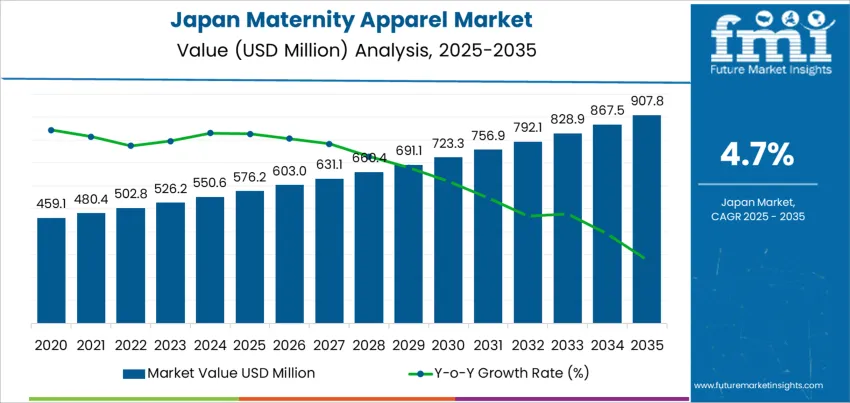

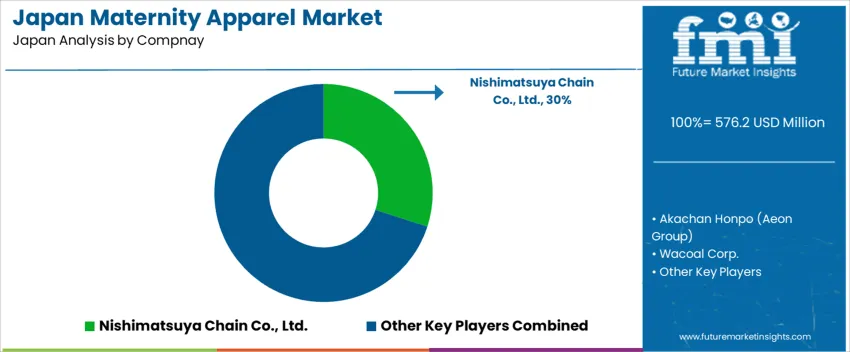

The Japan maternity apparel demand is valued at USD 576.2 million in 2025 and is projected to reach USD 907.8 million by 2035, reflecting a CAGR of 4.7%. Demand is shaped by continued preference for comfortable and functional clothing among pregnant women and new mothers. Increased focus on style, workplace-friendly fashion, and adaptive fits that accommodate body changes supports steady product adoption. Growth is also influenced by expanded e-commerce availability, improved product sizing standards, and rising interest in sustainable maternity wear.

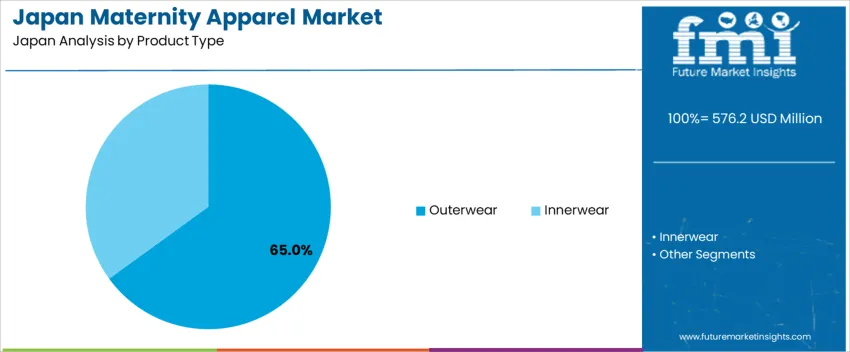

Outerwear holds the largest share due to essential usage throughout prenatal and postpartum periods. Jackets, cardigans, and stretchable tops remain key selections as they support seasonal comfort and versatility across formal and casual settings. Product development emphasizes breathable fabrics, adjustable waists, and soft-touch materials that reduce skin irritation while maintaining durability.

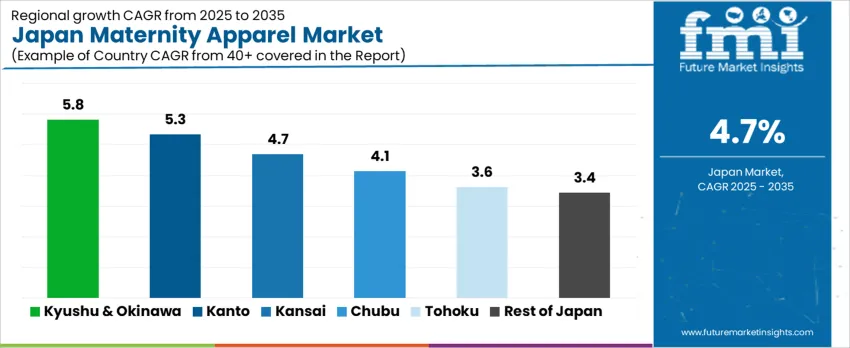

The highest consumption levels occur in Kyushu & Okinawa, Kanto, and Kansai, where expectant-parent populations, retail accessibility, and per-capita spending on apparel remain comparatively strong. These regions also exhibit established maternity specialty stores and active participation in online fashion platforms. Key suppliers include Nishimatsuya Chain Co., Ltd., Akachan Honpo (Aeon Group), Wacoal Corp., UNIQLO, and Maruzen Textile Co., Ltd. Their offerings include outerwear, innerwear, and nursing-specific garments designed for comfort, mobility, and daily practicality during pregnancy and early motherhood.

Demand for maternity apparel in Japan displays relatively higher volatility compared to other apparel categories due to demographic variables and short product-use cycles. Fluctuations in birth rates directly influence annual demand shifts, with Japan’s declining fertility creating periods of lower baseline growth. These troughs are partially balanced by rising focus on comfort-oriented clothing, which supports occasional momentum in premium and athleisure-style maternity ranges.

Retail channel dynamics contribute further variability. E-commerce gains add uplift through personalized sizing and design choices, while consolidation in physical stores can constrain visibility and lead to softer demand phases. Seasonal effects are also more pronounced because purchase timing is closely linked to pregnancy stages rather than standard fashion cycles. Despite variability, structural trends such as improved maternity workplace policies and inclusive product lines reduce the depth of trough phases. The growth rate volatility index therefore reflects a category sustained by qualitative demand drivers but vulnerable to short-term demographic and channel-based fluctuations. Stability relies on niche segmentation and convenience-led retail rather than broad consumer expansion, resulting in a moderate yet uneven long-term growth profile.

| Metric | Value |

|---|---|

| Japan Maternity Apparel Sales Value (2025) | USD 576.2 million |

| Japan Maternity Apparel Forecast Value (2035) | USD 907.8 million |

| Japan Maternity Apparel Forecast CAGR (2025-2035) | 4.7% |

Demand for maternity apparel in Japan is increasing because expectant mothers seek comfortable clothing that adapts to changing body size while maintaining a neat and practical style for daily activities. More women continue working during pregnancy, which supports purchases of office-appropriate maternity wear such as stretch trousers, dresses and tops designed for professional settings. Retailers focus on breathable fabrics, adjustable waist designs and nursing-friendly options that extend garment use after childbirth, which improves value for consumers in smaller households with careful spending habits.

E-commerce platforms strengthen accessibility by offering wider size options and home delivery, supporting purchases in regions where specialty maternity stores are limited. Growing awareness of prenatal health and active lifestyles encourages adoption of supportive leggings and outerwear suitable for light exercise. Seasonal changes and strong interest in layering clothing also influence steady repeat purchases during pregnancy. Constraints include Japan’s declining birth rate, which reduces overall potential customer numbers. Price-sensitive buyers may rely on rental services, hand-me-downs or versatile stretch clothing instead of dedicated maternity garments. Limited store space for niche categories can also restrict in-store assortment for some retailers.

Demand for maternity apparel in Japan reflects increased attention to comfort, fit adaptability, and workplace participation among expecting mothers. Brands design garments that accommodate body changes while maintaining professional appearance and cultural modesty. Growth is supported by rising e-commerce accessibility, ergonomic fabric innovation, and apparel choices aligned with different pregnancy stages. Retailers emphasize breathable textiles, adjustable waist support, and versatile styles suitable for home, work, and outdoor activities.

Outerwear accounts for 65.0%, reflecting the prominence of adaptable everyday clothing such as dresses, tops, pants, and workwear that support mobility and frequent wardrobe updates during pregnancy. Japanese consumers prioritize functional tailoring that preserves style, supports seasonal layering, and enables easy transition from maternity to postpartum use. Outerwear also aligns with social and workplace norms where expectant mothers remain active throughout pregnancy. Innerwear holds 35.0%, driven by supportive undergarments designed for body comfort, posture assistance, and maternity-nursing dual functionality. Innerwear demand is stable, but outerwear dominates due to broader category penetration, faster replacement cycles, and stronger alignment with fashion preferences within Japan’s metro retail clusters.

Key Points:

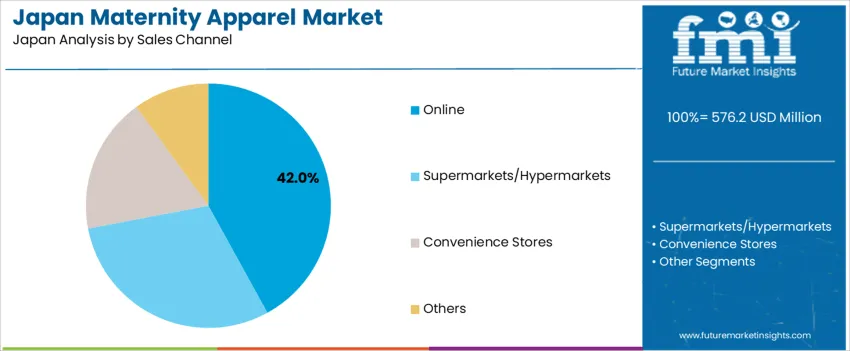

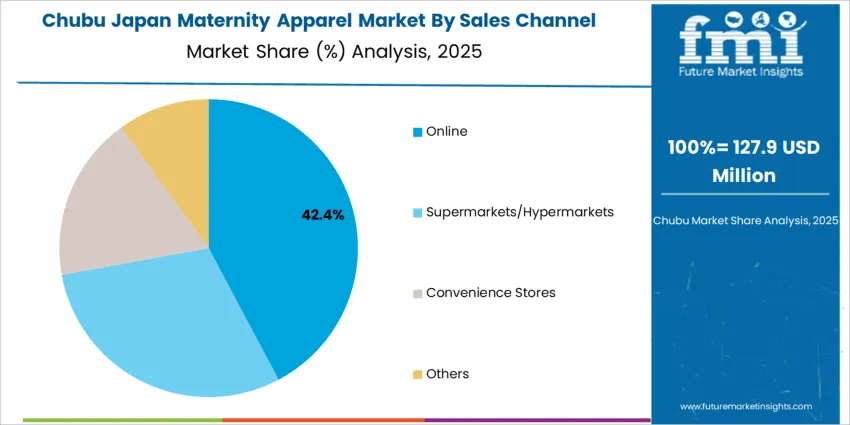

Online sales represent 42.0%, enabled by discreet selection, comprehensive size availability, and mobile shopping convenience. E-commerce supports home delivery and subscription-style replenishment for essential apparel items during pregnancy and postpartum. Supermarkets and hypermarkets account for 30.0%, serving routine shoppers seeking affordable basics. Convenience stores contribute 18.0%, supporting last-minute apparel needs in densely populated areas. Other channels represent 10.0%, including specialty maternity boutiques and department stores where personalized fitting services drive premium purchases. Channel dynamics reflect Japan’s strong digital adoption, compact urban living, and retailer efficiency in offering adjustable-fit options with clear size guidance.

Key Points:

Growth of comfort-focused clothing purchases, expansion of e-commerce fashion for expectant mothers and rising demand for workplace-appropriate maternity wear are driving demand.

In Japan, maternity apparel demand increases as expectant mothers prioritize stretch fabrics and adjustable fits that support mobility during daily activities. E-commerce platforms provide broad style availability for women in suburban and regional prefectures where specialized maternity stores are limited. Employers encourage continued workforce participation during pregnancy, especially in large cities such as Tokyo and Osaka, which creates sustained demand for professional clothing options that maintain comfort and appearance standards. Department stores and maternity boutiques serve pregnant women who seek high-quality garments for office, medical visits and social occasions, contributing to steady purchasing patterns throughout pregnancy stages.

Declining birth rate, limited retail shelf space for niche categories and high price sensitivity among younger families restrain demand.

Japan’s low fertility rate reduces the number of new maternity shoppers entering the industry each year, constraining overall category growth. Retailers in dense urban districts often limit space for maternity lines because product turnover is slower than mainstream fashion. Younger couples facing rising living costs may prioritize essential baby items over dedicated maternity outfits, relying on oversized regular clothing instead. These demographic and economic-driven behaviors limit broad category expansion despite steady usage among employed expectant mothers.

Shift toward versatile post-pregnancy wear, increased availability of rental and second-hand options and rising demand for natural and breathable fabrics define key trends.

Brands introduce designs that remain functional after childbirth, including nursing-friendly tops and waist-adjustable bottoms that extend garment life for cost-conscious families. Rental services and second-hand marketplaces are gaining participation, particularly among consumers motivated by sustainability and value. Cotton-forward, low-irritation fabrics are increasingly preferred to address sensitivity during pregnancy, supporting demand for natural fiber offerings. Online styling services tailored to each pregnancy stage improve access for women balancing work and home schedules. These trends indicate stable yet selective demand for maternity apparel aligned with Japan’s demographic realities and comfort-driven fashion preferences.

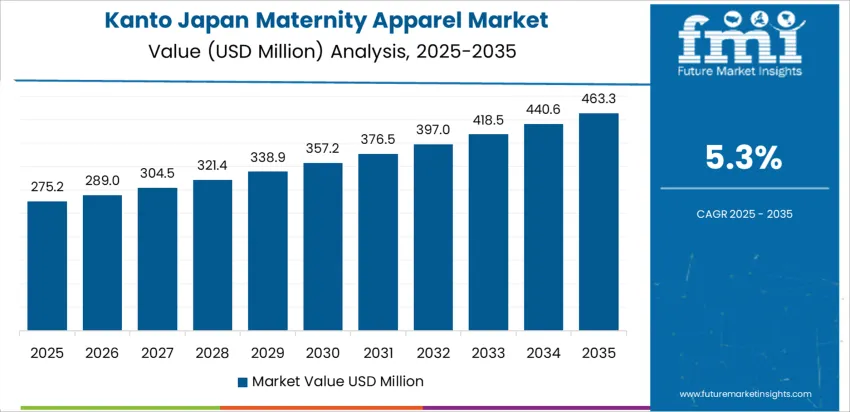

Demand for maternity apparel in Japan is guided by apparel purchasing behavior emphasizing comfort fit, design flexibility, and casual clothing suited for changing size ranges. Retail purchases concentrate in convenience malls, specialty clothing stores, and e-commerce channels that support size availability. Growth varies by region, led by Kyushu & Okinawa at 5.8%, followed by Kanto (5.3%), Kansai (4.7%), Chubu (4.1%), Tohoku (3.6%), and the Rest of Japan (3.4%).

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 5.8% |

| Kanto | 5.3% |

| Kansai | 4.7% |

| Chubu | 4.1% |

| Tohoku | 3.6% |

| Rest of Japan | 3.4% |

Kyushu & Okinawa posts 5.8% CAGR, influenced by mall-based apparel availability, family-focused retail zones, and preference for comfortable clothing used in everyday routines. Major shopping districts in Fukuoka and Okinawa City offer extended size assortments and adjustable-fit garments that support body-shape changes without frequent wardrobe replacement. Fabric choices prioritize breathability and stretch performance for extended daily wear at home and during travel. Retailers focus on neutral designs suitable for social activities and regular use rather than event-specific clothing. Small apparel manufacturers in the region evaluate pattern modifications to improve comfort around the waist and torso. Online ordering supports stable supply choices in smaller islands where store formats are limited. Distribution hubs in Kyushu enable timely restocking across suburban store networks.

Kanto records 5.3% CAGR, led by Tokyo and Kanagawa retail ecosystems that supply versatile clothing designed for flexible sizing. Urban consumers favor lightweight fabrics, smooth interior seams, and adjustable features that support comfort through daily commuting. Specialty clothing chains maintain focused product categories, while department stores stock higher-durability options for long wear cycles. E-commerce platforms with rapid shipment times provide broad size availability not always found in limited-space stores. Apparel companies in Tokyo design collections with muted tones aligned to professional dress codes, integrating stretch panels without visible design changes. Convenience of returns and online fit-guidance tools mitigates sizing uncertainty.

Kansai generates 4.7% CAGR, supported by Osaka and Kobe apparel districts producing cost-balanced garments for everyday use. Retailers emphasize easy-wear silhouettes featuring elasticized waist treatments and longer tops designed for extended wear durations. Department stores in Kyoto curate specialized sections with coordinated outfits enabling simple wardrobe selection. Logistics advantages within Kansai improve stock turnover for high-movement core products such as leggings, tunic tops, and soft-fabric outerwear. Brick-and-mortar stores maintain fitting-room consultations that assist buyers selecting appropriate sizes based on comfort priorities. Regional apparel producers evaluate durable stitching and modest design changes that maintain garment use across multiple size stages.

Chubu posts 4.1% CAGR, with demand supported by suburban shopping centers in Aichi, Shizuoka, and nearby prefectures that supply clothing designed for everyday flexibility. Retailers emphasize soft-touch fabrics, elasticized waist construction, and relaxed fits that reduce the need for frequent wardrobe adjustments. Consumer purchasing behavior prioritizes durability and comfort that supports continuous daily wear at home, during errands, or seated commuting. Local apparel factories use familiar knit materials to maintain consistent supply without introducing complex production changes. Retailers plan seasonal inventory that supports weather transitions, including cotton-based garments for warm months and lined outerwear during winter. E-commerce channels serve communities outside large urban districts, offering access to size variations not always stocked in mid-sized stores. Packaging and shipping operations favor lightweight garments that minimize freight costs across inland distribution routes.

Tohoku records 3.6% CAGR, shaped by climate-related clothing needs that prioritize warmth, comfort, and flexibility in motion. Retail assortments emphasize thicker knit garments, stretch leggings, fleece-backed pieces, and longer tops suited to colder weather across much of the year. Product selection focuses on stable wardrobe essentials rather than trend-driven items, supporting repeat purchasing of familiar styles. Distribution relies on regional malls located in key cities such as Sendai, while rural buyers frequently use online platforms to secure desired sizes and fits. Laundry durability is a primary requirement due to frequent washing cycles during winter. Apparel brands adopt consistent sizing systems that simplify repeat ordering. Packaging teams evaluate fold-flat garments to reduce space during regional transport.

The Rest of Japan posts 3.4% CAGR, driven by cost-balanced clothing purchases in smaller towns and rural retail hubs that prioritize flexibility in fit and extended use over style complexity. Buyers select garments with elastic waist adjustments, stretchable side seams, and neutral color palettes that align with regular daily routines across home, community, and workplace settings. Store assortments remain compact, focusing on garments with predictable year-round demand. Local boutiques maintain slower inventory rotation, widening reliance on online retailers for extended product choices. Product feedback through online reviews guides size selection accuracy. Logistics teams emphasize lightweight garment handling to suit short-distance deliveries across regional networks. Clothing manufacturers evaluate stitching reinforcements that maintain structural comfort throughout extended wear.

Demand for maternity apparel in Japan is shaped by retailers supplying fit-stabilized garments that accommodate body-size changes during pregnancy while maintaining comfort and functional support. Nishimatsuya Chain Co., Ltd. holds an estimated 30.0% share, supported by controlled sizing standards, consistent fabric elasticity, and strong availability through extensive suburban store networks used by Japanese households. Akachan Honpo maintains strong participation in pregnancy-to-infant transition clothing, supplying garments designed for stable support in daily activities and reliable compatibility with nursing requirements. Wacoal Corp. contributes meaningful share through maternal innerwear, delivering controlled stretch recovery and breathable fabrics suited to prolonged wear.

UNIQLO supports demand in basic maternity tops and bottoms that provide steady material comfort and accessible pricing across national retail channels. Maruzen Textile Co., Ltd. reinforces availability in specialized garments for protection, ease of movement, and coordinated postpartum usage. Competition in Japan centers on fit stability, textile comfort, skin-safety performance, easy nursing access, and convenient domestic availability. Demand remains steady as Japanese consumers rely on functional maternity clothing that supports mobility, temperature balance, and comfort throughout pregnancy and early childcare routines.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Product Type | Outerwear, Innerwear |

| Sales Channel | Online, Supermarkets/Hypermarkets, Convenience Stores, Others |

| Regions Covered | Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Nishimatsuya Chain Co., Ltd., Akachan Honpo (Aeon Group), Wacoal Corp., UNIQLO, Maruzen Textile Co., Ltd. |

| Additional Attributes | Growth influenced by rising pregnancy comfort clothing adoption, nursing-friendly apparel design, and expanding e-commerce distribution; preference for breathable, stretchable fabrics; inclusion of maternity-to-nursing transition wear; demographic aging impact counterbalanced by improved maternal support policies; increasing availability of functional innerwear with adjustable fittings and skin-safe materials. |

The demand for maternity apparel in Japan is estimated to be valued at USD 576.2 million in 2025.

The market size for the maternity apparel in Japan is projected to reach USD 907.8 million by 2035.

The demand for maternity apparel in Japan is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in maternity apparel in Japan are outerwear and innerwear.

In terms of sales channel, online segment is expected to command 42.0% share in the maternity apparel in Japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Maternity Apparel Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Maternity Apparel Providers

Demand for Maternity Apparel in USA Size and Share Forecast Outlook 2025 to 2035

Japan Faith-based Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Sports Tourism Market Size and Share Forecast Outlook 2025 to 2035

Japan Respiratory Inhaler Devices Market Size and Share Forecast Outlook 2025 to 2035

Japan Halal Tourism Market Size and Share Forecast Outlook 2025 to 2035

Maternity Activewear Market Size and Share Forecast Outlook 2025 to 2035

Japan Automated People Mover Industry Size and Share Forecast Outlook 2025 to 2035

Japan Automotive Load Floor Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Japan Food Cling Film Market Size and Share Forecast Outlook 2025 to 2035

Japan Polypropylene Packaging Films Market Size and Share Forecast Outlook 2025 to 2035

Apparel Market Size and Share Forecast Outlook 2025 to 2035

Maternity Products Market Size and Share Forecast Outlook 2025 to 2035

Apparel Re-commerce Market Size and Share Forecast Outlook 2025 to 2035

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

japan Tortilla Market - Growth, Trends and Forecast from 2025 to 2035

Maternity Innerwear Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Japan Cosmetics ODM Market Analysis - Size, Share & Trends 2025 to 2035

Japan Automotive Turbocharger Market Insights – Demand, Size & Industry Trends 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA