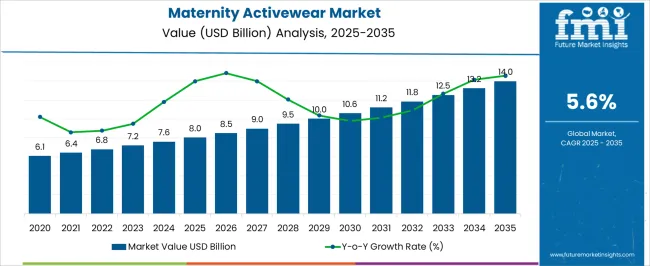

The Maternity Activewear Market is estimated to be valued at USD 8.0 billion in 2025 and is projected to reach USD 14.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

| Metric | Value |

|---|---|

| Maternity Activewear Market Estimated Value in (2025 E) | USD 8.0 billion |

| Maternity Activewear Market Forecast Value in (2035 F) | USD 14.0 billion |

| Forecast CAGR (2025 to 2035) | 5.6% |

The maternity activewear market is expanding rapidly, fueled by rising consumer awareness of health and fitness during pregnancy and growing demand for functional yet stylish apparel. Industry publications and brand announcements have emphasized a surge in demand for clothing that combines comfort, flexibility, and support, reflecting lifestyle shifts where women continue fitness routines throughout pregnancy.

Fashion houses and sportswear companies have broadened product ranges with dedicated maternity lines, supported by advanced fabric technologies designed to enhance breathability and stretch. Increasing online engagement and social media visibility of active lifestyles during pregnancy have further amplified consumer interest.

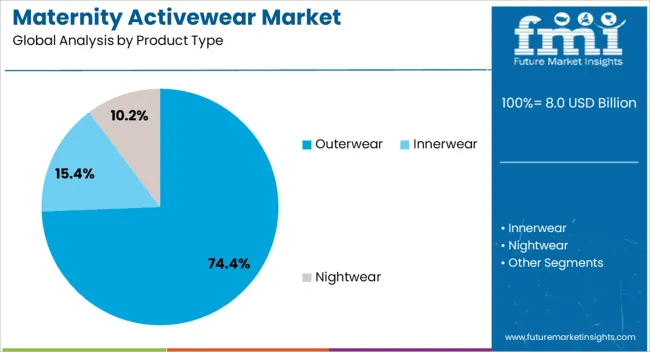

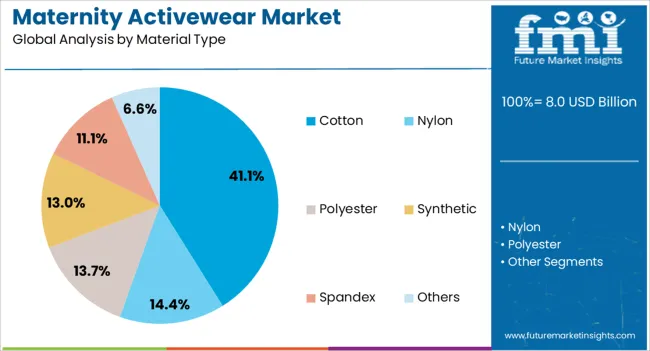

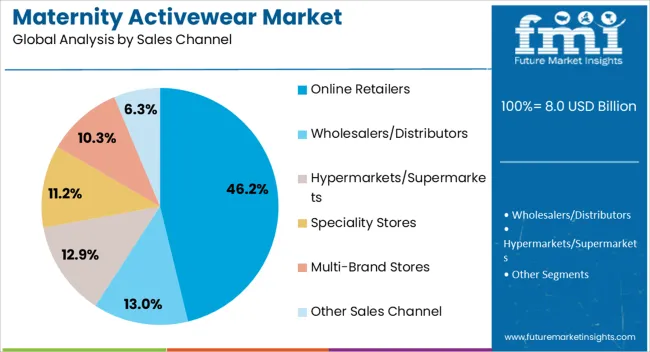

Additionally, rising disposable incomes and the expansion of organized retail across emerging economies have contributed to broader product accessibility. The market outlook is supported by sustainability initiatives, with natural fabrics gaining traction, and digital retail platforms creating new opportunities for personalized shopping experiences. Segmental growth is being driven by outerwear as the most widely used category, cotton for its comfort and breathability, and online retailers as the most preferred sales channel.

The Outerwear segment is projected to contribute 74.4% of the maternity activewear market revenue in 2025, making it the most dominant product type. Growth of this segment has been supported by the increasing demand for leggings, tops, and jackets that provide flexibility and support throughout pregnancy.

Outerwear products have been preferred due to their versatility in both casual wear and fitness routines, aligning with consumer needs for multi-purpose clothing. The segment has also benefited from advancements in stretch fabrics and seamless construction, which improve comfort and adaptability as the body changes.

Additionally, outerwear designs have been increasingly marketed as lifestyle apparel, broadening appeal beyond fitness to daily wear. This multi-functionality, combined with fashion-conscious styling, has secured outerwear’s leadership in the maternity activewear market.

The Cotton segment is projected to account for 41.1% of the maternity activewear market revenue in 2025, maintaining its leading position in material preference. This dominance has been driven by cotton’s natural breathability, softness, and skin-friendly properties, which are highly valued during pregnancy.

Consumers have increasingly preferred cotton-based maternity activewear for its comfort and ability to regulate body temperature during physical activity. The segment has also been supported by sustainability trends, with cotton being marketed as an eco-friendly and biodegradable option compared to synthetic fibers.

Furthermore, cotton’s adaptability in blending with elastane and other stretch fibers has enhanced garment durability and flexibility. As consumer priorities shift towards wellness and sustainable fashion choices, cotton remains the most favored material in maternity activewear.

The Online Retailers segment is projected to capture 46.2% of the maternity activewear market revenue in 2025, positioning itself as the leading sales channel. Growth in this segment has been supported by the rapid expansion of e-commerce platforms, offering convenience and a wide selection of maternity-specific activewear.

Online channels have provided access to global brands, niche maternity labels, and customizable sizing options, enhancing consumer choice. Digital marketing campaigns, influencer partnerships, and targeted social media advertising have further amplified sales through online platforms.

Additionally, flexible return policies and virtual fitting tools have addressed sizing concerns, which are especially relevant during pregnancy. The increasing reliance on online shopping for fashion and lifestyle products, combined with the ease of price comparison and home delivery, has solidified the position of online retailers as the preferred channel in the maternity activewear market.

| Historical CAGR (2020 to 2025) | 4.60% |

|---|---|

| Forecast CAGR (2025 to 2025) | 5.70% |

From 2020 to 2025, the market witnessed a CAGR of 4.60%, reflecting a gradual but consistent rise in demand. This period saw a boom in awareness of the importance of comfortable and stylish activewear tailored to the needs of expecting mothers.

With a projected CAGR of 5.70% from 2025 to 2035, the future holds promise for further advancement and innovation in this segment. Factors such as shifting consumer preferences towards more active lifestyles during pregnancy, coupled with advancements in fabric technology and design, are expected to fuel demand for maternity activewear.

As the market continues to evolve, embracing inclusivity, sustainability, and versatility, it paves the way for a flourishing future where expecting mothers can confidently embrace their active lifestyles with comfort and style.

Expecting mothers are prioritizing fitness and well-being, leading to a higher demand for activewear that offers comfort, support, and style.

The below section shows the leading segment. Based on product type, the outerwear segment is accounted to hold a market share of 74.4% in 2025. Based on material type, the cotton segment is accounted to hold a market share of 41.1% in 2025.

| Category | Market Share in 2025 |

|---|---|

| Outerwear | 74.4% |

| Cotton | 41.1% |

Based on product type, the outerwear sector is accounted to hold a market share of 74.4% in 2025. The dominance can be attributed to the essential role that outerwear plays in providing expecting mothers with comfort, support, and versatility during their active pursuits.

Outerwear pieces such as maternity jackets, hoodies, and pullovers are designed to accommodate a growing belly while offering protection from the elements, making them indispensable staples for pregnant women leading active lifestyles.

Based on material type, the cotton segment is accounted to hold a market share of 41.1% in 2025. Expecting mothers gravitate towards cotton-based activewear pieces for their ability to provide gentle support, regulate body temperature, and ensure maximum comfort during workouts, yoga sessions, or everyday activities.

The popularity of cotton reflects consumers' preference for natural, skin-friendly materials that prioritize both comfort and performance in maternity activewear.

The table mentions the top five countries ranked by revenue, with Singapore holding the top position. In Singapore, the maternity activewear market dominates by offering a range of stylish and comfortable options tailored to expectant mothers' needs.

With a focus on functionality and fashion, brands cater to the active lifestyles of the women of Singapore during pregnancy, capturing a significant market share of the maternity activewear market.

Forecast CAGRs from 2025 to 2035

| Countries | CAGR |

|---|---|

| The United States | 5.9% |

| The United Kingdom | 6.5% |

| Japan | 9.7% |

| Singapore | 10.4% |

| India | 9.2% |

In the United States, the maternity activewear market is primarily utilized by expecting mothers who prioritize fitness and wellness throughout their pregnancy journey.

With a strong emphasis on health-conscious lifestyles, pregnant women in the United States seek activewear that provides both comfort and functionality, allowing them to engage in various forms of exercise and physical activity to support their well-being during pregnancy.

In the United Kingdom, the maternity activewear market caters to expecting mothers who value both style and practicality.

With a growing emphasis on fashion-forward maternity wear, British pregnant women seek activewear that seamlessly blends trendy designs with functional features, allowing them to maintain an active lifestyle while embracing their sense of style during pregnancy.

In Japan, the maternity activewear market is majorly used by expecting mothers who prioritize comfort and quality in their apparel choices.

Focus on meticulous design and attention to detail leads the pregnant women of Japan to seek activewear that offers superior comfort and support, allowing them to navigate their daily activities with ease and confidence throughout their pregnancy.

In Singapore, the market caters to expecting mothers who lead active and dynamic lifestyles. With a bustling urban environment and a strong emphasis on fitness and wellness, pregnant women in Singapore seek activewear that enables them to stay active and engaged in various forms of exercise and leisure activities while ensuring maximum comfort and flexibility during their pregnancy.

With a diverse cultural landscape and a growing trend towards fitness and well-being, pregnant women in India seek activewear that combines traditional aesthetics with contemporary designs. The maternity activewear allows them to maintain an active lifestyle while staying true to their cultural heritage during pregnancy.

Emerging players innovate with eco-friendly materials and inclusive sizing options, challenging traditional market leaders.

Differentiation is achieved through a blend of fashion-forward designs, innovative fabric technologies, and personalized customer experiences as brands vie to capture the attention and loyalty of expecting mothers seeking comfort, style, and functionality in their maternity activewear choices.

Some of the key developments

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 8.0 billion |

| Projected Market Valuation in 2035 | USD 14.0 billion |

| Value-based CAGR 2025 to 2035 | 5.6% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East and Africa |

| Key Market Segments Covered | Product Type, Material Type, Sales Channel, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

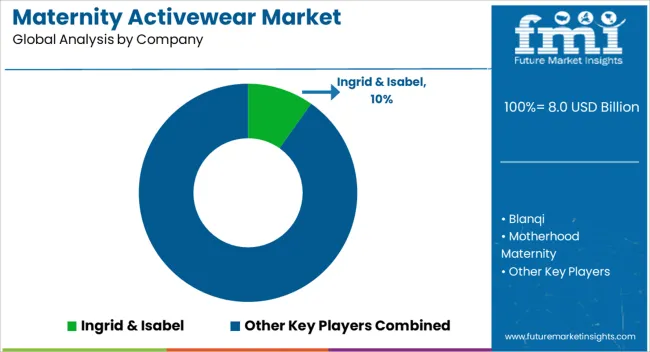

| Key Companies Profiled | Ingrid & Isabel; Blanqi; Motherhood Maternity; Seraphine; Active Truth; FittaMamma; Cadenshae; Cake Maternity; HATCH; Mumberry; Boob Design; Noppies; Beyond Yoga (Maternity Collection); Gap Maternity; PinkBlush Maternity |

The global maternity activewear market is estimated to be valued at USD 8.0 billion in 2025.

The market size for the maternity activewear market is projected to reach USD 14.0 billion by 2035.

The maternity activewear market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in maternity activewear market are outerwear, _tops, _tunics, _bottom, _dresses, _others, innerwear, _lingeries, _camisoles, _others and nightwear.

In terms of material type, cotton segment to command 41.1% share in the maternity activewear market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Overview of Maternity Activewear Market Share

Maternity Apparel Market Size and Share Forecast Outlook 2025 to 2035

Maternity Products Market Size and Share Forecast Outlook 2025 to 2035

Maternity Innerwear Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Market Share Distribution Among Maternity Apparel Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA