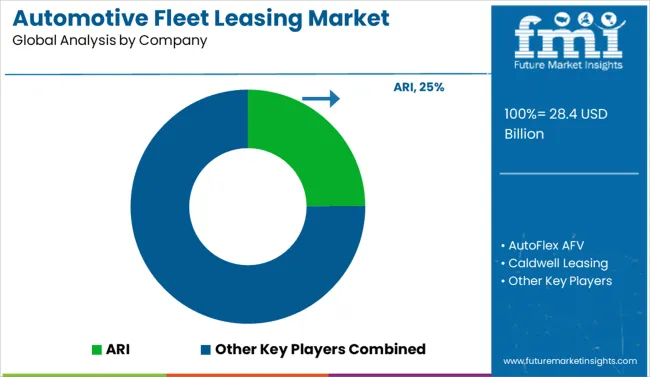

The Automotive Fleet Leasing Market is estimated to be valued at USD 28.4 billion in 2025 and is projected to reach USD 50.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

| Metric | Value |

|---|---|

| Automotive Fleet Leasing Market Estimated Value in (2025 E) | USD 28.4 billion |

| Automotive Fleet Leasing Market Forecast Value in (2035 F) | USD 50.9 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The automotive fleet leasing market is experiencing robust growth supported by increased demand for cost efficient mobility solutions, improved vehicle management strategies, and rising adoption of fleet services by enterprises seeking operational flexibility. Businesses are opting for fleet leasing to avoid large upfront capital expenditures and to ensure access to newer vehicle models with better fuel efficiency and lower emissions.

Additionally, regulatory pressures to reduce carbon footprints are pushing companies to shift toward leasing fleets that incorporate hybrid and electric vehicles. Advancements in telematics and fleet monitoring technologies have enhanced transparency and fleet performance, thereby improving decision making and compliance.

The long term outlook remains favorable as companies continue to embrace asset light models, subscription based services, and integrated mobility solutions that streamline operations while addressing environmental and financial goals.

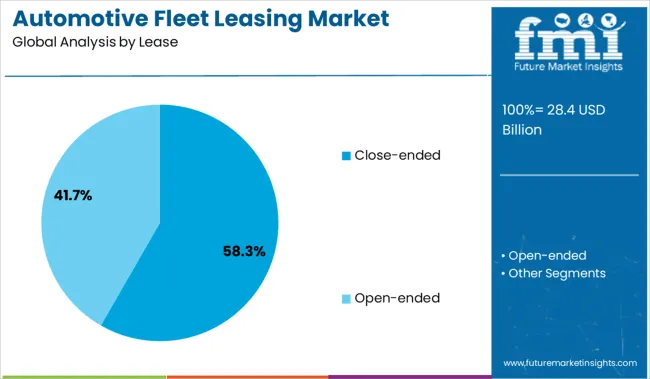

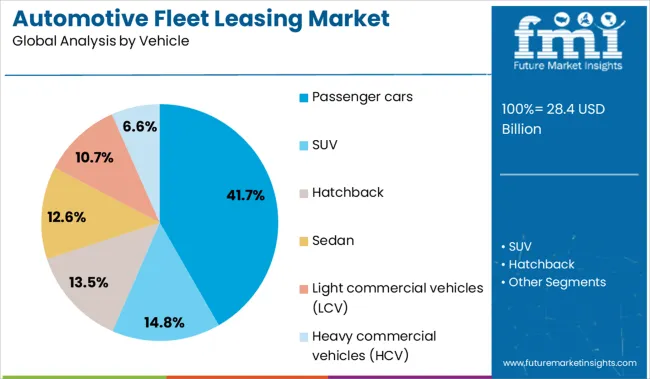

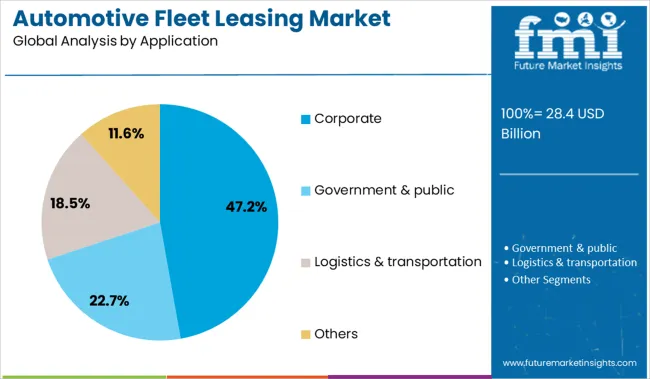

The automotive fleet leasing market is segmented by lease, vehicle, and application and geographic regions. The automotive fleet leasing market is divided into Closed-Ended and Open-ended. In terms of vehicles, the automotive fleet leasing market is classified into Passenger cars, SUVs, hatchbacks, sedans, Light commercial vehicles (LCVs), and Heavy commercial vehicles (HCVs). The automotive fleet leasing market is segmented into Corporate, Government & public, Logistics & transportation, and Others. Regionally, the automotive fleet leasing industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The close ended lease segment is projected to account for 58.30 percent of the total revenue by 2025 within the lease category, making it the dominant leasing structure. This preference is driven by the financial predictability and limited residual value risk that this lease type offers to lessees.

Businesses and individual users benefit from fixed monthly payments, clearly defined lease terms, and the option to walk away at the end of the contract without concern for market depreciation. The model simplifies asset planning and is widely favored by companies with structured vehicle rotation policies.

Close ended leases also align well with accounting practices and fleet standardization, contributing to their strong position in the market.

The passenger cars segment is expected to contribute 41.70 percent of the market share by 2025 under the vehicle category. This is due to the rising demand for compact and midsize vehicles in corporate and service based fleets, where fuel efficiency, lower maintenance costs, and ease of urban navigation are key priorities.

Passenger cars are increasingly being used in executive mobility, employee benefit programs, and ride sharing platforms, further supporting their relevance. Additionally, automakers are offering attractive leasing packages and fleet specific models tailored to urban commuting needs.

As organizations seek cost optimized and eco friendly vehicle solutions, the passenger cars category continues to lead the fleet leasing demand.

The corporate segment is anticipated to represent 47.20 percent of the total market revenue by 2025 within the application category, establishing it as the leading segment. This is largely attributed to the growing need among enterprises to provide flexible mobility to employees while minimizing ownership responsibilities and maximizing tax benefits.

Fleet leasing in the corporate sector supports standardized vehicle procurement, centralized maintenance, and predictable budgeting. The segment has gained traction across industries including information technology, pharmaceuticals, and field service operations where consistent and reliable transportation is critical.

With a strong emphasis on cost control, compliance, and sustainability goals, the corporate user base continues to be the primary driver of demand in the automotive fleet leasing landscape.

Demand for automotive fleet leasing is gaining traction due to digitized fleet operations and cost-optimized mobility models. Sales of EV-inclusive lease packages and predictive maintenance bundles are fueling contract renewals across logistics, ride-hailing, and corporate mobility sectors.

Demand for automotive fleet leasing rose 15% in 2025 as enterprise clients embraced telematics-driven optimization. Over 42% of new leasing contracts in Europe now include real-time fuel analytics, route tracking, and driver behavior scoring. USA logistics firms using predictive maintenance algorithms within lease terms reduced unscheduled downtime by 19%. Fleet lessors offering integrated vehicle-as-a-service (VaaS) platforms experienced 27% higher renewal rates due to improved total cost of ownership (TCO) visibility. Flexible mileage and tiered wear-and-tear clauses are replacing static contracts, especially in fast-scaling delivery networks. This pivot toward data-backed leasing strategies is driving higher fleet utilization and better asset lifecycle control.

Sales of automotive fleet leasing packages featuring electric vehicles (EVs) jumped 31% in 2025 amid decarbonization mandates. Public transport operators in Germany and municipal fleets in California shifted procurement toward battery-electric vans and sedans under 5-year operating leases. Leasing firms bundling EVs with home charging support and carbon offset tracking tools captured premium contracts with ESG-focused corporations. Light commercial EVs (LCEVs) accounted for 22% of new lease volumes in Southeast Asia, driven by fuel savings and compliance with urban emission caps. Companies offering vehicle-to-grid (V2G)-ready lease options gained traction among last-mile delivery providers looking to monetize idle battery storage.

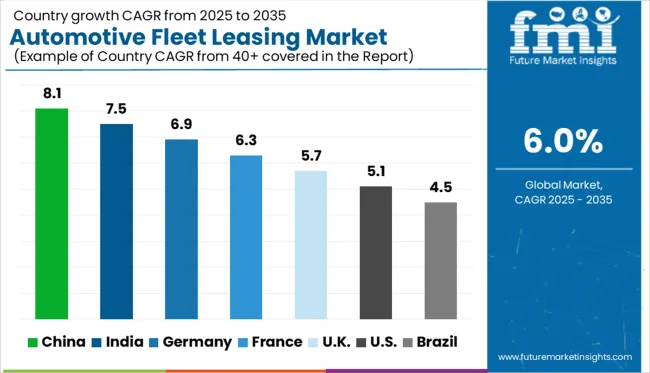

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

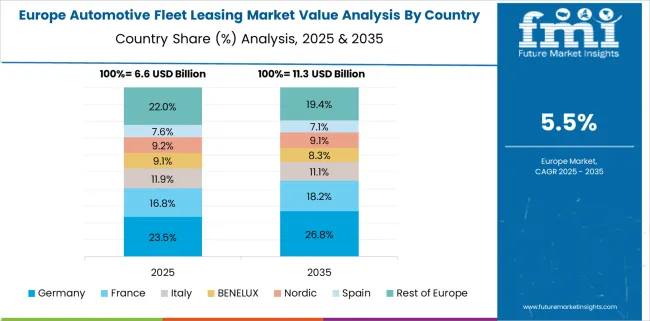

The global automotive fleet leasing market is projected to grow at a CAGR of 6.0% from 2025 to 2035. China (BRICS) leads the segment with a CAGR of 8.1%, exceeding the global average by 2.1 percentage points, driven by digital fleet management platforms and rising demand for mobility-as-a-service in tier-1 and tier-2 cities. India (BRICS) follows at 7.5% (+1.5 pp), bolstered by expanding logistics networks and the surge of corporate leasing models in urban hubs. Among OECD markets, Germany registers 6.9% (+0.9 pp), reflecting steady adoption in the SME segment and government support for EV fleet transitions. The UK lags slightly at 5.7% (–0.3 pp), influenced by cost pressures and shifting taxation on company cars. The United States trails at 5.1% (–0.9 pp), where leasing remains concentrated among large corporations with slower uptake in mid-size businesses. The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China is projected to expand at a CAGR of 8.1% from 2025 to 2035, driven by urban mobility solutions and rising demand from logistics and corporate leasing segments. Between 2020 and 2024, fleet leasing saw strong uptake from ride-hailing and e-commerce platforms. Over the next decade, electric vehicle (EV) fleets and AI-enabled leasing platforms are expected to further boost market penetration.

India’s automotive fleet leasing market is set to grow at a CAGR of 7.5% during 2025–2035, led by corporate leasing and shared mobility ecosystems. From 2020 to 2024, growth was spurred by rising operational lease adoption in metro areas. Going forward, expanding SME demand and structured vehicle replacement cycles are expected to sustain momentum.

Germany is anticipated to grow at a CAGR of 6.9% between 2025 and 2035, reflecting increased corporate focus on cost efficiency and sustainability. In the 2020–2024 period, demand was led by hybrid and electric fleet leasing in corporate mobility programs. The next phase of growth will likely be fueled by smart fleet integration and tax-optimized leasing solutions.

The UK market is forecast to register a CAGR of 5.7% from 2025 to 2035, supported by increasing demand in commercial transport and public sector leasing contracts. Between 2020 and 2024, demand surged as companies sought flexible, off-balance-sheet vehicle solutions. Over the coming years, smart mobility integration and carbon reduction policies are expected to steer market evolution.

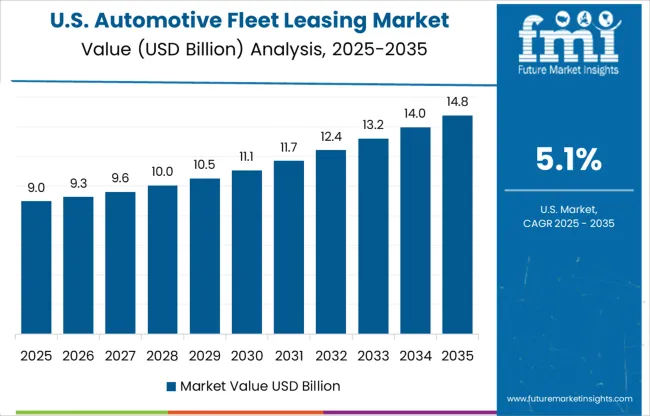

The USA is expected to grow at a CAGR of 5.1% from 2025 to 2035, driven by renewed interest in fleet optimization and electrification. Between 2020 and 2024, logistics, rental, and tech companies led leasing activity. Going forward, commercial vehicle leasing in construction, telecom, and healthcare will further expand the market footprint.

Demand for automotive fleet leasing services is increasing in 2025 as companies seek cost efficiency, lower emissions, and integrated telematics. ARI leads the global market with a significant share, leveraging strong enterprise contracts and vehicle lifecycle management platforms. Element Fleet Management and LeasePlan Corporation are expanding rapidly across Europe and North America, offering data-driven fleet optimization. Enterprise Holdings and Hertz Global maintain robust mid-size business portfolios, while Emkay and Wheels, Inc. cater to large multinationals. Samsara Networks and Nextraq are driving digital transformation via AI-powered fleet tracking solutions. United Leasing & Finance and Merchants Fleet are capturing SME demand in the USA Market fragmentation is high, with over 15 key players competing on sustainability, lease customization, and predictive maintenance capabilities.

In April 2024, Element Fleet Management announced a collaboration with BYD, establishing operations in Singapore to promote sustainable, zero-emission fleet solutions across Asia. The partnership leverages BYD’s NEV models and bolsters Element’s green mobility capabilities in the region.

| Item | Value |

|---|---|

| Quantitative Units | USD 28.4 Billion |

| Lease | Close-ended and Open-ended |

| Vehicle | Passenger cars, SUV, Hatchback, Sedan, Light commercial vehicles (LCV), and Heavy commercial vehicles (HCV) |

| Application | Corporate, Government & public, Logistics & transportation, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ARI, AutoFlex AFV, Caldwell Leasing, Element Fleet Management Corp., Emkay, Enterprise Holdings, Ewald Automotive Group, Glesby Marks, Hertz Global Holdings, Jim Pattison Lease, LeasePlan Corporation N.V., Merchants Fleet, Nextraq, PRO Leasing Services, Samsara Networks, Inc., Sixt Leasing SE, United Leasing & Finance, Velcor Leasing Corporation, Wheels, Inc., and Wilmar Inc. |

| Additional Attributes | Dollar sales by lease model (open‑ended, closed‑ended, subscription) and fleet type (passenger vs commercial), demand dynamics across corporate sectors and logistics firms, regional trends in North America vs. Asia‑Pacific adoption, innovation in EV leasing and predictive telematics, environmental impact of fleet emissions reduction, and emerging mobility‑as‑a‑service use cases. |

The global automotive fleet leasing market is estimated to be valued at USD 28.4 billion in 2025.

The market size for the automotive fleet leasing market is projected to reach USD 50.9 billion by 2035.

The automotive fleet leasing market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in automotive fleet leasing market are close-ended and open-ended.

In terms of vehicle, passenger cars segment to command 41.7% share in the automotive fleet leasing market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA