According to the research the global pet apparel market is anticipated to witness a substantial growth in the coming decade owing to the growing trend of pet humanization, increasing pet adoption rates, and rising meat product sales with increasing disposable income.

Pet apparel is the term used for pet clothing, including coats, jackets, sweaters, hoodies, shirts, tops, etc., providing functional as well as aesthetic benefits. These products provide extra environmental protection for pets while allowing pet owners to express their personal style and enhance the appearance of their pets.

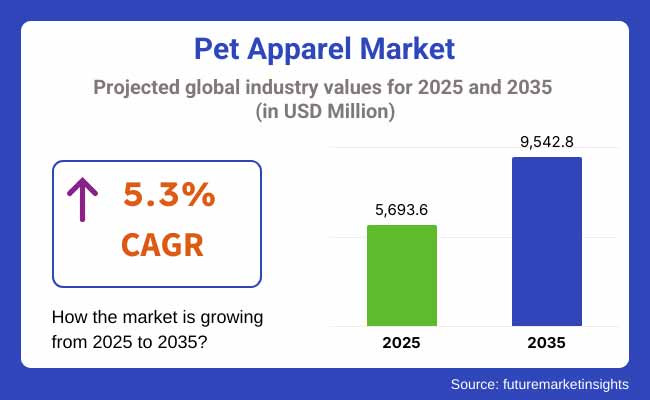

The market is anticipated to be worth roughly USD 9,542.8 Million by 2035, growing at a CAGR of approximately 5.3% from USD 5,693.6 Million in 2025.This growth is fueled by factors such as rising disposable incomes, increasing awareness of pet comfort and safety, and the impact of social media platforms highlighting pet fashion trends.

Moreover, the rising penetration of e-commerce platforms and increasing distribution channels of pet clothing products have been propelling the overall market growth.

The North America region accounts for a considerable share in the pet apparel market, as there is a high rate of pet ownership in the region and pets are treated like family. The demand for pet clothing, especially in the United States, is on the rise as owners look for functional and fashionable items for their furry friends.

Key market players and a strong foundation of retail infrastructure (such as specialized and online pet stores) further drive the growth. Also, holidays and seasons also find demand for pet costumes and themed apparel around Halloween and Christmas, which is a significant contributor.

The pet apparel market in Europe is continuing to grow, driven by a commitment to both fashion and pet welfare. Other frontrunners include countries like the United Kingdom, Germany, and France, where pet owners are showing propensity towards spending on the quality apparel segments.

Fashionably inclined to the very end, the area's designers and brands have developed exclusive lines of pet wear. Additionally, a growing understanding of pet wellbeing fuels the demand for functional garments like protective coats and calming shirts.

Growing nations will experience the fastest growth so commands the Asia-pacific region where increasing rates of pet adoption and rising disposable incomes coupled with the influence of Western pet fashion is driving the demand. The market is growing in countries such as China, Japan and South Korea, where an increasing number of pet owners are not afraid to put up the money for apparel and accessories.

Access to trendy pet attire grew with the rise of e-commerce platforms and social media influencers, appealing to the younger generation of pet parents. In this region, the need for a specialized kind of pet dress also increases due to cultural factors such as pet-friendly festivals and events.

Challenges: Price Sensitivity, Seasonal Demand Fluctuations, and Ethical Concerns

One of the challenges in the pet apparel market is price sensitivity of consumers since clothes for pets are seen as a non-essential product and keep on having a high competition and discount type sales. Seasonal demand fluctuations especially for winter clothing and festive costumes, complicates inventory handling for retailers.

Moreover, ethical concerns regarding animal comfort and material choices have contributed to heightened scrutiny of synthetic fabrics and restrictive pet apparel designs, impacting brand reputation and purchasing behavior.

Opportunities: Growth in Luxury Pet Fashion, Functional Pet Wear, and Sustainable Materials

Despite challenges, the market is expanding thanks to rising pet humanization, increasing disposable income, and growing demand for stylish, functional, and protective pet apparel. Luxury pet fashion is on the rise, with brands such as FitDog, Gucci, and Louis Vuitton rolling out designer petwear, premium fabrics, and customizable petfits.

The growth of pet apparel that is functional such as weatherproof coats, UV-resistant shirts, cooling vests, or orthopedic support wear is contributing to meeting practical pet care needs. Furthermore the growing emphasis on sustainability is leading to brands requiring greener fabrics like organic cotton, recycled polyester, and plant-based dyes.

Her interest in new technologies drives her exploration of trends like Pet e-commerce and personalized pet styling service, and how they create new market opportunities for direct-to-consumer (DTC) brands and online pet boutiques.

The pet apparel market growth rate between 2020 to 2024 was strong, driven by fluffy new bests friends being adopted, pets being treated as humans, and a demand for Insta-perfect pet outfits.

Sales of festive pet outfits, breed-specific apparel and weather-adaptive pet clothing were driven by pet owners, especially millennials and Gen Z consumers. On the other hand, volatile raw material prices, supply chain challenges, and increasing worry about pet comfort restrained the market growth.

By 2025 to 2035, the market will see a huge transition towards AI-Powered Pet Sizing, Smart Pet Wearables, Sustainable Pet Apparel Material. Performance-enhancing fabrics, odour-neutralising textiles and compostable pet gear will boom.

Replace with AI-powered pet fashion recommendations and 3D-printed custom pet apparel. Further, making an entry with all facets in pet travel accessories, adaptive gear for senior pets and tech-enabled pet monitoring clothing will also lead the innovation in the industry.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with pet safety regulations and animal comfort standards. |

| Consumer Trends | Demand for seasonal pet fashion, festive outfits, and breed-specific clothing. |

| Industry Adoption | Used primarily in winter protection, costume-based pet fashion, and casual wear. |

| Supply Chain and Sourcing | Dependence on synthetic fabrics, imported textiles, and mass-market manufacturing. |

| Market Competition | Dominated by pet accessory brands and retail pet stores. |

| Market Growth Drivers | Increased pet adoption, humanization trends, and rise of social media pet influencers. |

| Sustainability and Environmental Impact | Early adoption of organic cotton and eco-friendly dyes in pet fashion. |

| Integration of Smart Technologies | Introduction of custom pet sizing guides and temperature-resistant pet jackets. |

| Advancements in Pet Apparel | Development of waterproof, UV-protective, and breathable pet outfits. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter sustainability regulations, eco-friendly pet fashion mandates, and ethical pet clothing certifications. |

| Consumer Trends | Growth in smart pet apparel, temperature-regulating fabrics, and orthopedic support pet wear. |

| Industry Adoption | Expansion into functional pet apparel, AI-driven custom pet sizing, and pet wellness wearables. |

| Supply Chain and Sourcing | Shift toward organic, biodegradable, and recycled materials in pet clothing. |

| Market Competition | Entry of luxury pet fashion brands, AI-driven pet fashion startups, and sustainable pet clothing companies. |

| Market Growth Drivers | Accelerated by eco-conscious pet ownership, AI-powered personalized pet styling, and smart pet clothing innovations. |

| Sustainability and Environmental Impact | Large-scale shift toward recycled polyester, plant-based fabrics, and zero-waste pet clothing production. |

| Integration of Smart Technologies | Expansion into AI-driven pet outfit recommendations, real-time pet health monitoring wearables, and interactive pet fashion experiences. |

| Advancements in Pet Apparel | Evolution toward biodegradable pet clothing, self-cleaning pet fabrics, and AI-generated pet fashion designs. |

USA Pet Apparel Market is expanding owing to surging disposable income, growing number of pet owners and high demand for luxury pet fashion. Finite scope of premium pet brands and customized pet wear solutions is yet driving demand for luxury designer pet clothing, breed-oriented outfits, and environment-friendly pet fashion. Furthermore, there is a booming of e-commerce pet e-commerce and subscription pet clothes that is revolutionizing the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.4% |

Increasing expenditure on pet products and services, growing need for practical pet clothing, and rising progressive pet wear adoption are driving the UK market. The eco-friendly pet apparel and electronic pet gadgets are trending market trends. Similarly, high-end pet stores and custom pet apparel brands are also growing their footprint in the area.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.2% |

Stringent animal welfare norms, increasing demand for organic pet wear and growing inclination toward pet wellness wearables give narrative to the pet apparel market of Europe. Countries like Germany, France, the Netherlands are ahead in sustainable pet wear, AI-based pet styling, advanced pet outfitting for outdoor activities An increase in urban pet ownership and demand for travel-friendly pet attire is another factor that is fueling market growth.

| Region | CAGR (2025 to 2035) |

|---|---|

| EU | 5.3% |

High demand for personalized pet fashion, increasing focus on pet well-being, and rising disposable income for pet-related expenses are driving Japan's pet apparel market expansion Innovations such as smart pet wearables, temperature-regulating pet outfits and AI-driven pet fashion solutions are putting the industry on a new trajectory in the country.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.3% |

The pet apparel business is growing in South Korea, driven by pet humanization trends, increased market share of premium pet clothing brands, and rising expenditure on pet lifestyle equipment. The future of the market is also being influenced by the increasing popularity of animal influencers on social media, high-end animal fashion, and smart animal clothing technology.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.4% |

Pet apparel predominantly comprises coats and jackets, as their owners increasingly expect them to be fashionable and weather-resistant. These sections are critical to bringing heat, safety, and decor to animals in diverse environments and situations.

Coats Lead Market Demand as Functional and Fashionable Pet Wear Gains Popularity

There is one common segment of the both global and local market is pet coats, covering all sizes and breeds of pets, allowing pets to feel warm, safe and stylish. While traditional pet clothing is mostly used for aesthetics, coats provide insulation and water resistance as well as being adjustable, making them well suited for cold weather and outdoor activities.

Market adoption is driven by increasing demand for seasonal pet wear, such as insulated winter coats, waterproof raincoats, and lightweight windbreakers. According to studies, up to 60% of pet owners buy seasonal pet coats to keep their pets comfortable and safe in bad weather conditions.

The increased availability of premium and designer pet wear, equipped with luxury fabrics, personalized embroidery, and high-end fashion collaborations, has fortified market growth and ensures on a larger scale adoption in the pet lifestyle sector.

Functional pet coat designs including reflective strips for nighttime visibility, harness compatibility built into the coat, and temperature-regulating materials have drastically improved coat adoption due to heightened safety and convenience.

Sustainable Innovation: The introduction of green and sustainable pet coats is also expected to propel the market, with organic cotton, recycled polyester, and biodegradable waterproof coatings optimizing the growth of the market through sustainability-conscious pet owners.

Warmth, protection & fashion appeal gaining share, price sensitivity, seasonal demand fluctuations, sizing complexities yet, though pet coats are generally accessible, innovations in ai-powered pet sizing algorithms, patterned coat designs, and hybrid weather-adaptive fabrics are increasing affordability to make pet coat adoption even more prevalent.

Jackets Expand as Lightweight and Weather-Resistant Pet Apparel Gains Traction

Pet jackets have seen strong market adoption, particularly among pet owners who are looking for versatile, all-season outerwear solutions. Jackets are in contrast to heavy winter coats, as they deliver lightweight insulation, a wind barrier, and breathable fabric options so pets can stay comfortable in moderate climates.

Market adoption is boosted by the increasing demand for performance-oriented pet jackets that come with water-resistant materials, stretchable fit designs, and reinforced stitching ensuring durability. Thus, more than 55% of the pet owners demand lightweight jackets for protecting their pets on all seasons while giving freedom of movement.

The increasing range of adventure and outdoor pet wear, from insulated hiking jackets to reflective safety vests to packable travel-friendly designs, has also reinforced market growth to provide greater functionality for active pets.

The advance of smart pet clothing equipped with fabric technology for temperature-sensitive apparel, GPS-trackable pet jackets, and Bluetooth-enabled visibility features to enhance visibility have all increased the uptake of adoption with improved pet safety and monitoring.

Personalized and breed-specific pet jackets, with designs for various size fittings (including small breed-focused fits, large dog comfort, etc.) as well as adjustable closures are on the rise, driving growth of the market on the whole by optimizing usability and pet comfort.

While pet jackets have their merits in terms of lightweight protection, all-weather usability, and outdoor adaptability, the segment also inherits its share of challenges such as market saturation, competition from alternative pet wear gadgets, and differences in pet acceptance.

Nevertheless, innovations in AI-assisted pet wear manufacturers fitting, self-heating jacket materials, and high-performance fabric engineering are enhancing product differentiation, ensuring ongoing opportunities for expansion in pet jacket adoption.

The cotton and polyester made material segments are pertinent factors propelling the growth of the market as pet owners are continually searching for breathable, durable and easily maintainable fabrics for their apparel.

Cotton Leads Market Demand as Soft and Breathable Pet Wear Becomes a Priority

Cotton fibers stand as one of the major segments in the pet apparel market, which is naturally soft, breathable, and hypoallergenic. Cotton guarantees maximized comfort compared to any synthetic material, making it a perfect preference for pets with allergies and sensitive skin.

Growing demand for lightweight, comfortable pet wear including stretchable cotton coats, casual pet shirts, and light-weight breathable summer jackets among consumers is one of the key factors stimulating the market adoption. According to study over 65% of pet owners prefer cotton clothing for comfort and skin friendly purpose.

Growing use of GOTS-certified organic cotton, plant-dyed fabrics, and biodegradable cotton blends among organic and sustainable pet apparel is strengthening their market growth for better environmental sustainability.

The introduction of these high-performance fabrics that combine moisture-wicking technology, antibacterial treatments, and re-enforced stitching has encouraged more than ever widespread adoption, as they prove more long-lasting and hygienic than their predecessors.

Customization of cotton pet gear and stylish options, including embroidered names, themed seasonal prints, and adjustable cotton ties, has aided in market growth, maintaining enhanced aesthetic appeal and personalization.While cotton is soft, breathable, and more sustainable than synthetic materials, it also has its downfalls, including shrinkage, low water resistance, and higher production costs for organic cotton.

Yet, advances in blended cotton-polyester fabrics, stretch-cotton formulations, and AI-supported fabric adding capabilities are enhancing functionality, cementing further growth in cotton-pet attire.

Polyester Expands as Durable and Weather-Resistant Pet Apparel Gains Popularity

Polyester has built some solid market traction; especially amongst pet parents looking for water-resistant, durable and low-care apparel for the outdoor and active pet. While cotton is breathable, polyester offers stretch, dry quickly, and is resistant to damage.

The adoption of performance-oriented pet clothing, such as weatherproof polyester coats, wind-resistant jackets, and UV-protective fabrics, has maintained the market's demand. It has been reported that more than 55% of pet outerwear products contain polyester, which makes it long-lasting, durable and easy to care for.

The increasing availability of hybrid fabric technologies, including soft-touch polyester-cotton blends, stretchable polyester components with spandex for better fitting, and fleece-lined polyester jackets for increased warmth, strengthened the market growth and guaranteed broader material versatility.

The increasing adoption of water-repellent and stain-resistant coatings utilized in pet apparel with Nano-treated polyester fabrics, odour-resistant materials, and antibacterial polyester blends has further propelled the growth of the segment, as it guarantees enhanced endurance and cleanliness of the products.

High-tech polyester pet wear is being developed to address the demands of fluctuating weather conditions through the use of heat-retaining insulation, smart temperature-regulating fabrics, and breathable mesh panels, which drive optimal market growth.

Although the polyester sector has benefits such as durability, moisture resistance, and ease of upkeep, it also faces obstacles including relatively poor breathability against cotton, environmental issues related to synthetics, and consumer preference changes toward sustainable alternatives.

However, the sustainability of the market is widening the scope of polyester-based pet apparel products owing to innovations in recycled polyester fabrics, biodegradable synthetic alternatives, AI-driven material performance enhancements and so on.

The growing trends of pet humanization are propelling the global pet apparel market alongside a surge in the disposable income of pet owners and also advancements in the area of AI-powered customization of pet fashion. With increasing demand for functional clothing for pets such as weather protection, therapeutic wear, and seasonal clothing, the market is getting significant development.

Emerging trends include sustainability, comfort and smart wearables in pet fashion. This encompasses AI-enabled pet sizing technologies, sustainable fabric innovation for pet accessories, and luxurious fashion line-ups for the four-pawed family members. Significant players include pet clothing lines, specialty pet stores and fashion businesses doing fresh, trendy, useful and tailored pet ware.

Market Share Analysis by Key Players & Pet Apparel Providers

| Company Name | Estimated Market Share (%) |

|---|---|

| Petco Animal Supplies, Inc. | 18-22% |

| PetSmart Inc. | 14-18% |

| Hurtta | 12-16% |

| Canada Pooch | 8-12% |

| Ruffwear | 6-10% |

| Other Pet Apparel Providers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Petco Animal Supplies, Inc. | Develops AI-powered pet apparel sizing guides, weather-resistant clothing, and themed pet fashion collections. |

| PetSmart Inc. | Specializes in AI-assisted pet clothing customization, seasonal pet outfits, and premium pet lifestyle wear. |

| Hurtta | Focuses on AI-driven performance pet apparel, waterproof and thermal pet clothing, and durable outdoor wear. |

| Canada Pooch | Provides AI-optimized pet jackets, cooling vests, and sustainable pet apparel with advanced fabric technologies. |

| Ruffwear | Offers AI-enhanced adventure gear, high-durability pet jackets, and ergonomic activewear for dogs. |

Key Market Insights

Petco Animal Supplies, Inc. (18-22%)

Petco leads in AI-powered pet apparel sizing, offering a wide range of functional and fashion-forward pet clothing, including raincoats, sweaters, and costumes.

PetSmart Inc. (14-18%)

PetSmart specializes in AI-assisted pet fashion customization, providing premium lifestyle apparel, seasonal outfits, and themed pet collections.

Hurtta (12-16%)

Hurtta focuses on AI-driven pet performance wear, developing waterproof, windproof, and thermal protection apparel for active and outdoor pets.

Canada Pooch (8-12%)

Canada Pooch offers AI-optimized pet jackets, cooling and warming vests, and eco-friendly pet apparel designed for all-weather comfort.

Ruffwear (6-10%)

Ruffwear integrates AI-powered adventure pet gear, producing durable, ergonomic, and high-visibility clothing for active and working dogs.

Other Key Players (30-40% Combined)

Several pet fashion brands, specialty retailers, and sustainable pet apparel manufacturers contribute to next-generation pet clothing innovations, AI-driven fit customization, and eco-friendly materials. Key contributors include:

The overall market size for the pet apparel market was USD 5,693.6 Million in 2025.

The pet apparel market is expected to reach USD 9,542.8 Million in 2035.

The demand for pet apparel is rising due to increasing pet humanization, growing consumer spending on pet fashion, and rising awareness of pet comfort and protection. The expansion of e-commerce and social media trends promoting pet clothing are further driving market growth.

The top 5 countries driving the development of the pet apparel market are the USA, China, Japan, Germany, and the UK.

Cotton and Polyester Materials are expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Pet Type, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Pet Type, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Pet Type, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 36: Western Europe Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by Pet Type, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by Pet Type, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Units) Forecast by Pet Type, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 64: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 66: East Asia Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 68: East Asia Market Volume (Units) Forecast by Pet Type, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 70: East Asia Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Units) Forecast by Material Type, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Pet Type, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Units) Forecast by Pet Type, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Pet Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Pet Type, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Material Type, 2023 to 2033

Figure 28: Global Market Attractiveness by Pet Type, 2023 to 2033

Figure 29: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Pet Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Pet Type, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Material Type, 2023 to 2033

Figure 58: North America Market Attractiveness by Pet Type, 2023 to 2033

Figure 59: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Pet Type, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Pet Type, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Material Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Pet Type, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Pet Type, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 101: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 105: Western Europe Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 109: Western Europe Market Volume (Units) Analysis by Pet Type, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 113: Western Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Pet Type, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Pet Type, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by Pet Type, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Pet Type, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Pet Type, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by Pet Type, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Material Type, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Pet Type, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Pet Type, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 191: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 195: East Asia Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 199: East Asia Market Volume (Units) Analysis by Pet Type, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 203: East Asia Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Material Type, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Pet Type, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Pet Type, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Material Type, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Pet Type, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Units) Analysis by Pet Type, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Pet Type, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Pet Type, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Material Type, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Pet Type, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pet Tick and Flea Prevention Market Forecast and Outlook 2025 to 2035

Pet Hotel Market Forecast and Outlook 2025 to 2035

PET Vascular Prosthesis Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Preservative Market Forecast and Outlook 2025 to 2035

Petroleum Liquid Feedstock Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

PET Stretch Blow Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

PET Injectors Market Size and Share Forecast Outlook 2025 to 2035

PET Material Packaging Market Size and Share Forecast Outlook 2025 to 2035

Petri Dishes Market Size and Share Forecast Outlook 2025 to 2035

Petroleum And Fuel Dyes and Markers Market Size and Share Forecast Outlook 2025 to 2035

Petrochemical Pumps Market Size and Share Forecast Outlook 2025 to 2035

PET Dome Lids Market Size and Share Forecast Outlook 2025 to 2035

Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

PET Imaging Workflow Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Petroleum Refinery Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Pet Bird Health Market Size and Share Forecast Outlook 2025 to 2035

PET Film Coated Steel Coil Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Refinery Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Pet Collagen Treats Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA