehicle production, lightweight material adoption, and integration of advanced driver assistance systems. Asia Pacific leads at USD 3.8 billion in 2024, with China (USD 1.9 billion), Japan (USD 1.1 billion), and India (USD 0.8 billion). Europe contributes USD 2.7 billion, led by Germany (USD 1.2 billion), France (USD 0.8 billion), and UK (USD 0.7 billion). North America stands at USD 2.5 billion, mainly the USA, while Latin America and Middle East & Africa together represent USD 0.9 billion. Passenger cars account for 65% of demand, while commercial vehicles represent 35%.

Rising automotive production, safety regulations, and demand for weight reduction drive adoption of cross car beams. Passenger cars account for 65% of installations, while commercial vehicles make up 35%. Asia Pacific dominates at USD 3.8 billion, Europe at USD 2.7 billion, and North America at USD 2.5 billion. Global production of passenger vehicles exceeded 65 million units in 2023, each incorporating beams for structural rigidity and airbag support. Use of lightweight materials such as aluminum and magnesium alloys reduces component weight by 25–35%, improving fuel efficiency and lowering CO₂ emissions. Compliance with crash safety standards further accelerates usage.

Lightweight alloys, hybrid composite beams, and modular designs are reshaping adoption. Approximately 35% of beams use high-strength steel, while 30% integrate aluminum alloys to reduce mass by up to 7 kg per vehicle. Hybrid composite beams combining steel and plastic account for 20% of new models, offering 20–25% weight reduction with high durability. Modular cross car beam systems designed for platform sharing are applied in 25% of passenger cars, reducing manufacturing costs by 10–15%. Integration of brackets for sensors, displays, and airbags has become standard, with over 50% of new vehicles including multi-functional beam assemblies.

Significant opportunities exist in electric vehicles, premium passenger cars, and lightweight commercial vehicles. Asia Pacific is projected to reach USD 4.6 billion by 2027, Europe USD 3.2 billion, and North America USD 3 billion. With EV sales surpassing 12 million units globally in 2023, beams are redesigned to accommodate larger infotainment systems and battery protection. Lightweight beams lower EV curb weight, extending driving range by 5–7%. Demand for premium passenger cars, which feature advanced infotainment and ADAS systems, further increases design complexity. In commercial vehicles, durability and cost optimization create space for high-strength steel beam adoption.

High production costs, material limitations, and manufacturing complexity restrict market penetration. Cross car beams typically cost USD 120–300 per unit, while hybrid composite models exceed USD 400. Tooling and mold development for advanced composites can add USD 1–2 million in upfront investment per production line. Aluminum beams, though lighter, are 20–25% costlier than steel, impacting adoption in low-cost vehicles. Integration of multiple functions such as brackets and electronic housings increases assembly complexity, raising production time by 15–20%. Regional variability in safety standards also requires multiple design iterations, increasing compliance testing costs by USD 200,000–400,000 per model.

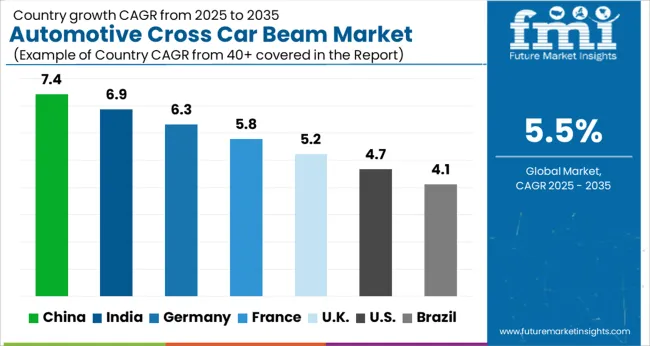

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

The automotive cross car beam market is projected to record a global CAGR of 5.5% through 2035, supported by lightweight vehicle architecture, safety compliance, and structural integration trends. China achieves 7.4%, about 1.35× higher than the global rate, with BRICS-driven vehicle production and the integration of aluminum and composite beams in electric vehicles. India follows at 6.9%, a 1.25× multiplier, supported by OEM expansion, passenger car sales, and rising adoption of advanced safety standards. Germany reports 6.3%, or 1.15× the global CAGR, with OECD-backed innovation in crash safety design, weight reduction, and precision engineering. The United Kingdom posts 5.2%, nearly aligned with the global benchmark, focusing on R\&D in material substitution and structural integrity for premium vehicles. The United States records 4.7%, slightly below the global pace at 0.85×, with steady adoption in SUVs and pickups supported by lightweight component integration. BRICS countries scale through high vehicle production, OECD nations emphasize safety technology and design precision, while ASEAN markets extend opportunities through rising automobile assembly and exports.

The automotive cross car beam market in China is expected to grow at a CAGR of 7.4%, supported by increased vehicle production, demand for lightweight structures, and integration of safety and electronic modules. Leading domestic suppliers such as HASCO, Minth Group, and Yanfeng are focusing on aluminum and composite cross beams that reduce vehicle weight while maintaining structural integrity. Adoption is driven by passenger cars, electric vehicles, and premium automotive segments.

The automotive cross car beam market in India is projected to grow at a CAGR of 6.9%, driven by expansion in small car manufacturing, regulatory safety mandates, and rising penetration of lightweight materials. Key players such as Tata Autocomp, Motherson Sumi, and Endurance Technologies provide steel and hybrid-material beams designed for cost efficiency and compliance with safety norms. Adoption is centered in compact cars, utility vehicles, and growing electric mobility projects.

Germany’s automotive cross car beam market is expected to grow at a CAGR of 6.3%, supported by luxury car manufacturing, use of advanced lightweight alloys, and integration of advanced driver-assistance systems. Leading suppliers such as Bosch, Benteler, and Kirchhoff Automotive develop high-strength aluminum and carbon composite cross beams to enhance safety and reduce weight. Adoption is concentrated in luxury sedans, premium SUVs, and electric mobility platforms.

The automotive cross car beam market in the United Kingdom is projected to grow at a CAGR of 5.2%, influenced by lightweight vehicle designs, integration of infotainment systems, and stringent crash safety compliance. Domestic manufacturing emphasizes tailored beams with modular features, supporting both passenger and electric vehicles. Suppliers such as Gestamp and Magna International play an active role in product development.

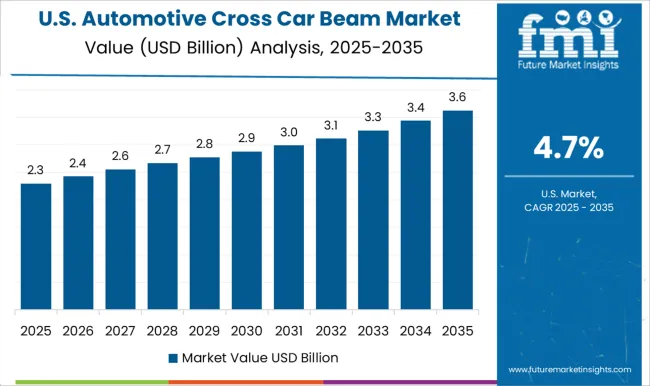

The automotive cross car beam market in the United States is expected to grow at a CAGR of 4.7%, driven by production of SUVs, trucks, and electric vehicles with advanced safety requirements. Key suppliers such as Magna, Flex-N-Gate, and Aisin provide high-strength beams engineered with modular architecture for durability and integration of electronic components. Adoption is focused on SUVs, pickup trucks, and electric vehicle models.

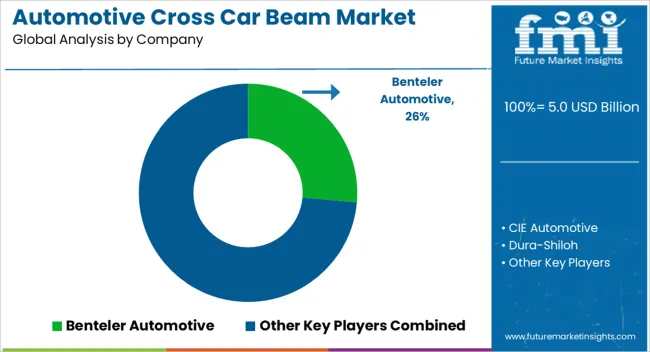

Competition in the automotive cross car beam market is being influenced by structural safety requirements, lightweight material adoption, and integration of electronic components to support modern vehicle platforms. Market positioning is being reinforced through the development of beams designed for crash performance, rigidity, and reduced overall vehicle weight. Benteler Automotive is being promoted with cross car beams engineered from advanced steel and aluminum for high strength-to-weight ratios. CIE Automotive and Dura-Shiloh are being represented with modular solutions developed to accommodate diverse OEM platforms and global production needs. Elringklinger AG is being advanced with products manufactured using composite technologies to optimize weight reduction and energy absorption. Faurecia and Gestamp are being highlighted with beams designed for structural reinforcement and improved passenger safety. GF Casting Solutions is being positioned with lightweight cast components tailored for electric and hybrid vehicles. KIRCHHOFF Automotive is being showcased with beams manufactured for robust integration of electronic systems and airbag modules. Magna International and Yorozu Corporation are being represented with scalable solutions designed for high-volume production and enhanced durability in global automotive markets. Strategies in the market are being directed toward the use of lightweight metals, hybrid materials, and optimized manufacturing processes to balance safety performance with fuel efficiency and electrification needs. Research and development are being allocated to improve crashworthiness, enable modular vehicle design, and support cost efficiency for OEMs. Product brochures are being structured with detailed specifications including beam material, dimensions, weight, load-bearing capacity, and compatibility with safety systems. Technical illustrations, crash test compliance data, and integration features are being presented clearly. Brochures are being arranged to emphasize benefits such as reduced vehicle mass, improved safety performance, design flexibility, and global production capabilities, ensuring that OEMs and tier suppliers receive precise information for evaluating and selecting automotive cross car beam solutions.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.0 Billion |

| Vehicle | Passenger cars, Light commercial vehicle (LCV), and Heavy commercial vehicle (HCV) |

| Material Type | Steel, Aluminum, Composites, and Others |

| Cross Section Type | Open cross-section and Closed cross-section |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Benteler Automotive, CIE Automotive, Dura-Shiloh, Elringklinger AG, Faurecia, Gestamp, GF Casting Solutions, KIRCHHOFF Automotive, Magna International, and Yorozu Corporation |

| Additional Attributes | Dollar sales by beam type and vehicle category, demand dynamics across passenger cars, commercial vehicles, and SUVs, regional trends in automotive safety and structural reinforcement, innovation in lightweight alloys, coatings, and crash energy absorption, environmental impact of material use and recycling, and emerging use cases in electric and autonomous vehicles. |

The global automotive cross car beam market is estimated to be valued at USD 5.0 billion in 2025.

The market size for the automotive cross car beam market is projected to reach USD 8.6 billion by 2035.

The automotive cross car beam market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in automotive cross car beam market are passenger cars, light commercial vehicle (lcv) and heavy commercial vehicle (hcv).

In terms of material type, steel segment to command 54.3% share in the automotive cross car beam market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA