The USA shrimp market is projected to reach a value of USD 20,157.8 Million in 2025, growing at a CAGR of 7.9% over the next decade to an estimated value of USD 43,197.9 Million by 2035.

| Attributes | Values |

|---|---|

| Estimated USA Industry Size (2025) | USD 20,157.8 Million |

| Projected USA Industry Value (2035) | USD 43,197.9 Million |

| Value-based CAGR from 2025 to 2035 | 7.9% |

High demand for shrimp in food, pharmaceutical, and biotechnology applications and advancements in sustainable shrimp farming and processing technologies lead to rapid market growth. Shrimp will remain one of the most widely consumed seafood products in the USA, based on high-protein and low-fat dietary preferences.

Expanding health awareness and increasing additions of seafood as part of consumer diets are stimulating demand for all forms of shrimp, including canned, breaded, peeled, and frozen. Both farmed and wild-caught shrimp options service diverse consumer choices, thereby strengthening the market growth rate.

Growing ethical consumerism and the need for sustainable seafood have been the driving force in the market, turning it toward organic shrimp production, with the rising demand for responsibly sourced and eco-friendly (ecological) seafood being the case.

Pharmaceutical and biotechnological industries mid-afternoon also happen to be the chief end-users of shrimp-based components in the field of medical research and pharmaceutical applications.

The continuous advancement of shrimp processing technologies and the emergence of value-added products will also contribute to market growth over the forecast period; this is particularly important because it reflects evolving consumer preferences. Although challenges remain, the overall trajectory appears positive.

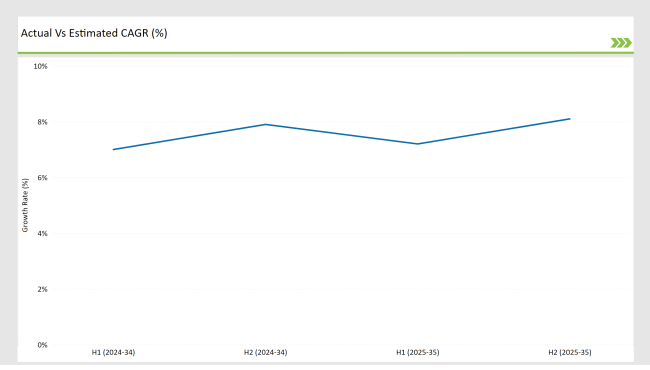

The semi-annual market update provided showed consistent growth in shrimp consumption and production. The demand is increasing steadily from the food and pharmaceutical industries.

H1 signifies period from January to June, H2 Signifies period from July to December

The market continues to benefit from increased distribution channels like supermarkets, specialty seafood retailers, and direct-to-consumer e-commerce platforms. On the other hand, improvements in cold storage and packaging solutions are enhancing the quality of shrimps, thereby increasing their shelf life to support market expansion.

| Date | Development/M&A Activity & Details |

|---|---|

| January 24 | Pacific Seafood: Expanded its organic shrimp farming operations to meet increasing demand for sustainably sourced seafood. |

| March 24 | Aqua Star: Introduced a new line of frozen breaded shrimp products targeting the quick-service restaurant industry. |

| May 24 | Eastern Fish Company: Launched a traceability program to ensure transparency in shrimp sourcing and supply chain management. |

| July 24 | Thai Union Group: Invested in innovative shrimp feed formulations to enhance sustainability and reduce environmental impact. |

| September 24 | High Liner Foods: Partnered with major retailers to expand the availability of value-added shrimp products in grocery stores nationwide. |

Increasing Demand for Organic and Sustainable Shrimp

The rising awareness among consumers regarding environmental impact has resulted in a notable surge in demand for organic shrimp. Organic shrimp cultivated in eco-friendly aquaculture farms devoid of antibiotics or harmful chemicals now represent approximately 20% of the market share.

Consumers are increasingly willing to pay a premium for ethically sourced seafood; this trend encourages industry players to invest in sustainable shrimp farming technologies. Retailers and restaurants, furthermore, tend to prefer sustainably certified shrimp.

They are particularly interested in collaborating with suppliers who implement the best fishing practices available. Increased growth in the certification programs, such as Best Aquaculture Practices (BAP) and Marine Stewardship Council (MSC), will further fuel the market for organic and responsibly sourced shrimp products.

Growth of Value-Added Shrimp Products in Retail and Foodservice

Shrimp processors are focused on creating added-value products such as breaded, pre-cooked, and seasoned shrimp that would respond to the consumers' desire for convenience. The ready-to-cook shrimp segment is experiencing significant growth because of the high-quality seafood demands of busy consumers who prefer minimal preparation time.

There are more shrimp-based menu offerings due to their versatility; however, they also appeal to health-conscious individuals. Foodservice operators (which include restaurants and fast-food chains) are becoming increasingly innovative with this seafood choice.

Flavored shrimp options such as garlic butter shrimp, Cajun-spiced shrimp, and tempura shrimp expand consumer choices and drive the emergence of novel market concepts. Although the competition is fierce, the popularity of these shrimp dishes continues to rise.

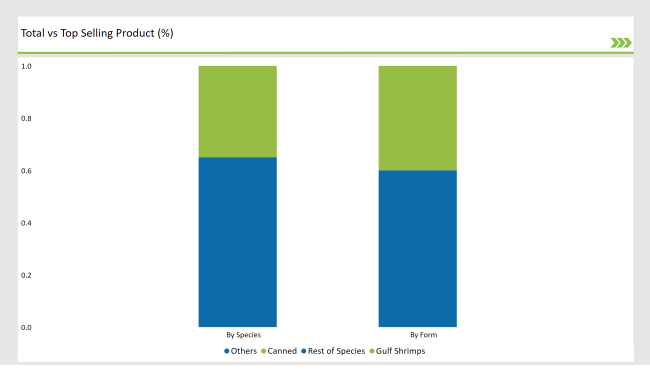

% share of Individual categories by Species and Forms in 2025

According to the statistics, Gulf shrimp is the number one shrimp variety suited in the USA market and is set to hold a total market share of 35% in the year 2025. The main reason is the wild-caught Gulf of Mexico fish species that are increasing the demand for locally sourced seafood and thus the support for the product.

The vegetable and other food sellers choose the product for its unique taste and texture. Environmental issues are growing fast, and the projects to upgrade Gulf shrimp fishing and encourage honest collecting are the triggers of ongoing market development

The total 2025 share of the global market for canned shrimp stands at 40 percent. Advantages like ready-to-eat convenience, durable shelf life, and affordability explain much of its following. Salads, pasta sauces, seafood dishes, and most food manufacturing make use of more canned shrimp.

This category has further driven the market due to consumer demand for such ready-to-serve seafood meals. Improved technological packaging for safe, non-toxic BPA-free cans, even vacuum-sealed pouches, will add to improving product standards and consumer choices.

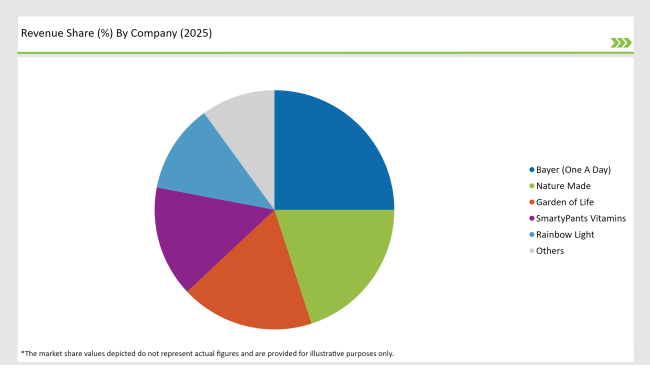

The shrimp market in the USA is exceptionally competitive. It comprises a blend of domestic seafood producers, international suppliers, and vertically integrated companies. Some key players in this market include Pacific Seafood, Aqua Star, Eastern Fish Company, Thai Union Group and High Liner Foods.

They are in the market not only because of the high scale of their production but also thanks to amazing distribution networks among the other. Additionally, they have made significant investments in sustainable shrimp farming.

However, the competition is as strong as ever. A thriving developing economy, being the growth that it is, makes all the participants step outside of the box. The dominance of these firms is balanced by the fact that the playing field is made more complex with the small firms.

The market is witnessing a surging demand for organic and responsibly sourced shrimp. Consumers are choosing products with traceability certifications and eco-friendly farming practices. The trend is making seafood producers invest in sustainable aquaculture and supply chain transparency.

Other developments are partnerships between seafood processors and food service operators that are broadening shrimp's reach in restaurants, fast-food chains, and meal delivery services. E-commerce platforms are also critical for direct-to-consumer sales of shrimp and diversifying channels of distribution.

By species, the market includes Gulf shrimp, farmed whiteleg shrimp, banded coral shrimp, royal red shrimp, giant tiger shrimp, blue shrimp, and ocean shrimp.

By form, the market is segmented into canned, breaded, peeled, cooked & peeled, shell-on, and frozen shrimp.

By source, the industry is divided into organic and conventional shrimp.

By application, the market includes food, pharmaceuticals, cosmetics, industrial, and biotechnology sectors.

The market is expected to grow at a CAGR of 7.9% from 2025 to 2035.

The USA Shrimp market is projected to reach USD 43,197.9 Million by 2035.

The market is expanding due to rising demand for seafood, increasing sustainability initiatives, and the growth of value-added shrimp products.

Canned shrimp leads the form segment with 40% market share, favored for its convenience and long shelf life.

Top manufacturers include Pacific Seafood, Aqua Star, Eastern Fish Company, Thai Union Group, and High Liner Foods.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

United States NFC Lemon Juice Market Analysis - Size, Growth and Forecast 2025 to 2035

USA and Canada Copper Market Insights - Demand, Size & Industry Trends 2025 to 2035

USA Ground and Precipitated Calcium Carbonate Market Growth by Product Type, Application, End-Use, and Region in 2025 to 2035

United States Animal Feed Additives Market Report – Trends, Growth & Forecast 2025–2035

United States Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United States Wood Vinegar Market Analysis – Trends, Growth & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA