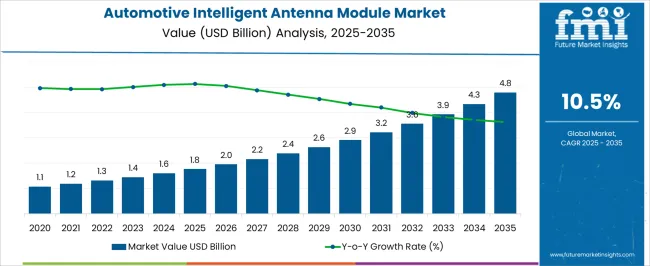

The automotive intelligent antenna module market is projected to grow from USD 1.8 billion in 2025 to USD 4.8 billion by 2035, reflecting a CAGR of 10.5%. A saturation point analysis indicates the stages at which market growth may begin to stabilize due to widespread adoption, technology maturity, and penetration limits in key segments.

Between 2025 and 2030, the market rises from USD 1.8 billion to USD 2.9 billion, representing the early growth phase, driven primarily by the integration of antenna modules in connected vehicles, infotainment systems, and advanced driver-assistance systems (ADAS). During this period, adoption is concentrated in premium and mid-range passenger vehicles in North America and Europe, while Asia-Pacific shows rising demand, particularly in China, Japan, and India. From 2030 to 2035, the market grows from USD 2.9 billion to USD 4.8 billion, entering the approaching-saturation phase, as intelligent antenna modules become standard in most new vehicles. Growth remains robust, but the rate gradually stabilizes as technological adoption reaches near-universal levels in developed automotive markets.

Innovation in multi-band antennas, 5G compatibility, and IoT-enabled connectivity continues to drive incremental revenue, particularly in emerging regions. The market exhibits a classic S-curve trajectory, with early acceleration, steady growth, and gradual approach toward saturation, emphasizing the importance of continuous innovation, regional expansion, and integration with next-generation automotive technologies to maintain long-term growth and competitive advantage.

| Metric | Value |

|---|---|

| Automotive Intelligent Antenna Module Market Estimated Value in (2025 E) | USD 1.8 billion |

| Automotive Intelligent Antenna Module Market Forecast Value in (2035 F) | USD 4.8 billion |

| Forecast CAGR (2025 to 2035) | 10.5% |

The automotive intelligent antenna module market is primarily driven by the automotive telematics and connectivity market, which accounts for approximately 35–40% of total demand, as intelligent antennas are essential for navigation, V2X communication, and connected car services. The connected and autonomous vehicle market contributes around 25–27%, reflecting the deployment of antenna modules for ADAS, infotainment, and autonomous driving functionalities. The electric vehicle (EV) market holds roughly 15–18%, driven by the need for vehicle-to-grid communication, charging coordination, and integrated connectivity solutions. The automotive infotainment systems market contributes approximately 12–14%, as in-car entertainment, navigation, and real-time traffic applications rely on high-performance antenna modules. Lastly, the 5G and wireless communication infrastructure market accounts for 5–6%, supporting high-speed data transmission, low latency, and reliable connectivity required by intelligent antenna modules. Collectively, these parent markets define the technological, operational, and integration ecosystem of the automotive intelligent antenna module market, enabling automakers, suppliers, and telematics providers to deliver enhanced connectivity, safety, and infotainment solutions across conventional, hybrid, and electric vehicles worldwide.

The automotive intelligent antenna module market is expanding steadily, supported by the rapid adoption of connected vehicle technologies, growing demand for advanced infotainment, and the integration of next-generation communication systems. Market momentum is being reinforced by rising consumer expectations for seamless connectivity and OEM strategies focused on enabling vehicle-to-everything (V2X) capabilities.

Regulatory initiatives promoting road safety and smart mobility have further encouraged the deployment of advanced antenna modules. The industry is witnessing increasing design sophistication, with compact, multi-functional modules replacing multiple standalone components, improving both performance and cost efficiency.

Global production growth in passenger and commercial vehicles, coupled with the shift towards electric and autonomous mobility, is driving sustained investments in antenna technology upgrades Over the forecast horizon, wider 5G network penetration, advancements in telematics infrastructure, and the proliferation of over-the-air (OTA) software updates are expected to accelerate adoption, while competitive advantages will be shaped by integration capability, reliability, and compliance with evolving automotive communication standards.

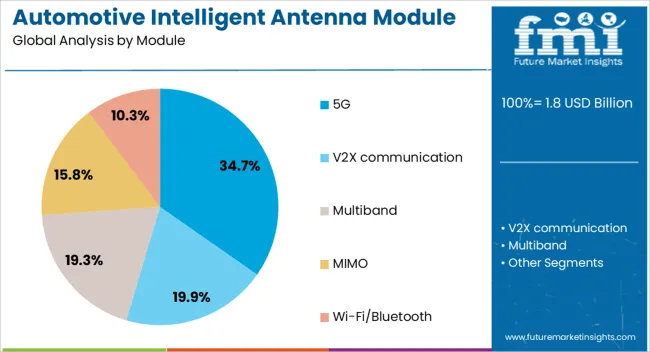

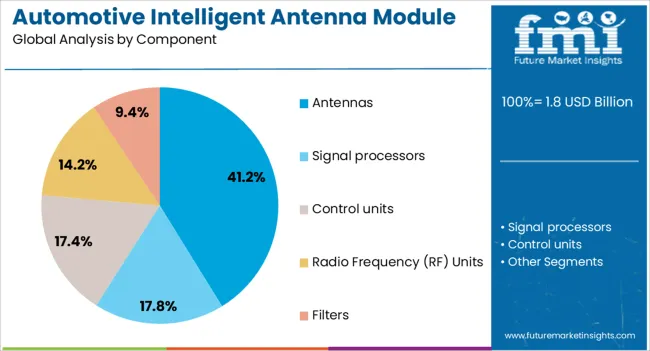

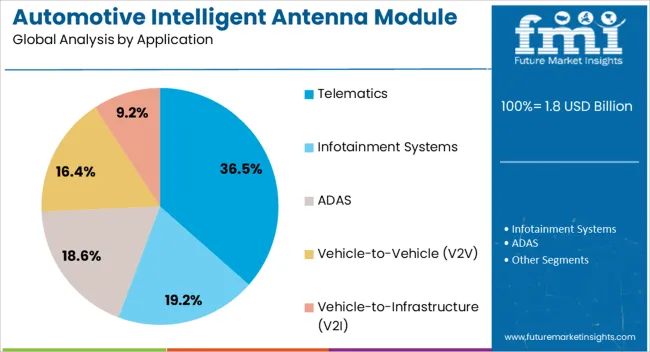

The automotive intelligent antenna module market is segmented by module, component, application, vehicle, propulsion, sales channel, and geographic regions. By module, automotive intelligent antenna module market is divided into 5G, V2X communication, Multiband, MIMO, and Wi-Fi/Bluetooth. In terms of component, automotive intelligent antenna module market is classified into Antennas, Signal processors, Control units, Radio Frequency (RF) Units, and Filters. Based on application, automotive intelligent antenna module market is segmented into Telematics, Infotainment Systems, ADAS, Vehicle-to-Vehicle (V2V), and Vehicle-to-Infrastructure (V2I). By vehicle, automotive intelligent antenna module market is segmented into Passenger cars and Commercial vehicles. By propulsion, automotive intelligent antenna module market is segmented into ICE and Electric. By sales channel, automotive intelligent antenna module market is segmented into OEM and Aftermarket. Regionally, the automotive intelligent antenna module industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 5G module segment, holding 34.7% of the module category, is leading due to its critical role in enabling high-speed, low-latency vehicle connectivity. The segment’s prominence has been driven by the automotive industry’s shift towards connected and autonomous vehicles, where real-time data exchange is essential.

Enhanced bandwidth and minimal latency offered by 5G technology support advanced applications such as cloud-based navigation, V2X communication, and immersive infotainment. OEM adoption has been strengthened by expanding 5G infrastructure in key markets, ensuring compatibility with next-generation mobility services.

Production scalability and the ability to integrate 5G modules into compact designs without compromising performance have further reinforced their appeal Long-term demand growth is expected as global network rollouts progress, enabling broader deployment across mid-range and entry-level vehicle models, consolidating the segment’s position in the market.

The antennas segment, accounting for 41.2% of the component category, has maintained its leadership due to its indispensable role in facilitating multi-band connectivity for various in-vehicle systems. High adoption rates are supported by technological advances in antenna design, enabling integration of multiple functionalities such as GNSS, LTE, 5G, and satellite radio within a single compact unit.

The segment’s growth is underpinned by OEM requirements for reliability, performance stability under varied conditions, and minimal signal interference. Continuous R&D investments have focused on improving reception quality, reducing manufacturing complexity, and achieving cost efficiency without sacrificing performance.

The increasing demand for advanced safety features, infotainment services, and connected vehicle diagnostics continues to reinforce the dominance of antennas, ensuring their critical role in the evolution of intelligent automotive communication systems.

The telematics segment, representing 36.5% of the application category, is leading as vehicles increasingly integrate data-driven services to enhance user experience, operational efficiency, and safety. The segment’s strength is supported by its role in enabling remote diagnostics, fleet management, real-time tracking, and emergency assistance functions.

Growth has been accelerated by regulatory pushes for telematics-enabled safety systems and insurance telematics adoption in several markets. OEM strategies have prioritized embedding telematics into standard vehicle offerings, leveraging its potential for recurring revenue streams through subscription services.

Technological advancements in cloud platforms and analytics are enhancing telematics capabilities, while 5G integration is enabling faster and more reliable data transmission Over the coming years, the expansion of connected mobility ecosystems and rising consumer demand for seamless digital interaction are expected to sustain the segment’s leadership.

The automotive intelligent antenna module market is driven by rising demand for connected vehicles, advanced driver assistance systems (ADAS), and enhanced in-car infotainment. Intelligent antenna modules integrate multiple functionalities, including GPS, cellular, Wi-Fi, and satellite communication, into compact designs, improving signal quality, reliability, and vehicle aesthetics. Growing adoption of electric vehicles, hybrid platforms, and smart mobility solutions is increasing the need for high-performance antennas that support real-time navigation, telematics, and V2X connectivity. Suppliers offering modular, customizable, and high-frequency capable antenna modules with robust technical support are well positioned to serve OEMs and Tier-1 suppliers seeking seamless connectivity and enhanced passenger experiences.

Automakers are increasingly integrating intelligent antenna modules to meet consumer expectations for uninterrupted connectivity, advanced navigation, and telematics services. These modules support multiple bands and protocols, enabling GPS navigation, 4G/5G communication, Wi-Fi hotspots, satellite radio, and emergency call services. Enhanced signal performance ensures reliable infotainment, fleet management, and safety functions, particularly in urban and high-speed environments. Growing vehicle electrification and hybrid models are accelerating adoption, as antenna modules can optimize performance while minimizing interference with other electronic systems. Suppliers providing compact, multi-functional, and application-specific antenna solutions with rigorous testing and certification support are positioned to meet evolving OEM requirements.

Market constraints include high component costs, complex multi-band design requirements, and strict regulatory compliance for electromagnetic compatibility, frequency allocation, and vehicle safety standards. Technical challenges involve minimizing interference, optimizing signal gain, and integrating antennas with varied vehicle body designs and materials. Supply chain disruptions for semiconductors, RF components, and connectors can affect production timelines. OEMs increasingly demand suppliers offering certified, reliable, and scalable antenna modules with end-to-end technical support, design validation, and quality assurance to ensure consistent performance, regulatory adherence, and seamless integration with onboard vehicle systems.

Opportunities exist in multi-band and multi-function intelligent antenna modules that integrate GPS, GNSS, cellular, Wi-Fi, and V2X capabilities. Compact and modular designs allow OEMs to reduce vehicle roof clutter, optimize aerodynamics, and simplify integration. Growing demand for connected services, autonomous driving, and enhanced infotainment in Asia-Pacific, North America, and Europe presents significant growth potential. Suppliers providing customizable, high-performance modules with robust design support, testing, and installation guidance are best positioned to capture emerging opportunities, enabling automakers to offer reliable, high-quality connectivity while improving vehicle design and user experience.

The market is trending toward compact, low-profile antenna modules capable of supporting multiple communication standards simultaneously. Integration of 4G/5G, GNSS, satellite radio, and V2X connectivity in a single module reduces complexity and improves vehicle aesthetics. High-frequency performance, low signal loss, and smart antenna algorithms are being incorporated to optimize reception, especially in dense urban environments. Modular and scalable designs allow easier upgrades and adaptation to different vehicle platforms. Suppliers offering high-quality, technically supported, and multi-functional intelligent antenna modules are best positioned to meet the evolving requirements of connected, autonomous, and infotainment-focused automotive markets globally.

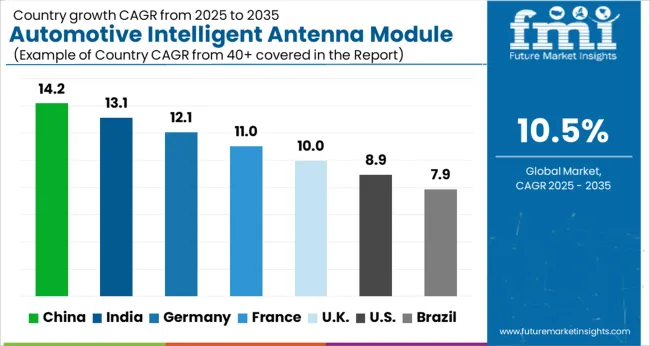

| Country | CAGR |

|---|---|

| China | 14.2% |

| India | 13.1% |

| Germany | 12.1% |

| France | 11.0% |

| UK | 10.0% |

| USA | 8.9% |

| Brazil | 7.9% |

The global automotive intelligent antenna module market is projected to grow at a CAGR of 10.5% from 2025 to 2035. China leads at 14.2%, followed by India at 13.1%, Germany at 12.1%, the UK at 10.0%, and the USA at 8.9%. Growth is driven by rising adoption of connected vehicles, EVs, telematics, and ADAS. Demand for multi-band, GNSS, and MIMO-enabled intelligent antennas is increasing globally. OEM and tier-1 collaborations with global technology providers enhance module precision, integration, and performance, while industrial clusters support large-scale production and rapid deployment worldwide. The analysis includes over 40+ countries, with the leading markets detailed below.

The automotive intelligent antenna module market in China is projected to grow at a CAGR of 14.2% from 2025 to 2035, driven by rising demand for connected vehicles, ADAS (advanced driver-assistance systems), and electric vehicles. Consumers and OEMs are increasingly adopting intelligent antennas for enhanced navigation, infotainment, and communication capabilities. Domestic manufacturers are investing in advanced MIMO, GPS, and GNSS-enabled modules, integrating them with vehicle connectivity platforms. Industrial clusters in Shanghai, Guangdong, and Jiangsu support large-scale production and supply chain efficiency. Collaborations with global automotive technology providers facilitate adoption of high-precision modules and low-latency communication systems. Growth is further supported by expanding EV adoption, urban mobility initiatives, and government policies promoting smart automotive technologies.

The automotive intelligent antenna module market in India is expected to grow at a CAGR of 13.1% from 2025 to 2035, fueled by increasing adoption of connected vehicles, electric mobility, and telematics systems. Rising awareness of ADAS and infotainment solutions is boosting demand for high-performance intelligent antenna modules. Domestic OEMs and tier-1 suppliers are investing in compact, multi-band antenna systems integrating GPS, GNSS, and cellular connectivity. Industrial hubs in Pune, Chennai, and Gurugram provide strong manufacturing and supply chain support. Collaborations with global module providers are enhancing technology transfer and module precision. Growing EV penetration, increasing urbanization, and government initiatives to support connected and smart vehicles further reinforce market growth. Rising consumer preference for connected car services such as real-time navigation, vehicle tracking, and infotainment integration is driving adoption.

The automotive intelligent antenna module market in Germany is projected to grow at a CAGR of 12.1% from 2025 to 2035, supported by its strong automotive manufacturing sector and early adoption of connected and autonomous vehicles. OEMs and tier-1 suppliers are increasingly integrating MIMO, GNSS, and telematics-enabled antenna modules into vehicles to enhance navigation, communication, and infotainment systems. Local manufacturers focus on high-precision, durable modules complying with EU automotive standards. Collaborations with global technology providers facilitate the adoption of compact, energy-efficient, and multi-functional antenna systems. Rising demand in electric vehicles and advanced driver-assistance systems further drives adoption. Extensive automotive R&D ecosystem ensures continuous innovation in antenna design, V2X communication, and connectivity performance, making the country a key market in Europe.

The UK market is expected to grow at a CAGR of 10.0% from 2025 to 2035, driven by increasing connected vehicle adoption, EV penetration, and telematics systems. Consumers and OEMs prefer intelligent antenna modules for high-accuracy navigation, infotainment, and vehicle-to-everything communication. Manufacturers focus on compact, energy-efficient, and multi-functional antennas integrating GPS, GNSS, and cellular connectivity. Industrial hubs in Birmingham, London, and Manchester provide strong production, assembly, and distribution support. Government initiatives supporting EVs, connected cars, and smart mobility solutions encourage adoption. Collaborations with global antenna technology providers enhance design precision, durability, and low-latency performance. Expansion of fleet telematics and connected car services further boosts demand.

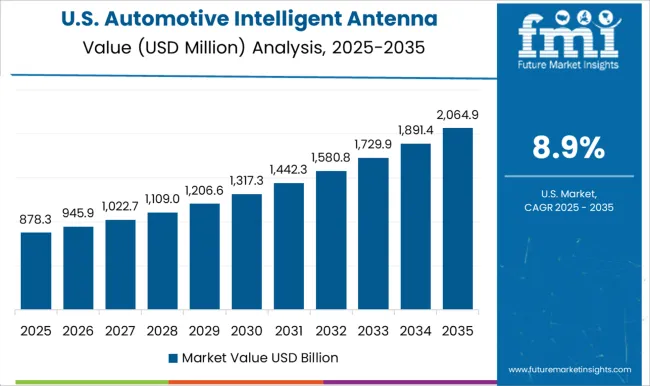

The USA market is projected to grow at a CAGR of 8.9% from 2025 to 2035, supported by widespread adoption of connected vehicles, EVs, and advanced telematics systems. Consumers increasingly demand high-precision navigation, infotainment, and V2X communication capabilities, driving adoption of intelligent antenna modules. OEMs and tier-1 suppliers are investing in multi-band, GNSS, and MIMO-enabled modules with energy-efficient designs. Industrial clusters in Michigan, California, and Texas provide strong manufacturing and distribution infrastructure. Collaborations with global technology providers enhance module performance, durability, and integration with advanced driver-assistance systems. Expansion of fleet management solutions, EV connectivity, and smart mobility initiatives further accelerates demand, positioning the USA as a mature yet steadily growing market for automotive intelligent antenna modules.

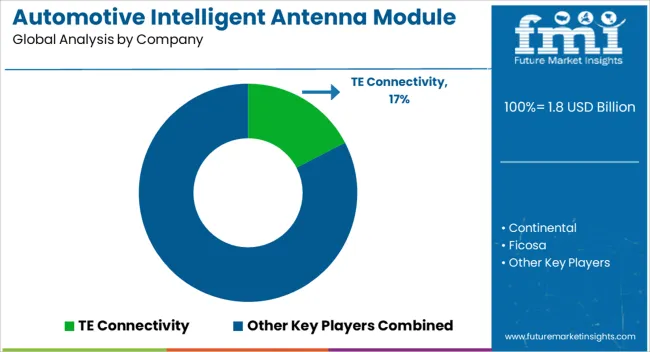

Competition in the automotive intelligent antenna module market is driven by signal quality, integration capability, and multi-band support. TE Connectivity leads with modular antenna systems supporting GNSS, cellular, and V2X communications for connected vehicles. Continental and Valeo differentiate through compact, multi-function antennas with embedded electronics for ADAS, infotainment, and telematics applications. Harman International and Ficosa focus on high-performance antenna arrays for premium passenger vehicles, emphasizing low interference and enhanced reception. Hirschmann Car Communication and Harxon Corporation compete with specialized solutions for commercial and industrial fleets, offering robust performance under vibration and environmental extremes. Pulse Electronics, Taoglas Limited, and Texas Instruments emphasize miniaturized modules, printed antenna designs, and integrated RF front-end components for electric and hybrid vehicles. Strategies revolve around multi-functionality, OEM partnerships, and integration with electronic control units. Antennas are optimized for low-profile design, thermal stability, and electromagnetic compatibility. Product roadmaps include support for emerging 5G NR bands, vehicle-to-everything (V2X) communication, GNSS precision, and OTA firmware updates. R&D investment prioritizes material innovation, signal amplification, and interference mitigation. Manufacturers leverage platform standardization to reduce unit costs and facilitate rapid deployment across vehicle models. Product brochure content is detailed and precise. Specifications include frequency bands, gain, VSWR, radiation patterns, and operating temperature ranges. Mounting options, connector types, and shielding methods are described. Modules are presented with integration guidelines for infotainment, telematics, and navigation systems. EMI/EMC compliance, environmental durability, and vibration resistance are highlighted. Antenna performance metrics such as multi-path mitigation, sensitivity, and signal-to-noise ratio are emphasized. Brochures also detail optional features including GPS/GNSS augmentation, LTE/5G support, and CAN/LIN bus compatibility, reflecting a market focused on connectivity reliability, compact design, and high-precision performance.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.8 Billion |

| Module | 5G, V2X communication, Multiband, MIMO, and Wi-Fi/Bluetooth |

| Component | Antennas, Signal processors, Control units, Radio Frequency (RF) Units, and Filters |

| Application | Telematics, Infotainment Systems, ADAS, Vehicle-to-Vehicle (V2V), and Vehicle-to-Infrastructure (V2I) |

| Vehicle | Passenger cars and Commercial vehicles |

| Propulsion | ICE and Electric |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | TE Connectivity, Continental, Ficosa, Harman International, Harxon Corporation, Hirschmann Car Communication, Pulse Electronics, Taoglas Limited, Texas Instruments, and Valeo |

| Additional Attributes | Dollar sales by antenna type (GPS, GNSS, cellular, hybrid, V2X), module configuration (single, multi-band, multi-technology), and application (passenger vehicles, commercial vehicles, electric vehicles, autonomous vehicles). Demand is driven by connected car adoption, autonomous driving development, and increasing telematics integration. Regional trends indicate strong growth in North America and Europe due to advanced automotive R&D and connected mobility initiatives, while Asia-Pacific shows rapid expansion driven by EV adoption, smart transportation projects, and rising automotive production. |

The global automotive intelligent antenna module market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the automotive intelligent antenna module market is projected to reach USD 4.8 billion by 2035.

The automotive intelligent antenna module market is expected to grow at a 10.5% CAGR between 2025 and 2035.

The key product types in automotive intelligent antenna module market are 5g, v2x communication, multiband, mimo and wi-fi/bluetooth.

In terms of component, antennas segment to command 41.2% share in the automotive intelligent antenna module market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA