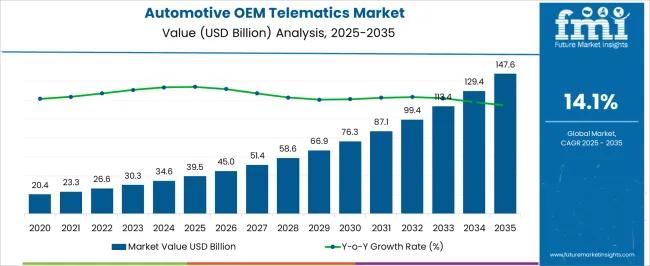

The automotive OEM telematics sector is forecasted to rise from USD 39.5 billion in 2025 to USD 147.6 billion in 2035 at a CAGR of 14.1%. The growth contribution index illustrates rapid expansion, with values advancing from 39.5 billion in 2025 to 58.6 billion in 2028 and 76.3 billion in 2030. This consistent climb reflects the growing integration of connected services, diagnostics, and fleet management solutions within vehicles.

Analysts suggest that the index highlights a transformative phase where telematics is no longer an optional add-on but a core feature driving buyer preference, OEM competitiveness, and aftermarket differentiation in mobility ecosystems. By 2031, values are projected at 87.1 billion, moving to 113.4 billion in 2033 and closing at 147.6 billion in 2035. The curve highlights a significant contribution from expanding adoption in passenger cars, commercial fleets, and electric vehicles, where real-time data is viewed as critical for performance, safety, and efficiency.

Index demonstrates how automotive telematics is contributing to revenue acceleration across OEM portfolios. The trajectory indicates that industry stakeholders who prioritize integrated platforms and scalable telematics services will capture stronger long-term value, with the index confirming sustained opportunities throughout the forecast horizon.

| Metric | Value |

|---|---|

| Automotive OEM Telematics Market Estimated Value in (2025 E) | USD 39.5 billion |

| Automotive OEM Telematics Market Forecast Value in (2035 F) | USD 147.6 billion |

| Forecast CAGR (2025 to 2035) | 14.1% |

The automotive OEM telematics segment is estimated to contribute nearly 42% of the automotive telematics market, about 35% of the connected vehicle market, close to 28% of the in-vehicle infotainment market, nearly 22% of the automotive electronics market, and around 30% of the fleet management solutions market. Collectively, this equates to an aggregated share of approximately 157% across its parent sectors. This proportion underscores the decisive role of OEM-installed telematics as a cornerstone of modern vehicle ecosystems, where connectivity, diagnostics, and navigation are integrated directly into manufacturing processes.

OEM telematics has been positioned as superior to aftermarket solutions due to its seamless integration, reliability, and compliance with automotive standards. Industry analysts consider this segment vital in shaping automaker strategies, as it directly influences brand differentiation, customer retention, and recurring revenue through subscription-based services. Demand has been driven by the need for real-time vehicle monitoring, predictive maintenance, safety enhancements, and compliance with government regulations on intelligent transport systems.

The automotive OEM telematics market is advancing steadily, driven by increasing connectivity requirements, regulatory mandates for vehicle safety, and the rising adoption of data-driven fleet and vehicle management solutions. Industry announcements and automotive technology reports have emphasized the role of telematics in enabling real-time monitoring, predictive maintenance, and enhanced driver assistance capabilities. OEMs are integrating advanced telematics systems as standard offerings to differentiate products, improve customer retention, and comply with safety and emissions standards.

The growth of connected vehicle ecosystems, supported by 4G/5G infrastructure expansion, has accelerated adoption rates across both passenger and commercial vehicles. Partnerships between automakers, telecom providers, and software developers are facilitating innovations in in-vehicle data services, over-the-air updates, and vehicle-to-everything (V2X) communication.

The market is poised to benefit from increasing consumer demand for infotainment and navigation services, evolving smart city initiatives, and the expansion of telematics applications into mobility-as-a-service (MaaS) platforms.

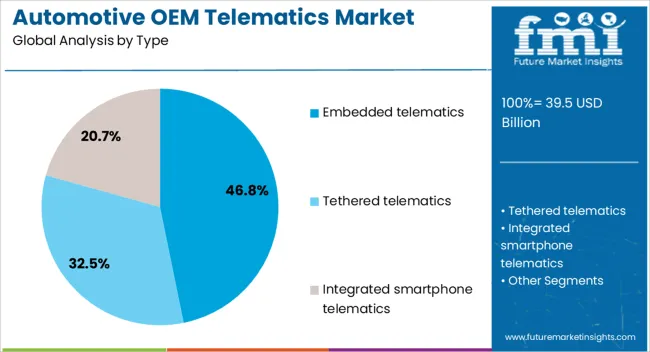

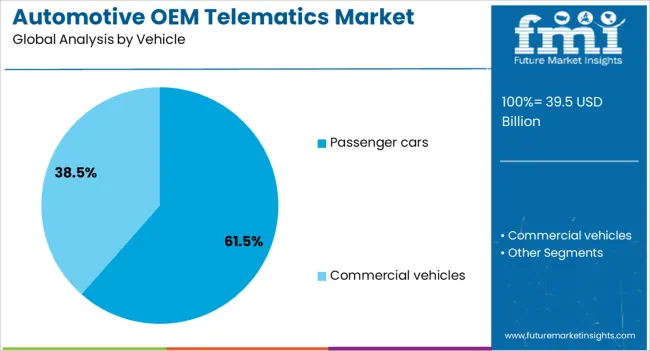

The automotive OEM telematics market is segmented by type, vehicle, application, connectivity, and geographic regions. By type, the automotive OEM telematics market is divided into embedded telematics, Tethered telematics, and Integrated smartphone telematics. In terms of vehicle, automotive oem telematics market is classified into Passenger cars and Commercial vehicles.

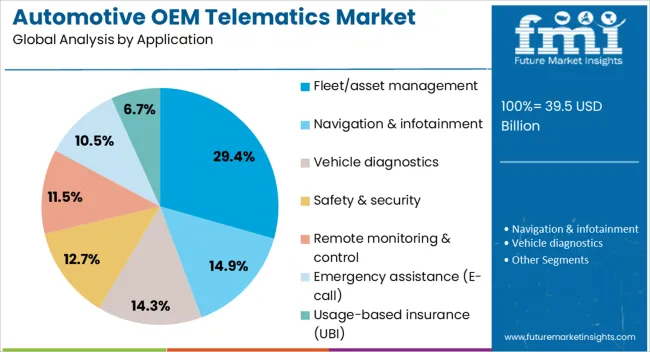

Based on application, the automotive OEM telematics market is segmented into Fleet/asset management, Navigation & infotainment, Vehicle diagnostics, Safety & security, Remote monitoring & control, Emergency assistance (E-call), and Usage-based insurance (UBI). By connectivity, the automotive OEM telematics market is segmented into 4G LTE, 3G, 5G, and Satellite communication. Regionally, the automotive OEM telematics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The embedded telematics segment is projected to hold 46.80% of the automotive OEM telematics market revenue in 2025, maintaining its lead due to its integration advantages and consistent performance. Growth in this segment has been driven by OEM preference for factory-installed telematics systems that ensure seamless compatibility with vehicle electronics and offer enhanced data security.

Embedded systems have become a key enabler for advanced connected services, such as emergency assistance, remote diagnostics, and software updates, without dependency on external devices. Automotive industry reports have noted that regulatory initiatives in various regions mandate embedded telematics for emergency call (eCall) functions, further boosting adoption.

Additionally, embedded solutions support richer data analytics for automakers, enabling predictive maintenance programs and improving customer engagement through personalized services. The ability to deliver high reliability and continuous connectivity under diverse driving conditions has reinforced the embedded telematics segment’s leadership position.

The passenger cars segment is projected to account for 61.50% of the automotive OEM telematics market revenue in 2025, reflecting the strong penetration of connected technologies in the consumer automotive segment. This growth has been supported by rising consumer expectations for real-time navigation, entertainment, and vehicle monitoring capabilities.

Automakers have increasingly equipped passenger cars with advanced telematics features to enhance safety, convenience, and brand value. Market developments have shown a surge in mid-range and premium vehicle models offering telematics as a standard or optional feature, influenced by competition and consumer demand.

Furthermore, passenger car owners are driving adoption of value-added services such as stolen vehicle tracking, insurance telematics, and remote vehicle control. Integration with smartphone applications and the broader connected home ecosystem has further enhanced the appeal of telematics in this segment. As automotive digitalization advances, passenger cars are expected to remain the largest contributor to market revenue.

The fleet/asset management segment is projected to capture 29.40% of the automotive OEM telematics market revenue in 2025, holding its position as the leading application area. This dominance has been underpinned by the growing need for operational efficiency, route optimization, and regulatory compliance in fleet operations.

OEM-integrated telematics solutions provide fleet operators with real-time visibility into vehicle location, driver behavior, fuel consumption, and maintenance needs, enabling data-driven decision-making. Industry adoption has accelerated as companies seek to reduce operating costs, minimize downtime, and improve asset utilization.

Additionally, telematics has become a critical tool in ensuring compliance with safety regulations, emissions standards, and electronic logging device (ELD) mandates in various regions. Cloud-based analytics and AI-driven predictive tools have further expanded the utility of OEM telematics for fleet applications. With the increasing adoption of electrified and autonomous fleet vehicles, fleet/asset management is expected to continue as a high-value growth segment for OEM telematics solutions.

The automotive OEM telematics market is expected to expand strongly, driven by demand for connected vehicle solutions, real-time monitoring, and predictive maintenance. Adoption is rising across passenger and commercial vehicles as automakers embed telematics to enhance safety and efficiency. Opportunities are growing in fleet management, insurance telematics, and integrated infotainment services. Trends highlight the rise of cloud-based platforms, over-the-air updates, and AI-enabled predictive analytics. Challenges such as data privacy concerns, high integration costs, and interoperability issues with legacy systems continue to influence growth trajectories in this evolving sector.

Demand for automotive OEM telematics has been reinforced by rising consumer expectations for connectivity, safety, and convenience. Automakers are embedding telematics units to deliver real-time navigation, diagnostics, and emergency assistance, positioning it as a standard feature in new vehicles. Fleet operators are relying on telematics for route optimization, fuel management, and compliance monitoring. Opinions suggest that insurance companies are increasingly pushing usage-based insurance models, further boosting demand for embedded telematics. Passenger vehicle buyers are also prioritizing connectivity as a differentiating factor in purchasing decisions. This widespread adoption reflects a structural shift in how vehicles are perceived—not just as transport solutions but as connected ecosystems delivering insights, efficiency, and enhanced user experience. Demand is likely to intensify as more regions mandate telematics for safety and regulatory compliance.

Opportunities in the automotive OEM telematics market are expanding through fleet management platforms, insurance telematics, and connected infotainment services. Fleet managers are adopting telematics solutions to enhance vehicle utilization, monitor driver behavior, and improve overall operational efficiency. Insurance firms are offering discounts on premiums for vehicles equipped with telematics that enable usage-based risk assessment. Opinions highlight that infotainment integration offers strong opportunities as consumers demand seamless connectivity with smartphones, entertainment, and voice assistants. Electric vehicle adoption has also created opportunities for OEMs to leverage telematics for range optimization and charging station navigation. Developing regions are becoming attractive markets, with governments promoting smart mobility projects that integrate telematics into transport planning. These opportunities demonstrate how OEM telematics is positioned at the intersection of safety, efficiency, and customer-centric services, offering significant scope for expansion.

Trends influencing the automotive OEM telematics market are centered on predictive analytics, over-the-air updates, and cloud-based platforms. Automakers are integrating telematics with predictive maintenance tools that alert users to potential component failures before breakdowns occur. Over-the-air updates are trending as they reduce dealership visits by allowing remote software upgrades. Opinions suggest that cloud-based telematics platforms are gaining traction as they enable real-time data sharing between vehicles, OEMs, and service providers. Integration of telematics with smart city infrastructure is also trending, allowing smoother traffic flow and better vehicle-to-infrastructure communication. The growing adoption of AI-enabled algorithms for driver assistance and safety analytics reinforces the trajectory of telematics as more than a monitoring tool, instead positioning it as a predictive and interactive driver support system. These trends signal telematics becoming a key pillar of automotive digital transformation.

Challenges in the automotive OEM telematics market are linked to high integration costs, interoperability issues, and data privacy concerns. OEMs face difficulties in standardizing telematics solutions across global markets due to fragmented regulations and differing infrastructure capabilities. Opinions stress that consumer reluctance persists around privacy, as telematics generates vast amounts of sensitive driving and personal data. High installation and subscription costs continue to deter adoption in cost-sensitive vehicle segments, limiting penetration in emerging markets. Interoperability with legacy systems in older fleets has posed further challenges, restricting seamless deployment. Cybersecurity risks have also been identified as a significant barrier, as connected systems remain vulnerable to breaches. These structural constraints underline that while telematics holds significant potential, its full-scale adoption depends on overcoming cost pressures, improving trust in data security, and ensuring regulatory harmonization.

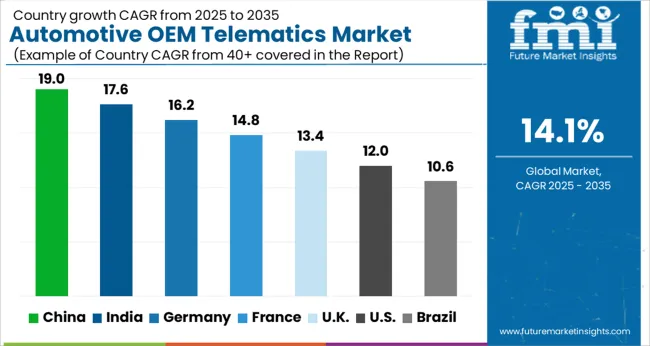

| Country | CAGR |

|---|---|

| China | 19.0% |

| India | 17.6% |

| Germany | 16.2% |

| France | 14.8% |

| UK | 13.4% |

| USA | 12.0% |

| Brazil | 10.6% |

The global automotive OEM telematics market is projected to grow at a CAGR of 14.1% between 2025 and 2035. China leads with 19.0%, followed by India at 17.6% and France at 14.8%. The United Kingdom is expected to grow at 13.4%, while the United States trails with 12.0%. Growth is propelled by rising demand for connected vehicles, safety compliance, fleet management services, and real time navigation. Asian markets outpace others due to rapid expansion of vehicle production, adoption of digital ecosystems, and strong government backing for connected mobility. European markets benefit from regulatory frameworks and integration of telematics into premium vehicles, while the USA reflects slower yet steady upgrades across consumer and fleet segments. This report includes insights on 40+ countries; the top markets are shown here for reference.

The automotive OEM telematics market in China is projected to grow at a CAGR of 19.0%. Strong expansion is supported by rapid growth in vehicle production, consumer adoption of connected cars, and integration of telematics into electric vehicles. Government policies promoting intelligent transportation and smart city mobility accelerate adoption. Local OEMs collaborate with global tech firms to embed AI powered telematics and cloud connectivity into vehicles. With rising EV sales and regulatory push for safety, China is positioned as the global leader in OEM telematics integration.

The automotive OEM telematics market in India is forecast to grow at a CAGR of 17.6%. Rising vehicle sales, expanding ride-hailing services, and growing fleet management demand support rapid adoption. Government initiatives like AIS 140 compliance mandate telematics for commercial vehicles, ensuring strong baseline demand. Domestic OEMs integrate navigation, emergency response, and diagnostics features into mid-range vehicles to attract buyers. With consumers embracing connectivity and after-sales services, India’s market continues to expand at a fast pace, positioning it as one of the most dynamic growth regions globally.

The automotive OEM telematics market in France is expected to grow at a CAGR of 14.8%. Growth is supported by strong demand for connected features in passenger cars, premium vehicle adoption, and compliance with EU safety standards. French OEMs emphasize partnerships with telecom and software firms to enhance vehicle connectivity and diagnostics. Expansion of EV infrastructure further reinforces demand, as telematics become essential for charging management and route optimization. France benefits from both consumer centric adoption and industrial scale integration, sustaining its position within Europe’s connected mobility landscape.

The automotive OEM telematics market in the UK is projected to expand at a CAGR of 13.4%. Uptake is shaped by consumer demand for navigation, emergency call systems, and remote diagnostics in passenger vehicles. Telematics integration is reinforced by fleet operators seeking cost efficiency through route optimization and real-time tracking. Regulatory pressure for eCall compliance also drives adoption across new vehicles. While growth is slower than Asia, consistent demand from both consumers and fleets ensures a steady trajectory, supported by OEM collaboration with software and data providers.

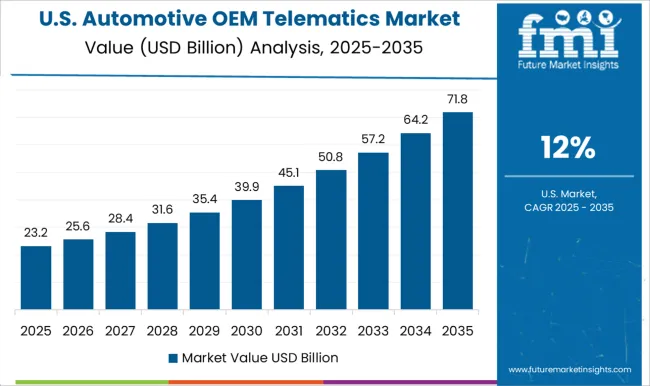

The automotive OEM telematics market in the US is expected to grow at a CAGR of 12.0%. Expansion is moderate due to market maturity, but rising consumer interest in connected features, over-the-air updates, and infotainment systems sustains growth. Fleet operators prioritize telematics for compliance, driver safety, and predictive analytics. OEMs increasingly bundle telematics with subscription services, offering long-term revenue streams. While slower than Asia and parts of Europe, the USA remains significant due to its strong automotive base and emphasis on software-driven vehicle ecosystems.

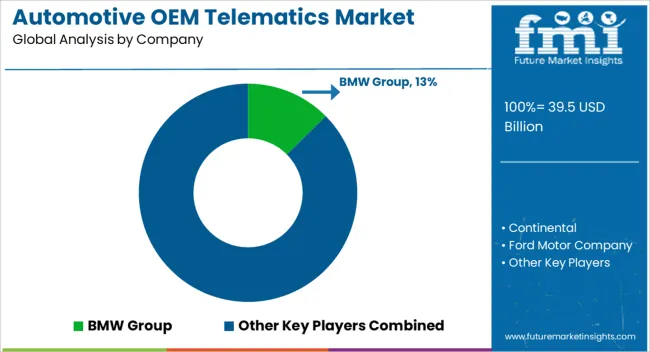

Competition in automotive OEM telematics has been framed around how convincingly brochures demonstrate safety, connectivity, and service integration. BMW Group, Mercedes-Benz Group, Toyota Motor, and Volkswagen Group issue brochures that emphasize in-vehicle concierge, real-time navigation, predictive maintenance, and connected infotainment. Ford and General Motors highlight brochures that detail subscription-based telematics platforms such as FordPass and OnStar, stressing driver assistance, emergency response, and vehicle health reports. Tesla differentiates with digital literature focusing on over-the-air updates and proprietary connectivity architecture.

Hyundai promotes Bluelink brochures with clear feature grids covering remote start, geofencing, and voice control. Continental and Robert Bosch compete on OEM-supplied telematics modules, publishing brochures that highlight scalable hardware, embedded SIM, and cybersecurity measures. Each player compresses complex ecosystems into brochures that illustrate value through feature matrices, network diagrams, and ROI illustrations for fleet and consumer buyers.

| Item | Value |

|---|---|

| Quantitative Units | USD 39.5 Billion |

| Type | Embedded telematics, Tethered telematics, and Integrated smartphone telematics |

| Vehicle | Passenger cars and Commercial vehicles |

| Application | Fleet/asset management, Navigation & infotainment, Vehicle diagnostics, Safety & security, Remote monitoring & control, Emergency assistance (E-call), and Usage-based insurance (UBI) |

| Connectivity | 4G LTE, 3G, 5G, and Satellite communication |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BMW Group, Continental, Ford Motor Company, General Motors, Hyundai Motor Company, Mercedes-Benz Group, Robert Bosch, Tesla, Toyota Motor, and Volkswagen Group |

| Additional Attributes | Dollar sales by service type (navigation, infotainment, safety & security, vehicle diagnostics, fleet management), Dollar sales by connectivity type (embedded, integrated, tethered), Trends in adoption of connected car platforms and data monetization, Role of telematics in regulatory compliance and accident prevention, Growth in demand for EV telematics and over-the-air software updates, Regional adoption patterns across North America, Europe, and Asia Pacific. |

The global automotive OEM telematics market is estimated to be valued at USD 39.5 billion in 2025.

The market size for the automotive OEM telematics market is projected to reach USD 147.6 billion by 2035.

The automotive OEM telematics market is expected to grow at a 14.1% CAGR between 2025 and 2035.

The key product types in automotive OEM telematics market are embedded telematics, tethered telematics and integrated smartphone telematics.

In terms of vehicle, passenger cars segment to command 61.5% share in the automotive OEM telematics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA