Leading Brands like Hatch, Kindred Bravely, and Fabletics dominate the maternity activewear market by combining functionality, comfort, and style. These companies address the needs of expecting mothers with innovative designs, such as adjustable waistbands, breathable fabrics, and seamless support.

Projected to grow at a CAGR of 7.3%, the market is expected to reach USD 13,215.6 million by 2035. Brands emphasizing sustainable materials, such as organic cotton and recycled polyester, capture the eco-conscious consumer segment. Size inclusivity and custom-fit options further expand their reach among diverse body types.

| Attribute | Details |

|---|---|

| Projected Value by 2035 | USD 13,215.6 Million |

| CAGR during the period 2025 to 2035 | 7.3% |

E-commerce platforms and social media marketing play pivotal roles in driving awareness and sales. Collaborations with fitness influencers and prenatal experts enhance brand credibility, attracting health-focused mothers-to-be.

In a competitive landscape, differentiation comes from innovation in design, transparency in manufacturing, and consumer-centric approaches. Brands that prioritize direct-to-consumer models and expand into emerging markets are well-positioned for long-term success.

Market Growth

The maternity activewear market is growing as modern mothers prioritize health and wellness during pregnancy. The trend toward prenatal fitness and yoga, coupled with the rising popularity of athleisure, boosts demand for stylish and functional activewear. Advances in fabric technology and ergonomic designs further enhance comfort and performance, appealing to a broad audience of expecting mothers.

Global Brand Share & Industry Share (%):

| Category | Industry Share (%) |

|---|---|

| Top 3 (HATCH, Seraphine, Blanqi) | 30% |

| Rest of Top 5 (Beyond Yoga, Kindred Bravely) | 20% |

| Next 5 of Top 10 (Storq, Gap Maternity, others) | 15% |

Type of Player & Industry Share (%):

| Type of Player | Industry Share (%) |

|---|---|

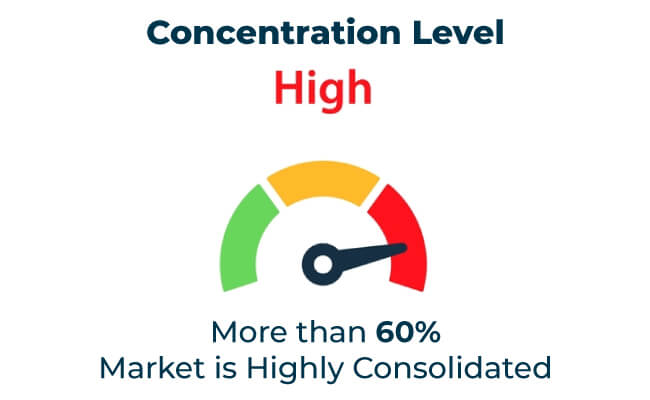

| Top 10 | 65% |

| Top 20 | 25% |

| Rest | 10% |

Year-over-Year Leaders:

Performance Fabrics

Ergonomic Design Features

AI-Powered Customization

Eco-Friendly Materials

Circular Fashion Initiatives

Energy-Efficient Production

Focus on Prenatal Wellness

Versatility and Style

Inclusive Sizing

The maternity activewear market will continue to grow as brands innovate with sustainable materials, ergonomic designs, and digital retail strategies. Companies that prioritize inclusivity, regional expansions, and eco-friendly initiatives will dominate the market. Emerging trends, such as smart textiles and wearable health monitors, will further transform the industry.

Revenue and Share by Brand

Market leaders like HATCH, Seraphine, and Blanqi maintain dominance through innovation, scalability, and strong distribution networks.

Figures/Visuals

| Brand | HATCH |

|---|---|

| Market Contribution (%) | 15% |

| Key Initiatives | Focused on premium, stylish maternity activewear |

| Brand | Seraphine |

|---|---|

| Market Contribution (%) | 13% |

| Key Initiatives | Expanded eco-friendly designs for prenatal and postpartum |

| Brand | Blanqi |

|---|---|

| Market Contribution (%) | 12% |

| Key Initiatives | Specialized in supportive, high-performance maternity wear |

Scope of Market Definition

The maternity activewear market includes clothing designed specifically for pregnant and postpartum women, such as leggings, tops, and sports bras. This analysis excludes general activewear not tailored for maternity use.

Key Terms and Terminology

The primary research involved a combination of primary interviews, secondary data analysis, and industry-specific modelling. The data was cross-validated with market experts and industry stakeholders to validate the accuracy and relevance of the data.

The global maternity activewear market will grow at a CAGR of 5.7% between 2025 and 2035.

The global maternity activewear market will reach USD 13,215.6 million by 2035.

The top 10 players account for over 58% of the global market.

Key manufacturers include HATCH, Seraphine, Blanqi, Beyond Yoga, and Kindred Bravely among others.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Maternity Activewear Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Maternity Apparel Providers

Maternity Apparel Market Size and Share Forecast Outlook 2025 to 2035

Maternity Products Market Size and Share Forecast Outlook 2025 to 2035

Maternity Innerwear Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Demand for Maternity Apparel in USA Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Pet Market Share & Industry Trends

Competitive Landscape of Hob Market Share

Leading Providers & Market Share in Kegs

Market Share Distribution Among Hops Manufacturers

Market Share Distribution Among Bran Manufacturers

Leading Providers & Market Share in the Straw Industry

Assessing Okara Market Share & Industry Trends

Analyzing Market Share & Industry Trends of Chitin Providers

Examining Shrimp Market Share Trends & Industry Leaders

Analyzing Pulses Market Share & Industry Trends

Competitive Overview of Labels Companies

Market Share Insights of Leading Mezcal Manufacturers

Market Share Breakdown of the IV Bag Market

Global MDO-PE Market Share Analysis – Trends, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA