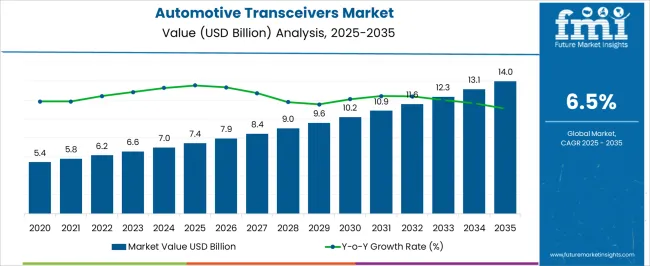

In 2025, the automotive transceivers market is valued at USD 7.4 billion and is expected to reach USD 14.0 billion by 2035, growing at a CAGR of 6.5%, with a multiplying factor of about 1.89x. Market growth curve shape analysis indicates an S-curve trajectory, characterized by an initial phase of gradual adoption, followed by rapid expansion, and eventual stabilization as penetration reaches maturity. During the early phase, from 2025 to 2028, growth is moderate, driven by the integration of transceivers in advanced driver-assistance systems (ADAS) and increasing demand for in-vehicle connectivity solutions in premium and mid-range vehicles.

From 2028 to 2032, the curve steepens, reflecting accelerated adoption across a wider range of vehicles, including electric and hybrid models. Technological advancements, such as higher data rate transceivers, improved electromagnetic compatibility, and low-latency communication modules, support this faster uptake. Expansion of connected car ecosystems, vehicle-to-everything (V2X) communication, and smart mobility solutions further contribute to mid-phase growth. In the later period, from 2032 to 2035, the curve begins to stabilize as most vehicles integrate advanced transceivers, and incremental growth depends on retrofits, system upgrades, and higher-value features. This S-curve pattern demonstrates that early adoption, technology innovation, and ecosystem expansion drive the long-term trajectory of the automotive transceivers market.

| Metric | Value |

|---|---|

| Automotive Transceivers Market Estimated Value in (2025 E) | USD 7.4 billion |

| Automotive Transceivers Market Forecast Value in (2035 F) | USD 14.0 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The automotive transceivers market is supported by several upstream sectors. Automotive OEMs account for approximately 39%, as transceivers are integrated into vehicle communication networks for infotainment, safety, and autonomous systems. Semiconductor and chipset manufacturers contribute around 27%, providing CAN, LIN, FlexRay, and Ethernet transceiver ICs. Electronic component suppliers represent roughly 16%, delivering connectors, cables, and interface modules. Software and system integrators hold close to 11%, developing communication protocols, diagnostics, and control software.

Aftermarket and service providers make up the remaining 7%, supporting retrofits, maintenance, and upgrades in both passenger and commercial vehicles. The market is expanding due to the increasing adoption of advanced driver-assistance systems (ADAS) and connected vehicle platforms. Automotive Ethernet transceivers now account for over 35% of new implementations, improving high-speed in-vehicle communication. CAN and LIN transceivers remain dominant for body and powertrain networks, with combined adoption of ~55% in 2024.

Integration of robust transceivers with enhanced electromagnetic compatibility is reducing communication errors by 10–12%. Growth in electric and autonomous vehicles is driving demand for multi-protocol transceivers to support sensor fusion and real-time data exchange. The OEMs are partnering with semiconductor companies to develop energy-efficient transceivers, lowering power consumption by 5–7% per vehicle network.

The automotive transceivers market is experiencing steady expansion, supported by the growing integration of advanced electronics and communication systems in modern vehicles. Automotive industry reports and OEM announcements have highlighted the increasing need for reliable in-vehicle networking solutions to support safety, infotainment, and driver assistance systems.

The push towards connected and autonomous vehicles has intensified demand for high-performance transceivers capable of handling complex data exchange with minimal latency. Regulatory requirements for vehicle safety, emissions control, and diagnostics have also driven adoption, as these systems rely heavily on robust communication protocols.

Additionally, the electrification trend has increased the number of electronic control units (ECUs) in vehicles, further boosting the need for efficient transceiver networks. The market’s growth outlook remains positive, with advancements in low-power designs, electromagnetic compatibility, and protocol versatility paving the way for wider deployment. Segmental leadership is currently driven by CAN protocol adoption in vehicle networking and body electronics as a key application area, reflecting their maturity, scalability, and cost efficiency.

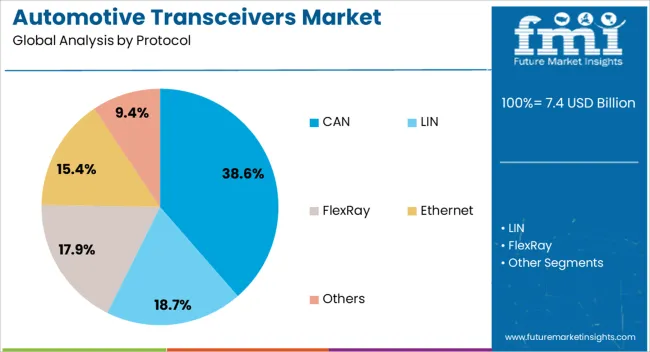

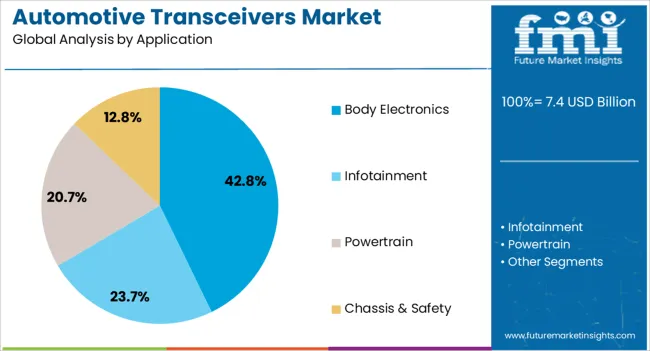

The automotive transceivers market is segmented by protocol, application, and geographic regions. By protocol, automotive transceivers market is divided into CAN, LIN, FlexRay, Ethernet, and Others. In terms of application, automotive transceivers market is classified into Body Electronics, Infotainment, Powertrain, and Chassis & Safety. Regionally, the automotive transceivers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The CAN segment is projected to account for 38.6% of the automotive transceivers market revenue in 2025, maintaining its leadership in protocol adoption. Growth in this segment has been driven by the protocol’s robustness, cost-effectiveness, and proven performance in automotive environments.

CAN technology offers high reliability for real-time data transmission between ECUs, making it essential for applications requiring deterministic communication, such as powertrain control, safety systems, and diagnostics. Industry data has shown that CAN’s standardized architecture enables interoperability across different vehicle systems while reducing wiring complexity.

Furthermore, the cost advantages of CAN over more complex protocols have ensured its continued preference in mass-market vehicles. The introduction of CAN FD (Flexible Data-rate) has extended the protocol’s capabilities, supporting higher data throughput for modern applications. Despite emerging alternatives like Ethernet in certain high-bandwidth use cases, CAN’s balance of performance, scalability, and affordability is expected to sustain its dominant position in automotive networking.

The body electronics segment is projected to hold 42.8% of the automotive transceivers market revenue in 2025, leading application adoption due to the growing sophistication of comfort, convenience, and safety features in vehicles.

This segment’s expansion has been fueled by increased deployment of electronic systems such as lighting control, climate management, power windows, central locking, and seat adjustment mechanisms. Automotive engineering reports indicate that these systems rely on transceivers for efficient and reliable communication between distributed ECUs.

The rise in consumer demand for enhanced in-cabin experiences and personalization has further driven OEM investment in advanced body electronics. Additionally, regulatory standards for vehicle safety, such as automated lighting and sensor integration for driver assistance, have expanded the functional scope of body electronics. The scalability and low-cost integration of transceivers in these systems make them essential for both premium and mass-market vehicle segments, ensuring the continued dominance of body electronics in transceiver applications.

The automotive transceivers market is expanding due to the increasing demand for advanced in-vehicle communication systems, connected cars, and autonomous driving technologies. Transceivers facilitate seamless data transfer between electronic control units, sensors, and infotainment systems, ensuring efficient vehicle operation. North America and Europe lead adoption, driven by automotive innovation, stringent safety regulations, and the integration of connected technologies. Asia Pacific is emerging rapidly with rising vehicle production and technology adoption. Advances in Ethernet-based and CAN-FD transceivers enhance data transfer speed, reduce latency, and support the integration of electric and autonomous vehicles.

The demand for connected and autonomous vehicles is a key factor driving the adoption of automotive transceivers. Real-time communication between sensors, control units, and infotainment systems is critical for vehicle safety, navigation, and diagnostics. Electric vehicles require high-speed data transfer for battery management and drive control. Autonomous driving systems rely on transceivers for precise sensor data and decision-making algorithms. The integration of Ethernet, CAN, and LIN transceivers ensures efficient communication, supporting advanced driver assistance systems and smart mobility solutions. The combination of technological advancements and growing vehicle electrification reinforces adoption across multiple automotive segments.

Ethernet-based and high-speed automotive transceivers provide opportunities for enhanced in-vehicle communication and integration with advanced safety and infotainment systems. These transceivers support large data transfers, high-resolution sensor networks, and real-time diagnostics. Automotive manufacturers are increasingly adopting high-speed communication solutions to enable autonomous driving, over-the-air updates, and vehicle-to-everything connectivity. Demand for modular, scalable, and high-performance transceivers is growing as vehicles incorporate multiple electronic systems. The shift toward electric and semi-autonomous vehicles further drives the need for reliable, low-latency communication technologies in automotive networks.

Automotive transceivers are increasingly integrated with advanced driver assistance systems (ADAS) and infotainment networks. Real-time data transmission from cameras, LiDAR, radar, and sensors ensures accurate navigation, collision avoidance, and adaptive cruise control. Infotainment systems leverage transceivers for seamless audio, video, and connectivity features. OEMs are focusing on robust, secure, and high-speed transceivers to meet consumer expectations for reliability and performance. The integration of communication modules with ADAS and infotainment solutions enhances user experience, operational safety, and vehicle intelligence, supporting broader market adoption across passenger and commercial vehicles globally.

High costs of advanced transceivers and the need for standardization across multiple automotive platforms pose challenges. Compatibility issues among different vehicle models and electronic systems can increase integration complexity. Maintaining low latency, high-speed performance, and electromagnetic compatibility is critical for safety and reliability. Manufacturers investing in scalable designs, modular solutions, and compliance with automotive communication standards are better positioned to overcome these challenges. Optimizing production, ensuring interoperability, and addressing cost barriers are essential for sustaining adoption and competitiveness in the automotive transceivers market.

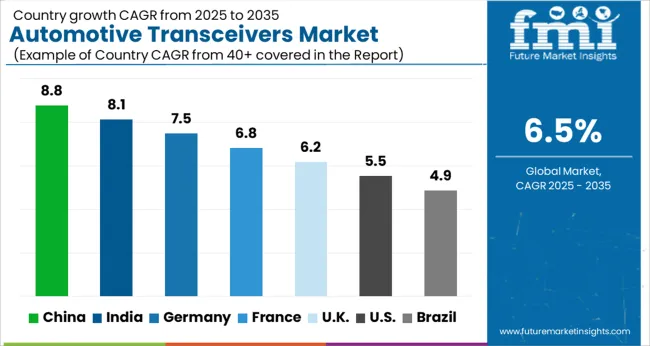

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

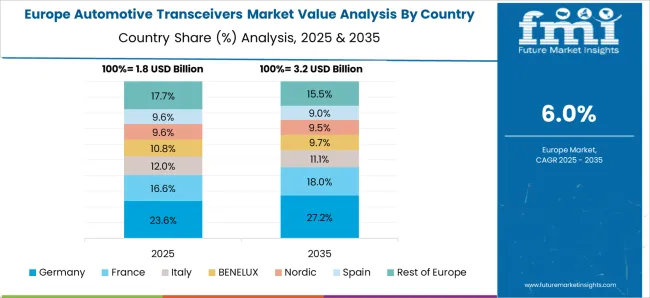

The automotive transceivers market is advancing at a global CAGR of 6.5% from 2025 to 2035, fueled by increasing demand for in-vehicle connectivity, smart transportation systems, and vehicle-to-everything (V2X) communication technologies. China leads with a CAGR of 8.8%, +35% above the global average, supported by BRICS-driven growth in connected vehicles, domestic automotive production, and government-backed smart mobility initiatives. India follows at 8.1%, +25% over the global benchmark, reflecting rising vehicle sales, adoption of intelligent transport systems, and investments in automotive electronics manufacturing. Germany records 7.5%, +15% above the global CAGR, shaped by OECD-supported innovation in premium automotive technologies and integration of advanced transceivers in luxury and electric vehicles. The United Kingdom posts 6.2%, slightly below the global rate, influenced by selective adoption of connected vehicle systems. The United States stands at 5.5%, −15% under the global benchmark, constrained by slower fleet turnover but supported by adoption in EVs and autonomous vehicle trials. BRICS economies are driving scale, while OECD nations emphasize precision engineering and advanced integration.

China is growing at a CAGR of 8.8%, which is 2.3% higher than the global CAGR of 6.5%, reflecting strong adoption of automotive transceivers in connected and electric vehicles. Domestic automakers are integrating CAN, LIN, and FlexRay transceivers in advanced driver-assistance systems (ADAS) and in-vehicle networking. Rapid growth in EV production, smart vehicle adoption, and government incentives for intelligent transport systems are fueling demand. Partnerships between chip manufacturers and automotive OEMs are supporting production scale-up and technology adoption.

India is recording a CAGR of 8.1%, which is 1.6% above the global CAGR, supported by growth in passenger vehicles, EVs, and connected vehicle technologies. Indian automotive manufacturers are increasingly deploying CAN, LIN, and FlexRay transceivers to meet ADAS and telematics requirements. Rising adoption of electric and hybrid vehicles, coupled with growing government support for intelligent transport systems, is boosting demand. Partnerships with semiconductor suppliers and technology providers are enabling faster integration of transceivers in domestic vehicles.

Germany is growing at a CAGR of 7.5%, which is 1.0% above the global CAGR, driven by premium automotive manufacturing, connected vehicles, and ADAS adoption. Automotive OEMs and suppliers are integrating high-performance transceivers for safety, telematics, and infotainment systems. Electric and hybrid vehicle production is further boosting adoption. Strong R&D in automotive electronics and partnerships with semiconductor manufacturers are supporting consistent market growth. Germany’s export-oriented vehicle sector also drives transceiver demand for international shipments.

The United Kingdom is expanding at a CAGR of 6.2%, which is slightly below the global CAGR of 6.5%, reflecting moderate growth in connected and electric vehicles. Adoption is concentrated among high-end automotive manufacturers and fleet operators. Imports of advanced transceivers from Europe and Asia supplement domestic production. Government incentives for EV adoption and connected vehicle infrastructure are supporting incremental demand. Collaborations between OEMs and semiconductor suppliers are enabling integration of CAN, LIN, and FlexRay systems in vehicles.

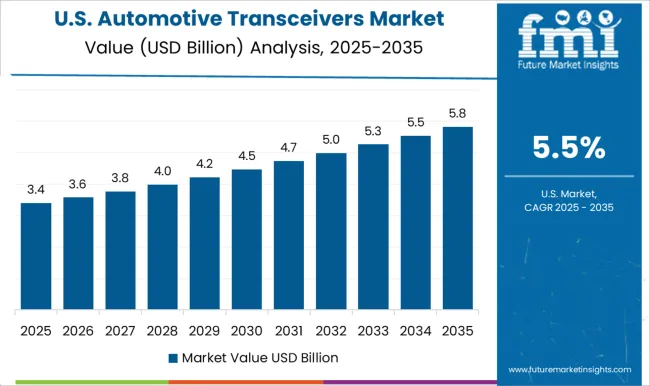

The United States is progressing at a CAGR of 5.5%, which is 1.0% below the global CAGR of 6.5%, reflecting slower growth relative to global benchmarks. Growth is driven by adoption in EVs, telematics, and ADAS systems in passenger and commercial vehicles. Domestic manufacturers are integrating transceivers in both legacy and new vehicle models, while imports from Asia support high-performance applications. Increasing adoption of connected vehicle technologies, fleet management solutions, and EV expansion are contributing to steady market growth, though below the global average due to market maturity.

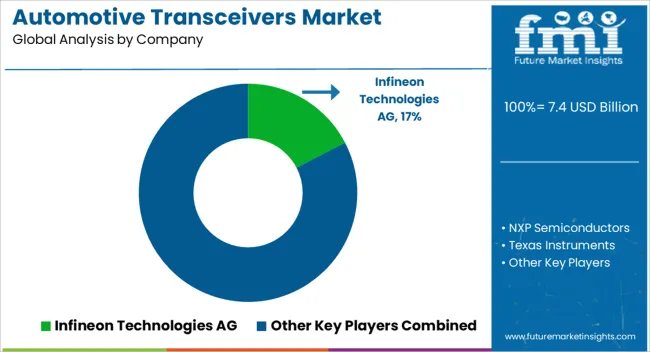

The automotive transceivers market is shaped by companies providing communication interface solutions for in-vehicle networking, including CAN, LIN, and FlexRay protocols. Infineon Technologies AG is assumed to be the leading player, supported by a broad portfolio of high-performance transceivers that ensure reliable data transmission, low latency, and electromagnetic compatibility in modern vehicles.

NXP Semiconductors and Texas Instruments maintain competitive positions with automotive-grade transceivers optimized for safety-critical applications, power efficiency, and seamless integration with electronic control units. STMicroelectronics and Renesas Electronics Corporation contribute by delivering robust interface ICs that enhance signal integrity and system reliability in advanced driver assistance and infotainment systems. National Instruments and Analog Devices, Inc. focus on testing, monitoring, and diagnostic solutions for automotive communication networks, supporting both OEMs and tier-1 suppliers. Microchip Technology, Inc. and Broadcom, Inc. strengthen the market with high-speed transceivers tailored for next-generation vehicle architectures and electric mobility platforms.

| Item | Value |

|---|---|

| Quantitative Units | USD 7.4 Billion |

| Protocol | CAN, LIN, FlexRay, Ethernet, and Others |

| Application | Body Electronics, Infotainment, Powertrain, and Chassis & Safety |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Infineon Technologies AG, NXP Semiconductors, Texas Instruments, STMicroelectronics, Renesas Electronics Corporation, National Instruments, Analog Devices, Inc., Microchip Technology, Inc., and Broadcom, Inc. |

| Additional Attributes | Dollar sales by transceiver type and vehicle segment, demand dynamics across passenger cars, commercial vehicles, and electric vehicles, regional trends across North America, Europe, and Asia-Pacific, innovation in high-speed data transfer, low-latency communication, and automotive Ethernet integration, environmental impact of energy-efficient designs, and emerging use cases in connected cars, ADAS, and autonomous driving systems. |

The global automotive transceivers market is estimated to be valued at USD 7.4 billion in 2025.

The market size for the automotive transceivers market is projected to reach USD 14.0 billion by 2035.

The automotive transceivers market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in automotive transceivers market are can, lin, flexray, ethernet and others.

In terms of application, body electronics segment to command 42.8% share in the automotive transceivers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA