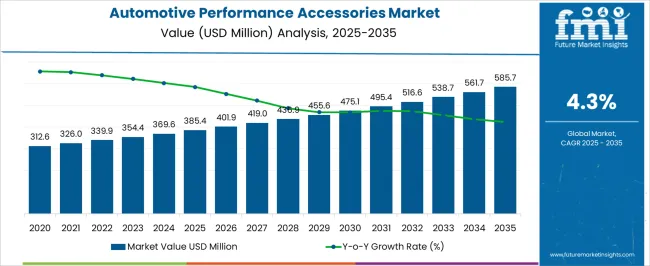

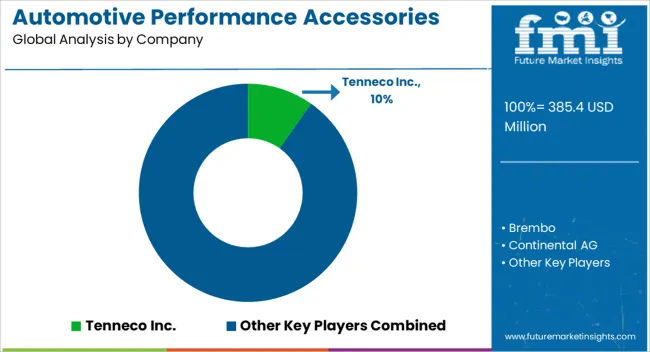

The Automotive Performance Accessories Market is estimated to be valued at USD 385.4 million in 2025 and is projected to reach USD 585.7 million by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

| Metric | Value |

|---|---|

| Automotive Performance Accessories Market Estimated Value in (2025 E) | USD 385.4 million |

| Automotive Performance Accessories Market Forecast Value in (2035 F) | USD 585.7 million |

| Forecast CAGR (2025 to 2035) | 4.3% |

The Automotive Performance Accessories market is experiencing steady growth, driven by increasing consumer interest in vehicle customization, performance optimization, and aesthetic enhancement. Rising demand for high-performance components is being supported by the growing automotive aftermarket and increasing penetration of advanced technologies in passenger vehicles. Consumers and automotive enthusiasts are prioritizing upgrades that enhance engine efficiency, fuel performance, and driving experience.

Continuous innovation in lightweight materials, corrosion-resistant alloys, and modular component designs has further strengthened market adoption. Integration of performance accessories with existing vehicle systems, along with enhanced durability and safety, is influencing purchasing decisions. The market is also being shaped by expanding automotive production in emerging economies and rising disposable income, which enable greater expenditure on aftermarket enhancements.

Increasing awareness of brand value and vehicle personalization is fueling demand across multiple regions As automakers and accessory manufacturers continue to innovate, offering performance, reliability, and compliance with regulatory standards, the market is expected to witness sustained growth over the coming years, with technology-driven solutions driving adoption.

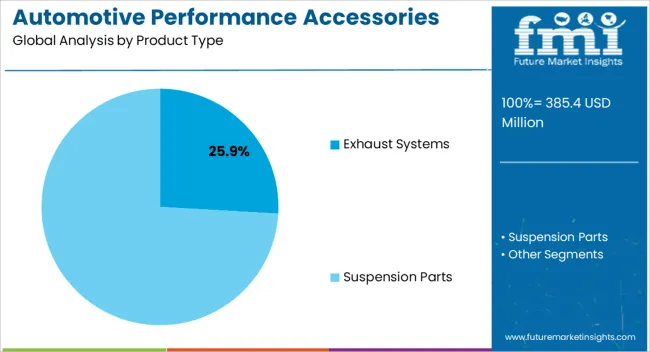

The exhaust systems product type segment is projected to hold 25.9% of the market revenue in 2025, establishing it as a leading product category. Growth in this segment is being driven by the increasing need for enhanced engine efficiency, reduced emissions, and improved vehicle performance. Exhaust systems designed for performance enhancement enable better airflow, noise optimization, and fuel efficiency, which are highly valued by vehicle owners.

Advancements in lightweight materials, corrosion resistance, and modular design have strengthened product adoption. Integration with modern engine systems allows for improved compatibility and ease of installation, which is influencing consumer preference.

Growing interest in aftermarket vehicle modification and tuning, along with rising awareness of emission standards, further supports adoption As demand for optimized engine performance continues to rise, exhaust systems are expected to maintain their leading market position, driven by innovation, performance reliability, and alignment with evolving vehicle regulations.

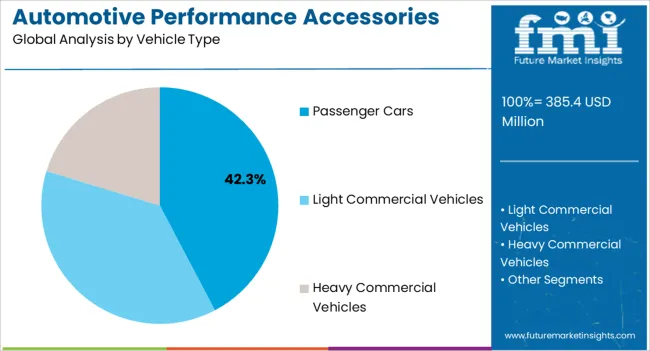

The passenger cars vehicle type segment is anticipated to account for 42.3% of the market revenue in 2025, making it the leading vehicle category. Growth in this segment is being driven by the widespread adoption of performance accessories among personal vehicle owners seeking customization and enhanced driving experience. Consumers are increasingly investing in upgrades that improve engine efficiency, handling, and aesthetics, particularly in mid-range and luxury vehicles.

The availability of modular and easy-to-install accessories has facilitated adoption among passenger car owners. Rising disposable incomes, growing automotive aftermarket penetration, and increasing awareness of brand differentiation are further supporting demand.

Performance accessories for passenger cars, including exhaust systems, suspension kits, and air intake systems, provide both functional and aesthetic benefits, which are driving consumer preference As vehicle personalization continues to gain traction, passenger cars are expected to remain the primary driver of market growth, supported by innovations in performance optimization and compliance with safety and environmental standards.

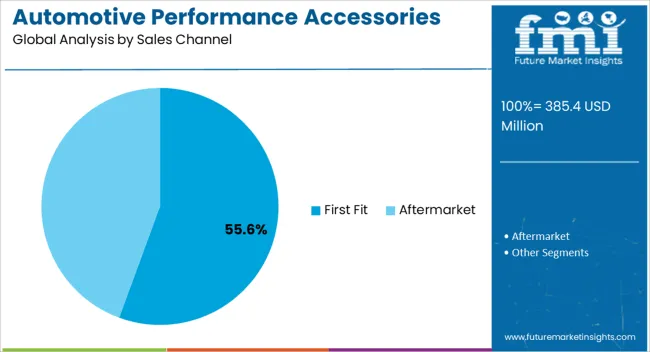

The first fit sales channel segment is projected to hold 55.6% of the market revenue in 2025, establishing it as the dominant distribution method. Its growth is being driven by the preference for performance accessories integrated during the manufacturing process, ensuring quality, compatibility, and warranty compliance. First fit offerings allow consumers to purchase factory-installed components that enhance vehicle performance without compromising system integrity.

Manufacturers are increasingly investing in developing performance accessories designed specifically for first fit applications, aligning with original equipment standards and reducing aftermarket installation complexity. This approach ensures seamless integration with existing vehicle systems and provides enhanced durability and reliability.

Rising demand for pre-installed performance features among passenger car buyers, coupled with growing awareness of vehicle optimization and compliance requirements, further supports adoption As manufacturers continue to focus on delivering enhanced driving performance and improved fuel efficiency through factory-installed accessories, the first fit sales channel is expected to remain the leading contributor to market growth.

From 2020 to 2025, the global Automotive Performance Accessories market experienced a CAGR of 3.5%, reaching a market size of USD 385.4 million in 2025.

The growing demand for customization among automotive enthusiasts was one of the key drivers of this expansion. Consumers sought to customize and improve the performance of their automobiles, fueling the demand for performance accessories such as turbochargers, exhaust systems and suspension improvements. Sporting events also played an important influence in strengthening the market.

Major Motorsports events like Formula 1, NASCAR and the World Rally Championship have sparked public interest in performance improvements for their own automobiles. Furthermore, the rise of off-road vehicles such as trucks and SUVs aided market expansion. Lifted suspensions and front-end exhausts were sought after by off-road enthusiasts to optimize their vehicles for adventurous travels.

From 2025 to 2035, the worldwide Automotive Performance Accessories industry is predicted to grow at a CAGR of 4.5%. The market is anticipated to reach USD 546.4 million over the forecast period.

The Automotive Performance Accessories business is expected to sustain its growth trajectory from 2025 to 2035, with the market benefiting significantly from the ongoing expansion of vintage car restoration and customization.

To retain the authenticity and performance of their valued automobiles, classic car collectors and enthusiasts will seek high-quality, period-correct accessories. As per the updated regulations by the government globally there will be an expansion in the product portfolio in the automotive performance accessories catering to the components creating less amount of noise and air pollution.

| Country | The United States |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 585.7 million |

| CAGR % 2025 to End of Forecast (2035) | 4.7% |

The Automotive Performance Accessories industry in the United States is expected to reach a market share of USD 585.7 million by 2035, expanding at a CAGR of 4.7%.

The automotive performance accessory market in the United States is growing, catering to a wide range of cars, jeeps and trucks. The obsession with vintage cars is the highest in the United States. Vintage car enthusiasts in the United States are passionate about the preservation and restoration of automobiles, and they seek performance additions that improve both looks and performance of these traditional vehicles.

Engine enhancements, suspension adjustments and braking systems are just a few of the products available from companies specializing in performance oriented accessories. These Vintage Cars are auctioned at very high price which convinces these cars collectors to keep their vehicles updated up to the required performance levels.

| Country | China |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 109.2 million |

| CAGR % 2025 to End of Forecast (2035) | 4.7% |

The Automotive Performance Accessories industry in China is anticipated to reach a market share of USD 109.2 million, moving at a CAGR of 4.7% during the forecast period.

With the establishment of various racetracks and the organization of international events, China has positioned itself as an emerging force in the racing world. The Shanghai International Circuit, home to the Formula 1 Chinese Grand Prix, has become an iconic venue attracting top-tier racing companies like Ferrari and many other domestic players. These companies are more focused to upgrade their vehicle with high performance accessories to make themselves forefront in the racing events.

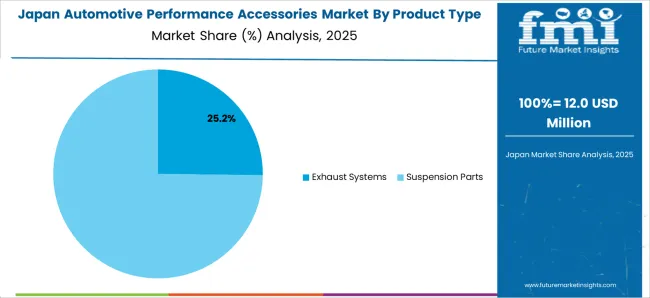

| Country | Japan |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 43.7 million |

| CAGR % 2025 to End of Forecast (2035) | 4.5% |

The Automotive Performance Accessories industry in Japan is estimated to reach a market share of USD 43.7 million by 2035, thriving at a CAGR of 4.5%.

With a strong focus on technological advancements and precision engineering, Japanese performance accessories are renowned for their reliability and efficiency. The market offers an extensive range of high-performance parts and accessories, allowing car enthusiasts to enhance their vehicles power, handling and aesthetics. From renowned tuners like HKS and Tomei to specialized workshops and manufacturers Japan provides a vast array of options for enthusiasts seeking to upgrade their vehicles.

The popularity of events like Tokyo Auto Salon showcases the widespread admiration for automotive customization and performance tuning in Japan. The country's rich motorsport heritage including prestigious racing events like Super GT and Super Formula demonstrates the enduring passion for high-performance vehicles.

By product type, Exhaust System segment is expected to dominate the Automotive Performance Accessories industry with a CAGR of 4.7% from 2025 to 2035. This segment captures a significant market share in 2025 due to its customization in Exhaust system.

As the Performance Exhaust systems are designed with larger diameter pipes and less restrictive mufflers, allowing for greater exhaust flow, consumers will focus to upgrade their vehicles. Upgrading to a performance exhaust system is a popular and effective technique to increase horsepower and torque, improve throttle response and improve a high-performance vehicle's overall driving experience.

By Vehicle type, Passenger Car segment is dominating the Automotive Performance Accessories industry with a market share of 62.3% from 2025 to 2035. Most of the automotive performance accessories are a great fit for the passenger cars respecting to the engine and size specifications. Most of the motorsports require lightweight cars to show the best performance of their accessories. Also most of the vehicles present in the market are in the passenger car category.

The Automotive Performance Accessories sector is fiercely competitive, with many companies striving for market dominance. To stay ahead of the competition in such a circumstance, essential players must employ smart techniques.

Key Strategies Adopted by the Players

Product Innovation

Companies invest heavily in Research and development to deliver novel products that improve efficiency, dependability, and cost-effectiveness. Product innovation allows businesses to differentiate themselves from their competition while also catering to the changing demands of their clients.

Strategic Partnerships and Collaborations

Key firms in the sector frequently develop strategic partnerships and collaborations with other companies in order to harness their strengths and increase their market reach. Such alliances can allow businesses to obtain access to new technology and markets.

Expansion into Emerging Markets

The Automotive Performance Accessories sector is expanding rapidly in emerging regions such as China and India. Key companies are increasing their presence in these markets by developing local manufacturing facilities and enhancing their distribution networks.

Mergers and Acquisitions

Mergers and acquisitions are frequently used by key players in the Automotive Performance Accessories business to consolidate their market position, expand their product portfolio and gain access to new markets.

Key Players in the Automotive Performance Accessories Industry

Key Developments in the Automotive Performance Accessories Market:

The global automotive performance accessories market is estimated to be valued at USD 385.4 million in 2025.

The market size for the automotive performance accessories market is projected to reach USD 585.7 million by 2035.

The automotive performance accessories market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in automotive performance accessories market are exhaust systems, _headers, _mufflers, _oxygen sensors, _exhaust pipes, suspension parts, _suspension bushing, _sway bars, _shock absorbers, _brakes, _brake pads, _brake rotors, _brake caliper, _brake lines, _brake master cylinders, _vacuum pumps, fuel air & intake systems, _air filters, _maf sensor, _intake manifold, _throttle bodies, _fuel filters, _spark plugs, _fuel injectors, _fuel pumps, transmission parts, _clutch pressure plates, _flywheels, _torque converters, _clutch linkage, power adders, _turbochargers, _intercoolers, _nitrous oxide systems and _superchargers.

In terms of vehicle type, passenger cars segment to command 42.3% share in the automotive performance accessories market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Tuning and Engine Remapping Services Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Tuning and Engine Remapping Industry Analysis in Japan Forecast & Analysis: 2025 to 2035

Automotive Tire Accessories Market Size and Share Forecast Outlook 2025 to 2035

Automotive seating accessories Market Size and Share Forecast Outlook 2025 to 2035

Automotive Lighting Accessories Market Growth - Trends & Forecast 2025 to 2035

Korea Automotive Performance Tuning and Engine Remapping Service Industry Size and Share Forecast Outlook 2025 to 2035

Western Europe Automotive Performance Tuning & Engine Remapping Market Size and Share Forecast Outlook 2025 to 2035

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA