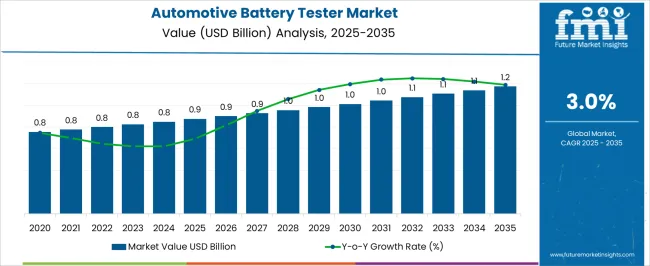

The automotive battery tester market, with an estimated value of USD 0.9 billion in 2025 and a projected value of USD 1.2 billion by 2035, exhibits a modest CAGR of 3.0%, indicating slow but steady growth. The regional dynamics of this market reveal a pronounced imbalance in adoption and revenue contribution across Asia-Pacific, Europe, and North America. Asia-Pacific, driven by rapid expansion of the automotive sector and increased electrification initiatives, is expected to lead in market share. The region’s high vehicle production volume and focus on battery maintenance solutions contribute to greater adoption of battery testing systems, supporting incremental annual growth in both consumer and commercial segments.

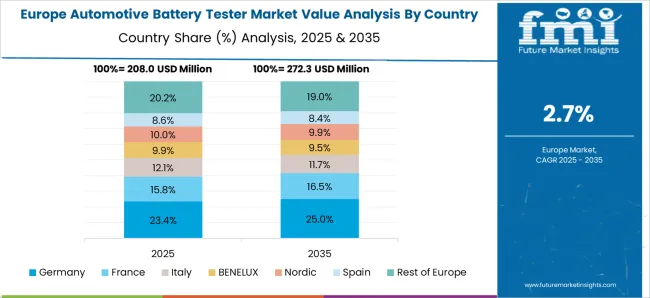

In contrast, Europe presents a mature market environment, where stringent automotive safety regulations and widespread deployment of diagnostic infrastructure drive consistent yet moderate growth. Market penetration is high, but revenue expansion is comparatively constrained due to saturation and slower new adoption rates. North America demonstrates a mixed growth profile, with technological upgrades and retrofitting in existing automotive fleets driving demand. The adoption remains moderate relative to Asia-Pacific, and market expansion is impacted by lower growth in new vehicle production. The Automotive Battery Tester Market highlights regional growth disparities, with Asia-Pacific as the primary growth engine, Europe showing steady maturity-driven expansion, and North America exhibiting moderate uptake influenced by fleet maintenance and technological integration. These regional differences are expected to persist over the forecast period, shaping investment and operational strategies for market participants.

| Metric | Value |

|---|---|

| Automotive Battery Tester Market Estimated Value in (2025 E) | USD 0.9 billion |

| Automotive Battery Tester Market Forecast Value in (2035 F) | USD 1.2 billion |

| Forecast CAGR (2025 to 2035) | 3.0% |

The automotive battery tester market represents a focused segment within the global automotive diagnostics and service equipment industry, emphasizing vehicle performance, maintenance efficiency, and battery health monitoring. Within the broader automotive workshop equipment sector, it accounts for about 5.7%, driven by demand from dealerships, repair shops, and vehicle service centers. In the battery testing and diagnostic tools segment, it secures 6.1%, reflecting reliance on accurate assessment of lead-acid, lithium-ion, and hybrid vehicle batteries. Across the automotive service and repair equipment market, the share is 4.5%, supporting timely maintenance and predictive servicing of battery systems. Within the electric vehicle and hybrid vehicle support category, it represents 4.0%, highlighting the increasing need for specialized testing solutions.

In the automotive electronics diagnostics sector, it contributes about 3.6%, emphasizing compatibility with onboard diagnostics and advanced battery management systems. Recent developments in this market have focused on digital integration, accuracy, and support for advanced battery technologies. Innovations include portable testers with Bluetooth connectivity, software-driven diagnostics, and cloud-enabled performance monitoring. Key players are collaborating with EV manufacturers and service networks to develop solutions compatible with lithium-ion and solid-state battery chemistries. The adoption of automated load testing, state-of-health reporting, and AI-based predictive maintenance is gaining traction to enhance service efficiency and minimize battery downtime. The multifunctional testers that combine battery, alternator, and starter analysis are being deployed for comprehensive vehicle diagnostics.

The automotive battery tester market is experiencing robust growth due to the rising demand for reliable diagnostic tools that ensure vehicle performance and reduce unexpected breakdowns. The increasing complexity of modern automotive electrical systems and the integration of advanced electronics have heightened the need for precise battery health assessment.

The adoption of preventive maintenance practices across both passenger and commercial vehicle segments is further driving demand. Technological advancements in battery testing, including digital displays, Bluetooth connectivity, and diagnostic integration, are improving usability and accuracy.

Regulatory pressures to maintain vehicle efficiency and reduce emissions are also encouraging the use of battery testers to prevent energy waste. With electric vehicle adoption accelerating, battery health monitoring is becoming a critical service component, creating sustained growth opportunities for manufacturers and service providers in the years ahead.

The automotive battery tester market is segmented by technology, application, mobility, vehicle, and geographic regions. By technology, automotive battery tester market is divided into simple testers, integrated testers, battery management information system (BMIS), IoT platforms, and others. In terms of application, automotive battery tester market is classified into OEM and aftermarket. Based on mobility, automotive battery tester market is segmented into portable and desktop. By vehicle, automotive battery tester market is segmented into two-wheeler vehicles and passenger & commercial vehicles. Regionally, the automotive battery tester industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The simple testers segment is expected to hold 41.6% of the total market revenue by 2025 within the technology category, making it a key contributor to overall growth. This dominance is attributed to their cost effectiveness, ease of use, and suitability for quick diagnostics in both professional workshops and personal use.

These testers are valued for their ability to provide immediate insights into battery condition without requiring advanced technical expertise. Their wide availability, low maintenance, and compatibility with multiple battery types have supported their adoption across various mobility segments.

The continued demand for affordable and user friendly diagnostic tools is expected to sustain the prominence of this segment in the market.

The OEM application segment is projected to account for 56.20% of market revenue by 2025, securing its position as the leading application area. This leadership is driven by the integration of battery testing processes in manufacturing and quality assurance protocols.

OEMs utilize advanced battery testers to ensure that vehicles meet performance standards before delivery, reducing warranty claims and enhancing customer satisfaction. The emphasis on delivering vehicles with optimal electrical system reliability has reinforced the importance of this segment.

Additionally, the growing production of electric and hybrid vehicles has further amplified OEM reliance on precise battery diagnostics, strengthening the segment’s market share.

The portable mobility segment is set to capture 63.40% of market revenue by 2025, making it the dominant mobility category. The popularity of portable testers stems from their convenience, lightweight design, and adaptability for both on site and remote battery diagnostics.

Technicians, fleet operators, and individual vehicle owners benefit from the flexibility to perform tests without being confined to fixed locations. Portable models often include digital interfaces and smart connectivity features, enabling quick analysis and data sharing.

The increasing need for mobility in diagnostics, especially in roadside assistance and field service operations, has driven the segment’s rapid growth and solidified its leadership in the market.

The market has grown significantly due to the increasing adoption of electric vehicles, hybrid vehicles, and advanced internal combustion engines. Battery testers are essential for assessing battery performance, state of charge, and overall health, ensuring vehicle reliability and safety. Demand has been influenced by rising vehicle parc, emphasis on preventive maintenance, and the need for accurate diagnostic solutions in automotive workshops and manufacturing plants. Modern testers are equipped with features such as digital displays, smart connectivity, and compatibility with diverse battery chemistries.

Automotive battery testers are increasingly integrated into vehicle diagnostic and maintenance routines to ensure optimal battery performance and prevent unexpected breakdowns. Workshops, fleet operators, and individual vehicle owners rely on testers to monitor battery voltage, resistance, and capacity. With the rise of hybrid and electric vehicles, specialized testers are required to evaluate lithium-ion and other advanced battery chemistries. The adoption of predictive maintenance strategies has further expanded demand, as testers help identify early signs of battery degradation and prevent costly failures. This focus on reliability and maintenance efficiency has positioned battery testers as indispensable tools in automotive service centers worldwide.

The global shift toward electric and hybrid vehicles has been a significant growth driver for the automotive battery tester market. These vehicles rely heavily on advanced batteries for propulsion and auxiliary functions, making performance monitoring critical. Battery testers designed for high-voltage systems, including lithium-ion modules, allow technicians to evaluate health, safety, and state of charge accurately. Fleet operators of EVs and public transportation systems are increasingly adopting battery testing solutions for routine maintenance and lifecycle management. Regulatory mandates on vehicle safety and emission reduction initiatives have further emphasized the need for reliable battery diagnostics, reinforcing the adoption of battery testers in both aftermarket and OEM environments.

Advances in automotive battery testers have focused on improving accuracy, speed, and versatility. Modern devices feature digital interfaces, Bluetooth and cloud connectivity, and automated reporting functions. Integration with vehicle onboard diagnostics allows seamless communication and real-time analysis of battery performance metrics. Testers capable of evaluating multiple battery chemistries and handling high-voltage systems have become essential for workshops servicing hybrid and electric vehicles. The calibration technologies and intelligent algorithms improve reliability and reduce testing errors. Continuous innovation ensures that battery testers meet evolving industry standards, support technician efficiency, and provide actionable insights for battery lifecycle management in increasingly complex automotive systems.

The market faces challenges from price sensitivity, equipment standardization, and complex regulatory requirements. Testing equipment must meet safety certifications, voltage handling specifications, and compatibility standards with diverse vehicle models. Fluctuations in component and sensor costs can impact pricing and margins, particularly for advanced high-voltage testers. The inadequate technician training and inconsistent calibration practices can reduce test reliability. Manufacturers are investing in robust, user-friendly, and compliant solutions to address these challenges. Despite these hurdles, the increasing complexity of automotive powertrains and growing emphasis on battery reliability continue to sustain strong market demand globally.

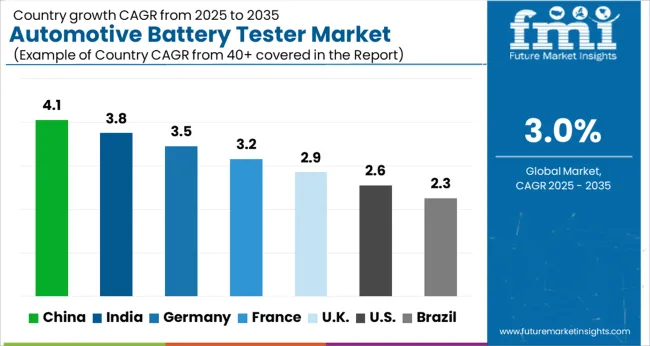

| Countries | CAGR |

|---|---|

| China | 4.1% |

| India | 3.8% |

| Germany | 3.5% |

| France | 3.2% |

| UK | 2.9% |

| USA | 2.6% |

| Brazil | 2.3% |

The market is projected to grow at a CAGR of 3.0% from 2025 to 2035, supported by increasing focus on battery diagnostics and automotive maintenance solutions. Germany reached 3.5%, driven by adoption of advanced testing technologies in automotive workshops and manufacturing plants. India recorded 3.8%, reflecting growing vehicle production and maintenance service expansion. China led with 4.1%, bolstered by large-scale automotive manufacturing and integration of smart diagnostic solutions. The United Kingdom accounted for 2.9%, with steady deployment in automotive service sectors. The United States registered 2.6%, where technological upgrades and regulatory compliance maintained consistent market activity. Together, these countries represent the primary hubs for production, deployment, and technological advancement in automotive battery testing. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is projected to grow at a CAGR of 4.1%, driven by increasing automotive production, electrification, and rising demand for battery health monitoring in vehicles. Adoption has been reinforced by domestic manufacturers offering advanced digital and portable battery testers compatible with lead acid and lithium ion batteries. Expansion of EVs, commercial vehicles, and fleet operations contributes to steady market growth. Technological integration such as IoT enabled testers and real time diagnostics enhances accuracy and service efficiency.

India is expected to grow at a CAGR of 3.8%, supported by rising passenger vehicle sales, two wheeler electrification, and fleet maintenance requirements. Adoption has been reinforced by demand for digital, portable, and multifunctional testers for both lead acid and lithium ion batteries. Domestic manufacturers collaborate with automotive service providers to expand usage in repair shops, dealerships, and fleet maintenance centers. EV adoption and government incentives for clean mobility support increased demand for battery testing equipment.

Germany is forecast to grow at a CAGR of 3.5%, driven by electrification of passenger cars and commercial fleets, alongside high adoption in automotive service centers. Adoption has been reinforced by demand for precision, high reliability, and digital battery diagnostics tools. German manufacturers focus on robust, multifunctional testers compatible with lead acid, lithium ion, and hybrid battery technologies. Fleet maintenance and workshop upgrades contribute to adoption, while EV incentives accelerate the use of advanced testing devices.

The United Kingdom is projected to grow at a CAGR of 2.9%, supported by adoption in fleet management, automotive service workshops, and EV maintenance programs. Imports of advanced testers complement domestic supply. Growth is reinforced by rising EV penetration and demand for reliable diagnostics in commercial and passenger vehicles. Service centers increasingly deploy digital and portable battery testers for fast and accurate assessments.

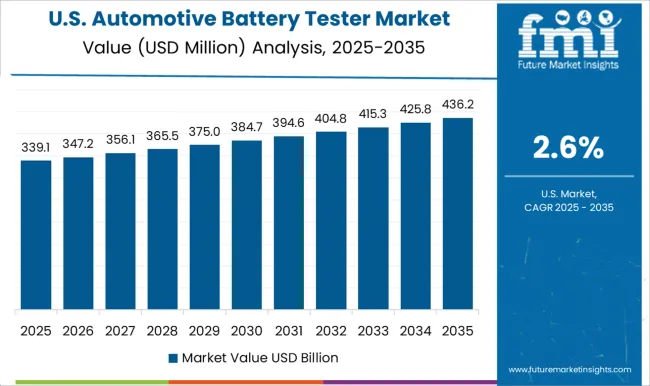

The United States is expected to grow at a CAGR of 2.6%, driven by widespread adoption in EVs, fleet maintenance, and aftermarket automotive services. Domestic manufacturers focus on high precision, digital, and multifunctional battery testing equipment for lead acid, lithium ion, and hybrid battery systems. Increasing fleet electrification and regulatory focus on battery safety reinforce market growth.

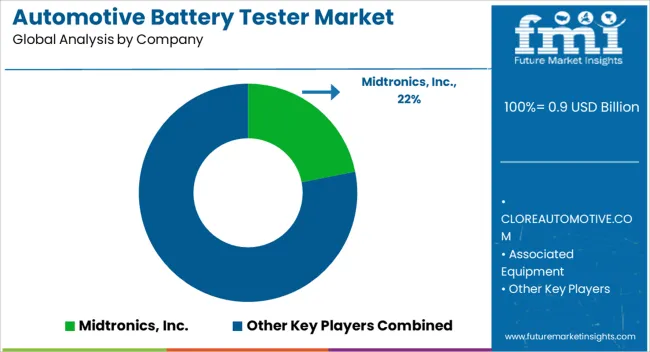

The market is characterized by companies offering diagnostic solutions for automotive batteries, focusing on accuracy, speed, and ease of use across workshops, dealerships, and fleet service providers. Midtronics, Inc. leads with advanced battery analysis systems, providing highly accurate state-of-health and charge assessments for conventional and hybrid vehicle batteries. Bosch Automotive Service Solutions delivers integrated testing solutions combining hardware and software for professional workshops, emphasizing reliability and compatibility with multiple battery types. Schumacher Electric Corporation and Clore Automotive offer portable, user-friendly battery testers aimed at small garages and DIY automotive enthusiasts, balancing affordability with essential diagnostic features.

Associated Equipment and Autometer Products provide specialized testers for commercial and heavy-duty vehicles, catering to fleet maintenance and industrial applications. IEC and MotoBatt focus on innovative design and rapid testing capabilities, supporting lead-acid, AGM, and lithium-ion batteries. Competitive dynamics are influenced by technological innovation, device portability, compatibility with emerging battery chemistries, and after-sales support.

Companies differentiate through calibration accuracy, real-time diagnostics, user interface design, and integration with vehicle management systems. Increasing adoption of electric and hybrid vehicles is driving demand for sophisticated testing equipment capable of handling high-voltage systems, positioning established players and new entrants to expand market penetration through innovation and service excellence.

| Items | Values |

|---|---|

| Quantitative Units | USD 0.9 billion |

| Technology | Simple Testers, Integrated Testers, Battery Management Information System (BMIS), IoT Platforms, and Others |

| Application | OEM and Aftermarket |

| Mobility | Portable and Desktop |

| Vehicle | Two-wheeler vehicles and Passenger & Commercial vehicles |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Midtronics, Inc., CLOREAUTOMOTIVE.COM, Associated Equipment, Schumacher Electric Corporation, Bosch Automotive Service Solutions Inc., Autometer Products, IEC, and MotoBatt |

| Additional Attributes | Dollar sales by tester type and application, demand dynamics across passenger, commercial, and electric vehicles, regional trends in automotive service and maintenance adoption, innovation in diagnostic accuracy, portability, and software integration, environmental impact of electronic component production and disposal, and emerging use cases in battery health monitoring, predictive maintenance, and EV fleet management. |

The global automotive battery tester market is estimated to be valued at USD 0.9 billion in 2025.

The market size for the automotive battery tester market is projected to reach USD 1.2 billion by 2035.

The automotive battery tester market is expected to grow at a 3.0% CAGR between 2025 and 2035.

The key product types in automotive battery tester market are simple testers, integrated testers, battery management information system (bmis), iot platforms and others.

In terms of application, oem segment to command 56.2% share in the automotive battery tester market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Battery Disconnect Unit (BDU) Market Size and Share Forecast Outlook 2025 to 2035

Automotive Battery Management System Market Growth - Trends & Forecast 2025 to 2035

Battery Resistance Tester Market Size and Share Forecast Outlook 2025 to 2035

Automotive Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Automotive Start-Stop Battery Market Size and Share Forecast Outlook 2025 to 2035

Automotive Portable Lithium Iron Phosphate Battery Market Size and Share Forecast Outlook 2025 to 2035

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA