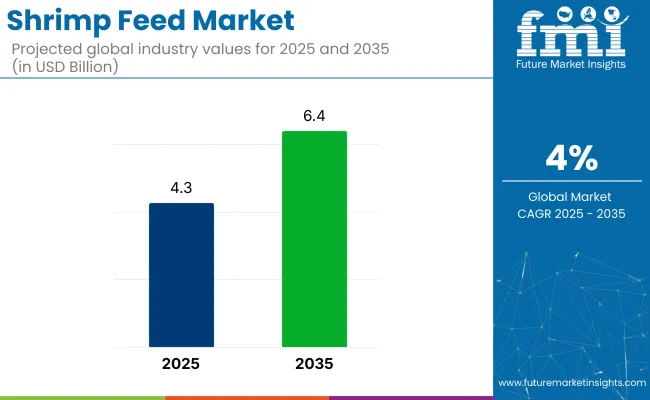

The global shrimp feed market is projected to grow from USD 4.3 billion in 2025 to USD 6.4 billion by 2035, registering a CAGR of 4%.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 4.3 billion |

| Industry Value (2035F) | USD 6.4 billion |

| CAGR (2025 to 2035) | 4% |

The market expansion is driven by rising aquaculture production, demand for high-quality seafood, and adoption of precision nutrition to improve shrimp health and yields. Sustainable feed formulations, functional ingredients such as probiotics and prebiotics, and precision feeding technologies are gaining traction to enhance feed efficiency and reduce environmental impacts, driving broader market adoption.

The market holds an estimated 18% share of aquaculture feed, highlighting its critical role in farmed seafood nutrition. It accounts for around 6% of the broader animal feed market, focused primarily on aquatic species rather than livestock. Within the seafood industry, it contributes 2%, reflecting its upstream role in production inputs. However, in the vast food and beverage industry, its share is minimal at below 0.1%.

Government regulations impacting the market focus on ensuring feed safety, environmental sustainability, and reduced antibiotic use. In Japan, strict Food Sanitation Law standards mandate that feeds must be free from harmful residues and contaminants. The USA enforces FDA guidelines under the Food Safety Modernization Act (FSMA) to ensure safe feed manufacturing and handling.

In the European Union, including Germany, France, and the UK, regulations under EC 767/2009 govern feed additive approvals, labelling, and traceability, promoting sustainable and functional feeds. These policies encourage manufacturers to adopt probiotics, prebiotics, and natural additives to enhance shrimp health responsibly.

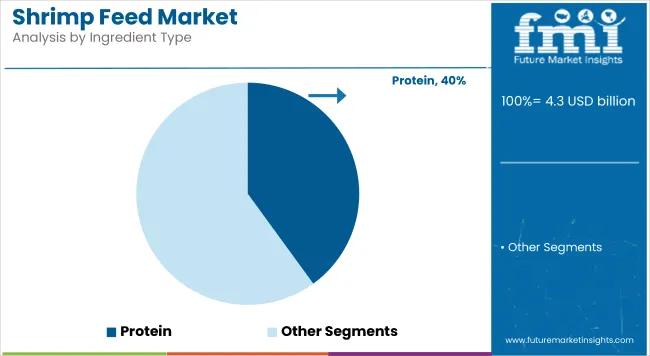

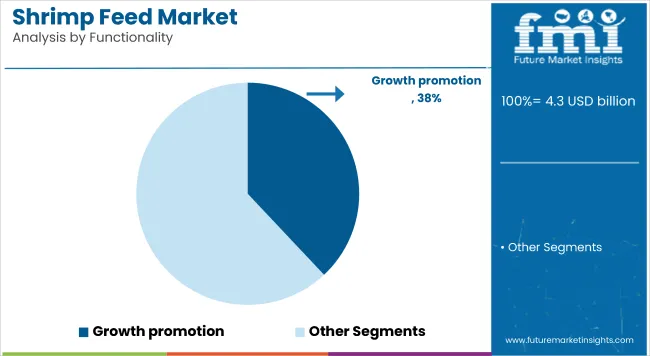

Japan is projected to be the fastest-growing market, expected to expand at a CAGR of 4.5% from 2025 to 2035. Protein sources will lead the ingredient type segment with a 40% market share due to their high protein density and cost-effectiveness, while growth promotion will dominate the functionality segment with a 38% share. The USA and Germany markets are also expected to grow steadily at CAGRs of 4% and 4.1%, respectively.

The market is segmented by ingredient type, functionality, and region. By ingredient type, the market is divided into protein sources, lipids, carbohydrates, and additives. Based on functionality, the market is segmented into growth promotion, disease prevention, color enhancement, digestive health support, and breeding & reproduction (immunity enhancement, stress tolerance, shell hardening, metabolic regulation). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia & Belarus, Balkans & Baltic, and Middle East & Africa.

Protein sources are projected to lead the ingredient type segment, accounting for 40% of the global market share by 2025. Soybean meal and fishmeal are widely used due to their high protein content and digestibility.

Growth promotion is expected to dominate the functionality segment, accounting for 38% of the market share by 2025. These include additives such as probiotics, prebiotics, enzymes, and essential nutrients that enhance animal growth, feed efficiency, and overall health.

The global shrimp feed market is experiencing steady growth, driven by rising demand for high-quality seafood and increased aquaculture production worldwide. Shrimp feed plays a crucial role in ensuring optimal growth, health, and survival of farmed shrimp, thereby supporting profitability and sustainability in aquaculture operations.

Recent Trends in the Shrimp Feed Market

Challenges in the Shrimp Feed Market

Japan leads shrimp feed production with a focus on precision nutrition, functional additives, and automated aquaculture systems. Major feed formulators have optimized protein and micronutrient profiles to align with Japan’s domestic shrimp farming standards and traceability frameworks. In Germany and France, annual growth of 4.1% each has been driven by compliance with EU feed additive directives, antibiotic restrictions, and a shift toward non-GMO feed formulations.

The USA shrimp feed market is expected to expand at a 4% CAGR, supported by recirculating aquaculture systems (RAS) and increasing inland shrimp production in states like Texas and Florida. The UK is recording a CAGR of 3.9%, with demand shaped by feed innovation targeting cold-water shrimp species and Brexit-aligned aquaculture policies.

The report covers an in-depth analysis of 40 plus countries; five top-performing OECD countries are highlighted below.

The Japan shrimp feed revenue is growing at a CAGR of 4.5% from 2025 to 2035. Growth is driven by high-quality seafood demands in domestic and export markets and adoption of feeds with precision nutrition for optimal shrimp growth and health.

The sales of shrimp feed in Germany are expected to expand at a CAGR of 4.1% during the forecast period. Growth is driven by stringent EU food safety standards, sustainability goals, and regulations on feed additive approvals and usage.

The French shrimp feed market is projected to grow at a 4.1% CAGR during the forecast period. Demand is driven by national food safety standards, environmental protection policies, and sustainable aquaculture initiatives.

The USA shrimp feed market is projected to grow at a 4% CAGR from 2025 to 2035. Growth is driven by feed innovations, sustainability certifications, and a shift toward efficiency in shrimp farming.

The UK shrimp feed revenue is projected to grow at a CAGR of 3.9% from 2025 to 2035. Growth is driven by premium seafood export demand and regulatory standards for feed safety and sustainability.

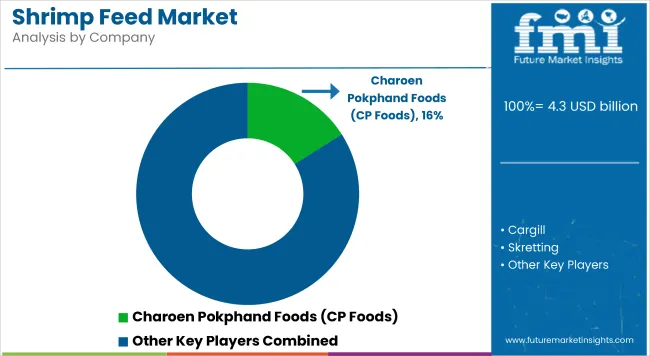

The market is moderately consolidated, with leading players like Charoen Pokphand Foods (CP Foods), Cargill, Skretting, Nutreco N.V., and BioMar Group dominating the industry. These companies provide advanced, nutritionally balanced shrimp feed catering to species such as Whiteleg shrimp and Tiger shrimp across aquaculture farms globally. Charoen Pokphand Foods (CP Foods) focuses on high-quality feed formulations ensuring rapid shrimp growth, while Cargill specializes in sustainable feeds enriched with probiotics and prebiotics.

These companies offer a range of specialized shrimp feed solutions focused on health, performance, and sustainability.Other key players like Guangdong Yuehai Feed Group Co., Ltd., BernAqua, Zeigler Bros., Inc., ADM (Archer Daniels Midland), and Aller Aqua contribute by providing specialized, high-performance shrimp feeds for hatcheries and farms globally.

Recent Shrimp Feed Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 4.3 billion |

| Projected Market Size (2035) | USD 6.4 billion |

| CAGR (2025 to 2035) | 4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value/volume in metric tons |

| By Ingredient Type | Protein Sources, Lipids, Carbohydrates, and Additives |

| By Functionality | Growth Promotion, Disease Prevention, Color Enhancement, Digestive Health Support, Breeding & Reproduction, and Others (Immunity Enhancement, Stress Tolerance, Shell Hardening, Metabolic Regulation) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia & Belarus, Balkan & Baltic Countries, and Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players Influencing the Market | Charoen Pokphand Foods (CP Foods), Cargill, Skretting, Nutreco N.V., BioMar Group, Guangdong Yuehai Feed Group Co., Ltd., BernAqua, Zeigler Bros., Inc., ADM (Archer Daniels Midland), Aller Aqua |

| Additional Attributes | Dollar sales by ingredient type, share by functionality, regional demand growth, regulatory influence, precision feeding trends, competitive benchmarking |

As per product type, the industry has been categorized into Protein Sources, Lipids, Carbohydrates, and Additives. Binders and Stabilizers

As per ingredient type, the industry has been categorized into Growth Promotion, Disease Prevention, Color Enhancement, Digestive Health support, Breeding and Reproduction, and Others.

Industry analysis has been carried out in key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia & Belarus, Balkans & Baltic Countries, and Middle East & Africa.

The market is valued at USD 4.3 billion in 2025.

The market is forecasted to reach USD 6.4 billion by 2035, reflecting a CAGR of 4%.

Protein sources will lead the ingredient type segment, accounting for 40% of the global market share in 2025.

Growth promotion will dominate the functionality segment with a 38% share in 2025.

Japan is projected to grow at the fastest rate, with a CAGR of 4.5% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Shrimp Market Size, Growth, and Forecast 2025 to 2035

Shrimps Disease Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Examining Shrimp Market Share Trends & Industry Leaders

UK Shrimp Market Insights – Growth, Demand & Forecast 2025-2035

USA Shrimp Market Insights – Demand, Size & Industry Trends 2025–2035

ASEAN Shrimp Market Trends – Growth, Demand & Forecast 2025–2035

Korea Shrimp Market Analysis by Species, Source, Form, Sales Channel, Application, and Region Through 2035

Japan Shrimp Market Analysis by Species, Source, Form, Sales Channel, Application, and Region Through 2035

Europe Shrimp Market Outlook – Share, Growth & Forecast 2025–2035

Australia Shrimp Market Outlook – Size, Share & Forecast 2025-2035

Demand for Shrimp in the EU Size and Share Forecast Outlook 2025 to 2035

Plant-Based Shrimp Market Size and Share Forecast Outlook 2025 to 2035

Latin America Shrimp Market Report – Trends, Growth & Forecast 2025–2035

Western Europe Shrimp Market Analysis by Species, Source, Form, Sales Channel, Application, and Country Through 2035

Feed Mixer for Livestock Market Size and Share Forecast Outlook 2025 to 2035

Feed Preparation Machine Market Size and Share Forecast Outlook 2025 to 2035

Feed Additive Nosiheptide Premix Market Size and Share Forecast Outlook 2025 to 2035

Feeder Container Market Size and Share Forecast Outlook 2025 to 2035

Feed Machine Market Forecast Outlook 2025 to 2035

Feed Pigment Market Forecast and Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA