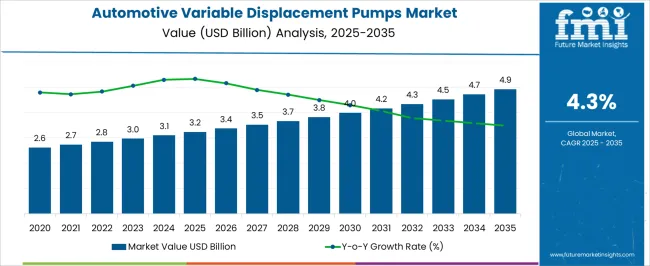

The automotive variable displacement pumps market is projected to grow from USD 3.2 billion in 2025 to USD 4.9 billion by 2035, reflecting a moderate CAGR of 4.3%. A peak-to-trough analysis of the market reveals a stable and steady growth pattern, with limited volatility throughout the decade. Between 2025 and 2030, the market rises from USD 3.2 billion to USD 4.0 billion, representing gradual expansion driven by increasing adoption in fuel-efficient and hybrid vehicles. The minor trough occurs around 2025–2026 at USD 3.2 billion, reflecting initial market saturation in mature regions and slower adoption rates in developing automotive markets.

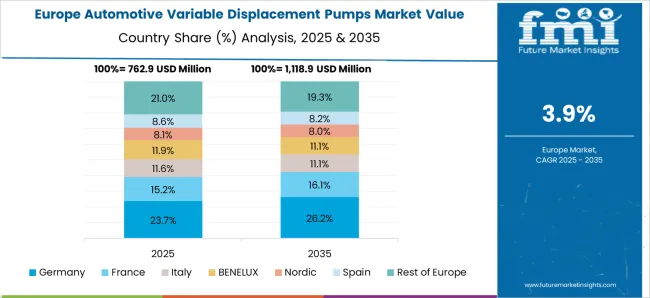

The market peaks in 2035 at USD 4.9 billion, highlighting the cumulative impact of incremental gains in light commercial vehicles (LCVs) and passenger cars, as well as increasing integration with advanced electronic control systems. Regional dynamics show Europe and North America leading with high-value, technologically advanced pump adoption, while Asia-Pacific experiences consistent growth fueled by rising automotive production and electrification trends. Technological improvements, such as lightweight designs, optimized hydraulic efficiency, and compatibility with hybrid systems.

The peak-to-trough spread is relatively narrow, indicating a mature, low-volatility market, where incremental technological innovations and regulatory incentives maintain consistent upward movement. This steady trajectory underscores the market’s stability and attractiveness for long-term supplier investments and OEM partnerships.

| Metric | Value |

|---|---|

| Automotive Variable Displacement Pumps Market Estimated Value in (2025 E) | USD 3.2 billion |

| Automotive Variable Displacement Pumps Market Forecast Value in (2035 F) | USD 4.9 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

The automotive variable displacement pumps market is primarily driven by the automotive power steering market, which accounts for approximately 40–45% of total demand, as these pumps are increasingly deployed in hydraulic and electro-hydraulic steering systems for passenger and commercial vehicles. The automotive engine systems market contributes around 20–22%, reflecting demand for engine-driven pumps that improve fuel efficiency, fluid circulation, and emission control.

The hydraulic systems and components market holds roughly 15–17%, driven by integration with hydraulic actuators, valves, and motors requiring variable displacement pumps for optimal performance. The commercial vehicle market contributes approximately 10–12%, as trucks, buses, and utility vehicles increasingly rely on heavy-duty steering and hydraulic systems. Lastly, the automotive aftermarket and maintenance market accounts for 5–6%, supported by the replacement and servicing of pumps in both passenger and commercial vehicles. These parent markets define the technological, operational, and integration ecosystem of the automotive variable displacement pumps market, enabling automakers and service providers to enhance steering performance, hydraulic efficiency, and vehicle reliability across global automotive segments.

The automotive variable displacement pumps market is witnessing steady growth, supported by increasing emphasis on fuel efficiency, emission reduction, and overall vehicle performance optimization. Demand has been reinforced by stringent regulatory frameworks compelling automakers to integrate advanced pump systems that enhance energy efficiency and reduce mechanical losses.

Market expansion is further facilitated by rising global automotive production, particularly in emerging economies, coupled with the continuous shift toward electrified and hybrid powertrains where optimized thermal and lubrication management systems are essential. Technological advancements in pump design and materials are improving durability, reducing noise levels, and enabling adaptive flow control, thereby strengthening adoption across various vehicle segments.

Strategic collaborations between OEMs and pump manufacturers are streamlining integration into next-generation vehicle platforms. Over the forecast period, sustained R&D investments, expansion of production capabilities, and the growing aftermarket potential are expected to drive stable revenue growth, positioning the market as a key enabler of automotive efficiency and compliance with evolving performance standards.

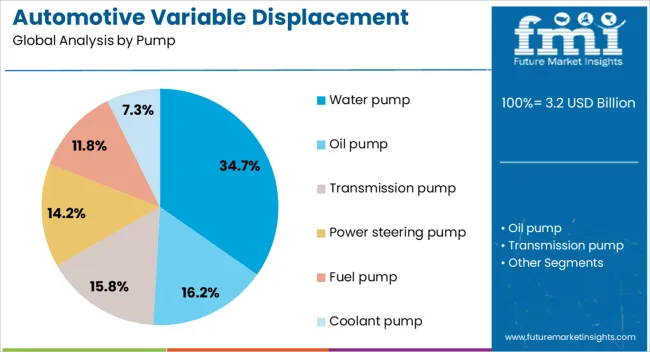

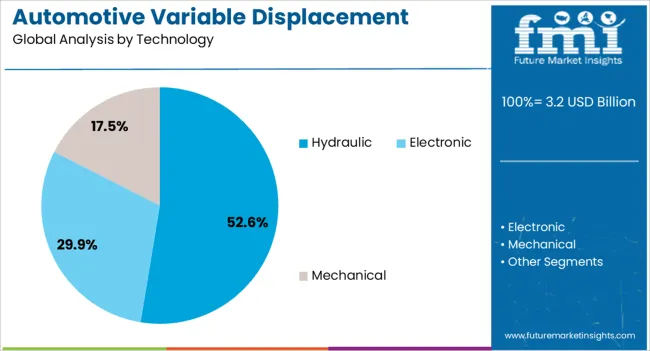

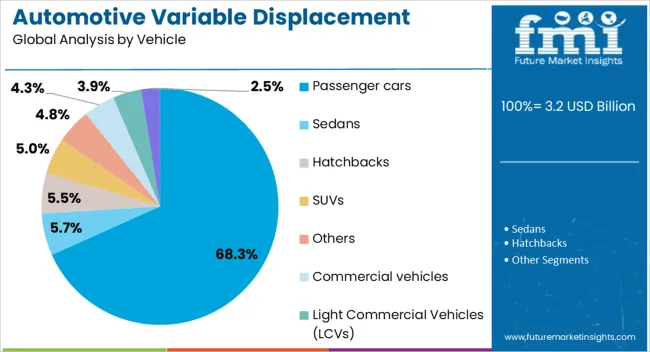

The automotive variable displacement pumps market is segmented by pump, technology, vehicle, material, application, and geographic regions. By pump, automotive variable displacement pumps market is divided into Water pump, Oil pump, Transmission pump, Power steering pump, Fuel pump, and Coolant pump. In terms of technology, automotive variable displacement pumps market is classified into Hydraulic, Electronic, and Mechanical. Based on vehicle, automotive variable displacement pumps market is segmented into Passenger cars, Sedans, Hatchbacks, SUVs, Others, Commercial vehicles, Light Commercial Vehicles (LCVs), and Heavy Commercial Vehicles (HCVs). By material, automotive variable displacement pumps market is segmented into Aluminum, Steel, Cast Iron, and Composite Materials. By application, automotive variable displacement pumps market is segmented into Power steering systems, Transmission systems, Engine systems, Fuel management systems, Brake systems, and Others. Regionally, the automotive variable displacement pumps industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The water pump segment, holding 34.70% of the pump category, remains the dominant type due to its essential role in regulating engine temperature and ensuring optimal operating conditions. Its market leadership is sustained by widespread applicability across internal combustion, hybrid, and certain electric vehicle platforms.

Continuous innovations in variable displacement water pump technology have enabled real-time flow adjustments, improving fuel efficiency and reducing parasitic losses. The adoption of lightweight materials and advanced sealing systems has enhanced durability and minimized maintenance requirements, contributing to higher operational efficiency.

Increasing production volumes in the passenger car segment, coupled with rising consumer demand for vehicles with improved thermal management systems, have reinforced the segment’s growth trajectory. In addition, compliance with increasingly strict emission standards has driven OEMs to favor advanced water pump designs, ensuring the segment’s continued prominence within the automotive variable displacement pumps market.

The hydraulic segment, accounting for 52.60% of the technology category, has maintained its leadership due to its proven efficiency, reliability, and adaptability in variable displacement applications. This dominance is driven by the ability of hydraulic systems to deliver precise flow control in response to engine load demands, resulting in improved fuel economy and reduced CO₂ emissions.

Market growth is supported by widespread OEM adoption, particularly in mid- to high-volume vehicle platforms where cost-effectiveness and performance consistency are critical. Advances in hydraulic system design, including integrated control modules and improved actuator responsiveness, have enhanced overall pump performance.

The segment also benefits from established manufacturing infrastructure, ensuring scalability and competitive pricing. With regulatory pressure encouraging the integration of efficient auxiliary systems, the hydraulic technology segment is expected to maintain a leading role in next-generation automotive designs, further solidifying its position within the overall market structure.

The passenger cars segment, representing 68.30% of the vehicle category, leads the market owing to its substantial share of global automotive production and the high penetration of variable displacement pump technology in this segment. Demand is fueled by the need for efficient cooling, lubrication, and hydraulic systems that meet stringent fuel economy and emission regulations.

Continuous growth in passenger car sales, particularly in Asia-Pacific and other emerging markets, has bolstered demand for advanced pump solutions. The segment benefits from broad adoption across both conventional and hybrid vehicle platforms, with OEMs integrating these systems to enhance overall vehicle efficiency and performance.

Technological innovations, such as electronically controlled pumps and adaptive flow management, have increased operational precision, further supporting their application in modern passenger cars. The combination of large-scale production volumes, regulatory compliance requirements, and evolving consumer expectations for performance and reliability ensures the passenger car segment’s continued dominance in the automotive variable displacement pumps market.

The automotive variable displacement pumps market is expanding as OEMs and Tier-1 suppliers prioritize fuel efficiency, adaptive performance, and integration with hybrid and conventional powertrains. Demand is driven by passenger cars, commercial vehicles, and heavy-duty trucks requiring precise fluid management, reduced parasitic losses, and enhanced steering or engine support. Challenges include high system costs, technical complexity, and competition from fully electric or fixed-displacement solutions. Opportunities exist in lightweight materials, retrofitting, and integration with advanced driver-assistance systems (ADAS). Trends highlight variable flow control, energy optimization, and adaptive performance under diverse operating conditions.

Automakers increasingly adopt variable displacement pumps to balance performance and energy efficiency across ICE, hybrid, and transitional powertrains. These pumps adjust flow based on load requirements, reducing energy loss and improving fuel economy while maintaining system performance for steering, braking, or engine lubrication. Passenger vehicles benefit from lighter steering effort and lower emissions, whereas commercial and heavy-duty vehicles leverage robust hydraulic support under variable load conditions. Regulatory mandates for reduced fuel consumption, coupled with growing hybridization and electrification trends, accelerate adoption. Key priorities include reliability, smooth operation, and integration with vehicle electronic control units (ECUs), positioning variable displacement pumps as critical components in modern adaptive automotive systems.

Market constraints include higher initial investment, maintenance complexity, and energy-intensive production of precision hydraulic components. Supply chain dependence on high-quality metals, sensors, and electronic controllers can affect manufacturing and delivery schedules. Regulatory compliance for emissions, safety, and performance standards adds operational challenges, particularly for hybrid and heavy-duty applications. Technical challenges involve ensuring flow accuracy, pressure stability, wear resistance, and long-term reliability under variable operating conditions. Buyers increasingly seek suppliers offering certified pumps, robust after-sales support, spare parts availability, and engineering guidance to ensure optimal system performance, minimize downtime, and comply with regional automotive standards.

Opportunities exist in lightweight alloys, modular pump configurations, and hybrid-compatible designs to improve efficiency and reduce vehicle weight. Integration with ADAS, regenerative braking, and semi-autonomous systems expands application potential, while retrofitting existing fleets offers additional market growth. Regional expansion in Asia-Pacific, Europe, and North America, driven by fuel efficiency regulations and growing hybrid vehicle adoption, supports further market penetration. Suppliers offering customizable, durable, and technically supported pumps are well positioned to capitalize on increasing demand across OEMs, Tier-1 suppliers, and aftermarket channels. Collaboration with vehicle manufacturers enhances system integration and performance optimization.

The market is trending toward smart pump systems with variable flow control, adaptive performance, and real-time electronic monitoring. Energy optimization is increasingly critical to reduce fuel consumption and emissions in ICE, hybrid, and transitional powertrains. Compact, low-noise, and high-durability designs are gaining traction across passenger, commercial, and heavy-duty vehicles. Integration with ECUs and predictive maintenance platforms enhances reliability and operational efficiency. Suppliers delivering high-performance, application-ready, and digitally supported variable displacement pumps are best positioned to meet the evolving requirements of global automotive manufacturers and fleet operators.

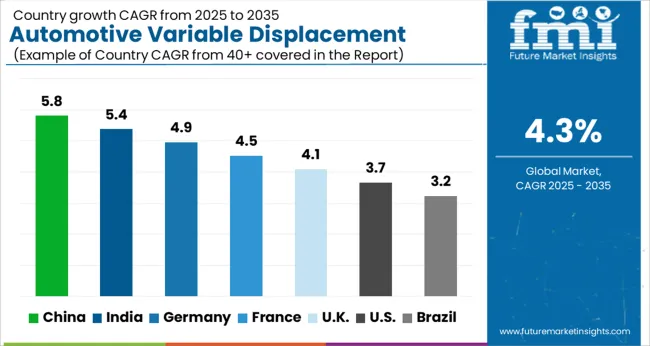

| Country | CAGR |

|---|---|

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| France | 4.5% |

| UK | 4.1% |

| USA | 3.7% |

| Brazil | 3.2% |

The global automotive variable displacement pumps market is projected to grow at a CAGR of 4.3% from 2025 to 2035. China leads at 5.8%, followed by India at 5.4%, France at 4.5%, the UK at 4.1%, and the USA at 3.7%. Growth is driven by rising demand for fuel-efficient vehicles, hybrid and electric powertrains, and commercial fleet optimization. Adoption of electronically controlled, high-precision pumps, global technology collaborations, and government initiatives promoting low-emission vehicles further accelerate market expansion. Fleet applications, energy optimization, and advanced hydraulic integration remain key catalysts across passenger and commercial vehicle segments worldwide. The analysis spans over 40+ countries, with the leading markets shown below.

The automotive variable displacement pumps market in China is projected to grow at a CAGR of 5.8% from 2025 to 2035, driven by expanding automotive production, EV adoption, and demand for fuel-efficient vehicles. Domestic OEMs are increasingly integrating variable displacement pumps into hydraulic steering, cooling, and fuel systems to improve energy efficiency and reduce emissions. Industrial hubs in Shanghai, Guangdong, and Jiangsu support R&D, manufacturing, and testing of high-performance pumps. Collaborations with global suppliers facilitate the adoption of advanced pump technologies, including electronically controlled variable displacement systems and high-precision components. Growth is also fueled by consumer preference for vehicles with optimized fuel consumption, quieter operation, and enhanced reliability. Government policies promoting EVs, hybrid vehicles, and energy-efficient technologies further stimulate market demand.

The automotive variable displacement pumps market in India is expected to grow at a CAGR of 5.4% between 2025 and 2035, supported by rising vehicle production, adoption of hybrid and electric powertrains, and a growing commercial vehicle segment. Domestic OEMs and pump manufacturers are focusing on fuel-efficient and compact variable displacement pumps for steering, transmission, and hydraulic applications. Industrial clusters in Pune, Chennai, and Gurugram facilitate manufacturing, testing, and after-sales support. Collaborations with international technology providers help implement electronically controlled pumps and high-precision components, meeting global quality standards. Government initiatives promoting EV adoption, energy efficiency, and emission reduction encourage manufacturers to integrate variable displacement pump systems in passenger and commercial vehicles. Rising consumer awareness of vehicle performance, fuel savings, and operational reliability is also fueling adoption.

The automotive variable displacement pumps market in France is projected to expand at a CAGR of 4.5% from 2025 to 2035, fueled by demand for fuel-efficient passenger vehicles, hybrid models, and commercial fleet optimization. French manufacturers focus on high-precision, electronically controlled variable displacement pumps that improve vehicle efficiency and reduce energy consumption. Collaborations with European technology providers enable adoption of advanced hydraulic systems, including integrated control units and lightweight designs. The market is supported by stringent European emission and fuel-efficiency regulations, driving innovation in pump technology. Industrial hubs in Île-de-France, Auvergne-Rhône-Alpes, and Nouvelle-Aquitaine facilitate R&D, production, and testing for both OEMs and aftermarket applications. Growing consumer preference for low-emission vehicles and reliable hydraulic systems further stimulates demand. Commercial vehicle operators also invest in variable displacement pumps for efficiency, reduced operational costs, and longer maintenance intervals.

The UK market is forecasted to expand at a CAGR of 4.1% from 2025 to 2035, driven by fuel-efficient vehicle designs, hybrid and electric powertrains, and increased commercial fleet adoption. Variable displacement pumps are widely integrated into hydraulic, steering, and transmission systems to improve energy efficiency and reduce operational costs. UK OEMs and component manufacturers focus on compact, high-performance, and electronically controlled pumps for passenger and commercial vehicles. Industrial hubs in the Midlands and northern England provide manufacturing, testing, and aftermarket support. Collaborations with international suppliers facilitate the integration of lightweight and energy-optimized pumps into modern vehicles. Rising consumer awareness of fuel economy, lower emissions, and reliable hydraulic performance further supports adoption. Commercial fleets and logistic operators increasingly rely on variable displacement pumps to reduce fuel consumption and enhance maintenance schedules.

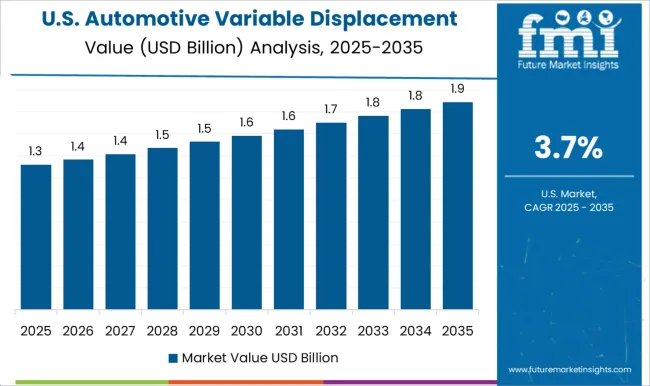

The USA market is projected to expand at a CAGR of 3.7% from 2025 to 2035, driven by fuel-efficient passenger cars, commercial vehicles, and hybrid/electric powertrains. Variable displacement pumps are increasingly used in hydraulic, steering, and transmission applications to optimize energy usage, reduce fuel consumption, and enhance vehicle reliability. OEMs and component suppliers in Michigan, Ohio, and Texas focus on electronically controlled, high-precision pumps with robust design and durability. Collaborations with international technology providers enable integration of advanced sensors, control units, and lightweight components. Fleet operators and logistics companies are adopting variable displacement pumps to enhance operational efficiency, reduce maintenance costs, and extend component life. Consumer preference for fuel savings, quieter operation, and low-emission vehicles further supports market expansion.

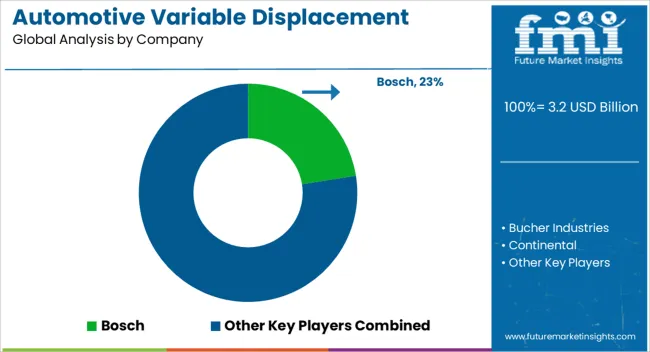

The automotive variable displacement pumps market is driven by growing demand for fuel-efficient powertrains, hybrid and electric vehicles, and advanced hydraulic systems in steering, braking, and transmission applications. Variable flow pumps reduce energy loss, optimize hydraulic system performance, and improve overall engine efficiency, making them essential for modern vehicle architectures. Market growth is further supported by stricter emission regulations, lightweight vehicle initiatives, and increased adoption of electro-hydraulic systems in both passenger and commercial vehicles. Rising focus on electrification and energy recovery technologies is also boosting demand for high-precision hydraulic components. Competition in the market is defined by flow control accuracy, energy efficiency, durability, and integration flexibility. Bosch leads with high-performance pumps offering low noise, compact design, and robust temperature tolerance. Continental and Eaton Corporation target hybrid powertrains and integrated engine systems with variable displacement solutions.

Bucher Industries and Danfoss differentiate through electro-hydraulic designs and modular configurations for commercial, off-highway, and specialty vehicles. GKN Automotive, Magna International, and Valeo compete via lightweight, compact pumps supporting fuel-efficient and electrified systems. Parker Hannifin and Schaeffler AG focus on advanced sealing technologies, corrosion resistance, and long service life to meet demanding operational conditions.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.2 Billion |

| Pump | Water pump, Oil pump, Transmission pump, Power steering pump, Fuel pump, and Coolant pump |

| Technology | Hydraulic, Electronic, and Mechanical |

| Vehicle | Passenger cars, Sedans, Hatchbacks, SUVs, Others, Commercial vehicles, Light Commercial Vehicles (LCVs), and Heavy Commercial Vehicles (HCVs) |

| Material | Aluminum, Steel, Cast Iron, and Composite Materials |

| Application | Power steering systems, Transmission systems, Engine systems, Fuel management systems, Brake systems, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bosch, Bucher Industries, Continental, Danfoss, Eaton Corporation, GKN Automotive, Magna International, Parker Hannifin, Schaeffler AG, and Valeo |

| Additional Attributes | Dollar sales by pump type (axial piston, bent axis, swash plate), displacement type (variable, fixed), and application (passenger vehicles, LCVs, HCVs, hybrid & electric vehicles). Demand is driven by fuel efficiency regulations, electrification trends, and advanced hydraulic system adoption. Regional trends indicate strong demand in Europe and North America due to stringent emission standards, while Asia-Pacific shows rapid growth driven by increasing automotive production and hybrid/electric vehicle adoption. |

The global automotive variable displacement pumps market is estimated to be valued at USD 3.2 billion in 2025.

The market size for the automotive variable displacement pumps market is projected to reach USD 4.9 billion by 2035.

The automotive variable displacement pumps market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in automotive variable displacement pumps market are water pump, oil pump, transmission pump, power steering pump, fuel pump and coolant pump.

In terms of technology, hydraulic segment to command 52.6% share in the automotive variable displacement pumps market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA