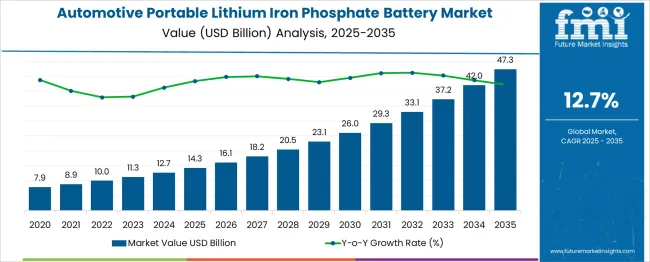

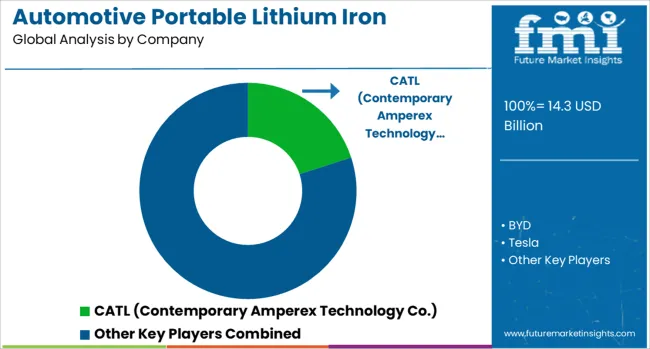

The automotive portable lithium iron phosphate battery market is estimated to be valued at USD 14.3 billion in 2025 and is projected to reach USD 47.3 billion by 2035, registering a compound annual growth rate (CAGR) of 12.7% over the forecast period.

Between 2024 and 2029, the market expands from USD 7.9 billion to USD 16.1 billion, contributing an incremental gain of USD 8.2 billion, which accounts for roughly 21% of the total projected growth. This growth phase is driven by increasing demand for portable energy storage solutions in automotive applications, especially for electric two-wheelers, light electric vehicles, and power tools. Technological advancements in lithium iron phosphate chemistry enhance battery safety, lifespan, and charge efficiency, which fuels adoption. From 2030 to 2034, the market further advances from USD 18.2 billion to USD 33.1 billion, adding USD 14.9 billion to the overall increase. This period witnesses expansion due to increased electric vehicle penetration, government incentives for clean energy adoption, and growing consumer preference for reliable and lightweight battery solutions.

The latter half of the forecast period, from 2035 to 2039, sees the market accelerate from USD 37.2 billion to USD 47.3 billion, adding USD 10.1 billion, driven by scaling production capacities, improved supply chain logistics, and ongoing innovations focused on energy density and cost reduction. The next few years multiplier of approximately 6x and consistent momentum indicate a robust outlook for the automotive portable lithium iron phosphate battery market, propelled by technological progress, expanding application areas, and supportive regulatory policies.

| Metric | Value |

|---|---|

| Automotive Portable Lithium Iron Phosphate Battery Market Estimated Value in (2025 E) | USD 14.3 billion |

| Automotive Portable Lithium Iron Phosphate Battery Market Forecast Value in (2035 F) | USD 47.3 billion |

| Forecast CAGR (2025 to 2035) | 12.7% |

The market is undergoing substantial growth, supported by the increasing shift toward sustainable mobility solutions and the accelerated electrification of vehicles globally. Governments and automotive manufacturers are aligning their strategies toward decarbonization, which has led to a surge in the adoption of lightweight, high-efficiency energy storage systems.

Lithium iron phosphate chemistry has gained prominence due to its thermal stability, longer lifecycle, and safer performance characteristics compared to other lithium-based alternatives. The growing demand for hybrid and electric vehicles, especially in urban environments, has intensified the need for compact, portable battery solutions that can support both primary and auxiliary power applications.

Additionally, advancements in battery management systems and modular configurations are making these batteries more adaptable for varying vehicle platforms. As battery production scales and material innovations improve energy density and cost-efficiency, the market is expected to maintain a strong growth trajectory across both OEM and aftermarket channels..

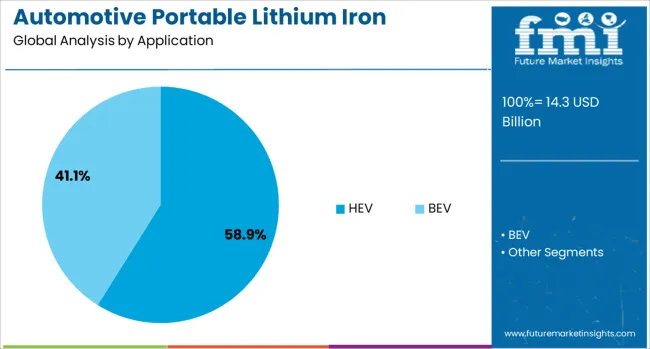

The automotive portable lithium iron phosphate battery market is segmented by application and geographic regions. By application, the market is divided into HEV and BEV. Regionally, the automotive portable lithium iron phosphate battery industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The HEV application segment is projected to account for 58.90% of the market revenue share in 2025, establishing it as the dominant application area. Growth in this segment has been supported by rising consumer preference for hybrid vehicles that offer improved fuel efficiency while reducing environmental impact. Lithium iron phosphate batteries have been favored in HEV configurations due to their high thermal stability and extended cycle life, which align with the performance expectations of hybrid powertrains.

These batteries have also demonstrated exceptional safety in variable operating conditions, making them suitable for repeated charge and discharge cycles without performance degradation. In the context of stricter emission standards and fuel economy regulations, automotive manufacturers have increasingly integrated lithium iron phosphate batteries into HEV platforms.

The growing availability of compact, portable battery modules that support rapid deployment and replacement has further accelerated adoption. This combination of performance reliability, environmental benefit, and regulatory alignment has solidified the HEV segment’s leadership within the market..

Automotive portable LFP batteries are gaining market share through their durability, safety, and adaptability across diverse automotive applications. Growth is supported by OEM adoption, aftermarket opportunities, and their suitability for off-grid mobility and auxiliary power systems.

Automotive portable lithium iron phosphate batteries are gaining traction due to their role in auxiliary power systems, off-grid vehicle support, and portable EV charging solutions. Their superior thermal stability, long cycle life, and safety profile make them suitable for demanding automotive environments. Growth is being fueled by the expansion of electric vehicle infrastructure and rising consumer demand for reliable backup power in passenger and commercial fleets. OEMs and aftermarket suppliers are integrating these batteries into maintenance kits, RV power units, and mobile service vehicles. The increasing preference for lightweight, quick-charging, and energy-dense solutions is further enhancing their market penetration across both emerging and developed automotive sectors.

The market benefits from the inherent advantages of LFP chemistry, including low degradation rates, stable voltage output, and enhanced safety over other lithium-ion variants. These attributes are particularly valuable in automotive applications where durability under frequent cycling is crucial. Manufacturers are focusing on delivering optimized battery modules with improved charge retention and higher energy density to meet diverse operational demands. This performance edge allows LFP batteries to maintain efficiency in extreme temperatures, which is critical for global automotive logistics and portable EV charging markets. The ability to consistently meet performance expectations is strengthening their position against competing chemistries.

Portable LFP batteries are increasingly used in applications supporting off-grid and remote mobility solutions, including roadside assistance, outdoor recreation, and fleet maintenance. Their compatibility with solar charging systems and portable charging stations enhances their versatility for mobile power delivery. Demand is growing in regions with limited charging infrastructure, as these batteries enable extended travel ranges and emergency backup without reliance on fixed facilities. Automotive manufacturers are collaborating with energy solution providers to develop integrated systems that combine portability with scalability, meeting the evolving requirements of both private and commercial vehicle owners who seek independence from traditional power networks.

The integration of portable LFP batteries into OEM vehicle designs and aftermarket upgrade packages is accelerating market adoption. Automakers are embedding these units as part of premium EV accessory kits, while aftermarket suppliers target RV, truck, and specialty vehicle segments. Strategic partnerships between battery producers and automotive brands are fostering customized solutions tailored for specific vehicle classes. Expansion into fleet applications for logistics, emergency response, and service vehicles is also notable, as organizations seek reliable, portable energy to reduce downtime. Enhanced distribution channels, including e-commerce, are improving accessibility, allowing the market to cater to a broader consumer base worldwide.

| Country | CAGR |

|---|---|

| China | 17.1% |

| India | 15.9% |

| Germany | 14.6% |

| France | 13.3% |

| UK | 12.1% |

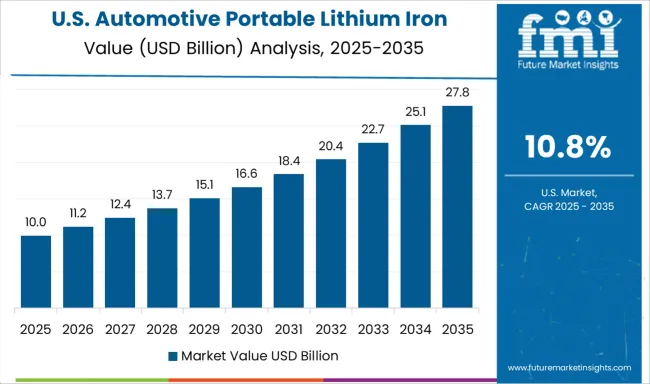

| USA | 10.8% |

| Brazil | 9.5% |

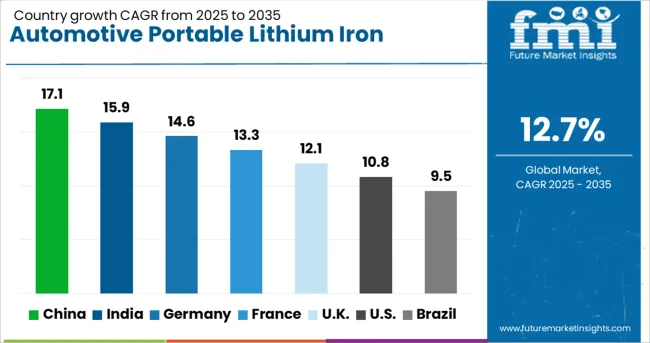

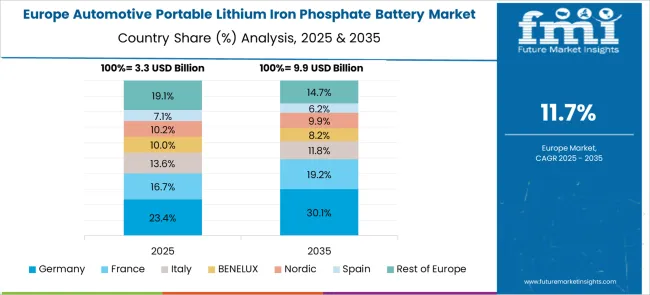

The automotive portable lithium iron phosphate (LFP) battery market is expected to grow globally at a CAGR of 12.7% from 2025 to 2035, supported by increasing adoption in electric vehicles, auxiliary power systems, and off-grid mobility solutions. China leads with a CAGR of 17.1%, driven by high EV penetration, rapid charging infrastructure deployment, and strong domestic battery manufacturing capacity. India follows at 15.9%, supported by expanding EV adoption, government-led electrification policies, and rising demand for portable energy solutions in logistics and personal mobility. France grows at 13.3%, benefiting from strategic EV incentives and a growing aftermarket for portable battery applications, while the United Kingdom records 12.1% growth due to rising adoption in commercial fleets and recreational vehicles. The United States registers 10.8%, supported by demand in both EV backup systems and portable charging infrastructure. The analysis covers more than 40 countries, with these markets serving as critical benchmarks for assessing innovation pathways, supply chain strategies, and investment opportunities in the automotive portable LFP battery sector.

China is projected to achieve a CAGR of 17.1% during 2025–2035, well above the global 12.7% pace. This uplift is supported by high EV penetration, dense aftermarket networks, and widespread acceptance of portable power for roadside support, service vans, and RV segments. Battery pack makers have expanded cell-to-pack formats for compact, carry-ready modules that pair with DC fast chargers and solar kits. OEM accessory catalogs now include portable LFP boosters, jump-starters, and auxiliary packs that preserve 12-V systems during software updates and diagnostics. Logistics fleets are adopting portable LFP to power tools and telematics during dwell, which raises unit turns. China is viewed as the scale anchor for cost-down learning curves and rapid SKU proliferation across consumer and professional channels.

India is expected to post a CAGR of 15.9% for 2025–2035, supported by expanding EV two-wheeler and three-wheeler ecosystems and rising demand for portable backup at dealerships, roadside workshops, and fleet depots. Portable LFP units are being used for diagnostic power, tire and compressor tools, and emergency top-ups for last-mile vehicles. Local assemblers have scaled enclosure and BMS integration, which lowers price points and improves serviceability. Passenger-vehicle owners show growing interest in compact in-boot power stations for camping and long intercity trips. Financial leasing for fleets has widened access, improving replacement cycles. India’s supplier parks are turning into assembly hubs for export to South Asia and Africa, which sustains run-rates and stabilizes component procurement.

France is projected to grow at 13.3% during 2025–2035, slightly above the global pace. Portable LFP is being adopted by rental, car-sharing, and assistance providers to power diagnostics, smart locks, and field service equipment. Dealer groups have standardized accessory bundles that include compact LFP boosters and 230-V inverters for customer add-on sales. Recreational vehicles, marine-adjacent users, and overlanding communities are adding portable LFP for hotel-load duties, which lifts watt-hour per unit averages. Insurance-linked roadside programs specify certified LFP packs for safe jump starts, which improves recovery times. Supplier partnerships with French electronics firms have delivered quiet, low-vibration packs suitable for urban service vans and mobile workshops. This mix builds predictable replacement demand and healthy attachment rates.

The United Kingdom is expected to record a CAGR of 12.1% for 2025–2035. The 2020–2024 CAGR is estimated at 10.4%. The rise to 12.1% has been driven by premium EV adoption, broader use of portable LFP in roadside assistance, and higher accessory take-rates at dealers. Field service and motorsport events have increased reliance on compact LFP for tools, diagnostics, and pit-lane electronics. Van and camper conversions require light, stable power that can be recharged from alternators or portable solar, which fits LFP chemistry well. Importers have improved channel coverage through e-commerce and trade wholesalers, raising SKU breadth and ensuring steady replenishment. In short, better availability, richer use cases, and premium EV density lifted the curve.

The United States is set to post a CAGR of 10.8% for 2025–2035. Pickup and SUV ownership supports larger portable power stations for camping, tailgating, and jobsite tools, which increases watt-hour per transaction. Roadside networks are deploying certified LFP jump-start units to reduce call times and improve safety. EV service centers use portable packs during software flashes and HV system isolation, cutting bay downtime. RV and marine channels provide a parallel path for automotive-adjacent sales, improving seasonality. Domestic brands emphasize UL-listed packs with clear cycle-life disclosures and swappable module options, which fosters repeat purchases. The result is consistent mid-teens unit growth in specialty retail, with pro channels adding stability.

The automotive portable LFP battery market features global leaders with advanced cell manufacturing capabilities, vertical integration strategies, and diversified application portfolios. CATL (Contemporary Amperex Technology Co.) maintains a dominant position through high-volume cell production, extensive R&D in energy density optimization, and partnerships with OEMs for portable battery accessories. BYD leverages its in-house LFP chemistry innovations and vehicle manufacturing to offer cost-efficient, durable portable battery solutions for both consumer and fleet use. Tesla integrates LFP chemistry in portable formats aligned with its EV and energy storage ecosystems, ensuring compatibility, fast-charging capability, and strong brand pull. LG Energy Solution focuses on high-reliability cell formats with thermal safety features, catering to roadside assistance units, RV power stations, and professional tool power packs.

A123 Systems specializes in high-power-density LFP solutions, targeting motorsports, emergency support vehicles, and defense-related portable energy systems. Strategic drivers in this competitive environment include expanding global manufacturing footprints, enhancing BMS and fast-charging compatibility, and collaborating with vehicle accessory distributors for aftermarket penetration. Companies are prioritizing product miniaturization without compromising cycle life, as well as entering adjacent markets such as marine, recreational vehicles, and off-grid applications. Continuous investment in production automation and cost-down initiatives, alongside raw material sourcing stability, is shaping competitive differentiation, ensuring consistent supply and performance across global markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 14.3 Billion |

| Application | HEV and BEV |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | CATL (Contemporary Amperex Technology Co.), BYD, Tesla, LG Energy Solution, and A123 Systems |

| Additional Attributes | Dollar sales, share, competitive landscape, regional demand trends, key end-user segments, pricing benchmarks, raw material supply risks, and regulatory compliance outlook. |

The global automotive portable lithium iron phosphate battery market is estimated to be valued at USD 14.3 billion in 2025.

The market size for the automotive portable lithium iron phosphate battery market is projected to reach USD 47.3 billion by 2035.

The automotive portable lithium iron phosphate battery market is expected to grow at a 12.7% CAGR between 2025 and 2035.

The key product types in automotive portable lithium iron phosphate battery market are hev and bev.

In terms of , segment to command 0.0% share in the automotive portable lithium iron phosphate battery market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA