The global plant-based shrimp market is projected to grow from USD 1.4 billion in 2025 to USD 3.2 billion by 2035, registering a CAGR of 8.6%. The market expansion is being driven by increasing consumer shift toward sustainable and cruelty-free seafood alternatives.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.4 billion |

| Industry Value (2035F) | USD 3.2 billion |

| CAGR (2025 to 2035) | 8.6% |

Rising awareness regarding health risks associated with traditional seafood consumption, such as mercury exposure and allergens, is contributing to heightened demand for plant-based shrimp across food service, retail, and e-commerce channels.

The market accounts for 14% of the plant-based seafood market, reflecting its growing traction among consumers seeking sustainable alternatives. Within the broader plant-based meat market, it holds a modest 4.5% share, owing to the dominance of products like burgers and sausages.

In the alternative protein market, its contribution stands at around 2.8%, while in the vegan food market, it represents nearly 1.5%. Its presence in the sustainable food and clean label food markets is estimated at 1% each, indicating early-stage development. Across all parent segments, the market is witnessing accelerated growth.

Government regulations impacting the market emphasize labeling transparency, sustainable sourcing, and food safety. The USA FDA and USDA enforce guidelines around plant-based food claims, allergen disclosures, and nutrition labeling. In Europe, EFSA mandates strict controls for plant-derived protein safety, while the Novel Food Regulation applies to innovative ingredients like algae-based shrimp.

Furthermore, global regulatory frameworks around sustainable aquaculture and marine preservation indirectly bolster demand for plant-based seafood, prompting manufacturers to invest in clean-label, allergen-free, and environmentally friendly shrimp alternatives.

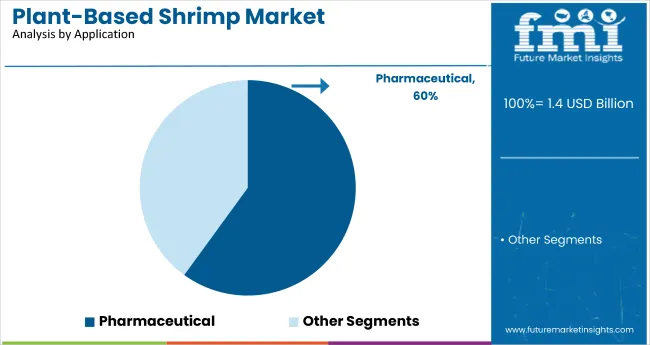

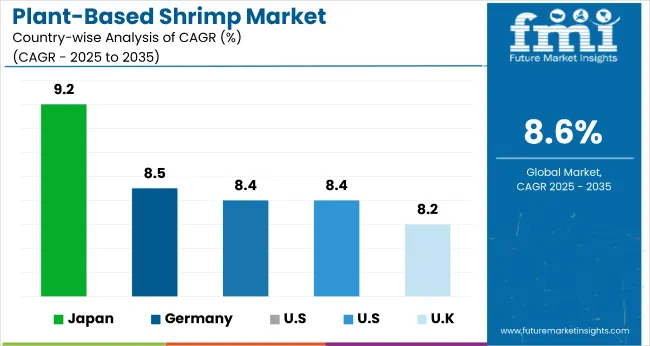

Japan is projected to be the fastest-growing market, expected to expand at a CAGR of 9.2% from 2025 to 2035. Frozen plant-based shrimp will lead the segment with a 50% share, while pharmaceutical will dominate the application segment with a 60% share. The USA and UK markets are expected to grow steadily at CAGRs of 8.3% and 8.2%, respectively, while Germany and France will grow at 8.5% and 8.4% CAGR, respectively.

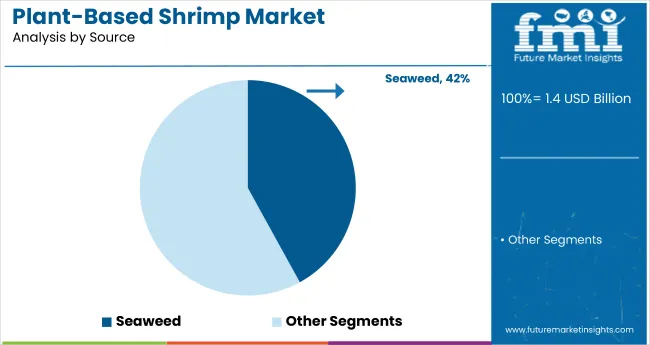

The global market is segmented by source, segment, product type, distribution channel, end-use, application, and region. By source, the market includes seaweed, legume protein, plant-based omega-3, soy protein, pea protein, and others (quinoa, oats, beans, and seeds).

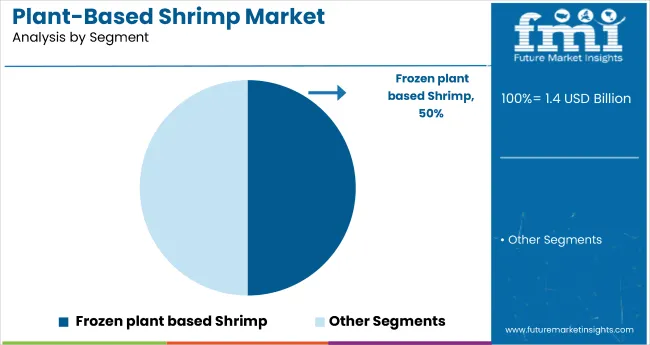

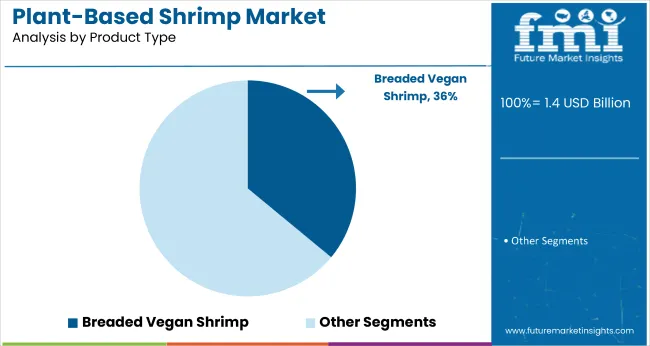

Based on product format, the market is categorized into frozen, refrigerated, and shelf-stable plant-based shrimp. By product type, the market is segmented into breaded vegan shrimp, crunchy coconut shrimp, crispy vegan shrimp, and raw vegan shrimp.

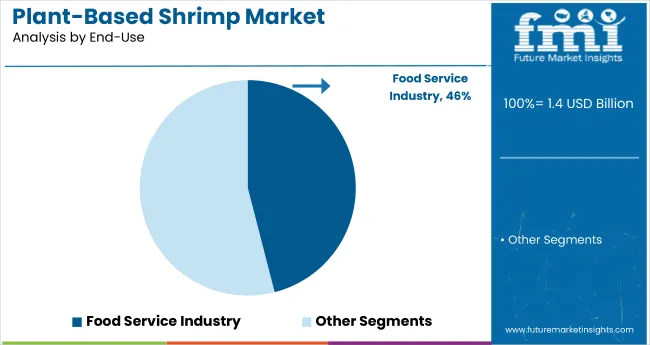

By distribution channel, the market is divided into B2B and B2C, with store-based retailing (hypermarkets/supermarkets, convenience stores, mass grocery retailers, food & drink specialty stores) and online retailing under B2C. Based on end-use, the market include food service industry, household, and retail. By application, the market is bifurcated into pharmaceutical and clinical trials. Regionally, the market is classified into North America, Latin America, Europe, East Asia, South Asia and Pacific, and the Middle East & Africa.

Seaweed is projected to dominate the source segment, accounting for 42% of the global market share by 2025. This growth is driven by its sustainability, allergen-free profile, and seafood-like flavor. Its rich content of essential minerals, iodine, and bioactive compounds supports its use in plant-based meat alternatives, functional foods, and clean-label formulations, further boosting its demand across health-conscious and environmentally aware consumer segments.

Frozen products are projected to hold 50% of the segment share by 2025, driven by extended shelf life, cold chain efficiency, and rising demand for ready-to-cook formats. Growth is further supported by expanding plant-based frozen offerings, nutrient retention technologies, and increased adoption across urban foodservice and retail distribution networks.

Breaded vegan shrimp is expected to lead the product type segment, capturing 36% of the global market share in 2025 due to its familiar texture, ease of preparation, and strong acceptance among flexitarian and vegan consumers. Rising retail listings, increased HoReCa adoption, and product launches with soy-free, gluten-free claims are accelerating category expansion.

B2C is projected to lead the distribution channel, accounting for 54% of the global market share in 2025, driven by increasing consumer access to plant-based products through supermarkets, specialty stores, and e-commerce. Expanding shelf space, promotional campaigns, and subscription-based online models are accelerating consumer adoption across regions.

The food service industry is expected to dominate the end-use segment in 2025 with a 46% share, supported by growing demand from restaurants, quick-service chains, and cafes introducing plant-based shrimp in their menu offerings. Product trials, bulk procurement, and limited-time menu placements drive segment growth.

Pharmaceutical is expected to lead the application segment with a 60% share, driven by the rising use of plant-based omega-3 and protein-rich ingredients in clinical nutrition, supplements, and therapeutic formulations. Growing regulatory approvals, aging populations, and innovation in encapsulation technologies further support demand across prescription and OTC product lines.

The global market is experiencing steady growth, fueled by rising consumer demand for sustainable, allergen-free seafood alternatives. Plant-based shrimp serves as a viable solution to environmental concerns, overfishing, and health risks associated with traditional seafood consumption, including mercury contamination and shellfish allergies.

Recent Trends in the Plant-Based Shrimp Market

Challenges in the Plant-Based Shrimp Market

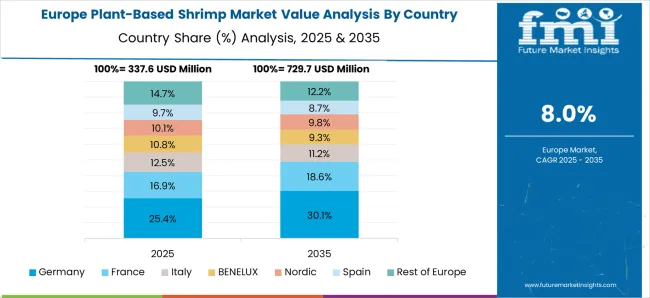

The global market is being propelled by a blend of dietary shifts, ethical concerns, and regulatory support. Countries with strong vegan and flexitarian movements are leading in both consumption and production. Developed economies such as the USA (8.3% CAGR), UK (8.2%), and Japan (9.2%) are growing at 0.95-1.07x the global growth rate, while Germany and France (both at 8.5%) remain closely aligned with EU-wide food innovation and sustainability policies.

Japan is witnessing the strongest momentum in the market, fueled by innovation in seaweed-based products and rising demand for clean-label seafood alternatives. Germany follows, supported by EU labeling regulations and growth in private-label frozen and refrigerated shrimp.

France is seeing increased interest through national health campaigns and greater organic retail adoption. The USA market is being driven by e-commerce expansion and growing consumer awareness of mercury-free, sustainable protein sources. The UK, while slower in comparison, maintains steady demand through shelf-stable product formats and widespread retail distribution, supported by its mature vegan consumer base.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The Japan plant-based shrimp market is growing at a CAGR of 9.2% from 2025 to 2035, outpacing the global average. Growth is driven by rising demand for seafood alternatives amid heightened environmental awareness and a robust vegan movement. With a cultural emphasis on seafood, Japan is experiencing strong investment in seaweed-based shrimp innovation and retail expansion. Local manufacturers are focusing on high-fidelity taste and texture using algae fermentation and sustainably sourced ingredients.

The Germany plant-based shrimp market is expected to expand at a CAGR of 8.5% during the forecast period, closely tracking global trends. EU-backed clean-label initiatives and a growing consumer shift toward meat-free diets are major growth drivers. Germany is emerging as a production hub for private-label plant-based seafood and is leveraging sustainable packaging and cold-chain innovations.

The French plant-based shrimp market is forecast to grow at a CAGR of 8.4% from 2025 to 2035, driven by national health campaigns and rising environmental awareness. French consumers are increasingly interested in seafood alternatives, with plant-based shrimp gaining traction in hypermarkets and organic retail channels. France is also witnessing growing interest from the foodservice sector, particularly in high-end vegan and seafood fusion menus.

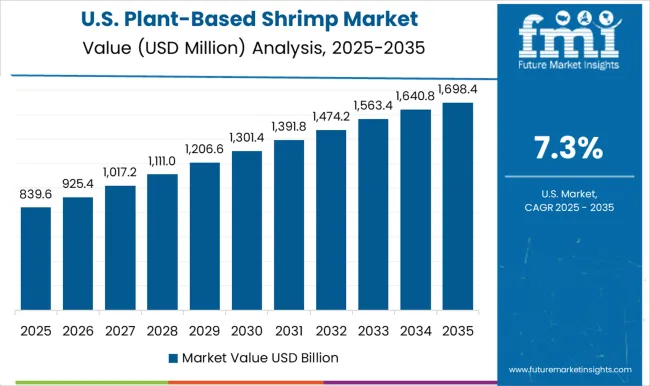

Sales of plant-based shrimp in the USA are projected to grow at a CAGR of 8.3% between 2025 and 2035, slightly below the global average. The market is driven by rapid innovation in alternative seafood and expanding retail distribution. Consumer preferences for cholesterol-free, sustainable protein sources are fueling demand. The presence of key players like Good Catch and New Wave Foods has accelerated product visibility.

The UK plant-based shrimp market is forecast to expand at a CAGR of 8.2% during the forecast period, representing the slowest growth among leading OECD markets at 0.95x the global rate. Growth is supported by a mature vegan consumer base and rising demand for clean-label products. However, economic uncertainty and cautious consumer spending have limited broader foodservice adoption. Retail and specialty stores remain the key distribution channels.

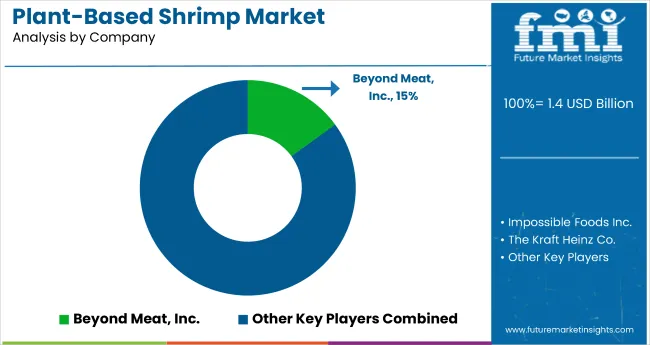

The global market is moderately consolidated, with leading players like Beyond Meat, Inc., Gathered Foods Corp., Maple Leaf Foods, Inc., Finless Foods, and Ocean Hunger Foods dominating the industry. These companies offer innovative, sustainable shrimp alternatives catering to consumers across retail, foodservice, and specialty health channels.

Beyond Meat, Inc. focuses on advanced plant protein development and clean-label shrimp analogs, while Gathered Foods Corp., through its Good Catch brand, specializes in shelf-stable and frozen seafood alternatives using proprietary legume blends.

Maple Leaf Foods, Inc. operates through its Greenleaf Foods division, offering high-quality vegan shrimp products. Finless Foods is pioneering cultivated seafood solutions, and Ocean Hunger Foods is known for algae-based shrimp with a focus on environmental sustainability.

The Vegetarian Butcher, The Kraft Heinz Co., Moving Mountains Foods, Monde Nissin Corp., and Tyson Foods, Inc. contribute to the market with global distribution capabilities and investments in R&D. Impossible Foods Inc., Van Cleve Seafood, Good Catch, and The Tofurky Co. Inc. also provide specialized, high-performance seafood alternatives for diverse dietary needs.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 1.4 billion |

| Projected Market Size (2035) | USD 3.2 billion |

| CAGR (2025 to 2035) | 8.6% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value/volume in metric tons |

| Source Analyzed | Seaweed, Legume Protein, Plant-Based Omega 3, Soy Protein, Pea Protein, Others (Quinoa, Oats, Beans, and Seeds) |

| Segments Analyzed | Frozen, Refrigerated, and Shelf-Stable |

| Product Type Analyzed | Breaded Vegan Shrimp, Crunchy Coconut Shrimp, Crispy Vegan Shrimp, and Raw Vegan Shrimp |

| Distribution Channel Analyzed | B2B, B2C [Store-based retailing (Hypermarkets/Supermarkets, Convenience Stores, Mass Grocery Retailers, Food and Drink Specialty Stores), and Online Retailing] |

| End-Use Analyzed | Food Service Industry, Household, and Retail |

| Application Analyzed | Pharmaceutical and Clinical Trials |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia and Pacific, Middle East and Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Japan, China, India, Brazil, South Korea, Australia and 40+ countries |

| Key Players Influencing the Market | Beyond Meat, Inc., Gathered Foods Corp., Maple Leaf Foods, Inc., Finless Foods, Ocean Hunger Foods, The Vegetarian Butcher, The Kraft Heinz Co., Moving Mountains Foods, Monde Nissin Corp., Tyson Foods, Inc., Impossible Foods Inc., Van Cleve Seafood, Good Catch, The Tofurky Co. Inc. |

| Additional Attributes | Volume and dollar sales by product type, retail and foodservice penetration, clean-label trends, sustainability regulations, ingredient innovations, competitive benchmarking |

The global plant-based shrimp market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the plant-based shrimp market is projected to reach USD 3.2 billion by 2035.

The plant-based shrimp market is expected to grow at a 8.6% CAGR between 2025 and 2035.

The key product types in plant-based shrimp market are seaweed, legume protein, plant based omega 3, soy protein, pea protein and others (quinoa, oats, beans and seeds).

In terms of segments, frozen plant based shrimp segment to command 53.2% share in the plant-based shrimp market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Shrimp Market Size, Growth, and Forecast 2025 to 2035

Shrimps Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Shrimp Feed Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Examining Shrimp Market Share Trends & Industry Leaders

UK Shrimp Market Insights – Growth, Demand & Forecast 2025-2035

USA Shrimp Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Shrimp Market Trends – Growth, Demand & Forecast 2025–2035

Korea Shrimp Market Analysis by Species, Source, Form, Sales Channel, Application, and Region Through 2035

Japan Shrimp Market Analysis by Species, Source, Form, Sales Channel, Application, and Region Through 2035

Europe Shrimp Market Outlook – Share, Growth & Forecast 2025–2035

Australia Shrimp Market Outlook – Size, Share & Forecast 2025-2035

Demand for Shrimp in the EU Size and Share Forecast Outlook 2025 to 2035

Latin America Shrimp Market Report – Trends, Growth & Forecast 2025–2035

Western Europe Shrimp Market Analysis by Species, Source, Form, Sales Channel, Application, and Country Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA