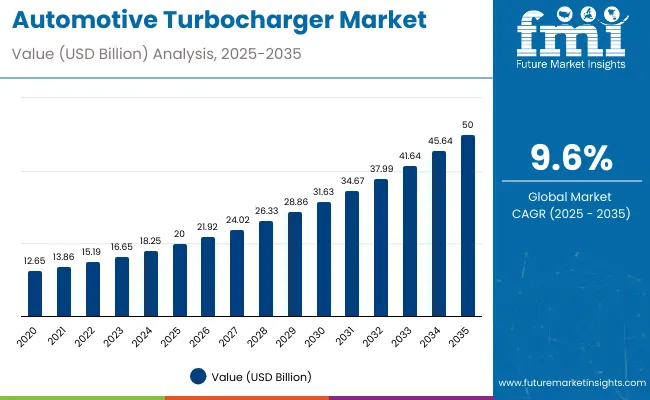

The automotive turbocharger market is estimated to be valued at USD 20 billion in 2025. It is projected to reach USD 50 billion by 2035, registering a compound annual growth rate (CAGR) of 9.6% over the forecast period. The market is projected to add an absolute dollar opportunity of USD 30 billion over the forecast period.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 20 billion |

| Projected Value (2035F) | USD 50 billion |

| CAGR (2025 to 2035) | 9.6% |

This reflects a 2.5 times growth at a compound annual growth rate of 9.6%. The market's evolution is expected to be shaped by stringent emission regulations, increasing demand for fuel-efficient engines, growing adoption of downsized engines, and rising demand for enhanced vehicle performance, particularly where efficient combustion and reduced carbon emissions are required.

By 2030, the market is projected to reach USD 33.1 billion, generating USD 13.1 billion in incremental value in the first half of the decade, with the remaining USD 16.9 billion expected in the second half, suggesting a moderately accelerated growth pattern. Product innovation in electric turbochargers and variable geometry systems is gaining traction due to their superior efficiency characteristics and regulatory compliance capabilities.

Companies such as Garrett Motion Inc. and BorgWarner Inc. are advancing their competitive positions through investment in next-generation turbocharger technologies and strategic OEM partnerships. Electrification trends and hybrid powertrains are supporting expansion into advanced turbocharging solutions, aftermarket services, and commercial vehicle applications. Market performance will remain anchored in emission compliance standards, fuel efficiency optimization, and technological innovation benchmarks.

The market holds a significant share across its parent industry segments. Within the automotive components market, it accounts for 2.8% due to its critical role in engine efficiency. In the engine technologies segment, it commands a 12.5% share, supported by increasing adoption of turbocharged engines.

It contributes nearly 8.7% to the emission control systems market and 15.3% to the engine downsizing solutions category. In commercial vehicle components, automotive turbochargers hold around 18.2% share, driven by heavy-duty applications and fuel economy requirements. Across the performance automotive parts market, its share is close to 22.1%, owing to its use in high-performance and sports vehicle applications.

The market is undergoing a strategic transformation driven by rising demand for fuel-efficient, high-performance, and environmentally compliant engine solutions. Advanced turbocharger technologies using variable geometry systems, electric assistance, and integrated waste heat recovery have enhanced power output, efficiency optimization, and emission reduction capabilities, making turbocharger systems essential alternatives to larger displacement engines.

Manufacturers are introducing specialized designs, such as twin-scroll and electrically assisted turbochargers, tailored for specific powertrain applications, expanding their role beyond basic forced induction functionality. Strategic collaborations between turbocharger manufacturers and automotive OEMs have accelerated innovation in product development and market penetration.

Automotive turbochargers’ ability to enhance efficiency, reduce emissions, and optimize performance makes them highly attractive to manufacturers aiming for regulatory compliance and consumer satisfaction. Their ability to increase power output while reducing fuel consumption appeals to both manufacturers meeting stringent emission standards and consumers prioritizing fuel economy and performance.

Growing awareness of climate change, implementation of Euro 7/EPA Tier 3 standards, and adoption of engine downsizing strategies are further propelling adoption, especially in passenger cars, commercial vehicles, and off-highway machinery sectors. Rising fuel costs, expanding electric vehicle infrastructure, and government incentives supporting clean technology adoption are also enhancing product accessibility and market penetration.

As emission regulations accelerate across global markets and performance requirements become critical, the market outlook remains favorable. With manufacturers and consumers prioritizing environmental compliance, fuel efficiency, and power optimization, automotive turbochargers are well-positioned to expand across various vehicle segments, hybrid applications, and industrial machinery sectors.

The market is segmented by vehicle type, product type, fuel type, sales channel, actuator, and region. By vehicle type, the market is categorized into passenger cars, light commercial vehicles (LCV), heavy commercial vehicles (HCV), agricultural machinery, and construction machinery. By product type, the market is segmented into wastegate, variable geometry turbocharger (VGT), and twin turbo. Based on fuel type, the market is bifurcated into gasoline and diesel. In terms of sales channel, the market is divided into OEM and aftermarket. By actuator, the market is divided into hydraulic, electric, and pneumatic. Regionally, the market covers North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

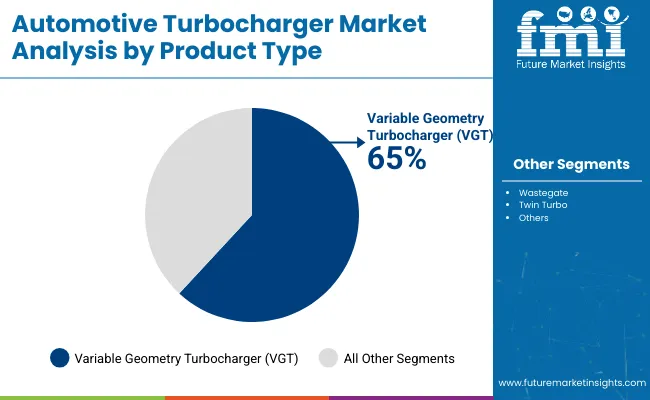

The Variable Geometry Turbocharger (VGT) segment holds a significant position with 65% of the market share in the product type category, owing to its superior efficiency characteristics, precise boost control capabilities, and enhanced performance optimization across varying engine loads. VGT technology is widely adopted across diesel and gasoline applications due to its ability to minimize turbo lag, optimize fuel consumption, and meet stringent emission requirements that appeal to both automotive manufacturers and performance-conscious consumers.

It enables manufacturers to deliver enhanced engine responsiveness while maintaining fuel efficiency and emission compliance in final products. As demand for cleaner, more efficient powertrains grows, the VGT segment continues to gain preference in both passenger car and commercial vehicle applications.

Manufacturers are investing in advanced VGT control systems, materials technology, and integration with engine management systems to enhance durability, responsiveness, and operational efficiency. The segment is poised to expand further as global emission standards favor variable geometry solutions and fuel economy optimization.

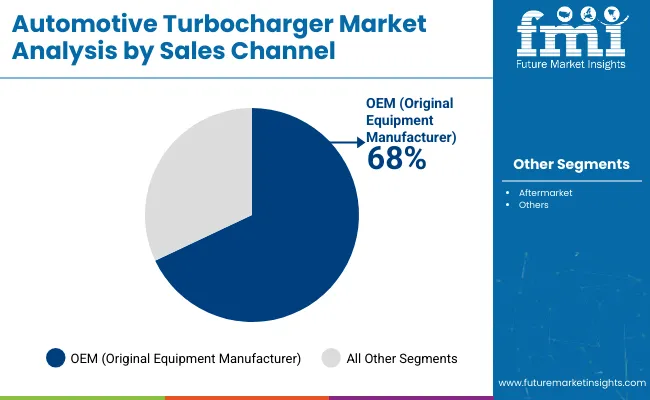

OEM (Original Equipment Manufacturer) remains the dominant sales channel segment with 68% of the market share in 2025, as automotive turbochargers are primarily integrated during vehicle manufacturing to meet emission standards, fuel economy targets, and performance specifications. Its dominance supports new vehicle production optimization, warranty coverage, and seamless integration with engine management systems.

OEM channels also provide quality assurance and technical support that ensure optimal turbocharger performance throughout the vehicle lifecycle. This makes them indispensable in modern automotive manufacturing and regulatory compliance environments.

Ongoing demand for fuel-efficient vehicles and the integration of turbocharging in mainstream vehicle segments are key trends driving the sustained relevance of OEM channels in this market.

In 2024, global automotive turbocharger adoption grew by 12% year-on-year, with Asia Pacific taking a 45% share. Applications include passenger vehicles, commercial trucks, agricultural machinery, and construction equipment. Manufacturers are introducing specialized turbocharger designs and electrically assisted variants that deliver superior fuel economy and emission reduction capabilities. Variable geometry formulations now support clean emission positioning. Environmental consciousness and fuel economy preferences support consumer confidence. Technology providers increasingly supply integrated turbocharger systems with advanced control algorithms to reduce complexity.

Emission Regulations Accelerate Automotive Turbocharger Demand

Automotive manufacturers are choosing turbocharger technologies to achieve superior emission reduction, enhance fuel economy positioning, and meet regulatory demands for cleaner, more efficient engines. In efficiency testing, turbocharged engines deliver up to 30% better fuel economy compared to naturally aspirated engines of equivalent power output.

Vehicles equipped with turbochargers maintain performance standards throughout various driving conditions and extended service intervals. In integrated applications, advanced turbocharger systems help reduce engine displacement requirements while maintaining power output by up to 40%. Turbocharger applications are increasingly deployed to meet regulatory compliance, driving adoption in emission-sensitive sectors. These advantages help explain why turbocharger adoption rates in new vehicles rose 35% in 2024 across North America and Europe.

Supply Chain Constraints, Cost Pressures and Technology Complexity Limit Growth

Market expansion faces constraints due to raw material price volatility, manufacturing capacity limitations, and sophisticated engineering requirements. High-grade steel and specialized alloy costs can vary from USD 2,500 to USD 4,200 per ton, depending on market conditions and quality specifications, impacting turbocharger pricing and leading to supply disruptions of up to 15% in automotive applications.

Advanced manufacturing technology requirements and quality control standards add 8 to 12 weeks to product development cycles. Specialized testing facilities and precision manufacturing extend production costs by 20-25% compared to conventional engine components. Limited availability among qualified suppliers restricts scalable production, especially for high-performance and commercial vehicle projects. These constraints make turbocharger adoption challenging in cost-sensitive vehicle segments despite growing regulatory requirements and performance benefits.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 10.5% |

| Germany | 9.7% |

| China | 9.6% |

| France | 8.5% |

| UK | 8.1% |

| India | 7.1% |

| Brazil | 6.5% |

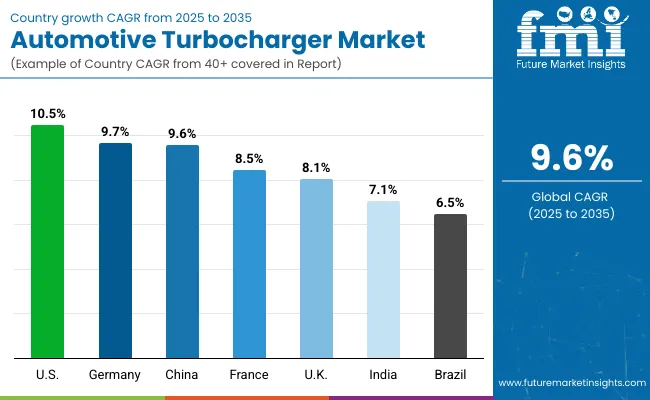

In the automotive turbocharger market, the United States leads with the highest projected CAGR of 10.5% from 2025 to 2035, driven by stringent EPA regulations and advanced engine technology adoption. Germany follows closely with a CAGR of 9.7%, supported by established automotive manufacturing and aggressive emission standards. China shows strong growth at 9.6%, benefiting from massive vehicle production volumes and increasing turbocharger penetration.

France demonstrates steady growth at 8.5%, supported by European emission regulations and diesel engine applications. The UK, with a CAGR of 8.1%, experiences consistent expansion driven by ULEZ implementation and fuel economy requirements. India, with a CAGR of 7.1%, shows solid growth supported by BS-VI emission norms and increasing vehicle production. Brazil, with a CAGR of 6.5%, is projected to expand gradually, supported by automotive manufacturing growth and emission compliance requirements.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

Revenue from automotive turbochargers in the United States is projected to grow at a CAGR of 10.5% from 2025 to 2035, significantly exceeding the global average. Stringent EPA regulations, CAFE fuel economy standards, and increasing adoption of turbocharged engines across passenger cars and commercial vehicles in California, Texas, and Michigan markets fuel growth. American consumers are increasingly embracing fuel-efficient cars as gasoline prices fluctuate and environmental awareness rises. OEM partnerships and aftermarket channels are driving market penetration.

The automotive turbocharger market in Germany is anticipated to expand at a CAGR of 9.7% from 2025 to 2035, exceeding the global rate by 0.1%. Growth is centered on premium automotive manufacturing and advanced engine technologies in Bavaria, Baden-Württemberg, and North Rhine-Westphalia regions. Advanced turbocharger technologies and Euro 7 compliance requirements are being deployed for luxury vehicles, commercial applications, and export markets. EU regulations and emission standards support practical turbocharger application development across diverse automotive segments.

Sales of automotive turbochargers in China are slated to flourish at a CAGR of 9.6% from 2025 to 2035, matching the global average. Growth has been concentrated in domestic vehicle production expansion and export market development in the Guangdong, Jiangsu, and Shanghai regions. Turbocharger adoption is shifting from limited luxury vehicle use toward mainstream passenger car and commercial vehicle applications. Domestic technology partnerships have strengthened, with increased collaboration between Chinese automakers and international turbocharger suppliers.

The demand for automotive turbochargers in France is expected to increase at a CAGR of 8.5% from 2025 to 2035, underperforming the global average by 1.1%. Demand is driven by diesel engine applications and commercial vehicle requirements in Île-de-France, Auvergne-Rhône-Alpes, and Grand Est markets. Automotive manufacturers and fleet operators are increasingly adopting turbocharger technology for fuel economy improvements and emission compliance. However, the transition to electric vehicles and reduced diesel adoption constrain broader market expansion.

Revenue from automotive turbochargers in the UK is projected to rise at a CAGR of 8.1% from 2025 to 2035, supported by strong demand for fuel-efficient engines and emission compliance requirements. Urban markets like London, Manchester, and Birmingham are experiencing increased adoption of turbocharged vehicles due to ULEZ requirements and fuel economy consciousness. Domestic automotive manufacturers are leveraging turbocharger technology to meet regulatory standards and consumer expectations for performance and efficiency.

The demand for automotive turbochargers in India is projected to expand at a CAGR of 7.1% from 2025 to 2035, below the global average due to price sensitivity and the market development stage. Growth is concentrated in urban metropolitan areas, including Delhi, Mumbai, and Chennai, where emission regulations and vehicle performance requirements are driving adoption. BS-VI emission norms and increasing consumer awareness about fuel efficiency are gradually building market acceptance. Technology transfer and local manufacturing initiatives are essential for market development.

The automotive turbocharger market in Brazil is expected to grow at a CAGR of 6.5% from 2025 to 2035, below the global average due to economic constraints and market maturity factors. Growth is driven by commercial vehicle applications and fuel economy requirements in São Paulo, Rio de Janeiro, and Minas Gerais regions. Local automotive production and increasing adoption in truck and bus applications are expanding market accessibility. Economic volatility and import dependency maintain elevated pricing levels while regulatory development focuses on emission compliance and fuel efficiency standards.

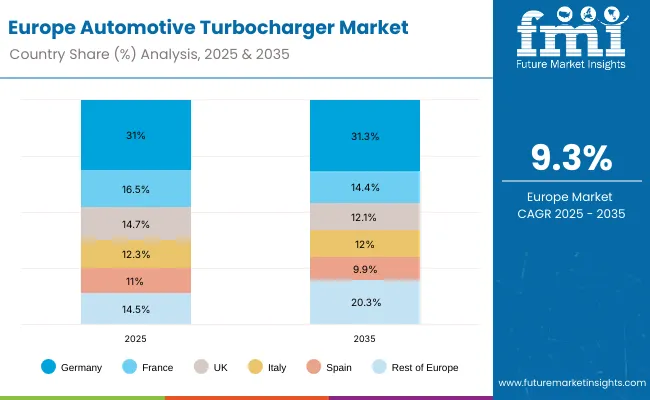

The automotive turbocharger market in Europe is projected to grow from USD 5.5 billion in 2025 to USD 13.4 billion by 2035, reflecting a CAGR of 9.3% over the forecast period. Germany will continue to dominate the regional market, accounting for 31.0% in 2025 and increasing slightly to 31.3% by 2035, supported by premium vehicle production and advanced VGT adoption to meet Euro 7 standards. France follows with a 16.5% share in 2025, though its share is expected to ease to 14.4% by 2035 due to below-average growth despite continued demand in diesel and commercial vehicle applications.

The automotive turbocharger market in Europe is projected to grow from USD 5.5 billion in 2025 to USD 13.4 billion by 2035, reflecting a CAGR of 9.3% over the forecast period. Germany will continue to dominate the regional market, accounting for 31.0% in 2025 and increasing slightly to 31.3% by 2035, supported by premium vehicle production and advanced VGT adoption to meet Euro 7 standards. France follows with a 16.5% share in 2025, though its share is expected to ease to 14.4% by 2035 due to below-average growth despite continued demand in diesel and commercial vehicle applications.

The United Kingdom holds 14.7% in 2025, projected to decline modestly to 12.1% by 2035 as post-Brexit supply chain adjustments and moderate growth weigh on performance. Italy maintains a steady position with 12.3% in 2025, edging slightly down to 12.0% by 2035, while Spain accounts for 11.0% in 2025 and is expected to decrease to 9.9% by 2035, supported by its automotive production base but trailing the regional average. The Rest of Europe is expected to strengthen significantly, expanding from 14.5% in 2025 to 20.3% by 2035, driven by modernization in Nordic countries, Eastern Europe, and the rising penetration of turbocharged gasoline engines.

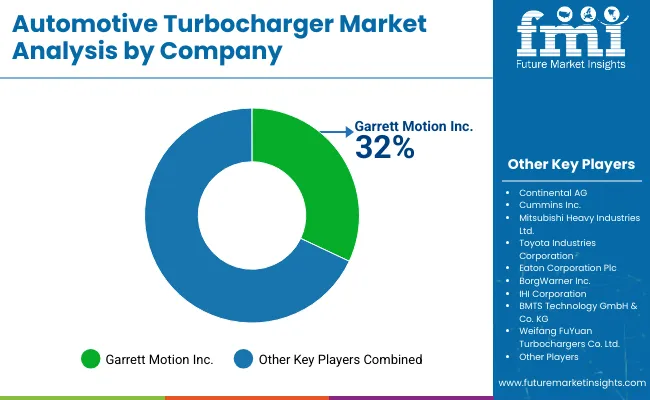

The market is highly consolidated, featuring a mix of global technology leaders, established automotive suppliers, and specialized manufacturers with varying degrees of engineering expertise, production scale, and OEM relationships. Garrett Motion Inc. and BorgWarner Inc. lead the market, supplying advanced turbocharger systems for passenger cars, commercial vehicles, and industrial applications. Their strength lies in comprehensive R&D capabilities, global manufacturing networks, and long-standing relationships with major automotive OEMs.

Mitsubishi Heavy Industries Ltd. and IHI Corporation differentiate through industrial expertise, heavy-duty applications, and specialized turbocharger technologies that cater to commercial vehicle, marine, and power generation segments. Cummins Inc. focuses on diesel engine integration and aftermarket services, addressing growing demand from commercial vehicle manufacturers and fleet operators.

Regional players such as Continental AG, Toyota Industries Corporation, and Eaton Corporation Plc focus on system integration, hybrid compatibility, and electric turbocharger development, strengthening their presence in premium automotive and next-generation powertrain applications.

Entry barriers remain significant, driven by challenges in advanced materials technology, precision manufacturing requirements, and compliance with automotive quality standards across multiple application categories. Competitiveness increasingly depends on technological innovation, manufacturing efficiency, and strategic partnerships with automotive OEMs for diverse passenger car and commercial vehicle manufacturing environments.

Continental AG

Garrett Motion Inc.

Cummins Inc.

Mitsubishi Heavy Industries Ltd.

Toyota Industries Corporation

Eaton Corporation Plc

BorgWarner Inc.

IHI Corporation

BMTS Technology GmbH & Co. KG

Weifang FuYuan Turbochargers Co. Ltd.

Vitesco Technologies GmbH

Rotomaster

Turbonetics Inc.

MAN Energy Solutions

| Items | Value |

|---|---|

| Quantitative Units (2025) | USD 20 billion |

| Vehicle Type | Passenger Cars, Light Commercial Vehicles (LCV), Heavy Commercial Vehicles (HCV), Agricultural Machinery, Construction Machinery |

| Product Type | Wastegate, Variable Geometry Turbocharger (VGT), Twin Turbo |

| Fuel Type | Gasoline, Diesel |

| Sales Channel | OEM (Original Equipment Manufacturer), Aftermarket |

| Actuator | Hydraulic, Electric, Pneumatic |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, China, France, United Kingdom, Japan, Brazil, India, Canada, Italy and 40+ Countries |

| Key Players | Continental AG, Garrett Motion Inc., Cummins Inc., Mitsubishi Heavy Industries Ltd., Toyota Industries Corporation, Eaton Corporation Plc, BorgWarner Inc., IHI Corporation, BMTS Technology GmbH & Co. KG, Weifang FuYuan Turbochargers Co. Ltd., Vitesco Technologies GmbH, Rotomaster, Turbonetics Inc., MAN Energy Solutions, Keyyang Precision Co. Ltd. |

| Additional Attributes | Dollar sales by vehicle, fuel, product, and channel, with regional demand, competitive landscape, variable versus conventional adoption, emission integration, electric turbocharger innovations, and specialized applications across passenger, commercial, and hybrid vehicles |

The global automotive turbocharger market is estimated to be valued at USD 20 billion in 2025.

The market size for automotive turbocharger is projected to reach USD 50 billion by 2035.

The automotive turbocharger market is expected to grow at a 9.6% CAGR between 2025 and 2035.

The variable geometry turbocharger (VGT) segment is projected to lead the automotive turbocharger market with 65% share in 2025.

In terms of sales channel, the OEM segment is projected to command 68% share in the automotive turbocharger market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

GCC Automotive Turbocharger Market Trends – Growth, Demand & Forecast 2025–2035

ASEAN Automotive Turbocharger Market Outlook – Share, Growth & Forecast 2025–2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Japan Automotive Turbocharger Market Growth – Trends & Forecast 2023-2033

Korea Automotive Turbocharger Market Growth – Trends & Forecast 2023-2033

Germany Automotive Turbocharger Market Growth – Trends, Demand & Innovations 2025–2035

Demand for Automotive Turbocharger in EU Size and Share Forecast Outlook 2025 to 2035

United States Automotive Turbocharger Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Automotive Turbocharger Market Outlook – Share, Growth & Forecast 2025–2035

Western Europe Automotive Turbocharger Market Growth – Trends & Forecast 2023-2033

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA