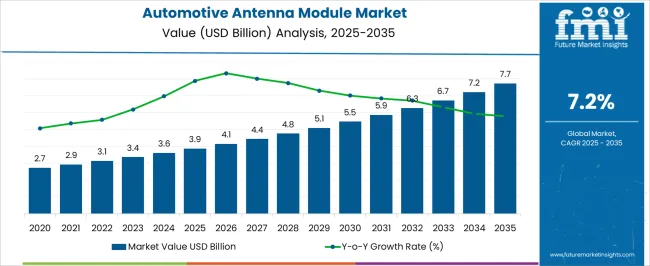

The automotive antenna module market is at USD 3.9 billion in 2025 and is expected to reach USD 7.7 billion by 2035, growing at a CAGR of 7.2%, with a multiplying factor of about 1.97x. Growth rate volatility index analysis highlights fluctuations in expansion caused by evolving automotive technologies, regional adoption patterns, and changing consumer preferences. In the initial phase, from 2025 to 2028, volatility is moderate as demand is concentrated on integration in passenger vehicles for infotainment, telematics, and basic connectivity functions.

Market expansion during this period is relatively stable due to consistent vehicle production and gradual adoption of advanced antenna solutions. Between 2028 and 2032, volatility increases as demand shifts toward electric vehicles, connected car systems, and advanced driver-assistance systems (ADAS), which require high-performance, multi-band, and compact antenna modules. Variations in adoption across regions, supply chain disruptions, and technology upgrades contribute to short-term fluctuations in growth rates. From 2032 to 2035, volatility moderates as market penetration stabilizes and mature players standardize production of next-generation antenna modules.

The index demonstrates that while overall growth is steady at 7.2% CAGR, periods of faster and slower expansion exist, influenced by technological innovation, vehicle electrification, and regional market dynamics.

| Metric | Value |

|---|---|

| Automotive Antenna Module Market Estimated Value in (2025 E) | USD 3.9 billion |

| Automotive Antenna Module Market Forecast Value in (2035 F) | USD 7.7 billion |

| Forecast CAGR (2025 to 2035) | 7.2% |

The automotive antenna module market is influenced by multiple upstream sectors. Automotive OEMs account for approximately 41%, integrating antenna modules into infotainment, telematics, and advanced driver-assistance systems. Electronic component and module manufacturers contribute around 26%, supplying antennas, connectors, and RF circuitry.

Telecommunication and connectivity solution providers represent roughly 16%, supporting 4G/5G, GPS, and vehicle-to-everything (V2X) communication. Aftermarket and retrofit service providers hold close to 10%, offering upgrades and replacements for older vehicle models. Software and system integrators make up the remaining 7%, providing signal processing, calibration, and network optimization solutions.

The market is evolving with the growing adoption of connected and autonomous vehicles. 5G-enabled antenna modules now account for over 30% of new module production, enhancing high-speed data communication and low-latency connectivity. Multi-band and embedded antennas are being increasingly integrated, improving signal quality and reducing design complexity by 10–12%.

Antenna modules with enhanced diversity and beamforming capabilities are gaining traction in premium and electric vehicles. Digital calibration and over-the-air software updates are improving module performance and reliability. OEMs are collaborating with component manufacturers to develop compact, lightweight modules to fit modern vehicle designs while maintaining signal efficiency.

The automotive antenna module market is expanding steadily, supported by rising connectivity requirements in modern vehicles and the integration of advanced telematics systems. Industry developments and OEM announcements have emphasized the role of multi-functional antenna systems in enabling navigation, infotainment, remote diagnostics, and vehicle-to-everything (V2X) communication.

Regulatory pushes for safety and emergency communication standards, along with consumer demand for seamless in-car connectivity, have driven manufacturers to adopt advanced antenna technologies. Furthermore, the shift towards electric and autonomous vehicles has accelerated innovation in compact, high-performance modules that integrate multiple communication functions.

Collaborations between automotive electronics suppliers and telecom providers have enhanced the design and compatibility of antenna modules with emerging 5G networks. Market growth is also supported by increasing passenger vehicle production in both established and emerging economies, alongside a rising preference for premium in-vehicle features. Over the forecast period, integrated antenna modules, GPS antenna modules, and passenger vehicles are expected to remain key revenue drivers due to their technological relevance and high-volume adoption.

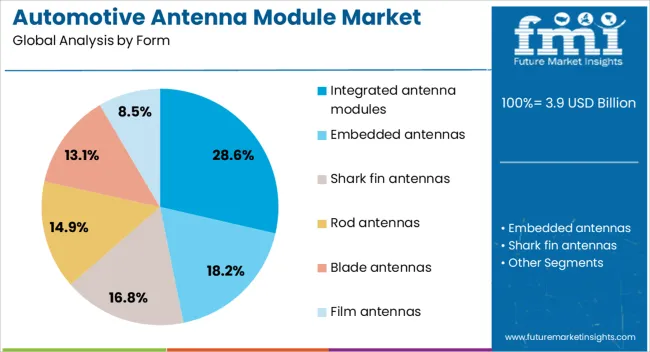

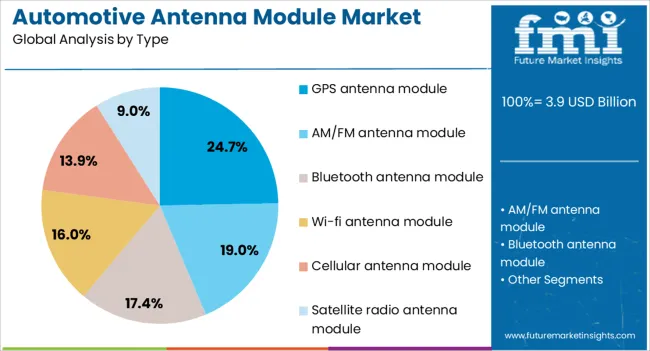

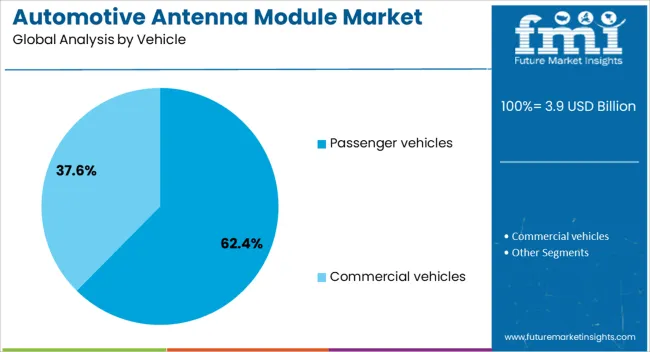

The automotive antenna module market is segmented by form, type, vehicle, propulsion, sales channel, and geographic regions. By form, automotive antenna module market is divided into Integrated antenna modules, Embedded antennas, Shark fin antennas, Rod antennas, Blade antennas, and Film antennas. In terms of type, automotive antenna module market is classified into GPS antenna module, AM/FM antenna module, Bluetooth antenna module, Wi-fi antenna module, Cellular antenna module, and Satellite radio antenna module. Based on vehicle, automotive antenna module market is segmented into Passenger vehicles and Commercial vehicles.

By propulsion, automotive antenna module market is segmented into ICE and Electric vehicles. By sales channel, automotive antenna module market is segmented into OEM and Aftermarket. Regionally, the automotive antenna module industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The integrated antenna modules segment is projected to hold 28.6% of the automotive antenna module market revenue in 2025, reflecting growing demand for compact solutions that combine multiple antenna functions into a single housing. This configuration has been favored by OEMs for its ability to reduce vehicle weight, optimize space utilization, and streamline assembly processes.

Integrated modules enhance aesthetics by eliminating the need for multiple external antenna elements while ensuring consistent performance across functions such as GPS, AM/FM, cellular, and satellite radio. Technological advancements in signal processing and material engineering have improved the reliability and bandwidth capabilities of integrated solutions, making them suitable for both conventional and next-generation vehicle platforms.

As vehicles increasingly rely on a unified communication architecture to support safety, navigation, and entertainment features, integrated antenna modules are expected to sustain strong adoption.

The GPS antenna module segment is expected to contribute 24.7% of the automotive antenna module market revenue in 2025, driven by the critical role of precise location tracking in navigation, fleet management, and connected vehicle services. Automotive manufacturers have prioritized GPS module integration to meet consumer expectations for accurate and responsive navigation systems, as well as regulatory requirements for emergency location services.

Developments in high-sensitivity GPS technology and multi-frequency reception have enhanced signal acquisition speed and accuracy, even in challenging urban or off-road environments. Additionally, GPS antenna modules serve as a backbone for advanced driver-assistance systems (ADAS) and emerging autonomous driving technologies, which require real-time positioning data for safe operation.

With the growing number of applications dependent on location-based services, the demand for high-performance GPS antenna modules is expected to remain strong.

The passenger vehicles segment is projected to account for 62.4% of the automotive antenna module market revenue in 2025, maintaining its position as the dominant vehicle category. Growth in this segment has been supported by rising production volumes, expanding adoption of connected car features, and consumer demand for infotainment, navigation, and telematics services.

OEMs have increasingly equipped passenger vehicles with advanced antenna modules to enhance connectivity, meet safety mandates, and improve driver experience. Premium and mid-range passenger vehicles, in particular, have adopted multi-functional antenna modules to support integrated communication platforms and over-the-air (OTA) updates.

The rise of electric and hybrid passenger vehicles has further stimulated demand for specialized antenna solutions that support EV-specific functionalities such as charging station navigation and energy management systems. With increasing emphasis on in-car connectivity and digital services, passenger vehicles are expected to continue driving the bulk of demand for automotive antenna modules.

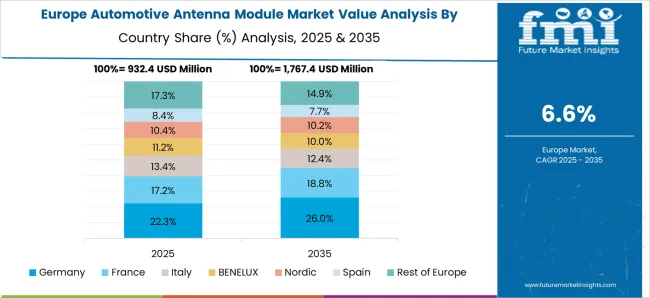

The automotive antenna module market is expanding with the increasing adoption of connected, electric, and autonomous vehicles. Antenna modules facilitate in-vehicle communication, infotainment, navigation, and telematics systems, ensuring seamless connectivity and data transfer. North America and Europe are major markets due to high penetration of advanced vehicles, while Asia Pacific is growing rapidly with increasing vehicle production and smart mobility adoption.

Technological advancements in multi-band, compact, and shark-fin antennas improve performance and aesthetic integration. Rising consumer demand for connected features, real-time navigation, and integrated infotainment systems supports consistent adoption across passenger, commercial, and electric vehicle segments.

Connected and electric vehicles are the primary drivers of automotive antenna module adoption. These vehicles require reliable modules for infotainment, GPS navigation, cellular communication, and V2X connectivity. Integration with advanced driver assistance systems and telematics platforms ensures vehicle safety, traffic management, and efficient navigation. Increasing consumer preference for high-performance, feature-rich vehicles drives manufacturers to adopt compact and multi-band antenna modules. Electric vehicles leverage antenna modules for battery monitoring, remote diagnostics, and connectivity-based services. Expanding EV production and connected vehicle penetration reinforce demand across passenger, commercial, and specialty vehicle segments.

Growth Opportunity Advancements in Multi-Band and Compact Designs

Multi-band and compact antenna modules are creating growth opportunities by enhancing signal reception and reducing design constraints. These modules support multiple communication standards, including GPS, LTE, 5G, and Wi-Fi, ensuring seamless connectivity across different regions and applications. Compact and shark-fin designs allow integration without affecting vehicle aerodynamics or aesthetics. OEMs focusing on modular, high-performance, and customizable solutions are positioned to capitalize on rising adoption. Increasing demand for integrated infotainment, telematics, and V2X communication in electric and autonomous vehicles further supports the expansion of automotive antenna module deployments globally.

Emerging Trend Integration with V2X and 5G Technologies

Automotive antenna modules are increasingly integrated with vehicle-to-everything (V2X) communication and 5G networks. This enables real-time vehicle communication, traffic management, and connected infotainment services. Integration with 5G allows higher data transfer rates, low-latency navigation, and improved telematics services. Emerging designs also support vehicle tracking, predictive maintenance, and smart city connectivity. Adoption of these technologies enhances vehicle intelligence, safety, and operational efficiency. Increasing collaboration between automakers, telecom providers, and technology companies is driving broader adoption of advanced antenna modules in connected and autonomous vehicle segments.

Market Challenge High Component Cost and Integration Complexity

High component costs and integration complexity pose challenges for adoption. Multi-band and compact antenna modules require precise engineering, quality control, and testing to ensure signal reliability. Integration with various vehicle systems, including infotainment, telematics, and ADAS, increases design and production complexity. OEMs investing in modular, scalable, and service-supported solutions are better positioned to mitigate adoption barriers. Ensuring consistent performance, compliance with communication standards, and cost-effectiveness is critical for sustaining adoption and competitiveness in the automotive antenna module market.

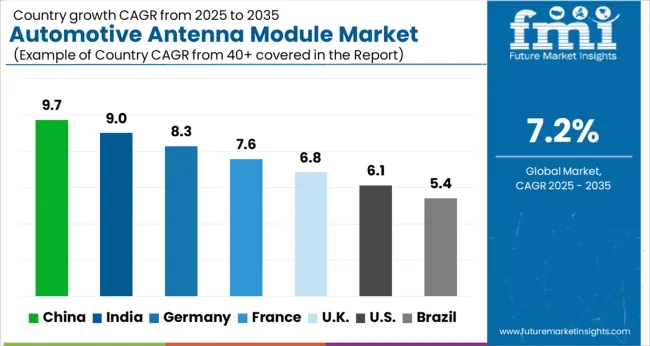

| Country | CAGR |

|---|---|

| China | 9.7% |

| India | 9.0% |

| Germany | 8.3% |

| France | 7.6% |

| UK | 6.8% |

| USA | 6.1% |

| Brazil | 5.4% |

The automotive antenna module market is growing at a global CAGR of 7.2% from 2025 to 2035, fueled by increasing demand for connected vehicles, advanced driver-assistance systems, and in-car infotainment solutions. China leads with a CAGR of 9.7%, +35% above the global benchmark, supported by BRICS-driven growth in automotive production, integration of smart connectivity features, and rising domestic demand for technologically advanced vehicles. India follows at 9.0%, +25% over the global average, reflecting expanding automotive manufacturing, rising vehicle sales, and adoption of connected car technologies. Germany records 8.3%, +15% above the global CAGR, shaped by OECD-supported innovation in premium vehicle connectivity and integration of multi-band antenna systems. The United Kingdom posts 6.8%, slightly below the global rate, influenced by selective upgrades in automotive fleets. The United States stands at 6.1%, −15% under the global benchmark, reflecting mature markets but steady adoption in electric and connected vehicles. BRICS economies are driving volume, while OECD nations focus on technology and system integration.

China is growing at a CAGR of 9.7%, 2.5% above the global CAGR of 7.2%, driven by strong adoption in passenger vehicles, EVs, and connected cars. Manufacturers are investing in multi-band, high-gain antenna modules that support 5G connectivity, navigation, and infotainment systems. Rapid growth in the electric vehicle segment and smart automotive electronics fuels demand. Partnerships between OEMs and technology providers enhance product integration, reliability, and performance. Increasing adoption of autonomous and connected vehicle technologies further accelerates market expansion. Domestic production capacity expansion and export potential strengthen China’s position in the global automotive antenna module market.

India is recording a CAGR of 9.0%, 1.8% above the global CAGR, supported by rising demand for connected vehicles, infotainment systems, and electric mobility solutions. Manufacturers are increasing production of high-performance antenna modules compatible with 4G, 5G, and GNSS systems. Adoption in passenger cars and commercial EVs is expanding rapidly. Partnerships with international technology providers enable faster adoption of advanced antenna solutions. Growth is further supported by automotive electronics development, smart city projects, and EV infrastructure expansion. India’s automotive electronics market is becoming a significant contributor to the regional and global antenna module industry.

Germany is growing at a CAGR of 8.3%, 1.1% above the global CAGR, driven by premium passenger cars, EV adoption, and connected mobility solutions. Automotive manufacturers are integrating advanced antenna modules supporting 5G, navigation, and infotainment. Strong R&D infrastructure and partnerships with technology providers enable innovative designs and high-quality production. Demand is driven by autonomous driving systems, connected vehicle platforms, and electric mobility adoption. Export of high-performance modules to European and global markets supports steady growth. Germany’s automotive antenna module market benefits from industrial expertise, precision manufacturing, and advanced electronic integration capabilities.

The United Kingdom is expanding at a CAGR of 6.8%, slightly below the global CAGR of 7.2%, reflecting moderate adoption. Growth is driven by passenger cars, EVs, and connected vehicle projects. Import of high-performance antenna modules from Europe and Asia supplements domestic supply. Adoption is supported by advancements in autonomous driving, infotainment, and navigation systems. Incremental growth in EV production and connected vehicle deployment ensures steady market expansion. Partnerships with research institutions and technology providers help enhance product performance, durability, and integration in automotive electronics.

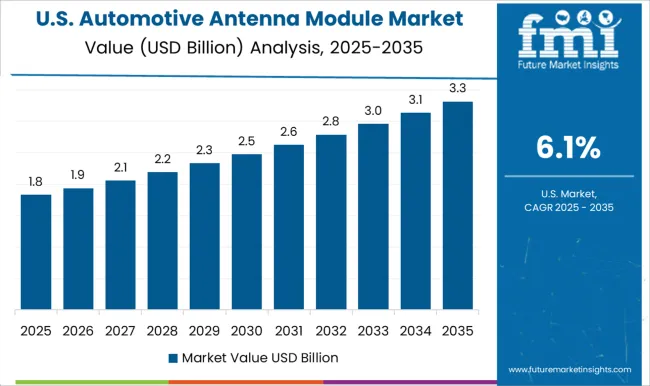

The United States is progressing at a CAGR of 6.1%, 1.1% below the global CAGR of 7.2%, reflecting slower growth due to market maturity. Adoption is concentrated in passenger vehicles, EVs, and connected car segments. Domestic manufacturers produce high-performance modules for infotainment, navigation, and 5G connectivity, complemented by imports from Europe and Asia. Growth is sustained by automotive electronics expansion, EV adoption, and connected vehicle initiatives. The US market remains steady, with high-value vehicles and commercial EVs driving incremental demand and technology upgrades.

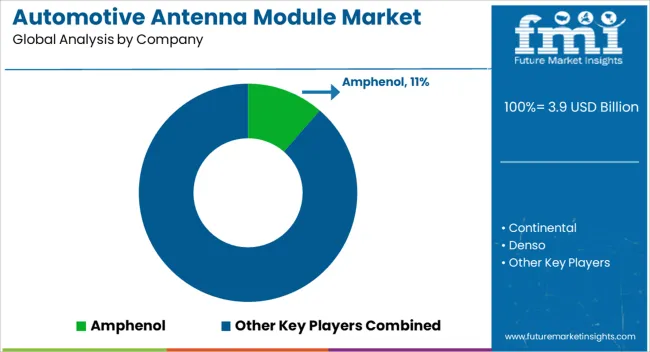

The automotive antenna module market is shaped by companies providing advanced connectivity solutions for vehicles, including infotainment systems, telematics, and navigation integration. Amphenol is assumed to be the leading player, offering a comprehensive portfolio of antenna modules engineered for high signal reception, low interference, and compatibility with multiple frequency bands. Continental and Denso maintain competitive positions with compact, multi-band antennas designed for passenger cars, commercial vehicles, and electric vehicles, emphasizing durability, signal stability, and integration flexibility. Ficosa and Harada focus on modular designs, lightweight materials, and enhanced mounting solutions suitable for modern automotive architectures.

Harman, Mitsubishi Electric, and Robert Bosch provide antenna systems optimized for telematics, connected car applications, and driver assistance technologies. TE Connectivity and Valeo SA strengthen the market through hybrid antennas, embedded solutions, and integration with radar and vehicle communication networks. Product brochures highlight features such as multi-frequency support, GPS/GNSS integration, 4G/5G readiness, compact design, and corrosion resistance. Installation guides and technical datasheets emphasize durability, thermal stability, vibration resistance, and low-noise signal transmission. Collectively, these offerings focus on performance consistency, integration ease, and reliability, enabling automotive manufacturers to enhance vehicle connectivity, support infotainment systems, and deliver seamless telematics services across diverse vehicle platforms worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.9 Billion |

| Form | Integrated antenna modules, Embedded antennas, Shark fin antennas, Rod antennas, Blade antennas, and Film antennas |

| Type | GPS antenna module, AM/FM antenna module, Bluetooth antenna module, Wi-fi antenna module, Cellular antenna module, and Satellite radio antenna module |

| Vehicle | Passenger vehicles and Commercial vehicles |

| Propulsion | ICE and Electric vehicles |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Amphenol, Continental, Denso, Ficosa, Harada, Harman, Mitsubishi Electric, Robert Bosch, TE Connectivity, and Valeo SA |

| Additional Attributes | Dollar sales by antenna type and vehicle segment, demand dynamics across passenger cars, commercial vehicles, and electric vehicles, regional trends across North America, Europe, and Asia-Pacific, innovation in multi-band, shark-fin, and embedded antenna designs, environmental impact of material usage and recyclability, and emerging use cases in connected cars, 5G integration, and autonomous driving systems. |

The global automotive antenna module market is estimated to be valued at USD 3.9 billion in 2025.

The market size for the automotive antenna module market is projected to reach USD 7.7 billion by 2035.

The automotive antenna module market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in automotive antenna module market are integrated antenna modules, embedded antennas, shark fin antennas, rod antennas, blade antennas and film antennas.

In terms of type, gps antenna module segment to command 24.7% share in the automotive antenna module market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Intelligent Antenna Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA