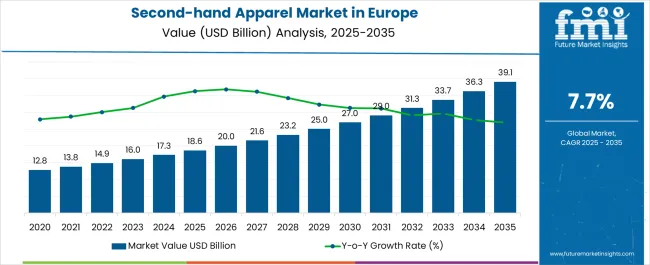

The European second-hand apparel market is projected to grow from USD 18.6 billion in 2025 to approximately USD 39.1 billion by 2035, recording an absolute increase of USD 20.5 billion over the forecast period. This translates into a total growth of 110.2%, with the market forecast to expand at a compound annual growth rate (CAGR) of 7.7% between 2025 and 2035. The overall market size is expected to grow by approximately 2.1X during the same period, supported by the rising environmental consciousness among European consumers, increasing acceptance of circular fashion principles, and growing digitalization of second-hand shopping platforms.

Between 2025 and 2030, the European second-hand apparel market is projected to expand from USD 18.6 billion to USD 26.9 billion, resulting in a value increase of USD 8.3 billion, which represents 40.5% of the total forecast growth for the decade. This phase of growth will be shaped by increasing environmental awareness among European consumers, growing acceptance of pre-owned fashion as mainstream shopping behavior, and expanding digital marketplace platforms. Retailers are enhancing their online presence and authentication services to address the growing sophistication of second-hand fashion consumers across diverse European markets.

From 2030 to 2035, the market is forecast to grow from USD 26.9 billion to USD 39.1 billion, adding another USD 12.2 billion, which constitutes 59.5% of the overall ten-year expansion. This period is expected to be characterized by expansion of luxury resale segments, integration of artificial intelligence for pricing and authentication, and development of comprehensive circular economy business models. The growing emphasis on sustainable fashion consumption will drive demand for premium second-hand apparel platforms that offer authenticated luxury goods and personalized shopping experiences.

Between 2020 and 2025, the market experienced accelerated expansion, driven by changing consumer attitudes toward sustainability and the normalization of pre-owned fashion purchases. The market developed as digital platforms made second-hand shopping more accessible, convenient, and socially acceptable among younger demographics. Environmental concerns and economic considerations began driving mainstream adoption of circular fashion principles across diverse European consumer segments.

| Metric | Value |

|---|---|

| Second-hand Apparel Market Value in Europe (2025) | 18.6 billion USD |

| Second-hand Apparel Market Forecast Value in Europe (2035) | 39.1 billion USD |

| Second-hand Apparel Market Forecast CAGR in Europe | 7.7 |

Market expansion is being supported by the rapid increase in environmental consciousness among European consumers and the corresponding shift toward sustainable fashion consumption patterns that prioritize circular economy principles. Modern European consumers increasingly view second-hand apparel as a responsible alternative to fast fashion, creating demand for quality pre-owned clothing that extends product lifecycles while reducing environmental impact. The growing recognition of fashion industry environmental costs is driving consistent adoption of second-hand shopping across diverse demographic groups and income levels.

The growing sophistication of digital marketplace platforms and increasing consumer confidence in online second-hand transactions are driving demand for authenticated, quality-assured pre-owned apparel from established platforms with comprehensive buyer protection policies. European consumers are increasingly comfortable with digital-first shopping experiences that offer detailed product descriptions, authentication services, and return policies comparable to traditional retail. Platform innovations and consumer education programs are establishing trust and convenience standards that support mainstream second-hand fashion adoption.

The market is segmented by product type, sector, consumer group, sales channel, and region. The product type segment covers dresses & tops, shirts & t-shirts, sweaters, coats & jackets, jeans & pants, and others. The sector segment includes resale and traditional thrift stores & donations. The consumer group segment comprises men, women, and kids. The sales channel segment includes wholesalers/distributors, hypermarkets/supermarkets, multi-brand stores, independent small stores, departmental stores, online retailers, and other sales channels.Regionally, the market is divided into Western Europe, Southern Europe, Northern Europe, and Eastern Europe.

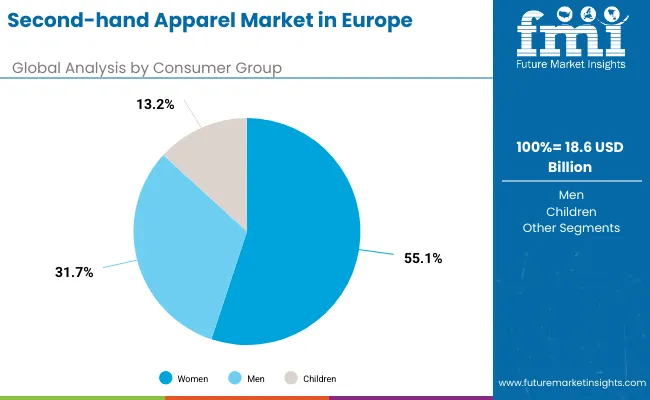

Women consumers are expected to represent 55.1% of European second-hand apparel demand in 2025. This dominant share reflects the higher fashion consumption rates among women and their greater willingness to engage with sustainable fashion alternatives including pre-owned clothing purchases. Women demonstrate stronger environmental consciousness in fashion choices and greater comfort with digital marketplace platforms for clothing transactions. The segment benefits from extensive product variety, active online communities around sustainable fashion, and established social acceptance of second-hand clothing among female demographics.

.webp)

Dresses & tops are projected to account for 20.0% of the European second-hand apparel market in 2025. This leading share is supported by the high frequency of dress and top purchases among female consumers and the strong resale value retention of quality dresses and designer tops in the second-hand market. These items often represent significant original investments that retain appeal and functionality over extended periods, making them attractive to both sellers and buyers. The segment benefits from diverse style options, seasonal demand patterns, and strong brand recognition that supports pricing stability in resale markets.

The European second-hand apparel market is advancing rapidly due to increasing environmental awareness and growing acceptance of circular fashion principles among diverse consumer demographics. However, the market faces challenges including concerns about product authenticity, varying quality standards, and cultural barriers to second-hand purchasing in certain market segments. Innovation efforts and platform development programs continue to influence consumer confidence and market expansion patterns across different European regions.

The growing development of authenticated luxury resale platforms is enabling access to high-end fashion items at reduced prices while maintaining product authenticity and quality assurance. Specialized platforms provide authentication services, condition assessments, and premium customer experiences that appeal to luxury fashion consumers. These developments are particularly valuable for consumers seeking designer items and investment pieces while supporting sustainable luxury consumption patterns.

Modern second-hand apparel platforms are incorporating artificial intelligence technologies that optimize pricing strategies, recommend products based on consumer preferences, and enhance search functionality for improved shopping experiences. Integration of machine learning algorithms enables dynamic pricing based on market demand, brand popularity, and item condition while providing personalized recommendations. Advanced technologies support efficient marketplace operations while enhancing consumer satisfaction and platform engagement.

| Country | CAGR (2025 to 2035) |

|---|---|

| Spain | 8.1% |

| Italy | 7.4% |

| France | 6.6% |

| Netherlands | 6.2% |

| Belgium | 5.8% |

| Germany | 5.4% |

| United Kingdom | 3.7% |

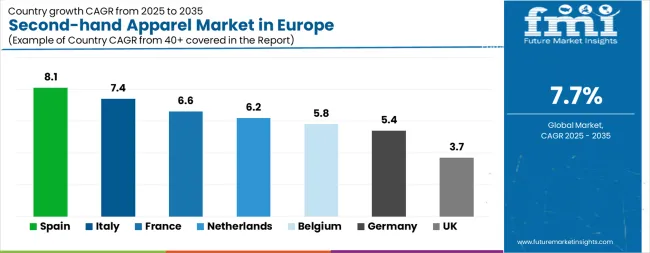

The European second-hand apparel market demonstrates varied growth patterns across key countries, with Spain leading at 8.1% market share, followed by Italy at 7.4%, France at 6.6%, Netherlands at 6.2%, Belgium at 5.8%, Germany at 5.4%, and the United Kingdom at 3.7%. These markets reflect different stages of digital platform adoption, consumer acceptance of second-hand fashion, and cultural attitudes toward circular economy principles.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

Revenue from second-hand apparel in Spain is expanding at a CAGR of 8.1%, driven by rapid adoption of digital marketplace platforms and growing environmental consciousness among Spanish consumers across diverse age demographics. The country's expanding e-commerce infrastructure and increasing smartphone penetration create favorable conditions for online second-hand fashion transactions. Spanish consumers demonstrate strong interest in sustainable fashion alternatives, supported by cultural values emphasizing resourcefulness and community-based commerce that align with second-hand shopping principles. Environmental education initiatives promote circular fashion consumption, driving adoption of second-hand apparel as mainstream shopping behavior among environmentally conscious consumer segments.

Revenue from second-hand apparel in Italy is projected to grow at a CAGR of 7.4%, supported by the country's deep fashion heritage and sophisticated consumer understanding of clothing quality, design, and value retention. Italian consumers demonstrate discerning taste in second-hand fashion selection, creating demand for authentic designer items and high-quality vintage pieces. The country's established fashion culture provides favorable context for appreciating pre-owned luxury and designer items as valuable investment pieces rather than mere alternatives to new clothing. Cultural acceptance of vintage and heritage fashion items supports mainstream adoption of second-hand shopping among fashion-conscious consumer demographics seeking unique and quality pieces.

Revenue from second-hand apparel in France is projected to grow at a CAGR of 6.6%, characterized by increasing consumer interest in sustainable fashion alternatives and growing acceptance of circular economy principles among urban populations. French consumers demonstrate rising environmental consciousness that translates into second-hand apparel purchases as responsible consumption choices. The country's established fashion retail infrastructure provides favorable conditions for integrating second-hand options into mainstream shopping behaviors. Sustainability education programs promote awareness of fashion industry environmental impacts, driving consumer interest in circular fashion alternatives and second-hand purchasing decisions. Digital platform adoption increases among younger demographics seeking affordable access to designer and quality fashion items through authenticated resale channels.

Revenue from second-hand apparel in the Netherlands is projecetd to grow at a CAGR of 6.2%, driven by advanced digital infrastructure and high consumer comfort with online marketplace transactions across diverse product categories including fashion. Dutch consumers demonstrate practical approaches to consumption that align with circular economy principles and environmental responsibility. The country's established e-commerce ecosystem provides robust foundation for second-hand apparel platform adoption and growth. Environmental consciousness initiatives promote sustainable consumption patterns that include second-hand apparel purchasing as responsible consumer behavior.

Demand for second-hand apparel in Belgium is projected to grow at a CAGR of 5.8%, supported by increasing consumer awareness of sustainable fashion options and growing acceptance of pre-owned clothing among environmentally conscious demographics. Belgian consumers demonstrate rising interest in circular fashion principles that support second-hand apparel as viable alternatives to fast fashion purchases. The country's multilingual consumer base and proximity to major European fashion markets create favorable conditions for diverse second-hand apparel access and selection. Digital marketplace adoption increases among younger consumers seeking affordable access to quality fashion items while supporting environmental responsibility through circular consumption patterns.

Demand for second-hand apparel in Germany is projected to grow at a CAGR of 5.4%, characterized by consumer emphasis on product quality, authenticity verification, and environmental responsibility in fashion purchasing decisions. German consumers prioritize sustainable consumption practices that include second-hand apparel as environmentally responsible alternatives to conventional retail. The country's strong environmental consciousness and quality standards create demand for authenticated, well-maintained pre-owned clothing items. Environmental education programs promote circular economy principles that include second-hand fashion consumption as responsible consumer behavior aligned with sustainability goals.

Demand for second-hand apparel in the United Kingdom is projected to grow at a CAGR of 3.7%, characterized by mature digital marketplace infrastructure and established consumer familiarity with online second-hand transactions across various product categories. British consumers demonstrate practical approaches to fashion consumption that include second-hand options as cost-effective alternatives to new clothing purchases. The country's established e-commerce ecosystem supports diverse second-hand apparel platforms and marketplace options. Cultural acceptance of vintage and pre-owned items supports mainstream adoption of second-hand shopping as viable fashion consumption alternative among diverse demographic groups.

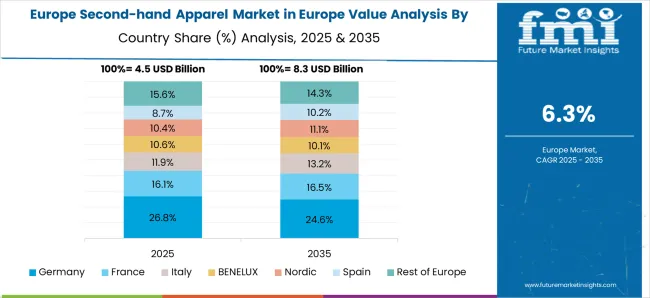

The Europe second-hand apparel market is projected to grow from USD 18.6 billion in 2025 to USD 39.1 billion by 2035, registering a CAGR of 7.7% over the forecast period. Germany is expected to maintain its leadership despite a slight reduction in share from 22.1% in 2025 to 20.3% by 2035, supported by its robust e-commerce infrastructure and established thrift culture, though growth moderates due to market maturity.

Spain is projected to gain the most ground, expanding its share from 8.7% to 10.4%, attributed to rising Gen-Z adoption of thrift culture and aggressive marketplace expansion by platforms like Wallapop. Italy will also see gains from 10.1% to 10.9%, driven by vintage fashion tourism and increasing mobile resale adoption. The Rest of Europe region is expected to expand its share from 21.8% to 23.1%, fueled by rising sustainability mandates in Eastern and Nordic regions and supportive circular economy policie

The European second-hand apparel market is defined by competition among specialized online marketplaces, established e-commerce platforms, and luxury resale specialists. Companies are investing in authentication technologies, user experience enhancement, mobile platform optimization, and community building features to deliver trustworthy, convenient second-hand apparel shopping experiences. Strategic partnerships, influencer collaborations, and sustainability messaging are central to building brand recognition and expanding user bases across diverse European markets.

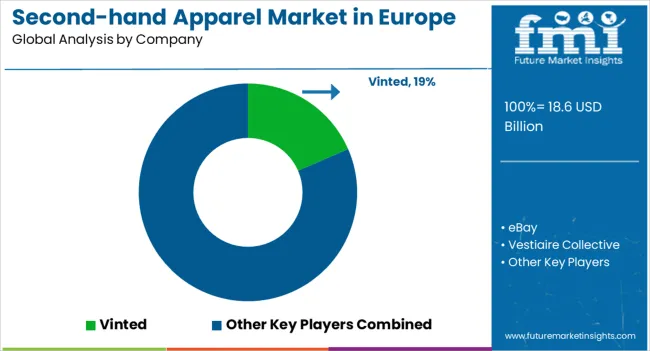

Vinted leads the European market with 19% share, offering comprehensive peer-to-peer marketplace solutions with focus on user-friendly interfaces, secure payment systems, and community-driven selling experiences. eBay holds 15.2% market share, providing established marketplace infrastructure and broad product selection for second-hand apparel transactions. Vestiaire Collective maintains 12.3% share through luxury focus and authentication services that appeal to premium fashion consumers.

Depop commands 9.8% of the market, emphasizing social commerce features and community engagement that appeals to younger demographics interested in unique and vintage fashion items. StockX holds 7.4% share, focusing on authentication services and marketplace integrity for designer and limited-edition fashion items. These companies collectively represent the leading platforms in the European second-hand apparel market, each contributing unique value propositions and user experience innovations.

| Item | Value |

|---|---|

| Quantitative Units | USD 18.6 billion |

| Product Segment | Dresses & Tops, Shirts & T-Shirts, Jeans & Pants, Sweaters, Coats & Jackets, Others |

| Sector | Resale, Traditional Thrift Stores & Donations |

| Consumer Group | Men, Women, Kids |

| Sales Channel | Wholesalers/Distributors, Hypermarkets/Supermarket, Multi-Brand Store, Independent Small Stores, Departmental Stores, Online Retailers, Other Sales Channel |

| Regions Covered | Western Europe, Southern Europe, Northern Europe, Eastern Europe |

| Key Countries Covered | Spain, Italy, France, Netherlands, Belgium, Germany, United Kingdom, and 40+ countries |

| Key Companies Profiled | Vinted, Ebay, Vestaire Collective, Garson & Shaw, Depop, F&P Stock Solutions, Etsy, Yaga, Farfetch |

| Additional Attributes | Market analysis by product categories and consumer demographics, regional adoption patterns across European markets, competitive landscape with digital marketplace platforms and luxury resale specialists, consumer behavior trends in sustainable fashion consumption, platform technology innovations including authentication and personalization, environmental impact considerations, and integration with circular economy principles and sustainable fashion movements |

The global second-hand apparel market in Europe is estimated to be valued at USD 18.6 billion in 2025.

The market size for the second-hand apparel market in Europe is projected to reach USD 39.1 billion by 2035.

The second-hand apparel market in Europe is expected to grow at a 7.7% CAGR between 2025 and 2035.

The key product types in second-hand apparel market in Europe are dresses & tops, shirts & t-shirts, jeans & pants, sweater, coats & jackets and others.

In terms of consumer group, women segment to command 55.1% share in the second-hand apparel market in Europe in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Europe Second-hand Apparel Market Growth – Trends & Forecast 2024-2034

Apparel Market Size and Share Forecast Outlook 2025 to 2035

Apparel Re-commerce Market Size and Share Forecast Outlook 2025 to 2035

Gym Apparel Market Size and Share Forecast Outlook 2025 to 2035

Pet Apparel Market Analysis - Size, Demand & Forecast 2025 to 2035

Chef Apparel Market Size and Share Forecast Outlook 2025 to 2035

Kids Apparel Market Trends - Growth, Demand & Forecast 2025 to 2035

Rugby Apparel Market Forecast and Outlook 2025 to 2035

Blank Apparel Market – Growth & Demand Forecast 2025 to 2035

Bamboo Apparel Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Apparel and Accessories Market Size and Share Forecast Outlook 2025 to 2035

TIC For Apparel Market

Sequins Apparel Market Size and Share Forecast Outlook 2025 to 2035

Crossfit Apparel Market Size and Share Forecast Outlook 2025 to 2035

Maternity Apparel Market Size and Share Forecast Outlook 2025 to 2035

Decorated Apparel Market segmented by Product, End-user and Distribution Channel through 2025 to 2035

Market Share Distribution Among Maternity Apparel Providers

Equestrian Apparel Market Size and Share Forecast Outlook 2025 to 2035

Secondhand Apparel Market Analysis - Size, Share, and Forecast 2025 to 2035

Competitive Overview of Secondhand Apparel Market Share

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA