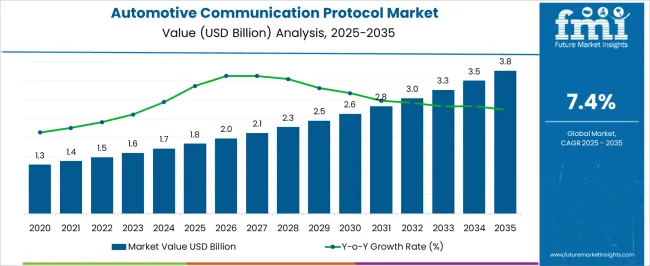

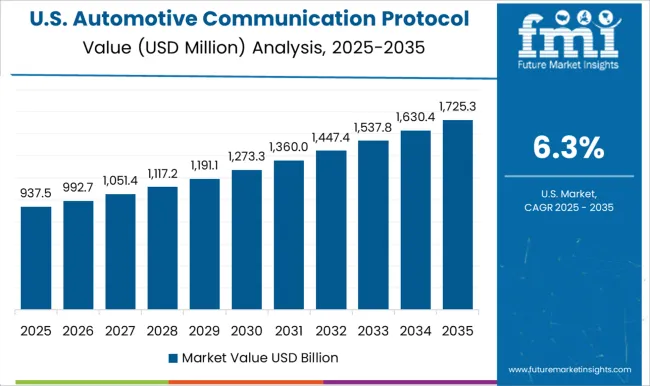

The automotive communication protocol market is projected to grow from USD 1.8 billion in 2025 to USD 3.8 billion by 2035, reflecting a CAGR of 7.4%. This growth represents an absolute dollar opportunity of USD 2.0 billion over the decade. Starting at USD 1.3 billion in the early years, the market experiences steady expansion, reaching USD 2.6 billion by 2030. For companies in automotive electronics and software, this growth indicates significant revenue potential.

The absolute dollar opportunity from 2025 to 2035 emphasizes annual gains that rise from USD 2.0 billion in 2026 to USD 3.5 billion in 2034, culminating at USD 3.8 billion in 2035. This predictable growth allows businesses to plan production, partnerships, and sales strategies effectively. Capturing market share during this period ensures meaningful revenue gains while reducing investment risk. Companies entering or scaling operations in alignment with these trends can secure strong returns and establish a competitive advantage in the evolving automotive communication protocol market.

| Metric | Value |

|---|---|

| Automotive Communication Protocol Market Estimated Value in (2025 E) | USD 1.8 billion |

| Automotive Communication Protocol Market Forecast Value in (2035 F) | USD 3.8 billion |

| Forecast CAGR (2025 to 2035) | 7.4% |

A breakpoint analysis of the automotive communication protocol market highlights periods of steady and accelerated growth. From 2025 to 2028, the market grows from USD 1.8 billion to USD 2.1 billion, with annual increments of around USD 0.1–0.2 billion. This early-stage period represents a stable phase where companies can establish operations, test integration strategies, and optimize supply chains with minimal risk. Recognizing this initial breakpoint helps businesses allocate resources efficiently and prepare for the next growth phase.

Early engagement allows companies to build a foundation for capturing higher-value opportunities as adoption increases across automotive segments. The second breakpoint occurs between 2030 and 2035, as the market expands from USD 2.6 billion to USD 3.8 billion, reflecting larger annual increments averaging USD 0.3–0.4 billion. This stage represents accelerated growth and significant absolute dollar opportunity, making strategic positioning essential for maximizing market share. Companies entering or scaling operations during this phase can capture substantial revenue gains and strengthen competitive positioning.

The automotive communication protocol market is expanding in line with the increasing integration of electronic systems and software-driven functions in modern vehicles. Industry publications and OEM technology updates have emphasized the growing complexity of in-vehicle networks, which require reliable, high-speed, and secure communication frameworks to support advanced driver assistance systems (ADAS), infotainment, and powertrain control.

The transition toward connected and autonomous vehicles has accelerated demand for robust communication protocols that can handle large data volumes with minimal latency. Additionally, regulatory requirements for safety and emissions compliance have encouraged automakers to adopt standardized communication systems to streamline diagnostics and performance monitoring.

Collaborative development between automakers, semiconductor suppliers, and software developers has led to advancements in protocol efficiency, scalability, and cybersecurity. Over the coming years, growth is expected to be fueled by higher adoption of established protocols like CAN for cost-sensitive applications, increased deployment in passenger vehicles, and expanding infotainment system functionalities driven by consumer demand for connectivity and personalization.

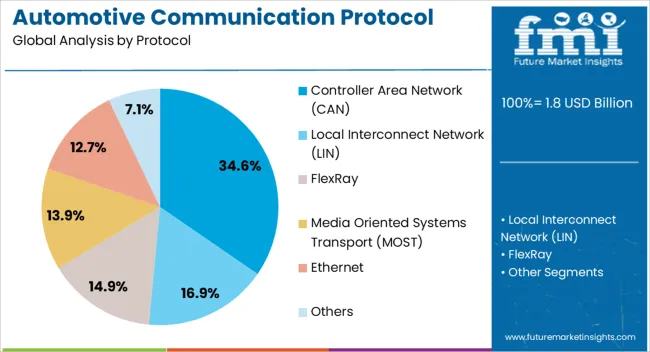

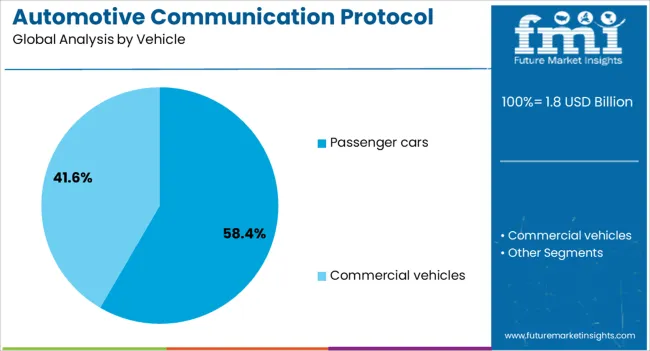

The automotive communication protocol market is segmented by protocol, vehicle, application, and geographic regions. By protocol, automotive communication protocol market is divided into Controller Area Network (CAN), Local Interconnect Network (LIN), FlexRay, Media Oriented Systems Transport (MOST), Ethernet, and Others. In terms of vehicle, automotive communication protocol market is classified into Passenger cars and Commercial vehicles.

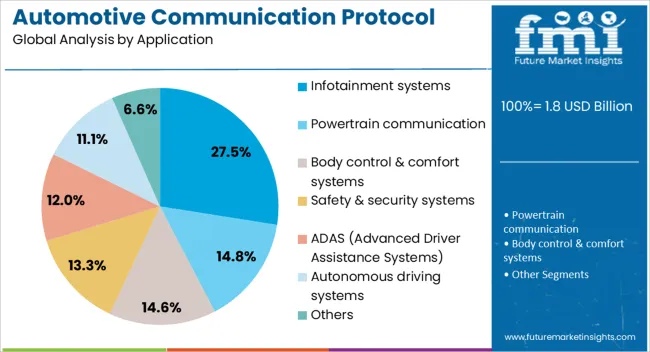

Based on application, automotive communication protocol market is segmented into Infotainment systems, Powertrain communication, Body control & comfort systems, Safety & security systems, ADAS (Advanced Driver Assistance Systems), Autonomous driving systems, and Others. Regionally, the automotive communication protocol industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Controller Area Network (CAN) segment is projected to hold 34.6% of the automotive communication protocol market revenue in 2025, maintaining its position as the leading protocol. This dominance is supported by CAN’s proven reliability, cost-effectiveness, and robustness in handling real-time communication for automotive applications.

Manufacturers have favored CAN for its ability to operate efficiently in harsh vehicle environments while ensuring consistent performance in safety-critical functions such as engine control, braking, and airbag deployment. Furthermore, the widespread standardization of CAN across OEM platforms has simplified integration, reduced development costs, and ensured interoperability between components from different suppliers.

The availability of established diagnostic tools and the protocol’s scalability to meet evolving vehicle electronics requirements have further strengthened its adoption. Even as newer high-speed protocols gain traction for data-intensive applications, CAN remains integral to automotive architectures, especially in core control systems, due to its balance of performance, cost, and proven field reliability.

The passenger cars segment is projected to account for 58.4% of the automotive communication protocol market revenue in 2025, reflecting the sector’s high production volumes and rapid adoption of electronic innovations. Growth in this segment has been fueled by consumer demand for advanced infotainment, safety, and driver-assistance features, all of which require sophisticated communication frameworks.

Automakers have increasingly incorporated multiple network protocols within passenger cars to enable seamless data exchange between sensors, ECUs, and onboard systems. Passenger cars also lead in adopting connectivity solutions that integrate smartphones, cloud services, and navigation systems, further driving protocol implementation.

Additionally, competitive differentiation in the passenger car market has accelerated the pace of technology integration, compelling manufacturers to upgrade communication infrastructure to support features such as over-the-air updates, predictive maintenance, and real-time diagnostics. These factors have positioned passenger cars as the dominant vehicle category for communication protocol deployment.

The infotainment systems segment is projected to contribute 27.5% of the automotive communication protocol market revenue in 2025, leading the application category due to the growing importance of in-vehicle connectivity and digital user experiences. Infotainment systems now serve as central hubs for navigation, entertainment, communication, and vehicle settings, requiring high-speed, low-latency communication between multiple subsystems.

Advances in high-definition displays, voice recognition, and streaming capabilities have increased data transmission requirements, making reliable communication protocols critical for seamless operation. Automakers and technology suppliers have collaborated to ensure infotainment systems can interface with external devices, cloud platforms, and vehicle control systems without compromising performance or safety.

The trend toward personalized in-car experiences, driven by AI-powered interfaces and subscription-based services, has further expanded the role of infotainment in overall vehicle value. As consumers continue to prioritize connectivity, the infotainment systems segment is expected to retain its leading position in protocol-driven applications.

The automotive communication protocol market is expanding as vehicles integrate advanced electronics for safety, infotainment, and autonomous driving. Protocols like CAN, LIN, FlexRay, and Automotive Ethernet connect ECUs, sensors, and control systems. North America and Europe lead in adoption of high-speed, secure networks for premium vehicles, while Asia-Pacific shows rapid growth driven by high-volume manufacturing and electric vehicle initiatives. Key players differentiate through protocol interoperability, OEM certifications, and support for emerging vehicle architectures. Market growth is fueled by increasing electrification, connected vehicle deployments, and regulatory requirements for functional safety and cybersecurity.

Automotive communication protocol selection directly affects vehicle performance, system integration, and upgrade potential. High-speed Ethernet and FlexRay are preferred for autonomous and electric vehicles in Europe and North America due to their bandwidth and reliability. CAN and LIN dominate cost-sensitive mass-market vehicles in Asia-Pacific. Differences in protocol selection impact data handling, latency, and integration of advanced driver-assistance systems. Global suppliers offer multi-protocol solutions for flexible vehicle platforms, whereas regional players focus on single-protocol modules. These contrasts shape OEM adoption, system complexity, and long-term scalability. Vehicles designed with advanced protocols achieve higher reliability and connectivity, while models relying on legacy systems face limits in integrating emerging automotive technologies.

Standardization and certification play a critical role in market competitiveness. Europe and North America require ISO, SAE, and OEM certifications for functional safety, cybersecurity, and network interoperability. Suppliers meeting these standards secure long-term contracts and credibility. Asia-Pacific markets are evolving, with some manufacturers using local validation methods. Differences in compliance capability affect integration complexity, adoption timelines, and regional expansion. Multinational suppliers invest heavily in validation and testing to serve global OEMs, while smaller regional suppliers may have limited acceptance for advanced vehicles. Regulatory alignment and certified protocol support distinguish leading companies and influence market penetration across vehicle categories.

Electric and hybrid vehicles demand reliable, high-speed communication to manage battery, motor, and charging systems. Connected and autonomous vehicles increase the need for data-intensive protocols for sensors, infotainment, and ADAS. In Europe and North America, early adoption of Automotive Ethernet supports next-generation mobility solutions, whereas Asia-Pacific adoption remains centered on cost-effective CAN networks for mid-range EVs. Differences in vehicle architecture, production volume, and OEM priorities drive protocol deployment decisions. Companies offering scalable, high-bandwidth solutions for electrified and connected platforms capture a larger share of advanced vehicle segments compared with suppliers limited to legacy protocols.

Protocol module cost varies depending on technology, certification, and production scale. Europe and North America emphasize premium, high-compliance modules, whereas Asia-Pacific focuses on affordable high-volume solutions. Differences in manufacturing efficiency, component sourcing, and R&D investment influence pricing and supplier margins. Global suppliers capable of meeting performance, regulatory, and cost requirements maintain competitive advantage, while smaller vendors often focus on regional, cost-sensitive markets. These variations in production cost and regional priorities directly shape adoption rates, procurement strategies, and the pace at which advanced communication protocols penetrate automotive markets worldwide.

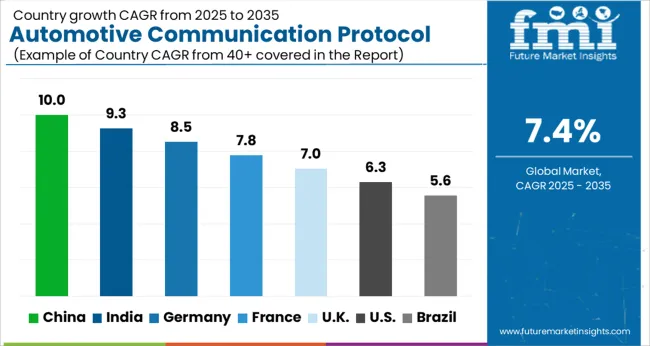

| Country | CAGR |

|---|---|

| China | 10.0% |

| India | 9.3% |

| Germany | 8.5% |

| France | 7.8% |

| UK | 7.0% |

| USA | 6.3% |

| Brazil | 5.6% |

The global automotive communication protocol market was projected to grow at a 7.4% CAGR through 2035, driven by demand in connected vehicles, in-vehicle networks, and automotive electronics. Among BRICS nations, China recorded 10.0% growth as large-scale protocol integration and testing facilities were commissioned and compliance with automotive standards was enforced, while India at 9.3% growth saw expansion of manufacturing units to support rising regional adoption of connected vehicle technologies. In the OECD region, Germany at 8.5% maintained substantial output under strict automotive and electronic regulations, while the United Kingdom at 7.0% relied on moderate-scale operations for passenger and commercial vehicle applications. The USA, expanding at 6.3%, remained a mature market with steady demand in automotive electronics, supported by adherence to federal and state-level quality and safety standards. This report includes insights on 40+ countries; the top five markets are shown here for reference.

Automotive communication protocol market in China is growing at a CAGR of 10.0%. Between 2020 and 2024, growth was driven by rapid adoption of connected and electric vehicles, and expansion of intelligent transportation systems. Automotive manufacturers implemented protocols such as CAN, LIN, FlexRay, and Ethernet to improve vehicle safety, performance, and data communication. In the forecast period 2025 to 2035, growth is expected to accelerate with increasing integration of autonomous driving technologies, vehicle-to-everything communication, and smart vehicle networks. Government initiatives promoting electric mobility and smart transportation infrastructure will continue to support market growth. Domestic and international suppliers are focusing on high speed, reliable, and secure communication protocols to meet evolving automotive standards. China remains a leading market for automotive communication protocols due to industrial scale, technological adoption, and supportive policies.

Automotive communication protocol market in India is growing at a CAGR of 9.3%. Historical period 2020 to 2024 saw growth driven by increasing production of connected and electric vehicles, and rising demand for advanced safety features. Manufacturers implemented standard protocols including CAN and LIN to ensure reliable in-vehicle communication. For the forecast period 2025 to 2035, market growth is expected to continue with adoption of Ethernet and FlexRay protocols for autonomous vehicles and smart transportation systems. Government initiatives for electric mobility and emission reduction will encourage adoption of advanced communication standards. Indian market growth is supported by domestic automotive manufacturers, OEMs, and rising consumer demand for connected vehicles.

Automotive communication protocol market in Germany is growing at a CAGR of 8.5%. Between 2020 and 2024, growth was supported by advanced automotive manufacturing, adoption of electric and autonomous vehicles, and rising focus on in-vehicle network reliability. Manufacturers implemented high speed CAN, LIN, FlexRay, and automotive Ethernet protocols. In the forecast period 2025 to 2035, growth is expected to continue steadily with increased adoption of secure communication protocols, V2X connectivity, and autonomous driving solutions. Regulatory standards and industry focus on vehicle safety and interoperability further support market expansion. Germany remains a key market in Europe for automotive communication protocols due to strong automotive industry presence and technological innovation.

Automotive communication protocol market in the United Kingdom is growing at a CAGR of 7.0%. During 2020 to 2024, adoption was driven by connected car features, electric vehicle production, and government incentives for emission reduction. Manufacturers implemented standard CAN and LIN protocols to improve reliability and safety. For the forecast period 2025 to 2035, market growth is expected to continue with increased use of Ethernet and FlexRay protocols in autonomous and smart vehicles. Rising adoption of vehicle-to-vehicle and vehicle-to-infrastructure communication systems will further support growth. The United Kingdom market demonstrates steady adoption with emphasis on safety, connectivity, and compliance with regulatory standards.

Automotive communication protocol market in the United States is growing at a CAGR of 6.3%. Historical period 2020 to 2024 saw growth driven by adoption of connected, electric, and semi-autonomous vehicles. Automotive manufacturers implemented protocols such as CAN, LIN, FlexRay, and Ethernet for reliable data transfer, safety, and vehicle performance. In the forecast period 2025 to 2035, growth is expected to continue with increasing integration of V2X systems, autonomous vehicle communication, and smart mobility solutions. Technological innovation, OEM adoption, and regulatory emphasis on safety and emissions reduction will further support market expansion. The United States remains a key market with focus on connectivity, security, and advanced automotive communication standards.

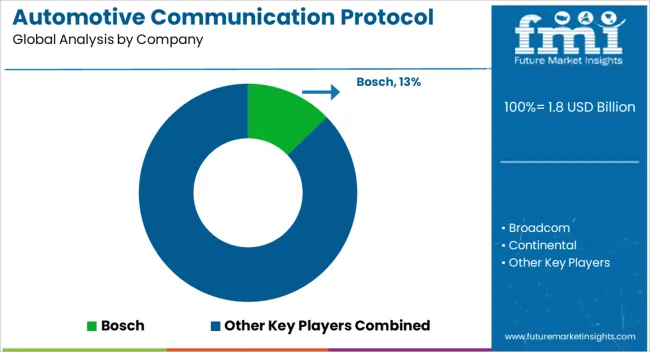

The automotive communication protocol market is supplied by Bosch, Broadcom, Continental, Denso, Infineon, Kvaser, NXP Semiconductors, Onsemi, Renesas, and Texas Instruments, with competition focused on data transfer speed, protocol compatibility, and reliability under automotive conditions. Bosch and Continental brochures highlight CAN, LIN, and FlexRay protocol support, specifying bit rates, bus load capacity, and error detection features. NXP Semiconductors and Infineon provide datasheets detailing automotive-grade transceivers, signal integrity parameters, and temperature operating ranges.

Denso and Renesas emphasize protocol stacks for in-vehicle networking, with technical sheets including latency, jitter specifications, and electromagnetic compatibility performance. Observed industry patterns indicate growing demand for high-speed, robust communication solutions supporting advanced driver-assistance systems (ADAS) and infotainment integration. Market strategies revolve around differentiation through protocol variety, integration support, and ecosystem partnerships.

Bosch and NXP focus on multi-protocol transceivers compatible with CAN FD, Ethernet AVB, and LIN networks, allowing seamless in-vehicle data communication. Infineon and Texas Instruments provide reference designs and development kits for automotive OEMs and tier-1 suppliers to accelerate system integration. Kvaser and Onsemi target specialized applications such as electric vehicles and hybrid architectures, offering high-reliability transceivers for harsh operating environments.

Observed trends show suppliers increasingly aligning with global automotive standards like ISO 11898 and AUTOSAR to ensure interoperability across manufacturers and platforms. Broadcom and Renesas emphasize modular solutions for scalable network designs, while Bosch and Continental offer diagnostic support tools, firmware updates, and software libraries to reduce development time. Product brochures and technical datasheets communicate critical specifications including supported protocols, data rates, voltage tolerance, thermal range, electromagnetic compliance, signal integrity metrics, and packaging formats.

NXP and Infineon provide design guidelines, reference schematics, and integration notes for automotive control units. Texas Instruments and Onsemi include latency charts, power consumption data, and recommended termination networks. Denso, Bosch, and Continental highlight automotive compliance testing results, operating life data, and interoperability validation.

Clear technical documentation enables automotive engineers, ECU designers, and system integrators to assess suitability, ensuring adoption based on verified performance, reliability, and compatibility with in-vehicle network architectures and global automotive communication standards.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.8 Billion |

| Protocol | Controller Area Network (CAN), Local Interconnect Network (LIN), FlexRay, Media Oriented Systems Transport (MOST), Ethernet, and Others |

| Vehicle | Passenger cars and Commercial vehicles |

| Application | Infotainment systems, Powertrain communication, Body control & comfort systems, Safety & security systems, ADAS (Advanced Driver Assistance Systems), Autonomous driving systems, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bosch, Broadcom, Continental, Denso, Infineon, Kvaser, NXP Semiconductors, Onsemi, Renesas, and Texas Instruments |

| Additional Attributes | Dollar sales vary by protocol type, including CAN, LIN, FlexRay, MOST, and Ethernet; by application, such as infotainment, advanced driver-assistance systems (ADAS), body electronics, and powertrain; by vehicle type, spanning passenger cars, commercial vehicles, and electric/hybrid vehicles; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising automotive electronics integration, connected vehicle adoption, and demand for reliable in-vehicle communication. |

The global automotive communication protocol market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the automotive communication protocol market is projected to reach USD 3.8 billion by 2035.

The automotive communication protocol market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in automotive communication protocol market are controller area network (can), local interconnect network (lin), flexray, media oriented systems transport (most), ethernet and others.

In terms of vehicle, passenger cars segment to command 58.4% share in the automotive communication protocol market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA