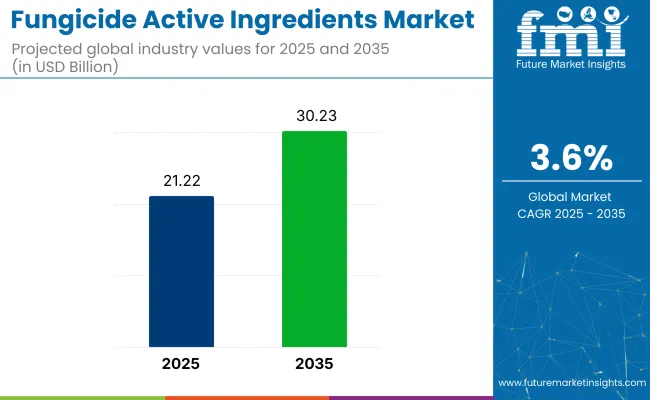

Fungicide Active Ingredients Market revenue is forecast to advance from USD 21.22 billion in 2025 to USD 30.23 billion by 2035, translating into a 3.6% CAGR for the period. Demand has been shaped by stricter residue‐limit enforcement and the widening adoption of integrated pest-management schemes that prioritise crop-specific efficacy.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 21.22 billion |

| Industry Value (2035F) | USD 30.23 billion |

| CAGR (2025 to 2035) | 3.6% |

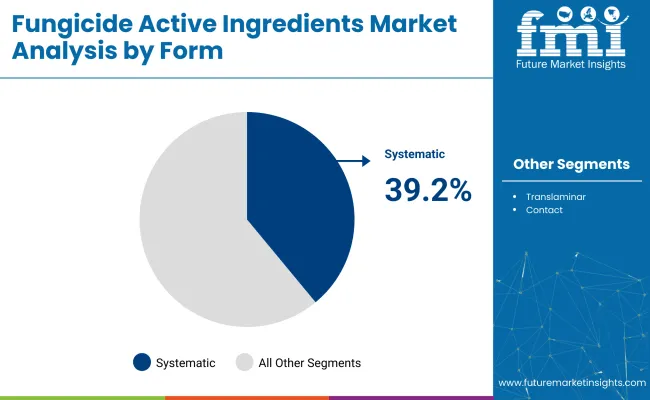

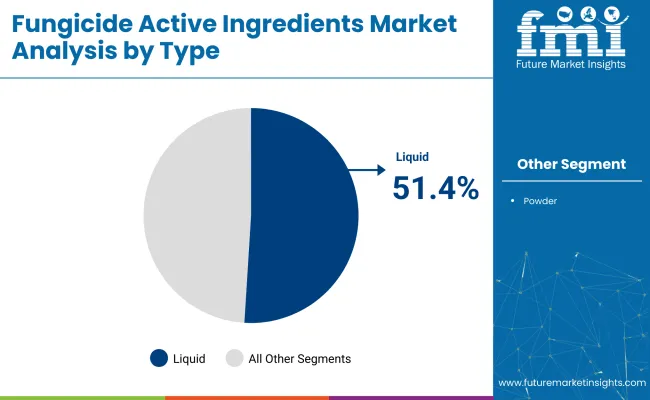

Systematic fungicides, projected at 39.2% share, have been chosen for their xylem mobility and season-long protection against vascular pathogens. Liquid formulations are set to hold 51.4% share owing to simplified tank-mixing and compatibility with drone and electrostatic spray systems.

Process efficiencies have been raised through continuous-flow synthesis, which lowers solvent demand and shortens reaction times when manufacturing triazoles and strobilurins. Micro-encapsulation techniques have reduced active-ingredient loss, permitting lower field rates while maintaining lesion-suppression thresholds. Large-volume production has been underpinned by multipurpose plants equipped with automated cleaning protocols that minimise downtime between chemistry campaigns.

Gilboa was launched by ADAMA UK. It is a novel mode-of-action molecule, that delivers control of septoria, rusts, and powdery mildew in cereals and oilseed rape, integrating with existing actives to slow resistance, enhance grain quality, profitability across variable weather seasons.

The fungicide active ingredients market holds specific shares within its parent markets. In the agricultural chemicals market, it accounts for around 10-12%, as fungicides are essential for crop protection alongside other chemicals like herbicides and insecticides. Within the crop protection market, the share is approximately 20-25%, driven by the vital role fungicides play in managing plant diseases.

In the pesticide market, the share is about 15-18%, with fungicides being a significant component of the broader pesticide category. The biopesticide market contributes around 5-7%, with bio-based fungicides gaining attention. In the fine chemicals market, the share is around 3-4%, as fungicide active ingredients are classified under specialized fine chemicals for agricultural use.

Systemic chemistries, liquid formulations, azoxystrobin products, and agricultural deployments together concentrate more than 70% of 2025 fungicide-ingredient revenue. Their popularity has been driven by resistance-management mandates, simplified logistics, and crop-yield preservation standards set by major global grain merchants and input distributors.

Systemic fungicides are projected to secure a 39.2% share of 2024 demand, since xylem-mobile molecules distribute internally and resist wash-off during peak rainfall windows. Crop-science divisions from BASF and UPL have prioritised triazole-strobilurin co-formulations to prolong curative intervals while meeting residue-tolerance rules in export markets.

A 51.4% revenue share is expected to be held by liquid fungicides, because flowable suspensions ease closed-transfer system adoption at large custom-application co-ops. Viscosity has been standardised near 700 cP, allowing metering pumps on 3,000-litre nurse tanks to dose precisely without shear-induced settling.

Azoxystrobin is forecasted to account for 30% of product-specific fungicide sales, supported by its QoI mode of action and 21-day residual activity in soybean, maize, and peanut rotations. Patent-expired status has widened technical sourcing, reducing cost per hectare for multi-state cooperatives.

In 2025, agriculture is anticipated to capture 50% of fungicide active-ingredient volume because food-security policies and contract farming require strict disease-loss thresholds. Growers have adopted season-long programmes aligned with crop insurance performance metrics to guarantee grain-quality specifications for maltsters and feedlots.

Surging disease resistance and weather-triggered pathogen surges are driving demand for next-generation fungicide formulations. At the same time, market openings in protective horticulture and seed treatment systems offer targeted avenues for ingredient innovation and global formulation differentiation.

Resistance Management Demands Fuel Multi-Site Active Ingredient Adoption

Rising fungicide resistance-particularly in Zymoseptoria and Botrytis strains-has forced formulators to pivot toward multi-site modes of action. Farmers in the USA Corn Belt and EU cereals sector are being guided to rotate and stack actives using strobilurin-DMI combinations or SDHI-linked mixtures.

BASF and FMC have introduced pre-mixes where azoxystrobin is buffered by less resistance-prone protectants. Regulatory extension programs across Italy, Germany, and Brazil now mandate active rotation documentation during field audits. Adoption of resistance monitoring platforms is reshaping demand, pushing buyers toward tailored formulations with diversified active profiles to preserve field efficacy.

High-Value Protected Crops Open Targeted Formulation Opportunities

Expansion of protected cultivation-greenhouses, tunnels, hydroponic systems-has created niche demand for low-residue, fast-acting fungicide actives. Companies such as Isagro and UPL have launched downscaled formulations of cymoxanil, mandipropamid, and fludioxonil tailored for short-cycle vegetables and ornamentals.

Residue limits for cucumber and bell pepper in Japan and UAE have encouraged low-PHI (pre-harvest interval) products with rapid breakdown. Opportunity lies in seed treatment integration, where microencapsulated actives enable slow release without phytotoxicity. Suppliers investing in surfactant-enhanced carriers for foliar sprays have gained preference among growers facing tight harvest cycles.

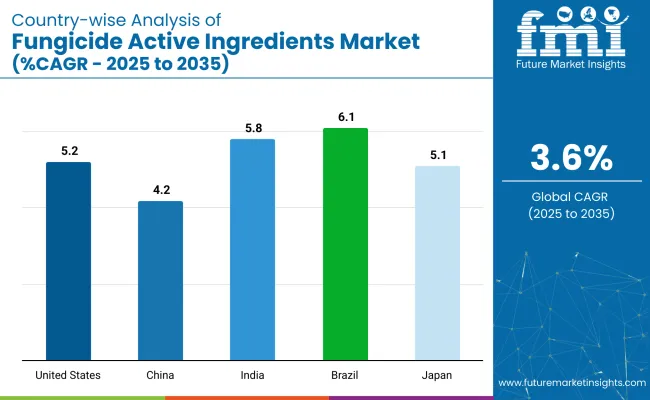

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 5.2% |

| Brazil | 6.1% |

| India | 5.8% |

| Japan | 5.1% |

| China | 4.2% |

Rising pathogen pressure in row crops lifts fungicide-active demand at a projected 3.6% CAGR from 2025 to 2035. Brazil tops at 6.1%, a +69% premium driven by soybean rust resilience programs and BRICS-aligned export acreage. India follows at 5.8% (+61%), where rice blast outbreaks and generic azoxystrobin production expand local application.

The USA records 5.2% (+44%), its OECD share tempered by tighter residue tolerances and crop-rotation IPM incentives. Japan posts 5.1% (+42%), focusing on high-value horticulture and precision spraying to curb resistance. China lags at 4.2% (+17%) amid regulatory scrutiny on triazoles and consolidation of domestic formulators. The report covers detailed analysis of 40+ countries and the top five countries have been shared as a reference.

The United States fungicide active ingredients sector is expected to expand at 5.2% CAGR through 2035. Growth is predicted to be underpinned by broad-acre adoption across corn-soy rotations, tight Environmental Protection Agency residue limits, and rising integration of triazole-strobilurin premixes in seed-treatment lines.

Competitive advantage is being claimed by multinationals commercializing next-generation succinate dehydrogenase inhibitors that combat resistance clusters identified by the Fungicide Resistance Action Committee. Domestic formulation capacity in the Midwest is being scaled to shorten delivery lead-times during peak spray windows. Consolidation among ag-retail cooperatives is positioning bundled crop-protection programs as the preferred procurement route for large farm enterprises.

The fungicide active ingredients market in Brazil, rising at 6.1% CAGR to 2035, is projected to benefit from soybean and maize acreage expansion in the Cerrado belt, where high disease pressure demands multi-shot control programs. Circular regulation involving ANVISA and MAPA has accelerated approvals for generic azoxystrobin, propiconazole, and fluxapyroxad formulations, shrinking application costs for cooperatives.

Domestic toll formulation plants in Mato Grosso have been retrofitted to produce high-load emulsifiable concentrates, reducing import dependence and strengthening credit profiles. Crop-specific technical assistance provided by Embrapa is shaping demand for resistance-management alternations, creating rotation-driven volume gains for newer carboxamide actives positioned as cost-efficient protection options.

The fungicide active ingredients market in India is forecast to register 5.8% CAGR through 2035. Growth is anticipated to stem from intensive rice-wheat double-cropping in Punjab and Uttar Pradesh, where leaf-spot outbreaks have been increasing spray frequencies.

The Directorate of Plant Protection, Quarantine & Storage is fast-tracking label expansions for hexaconazole and tebuconazole combinations, enabling spectrum control under integrated disease-management advisories issued by ICAR.

Gujarat-based active-ingredient producers are expanding triazole fermentation capacity by utilizing captive solvent recovery loops that cut input costs. Rising counterfeit crackdowns led by the Central Insecticides Board are expected to redirect volumes toward branded portfolios with assured quality guarantees.

The sales of fungicide active ingredients are anticipated to witness 5.1% CAGR until 2035 in Japan. Demand is projected to hinge on the protected horticulture sector, where tomatoes, cucumbers, and strawberries command high values and require precise disease suppression under glasshouse humidity.

The Ministry of Agriculture, Forestry and Fisheries enforces strict maximum residue limits, compelling formulators to market low-dose suspension concentrates employing microencapsulation technology. Domestic chemical majors are scaling succinate dehydrogenase inhibitor production via continuous-flow synthesis platforms to improve batch consistency.

Retail distribution has been shifting toward cooperative-owned e-commerce portals, enabling rapid overnight fulfillment that aligns with growers’ tight spraying schedules during critical windows.

The fungicide active ingredient sales in China are forecast to advance at 4.2% CAGR through 2035. Expansion is expected to rely on cereal and horticulture disease management, as government programs drive adoption of low-toxicity formulations to replace older chlorothalonil and carbendazim chemistry.

Provincial subsidies encourage growers to adopt alternating spray calendars that limit resistance while boosting carboxamide demand. State-owned enterprises have integrated upstream intermediates, allowing scale efficiencies and margin retention despite volatile raw-material prices.

The National Agro-Tech Extension Service Center is promoting digital prescription platforms that match pathogen monitoring data with targeted active-ingredient mixes, supporting precise input use across diverse agro-ecological zones nationwide.

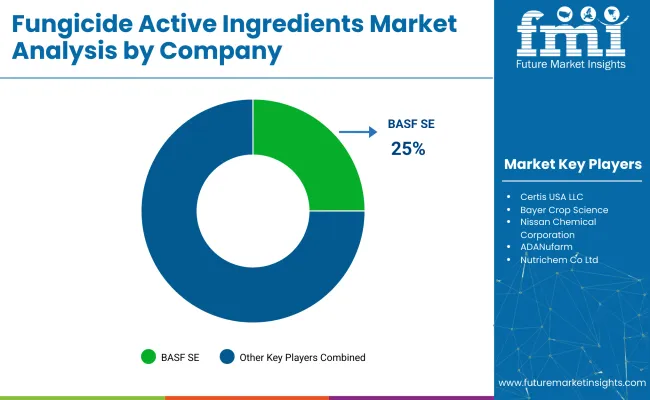

Top players in the fungicide active ingredients market, including BASF SE, Syngenta Group, and Bayer Crop Science, are fiercely competing through strategic investments in R&D to develop new, more effective fungicide formulations. BASF focuses on expanding its product portfolio by targeting emerging markets and optimizing crop protection solutions with enhanced efficiency.

Syngenta, through its ADAMA subsidiary, is advancing its position by integrating digital tools with crop protection products, improving application efficiency. Bayer Crop Science is focusing on biotechnological advancements, collaborating with ag-tech startups to improve sustainable agriculture.

FMC Corporation and DuPont emphasize global market expansion, particularly in Asia and Latin America, to cater to the increasing demand for fungicides. The market remains competitive with innovation at its core, driven by both large players and niche specialists.

Recent Industry News

| Report Attributes | Key Insights |

|---|---|

| Estimated Market Value (2025) | USD 21.22 billion |

| Projected Market Value (2035) | USD 30.23 billion |

| CAGR (2025 to 2035) | 3.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD billion |

| Product | Azoxystrobin, Boscalid, Chlorothalonil, Cyazofamid, Etridiazole ( Ethazole ), Fenarimol, and Others |

| Type | Powder, Liquid |

| Form | Systematic, Contact, Translaminar |

| End Use | Food Industry, Medicinal, Agriculture, Chemical Laboratory, Others |

| Regions | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltics, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players | BASF SE, Syngenta Group (ADAMA, Ltd.), Certis USA LLC, Bayer Crop Science, Nissan Chemical Corporation, ADANufarm, Nutrichem Co Ltd., Sumitomo Chemical Co. Ltd., FMC Corporation, Isagro S.P.A, DuPont |

| Additional Attributes | Dollar sales, CAGR trends, product type distribution, size preferences, price range segmentation, competitor dollar sales & market share, regional growth patterns |

As per Product, the industry has been categorized into Azoxystrobin, Boscalid, Chlorothalonil, Cyazofamid, Etridiazole (Ethazole), Fenarimol, and Others.

As per Type, the industry has been categorized into Powder and Liquid.

As per Form, the industry has been categorized into Systematic, Contact, and Translaminar.

This segment is further categorized into Food Industry, Medicinal, Agriculture, Chemical Laboratory, and Others.

Industry analysis has been carried out in key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltics, and the Middle East & Africa.

The fungicide active ingredients market is expected to grow at a CAGR of 3.6% from 2025 to 2035.

Systematic fungicides are projected to hold around 39% of the market share in 2035.

Liquid formulations are set to hold 51.4% of the market share in 2025.

India is expected to lead the growth with a projected CAGR of 5.8%.

The fungicide active ingredients market is forecast to reach USD 21.22 billion in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Copper Fungicides Market Size and Share Forecast Outlook 2025 to 2035

Inorganic Fungicide Market - Growth & Demand 2025 to 2035

Amphimobile Fungicides Market Size and Share Forecast Outlook 2025 to 2035

Bio-rational Fungicides Market Growth – Trends & Forecast 2025 to 2035

Bacillus-based Biofungicides Market Size and Share Forecast Outlook 2025 to 2035

Active Wear Market Size and Share Forecast Outlook 2025 to 2035

Active, Smart, and Intelligent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Active Charcoal Complexes Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Active & Intelligent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Active Network Management Market Analysis by Component, End Users, and Region Through 2025 to 2035

Active Oxygens Market Analysis by Product Type, Application and Region: Forecast for 2025 to 2035

Competitive Overview of Active and Modified Atmospheric Packaging Companies

Market Share Insights for Active Packaging Providers

Market Share Distribution Among Active, Smart, and Intelligent Packaging Manufacturers

Active Spoiler Market Growth - Trends & Forecast 2025 to 2035

Active Optical Cable Market Insights - Growth & Forecast 2025 to 2035

Active Damping Smartphone Case Market Growth - Demand & Trends 2025 to 2035

Active Humidifier Devices Market - Demand & Forecast 2025 to 2035

Active Packaging Market Analysis - Demand, Growth & Future Outlook 2024 to 2034

Active & Modified Atmospheric Packaging Market Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA