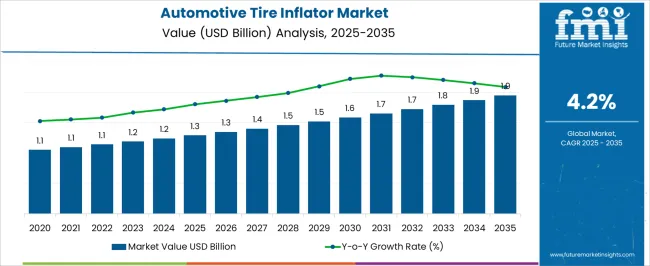

The Automotive Tire Inflator Market is estimated to be valued at USD 1.3 billion in 2025 and is projected to reach USD 1.9 billion by 2035, registering a compound annual growth rate (CAGR) of 4.2% over the forecast period. Over this five-year period, the market experiences gradual expansion driven by increased vehicle ownership and the growing emphasis on vehicle maintenance and safety. Between 2025 and 2030, the rising demand for portable and easy-to-use tire inflators supports steady revenue growth. Consumers and fleet operators alike are seeking reliable solutions to maintain proper tire pressure, which directly impacts fuel efficiency, tire lifespan, and overall driving safety. Additionally, the increasing prevalence of advanced driver assistance systems (ADAS) indirectly promotes market growth by highlighting the importance of tire condition monitoring. Incremental improvements in product design, such as enhanced portability, digital pressure displays, and multi-functionality, also contribute to expanding market interest.

Replacement of older inflators with newer, more efficient models helps sustain demand during this period. Although the growth rate remains moderate, the tire inflator market benefits from a consistent need for convenient, cost-effective tire maintenance tools. By 2030, the market is well-positioned for continued growth, supported by steady vehicle production rates and consumer awareness around tire care and safety measures.

| Metric | Value |

|---|---|

| Automotive Tire Inflator Market Estimated Value in (2025 E) | USD 1.3 billion |

| Automotive Tire Inflator Market Forecast Value in (2035 F) | USD 1.9 billion |

| Forecast CAGR (2025 to 2035) | 4.2% |

The automotive tire inflator market is experiencing consistent growth, fueled by rising vehicle ownership, increasing emphasis on roadside safety, and heightened consumer awareness regarding tire maintenance. Portable inflators are gaining traction due to their compactness, ease of use, and integration with smart digital features such as automatic pressure detection and USB compatibility.

Regulatory push for vehicle safety standards and the rising frequency of long-distance road travel have accelerated the demand for on-the-go inflation solutions. OEMs and aftermarket players are investing in lightweight, energy-efficient models to support electric and hybrid vehicle segments.

Additionally, the expansion of e-commerce platforms has broadened access to advanced inflator models, allowing consumers to purchase based on functionality, size, and compatibility. The market is projected to see increased innovation in compact air compressor technologies, especially with the rise of autonomous and connected car ecosystems.

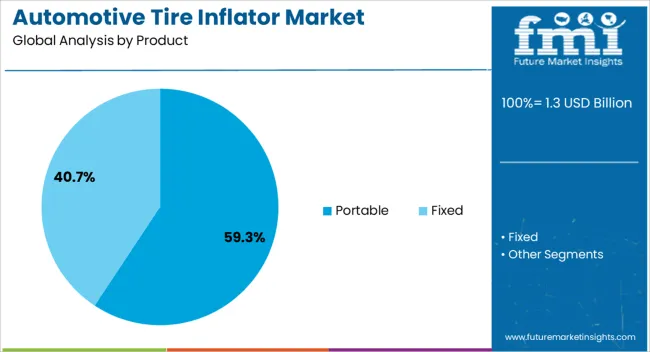

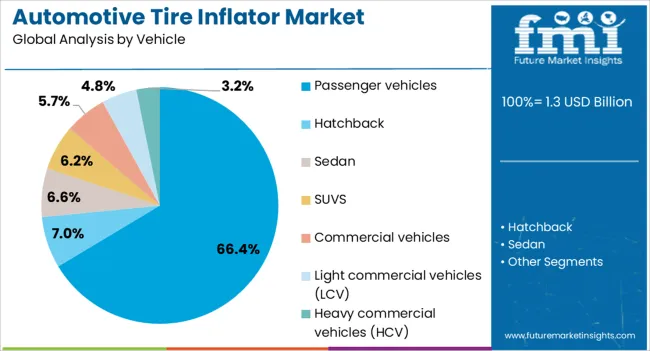

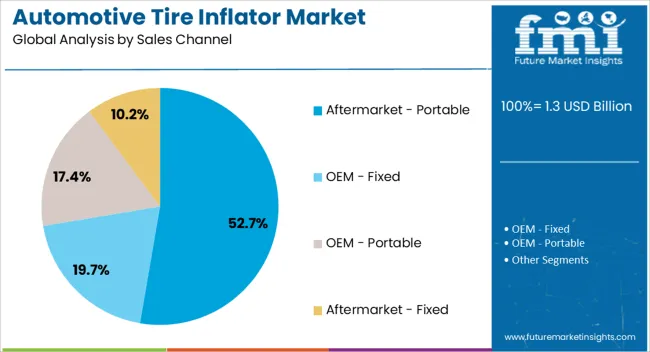

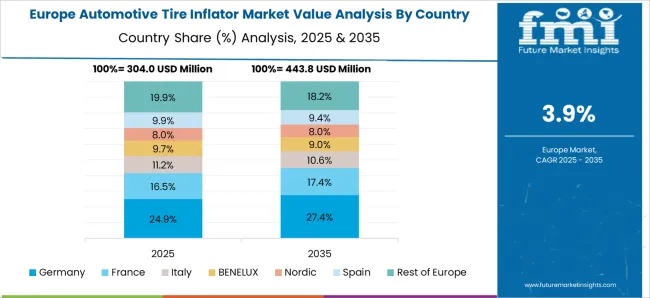

The automotive tire inflator market is segmented by product, vehicle, sales channel, application, component, and geographic region. The automotive tire inflator market is divided into Portable and Fixed. In terms of vehicles, the automotive tire inflator market is classified into Passenger vehicles, Hatchbacks, Sedans, SUVs, Commercial vehicles, Light commercial vehicles (LCV), and Heavy commercial vehicles (HCV). The automotive tire inflator market is segmented by sales channel into Aftermarket - Portable, OEM - Fixed, OEM - Portable, and Aftermarket - Fixed. The automotive tire inflator market is segmented into Household, Commercial, and Industrial. The automotive tire inflator market is segmented into Compressor, ECU, Pressure sensor, and Others. Regionally, the automotive tire inflator industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Portable tire inflators are projected to account for 59.30% of total market revenue in 2025, establishing them as the dominant product category. Their popularity stems from the convenience they offer in addressing sudden tire pressure drops, especially in remote areas without immediate service access.

The compact form factor, compatibility with multiple power sources, and integration of digital gauges and auto shut-off functions have contributed to widespread adoption among individual consumers. Increasing availability of wireless and rechargeable inflators further supports their use across varied vehicle types.

Enhanced portability also reduces dependency on professional workshops, aligning well with the DIY maintenance trend growing among urban car owners.

Passenger vehicles are expected to hold 66.40% of the overall revenue share in 2025, making this the largest vehicle category in the market. Growth in this segment is being driven by the surge in private vehicle ownership, especially in emerging economies, where road infrastructure continues to develop rapidly.

Portable inflators have become a staple accessory for passenger vehicles, as users increasingly prioritize self-sufficiency and preventive maintenance. Vehicle manufacturers and accessory brands are collaborating to offer compact inflators as part of tool kits or bundled add-ons.

Rising concerns over fuel efficiency and tire longevity are encouraging regular tire pressure checks, further supporting demand across this segment.

Aftermarket – portable sales are expected to command 52.70% of total market revenue by 2025, positioning this as the leading sales channel. The dominance of this segment is attributed to wide consumer access through retail, e-commerce, and specialty automotive outlets.

As users look for cost-effective alternatives to dealership accessories, aftermarket products provide a broader range of functionality, customization, and pricing options. Technological improvements such as smart inflators with Bluetooth integration and voice-guided operation are typically introduced first through aftermarket channels.

Additionally, the ability to directly compare user reviews and performance specifications has made online aftermarket platforms a preferred destination for purchasing portable inflators.

The automotive tire inflator market is witnessing steady growth driven by increased vehicle ownership and the rising emphasis on vehicle maintenance and safety. Tire inflators provide quick and convenient solutions for maintaining optimal tire pressure, improving fuel efficiency, and enhancing driving safety. Growing consumer awareness about the importance of regular tire inflation and the surge in aftermarket automotive accessories further support demand. However, challenges related to product durability and power source limitations persist. Innovations in portable, digital, and multi-function inflators are helping manufacturers differentiate their offerings. Expansion in emerging economies with growing automotive sectors presents significant opportunities for market players.

Proper tire inflation is critical for vehicle safety, performance, and fuel economy, fueling demand for automotive tire inflators. Consumers are more aware of the dangers associated with underinflated tires, including blowouts and decreased handling. Routine tire maintenance practices, encouraged by governments and automobile associations, drive the use of convenient inflators both at home and on the go. Inflation devices that provide accurate pressure readings and quick inflation times are preferred. This trend is especially strong among commercial vehicle operators who rely on timely tire checks to avoid costly downtime and accidents.

Despite growing demand, the market faces challenges related to product reliability and operational constraints. Many inflators rely on vehicle power outlets, limiting portability and use in emergency roadside conditions if the car battery is drained. Battery-operated units may suffer from short run times and long charging periods. Additionally, the durability of pumps and hoses can vary, with some models prone to overheating or mechanical failure. Consumers often seek inflators that combine robustness with ease of use, pushing manufacturers to improve component quality and offer warranties. Overcoming these limitations is critical for building trust and encouraging repeat purchases.

Innovations are transforming tire inflators from simple pumps to multifunctional tools. Digital pressure gauges with backlit displays, automatic shutoff features, and LED work lights add convenience. Some inflators incorporate USB charging ports, emergency flashers, or CO2 cartridges for faster inflation. Compact, lightweight designs enhance portability, making them suitable for everyday carry in vehicles. Connectivity options such as smartphone apps for remote monitoring are emerging but remain niche. Product differentiation through smart design and additional features attracts tech-savvy consumers and expands market reach beyond traditional users.

Growing vehicle fleets in developing countries drive the adoption of tire inflators, especially as road infrastructure and safety awareness improve. Rising disposable incomes and increased aftermarket spending create opportunities for affordable and mid-range inflators. Localized marketing campaigns and partnerships with automotive service centers help educate consumers on the benefits of regular tire maintenance. However, price sensitivity in these markets requires manufacturers to balance cost and feature sets carefully. Strengthening distribution channels through online platforms and retail outlets is essential to reach diverse customer segments. As vehicle ownership continues to rise globally, these regions represent a key growth frontier.

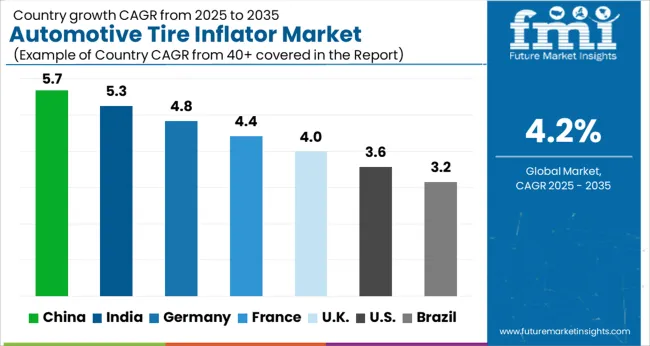

The global automotive tire inflator market is expanding at a 4.2% CAGR, driven by rising vehicle ownership and demand for convenient tire maintenance solutions. China leads with 5.7% growth, supported by a large automotive industry and growing aftermarket services. India follows at 5.3%, fueled by increasing vehicle sales and road safety awareness. Germany records 4.8% growth, reflecting high-quality manufacturing standards and innovation. France grows at 4.4%, driven by steady demand in automotive maintenance. The United Kingdom shows 4.0% growth, supported by automotive aftermarket expansion. The United States, a mature market, registers 3.6% growth, shaped by stringent safety regulations and technological enhancements. These countries collectively influence market trends through advancements in product reliability, portability, and energy efficiency. This report includes insights on 40+ countries; the top countries are shown here for reference.

China automotive tire inflator market is experiencing a robust 5.7% CAGR as vehicle ownership continues to expand rapidly. Increased long-distance travel fuel demand for reliable tire maintenance tools. Consumers favor portable, digital tire inflators that offer fast inflation and accurate pressure readings. Compared to Western countries, Chinese buyers are quick to adopt technologically advanced and compact inflators that can be easily stored in vehicles. The e-commerce boom in China has made these products widely accessible across cities and smaller towns. Local manufacturers focus on delivering cost-effective innovations to attract a broad consumer base, including fleet operators. Maintenance programs for commercial vehicles increasingly include bulk inflator solutions, supporting fleet efficiency. The combination of rising safety awareness and government regulations on vehicle upkeep further propels the market. As a result, China leads the global automotive tire inflator market with rapid product adoption and increasing consumer trust.

India automotive tire inflator market is growing at a strong 5.3% CAGR, driven by rising vehicle ownership in both two-wheeler and passenger car segments. Increasing road safety campaigns and government focus on regular tire maintenance encourage product adoption. Indian consumers prefer affordable and multi-functional inflators that can serve a variety of vehicles, including motorcycles, cars, and small trucks. Compared to China, India’s market is still developing but expanding quickly, particularly in metro and tier-2 cities with improving internet connectivity. Workshops and automotive service centers are actively promoting tire inflator usage as part of routine maintenance to improve safety and fuel efficiency. E-commerce penetration enhances product availability, making it easier for consumers to access inflators nationwide. Infrastructure development and new highway projects also increase long-distance travel, pushing the need for convenient tire care devices. The market shows strong potential for continued growth with rising awareness and digital adoption.

Germany automotive tire inflator market maintains steady growth with a 4.8% CAGR, supported by high vehicle safety standards and environmentally conscious consumers. German buyers prefer durable and precise inflators that comply with strict EU safety regulations, featuring accurate pressure monitoring and rechargeable batteries. Compared to Asian markets, Germany’s consumers demand premium quality products with longer lifespans and energy efficiency. Automotive workshops and retail chains promote tire inflators alongside tire replacement and repair services. The market also benefits from collaborations between manufacturers and environmental organizations aiming to reduce fuel consumption through proper tire inflation. Retrofitting inflators into automotive toolkits is increasingly common. Moreover, rising sustainability trends encourage consumers to invest in energy-efficient, eco-friendly inflators that minimize power use without compromising performance. The combination of safety regulations and green initiatives supports consistent demand growth in Germany.

United Kingdom automotive tire inflator market is growing steadily with a 4.0% CAGR, driven by a rising culture of do-it-yourself vehicle maintenance. British consumers prioritize portability and ease of use in inflator devices, favoring models that can handle multiple vehicle types such as cars, motorcycles, and bicycles. Compared to France, the UK market shows higher integration of smartphone connectivity, allowing users to monitor tire pressure and receive alerts via apps. Retailers promote bundled packages combining inflators with tire repair kits to provide comprehensive maintenance solutions. Environmental concerns also motivate consumers to choose energy-efficient inflators with longer battery life and lower power consumption. The expanding cycling community in urban areas further boosts demand for compact, portable inflators suitable for various tire sizes. Growing awareness campaigns reinforce regular tire checks as essential for safety and fuel economy.

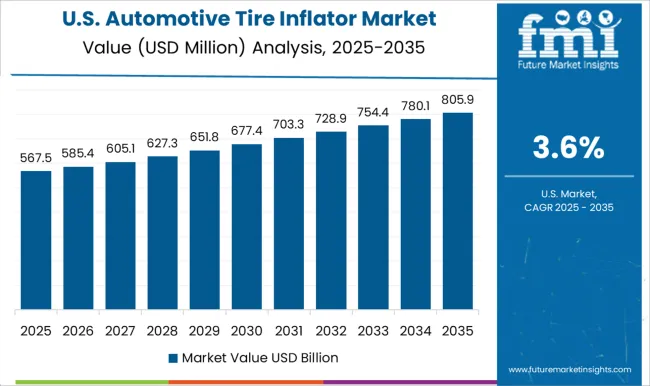

United States automotive tire inflator market is growing at a 3.6% CAGR, supported by widespread vehicle ownership and safety regulations. American consumers demand reliable inflators capable of fast inflation for a broad range of vehicles including cars, trucks, SUVs, and off-road vehicles. Compared to European markets, USA buyers favor heavy-duty inflators designed for larger tires and more rugged use cases. Online retail and automotive service chains offer convenient access to inflators, often bundled with tire repair and maintenance products. The increasing adoption of electric vehicles presents new opportunities for smart, energy-efficient inflators optimized for these models. Innovations in digital displays and pressure sensors improve ease of use and accuracy. Growing public focus on vehicle safety and fuel efficiency further supports market expansion, as more drivers seek reliable tools for maintaining optimal tire pressure.

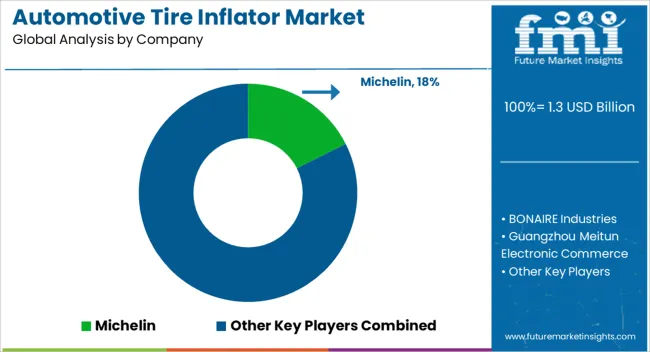

The automotive tire inflator market is competitive and diverse, featuring a range of players from global tire manufacturers to specialized equipment producers. Michelin, a major name in the tire industry, leverages its extensive expertise in tires to offer reliable and innovative inflator products that complement its core offerings. Similarly, companies like VIAIR Corporation and BONAIRE Industries focus specifically on high-performance inflators, delivering products designed for durability, efficiency, and versatility in both consumer and professional markets.

Contrasting these larger and more established players, manufacturers such as Guangzhou Meitun Electronic Commerce and Kensun cater primarily to budget-conscious consumers and emerging markets, providing affordable inflator options with adequate features for everyday use. ITW Global Tire Repair and Slime stand out by integrating inflator products with tire repair solutions, targeting convenience and emergency readiness for vehicle owners.

These companies focus on portability and ease of use, appealing to a wide demographic. Meanwhile, Hendrickson USA and Marmon Holdings add value through their expertise in heavy-duty and commercial vehicle components, offering inflators that are robust and suitable for larger vehicles and industrial applications. TireTek offers specialized products that emphasize innovation in air delivery technology, aiming to improve inflator speed and reliability.

The market thus contrasts companies focused on premium, technologically advanced inflators with those emphasizing affordability and accessibility, creating a dynamic competitive landscape that serves a broad spectrum of consumer and commercial needs.

Manufacturers are innovating to improve efficiency, portability, and smart features. Companies are introducing compact, lightweight models with cordless operation, powered by rechargeable batteries, enhancing convenience for consumers. Many inflators now include digital pressure gauges, auto shut-off features, and Bluetooth connectivity for real-time monitoring via smartphone apps. Some manufacturers, like DEWALT and BLACK+DECKER, are focusing on multi-functional designs, allowing inflators to serve multiple purposes, such as inflating sports equipment and bicycles.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| Product | Portable and Fixed |

| Vehicle | Passenger vehicles, Hatchback, Sedan, SUVS, Commercial vehicles, Light commercial vehicles (LCV), and Heavy commercial vehicles (HCV) |

| Sales Channel | Aftermarket - Portable, OEM - Fixed, OEM - Portable, and Aftermarket - Fixed |

| Application | Household, Commercial, and Industrial |

| Component | Compressor, ECU, Pressure sensor, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Michelin, BONAIRE Industries, Guangzhou Meitun Electronic Commerce, Hendrickson USA, ITW Global Tire Repair, Kensun, Marmon Holdings, Slime, TIRETEK, and VIAIR Corporation |

| Additional Attributes | Dollar sales vary by type, including portable, digital, cordless, and fixed inflators; by power source, such as 12V, 120V, and rechargeable; by application, spanning passenger cars, light commercial vehicles (LCVs), and heavy commercial vehicles (HCVs); and by region, led by North America, Europe, and Asia-Pacific. Growth is driven by increasing vehicle production, rising safety concerns, adoption of tire pressure monitoring systems (TPMS), and technological advancements. |

The global automotive tire inflator market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the automotive tire inflator market is projected to reach USD 1.9 billion by 2035.

The automotive tire inflator market is expected to grow at a 4.2% CAGR between 2025 and 2035.

The key product types in automotive tire inflator market are portable and fixed.

In terms of vehicle, passenger vehicles segment to command 66.4% share in the automotive tire inflator market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Tire Market Size and Share Forecast Outlook 2025 to 2035

Automotive Tire Accessories Market Size and Share Forecast Outlook 2025 to 2035

Automotive Tire Chains Market Size and Share Forecast Outlook 2025 to 2035

Automotive Green Tires Market Size and Share Forecast Outlook 2025 to 2035

Material, Thickness, Capacity, and Type of Europe Automotive Tire Market Forecast Economic Projections to 2035

Automotive Direct Liquid Cooling IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hoses and Assemblies Market Size and Share Forecast Outlook 2025 to 2035

Automotive Network Testing Market Size and Share Forecast Outlook 2025 to 2035

Automotive Performance Part Market Size and Share Forecast Outlook 2025 to 2035

Automotive Carbon Ceramic Brake Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Stamping Industry Analysis in India Size and Share Forecast Outlook 2025 to 2035

Automotive Cylinder Liner Market Size and Share Forecast Outlook 2025 to 2035

Automotive Microcontroller Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Tire Marking Machine Market Size and Share Forecast Outlook 2025 to 2035

Automotive Active Safety System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Diagnostic Scan Tool Market Size and Share Forecast Outlook 2025 to 2035

Automotive Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Dynamic Map Data Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA