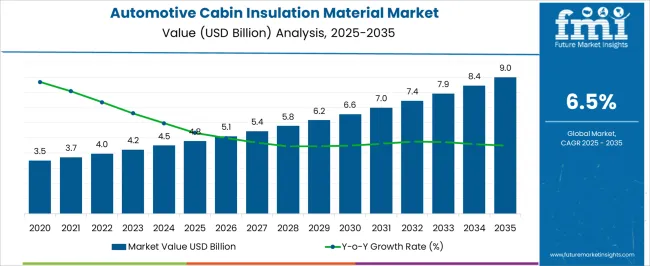

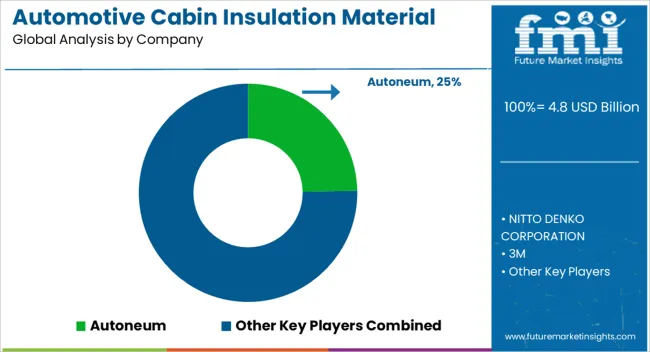

The Automotive Cabin Insulation Material Market is estimated to be valued at USD 4.8 billion in 2025 and is projected to reach USD 9.0 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

| Metric | Value |

|---|---|

| Automotive Cabin Insulation Material Market Estimated Value in (2025 E) | USD 4.8 billion |

| Automotive Cabin Insulation Material Market Forecast Value in (2035 F) | USD 9.0 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The Automotive Cabin Insulation Material market is witnessing steady growth due to increasing consumer demand for enhanced passenger comfort, noise reduction, and thermal insulation in vehicles. In the current scenario, manufacturers are prioritizing lightweight and high-performance insulation solutions that improve fuel efficiency while maintaining safety and acoustic performance. The market expansion is supported by the rising production of passenger cars, growing urbanization, and the shift towards electric vehicles that require advanced thermal management.

Investments in research and development have enabled innovations in material composition and integration techniques, allowing cabin insulation systems to be both durable and adaptable to diverse vehicle architectures. As regulations around noise, vibration, and thermal standards become more stringent, automotive OEMs are increasingly focusing on high-quality insulation solutions that meet performance benchmarks.

Future growth opportunities are expected in the development of sustainable and recyclable insulation materials, which cater to environmental regulations while maintaining high acoustic and thermal performance The trend of modular and easily installed insulation systems is further encouraging adoption across vehicle segments.

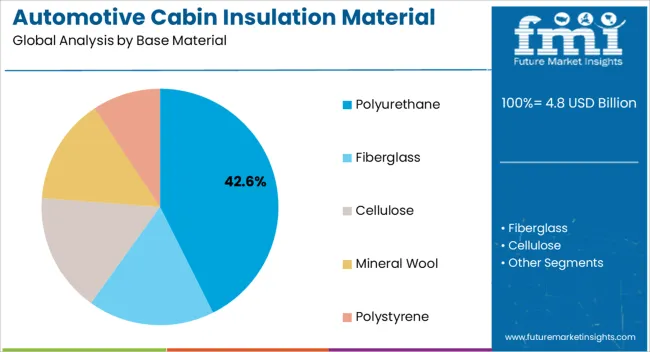

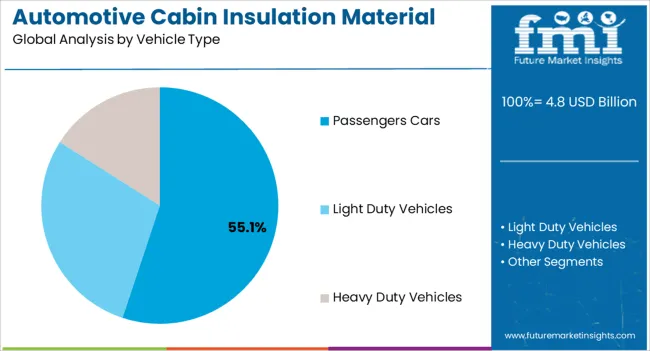

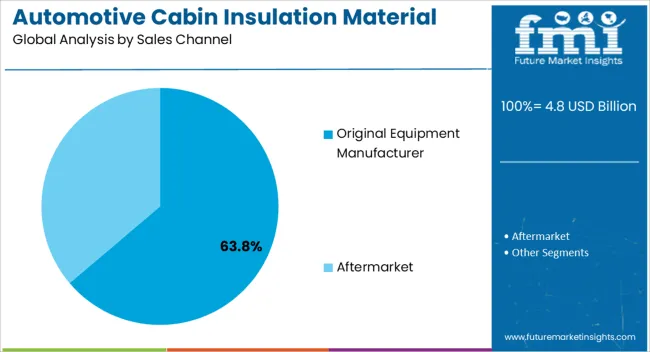

The automotive cabin insulation material market is segmented by base material, vehicle type, sales channel, and geographic regions. By base material, automotive cabin insulation material market is divided into Polyurethane, Fiberglass, Cellulose, Mineral Wool, and Polystyrene. In terms of vehicle type, automotive cabin insulation material market is classified into Passengers Cars, Light Duty Vehicles, and Heavy Duty Vehicles. Based on sales channel, automotive cabin insulation material market is segmented into Original Equipment Manufacturer and Aftermarket. Regionally, the automotive cabin insulation material industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Polyurethane base material is projected to hold 42.60% of the Automotive Cabin Insulation Material market revenue share in 2025, making it the leading material type. This position has been driven by its excellent thermal insulation properties, high durability, and lightweight characteristics, which contribute to fuel efficiency and cabin comfort. Adoption has been accelerated by the material’s versatility, allowing it to be molded into complex shapes that fit diverse cabin architectures.

Additionally, Polyurethane offers superior noise absorption and vibration damping capabilities, which are critical for enhancing passenger comfort. The material’s compatibility with adhesive bonding, mechanical fastening, and spray applications has further reinforced its widespread use in vehicle assembly lines.

The growth of the electric vehicle segment has also created demand for materials with high thermal resistance, where Polyurethane has proven effective Future market opportunities are expected from innovations in environmentally friendly and recyclable Polyurethane variants, which align with sustainability initiatives in the automotive industry.

Passenger cars are anticipated to account for 55.10% of the Automotive Cabin Insulation Material market revenue in 2025, establishing this segment as the dominant vehicle type. This leadership is being attributed to the growing production and sales of passenger vehicles globally, driven by rising disposable income, urbanization, and consumer focus on comfort and noise reduction. Cabin insulation in passenger cars is increasingly being optimized to enhance thermal management, reduce vibration, and improve overall ride quality.

The segment benefits from high adoption of lightweight materials such as Polyurethane, which contributes to fuel efficiency and performance. OEMs are prioritizing noise, vibration, and harshness control in passenger cars, making advanced insulation systems a key component in design and manufacturing.

Regulatory emphasis on vehicle safety and emission standards also encourages the integration of effective insulation materials Looking forward, continued technological advancements in cabin comfort solutions and growing demand for electric and hybrid passenger vehicles are expected to sustain the segment’s leading position in the market.

The Original Equipment Manufacturer sales channel is projected to hold 63.80% of the Automotive Cabin Insulation Material market revenue in 2025, making it the dominant distribution route. This leadership has been influenced by OEMs’ preference for directly sourcing high-quality insulation materials that meet precise specifications and ensure consistent performance across vehicle lines. Direct procurement by OEMs allows for seamless integration into production lines, ensuring compliance with safety, thermal, and acoustic standards.

The segment has benefited from growing vehicle production, particularly in passenger cars, and the rising trend of electric and hybrid vehicles that require specialized insulation solutions. Long-term contracts and partnerships with material suppliers further strengthen the OEM channel, providing stability in supply and innovation adoption.

Moreover, OEM-driven installations reduce risks associated with aftermarket inconsistencies and ensure better quality control The segment’s growth is expected to continue as manufacturers increasingly focus on integrating advanced insulation solutions into vehicles to meet regulatory, performance, and consumer comfort expectations.

Automotive cabin insulation material is a material or a combination of materials that retard the flow of heat energy, absorb vibration and reduce the squeaking sounds in automobiles. This material helps maintain the automotive cabin temperature at a desired level and prevents or reduces damage to vehicles from exposure to fire and corrosive atmospheres.

Furthermore, manufacturers are introducing optimum options for reducing the weight of automotive vehicles and boosting eco-friendliness, which is likely to drive the automotive cabin insulation material market. Moreover, automotive cabin insulation material possesses certain properties such as chemical & water resistance, high strength and fire resistance, among others.

Furthermore, automotive cabin insulation material is widely used in passenger cars and light-duty vehicles across the globe. It is also used in passenger cars for the addition of luxurious features such as acoustics, weight reduction for high efficiency and for reducing the thermal effect to provide comfort & safe zone during driving. In electric vehicles, this material is frequently used for heat management applications.

Electrification and autonomous driving are posing new challenges to automotive manufacturers. Moreover, the higher usage of passenger cabins has increased the need for appropriate acoustic and thermal management to deal with heat energy and noise sources, and this has boosted the demand for automotive cabin insulation material.

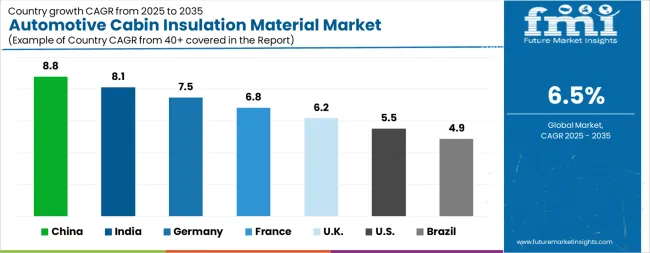

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

The Automotive Cabin Insulation Material Market is expected to register a CAGR of 6.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 8.8%, followed by India at 8.1%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 4.9%, yet still underscores a broadly positive trajectory for the global Automotive Cabin Insulation Material Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 7.5%. The USA Automotive Cabin Insulation Material Market is estimated to be valued at USD 1.6 billion in 2025 and is anticipated to reach a valuation of USD 2.8 billion by 2035. Sales are projected to rise at a CAGR of 5.5% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 242.4 million and USD 128.5 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.8 Billion |

| Base Material | Polyurethane, Fiberglass, Cellulose, Mineral Wool, and Polystyrene |

| Vehicle Type | Passengers Cars, Light Duty Vehicles, and Heavy Duty Vehicles |

| Sales Channel | Original Equipment Manufacturer and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Autoneum, NITTO DENKO CORPORATION, 3M, FXI, Autins Group, Grupo Antolin, L&L Products, Pritex, and TMAT |

The global automotive cabin insulation material market is estimated to be valued at USD 4.8 billion in 2025.

The market size for the automotive cabin insulation material market is projected to reach USD 9.0 billion by 2035.

The automotive cabin insulation material market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in automotive cabin insulation material market are polyurethane, fiberglass, cellulose, mineral wool and polystyrene.

In terms of vehicle type, passengers cars segment to command 55.1% share in the automotive cabin insulation material market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Automotive Actuator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Manifold Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA