The active wear market is experiencing robust growth driven by rising health consciousness, increasing participation in fitness activities, and growing demand for multifunctional apparel suitable for both performance and lifestyle use. The current market landscape reflects strong consumer engagement with wellness-oriented products, accelerated by urbanization and social media influence promoting active lifestyles.

Technological advancements in textile engineering and design are improving fabric comfort, durability, and moisture management, which are strengthening brand competitiveness. The future outlook is defined by the blending of fashion and functionality, with brands focusing on sustainable production practices and the use of eco-friendly materials to attract environmentally aware consumers.

Growth rationale is anchored in the continuous evolution of athleisure trends, expanding product lines catering to diverse demographics, and the strategic retail integration of online and offline channels that enhance product accessibility These factors collectively are positioning the market for sustained expansion across global regions with steady growth in premium and mass-market segments.

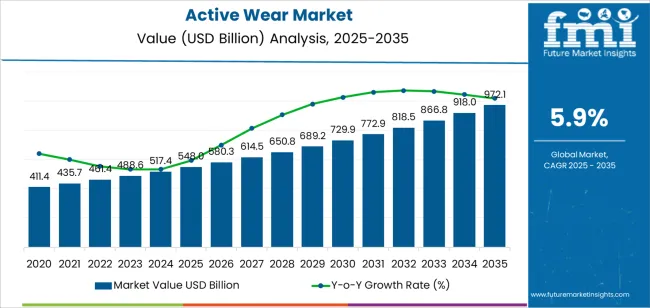

| Metric | Value |

|---|---|

| Active Wear Market Estimated Value in (2025 E) | USD 548.0 billion |

| Active Wear Market Forecast Value in (2035 F) | USD 972.1 billion |

| Forecast CAGR (2025 to 2035) | 5.9% |

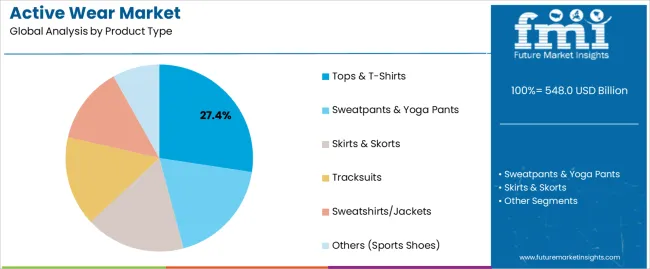

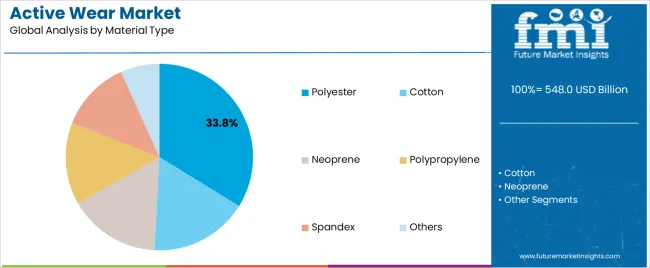

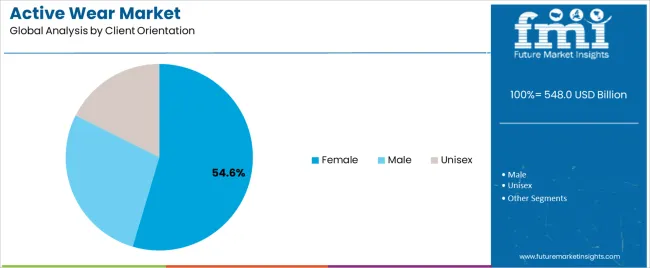

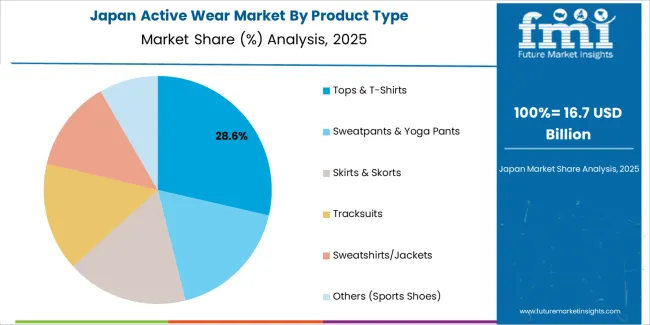

The market is segmented by Product Type, Material Type, Client Orientation, and Sales Channel and region. By Product Type, the market is divided into Tops & T-Shirts, Sweatpants & Yoga Pants, Skirts & Skorts, Tracksuits, Sweatshirts/Jackets, and Others (Sports Shoes). In terms of Material Type, the market is classified into Polyester, Cotton, Neoprene, Polypropylene, Spandex, and Others. Based on Client Orientation, the market is segmented into Female, Male, and Unisex. By Sales Channel, the market is divided into Online Sales Channel and Offline Sales Channel. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The tops and T-shirts segment, accounting for 27.40% of the product type category, has emerged as the leading segment owing to its widespread adoption across both casual and performance wear. Consistent consumer demand is being driven by comfort, versatility, and adaptability for multiple activities such as gym workouts, yoga, and outdoor sports.

Advancements in breathable and quick-dry fabrics have enhanced product functionality, while continuous innovation in design aesthetics has supported fashion appeal. Manufacturers are leveraging branding and celebrity endorsements to strengthen consumer loyalty and expand reach across digital retail platforms.

The segment’s leadership is expected to persist as brands increasingly integrate smart textiles and sustainability-driven materials, aligning with evolving consumer preferences for high-performance yet eco-conscious apparel.

The polyester segment, holding 33.80% of the material type category, remains dominant due to its superior moisture-wicking capability, elasticity, and cost efficiency. Its functional versatility has made it the preferred material in both professional sportswear and casual activewear lines.

The segment’s strength is being reinforced by continuous innovation in fabric finishing technologies that enhance breathability, UV resistance, and durability. Manufacturers are focusing on recycled polyester production to align with sustainability targets and reduce environmental impact.

The balance between performance quality and affordability has ensured its sustained use across global brands Over the forecast period, the segment is expected to maintain its leading position as technological refinement and circular textile initiatives further elevate polyester’s market relevance in the active wear industry.

The female segment, representing 54.60% of the client orientation category, has been leading due to expanding female participation in fitness, sports, and athleisure trends. Increased emphasis on wellness and body positivity has strengthened product demand, while the proliferation of influencer marketing has accelerated brand engagement among women consumers.

Product design innovations emphasizing comfort, support, and style diversity are driving repeat purchases and expanding premium segment penetration. Retailers are tailoring marketing strategies and assortments to reflect the evolving preferences of female consumers, supported by personalized online experiences and inclusive sizing options.

The segment’s dominance is further reinforced by a strong cultural shift toward health-oriented lifestyles and fashion-conscious activewear choices Continued investment in women-specific product development and sustainable materials is expected to sustain its leading market share throughout the forecast period.

The Market of Active Wear Products Experiencing a Surge in Demand due to Sustainability and Eco-friendly initiatives

Long-term brand survival requires active wear manufacturers to include sustainable practices in their production methodes. Customers are expecting foil and right sourcing arsenic they go further environmentally concerned.

As well as supporting corporate social responsibility goals, using recycled materials, reducing waste, improving supply chain productivity to appeal to ecologically concerned customers, constructing brand loyalty, and differentiating the company in a crowded market.

Adopting sustainability is not only a trend but is is important and essential for future-evidenceing the industry and reduction risks relevant to loose customer preferences and environmental concerns

Several brands are hopping on this trend. For instance, in May 2025, leading materials science specialists RecoverTM and global lifestyle brand Perry Ellis collaborated to launch 'eco denim' collections to consumers using Recover's low-impact recycled cotton fiber.

Smart and High-tech Fabric Integration Rises in the Market

Investing in research & development to incorporate sophisticated technology into active wear textiles is a strategic step for improving product performance and distinguishing it from the competition. Moisture-wicking characteristics, temperature management, and antibacterial features boost user comfort and functionality while positioning the brand as unique and cutting-edge.

In this increasingly competitive market, premium pricing and brand loyalty are fostered by utilizing high-tech materials, which show a dedication to providing customers with exceptional quality and value.

For instance, in November 2025, Goldwin launched the Re-Optimum line, a functional clothing line designed to improve the quality of passive rest and aid in promoting recovery. The innovative KODENSHI® material provides exceptional performance for these clothes. The fundamental idea behind the design is to keep the body temperature near its ideal range because even a one-degree temperature dip can substantially negatively impact the immune system's efficiency.

CBD-infused Active Wear Emerges as an Exciting New Trend in the Market

The increasing popularity of CBD-infused active wear is driven by a shift toward holistic well-being, with consumers looking for goods that promote physical and mental well-being. CBD's putative anti-inflammatory and relaxing qualities correspond to post-workout recovery requirements, providing an innovative approach to maximizing physical recuperation.

The trend responds to a need for comfort and performance enhancement, with the ability to reduce stress during exercises. It is consistent with the growing popularity of mindful exercise approaches, which emphasize mental clarity. Brands that follow this trend stand out in the competitive activewear industry and capitalize on CBD-based goods' growing acceptability and appeal across sectors.

For instance, in September 2025, Acabada, a rising startup in the active wear industry, launched its new CBD-infused sportswear line. The company aims to provide garments that converge fashion, wellness, and fitness.

| Attribute | Details |

|---|---|

| Trends |

|

| Opportunities |

|

| Challenges |

|

| Segment | Ready to Wear (Type) |

|---|---|

| Value Share (2025) | 41.6% |

Based on type, the ready-to-wear segment garnered 41.6% of active wear market shares in 2025.

| Segment | Women (Client Orientation) |

|---|---|

| Value Share (2025) | 48.2% |

Based on client orientation, the women segment holds 48.2% of active wear market shares in 2025.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 3.2% |

| Germany | 1.9% |

| Japan | 7.6% |

| China | 10.0% |

| India | 10.8% |

The demand for activewear in the United States is expected to grow at a 3.2% compound annual growth rate (CAGR) through 2035.

The active wear market growth in Germany is estimated at a 1.9% CAGR through 2035.

The sales of active wear in Japan are anticipated to surge at a 7.6% CAGR through 2035.

The demand for active wear in China is predicted to amplify at a 10.0% CAGR through 2035.

Active wear sales in India are expected to rise at a 10.8% CAGR through 2035.

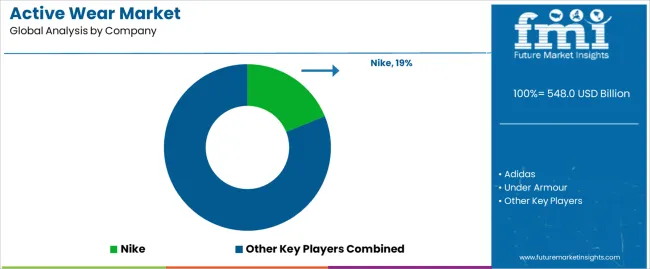

The active wear market is highly competitive, with leading firms striving for dominance and consumer loyalty in the market. Prominent global brands like Nike, Adidas, and Under Armour influence the market using their broad product portfolios, cutting-edge technology, and strong brand awareness. These industry titans continually spend in R&D to produce breakthrough fabrics, designs, and performance characteristics, resulting in a continuous push for distinction and market supremacy.

Recent Developments

The global active wear market is estimated to be valued at USD 548.0 billion in 2025.

The market size for the active wear market is projected to reach USD 972.1 billion by 2035.

The active wear market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in active wear market are tops & t-shirts, sweatpants & yoga pants, skirts & skorts, tracksuits, sweatshirts/jackets and others (sports shoes).

In terms of material type, polyester segment to command 33.8% share in the active wear market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Maternity Activewear Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Maternity Activewear Market Share

Wearable Fall Detector Market Size and Share Forecast Outlook 2025 to 2035

Wearable Industrial Exoskeleton Devices Market Size and Share Forecast Outlook 2025 to 2035

Wear Grade PEEK Polymer Market Size and Share Forecast Outlook 2025 to 2035

Wearable Healthcare Devices Market Size and Share Forecast Outlook 2025 to 2035

Wearable Sensor Market Size and Share Forecast Outlook 2025 to 2035

Wearable Sleep Tracker Market Forecast and Outlook 2025 to 2035

Wearable Medical Device Market Size and Share Forecast Outlook 2025 to 2035

Active, Smart, and Intelligent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Wearable Injectors Market Size and Share Forecast Outlook 2025 to 2035

Wearable Defibrillator Patch Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Wearable Fitness Tracker Market Size and Share Forecast Outlook 2025 to 2035

Wearable Translator Market Size and Share Forecast Outlook 2025 to 2035

Wearable Cardioverter Defibrillator Market Size and Share Forecast Outlook 2025 to 2035

Active Charcoal Complexes Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Wearable Electronics Market Size and Share Forecast Outlook 2025 to 2035

Wearable Band Market Size and Share Forecast Outlook 2025 to 2035

Wearable Gaming Technology Market Size and Share Forecast Outlook 2025 to 2035

Active & Intelligent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA