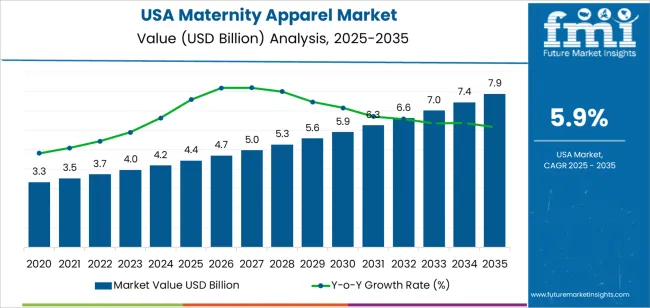

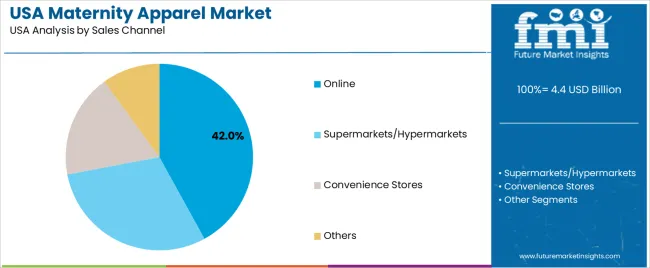

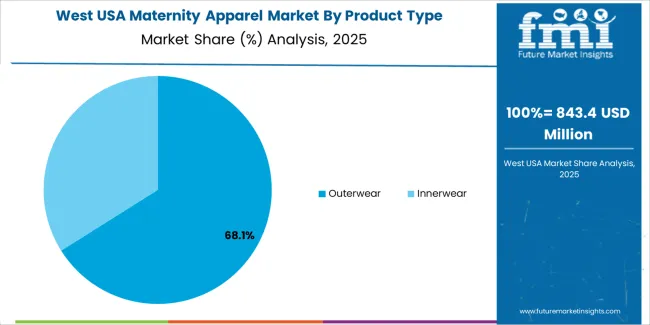

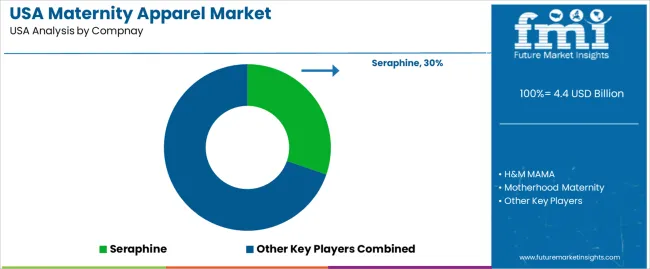

In 2025, demand for maternity apparel in the USA is valued at USD 4.4 billion and is projected to reach USD 7.9 billion by 2035 at a CAGR of 5.9%. Growth reflects steady birth rates within key age cohorts, higher labor force participation among pregnant women, and wider acceptance of purpose designed maternity fashion beyond basic necessity wear. Outerwear holds the dominant share at 65%, driven by demand for dresses, tops, and workwear that align with office and social use. Innerwear accounts for 35%, supported by functional demand for nursing bras, shapewear, and comfort basics. Online channels lead with 42% share as consumers prioritize size flexibility, discreet purchasing, and broader style selection.

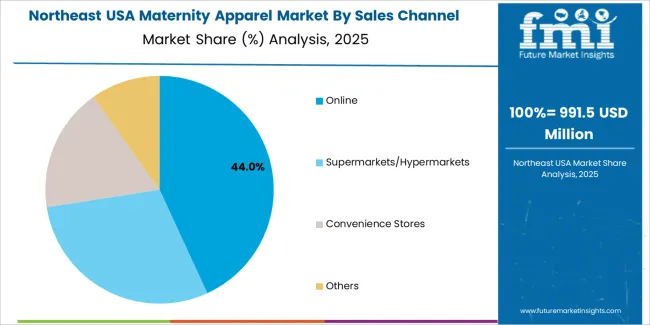

From 2030 onward, market expansion is shaped more by channel mix and product positioning than by demographic shifts alone. Supermarkets and hypermarkets hold 30% of sales as private label assortments expand, while convenience stores account for 18% through localized essentials. Key brands active in the USA include Seraphine, H&M MAMA, Motherhood Maternity, Isabella Oliver, and ASOS Maternity, each targeting distinct price and style tiers. Brand strategies center on fit engineering, stretch fabric development, season less designs, and postpartum crossover use. Sustainability messaging influences marketing but purchasing decisions remain driven by price, comfort, and versatility. Rental and resale platforms add limited value support at the premium end, while mass market growth remains anchored in digitally led retail models.

The overall demand for maternity apparel in USA increases from USD 4.4 billion in 2025 to USD 4.7 billion by 2030, adding USD 0.3 billion in absolute value. This phase reflects steady expansion tied to consistent birth rates within core age cohorts and the normalization of maternity-specific fashion across mass retail and digital-first brands. Demand growth is supported by wider product availability across workwear, athleisure, and casual categories, rather than reliance on traditional maternity-only formats. Value growth remains structurally controlled as price points stay accessible and private label penetration increases across large retail chains. The growth curve during this period remains smooth and consumption driven, supported by routine wardrobe replacement cycles.

From 2030 to 2035, the market expands from USD 4.7 billion to USD 7.9 billion, adding a substantially larger USD 3.2 billion in the second half of the decade. This back weighted acceleration reflects structural changes in consumer behavior, including later maternal age, longer workforce participation during pregnancy, and rising demand for multi-functional apparel USAble before and after pregnancy. As comfort engineering, stretch fabrics, and adaptive sizing improve, value per consumer increases alongside unit demand. Digital distribution, subscription apparel models, and direct to consumer maternity brands further amplify value density, shifting growth from basic volume expansion toward lifestyle-driven spending escalation.

| Metric | Value |

|---|---|

| Industry Value (2025) | USD 4.4 billion |

| Forecast Value (2035) | USD 7.9 billion |

| Forecast CAGR (2025–2035) | 5.9% |

Demand for maternity apparel in the USA grew as pregnancy became more visible and socially accepted and as more women continued working during pregnancy rather than pausing their professional lives. The rise in workforce participation among pregnant women increased need for clothing that balances comfort, flexibility, and professional styling. Designers responded with adjustable fits, stretch fabrics, and garments that adapt across trimesters. Retailers expanded selection to include casual wear, formal office-appropriate outfits, and everyday basics. The combination of shifting social norms around pregnancy and practical needs for comfort and style sustained steady growth in the maternity apparel segment.

Looking ahead, demand will depend on evolving lifestyle preferences, demographic shifts, and fashion trends among expectant mothers. Growing interest in versatile wardrobe pieces that accommodate pregnancy, postpartum recovery, and nursing will support demand. Digital retail platforms offering wide size ranges, diverse styles, and inclusive sizing will broaden the customer base. At the same time, pressure on birth rates and changing family planning choices could reduce the number of pregnancies, which may limit long-term growth potential. The market will evolve through diversification of offerings: activewear, sustainable fabrics, maternity-to-postpartum transition clothing, and fashion-forward designs that appeal to younger parents seeking functionality and style.

The demand for maternity apparel in the USA is structured by product type and sales channel. Outerwear accounts for 65% of total demand, followed by innerwear used for daily support and comfort needs. By sales channel, online retail represents 42.0% of total purchases, followed by supermarkets or hypermarkets, convenience stores, and other physical retail formats. Demand behavior is shaped by comfort requirements across pregnancy stages, price sensitivity, size availability, and shopping convenience. These segments reflect how lifestyle changes, digital access, and product functionality determine purchasing patterns across expecting mothers in the USA.

Outerwear accounts for 65% of total maternity apparel demand in the USA. This dominance reflects the continuous need for visible clothing such as tops, dresses, jeans, and casual wear that accommodates body changes across all pregnancy stages. Outerwear must balance comfort, stretch, breathability, and appearance, which drives repeat purchases as sizing needs evolve. Consumers prioritize adaptable designs that extend USAbility from early pregnancy through post delivery periods.

Seasonal USAge further reinforces outerwear demand through maternity jackets, sweaters, and layered clothing. Workplace dress codes and social wear requirements increase the need for multiple outerwear options across different settings. Retail collections increasingly emphasize adjustable waistbands, flexible fabrics, and multi use designs. These functional and lifestyle driven factors sustain outerwear as the dominant product type across the US maternity apparel landscape.

Online sales account for 42.0% of total maternity apparel demand in the USA. This leadership reflects the convenience of home based shopping, broader size availability, and access to extended style assortments beyond physical store limitations. Expecting mothers rely on online platforms to compare fit guidance, fabric details, and peer reviews before purchase. Home delivery reduces travel burden during later pregnancy stages.

Online channels also support subscription models, bundle purchases, and easy return policies that stabilize repeat ordering behavior. Digital marketing campaigns and social media recommendations play a direct role in product discovery within this category. Pandemic induced shifts toward online shopping have remained structurally embedded in apparel purchasing behavior. These accessibility, assortment, and fulfillment advantages position online retail as the leading sales channel for maternity apparel in the USA.

Demand for maternity apparel in the USA is driven by changing work patterns, later-age pregnancies, and sustained consumer spending on comfort-focused clothing. A large share of pregnant women remain active in professional roles and require office-appropriate maternity wear rather than only casual garments. Remote and hybrid work has also shifted demand toward versatile pieces suited for both home and public settings. Growth in athleisure and stretch-based fabrics supports everyday maternity USAge beyond formal occasions. Social media exposure and celebrity maternity styling further reinforce demand for fashion-forward maternity collections rather than purely functional garments.

The USA workforce participation rate among pregnant women remains high, which increases demand for structured maternity wear suitable for meetings, travel, and public-facing roles. Climate variation across regions shapes product mix, with heavier knitwear needed in northern states and lightweight breathable fabrics in southern regions. Seasonal retail cycles also influence purchase timing, as winter pregnancies require layering solutions while summer demand centers on breathable dresses and casual silhouettes. Fitness-conscious lifestyles increase demand for maternity activewear used before and after childbirth. These lifestyle and climate patterns shape design, material selection, and inventory planning.

Maternity apparel growth in the USA faces limits tied to short product USAge cycles and consumer price sensitivity. Many buyers hesitate to invest heavily in clothing designed for a limited period of wear. Standardization of sizing remains difficult due to varying body changes across pregnancy trimesters. Brick-and-mortar retail for maternity clothing has shrunk, which reduces in-store trial access. Online returns linked to sizing mismatches increase logistics cost for brands. These behavioral, sizing, and retail structural challenges moderate aggressive volume growth in the maternity apparel segment.

Maternity apparel in the USA is shifting toward stretch-driven fabrics that adapt across multiple pregnancy stages and extend USAbility post-pregnancy. Adjustable waistbands, wrap silhouettes, and moisture-wicking materials are now widely integrated into everyday maternity collections. Inclusive sizing across body types increases brand reach beyond traditional limited size ranges. There is also growing interest in transitional apparel designed for pregnancy and nursing in one garment. Sustainability-focused buyers seek organic cotton and low-impact dyes. These trends indicate maternity apparel moving from short-term utility wear toward adaptable, longer-life wardrobe solutions.

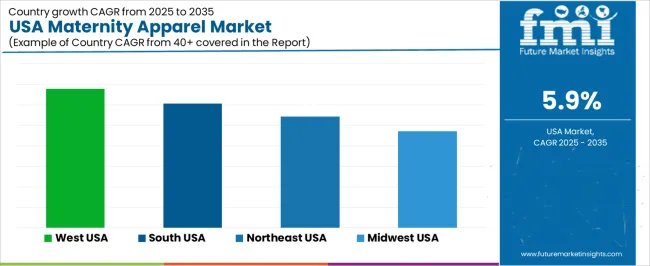

| Region | CAGR (%) |

|---|---|

| West | 6.8% |

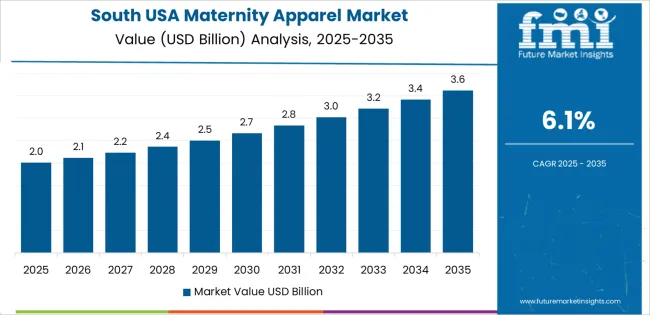

| South | 6.1% |

| Northeast | 5.4% |

| Midwest | 4.7% |

The demand for maternity apparel in the USA shows a distinct regional variation, with the West leading at 6.8% CAGR. This growth is likely driven by lifestyle changes, rising urbanisation, and increasing fashion-conscious maternity wear demand in western states. The South’s 6.1% growth reflects expanding retail penetration, growing population, and rising birth rates. The Northeast at 5.4% sees steady growth supported by dense urban population and maternity retail channels. The Midwest’s 4.7% growth indicates a more gradual increase, possibly tied to stable but slower demographic growth and lower fashion-driven maternity wear adoption. Overall the pattern suggests rising maternity apparel demand nationwide, with stronger growth in more urbanised and economically dynamic regions.

Growth in the West reflects a CAGR of 6.8% through 2035 for maternity apparel demand, supported by higher average maternal age, strong fashion led retail adoption, and premium lifestyle spending across coastal urban centers. Expectant consumers show higher preference for stylish, functional, and sustainable fabric maternity wear. Work from home culture also supports demand for comfort focused apparel categories. Specialty maternity brands and online platforms dominate distribution. Demand remains design driven rather than purely necessity based, with higher repeat purchase behavior across pregnancy stages supported by influencer visibility and digital retail engagement.

The South advances at a CAGR of 6.1% through 2035 for maternity apparel demand, driven by higher birth rates, population migration, and expanding suburban retail infrastructure. Young family formation supports steady apparel turnover. Large format retail chains and private label brands remain the primary sales channels. Climate conditions favor lightweight and seasonal maternity clothing assortments. Price sensitivity remains moderate, with balanced demand across value and mid range product segments. Demand growth remains volume driven rather than trend driven, supported by consistent population inflows and expanding regional residential development.

The Northeast records a CAGR of 5.4% through 2035 for maternity apparel demand, shaped by delayed parenthood trends, dual income households, and strong urban professional buyer concentration. Demand centers on functional workwear, casual office attire, and cold weather maternity outerwear. Compact living environments encourage efficient wardrobe replacement rather than bulk purchasing. Department stores, specialty boutiques, and ecommerce platforms share distribution. Demand remains driven by necessity and seasonal weather needs rather than fashion cycles, with steady replacement volumes across professional urban consumer segments.

The Midwest expands at a CAGR of 4.7% through 2035 for maternity apparel demand, supported by stable birth rates, family oriented communities, and steady brick and mortar retail presence. Practical clothing preferences dominate product selection, with comfort and durability guiding purchasing behavior. Online channels supplement physical stores in rural areas. Seasonal outerwear demand remains important due to extended winters. Demand remains necessity driven rather than fashion influenced, with predictable purchasing cycles aligned to pregnancy timelines rather than discretionary trend adoption across regional consumer households.

Demand for maternity apparel in the USA is rising as more women combine pregnancy with active lifestyles, employment, and social participation. Expectant mothers seek clothing that balances comfort, fit adjustment, and modern style. Growing appreciation for “maternity fashion” rather than purely functional garments boosts demand for designs suitable for daily wear, work, and social outings. Rising acceptance of pregnancy as part of contemporary lifestyle encourages purchases not only for short term use but also for postpartum wear or resale. Wider availability of online shopping and flexible sizing supports greater access and repeat use among consumers. Major brands shaping the USA maternity apparel market include Seraphine, H&M MAMA, Motherhood Maternity, Isabella Oliver, and ASOS Maternity.

These firms offer a range of apparel from casual tops and bottoms to workwear ready outfits and activewear styles. Seraphine and Isabella Oliver target premium and style conscious segments with fashionable fits. H&M MAMA and ASOS Maternity cater to more price sensitive or trend focused customers with wide size ranges and frequent collection refreshes. Motherhood Maternity emphasizes practical, everyday maternity basics. This mix of premium, mid range, and budget oriented brands ensures the market meets varied consumer preferences and supports continued growth in the maternity wear segment.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD billion |

| Product Type | Outerwear, Innerwear |

| Sales Channel | Online, Supermarkets/Hypermarkets, Convenience Stores, Others |

| Region | West USA, South USA, Northeast USA, Midwest USA |

| Countries Covered | USA |

| Key Companies Profiled | Seraphine, H&M MAMA, Motherhood Maternity, Isabella Oliver, ASOS Maternity |

| Additional Attributes | Dollar-value distribution by product type and sales channel; regional CAGR projections; outerwear leads product type demand at 65% driven by workwear, dresses, and casual tops; innerwear accounts for 35% for comfort and nursing products; online retail dominates sales with 42% share for size flexibility and discreet purchasing; supermarkets/hypermarkets hold 30% with private label expansion, convenience stores 18% for essentials; growth accelerated 2030–2035 by multi-functional apparel, digital channels, subscription models, and postpartum crossover use; fashion-led, comfort-focused design drives repeat purchases; price, versatility, and digital access shape structural demand patterns. |

The demand for maternity apparel in USA is estimated to be valued at USD 4.4 billion in 2025.

The market size for the maternity apparel in USA is projected to reach USD 7.9 billion by 2035.

The demand for maternity apparel in USA is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in maternity apparel in USA are outerwear and innerwear.

In terms of sales channel, online segment is expected to command 42.0% share in the maternity apparel in USA in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Maternity Apparel Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Maternity Apparel Providers

USA & Canada Secondhand Apparel Market Growth, Trends and Forecast from 2025 to 2035

Maternity Activewear Market Size and Share Forecast Outlook 2025 to 2035

USA Medical Coding Market Size and Share Forecast Outlook 2025 to 2035

USA Labels Market Size and Share Forecast Outlook 2025 to 2035

USA Plant-based Creamers Market Size and Share Forecast Outlook 2025 to 2035

USA Barrier Coated Paper Market Size and Share Forecast Outlook 2025 to 2035

USA Electronic Health Records (EHR) Market Size and Share Forecast Outlook 2025 to 2035

USA Animal Model Market Size and Share Forecast Outlook 2025 to 2035

Apparel Market Size and Share Forecast Outlook 2025 to 2035

Maternity Products Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Packer Bottle Market Size and Share Forecast Outlook 2025 to 2035

USA Stretch Hood Films Market Size and Share Forecast Outlook 2025 to 2035

USA and Canada Fence Screen Market Size and Share Forecast Outlook 2025 to 2035

USA Lubricant Contaminated HDPE Container Waste Market Size and Share Forecast Outlook 2025 to 2035

USA Commercial Walk-In Refrigeration Market Size and Share Forecast Outlook 2025 to 2035

USA & Canada Pre-painted Steel Roofing and Cladding Market Size and Share Forecast Outlook 2025 to 2035

USA Residential Cotton Candy Maker Market Size and Share Forecast Outlook 2025 to 2035

USA Faith Based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA