The gym apparel market is experiencing strong growth driven by increasing participation in fitness activities, the influence of athleisure trends, and rising consumer awareness regarding performance-oriented sportswear. Expanding gym memberships, coupled with lifestyle shifts toward active living, have strengthened demand across global markets. Manufacturers are focusing on integrating advanced materials, ergonomic designs, and aesthetic appeal to enhance product functionality and comfort.

The current scenario reflects a competitive landscape where brand differentiation is achieved through innovation, sustainability, and digital engagement. The future outlook remains optimistic as consumers prioritize quality, moisture control, and durability in workout clothing.

Growth rationale is supported by continuous product diversification, the use of eco-friendly fabrics, and the proliferation of e-commerce platforms that enhance accessibility The industry is expected to sustain momentum through collaborations between fitness influencers and apparel brands, alongside regional market expansion driven by growing urbanization and disposable incomes.

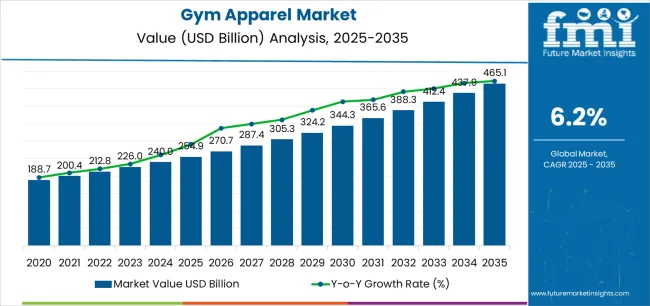

| Metric | Value |

|---|---|

| Gym Apparel Market Estimated Value in (2025 E) | USD 254.9 billion |

| Gym Apparel Market Forecast Value in (2035 F) | USD 465.1 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

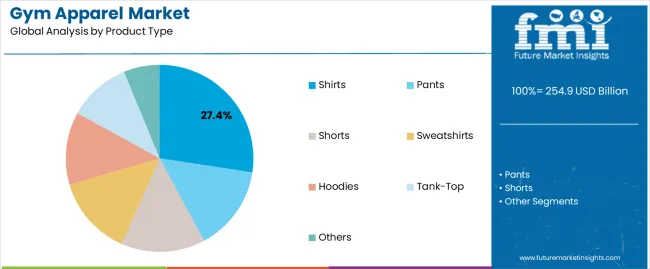

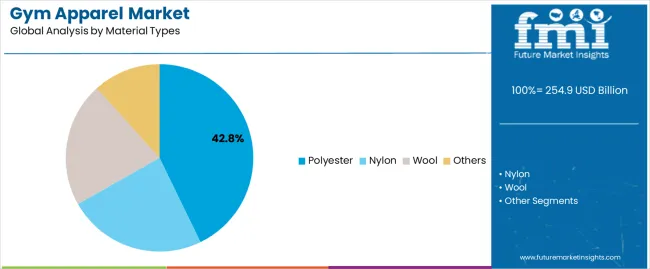

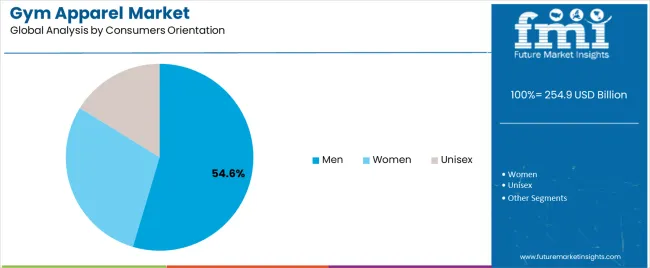

The market is segmented by Product Type, Material Types, Consumers Orientation, and Sales Channel and region. By Product Type, the market is divided into Shirts, Pants, Shorts, Sweatshirts, Hoodies, Tank-Top, and Others. In terms of Material Types, the market is classified into Polyester, Nylon, Wool, and Others. Based on Consumers Orientation, the market is segmented into Men, Women, and Unisex. By Sales Channel, the market is divided into Online Retailers, Direct Sales, Franchised Stores, Specialty Stores, Mono Brand Stores, Wholesalers or Retailers, and Other Sales Channel. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The shirts segment, holding 27.4% of the product type category, is leading the market due to its universal appeal and functionality across both professional and casual fitness routines. Demand is being supported by innovations in design, such as ventilation zones and compression features, that enhance comfort and performance.

Manufacturers are emphasizing lightweight and quick-dry fabrics to address the needs of high-intensity workouts. The segment benefits from continuous updates in fashion trends, merging practicality with style, which has attracted a wider consumer base.

Increased availability through online platforms and retail chains has expanded accessibility, while customization options and brand collaborations have strengthened engagement With ongoing improvements in fabric technology and styling versatility, the shirts segment is expected to maintain its leadership and contribute significantly to the overall gym apparel market.

The polyester segment, accounting for 42.8% of the material type category, dominates due to its superior moisture-wicking, flexibility, and durability characteristics. It remains the preferred choice for manufacturers aiming to deliver lightweight, stretchable, and breathable gym wear suitable for various activities.

The material’s resistance to shrinkage and quick-drying nature enhances user convenience and prolongs garment lifespan. Technological advancements in fiber blending and fabric finishing are further improving comfort and performance.

The segment also benefits from sustainable production initiatives using recycled polyester, aligning with consumer demand for eco-conscious apparel As global fitness participation continues to expand, the polyester category is expected to maintain its dominance through consistent innovation and strategic product positioning across premium and mass-market segments.

The men’s segment, representing 54.6% of the consumer orientation category, has remained the leading contributor due to strong participation rates in gym and fitness activities. The segment’s dominance is reinforced by increasing adoption of performance-oriented clothing that supports endurance, flexibility, and style.

Market growth is driven by high spending power among male consumers and a rising preference for branded and functional apparel. Product innovations focused on comfort, fit, and moisture control have enhanced appeal.

Marketing strategies emphasizing sports performance, lifestyle integration, and influencer partnerships have strengthened brand visibility With expanding gym memberships and the growing popularity of strength and endurance training among men, this segment is expected to continue driving the market’s overall growth trajectory through sustained demand and evolving fashion preferences.

Gym subscriptions, especially in urban localities, are increasing at a rapid pace. Gym-goers are thus purchasing gym apparel to comfortably and efficiently perform exercises informed by their trainers.

Good portion of gym goers are youngsters and young working professionals. They are frequently spotted at gyms to maintain their physique or add some movement to their otherwise sedentary lifestyle.

Corporations and public institutions too are constructing in-house gyms to promote the health of working professionals. These market dynamics are supporting sales of gym apparel.

Key brands in the market are developing activewear made out of special breathable fabric to ensure optimal body temperature while exercising. Some widely sought fabrics include spandex, calico, and microfiber.

People are purchasing gym apparel products from eCommerce platforms or brands’ websites. Wide collection of workout clothes, easy return policies, new user discounts, and various deals motivate customers to shop for gym apparel online.

| Leading Material Type | Nylon |

|---|---|

| Value Share (2025) | 34.30% |

Nylon is a highly favored material among activewear brands to manufacture gym apparel. Share of nylon in the global market is estimated to be 34.30% in 2035.

Brands use nylon in gym apparel as they offer extreme comfort to the wearer. Nylon is adept at drawing moisture towards the fabric’s surface, allowing it to dry faster. As a result, consumers look for nylon-based gym apparel to avoid any sticky feeling from sweating while exercising at the gym.

| Leading Sales Channel | Direct Sales |

|---|---|

| Value Share (2025) | 31.80% |

Direct sales are on the rise for gym apparel. This sales channel is set to enjoy a share of 31.80% in 2025.

Brands are selling their products on various channels, but direct sales remain the preferred medium for sales of gym apparel. By directly selling to customers, brands gather data on consumer preferences and stock their products accordingly. Another benefit of direct sales is that brands can gain feedback in case a product needs improvement.

| Countries | Forecast CAGR (2025 to 2035) |

|---|---|

| Canada | 5.90% |

| France | 5.60% |

| India | 11.70% |

| China | 9.70% |

| Australia | 8.90% |

Spending on gym apparel in Canada is estimated to rise at a CAGR of 5.90% over the assessment period. According to the latest market estimates by FMI analysts, this growth rate is higher than the one in the United States. Thus, suggesting greater business prospects for players in Canada.

Manufacturers in Canada are creating athlete-inspired workout clothing for both genders. The clothing line typically includes leggings, sports bras, shirts and tanks, etc. Gym-going consumers shop for these fitness clothing on online platforms to elevate their workout experience.

Customers are inquiring about custom apparel to meet their likes and preferences. With the growing market for custom apparel, companies have started giving customization options to meet this emerging demand for gym apparel.

Increasing disposable income of people in Canada as well as rising interest in fitness activities is creating demand for premium leggings and activewear. To meet this demand, brands are releasing ultrasoft yoga wear and activewear. Companies further offer hot deals on their collections to rapidly increase their sales.

Consumer demand for gym apparel in France is predicted to report a CAGR of 5.60% from 2025 to 2035. France ranks high in terms of growth than the other countries in Europe.

People in France are committed to physical health and fitness. Therefore, gym memberships are rising at a steady rate. This market situation is opening up opportunities for sellers of gym clothes and workout clothes. Providers of gym clothes are also making extra efforts to ensure their offering is of perfect fit and high quality.

There is an increasing popularity of t-shirts and sweatshirts among people in France as they tend to wear sportswear in daily life.

The gym apparel sales in India are projected to increase at a CAGR of 11.70% in the following decade. Rising economic activities, growing fitness-conscious customers, and increasing disposable income of the population in India are common elements that are driving sales of gym apparel.

The working population in India has busy schedules, which makes it difficult for them to exercise on their own. To make fitness a part of their routine, working professionals are investing in gym memberships and apparel.

Growing customer base for gym apparel is motivating brands in India to offer a wide range of high-quality gym wear, including oversized fits, tank tops, shorts, joggers, etc. The gym clothing brands are selling their product online to reach gym enthusiasts pan India.

Revenue estimation from the sales of gym apparel in China is predicted to expand at a CAGR of 9.70% over the forecast period. Government initiatives, increasing health awareness, and shifting fashion trends in China are creating opportunities for foreign players.

China’s demographics, consisting significantly of millennials and middle-class population, is favoring the leading brands. This is supported by the rising purchases of gym apparel made by young workers who have comparably high disposable incomes and an inclination for more leisure activities like sports.

Gym memberships are also shooting up in China, alongside several marathons held each year. This is expected to continue promoting sales of gym apparel over the next decade.

Emerging businesses in the country are introducing functional activewear to capture specific consumer market and carve a position for themselves. Some players are also integrating eco-friendly materials in their products to capture environmentally conscious customers.

Demand for gym apparel in Australia is expected to observe a CAGR of 8.90% between 2025 to 2035. Growing population of gym fanatics, runners, and occasional at-home exercisers is providing a substantial market for brands to sell their latest workout gear.

Activewear brands in Australia are presenting innovatively designed and brightly colored sports bras, crops, leggings, tanks, crops, t-shirts, etc. This clothing supports their customers through all the marathons, HIIT workouts, yoga classes, and more.

Leading activewear brands in the market like Reebok, Nike, and Adidas are collaborating with A-list celebrities and high-end luxury fashion names. As a consequence of this strategy, they gain visibility among their followers and potentially convert them into purchasers.

Big brands that offer gym apparel are incorporating features like breathable materials and moisture-wicking fabrics to attract a wider population of gym enthusiasts. Companies are also releasing gym apparel made of organic materials and recycled fabrics, as the consumer segment for eco-friendly gym wear increases in size.

Key players are introducing fashionable gym clothes, just in time to leverage the athleisure trend, as customers want to own activewear that looks appealing even outside the gym. Market participants are partnering with fitness influencers and popular athletes to promote their gym apparel.

Competitors are running social media campaigns to engage and direct potential customers to their brand’s website for online purchases. Brands also announce discounts and deals on their social media channels via Posts and Stories to increase their sales rate.

Some gym apparel companies are doubling down on specific niches like weightlifting, yoga, etc., where they observe rapid turnovers.

Key Players in the Gym Apparel Market Take Over the News Headlines

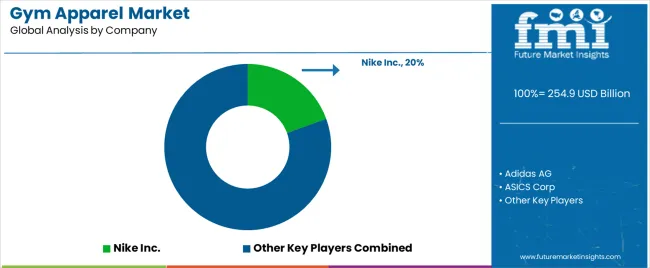

The global gym apparel market is estimated to be valued at USD 254.9 billion in 2025.

The market size for the gym apparel market is projected to reach USD 465.1 billion by 2035.

The gym apparel market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in gym apparel market are shirts, pants, shorts, sweatshirts, hoodies, tank-top and others.

In terms of material types, polyester segment to command 42.8% share in the gym apparel market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Apparel Market Size and Share Forecast Outlook 2025 to 2035

Gym Shoes Market Size and Share Forecast Outlook 2025 to 2035

Apparel Re-commerce Market Size and Share Forecast Outlook 2025 to 2035

Gym Bag Market Analysis, Size, Share & Forecast 2025 to 2035

Gymnema extract Market

Pet Apparel Market Analysis - Size, Demand & Forecast 2025 to 2035

Chef Apparel Market Size and Share Forecast Outlook 2025 to 2035

Aqua Gym Equipment Market Size and Share Forecast Outlook 2025 to 2035

Home Gym Equipment Market Size and Share Forecast Outlook 2025 to 2035

Kids Apparel Market Trends - Growth, Demand & Forecast 2025 to 2035

Rugby Apparel Market Forecast and Outlook 2025 to 2035

Blank Apparel Market – Growth & Demand Forecast 2025 to 2035

Bamboo Apparel Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Apparel and Accessories Market Size and Share Forecast Outlook 2025 to 2035

Sequins Apparel Market Size and Share Forecast Outlook 2025 to 2035

TIC For Apparel Market

Crossfit Apparel Market Size and Share Forecast Outlook 2025 to 2035

Maternity Apparel Market Size and Share Forecast Outlook 2025 to 2035

Decorated Apparel Market segmented by Product, End-user and Distribution Channel through 2025 to 2035

Market Share Distribution Among Maternity Apparel Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA