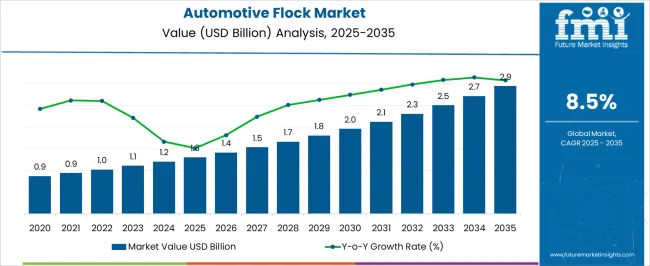

The Automotive Flock Market is estimated to be valued at USD 1.3 billion in 2025 and is projected to reach USD 2.9 billion by 2035, registering a compound annual growth rate (CAGR) of 8.5% over the forecast period.

| Metric | Value |

|---|---|

| Automotive Flock Market Estimated Value in (2025 E) | USD 1.3 billion |

| Automotive Flock Market Forecast Value in (2035 F) | USD 2.9 billion |

| Forecast CAGR (2025 to 2035) | 8.5% |

The Automotive Flock market is experiencing steady growth due to the increasing demand for enhanced interior aesthetics, noise reduction, and tactile comfort in vehicles. The current market landscape reflects a strong focus on lightweight, high-quality interior materials that improve user experience while contributing to overall vehicle efficiency. Growth has been driven by consumer preference for premium finishes and the adoption of noise dampening solutions in both conventional and electric vehicles.

Additionally, the shift toward environmentally sustainable manufacturing practices has encouraged the use of fiber-based flocking materials, which are versatile and customizable. Investments in modern automotive production lines and increased collaboration between material suppliers and automakers are enhancing product availability and reducing lead times.

The integration of flocked surfaces in dashboards, door panels, and headliners allows automakers to achieve consistent quality, enhanced aesthetics, and reduced vibration With continued advancements in flocking technologies and rising vehicle production worldwide, the market is projected to maintain a positive growth trajectory, offering long-term opportunities for fiber-based materials in interior automotive applications.

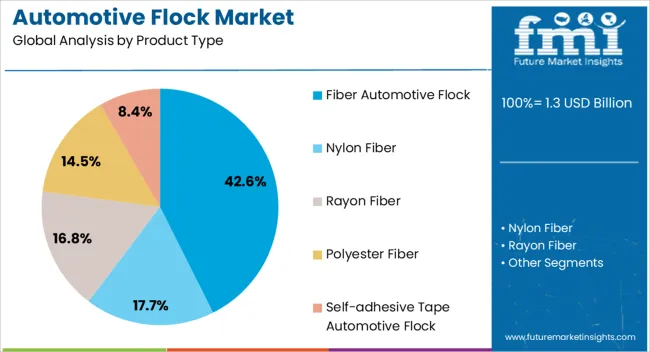

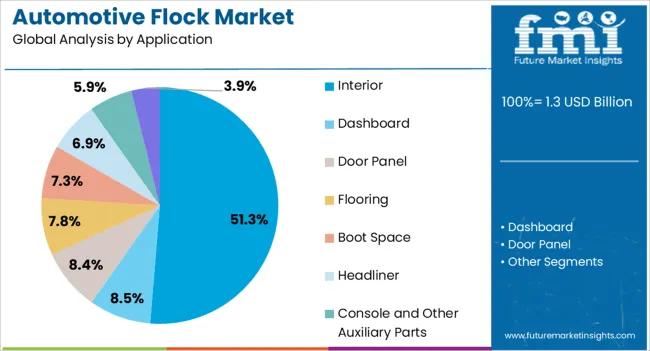

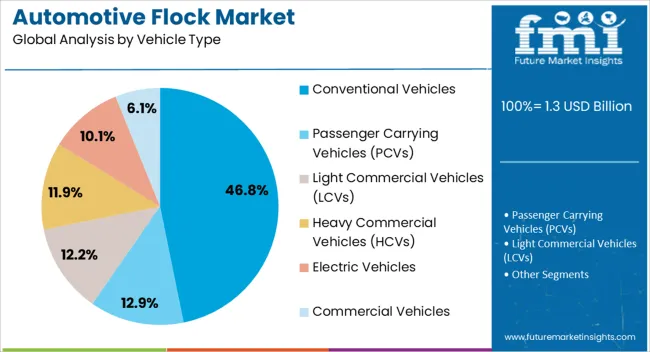

The automotive flock market is segmented by product type, application, vehicle type, and geographic regions. By product type, automotive flock market is divided into Fiber Automotive Flock, Nylon Fiber, Rayon Fiber, Polyester Fiber, and Self-adhesive Tape Automotive Flock. In terms of application, automotive flock market is classified into Interior, Dashboard, Door Panel, Flooring, Boot Space, Headliner, Console and Other Auxiliary Parts, and Exterior. Based on vehicle type, automotive flock market is segmented into Conventional Vehicles, Passenger Carrying Vehicles (PCVs), Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), Electric Vehicles, and Commercial Vehicles. Regionally, the automotive flock industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Fiber Automotive Flock segment is projected to hold 42.60% of the total Automotive Flock market revenue in 2025, making it the leading product type. This prominence is being attributed to the segment's flexibility, durability, and compatibility with a wide range of interior surfaces. Fiber flocking enables a uniform, high-quality finish that enhances both visual appeal and tactile sensation while providing effective noise reduction and insulation.

Adoption has been accelerated by the growing demand for premium interior designs and the need to meet stricter vehicle cabin acoustics standards. The ability to apply fiber flocking on complex surfaces without compromising material performance has further reinforced its market leadership.

Additionally, manufacturers have increasingly favored fiber flocking due to its scalability, cost efficiency, and compatibility with automated application systems As vehicle interiors continue to evolve with rising consumer expectations for luxury and comfort, the Fiber Automotive Flock segment is expected to retain its dominant market position, driven by its proven performance and adaptability in diverse automotive applications.

The Interior application segment is anticipated to hold 51.30% of the Automotive Flock market revenue in 2025, establishing it as the leading application area. This growth has been fueled by the demand for aesthetically appealing and functionally superior cabin components such as dashboards, door panels, consoles, and headliners. Software-defined design preferences and consumer expectations for tactile comfort have accelerated adoption of flocked surfaces in interior applications.

The segment's growth is supported by the capability of flocking to reduce noise, improve scratch resistance, and provide a uniform finish, which aligns with automakers' goals of enhancing passenger comfort and overall vehicle quality perception. The ability to integrate fiber flocking into automated production lines has improved manufacturing efficiency while minimizing production costs.

Furthermore, increasing vehicle production globally and a rising focus on premium and mid-segment vehicles have expanded the interior flocking opportunity As automakers continue to prioritize design differentiation, cabin refinement, and operational efficiency, the Interior application segment is projected to maintain leadership and contribute significantly to overall market growth.

The Conventional Vehicles segment is projected to account for 46.80% of total Automotive Flock market revenue in 2025, representing the leading vehicle type. This predominance is being driven by the high global production volume of conventional vehicles, which continues to generate demand for interior enhancements and premium materials. The adoption of flocked interiors in these vehicles is facilitated by its ability to improve aesthetics, reduce noise, and provide durability at a cost-effective scale.

Automakers are increasingly leveraging fiber flocking in dashboards, door trims, and other interior panels to achieve consistent quality and tactile performance across mass-produced vehicles. Conventional vehicles benefit from proven supply chains, established manufacturing standards, and widespread consumer familiarity with interior flocked finishes.

As consumer expectations for comfort and quality in non-electric vehicles continue to rise, the integration of fiber-based flocking solutions is being prioritized to enhance cabin refinement and user experience The segment is expected to sustain growth, driven by ongoing production volumes and the continued preference for high-quality, functional interior surfaces in conventional automotive models.

Automotive flock is a powder composed of various fibers. Being light, odorless, and soft, automotive flock is mostly colored, as it is dyed during the manufacturing process. The length of the fibers used in automotive flock is usually constant, and ranges between 0.3 mm and 10 mm. Automotive flock is applied to vehicle parts using a versatile process known as flocking. Automotive flock can enhance the appearance of interiors, improving their aesthetics and colors.

Moreover, automotive flock improves the grip on the parts by increasing friction. Automotive flock has lower reflectivity, being one of the key factors for its application in vehicles that are used in motorsports. Automotive flock has also proven to minimize cabin noise and noise from vibrations. Automotive flock is also available as a self-adhesive tape, which is widely used in window seals in order to reduce window friction and maintain a clean surface. Apart from the aesthetics point of view, automotive flock is used in a vehicles to avoid scratching and to improve the anti-skidding properties.

Automotive flock is mainly applied in the interior parts of an automotive. While it can be installed on exterior surfaces as well, automotive flock on the exterior body of a vehicle is a customer's choice.

In emerging economies, the use of luxury cars is comparatively lower than mid-size and compact cars. As a large group of car owners belong to the middle to lower income groups, a majority of car owners do not opt for the installation of automotive flock. This can also be attributed to the fact that, a lower share of disposable income is dispensed on automotive. However, it is anticipated that, with the introduction of electric vehicles, the consumption of automotive flock will also increase, as the majority of cars introduced are compact and mid-sized cars. Self-adhesive tapes enable the DIY application of automotive flock, making the price economical, and potentially driving the market

Manufacturers are noted to enter into long-term contracts with vehicle manufacturers. Several automotive flock manufacturers either supply the product to OEMs and service providers or are forward integrated into manufacturing and providing the service to vehicles.

Regionally, the automotive flock market is estimated to be very strong in North America. Due to its rising popularity, car owners in North America are showing a demand for flocking services. As several OEMs are offering pre-installed automotive flock on vehicle parts, the market is expected to follow the growth observed in the automotive industry.

Europe, being one of the major automotive producers, is also expected to consume a larger share of automotive flock. The presence of several emerging economies in Asia Pacific is estimated to create opportunities for the automotive flock manufacturers in the region. The Middle East & Africa and Latin America automotive flock markets are estimated to grow at steady rates, and account for vital shares in the global automotive flock market.

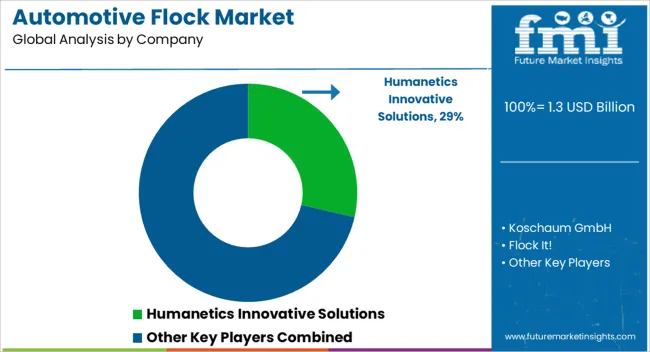

Some of the market participants in the global automotive flock market identified across the value chain include Koschaum GmBH, Flock It!, FLOCKING KF, Cellusuede Products, Inc., Decatur Plastic Products, Inc., Fratelli Casati snc, Claremont Flock, Alpha Coatings, Inc., Global Flock Group, SwissFlock AG, Maag Flockmaschinen GmbH, INNOVAFLOCK SL, DOLAN GmbH, and Flock Tex Incorporated.

The research report presents a comprehensive assessment of the automotive flock market, and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to market segments such as geography, product type, application, and vehicle type.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, and inputs from industry experts and industry participants across the value chain. The report provides in-depth analysis of parent market trends, macro-economic indicators, and governing factors, along with market attractiveness as per segment. Theautomotive flock report also maps the qualitative impact of various market factors on market segments and geographies.

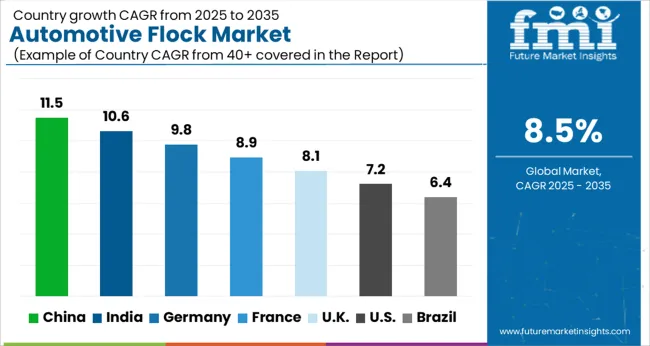

| Country | CAGR |

|---|---|

| China | 11.5% |

| India | 10.6% |

| Germany | 9.8% |

| France | 8.9% |

| UK | 8.1% |

| USA | 7.2% |

| Brazil | 6.4% |

The Automotive Flock Market is expected to register a CAGR of 8.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 11.5%, followed by India at 10.6%. Developed markets such as Germany, France, and the UK. continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 6.4%, yet still underscores a broadly positive trajectory for the global Automotive Flock Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 9.8%. The USA Automotive Flock Market is estimated to be valued at USD 484.9 million in 2025 and is anticipated to reach a valuation of USD 974.0 million by 2035. Sales are projected to rise at a CAGR of 7.2% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 64.4 million and USD 32.7 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| Product Type | Fiber Automotive Flock, Nylon Fiber, Rayon Fiber, Polyester Fiber, and Self-adhesive Tape Automotive Flock |

| Application | Interior, Dashboard, Door Panel, Flooring, Boot Space, Headliner, Console and Other Auxiliary Parts, and Exterior |

| Vehicle Type | Conventional Vehicles, Passenger Carrying Vehicles (PCVs), Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), Electric Vehicles, and Commercial Vehicles |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Humanetics Innovative Solutions, Koschaum GmbH, Flock It!, Cellusuede Products, Decatur Plastic Products, Casati Flock, Claremont Flock, Alpha Coatings, Global Flock Group, SwissFlock AG, Maag Flockmaschinen GmbH, Innovaflock, Dolan GmbH, Flock Tex, and Sika |

The global automotive flock market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the automotive flock market is projected to reach USD 2.9 billion by 2035.

The automotive flock market is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types in automotive flock market are fiber automotive flock, nylon fiber, rayon fiber, polyester fiber and self-adhesive tape automotive flock.

In terms of application, interior segment to command 51.3% share in the automotive flock market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Automotive Actuator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Manifold Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Resonator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Counter Shaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wheel Coating Market Size and Share Forecast Outlook 2025 to 2035

Automotive Water Separation Systems Market Size and Share Forecast Outlook 2025 to 2035

Automotive Refinish Coating Market Size and Share Forecast Outlook 2025 to 2035

Automotive Emission Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Tire Market Size and Share Forecast Outlook 2025 to 2035

Automotive Glass Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wire & Cable Material Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive DC-DC Converter Market Size and Share Forecast Outlook 2025 to 2035

Automotive Key Blank Market Size and Share Forecast Outlook 2025 to 2035

Automotive Tensioner Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA