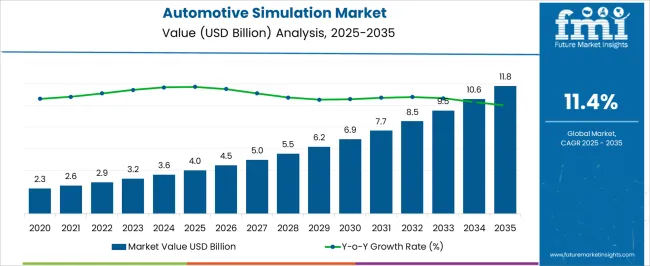

The automotive simulation market is projected to expand from USD 4.0 billion in 2025 to USD 11.8 billion by 2035, reflecting a robust CAGR of 11.4%. Between 2025 and 2030, the market grows from USD 4.0 billion to USD 6.9 billion, indicating accelerated adoption of simulation technologies, particularly in passenger vehicles and electric mobility.

Key drivers during this period include increasing demand for virtual prototyping, reduction in physical testing costs, and rising integration of AI and machine learning for predictive vehicle modeling. OEMs and Tier-1 suppliers invest heavily in real-time simulations for advanced driver-assistance systems (ADAS), crash testing, and autonomous vehicle validation. From 2030 to 2035, the market further accelerates from USD 6.9 billion to USD 11.8 billion, driven by the rapid shift toward connected, autonomous, shared, and electric (CASE) mobility. Regulatory pressure for safety compliance, carbon emission reduction, and lightweight vehicle designs increases reliance on digital twin technologies and multi-physics simulations. Asia-Pacific, particularly China and India, contributes significantly, supported by expanding automotive production and urban mobility infrastructure.

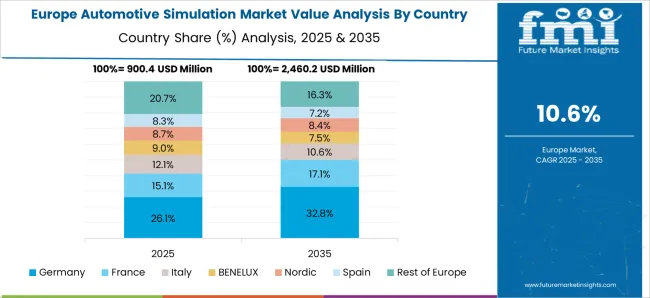

North America and Europe continue to drive innovation through R&D investments in scenario-based testing, virtual reality, and cloud-based simulation platforms. This decade-long growth emphasizes the strategic importance of simulation in reducing development cycles, cost, and time-to-market for next-generation vehicles.

| Metric | Value |

|---|---|

| Automotive Simulation Market Estimated Value in (2025 E) | USD 4.0 billion |

| Automotive Simulation Market Forecast Value in (2035 F) | USD 11.8 billion |

| Forecast CAGR (2025 to 2035) | 11.4% |

The automotive simulation market is strongly influenced by five interconnected parent industries, each driving demand and technological adoption. The automotive design and engineering software market holds the largest share at 30%, as simulation tools are essential for CAD, CAE, and product lifecycle management, enabling engineers to develop vehicles with enhanced performance, efficiency, and reliability. The autonomous vehicle development market contributes 25%, since simulations allow virtual testing of sensors, AI algorithms, and control systems, reducing the need for costly real-world trials and accelerating development timelines.

The vehicle safety and regulatory compliance market accounts for 20%, with crash simulations, structural testing, and durability assessments critical for meeting strict international safety standards and ensuring passenger protection. The connected vehicle and mobility technologies market makes up 15%, as simulation environments are used to test V2X communication, telematics, and infotainment systems, enabling manufacturers to address complex connectivity requirements before deployment.

The electrification and powertrain innovation market is expected to grow by 10%, driven by the need for testing battery performance, thermal management, and electric motor operation in controlled scenarios, which reduces development risks.

The automotive simulation market is witnessing robust growth, supported by the increasing adoption of advanced design, testing, and validation processes across the automotive value chain. Rising demand for cost-efficient product development, reduced prototyping cycles, and improved vehicle performance assessment is driving the shift toward simulation technologies.

Automakers and suppliers are leveraging simulation platforms to enhance precision in engineering, ensure regulatory compliance, and accelerate time-to-market while reducing physical testing costs. Technological advancements, such as AI integration, cloud-based simulation, and real-time analytics, are improving simulation capabilities, enabling complex scenario modeling and better predictive insights.

The market is also benefiting from the rising complexity of modern vehicles, including electric and autonomous models, which require extensive digital testing for safety, durability, and performance. Over the forecast period, continued investments in R&D, digital twin integration, and expansion into emerging markets are expected to sustain high adoption rates, solidifying simulation as a core enabler of innovation in the automotive industry.

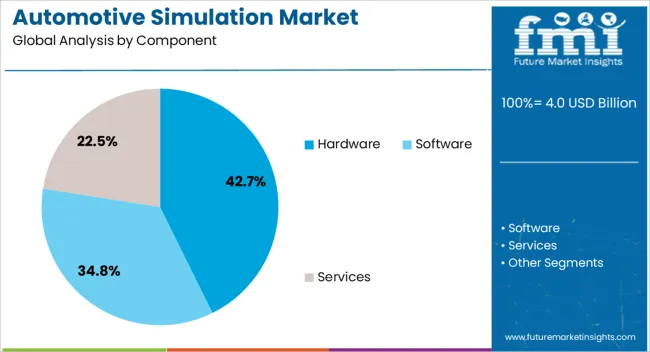

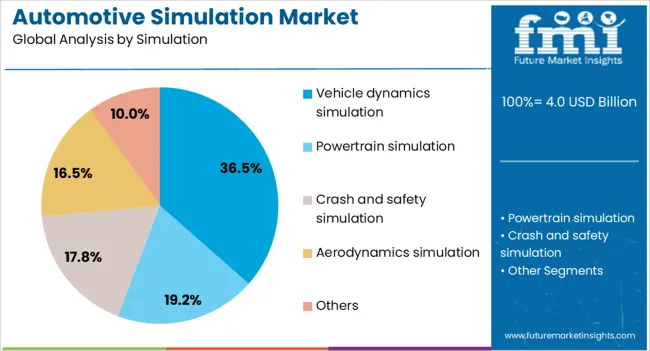

The automotive simulation market is segmented by component, simulation, application, end use, vehicle, and geographic regions. By component, automotive simulation market is divided into Hardware, Software, and Services. In terms of simulation, automotive simulation market is classified into Vehicle dynamics simulation, Powertrain simulation, Crash and safety simulation, Aerodynamics simulation, and Others.

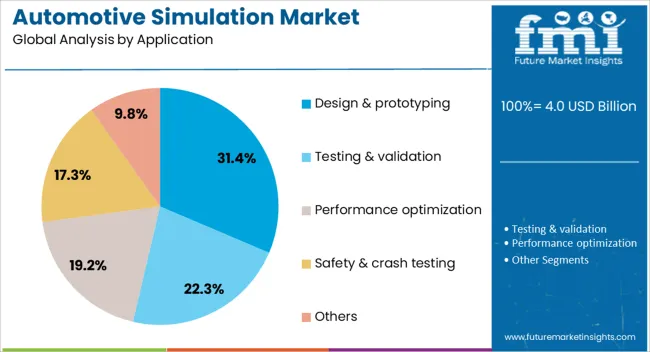

Based on application, automotive simulation market is segmented into Design & prototyping, Testing & validation, Performance optimization, Safety & crash testing, and Others. By end use, automotive simulation market is segmented into Original equipment manufacturers, Automotive software & tool providers, Government and regulatory agencies, and Research & development institutes. By vehicle, automotive simulation market is segmented into Passenger car, SUV, Sedan, Hatchback, Commercial vehicle, LCV, HCV, and Off-highway vehicle. Regionally, the automotive simulation industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hardware segment, holding 42.70% of the component category, has retained its leadership due to its critical role in delivering the computational power and real-time processing necessary for high-fidelity simulations. Advanced simulation hardware enables the execution of complex modeling tasks, supporting faster and more accurate design validation.

The segment’s growth has been reinforced by the increasing need for high-performance computing in applications such as autonomous vehicle testing, electric drivetrain optimization, and advanced driver-assistance system (ADAS) development. Strategic investments in next-generation processors, GPUs, and integrated simulation systems are enhancing scalability and operational efficiency.

Additionally, the rise in cloud-based simulation has driven hybrid infrastructure demand, where high-capacity hardware complements virtual environments. Continuous improvements in processing speed, energy efficiency, and compatibility with evolving simulation software are ensuring the hardware segment’s sustained dominance in the automotive simulation market.

Vehicle dynamics simulation, accounting for 36.50% of the simulation category, has remained dominant due to its indispensable role in evaluating handling, stability, suspension, and performance under diverse operating conditions. This simulation type enables manufacturers to optimize chassis design, improve ride comfort, and ensure safety compliance without extensive reliance on physical prototypes.

The increasing complexity of vehicle platforms, particularly in electric and autonomous models, has amplified the importance of accurate dynamic modeling. Advancements in real-time physics engines, AI-enhanced prediction models, and integrated multi-domain simulation have strengthened this segment’s capabilities.

Its adoption is further supported by cost savings in testing, reduced development cycles, and enhanced customization options for specific vehicle classes. As regulatory bodies continue to emphasize safety and performance standards, vehicle dynamics simulation is expected to remain a core engineering tool, underpinning its leading market share within the simulation segment.

Design and prototyping, with 31.40% of the application category, has maintained its leadership position by enabling manufacturers to accelerate product development cycles and reduce costs through virtual validation. This application area allows engineers to visualize and refine vehicle designs in a virtual environment, identifying potential flaws before physical production begins.

The ability to iterate rapidly and test multiple configurations has become essential in the competitive automotive landscape, particularly as vehicle models incorporate new materials, propulsion systems, and advanced electronics. The segment’s growth is being bolstered by the adoption of immersive technologies such as VR and AR, which enhance collaborative design processes across geographically dispersed teams.

Integration with digital twin frameworks further optimizes workflows, improves accuracy, and reduces rework. As the pressure to deliver innovative, compliant, and cost-effective vehicles intensifies, design and prototyping are expected to continue as a leading application within the automotive simulation market.

The automotive simulation market is growing as OEMs, Tier-1 suppliers, and research institutions adopt advanced virtual testing for design, safety, and performance optimization. Demand is driven by electrification, autonomous driving development, and regulatory compliance requiring extensive vehicle validation. Challenges include high software costs, integration complexity, and ensuring data accuracy across diverse systems.

Opportunities exist in cloud-based platforms, AI-driven predictive modeling, and digital twin applications for faster prototyping and reduced physical testing. Trends highlight real-time simulation for autonomous systems, scalable virtual environments, and cross-industry partnerships between automakers and software providers.

Automakers are increasingly relying on simulation tools to accelerate vehicle design, reduce prototyping costs, and ensure compliance with stringent safety and performance standards. These tools support applications such as crash testing, aerodynamics, thermal management, battery optimization, and autonomous vehicle algorithm validation. The shift toward electric vehicles and ADAS requires high-precision models that replicate real-world conditions with accuracy. By replacing a portion of costly physical testing, simulation enables faster time-to-market and improved design flexibility. With growing emphasis on digital validation in global R&D programs, simulation platforms are becoming indispensable for achieving cost efficiency, safety assurance, and technological innovation.

The market faces constraints from the high upfront costs of advanced simulation software and the technical expertise required for implementation. Integration challenges with legacy systems and ensuring compatibility across different vehicle platforms add complexity. Data quality and accuracy are critical, as simulation errors can result in costly design flaws. Compliance with regional safety and emission regulations requires continual updates to simulation models, raising development overhead. Supply chain issues in hardware, including GPUs and high-performance servers, can limit adoption in resource-constrained organizations. Automakers increasingly look for scalable, validated, and regulatory-compliant platforms backed by technical training and long-term vendor support.

Significant opportunities exist in cloud-based simulation platforms that reduce hardware dependency and enable collaborative engineering across geographies. AI-driven predictive analytics enhance design optimization and fault detection, while digital twins allow real-time monitoring and lifecycle management of vehicles. Expansion of autonomous and connected vehicle programs across North America, Europe, and Asia-Pacific drives demand for high-fidelity virtual environments. Suppliers offering tailored simulation solutions for EVs, ADAS, and smart mobility applications are well positioned to capture growth. Partnerships with automotive OEMs, chipmakers, and mobility startups strengthen integration, scalability, and time-to-market benefits, creating long-term opportunities for simulation providers.

The market is trending toward real-time simulation for autonomous driving and connected mobility, with digital twin technology gaining prominence for predictive performance insights. Integration of simulation with hardware-in-the-loop (HIL) and software-in-the-loop (SIL) testing improves validation speed and accuracy. Cloud-enabled platforms support distributed design and reduce reliance on physical prototypes. Electric vehicle growth accelerates demand for battery thermal simulation, charging infrastructure modeling, and energy efficiency testing. Collaboration between OEMs and simulation software vendors fosters innovation in digital ecosystems. Suppliers delivering scalable, real-time, and AI-enhanced simulation platforms are best positioned to meet the evolving demands of the automotive industry.

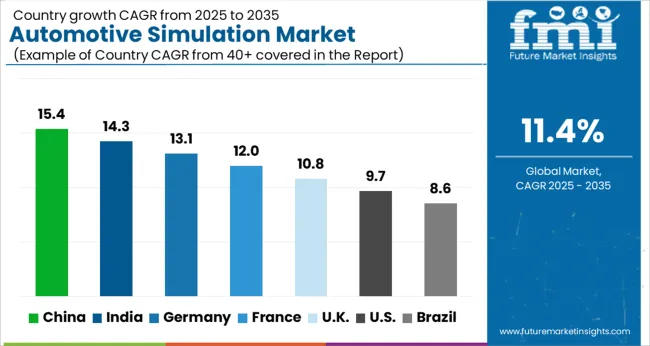

| Country | CAGR |

|---|---|

| China | 15.4% |

| India | 14.3% |

| Germany | 13.1% |

| France | 12.0% |

| UK | 10.8% |

| USA | 9.7% |

| Brazil | 8.6% |

The global automotive simulation market is projected to grow at a CAGR of 11.4% from 2025 to 2035. China leads with 15.4%, followed by India (14.3%), France (12.0%), the UK (10.8%), and the USA (9.7%). Growth is driven by EV adoption, autonomous driving technologies, vehicle safety testing, and digital prototyping. OEMs and suppliers are increasingly integrating AI, machine learning, and digital twins into simulation workflows to reduce development costs, accelerate time-to-market, and optimize vehicle performance. Multi-physics simulations and virtual prototyping are widely adopted across passenger, commercial, and hybrid vehicle segments, supporting rapid global market expansion. The analysis spans over 40+ countries, with the leading markets shown below.

The automotive simulation market in China is projected to grow at a CAGR of 15.4% from 2025 to 2035, driven by rapid adoption of electric vehicles (EVs), advanced driver-assistance systems (ADAS), and autonomous driving technologies. OEMs and Tier-1 suppliers are increasingly investing in simulation software for vehicle dynamics, crash testing, and virtual prototyping to reduce physical testing costs and accelerate time-to-market. Automotive R&D centers in Shanghai, Beijing, and Guangzhou are collaborating with software providers to integrate AI and digital twins into simulation workflows. Simulation adoption is also supported by government incentives promoting smart mobility and EV manufacturing. Suppliers are offering modular and scalable simulation solutions that support multi-physics modeling, real-time vehicle dynamics, and hybrid powertrain testing. Growing focus on reducing product development cycles, improving safety standards, and optimizing vehicle performance further reinforces market expansion in China.

The automotive simulation market in India is expected to grow at a CAGR of 14.3% from 2025 to 2035, driven by increasing investments in EVs, connected vehicles, and vehicle safety testing. OEMs and automotive component manufacturers are leveraging simulation for vehicle dynamics, crashworthiness, and powertrain optimization to accelerate product development. Tier-1 suppliers are collaborating with software providers to implement multi-physics simulations and digital twin solutions, reducing dependence on costly prototypes. Major automotive clusters in Pune, Chennai, and Gurgaon provide strong infrastructure for simulation testing and validation. Government policies supporting EV adoption, emission reductions, and safety regulations are boosting demand for digital design and testing solutions. Growing R&D centers, coupled with rising automation in vehicle development, are further accelerating the adoption of simulation tools across passenger cars, commercial vehicles, and two-wheelers in India.

The automotive simulation market in France is forecasted to grow at a CAGR of 12.0% from 2025 to 2035, supported by high adoption of electric, hybrid, and autonomous vehicles. French OEMs and suppliers rely on simulation software for crash analysis, aerodynamic optimization, and battery performance testing. R&D centers in Paris, Lyon, and Toulouse focus on integrating multi-physics simulations, AI, and predictive analytics to improve vehicle safety, efficiency, and performance. Collaborations with European software firms enable access to advanced tools for vehicle dynamics, thermal management, and emission compliance. Government incentives for clean mobility and safety standards are increasing simulation adoption in both passenger and commercial vehicle segments. Automotive suppliers are using virtual prototyping to reduce development costs and accelerate time-to-market, particularly for high-end and niche vehicles.

The UK automotive simulation market is projected to grow at a CAGR of 10.8% from 2025 to 2035, driven by adoption of EVs, autonomous driving technologies, and stricter safety regulations. Automotive manufacturers are increasingly leveraging simulation tools for crash testing, aerodynamics, and thermal management to optimize vehicle performance and comply with regulatory standards. Software adoption is also increasing among suppliers for advanced driver-assistance systems, powertrain efficiency, and hybrid vehicle development. R&D clusters in the Midlands and London provide access to high-tech simulation labs and skilled engineering talent. Collaborative efforts with global software vendors enable integration of multi-physics simulations, digital twins, and AI-driven predictive modeling. Market expansion is further reinforced by the need to reduce physical prototyping costs, accelerate time-to-market, and enhance vehicle safety and reliability.

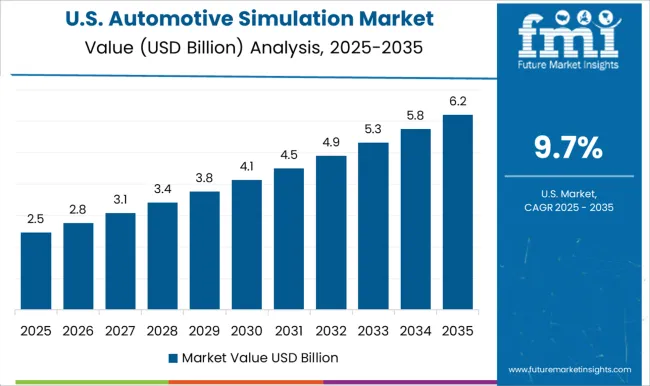

The USA automotive simulation market is projected to grow at a CAGR of 9.7% from 2025 to 2035, driven by advancements in EVs, autonomous driving, and connected vehicles. OEMs and Tier-1 suppliers are heavily investing in simulation software for vehicle dynamics, safety testing, and thermal management. Automotive clusters in Michigan, California, and Ohio serve as key hubs for integrating AI, machine learning, and digital twin technology into virtual prototyping and crash simulations. Adoption is further fueled by stringent safety standards, emission regulations, and the need to accelerate product development cycles while reducing physical testing costs. Suppliers are providing scalable, modular, and cloud-enabled simulation solutions for real-time analysis and predictive modeling across passenger cars, commercial vehicles, and EVs. Collaborative R&D with software providers is increasing adoption and innovation in automotive simulation tools.

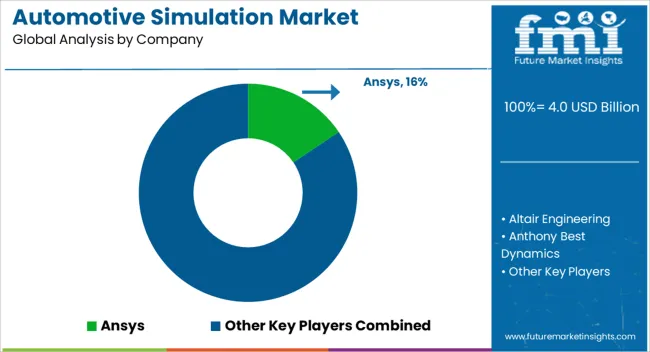

The automotive simulation market is expanding rapidly, driven by increasing vehicle complexity, electrification, and the need for shorter development cycles. Simulation tools allow automakers and suppliers to design, test, and validate components virtually, reducing physical prototyping, development costs, and time to market. Rising demand for electric vehicles (EVs), autonomous driving systems, and connected mobility solutions further fuels adoption, as simulation supports battery management, crash safety, thermal management, and powertrain optimization. Key players in the automotive simulation market include Ansys, Altair Engineering, Anthony Best Dynamics, Autodesk, AVL List, Dassault Systèmes, Design Simulation Technologies, dSPACE, ESI Group, and Gamma Technologies.

Ansys leads with multi-physics simulation suites covering structural, thermal, fluid, and electromagnetic analyses, while Altair focuses on lightweighting, topology optimization, and finite element analysis for performance and fuel efficiency. Dassault Systèmes provides virtual twin and 3DEXPERIENCE platforms for end-to-end vehicle design. dSPACE and Anthony Best Dynamics specialize in hardware-in-the-loop (HIL) and real-time simulation for ADAS and autonomous testing. Autodesk delivers CAD-integrated simulation solutions for rapid design iterations, and AVL List supports powertrain and driveline modeling for conventional and electric vehicles.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.0 Billion |

| Component | Hardware, Software, and Services |

| Simulation | Vehicle dynamics simulation, Powertrain simulation, Crash and safety simulation, Aerodynamics simulation, and Others |

| Application | Design & prototyping, Testing & validation, Performance optimization, Safety & crash testing, and Others |

| End Use | Original equipment manufacturers, Automotive software & tool providers, Government and regulatory agencies, and Research & development institutes |

| Vehicle | Passenger car, SUV, Sedan, Hatchback, Commercial vehicle, LCV, HCV, and Off-highway vehicle |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ansys, Altair Engineering, Anthony Best Dynamics, Autodesk, AVL List, Dassault, Design Simulation Technologies, dSPACE, ESI Group, and Gamma Technologies |

| Additional Attributes | Dollar sales by simulation type (structural, thermal, fluid dynamics, ADAS, powertrain), deployment mode (on-premise, cloud-based), and application (passenger vehicles, commercial vehicles, EVs, autonomous systems). Demand is driven by automotive electrification, safety regulations, autonomous vehicle development, and the need for reduced design cycles. Regional trends show strong adoption in North America and Europe, while Asia-Pacific exhibits rapid growth due to increasing EV production and expanding automotive R&D infrastructure. |

The global automotive simulation market is estimated to be valued at USD 4.0 billion in 2025.

The market size for the automotive simulation market is projected to reach USD 11.8 billion by 2035.

The automotive simulation market is expected to grow at a 11.4% CAGR between 2025 and 2035.

The key product types in automotive simulation market are hardware, high-performance computers, simulation workstations, specialized simulation servers, graphics processing unit (gpu), software, modeling & design simulation tools, performance simulation platforms, virtual testing software, visualization solutions and services.

In terms of simulation, vehicle dynamics simulation segment to command 36.5% share in the automotive simulation market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA