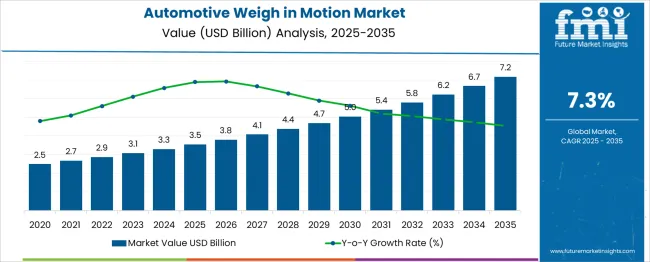

The automotive weigh-in-motion market is projected to grow from USD 3.5 billion in 2025 to USD 7.2 billion by 2035, recording a CAGR of 7.3% during this period. From 2025 to 2030, the market is expected to expand from USD 3.5 billion to USD 5.0 billion, highlighting steady adoption driven by infrastructure modernization and the increasing need for traffic load management.

Year-on-year analysis shows consistent growth, with values rising to USD 3.8 billion in 2026 and USD 4.1 billion in 2027, supported by regulatory initiatives focused on road safety and weight compliance monitoring. By 2028, the market is forecasted to reach USD 4.4 billion, followed by USD 4.7 billion in 2029 and USD 5.0 billion in 2030. Wider integration with intelligent transportation systems and the application of IoT and AI in weigh-in-motion systems are expected to enhance accuracy and operational efficiency. Adoption by highway authorities for dynamic vehicle monitoring and enforcement will remain a key growth factor. These developments position automotive weigh-in-motion systems as a critical component of smart traffic management solutions, ensuring reduced road damage, compliance adherence, and improved logistics flow across regional and national road networks.

| Metric | Value |

|---|---|

| Automotive Weigh-In Motion Market Estimated Value in (2025 E) | USD 3.5 billion |

| Automotive Weigh-In Motion Market Forecast Value in (2035 F) | USD 7.2 billion |

| Forecast CAGR (2025 to 2035) | 7.3% |

The automotive weigh in motion market is gaining momentum as the need for efficient traffic management, regulatory compliance, and infrastructure optimization grows across regions. Increasing vehicle volumes on highways, coupled with stricter enforcement of axle load limits, have positioned weigh in motion systems as a critical component of smart transportation networks.

Technological advancements in sensors and data processing capabilities are improving system accuracy and durability, enabling broader deployment in challenging environments. Future growth is expected to be supported by investments in intelligent transport systems, rising concerns about road safety, and initiatives to reduce infrastructure damage from overloaded vehicles.

Opportunities are emerging from the integration of real-time analytics, predictive maintenance features, and interoperability with existing tolling and traffic monitoring infrastructure, paving the path for sustained adoption and innovation.

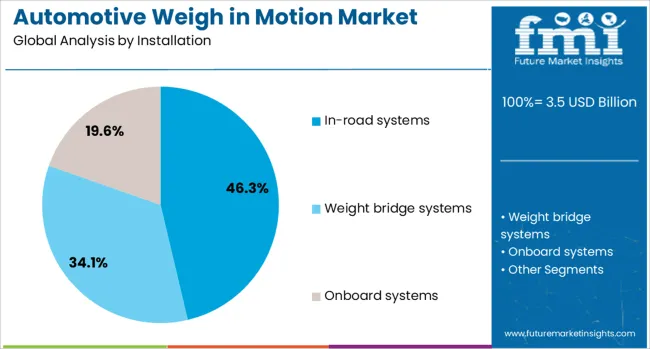

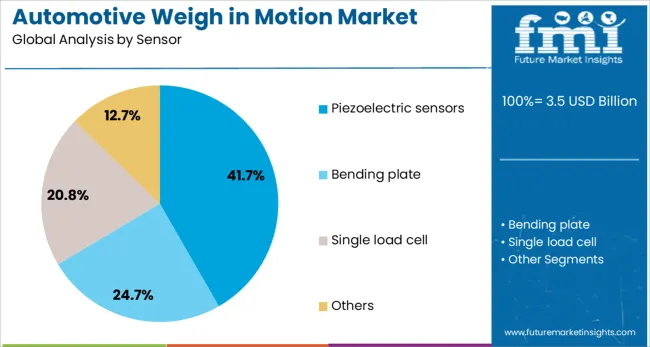

The automotive weigh-in motion market is segmented by installation, sensor, axle configuration, application, end use, and geographic regions. By installation, the automotive weigh-in motion market is divided into In-road systems, Weight bridge systems, and Onboard systems. In terms of sensor of the automotive weigh-in motion market is classified into Piezoelectric sensors, Bending plate, Single load cellOthers.

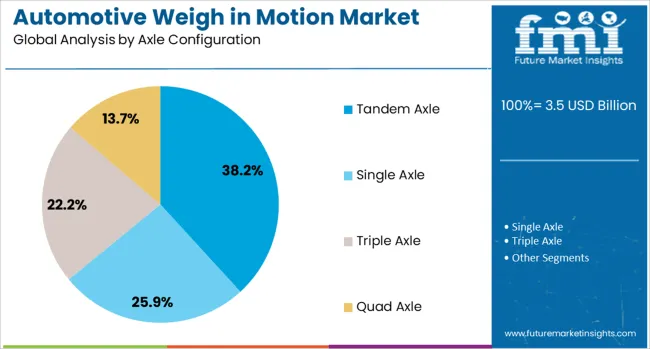

Based on axle configuration, the automotive weigh-in motion market is segmented into Tandem Axle, Single Axle, Triple Axle, and Quad Axle. By application, the automotive weigh-in-motion market is segmented into Weight enforcement, Traffic data collection, weight-based tolling, Bridge protection, and industrial truck weighing. By end use, the automotive weigh-in motion market is segmented into Government, Transportation, Private Sector, and others. Regionally, the automotive weigh-in motion industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by installation, in-road systems are projected to hold 46.3% of the total market revenue in 2025, making it the leading installation segment. This dominance is attributed to their ability to deliver high-accuracy readings under real traffic conditions without requiring vehicle stoppage, which enhances efficiency and compliance monitoring.

Their embedded design within the road surface has enabled reliable operation in diverse weather and load conditions, reducing maintenance downtime and improving service life. The preference for in-road systems has been reinforced by their compatibility with existing highway infrastructure and their minimal disruption to traffic flow during operation.

These advantages have positioned road systems as the preferred choice for highway authorities seeking long-term, scalable solutions to enforce load regulations and protect roadway integrity.

Segmented by sensor type, piezoelectric sensors are expected to account for 41.7% of the market revenue in 2025, establishing themselves as the leading sensor segment. Their leadership is driven by their proven durability, high sensitivity, and cost efficiency, which have made them suitable for widespread deployment.

Piezoelectric sensors have demonstrated reliable performance in measuring axle load and vehicle weight with precision while being relatively easy to install and maintain. The lightweight and compact nature of these sensors has facilitated seamless integration into both temporary and permanent weigh-in-motion installations.

Their capability to function effectively across varied temperature and load conditions has further strengthened their adoption among transportation agencies prioritizing accurate data collection and long-term operational stability.

When segmented by axle configuration, tandem axle systems are projected to capture 38.2% of the market revenue in 2025, securing their position as the leading axle configuration segment. This leadership stems from the prevalence of tandem axle configurations in commercial and heavy goods vehicles, which represent a significant portion of highway traffic.

Weigh-in-motion systems designed for tandem axle configurations have been preferred for their ability to accurately capture distributed loads, ensuring compliance with axle weight limits and preventing roadway damage. The robustness of these systems in handling higher loads and their effectiveness in detecting overload conditions have contributed to their sustained adoption.

Additionally, the tandem axle segment has benefited from regulatory focus on heavy vehicle monitoring, reinforcing its dominance in the market.

The automotive weigh-in-motion market is gaining momentum as transportation authorities and logistics operators adopt real-time axle load monitoring to improve compliance and road safety. In 2024, installations expanded on highways and toll roads to detect overloaded vehicles without causing traffic delays. By 2025, infrastructure modernization projects and digital traffic enforcement programs accelerated the adoption of weigh-in-motion technology. Companies providing accurate, scalable solutions with easy integration into smart transportation systems are well positioned to lead this evolving sector.

The implementation of automated enforcement systems has made weigh-in-motion solutions essential for monitoring vehicle weight on the move. In 2024, highways incorporated in-road sensors to capture axle load data and reduce dependency on traditional weigh stations. By 2025, regulatory authorities will have expanded the use of these systems to minimize road damage, improve compliance, and enhance traffic flow. These developments indicate that automation and accuracy, not manual processes, are setting industry standards. Manufacturers offering integrated weigh-in-motion platforms with real-time analytics and reliable precision are expected to gain significant traction among transport authorities and fleet operators.

The growing application of low-speed weigh-in-motion systems is creating opportunities beyond highways. In 2024, industries such as mining, logistics, and agriculture introduced these solutions to monitor load compliance without interrupting operations. By 2025, low-speed systems will become common in freight yards and industrial facilities for asset tracking and safety assurance. This transition highlights the value of operational flexibility over conventional approaches. Suppliers delivering durable, adaptable low-speed WIM solutions with simplified installation and rugged performance are positioned to capture significant demand in off-highway and specialized industrial environments.

In 2024 and 2025, the adoption of weigh-in-motion systems faced significant limitations due to the high cost of installation. These systems require advanced load sensors, reinforced road sections, and precise calibration equipment, which collectively raise project expenses for authorities and highway operators. Smaller municipalities and developing regions delayed implementation because budget allocations could not accommodate such costs. Maintenance expenses, including sensor recalibration and surface repairs, further added to long-term financial commitments. Unless cost-effective deployment models or shared infrastructure strategies are introduced, these financial constraints will continue to slow down large-scale adoption across transportation corridors.

In 2024 and 2025, weigh-in-motion technology increasingly became integrated with intelligent traffic management platforms to improve enforcement accuracy. Real-time vehicle data, including axle load and speed metrics, was combined with automated alert systems for overweight vehicles. Countries in Europe and North America launched smart highway projects incorporating these integrated solutions to reduce road wear and enhance freight safety. This approach minimized manual intervention and enabled seamless monitoring at scale. The growing alignment between weigh-in-motion technology and smart traffic systems presents a significant opportunity for providers to deliver comprehensive compliance-focused solutions for modern transportation networks.

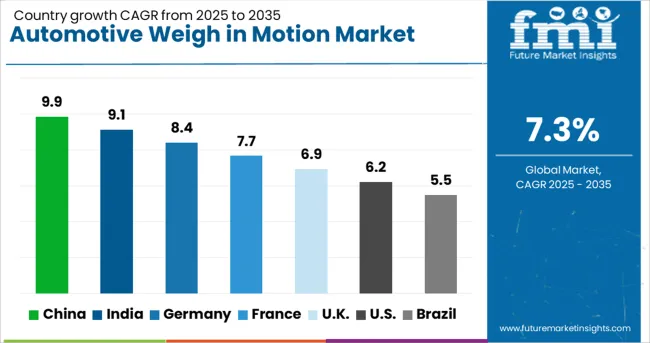

| Country | CAGR |

|---|---|

| China | 9.9% |

| India | 9.1% |

| Germany | 8.4% |

| France | 7.7% |

| UK | 6.9% |

| USA | 6.2% |

| Brazil | 5.5% |

The global automotive weigh-in-motion (WIM) market is expected to grow at a CAGR of 7.3% from 2025 to 2035. China leads with 9.9%, followed by India at 9.1% and Germany at 8.4%. France posts 7.7%, while the United Kingdom stands at 6.9%. Growth is driven by smart transportation initiatives, strict axle load regulations, and demand for real-time vehicle weight monitoring. China and India dominate due to large-scale highway infrastructure development, while Germany emphasizes advanced WIM integration for smart mobility. France and the UK prioritize portable WIM systems to enhance road safety and reduce overloading violations.

China is forecast to grow at 9.9%, supported by rapid highway expansion and smart city projects. High-speed WIM systems dominate for integration into intelligent transportation networks. Manufacturers adopt AI-driven analytics for accurate vehicle weight prediction and enforcement. Government policies promoting automated tolling and overloading control further strengthen demand.

India is expected to grow at 9.1%, driven by rapid infrastructure modernization and regulatory emphasis on axle load compliance. Portable WIM systems dominate early-stage deployment for cost-effectiveness. Manufacturers develop ruggedized systems suitable for extreme weather conditions. Public-private partnerships enhance investments in WIM integration across freight corridors and industrial zones.

Germany is projected to grow at 8.4%, driven by adoption in tolling and traffic management systems. Permanent in-road WIM systems dominate urban and highway infrastructure. Manufacturers integrate IoT-enabled WIM platforms for real-time weight compliance monitoring. Growing emphasis on autonomous freight transport accelerates the adoption of advanced WIM solutions in smart logistics applications.

France is forecast to grow at 7.7%, supported by the expansion of intelligent traffic enforcement solutions. Low-speed WIM systems dominate deployment in urban traffic zones. Manufacturers introduce modular WIM designs compatible with existing road infrastructure. Integration with video analytics platforms strengthens enforcement of weight regulations in congested city areas.

The UK is projected to grow at 6.9%, driven by infrastructure upgrades and road safety programs. Compact WIM systems dominate retrofitting projects in older highways. Manufacturers incorporate machine learning algorithms for predictive vehicle load analysis. Increased investments in smart road projects and freight monitoring accelerate long-term adoption of WIM technology.

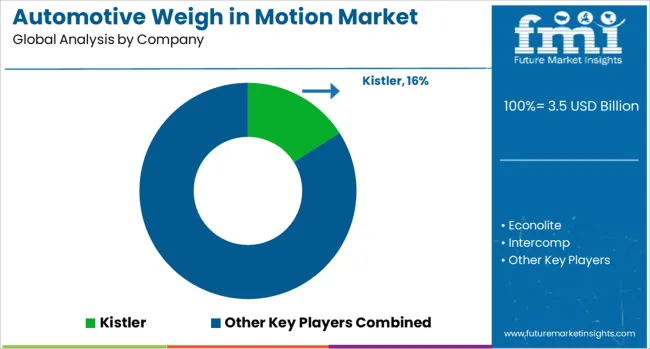

The automotive weigh-in-motion (WIM) market is moderately consolidated, with Kistler holding a leading position through its advanced piezoelectric sensor technology and modular WIM systems designed for accurate vehicle weight enforcement and traffic monitoring. The company’s strong global presence and proven expertise in dynamic weighing solutions solidify its leadership in this segment. Key players include Econolite, Intercomp, International Road Dynamics, Kapsch TrafficCom, Q‑Free ASA, Siemens Mobility, SWARCO AG, TDC Systems Ltd., and TE Connectivity. These companies offer integrated WIM systems that combine hardware, software, and data analytics for applications such as tolling, traffic management, and compliance monitoring.

Market growth is fueled by the increasing need for intelligent transport systems, strict axle-load regulations, and rising investments in smart infrastructure projects. Leading companies are focusing on innovations like wireless sensor integration, real-time data processing, and AI-driven analytics to improve accuracy and scalability. Emerging trends include portable and onboard WIM solutions tailored for fleet operators and logistics companies, along with the adoption of cloud-based platforms for data sharing and enforcement automation. Asia-Pacific is expected to be the fastest-growing region due to rapid highway modernization, while North America and Europe remain major markets driven by regulatory enforcement and advanced transportation networks.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.5 Billion |

| Installation | In-road systems, Weight bridge systems, and Onboard systems |

| Sensor | Piezoelectric sensors, Bending plate, Single load cell, and Others |

| Axle Configuration | Tandem Axle, Single Axle, Triple Axle, and Quad Axle |

| Application | Weight enforcement, Traffic data collection, Weight based tolling, Bridge protection, and Industrial truck weighing |

| End Use | Government, Transportation, Private Sector, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Kistler, Econolite, Intercomp, International Road Dynamics, Kapsch TrafficCom, Q‑Free ASA, Siemens Mobility, SWARCO AG, TDC Systems Ltd., and TE Connectivity |

| Additional Attributes | Dollar sales by system type (flexible sensors, rigid loops, embedded scales), Dollar sales by application (highways, weigh stations, toll systems), regional demand trends, competitive landscape, buyer preferences for accuracy and non-intrusive installation, integration with ITS and traffic management systems, innovations in wireless sensing and AI-enhanced axle load prediction. |

The global automotive weigh-in motion market is estimated to be valued at USD 3.5 billion in 2025.

The market size for the automotive weigh-in motion market is projected to reach USD 7.2 billion by 2035.

The automotive weigh-in motion market is expected to grow at a 7.3% CAGR between 2025 and 2035.

The key product types in automotive weigh-in motion market are in-road systems, weight bridge systems and onboard systems.

In terms of sensor, piezoelectric sensors segment to command 41.7% share in the automotive weigh-in motion market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive E-Tailing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Interior Market Forecast Outlook 2025 to 2035

Automotive Key Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Forecast and Outlook 2025 to 2035

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA