The global shrimp market operates in a mixed market structure with widely varying degrees of concentration across the different segments and regions. Multinationals such as Thai Union Group, CP Foods, and Minh Phu Seafood Corporation lead, accounting for approximately 50% of the combined market share by leveraging economies of scale, integrated supply chains, and global brand recognition.

Regional players include Omarsa from Ecuador and Seajoy Group from Honduras, which together capture 35% market share. The regional players mostly focus on exporting markets because of their expertise in sustainably farming shrimps and their conformity to international certifications such as Aquaculture Stewardship Council (ASC).

This focuses on areas with suitable climatic conditions and already established aquaculture practices, which enable them to cater toward specific regional demand. The small players and niche brands represent 15% of the market.

Here, most players use a differentiation strategy where they emphasize their product being organic, free from antibiotics, or sustainably farmed to reach health-conscious and environmentally sensitive consumers.

| Global Market Share 2025 | Industry Share (%) |

|---|---|

| Top 5 Players (Thai Union Group, CP Foods, Minh Phu, Zhanjiang Guolian, Maruha Nichiro) | 40% |

| Regional Leaders (Omarsa, Seajoy Group, Avanti Feeds, Apex Frozen Foods, Santa Priscila) | 35% |

| Startups and Niche Brands (Blue Star Foods, Ocean More Foods, Artisanal Local Farmers) | 25% |

The shrimp market remains moderately fragmented on a global basis, with many small players competing against major multinationals.

The gulf variety holds the maximum market share, that is, 35%. These wild-caught shrimps, mainly from the Gulf of Mexico, are valued for their firm texture and sweet, delicate flavor. The Gulf shrimp industry has been under stress in recent years due to environmental factors and regulatory changes, but it is still a major player in the global market.

Farmed Whiteleg Shrimps account for 25% of the market share. Also known as Pacific white shrimp, this species is widely cultivated in Asia and Latin America, offering consistent supply and competitive pricing. The farmed whiteleg shrimp segment has been growing because of the better technology developed in aquaculture and the rising demand for affordable, high-quality shrimp.

The canned shrimp segment constitutes nearly 40% of the global market sales. Canned shrimp has several benefits that explain its appeal, such as longer shelf life, ease of preparation, and greater availability to the consumer.

Canned shrimp is available in retail and foodservice markets and reaches many different end-users, from home to commercial. Breaded and peeled shrimp comprise 25% of the total shrimp market. This value-added form attracts those who look for ready-to-cook shrimp, especially retail and frozen food.

The remaining market share is occupied by the other shrimp forms, namely cooked & peeled, shell on, and frozen shrimp. Cooked & peeled shrimp caters to consumers who are looking at a partially prepared product which does not entail much preparation.

It was quite a radical year for the international markets of shrimps, one that followed improvements in sustainable fishing practices, technological innovations, and strategic partnerships. On a competitive edge, leading companies aimed at ruling the market by following the consumer demand for eco-friendly and premium quality shrimps.

Production capacity is being developed, smart aquaculture technologies adopted, and sustainable global goals are integrated to redefine the competitive landscape. Regional players have focused on local preferences with multinational players establishing their presence through multi-certification and innovative new product lines.

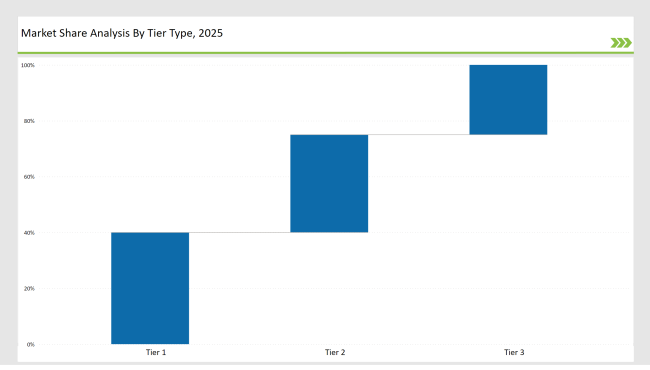

| By Tier Type | Tier 1 |

|---|---|

| Market Share (%) | 50% |

| Example of Key Players | Thai Union, CP Foods, Minh Phu |

| By Tier Type | Tier 2 |

|---|---|

| Market Share (%) | 35% |

| Example of Key Players | Omarsa, Seajoy, Avanti Feeds |

| By Tier Type | Tier 3 |

|---|---|

| Market Share (%) | 15% |

| Example of Key Players | Small-Scale Producers and Startups |

| Brand | Key Focus |

|---|---|

| Thai Union Group | Scaling sustainable shrimp farming practices globally |

| CP Foods | Investing in R&D for disease-resistant shrimp |

| Minh Phu | Enhancing European market penetration through certifications |

| Zhanjiang Guolian | Launching premium frozen shrimp lines |

| Omarsa | Developing organic and antibiotic-free shrimp products |

| Seajoy | Partnering with NGOs for sustainable aquaculture |

| High Liner Foods | Expanding breaded shrimp product lines in North America |

| Santa Priscila | Investing in eco-friendly packaging |

| Apex Frozen Foods | Upgrading processing facilities to enhance export potential |

| Avanti Feeds | Increasing domestic shrimp production capacity in India |

The demand for value-added shrimp products, such as breaded and marinated varieties, is expected to grow significantly, especially in the North American and European markets.

Manufacturers can capitalize on this trend by investing in advanced automation technologies and streamlining their processing facilities to enhance efficiency, productivity, and the ability to meet the evolving consumer preferences for convenient and flavorful shrimp offerings.

The production of eco-certified shrimp will fuel market growth, especially within the developed regions where consumers have increasingly become more conscious of the environmental impact of seafood choices.

ASC and other similar certifications will be a necessary process to enter the market, since manufacturers will be inclined to better demonstrate their commitment to sustainable aquaculture processes and meet the evolving expectations of environmentally aware consumers.

As of today, the Asia-Pacific region emerges as a global leader in producing shrimp. Growth in its aquaculture centers and production capabilities will continue over the foreseeable future. Manufacturers can, therefore, take advantage of these developments and establish strategic alliances with local authorities and tap into the subsidies, technological and infrastructural investments available to develop their presence in the market as well as their competitiveness.

Shrimp is widely consumed in foodservice (45%), retail (40%), and industrial applications (15%), including ready-to-eat meals and pet food.

Processed shrimp constitutes 10% of the market, with breaded and marinated products driving demand in North America and Europe.

Trends include eco-certified farming, AI and IoT integration for aquaculture management, and disease-resistant shrimp species development.

Thai Union Group, CP Foods, and Minh Phu are the top three players, collectively holding 40% of the market.

Leading players like Omarsa and Thai Union are adopting antibiotic-free practices, eco-certifications, and innovative packaging solutions to meet sustainability goals.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Shrimp Market Size, Growth, and Forecast 2025 to 2035

Shrimps Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Shrimp Feed Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

UK Shrimp Market Insights – Growth, Demand & Forecast 2025-2035

USA Shrimp Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Shrimp Market Trends – Growth, Demand & Forecast 2025–2035

Korea Shrimp Market Analysis by Species, Source, Form, Sales Channel, Application, and Region Through 2035

Japan Shrimp Market Analysis by Species, Source, Form, Sales Channel, Application, and Region Through 2035

Europe Shrimp Market Outlook – Share, Growth & Forecast 2025–2035

Australia Shrimp Market Outlook – Size, Share & Forecast 2025-2035

Demand for Shrimp in the EU Size and Share Forecast Outlook 2025 to 2035

Plant-Based Shrimp Market Size and Share Forecast Outlook 2025 to 2035

Latin America Shrimp Market Report – Trends, Growth & Forecast 2025–2035

Western Europe Shrimp Market Analysis by Species, Source, Form, Sales Channel, Application, and Country Through 2035

Competitive Overview of Pet Market Share & Industry Trends

Competitive Landscape of Hob Market Share

Leading Providers & Market Share in Kegs

Market Share Distribution Among Hops Manufacturers

Market Share Distribution Among Bran Manufacturers

Leading Providers & Market Share in the Straw Industry

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA