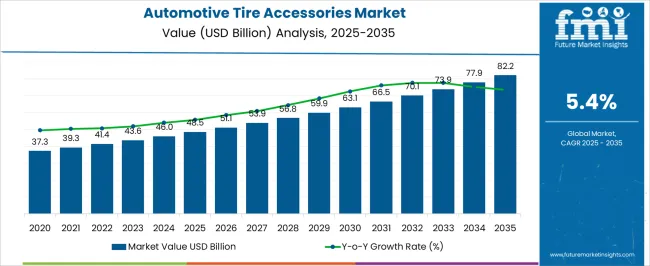

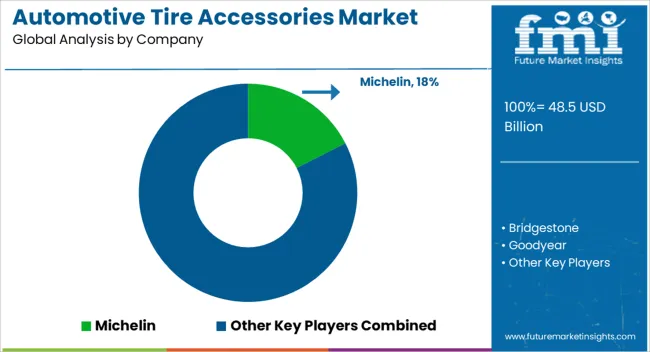

The Automotive Tire Accessories Market is estimated to be valued at USD 48.5 billion in 2025 and is projected to reach USD 82.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period.

| Metric | Value |

|---|---|

| Automotive Tire Accessories Market Estimated Value in (2025 E) | USD 48.5 billion |

| Automotive Tire Accessories Market Forecast Value in (2035 F) | USD 82.2 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The Automotive Tire Accessories market is experiencing robust growth, driven by the increasing adoption of vehicle maintenance and safety accessories across passenger and commercial vehicles. Rising awareness regarding tire performance, safety, and longevity has encouraged consumers and fleet operators to invest in high-quality tire accessories. Advancements in product innovation, including digital tire inflators, pressure monitoring systems, and repair kits, are enhancing user convenience and operational efficiency.

The integration of smart technologies into automotive accessories has further improved functionality, enabling real-time monitoring and preventive maintenance. Market expansion is also being supported by the growing automotive production in emerging economies, increased vehicle ownership, and the rising focus on reducing tire-related accidents. Distribution channels such as original equipment manufacturers (OEMs) and aftermarket suppliers are enabling wider accessibility and adoption of tire accessories.

Regulatory emphasis on road safety and vehicle standards further reinforces market demand As consumer preference for durable, reliable, and technologically advanced tire accessories continues to rise, the market is expected to sustain steady growth in the coming decade.

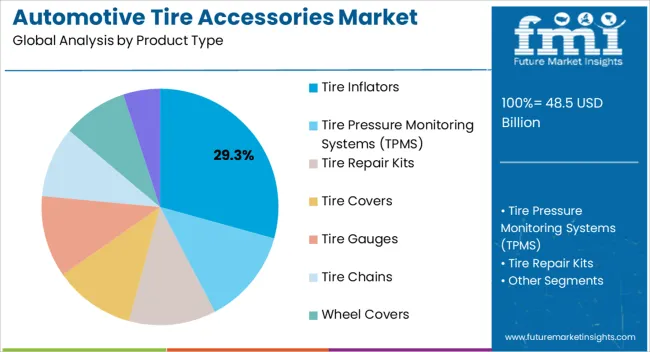

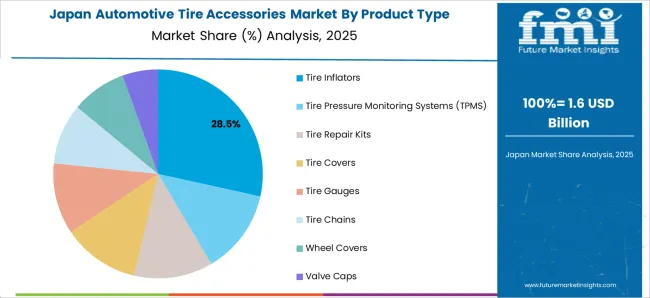

The tire inflators product type segment is projected to hold 29.3% of the market revenue in 2025, establishing it as the leading product type. Growth in this segment is being driven by the increasing demand for convenient and reliable tire maintenance solutions that ensure proper inflation and enhance safety. Tire inflators offer portable and automated functionalities, enabling consumers to maintain optimal tire pressure without the need for frequent service center visits.

Advanced digital inflators with integrated pressure sensors and automatic shut-off features have further improved usability and reliability. Their widespread application across passenger vehicles, commercial fleets, and roadside assistance services has strengthened adoption.

The ability to integrate inflators into emergency kits and aftermarket maintenance packages provides additional convenience and value to users As vehicle owners increasingly prioritize safety, efficiency, and preventive maintenance, the tire inflators segment is expected to maintain its market leadership, supported by technological innovation, product reliability, and growing consumer awareness.

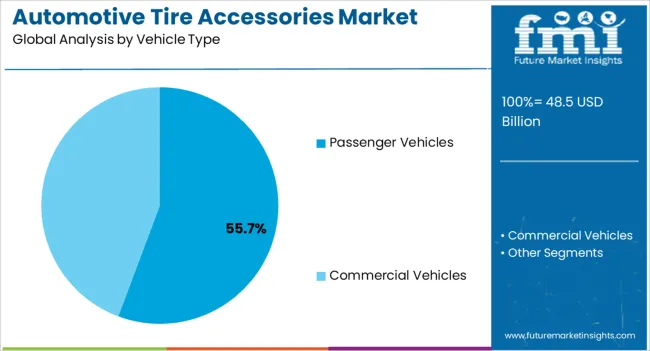

The passenger vehicles segment is anticipated to account for 55.7% of the market revenue in 2025, making it the leading vehicle type. Growth is being driven by the expanding global fleet of passenger vehicles, rising vehicle ownership rates, and increasing consumer focus on safety and maintenance. Tire accessories for passenger vehicles, including inflators, pressure monitoring systems, and repair kits, enable optimal performance, longer tire life, and reduced fuel consumption.

OEM integration of tire accessories ensures standardized quality and reliability, while aftermarket options provide flexibility for additional features and upgrades. Technological innovations such as portable inflators, AI-enabled pressure monitoring, and durable repair kits have further accelerated adoption among vehicle owners.

Awareness campaigns regarding tire safety, regulatory requirements for tire pressure management, and the rising number of road safety initiatives are reinforcing demand As passenger vehicles continue to dominate global automotive production, the segment is expected to remain the largest revenue contributor, driven by consumer focus on convenience, safety, and vehicle performance.

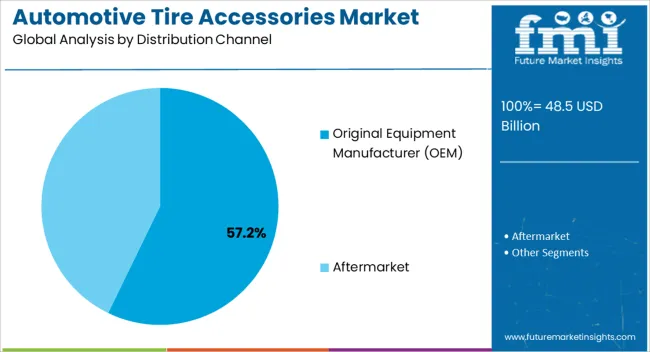

The original equipment manufacturer (OEM) distribution channel segment is projected to hold 57.2% of the market revenue in 2025, establishing it as the leading channel. Growth is being driven by the integration of tire accessories directly into new vehicles during manufacturing, ensuring product reliability, quality standards, and compatibility. OEM channels provide end users with accessories that meet safety regulations and performance specifications, reducing the risk of malfunctions or inconsistencies.

Collaboration between vehicle manufacturers and accessory suppliers has enabled seamless supply chain management, consistent quality, and widespread availability. The preference for OEM products is further strengthened by consumer trust in manufacturer-provided solutions, warranty coverage, and aftersales support.

As vehicle production continues to rise globally, particularly in emerging markets, OEM channels are expected to dominate market distribution The growing emphasis on road safety, maintenance efficiency, and pre-installed accessory convenience is anticipated to sustain the OEM segment’s leadership, supported by technological innovation, standardization, and consumer confidence.

From 2020 to 2025, the global automotive tire accessory market experienced a CAGR of 5.7 %, reaching a market size of USD 48.5 billion in 2025.

During this period, the automotive tire accessory industry witnessed steady growth driven by several factors. Firstly, the increasing production and sales of automobiles worldwide contributed to the demand for tire accessories such as tire pressure monitoring systems, tire inflators, and tire repair kits. As the automotive industry continued to expand, the need for efficient and reliable tire accessories grew as well.

Looking ahead, the global automotive tire accessory market is expected to continue its upward trajectory from 2025 to 2035, with a forecasted CAGR of 5.7 %. Factors such as the ongoing expansion of the automotive industry, advancements in tire technology, and the increasing focus on vehicle safety and performance will drive the demand for tire accessories. Additionally, the emergence of electric vehicles and autonomous vehicles is likely to create new opportunities for tire accessory manufacturers to cater to the specific requirements of these vehicles.

| Country | The United States |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 8.33 billion |

| CAGR % 2025 to End of Forecast (2035) | 5.2% |

By 2035, the United States market for vehicle tire accessories is projected to be worth USD 8.33 billion, growing at a CAGR of 5.2%. Due to the increased emphasis on road safety, the automobile tire accessories market in the United States is anticipated to expand. Other elements that are anticipated to influence the demand for automobile tire accessories in the nation include:

| Country | China |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 6.79 billion |

| CAGR % 2025 to End of Forecast (2035) | 6.0 % |

During the projected period, it is expected that the automotive tire accessories market in China will grow at a CAGR of 6.0 % and reach a market share of USD 6.79 billion. Due to the rising demand for automobiles, the automotive tire accessories market in China is anticipated to rise significantly. In addition, the government's emphasis on traffic safety and the adoption of strict laws to reduce traffic accidents are anticipated to fuel market expansion.

| Country | Japan |

|---|---|

| Market Size (USD billion) by End of Forecast Period (2035) | USD 781.2 million |

| CAGR % 2025 to End of Forecast (2035) | 5.9 % |

By 2035, it is anticipated that the Japanese market for vehicle tire accessories will be worth USD 781.2 million, growing at a CAGR of 5.9 %. The increasing use of automotive tire accessories in a variety of Vehicles, including passenger cars, commercial vehicles, and two-wheelers, is credited with driving the market's expansion. In addition, the government's programmers to encourage the adoption of environmentally friendly tire accessories and the rising demand for fuel-efficient cars are anticipated to spur market expansion.

A variety of factors, including changing consumer preferences, advancements in technology, and the rise of e-commerce, are driving the popularity of personalized and customized vehicle wheel covers.

Consumers are seeking unique styles and personal expression, staying current with the latest trends, and reducing their environmental impact. The growth of e-commerce has made it easier for customers to find and purchase personalized and customized wheel covers. Advances in technology, such as 3D printing, have made it more accessible and cost-effective for customers to design their own customized wheel covers.

The automotive tire accessories industry is highly competitive, with numerous players vying for market share. In such a scenario, key players must adopt effective strategies to stay ahead of the competition.

Key Strategies Adopted by the Players

Product Innovation

Product Innovation: Businesses in the automobile tire accessories industry spend a lot of money on Research & Development to create new products that improve use, performance, and durability. Product innovation enables businesses to stand out from rivals and satisfy changing consumer wants.

Strategic Partnerships and Collaborations

Key players in the sector collaborate and develop strategic alliances with other businesses to benefit from their knowledge, broaden their market reach, and gain access to fresh technology or distribution channels. Manufacturers of tires, vehicles, or other parties with an interest in the automotive sector may collaborate.

Expansion into Emerging Markets

In developing nations like China, India, and Southeast Asia, the automobile sector is expanding significantly. Key players in the tire accessory market are creating local production facilities, distribution networks, and partnerships with regional distributors to increase their presence in these areas.

Sustainable and eco-friendly solutions

Sustainable and eco-friendly solutions are being prioritized by major participants in the automotive tire accessories market due to rising environmental awareness. This entails creating environmentally friendly materials, starting recycling programmers, and using energy-efficient production techniques. Businesses satisfy the interests of consumers who care about the environment by providing sustainable solutions.

Key Players in the Automotive Tire Accessories Industry

Key Developments in the Automotive Tire Accessories Market:

The global automotive tire accessories market is estimated to be valued at USD 48.5 billion in 2025.

The market size for the automotive tire accessories market is projected to reach USD 82.2 billion by 2035.

The automotive tire accessories market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in automotive tire accessories market are tire inflators, tire pressure monitoring systems (tpms), tire repair kits, tire covers, tire gauges, tire chains, wheel covers and valve caps.

In terms of vehicle type, passenger vehicles segment to command 55.7% share in the automotive tire accessories market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Tire Market Size and Share Forecast Outlook 2025 to 2035

Automotive Tire Inflator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Tire Chains Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Automotive seating accessories Market Size and Share Forecast Outlook 2025 to 2035

Automotive Lighting Accessories Market Growth - Trends & Forecast 2025 to 2035

Automotive Performance Accessories Market Size and Share Forecast Outlook 2025 to 2035

Material, Thickness, Capacity, and Type of Europe Automotive Tire Market Forecast Economic Projections to 2035

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Tire Marking Machine Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA