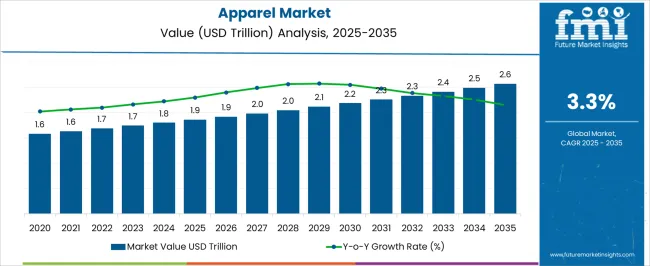

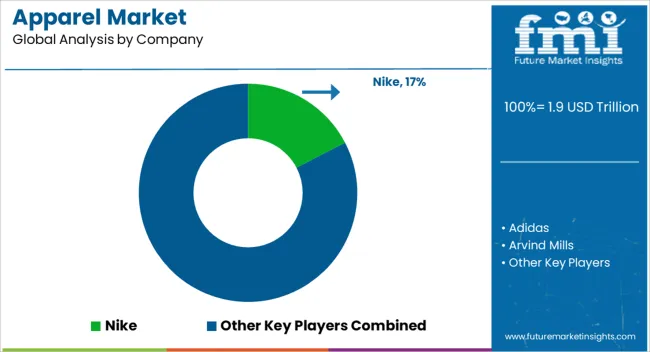

The apparel market is estimated to be valued at USD 1.9 trillion in 2025 and is projected to reach USD 2.6 trillion by 2035, registering a compound annual growth rate (CAGR) of 3.3% over the forecast period. When analyzing the 5-year growth blocks, the market demonstrates steady momentum across global regions, driven by evolving consumer behavior, demographic trends, and rising digital integration.

From 2025 to 2030, the industry is anticipated to expand from around USD 1.9 trillion to nearly USD 2.0 trillion, supported by increasing adoption of e-commerce platforms, greater emphasis on fast fashion cycles, and the rising influence of social commerce. The 2030–2035 period is projected to further boost revenues from USD 2.0 trillion to USD 2.6 trillion, attributed to premiumization, sustainable sourcing, and higher penetration of apparel into emerging economies.

Apparel demand in Asia-Pacific and the Middle East is forecasted to outpace global averages, given the region’s young demographics and rising disposable incomes. Meanwhile, North America and Europe will sustain moderate but stable growth, focusing on athleisure, workwear redefinition, and circular fashion models. The industry’s resilience lies in its ability to continuously adapt to consumer shifts, from digital-first shopping to greater customization. Over the next few years, collaborations between retailers and tech platforms are likely to reshape competitive dynamics, offering both challenges and opportunities for established brands and new entrants.

| Metric | Value |

|---|---|

| Apparel Market Estimated Value in (2025 E) | USD 1.9 trillion |

| Apparel Market Forecast Value in (2035 F) | USD 2.6 trillion |

| Forecast CAGR (2025 to 2035) | 3.3% |

The apparel market is shaped by several interlinked parent categories that define its overall size, demand dynamics, and global growth trajectory. The casual wear and everyday clothing segment holds the largest share at 38%, driven by mass adoption, affordability, and the ongoing influence of fast fashion that caters to frequent wardrobe refreshes. The formal and office wear category contributes 22%, supported by corporate dressing standards, event-driven purchases, and premium tailoring demand in both developed and emerging economies.

Sportswear and athleisure collectively account for 18%, reflecting the strong global push toward fitness, wellness lifestyles, and the blurring lines between athletic and casual apparel. Luxury and premium fashion represent 12%, concentrated in advanced markets but expanding steadily in Asia-Pacific due to growing high-net-worth populations and aspirational consumers. Finally, children’s and specialty apparel make up 10%, fueled by increasing global birth rates in developing economies, brand-conscious parenting, and niche demand for school uniforms and seasonal collections.

Casual, formal, and sportswear collectively dominate nearly 78% of the apparel market’s share, underlining how lifestyle shifts, affordability, and functionality continue to steer consumer spending patterns. This composition also highlights the balance between mass-market accessibility and aspirational consumption as central growth levers for the apparel industry worldwide.

The apparel market is currently witnessing consistent growth driven by evolving fashion trends, rising consumer spending on lifestyle products, and the expansion of organized retail channels. The increasing influence of social media and digital marketing has significantly shaped consumer behavior, encouraging demand for frequent wardrobe updates and seasonal collections.

With a growing population of young consumers and a shift toward value-based purchases, the market has shown resilience across both premium and mass-market segments. Advancements in supply chain efficiency and greater penetration of e-commerce platforms are supporting faster product turnover and broader reach across urban and semi-urban regions.

As fashion becomes more inclusive and personalized, manufacturers are increasingly focused on offering a wide variety of product categories, flexible price ranges, and sustainable material options. The future outlook remains promising, with technology integration such as virtual try-ons and AI-based trend forecasting expected to streamline product development further and boost customer engagement.

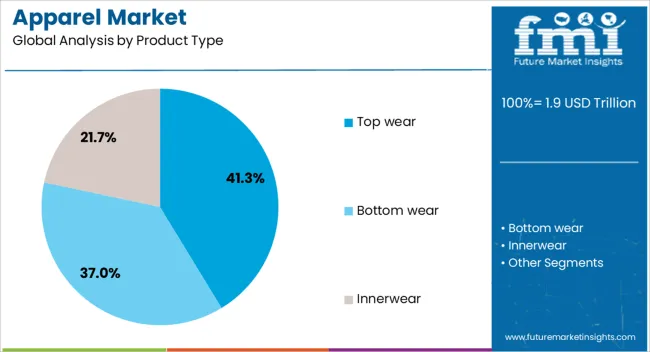

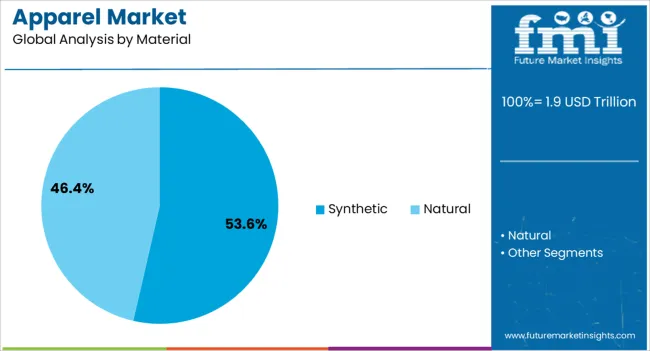

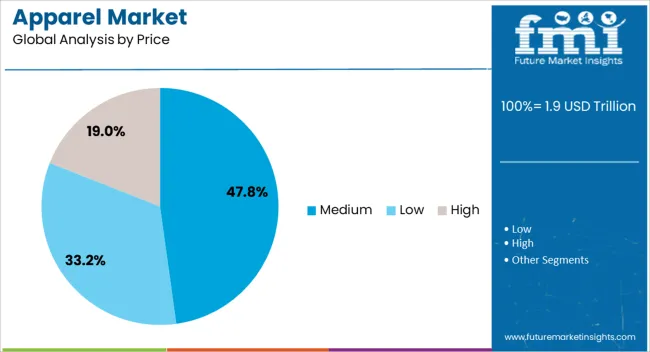

The apparel market is segmented by product type, material, price, consumer group, and geographic regions. By product type, the apparel market is divided into Top wear, Bottom wear, and Innerwear. In terms of material, the apparel market is classified into Synthetic and Natural. Based on price, the apparel market is segmented into Medium, Low, and High. By consumer group, the apparel market is segmented into Women, Men, and Kids. Regionally, the apparel industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The top wear segment is expected to account for 41.3% of the apparel market revenue in 2025, positioning it as the leading product category. This dominance is being attributed to its high purchase frequency and broad relevance across genders, age groups, and fashion preferences. Top wear products, including shirts, t-shirts, blouses, and tunics, are considered wardrobe essentials and are typically updated more frequently than other apparel types.

Consumer interest in casual and semi-formal dressing, influenced by remote working trends and lifestyle shifts, has significantly driven growth in this category. Retailers have focused heavily on expanding their top wear assortments due to consistent demand and high volume sales potential.

Moreover, the ability to easily customize designs, prints, and fits within this category has allowed brands to quickly adapt to seasonal trends and market feedback. As fashion cycles shorten and digital fashion influencers shape buying preferences, the top wear segment is anticipated to maintain its lead through ongoing innovation and mass accessibility.

The synthetic material segment is projected to hold 53.6% of the apparel market share in 2025, emerging as the dominant material type. This leadership is being supported by the material's cost efficiency, versatility, and enhanced performance properties such as durability, wrinkle resistance, and color retention. Synthetic fabrics like polyester and nylon have become a preferred choice for manufacturers due to ease of production and compatibility with a wide range of apparel designs.

The fast fashion model has further accelerated the use of synthetic materials, as they enable rapid turnaround from design to shelf without compromising on aesthetic appeal. Consumers have increasingly embraced synthetic garments for their lightweight comfort and affordability, especially in high-demand segments such as sportswear, casualwear, and uniforms.

Additionally, improvements in synthetic fiber technology have addressed concerns around breathability and sustainability, further enhancing market adoption. As demand for affordable and functional clothing continues to rise, the synthetic segment is expected to retain its leadership across diverse end-use categories.

The medium price segment is estimated to represent 47.8% of the Apparel market revenue in 2025, making it the most prominent pricing tier. This segment's growth has been driven by consumer preference for value-driven purchases that offer a balance between quality and affordability. Middle-income buyers, particularly in emerging economies, are propelling demand in this range due to rising disposable incomes and aspirations for fashion-forward apparel.

Retailers and brands have strategically positioned their offerings within this segment to attract a broad consumer base while ensuring profitable margins. The segment benefits from high sales volumes through both offline and online channels, supported by regular discount cycles and promotional campaigns.

Furthermore, the medium price range allows brands to maintain consistent product quality while accommodating seasonal fashion trends. As economic conditions stabilize and fashion-conscious consumers seek budget-friendly yet trend-aligned options, the medium price segment is expected to continue leading in terms of overall market contribution.

The apparel market is primarily driven by rising income and fashion consciousness, lifestyle changes shaping preferences, global supply chain networks, and branding with retail expansion. Together, these dynamics fuel growth and competition worldwide.

Growing disposable income across developed and emerging markets is reshaping how consumers allocate spending on apparel. Individuals are more willing to purchase premium clothing and follow global fashion trends, resulting in higher demand for branded products. The rise of social media platforms and fashion influencers has intensified style awareness, making consumers highly responsive to new designs and seasonal launches. As younger generations prioritize self-expression through clothing, their purchasing decisions are driven by brand positioning and perceived lifestyle value rather than just functionality. This dynamic is creating a continuous churn in demand, encouraging apparel manufacturers and retailers to adapt swiftly with updated collections and wider assortments, ensuring alignment with rapidly changing consumer preferences.

Changing lifestyle patterns, including greater focus on fitness, casual dressing, and flexible work environments, have transformed apparel consumption. The growing popularity of hybrid workplaces has reduced the need for formal attire while boosting casual and semi-formal categories. Athleisure has also surged as consumers seek clothing that blends comfort, versatility, and style. Additionally, online shopping has fundamentally shifted buying habits, offering convenience, variety, and access to global brands at competitive prices. Impulse purchasing, especially during festive seasons, flash sales, or influencer promotions, further drives market momentum. These shifts highlight how lifestyle trends directly translate into structural changes in apparel demand, influencing both product design and retail distribution strategies worldwide.

The apparel industry is highly dependent on global supply chain networks, making production efficiency and trade relations critical market dynamics. Countries such as China, Bangladesh, and Vietnam dominate textile manufacturing due to cost advantages, skilled labor, and large-scale infrastructure. However, shifting trade policies, tariffs, and regional sourcing diversification are gradually influencing production flows. Brands are increasingly looking for flexible supply chains capable of meeting sudden demand fluctuations and minimizing delays. Logistics improvements, reshoring strategies in developed markets, and supplier diversification are also key approaches to ensuring resilience. These dynamics underscore the critical role of supply chains in maintaining competitive costs and timely delivery, ultimately shaping consumer pricing and brand positioning.

Branding has become central to the apparel industry, where consumer perception often drives market share more than actual utility. Global fashion labels compete not only on quality and style but also on aspirational value and storytelling. Marketing campaigns, celebrity endorsements, and exclusive launches play pivotal roles in building a strong brand identity.

Retail expansion strategies, ranging from flagship stores in metropolitan hubs to digital-first platforms, are enabling wider consumer outreach. Multi-channel retailing, pop-up stores, and influencer collaborations create stronger consumer engagement. As competition intensifies, companies are prioritizing differentiation through niche branding, limited-edition collections, and customer loyalty programs, which significantly impact both brand equity and long-term growth prospects in the global apparel market.

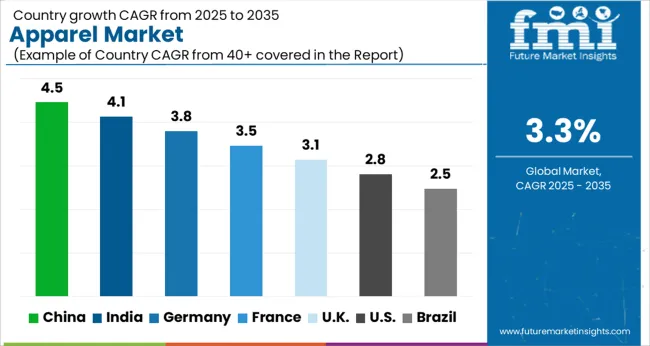

| Country | CAGR |

|---|---|

| China | 4.5% |

| India | 4.1% |

| Germany | 3.8% |

| France | 3.5% |

| UK | 3.1% |

| USA | 2.8% |

| Brazil | 2.5% |

The global apparel market is projected to expand at a CAGR of 3.3% between 2025 and 2035, reflecting steady growth driven by evolving consumer demand and expanding retail ecosystems. China leads with a CAGR of 4.5%, supported by its vast manufacturing base, strong domestic consumption, and rising premium fashion adoption. India follows closely at 4.1%, benefiting from a rapidly expanding middle class, increasing e-commerce penetration, and growing urban lifestyle trends. Germany, with 3.8% CAGR, is characterized by its premium apparel demand, sustainability-driven consumer behavior, and established retail networks. France records a 3.5% CAGR, driven by its luxury fashion dominance and export competitiveness. The UK, at 3.1%, focuses on online retail channels and fast-fashion growth, while the USA, with 2.8% CAGR, remains stable with high market maturity, premium brand strength, and strong retail infrastructure. Asia is shaping volume growth, while Europe and North America are reinforcing innovation, premium categories, and brand-driven strategies. The analysis covers 40+ countries, with the most influential contributors highlighted below.

The apparel market in China is anticipated to grow at a CAGR of 4.5% between 2025 and 2035, making it the largest contributor to global apparel expansion. The country’s dominance is driven by its vast manufacturing ecosystem, rising domestic consumption, and growing appetite for premium and luxury fashion. The e-commerce sector plays a defining role, with platforms such as Alibaba and JD.com offering unparalleled access to a wide consumer base. Local brands are leveraging affordability and quick production cycles, while international players focus on premiumization and brand loyalty. China will remain both a production hub and a top consumer market for apparel.

The apparel market in India is expected to expand at a CAGR of 4.1%, supported by rising fashion consciousness, growing disposable incomes, and increasing penetration of organized retail and e-commerce channels. Local and international brands including Fabindia, Raymond, Zara, and H&M are expanding presence across metropolitan and tier-2 cities, offering casual, formal, and athleisure products. Online platforms such as Myntra and Flipkart drive growth with discounts, extensive product range, and personalized recommendations. Consumer preference is shifting toward branded and versatile clothing suitable for both work and leisure. Investments in supply chain efficiency, digital marketing, and technology-enabled inventory management enhance adoption. Awareness about eco-friendly textiles and sustainable production is gradually influencing consumer choices. Demand for fashion-forward clothing, coupled with increasing urban population, continues to fuel market growth across India.

The apparel market in Germany is projected to grow at a CAGR of 3.8%, influenced by urban consumer demand for premium, casual, and athleisure clothing. Leading brands such as Hugo Boss, Adidas, and Puma focus on quality, performance, and innovation in design to cater to both fashion and functional needs. Adoption is concentrated in metropolitan areas and retail hubs where consumers favor sustainable and eco-friendly textiles. E-commerce supports convenience and broader product selection, whereas offline retail remains important for premium and experiential shopping. Consumers increasingly value recycled fabrics, ethical sourcing, and smart wearable integrations. Government policies promoting environmental responsibility and regulations on textile production reinforce sustainable adoption. Technological solutions, including digital marketing and smart inventory management, further strengthen the competitive landscape and support steady market growth.

The apparel market in the United States is expected to grow at a CAGR of 2.8%, driven by casual, athleisure, and performance wear adoption. Leading brands such as Nike, Levi Strauss, and Gap are expanding online and offline channels to capture both metropolitan and suburban consumer bases. E-commerce growth is supported by convenience, personalized recommendations, and loyalty programs, while retail stores emphasize experiential shopping and brand engagement. Consumers increasingly consider sustainable and ethically produced apparel, influencing brand strategies and product offerings. Demand is strong in residential, retail, and hospitality sectors where branded clothing is a preference. Technological adoption, including smart marketing, digital inventory, and virtual fitting, enhances efficiency and consumer engagement. Market expansion is further reinforced by urbanization, growing fashion awareness, and corporate partnerships promoting athleisure.

The apparel market in the United Kingdom is forecast to grow at a CAGR of 3.1%, driven by urban demand for casual, premium, and athleisure clothing. Key brands such as Marks & Spencer, Next, Zara, and H&M are expanding omnichannel strategies to reach both in-store and online consumers. Demand is concentrated in metropolitan areas where fashion awareness is high and trends change rapidly. Sustainability and recycled fabric adoption are growing due to government regulations and consumer consciousness. Retailers increasingly integrate digital marketing, loyalty programs, and online sales channels to enhance engagement and drive purchases. Premium and casual segments remain popular, supported by e-commerce convenience, lifestyle-focused marketing, and trend-driven collections. Investments in smart supply chains and eco-friendly production reinforce market stability and growth.

Competition in the global apparel market is shaped by brand strength, supply chain agility, pricing strategies, and the ability to cater to both luxury and mass-market demand. Nike and Adidas dominate the sportswear and athleisure segment, leveraging global recognition, innovation in performance fabrics, and celebrity endorsements to maintain leadership.

Inditex, with brands like Zara and H&M (fast-fashion peer not in list), focuses on speed-to-market and responsive supply chains that rapidly translate runway trends into affordable collections. Luxury powerhouses like Dior, Hermes, and Kering (with brands like Gucci and Balenciaga) drive premium apparel growth by emphasizing exclusivity, craftsmanship, and heritage-driven brand equity. Ralph Lauren and Tapestry (owning Coach, Kate Spade) position themselves in the accessible luxury segment, balancing aspirational branding with wider retail reach. Arvind Mills, Raymond, and Royal Apparel strengthen India’s and global markets in textiles, formal wear, and sustainable apparel, with strong roots in fabric innovation and value pricing.

Good Clothing Company and Los Angeles Apparel highlight niche competitiveness, with an emphasis on ethical manufacturing and domestic production that appeals to conscious consumers. TJX Companies, with its off-price retail model (TJ Maxx, Marshalls), plays a vital role in offering branded apparel at discounted rates, appealing to price-sensitive shoppers globally. Competition revolves around digital transformation, e-commerce growth, and balancing affordability with brand identity.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.9 Trillion |

| Product Type | Top wear, Bottom wear, and Innerwear |

| Material | Synthetic and Natural |

| Price | Medium, Low, and High |

| Consumer Group | Women, Men, and Kids |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nike, Adidas, Arvind Mills, Dior, Good Clothing Company, Hermes, Inditex, Kering, Los Angeles Apparel, Ralph Lauren, Raymond, Royal Apparel, Tapestry, and TJX Companies |

| Additional Attributes | Dollar sales, share, growth rates, consumer trends, competitive landscape, retail channels, regional demand, pricing strategies, raw material costs, regulations, and future forecasts. |

The global apparel market is estimated to be valued at USD 1.9 trillion in 2025.

The market size for the apparel market is projected to reach USD 2.6 trillion by 2035.

The apparel market is expected to grow at a 3.3% CAGR between 2025 and 2035.

The key product types in apparel market are top wear, _shirts & t-shirts, _coats & jackets, _sweatshirts, _pullover & cardigans, _others (hats, gloves etc.), bottom wear, _trousers & jeans, _skirts & shorts, _joggers & leggings, _other (socks, etc.), innerwear, _bra, _briefs and _others (vests, panties, etc.).

In terms of material, synthetic segment to command 53.6% share in the apparel market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Apparel Re-commerce Market Size and Share Forecast Outlook 2025 to 2035

Pet Apparel Market Analysis - Size, Demand & Forecast 2025 to 2035

Gym Apparel Market Analysis – Growth & Forecast 2024-2034

Chef Apparel Market Size and Share Forecast Outlook 2025 to 2035

Kids Apparel Market Trends - Growth, Demand & Forecast 2025 to 2035

Rugby Apparel Market Forecast and Outlook 2025 to 2035

Blank Apparel Market – Growth & Demand Forecast 2025 to 2035

Bamboo Apparel Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Apparel and Accessories Market Size and Share Forecast Outlook 2025 to 2035

Sequins Apparel Market Size and Share Forecast Outlook 2025 to 2035

TIC For Apparel Market

Crossfit Apparel Market Size and Share Forecast Outlook 2025 to 2035

Maternity Apparel Market Size and Share Forecast Outlook 2025 to 2035

Decorated Apparel Market segmented by Product, End-user and Distribution Channel through 2025 to 2035

Market Share Distribution Among Maternity Apparel Providers

Equestrian Apparel Market Size and Share Forecast Outlook 2025 to 2035

Secondhand Apparel Market Analysis - Size, Share, and Forecast 2025 to 2035

Competitive Overview of Secondhand Apparel Market Share

Second-hand Apparel Market in Europe Analysis - Size, Share, and Forecast Outlook 2025 to 2035

The Dye Sublimated Apparel Market is segmented by product, printing technique, distribution and region through 2025 to 2035.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA